Transformer-Free UPS Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435691 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Transformer-Free UPS Market Size

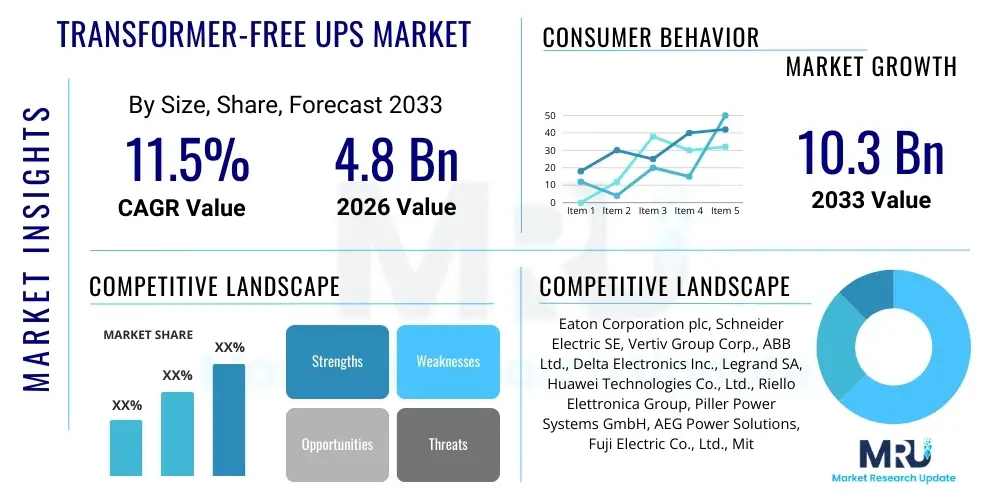

The Transformer-Free UPS Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 10.3 Billion by the end of the forecast period in 2033.

Transformer-Free UPS Market introduction

The Transformer-Free Uninterruptible Power Supply (UPS) market encompasses advanced power protection solutions that utilize modern electronic components, such as high-frequency switching technologies and digital signal processors (DSPs), to eliminate the need for traditional, bulky isolation transformers in the main power path. This design innovation significantly enhances system efficiency, reduces weight and footprint, and lowers overall operational costs compared to conventional transformer-based systems. These units are predominantly utilized in critical infrastructure where power quality and continuous operation are paramount, including hyperscale data centers, cloud computing facilities, telecommunications networks, and healthcare systems where any interruption can result in substantial financial losses or critical safety failures.

The core product description centers on high-efficiency double-conversion topology, typically achieving efficiency levels exceeding 96% in online mode and often incorporating advanced features like Eco-mode operation to further conserve energy. The adoption of transformer-free designs aligns perfectly with global sustainability mandates and the increasing demand for energy-efficient data center operations. Major applications span across industrial automation, transportation signaling, financial services, and increasingly, edge computing deployments where space constraints and cooling efficiency dictate equipment choice. The inherent scalability and modular nature of many transformer-free UPS systems also facilitate flexible capacity planning for rapidly expanding enterprises.

Driving factors propelling market expansion include the exponential growth in global data traffic, necessitating continuous construction and expansion of data centers, particularly in the Asia Pacific region. Furthermore, stringent regulations focusing on energy consumption and carbon footprint reduction mandate the deployment of high-efficiency power protection infrastructure. The key benefits derived from these systems—namely superior power density, reduced total cost of ownership (TCO) through lower cooling and energy costs, and enhanced reliability due to fewer components prone to mechanical failure—firmly establish transformer-free UPS as the preferred choice for modern mission-critical facilities worldwide. This technological shift represents a critical evolution in power management solutions.

Transformer-Free UPS Market Executive Summary

The Transformer-Free UPS market is currently undergoing significant evolution, driven primarily by robust business trends favoring digitalization and infrastructure modernization. Key business trends indicate a strong move toward modular UPS architectures, allowing organizations to scale power capacity incrementally and minimize upfront capital expenditure. This flexibility is highly valued by hyperscale cloud providers and co-location data center operators. Furthermore, technological innovation focuses heavily on enhancing battery performance, particularly the integration of Lithium-Ion (Li-ion) batteries, which offer superior cycle life, faster charging capabilities, and reduced weight compared to traditional Valve Regulated Lead Acid (VRLA) batteries. The market is also seeing increased competitive intensity centered on providing comprehensive, integrated power management software and advanced predictive maintenance services to maximize uptime and minimize manual intervention, positioning total solution providers favorably.

Regional trends highlight the Asia Pacific (APAC) region, specifically China and India, as the leading growth engine for the market due to massive investments in IT infrastructure, burgeoning smart city projects, and the rapid deployment of 5G networks and associated edge computing facilities. North America and Europe, while mature, maintain high demand due to ongoing data center upgrade cycles and strict energy efficiency standards that favor transformer-free systems. The Middle East and Africa (MEA) exhibit promising growth, fueled by government initiatives aimed at diversifying economies away from oil and gas, thereby stimulating technology adoption in sectors like finance and telecommunications. Regional variation also exists in preference for power rating, with APAC often prioritizing lower and mid-range systems for distributed infrastructure, while North America demands higher kVA ratings for centralized facilities.

Segmentation trends reveal that the service segment, encompassing maintenance, installation, and monitoring, is growing faster than the hardware segment, reflecting the increasing complexity of modern UPS installations and the need for specialized expertise to maintain peak efficiency. By rating, the 10.1 kVA to 100 kVA segment holds the largest market share, serving enterprise data centers and mid-sized industrial applications effectively. However, the >100 kVA segment, crucial for hyperscale deployments, is projected to register the fastest growth rate, fueled by the accelerating consolidation of computing power into fewer, extremely large facilities. End-user segmentation shows that the IT and telecommunications sector remains the dominant consumer, although the healthcare and manufacturing segments are demonstrating robust adoption rates as they transition towards automated, power-sensitive operations, requiring highly reliable, compact power protection.

AI Impact Analysis on Transformer-Free UPS Market

User queries regarding the impact of Artificial Intelligence (AI) on the Transformer-Free UPS market overwhelmingly center on two critical areas: the massive power demands generated by AI infrastructure, particularly GPU clusters, and the potential of AI itself to revolutionize UPS monitoring and maintenance. Users frequently ask about how current UPS systems can handle the intense, fluctuating, and high-density power loads characteristic of AI and machine learning (ML) server racks. They are concerned about the strain placed on power infrastructure and cooling systems by AI accelerators, which push kW per rack density far beyond traditional enterprise levels. The consensus expectation is that the need for incredibly efficient and scalable power solutions will become non-negotiable, directly driving demand for high-kVA, transformer-free modular units that can deliver power precisely and reliably under extreme conditions.

The second major theme relates to utilizing AI and machine learning algorithms to enhance the reliability and longevity of the UPS system itself. Users are keenly interested in predictive maintenance solutions that use AI to analyze real-time operational data, identifying anomalies in battery performance, capacitor degradation, or cooling fan function before they lead to failure. This shift from reactive or preventative maintenance to predictive maintenance is anticipated to drastically improve uptime and reduce the total cost of ownership. Furthermore, AI is expected to optimize energy management strategies within data centers, potentially dynamically adjusting the UPS operating mode (e.g., between online and Eco-mode) based on anticipated load requirements or grid stability forecasts, thereby maximizing efficiency without compromising power quality.

In essence, AI acts as both a significant market accelerator and a technological enhancer. As a driver, AI workloads necessitate higher efficiency and density, favoring transformer-free designs. As a technology, AI integrates into the UPS management layer to provide smarter, more resilient, and self-optimizing power protection. The integration of advanced analytics platforms with UPS telemetry data enables highly sophisticated diagnostics, moving the industry toward 'self-healing' infrastructure. This synergy ensures that transformer-free UPS remains the foundational power solution for the computationally intensive future defined by AI and advanced analytics.

- AI infrastructure drastically increases power density (kW/rack), necessitating the high-efficiency and small footprint of transformer-free UPS.

- Predictive maintenance driven by AI algorithms monitors battery health and component degradation, significantly extending UPS lifespan and reliability.

- AI-powered energy management optimizes UPS operational modes (e.g., Eco-mode activation) in real-time to maximize PUE (Power Usage Effectiveness).

- The rise of edge AI deployments demands rugged, compact, and efficient power solutions, exclusively favoring modular transformer-free systems.

- AI workloads require extremely stable and clean power, reinforcing the market need for double-conversion topology inherent in most transformer-free designs.

DRO & Impact Forces Of Transformer-Free UPS Market

The dynamics of the Transformer-Free UPS market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), all subject to various internal and external Impact Forces. The primary drivers revolve around the global mandate for energy efficiency and the unprecedented expansion of digital infrastructure, particularly data centers and 5G networks. The inherent high efficiency (up to 97%) of transformer-free systems directly translates into massive energy savings and reduced operational expenditure over the system's lifecycle, making them an economically superior choice despite potentially higher initial capital costs. This factor is amplified by governmental and regulatory pressures worldwide to decrease carbon emissions and improve the sustainability of IT operations, creating a continuous upward demand trajectory for these advanced power solutions.

However, the market faces significant restraints, notably the relatively high initial investment cost associated with transformer-free technology compared to older, transformer-based systems, especially in price-sensitive emerging markets. Furthermore, the complexity of the solid-state electronics and the specialized cooling requirements for high-density units necessitate highly skilled personnel for installation, maintenance, and troubleshooting, representing a labor skill gap in certain regions. There is also a persistent concern regarding the market perception of robustness, where traditional systems are sometimes still perceived as more resilient in harsh electrical environments, although modern transformer-free designs have mitigated these concerns significantly through advanced digital controls and robust component selection.

Significant opportunities lie in the rapid proliferation of edge computing, IoT devices, and modular data centers, all of which require compact, scalable, and highly reliable power protection, perfectly aligning with the features of transformer-free technology. The shift toward next-generation battery solutions, such as Li-ion, offers manufacturers opportunities to integrate these batteries seamlessly into modular transformer-free units, creating highly efficient, reduced-footprint solutions that yield lower cooling burdens. Impact forces, such as fluctuating raw material costs (e.g., semiconductors and specialized metals) and geopolitical instability affecting global supply chains, influence manufacturing costs and delivery timelines. Regulatory impact forces, particularly those relating to battery disposal and energy efficiency standards (like the EU's Ecodesign requirements), compel continuous innovation in system design, favoring manufacturers capable of meeting the highest sustainability benchmarks.

- Drivers:

- Stringent energy efficiency regulations and sustainability mandates globally.

- Explosive growth of data center infrastructure, hyperscale facilities, and cloud computing.

- Increasing demand for compact, high-power-density solutions suitable for modern IT environments.

- Lower Total Cost of Ownership (TCO) driven by high operating efficiency (96%+).

- Restraints:

- Higher initial capital expenditure compared to conventional transformer-based systems.

- Dependence on highly skilled technical labor for sophisticated installation and maintenance.

- Supply chain volatility for crucial electronic components (e.g., IGBTs, capacitors).

- Opportunities:

- Expansion into emerging markets adopting new infrastructure standards.

- Integration of advanced energy storage technologies, particularly Lithium-Ion batteries.

- Growth of edge computing and micro data center deployments requiring modular solutions.

- Development of integrated software platforms offering predictive maintenance and optimization.

- Impact Forces:

- Technological advancements in semiconductor power switches increasing performance boundaries.

- Global regulatory landscape shifts regarding PUE and data center emissions.

- Economic cycles influencing IT infrastructure investment decisions globally.

Segmentation Analysis

The Transformer-Free UPS market is segmented based on critical technical and application parameters, providing a detailed view of evolving demand patterns across various industries and power capacity requirements. Key segmentation includes Power Rating, Component, End-User Industry, and Geographic Region. Analyzing these segments helps stakeholders understand which parts of the market offer the highest growth potential and where technological investments should be prioritized. The dominance of the IT and Telecommunications sector underpins the overall market structure, as these industries require uninterrupted, clean power for their core operations, often favoring systems in the high-kVA ranges to support massive computing loads.

Component segmentation highlights the crucial role of the hardware (UPS units) alongside the burgeoning growth of the services segment. As UPS technology becomes increasingly sophisticated, the complexity of installation, commissioning, preventative maintenance, and especially predictive monitoring services has grown exponentially. Companies that offer comprehensive managed services alongside their hardware benefit from recurring revenue streams and deeper customer relationships. This focus on service ensures system reliability and efficiency optimization throughout the product lifecycle, which is a major purchasing criterion for large enterprises.

The segmentation by power rating is critical, revealing distinct market dynamics. While systems rated between 10.1 kVA and 100 kVA currently occupy the largest volume share, catering to traditional enterprise data centers and critical industrial loads, the segment above 100 kVA is experiencing the fastest revenue growth. This rapid expansion is directly linked to the development of hyperscale facilities and co-location centers that demand high-density, centralized power protection. Manufacturers are responding by focusing R&D on achieving even higher efficiency and greater modularity in these very high-power systems, often incorporating advanced liquid-cooling compatibility to handle the resulting heat load efficiently.

- By Power Rating:

- < 10 kVA

- 10.1 kVA - 100 kVA

- > 100 kVA

- By Component:

- UPS Hardware/Units

- Services (Maintenance, Installation, Consulting, Monitoring)

- By End-User Industry:

- IT and Telecommunications (Data Centers, Cloud Services, Network Equipment)

- Healthcare (Hospitals, Diagnostic Centers, Medical Imaging)

- Manufacturing and Industrial (Process Control, Automation)

- Banking, Financial Services, and Insurance (BFSI)

- Retail and Commercial

- Others (Government, Education, Transportation)

- By Topology:

- Modular

- Standalone

Value Chain Analysis For Transformer-Free UPS Market

The value chain for the Transformer-Free UPS market starts with upstream analysis, which involves the sourcing and production of critical components, predominantly high-performance power semiconductors (IGBTs, MOSFETs), specialized high-capacity capacitors, advanced digital signal processors (DSPs), and energy storage solutions (VRLA and Li-ion batteries). Key suppliers in this segment are highly specialized electronics manufacturers located primarily in Asia and Europe. Efficiency, quality control, and the stability of the supply chain for these highly technical components directly impact the final reliability and cost of the UPS unit. Manufacturers often engage in strategic, long-term contracts with semiconductor suppliers to mitigate volatility and ensure a consistent supply of cutting-edge power modules necessary for achieving ultra-high efficiency.

The midstream process is dominated by UPS original equipment manufacturers (OEMs) who focus on advanced R&D, system integration, software development (for monitoring and diagnostics), and final assembly. Differentiation at this stage relies heavily on patented topologies, modular design flexibility, integration capabilities with building management systems (BMS), and the incorporation of features like hot-swappable modules and high-density packaging. Distribution channels are complex, involving both direct sales to major hyperscale clients and indirect channels through value-added resellers (VARs), system integrators (SIs), and specialized electrical distributors who handle smaller enterprise and regional sales. The indirect channel relies heavily on the expertise of these partners to provide localized support and complex installation services.

Downstream analysis focuses on installation, commissioning, and comprehensive lifecycle services delivered to the end-users. Direct interaction is most common with large, sophisticated buyers like major data center operators who often deal directly with manufacturers for custom specifications and global deployment contracts. Conversely, small and medium enterprises (SMEs) and localized applications are usually served by indirect channels, including local electrical contractors and facility management firms. The long-term value in the downstream segment is highly concentrated in maintenance, monitoring contracts, and battery replacement cycles. The increasing sophistication of the product means that the service component of the value chain is growing in importance, often generating more long-term revenue than the initial hardware sale.

Transformer-Free UPS Market Potential Customers

The primary segment of potential customers for the Transformer-Free UPS Market comprises organizations operating mission-critical infrastructure where uninterrupted, clean power is non-negotiable and high operational efficiency is mandated. The leading end-user/buyer group is the IT and Telecommunications sector, specifically hyperscale data center operators (like Google, Amazon, Microsoft), co-location providers, and large enterprises running private cloud environments. These entities prioritize scalability, PUE optimization, and power density, making transformer-free modular UPS solutions the preferred architecture for their massive electrical loads.

The second major cohort includes healthcare institutions, particularly large regional hospitals and specialized medical centers. In these environments, power failures can jeopardize patient safety and disrupt life-saving operations, requiring high-reliability, instantaneous failover systems. Transformer-free UPS units are increasingly adopted in healthcare due to their superior power quality characteristics and smaller physical footprint, which is beneficial in space-constrained hospital facilities. Additionally, the increasing reliance on complex medical imaging equipment and electronic health records (EHR) systems further solidifies their demand for best-in-class power protection.

Furthermore, the BFSI sector (Banking, Financial Services, and Insurance) represents a stable, high-value customer base. Financial transactions, algorithmic trading, and customer data security require constant system availability, often supported by geographically distributed data center hubs. Finally, the Manufacturing and Industrial automation sectors, particularly those involved in continuous process manufacturing (e.g., semiconductors, chemicals), are adopting these units to protect highly sensitive production equipment from voltage dips and power anomalies that could cause significant downtime and material loss. The adoption rate in these industrial segments is accelerating due to the integration of IoT and Industry 4.0 technologies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 10.3 Billion |

| Growth Rate | CAGR 11.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eaton Corporation plc, Schneider Electric SE, Vertiv Group Corp., ABB Ltd., Delta Electronics Inc., Legrand SA, Huawei Technologies Co., Ltd., Riello Elettronica Group, Piller Power Systems GmbH, AEG Power Solutions, Fuji Electric Co., Ltd., Mitsubishi Electric Corporation, Socomec Group S.A., Borri S.p.A., Gamatronic Electronic Industries Ltd., Shenzhen KSTAR Science and Technology Co., Ltd., Cyber Power Systems, Inc., Xiamen Kehua Digital Energy, Active Power (Piller), Toshiba Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Transformer-Free UPS Market Key Technology Landscape

The technological landscape of the Transformer-Free UPS market is dominated by advancements in high-frequency switching technology, particularly the utilization of Insulated Gate Bipolar Transistors (IGBTs) and, increasingly, Wide Bandgap (WBG) semiconductors like Silicon Carbide (SiC) and Gallium Nitride (GaN). These advanced semiconductor materials allow for faster switching speeds, which reduces energy loss, minimizes the size of passive components (like capacitors and inductors), and ultimately results in the higher overall efficiency and power density characteristic of transformer-free designs. The continuous development of these power electronics components is central to improving the overall performance metrics, including transient response and power factor correction capabilities, positioning SiC and GaN as critical future accelerators for this market segment.

Another fundamental technological pillar is the evolution of digital control systems. Modern transformer-free UPS systems rely heavily on high-speed Digital Signal Processors (DSPs) to manage complex tasks such as precise voltage regulation, immediate fault detection, load sharing in parallel systems, and active power factor correction. These digital controls enable features like dynamic Eco-mode operation, which maximizes efficiency under low-load conditions without sacrificing protection, and ensures seamless synchronization between multiple UPS modules in large, modular deployments. The sophistication of these control algorithms directly contributes to the system's resilience against complex load changes and grid anomalies, making them significantly more reliable than older analog-controlled systems.

Furthermore, energy storage innovation is profoundly influencing the technology landscape. The rapid shift from traditional VRLA batteries to Lithium-Ion (Li-ion) battery solutions is a major technological trend. Li-ion batteries offer numerous advantages in terms of reduced weight, higher energy density, longer lifespan (up to 15 years), and improved monitoring capabilities. When paired with transformer-free UPS architecture, they dramatically reduce the physical footprint and complexity of the overall power solution. Manufacturers are also exploring and integrating advanced battery monitoring systems and thermal management solutions optimized for Li-ion, further enhancing safety and operational reliability within high-density data center environments. Future developments also include exploring integration with alternative power sources like fuel cells, requiring UPS systems to accommodate complex DC input integration.

Regional Highlights

The global Transformer-Free UPS market exhibits distinct growth profiles and demand characteristics across key regions, fundamentally driven by varying levels of digital maturity, infrastructure spending, and regional energy efficiency mandates. North America, particularly the United States, remains a key stronghold, characterized by massive investments in hyperscale and co-location data centers. Demand here is focused on high-kVA (>100 kVA), highly modular, and highly efficient systems (often mandated by PUE targets) that are quickly integrating Lithium-Ion batteries. The high concentration of cloud service providers and demanding financial services entities ensures continuous market dominance in terms of technology adoption and average selling price (ASP).

Europe represents a mature but rapidly evolving market, highly focused on regulatory compliance and sustainability. European Union regulations, especially those targeting energy efficiency and carbon emissions (such as the Code of Conduct for Data Centres), strongly favor transformer-free systems due to their superior PUE performance. The market here is characterized by strong demand for standardized, reliable, and often geographically distributed modular UPS solutions. Germany, the UK, and the Nordics are major markets, driven by stringent environmental standards and robust industrial and digital infrastructure investments.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally, propelled by unparalleled urbanization, government-led digitalization initiatives (such as India's Digital India and China's investments in 5G and industrial infrastructure), and the explosive growth of local e-commerce and internet services. While price sensitivity remains a factor in certain countries, the sheer volume of data center and edge computing deployment, particularly in China, Japan, and Southeast Asia, ensures astronomical growth. The demand profile in APAC is diverse, ranging from small modular units for distributed infrastructure to large centralized systems for new hyperscale projects.

Latin America and the Middle East & Africa (MEA) are emerging regions experiencing accelerated growth. Latin America is investing in modernizing telecom networks and expanding local cloud services, driving mid-range UPS demand. The MEA region, notably the GCC countries, is channeling significant capital into developing smart city projects, finance hubs, and diversifying their digital economies, requiring world-class power protection infrastructure. Adoption in these regions is influenced by localized environmental conditions (e.g., high temperatures), favoring robust, high-efficiency systems that minimize cooling requirements.

- North America: Dominant market share fueled by hyperscale data center expansion, early adoption of Li-ion integration, and strict PUE targets.

- Europe: High growth driven by strong regulatory mandates for energy efficiency, leading to rapid replacement of older infrastructure with transformer-free modular units.

- Asia Pacific (APAC): Fastest growing region, characterized by massive greenfield data center projects in China and India, coupled with rapid 5G and edge computing rollouts.

- Latin America: Emerging market with increasing demand in the BFSI and telecommunications sectors as infrastructure modernization accelerates.

- Middle East and Africa (MEA): Growth driven by smart city initiatives, economic diversification efforts, and the development of regional finance and cloud hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Transformer-Free UPS Market.- Eaton Corporation plc

- Schneider Electric SE

- Vertiv Group Corp.

- ABB Ltd.

- Delta Electronics Inc.

- Legrand SA

- Huawei Technologies Co., Ltd.

- Riello Elettronica Group

- Piller Power Systems GmbH

- AEG Power Solutions

- Fuji Electric Co., Ltd.

- Mitsubishi Electric Corporation

- Socomec Group S.A.

- Borri S.p.A.

- Gamatronic Electronic Industries Ltd.

- Shenzhen KSTAR Science and Technology Co., Ltd.

- Cyber Power Systems, Inc.

- Xiamen Kehua Digital Energy

- Active Power (Piller)

- Toshiba Corporation

Frequently Asked Questions

Analyze common user questions about the Transformer-Free UPS market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of transformer-free UPS systems over traditional UPS?

The primary advantage is significantly higher energy efficiency, typically exceeding 96% in double-conversion mode, leading to reduced cooling costs and a much lower Total Cost of Ownership (TCO). Transformer-free designs also offer higher power density and a smaller physical footprint, which is crucial for modern data centers.

How does the integration of Lithium-Ion batteries affect the transformer-free UPS market?

Li-ion batteries enhance the transformer-free UPS offering by providing longer operational life, lighter weight, faster recharge times, and integrated monitoring capabilities. This synergy maximizes efficiency and minimizes the physical space required for backup power, accelerating adoption in hyperscale and edge computing environments.

What kVA power rating segment is experiencing the fastest growth in this market?

The segment covering power ratings greater than 100 kVA (> 100 kVA) is exhibiting the fastest growth rate. This is directly attributable to the global trend toward hyperscale data center construction, which requires extremely large, modular, and highly efficient centralized power protection solutions.

Which end-user industry is the largest consumer of transformer-free UPS solutions?

The IT and Telecommunications sector, encompassing data centers, cloud service providers, and network infrastructure, remains the largest consumer. These industries have the highest demand for continuous system uptime, scalability, and superior power quality, aligning perfectly with the capabilities of transformer-free technology.

How is predictive maintenance influencing the transformer-free UPS service market?

Predictive maintenance, often powered by AI and machine learning analyzing real-time UPS data, is shifting the service market from reactive repairs to proactive health management. This minimizes unplanned downtime, optimizes battery life, and increases overall reliability, making services a critical, high-growth component of the value chain.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager