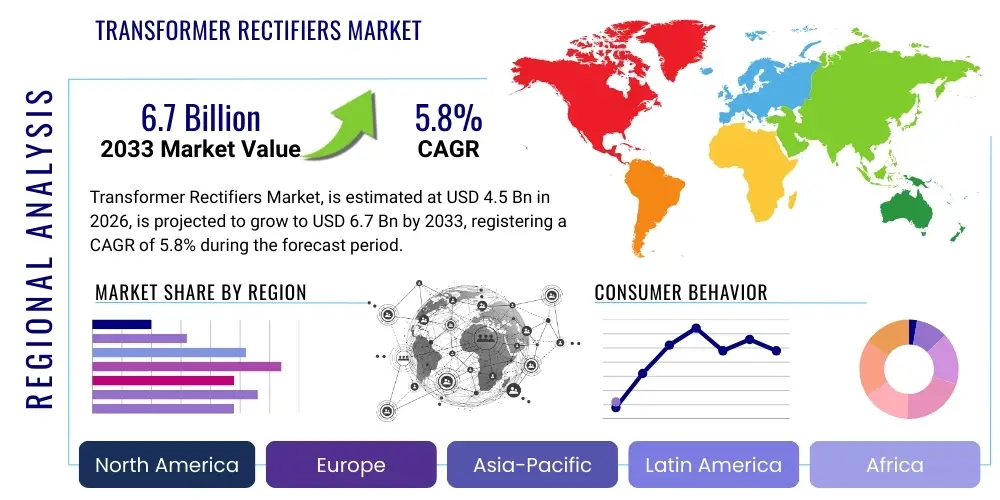

Transformer Rectifiers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436853 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Transformer Rectifiers Market Size

The Transformer Rectifiers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Transformer Rectifiers Market introduction

The Transformer Rectifiers Market encompasses specialized electrical equipment essential for converting high-voltage AC (Alternating Current) power input into controlled low-voltage DC (Direct Current) output. These systems integrate a power transformer for voltage step-down and a rectifier circuit (typically semiconductor diodes or thyristors) for AC/DC conversion. The primary objective is to provide stable, regulated DC power, which is critical for demanding industrial processes where precise voltage and current control are non-negotiable, such as in high-integrity cathodic protection systems used across infrastructure like oil and gas pipelines, storage tanks, and marine facilities. The robustness and reliability of these units under harsh operating conditions drive their adoption across heavy industries.

Transformer Rectifiers are fundamentally engineered products designed to meet rigorous standards for efficiency and durability, particularly in corrosive and remote environments. The product spectrum ranges from small, air-cooled units used for localized protection to massive, oil-cooled systems employed in large-scale industrial electrochemical processes. Major applications span industrial sectors including critical infrastructure protection, where they prevent corrosion; electroplating and metal finishing, where they provide precise DC current density for deposition; and specialized processes like chlor-alkali production and aluminum smelting. The capability to offer highly customized output specifications, including constant current or constant voltage modes, further solidifies their crucial role in the industrial power conversion landscape.

Market growth is predominantly driven by the accelerating global expansion of energy infrastructure, especially long-distance oil and gas transmission pipelines that mandate extensive cathodic protection coverage. Furthermore, stringent regulatory mandates regarding asset integrity and environmental safety compel operators to invest in high-quality, reliable transformer rectifier units to minimize leakage, infrastructure failure, and associated environmental damages. The extended operational lifetime and enhanced efficiency of modern solid-state rectifier designs, coupled with integration capabilities for remote monitoring and diagnostics, provide significant benefits, positioning these devices as indispensable components in the longevity management of large-scale industrial assets.

Transformer Rectifiers Market Executive Summary

The Transformer Rectifiers Market is characterized by steady, infrastructure-driven growth, propelled primarily by global investments in oil, gas, and water infrastructure, alongside the revitalization of industrial manufacturing and metal finishing sectors. Key business trends indicate a shift towards advanced solid-state designs offering higher power density and improved energy efficiency, aligning with global sustainability initiatives and lowering operational expenditure for end-users. Consolidation activities and strategic partnerships focused on expanding service networks, particularly in challenging environments like offshore drilling and remote pipeline routes, are defining competitive strategies. Geographically, Asia Pacific and the Middle East are emerging as the primary growth engines due to massive infrastructure projects and ongoing expansion of energy transmission networks, demanding robust cathodic protection solutions. Manufacturers are increasingly integrating digital monitoring capabilities, enabling predictive maintenance and enhancing asset management efficiency.

Regionally, North America and Europe maintain high maturity, focusing on replacing legacy systems with digitally integrated, highly efficient units, often driven by strict environmental and safety regulations for aging pipeline networks. In contrast, the rapid industrialization and urbanization across countries like China, India, and GCC nations are fueling demand for new installations, particularly oil-cooled and water-cooled units required for large-scale energy projects and specialized processes such as non-ferrous metal production. The market resilience is underpinned by the essential nature of cathodic protection, which is mandatory for maintaining the structural integrity of steel assets exposed to corrosive media, ensuring continuous demand regardless of short-term commodity price fluctuations.

Segment-wise, the Oil Cooled segment holds a significant market share due to its superior heat dissipation capabilities required for high-power applications in harsh environments like deserts or offshore platforms, guaranteeing reliable performance. However, the Air Cooled segment is rapidly expanding in localized industrial applications and urban water infrastructure due to its lower cost and easier maintenance. Applications in Oil & Gas dominate due to the sheer volume and critical nature of pipeline infrastructure, but the Metal Finishing/Electroplating segment is exhibiting faster growth, fueled by the rising demand for sophisticated surface treatment in automotive and electronics manufacturing. The market trajectory is therefore bifurcated: mature markets emphasize digitalization and efficiency, while developing regions prioritize scale and installation volume for new projects.

AI Impact Analysis on Transformer Rectifiers Market

Common user questions regarding the impact of AI on the Transformer Rectifiers Market often center on how these traditionally analog power devices can be integrated into smart infrastructure ecosystems. Users are primarily concerned with whether AI can improve energy efficiency, predict system failures (especially rectifier component degradation), and optimize the DC output parameters based on real-time environmental data (e.g., soil resistivity or moisture levels in pipelines). There is also significant interest in using AI-driven analytics to manage vast networks of distributed cathodic protection systems efficiently across expansive areas, reducing the need for continuous physical site inspections and enhancing compliance reporting accuracy. Key expectations include advanced anomaly detection, automated fault diagnosis, and the transformation of reactive maintenance into predictive operational strategies. The summary suggests users anticipate AI will shift TR units from simple power supplies to intelligent, self-optimizing network endpoints.

The application of Artificial Intelligence within the Transformer Rectifiers Market is predominantly realized through advanced monitoring and control systems (SCADA integration) that leverage machine learning algorithms to analyze large datasets gathered from connected TR units. These algorithms can process electrical parameters, environmental sensors, and historical performance data to establish baseline operational profiles. Deviations from these profiles trigger high-fidelity alerts, significantly enhancing predictive maintenance capabilities. For instance, AI can detect subtle trends in voltage ripple or temperature fluctuations that precede component failure, allowing maintenance teams to intervene proactively, thus minimizing downtime and extending the service life of critical infrastructure components like diodes and internal wiring harnesses. This transformation is shifting maintenance paradigms from scheduled, resource-intensive inspections to condition-based monitoring.

Furthermore, AI algorithms are crucial for optimizing the performance of cathodic protection systems. Corrosion rates are highly dynamic, influenced by factors such as soil moisture, temperature, and microbiological activity. By continuously analyzing these dynamic inputs, AI can adjust the DC output (current and voltage) of the transformer rectifier in real time to maintain optimal protection potential, ensuring maximum asset protection while minimizing excessive power consumption. This intelligent optimization is vital for large pipeline networks where uniform protection levels are challenging to maintain manually. This capability not only results in significant energy savings over the operational life of the pipeline but also ensures stringent adherence to regulatory compliance standards regarding corrosion prevention.

- AI enables predictive failure detection in rectifier components, optimizing maintenance scheduling.

- Machine learning algorithms analyze environmental and electrical data for real-time DC output optimization.

- AI integration enhances remote monitoring and diagnostics (RMD) for large distributed TR networks.

- Automated anomaly detection improves system reliability and reduces the risk of catastrophic infrastructure failure.

- AI facilitates the integration of TR data into broader Digital Twin models for comprehensive asset lifecycle management.

- Advanced analytics support optimized power consumption strategies, leading to higher energy efficiency.

DRO & Impact Forces Of Transformer Rectifiers Market

The Transformer Rectifiers Market is principally driven by non-negotiable regulatory requirements for asset integrity, particularly concerning critical infrastructure such as oil and gas pipelines, marine assets, and large storage tanks where corrosion prevention is mandatory. The continuous expansion of global energy transmission and distribution networks necessitates widespread installation of new cathodic protection systems, serving as a fundamental market driver. However, the market faces significant restraints, primarily stemming from the substantial initial capital expenditure required for high-quality, large-capacity transformer rectifier units, coupled with the extended operational lifespan of existing units which delays replacement cycles. Opportunities abound in the transition towards sustainable infrastructure, focusing on water and wastewater treatment plants requiring robust anti-corrosion solutions, and the emerging need for advanced monitoring features integrated via IoT technologies. The key impact forces include fluctuating raw material costs (especially copper and steel), the increasing emphasis on energy efficiency standards (driving the adoption of high-frequency switching technology), and the evolving geopolitical landscape affecting large-scale energy infrastructure projects.

Drivers are strongly tied to macro-economic development and infrastructure longevity goals. The aging global infrastructure base, particularly in developed economies, necessitates comprehensive refurbishment and retrofitting programs, where modern, high-efficiency TR units replace outdated systems, thereby ensuring compliance with contemporary safety and operational standards. Additionally, the proliferation of large photovoltaic and wind farms requires reliable power electronics for grid integration and power quality management, indirectly boosting demand for similar high-reliability power conversion technologies. The demand cycle is relatively stable because cathodic protection is a continuous operational requirement, not an optional expenditure, guaranteeing a baseline demand floor.

Conversely, significant restraints are related to technological inertia and market fragmentation. While solid-state technology offers high efficiency, the perception of ruggedness associated with older, simpler magnetic rectifier designs often dictates procurement decisions in harsh environments, slowing the adoption of newer, potentially more expensive solutions. Furthermore, the specialized nature of these devices requires highly skilled labor for installation, commissioning, and maintenance, which presents a challenge in remote locations. Opportunities are primarily realized through geographical expansion into high-growth developing markets and strategic diversification into niche applications such as maritime cathodic protection for ships and harbor structures, where high performance in salt-laden environments is critical. The push towards smart grid integration and digitalization represents a long-term opportunity for value creation through enhanced data services.

Segmentation Analysis

The Transformer Rectifiers Market segmentation provides a clear structure for analyzing market dynamics based on technical specifications, application area, and operational capacity. The primary segmentation parameters include Type (based on cooling method: air, oil, water), Output Current capacity (low, medium, high), and critical End-Use Applications (such as oil and gas, marine, chemical processing, and metal finishing). These segments reflect the diverse requirements of end-users, ranging from low-power, localized cathodic protection systems to high-power rectifiers necessary for large electrochemical processing facilities. Understanding these segments is crucial for manufacturers to tailor product specifications, pricing strategies, and regional distribution efforts effectively, ensuring alignment with specific industrial demands and regulatory compliance needs globally.

The dominance of Oil & Gas as an application segment is primarily due to the extensive network of steel pipelines requiring constant protection, making it the largest volume consumer of high-capacity, highly reliable transformer rectifiers, particularly those utilizing oil cooling for thermal stability in remote, high-temperature locations. Concurrently, the increasing stringency of anti-corrosion standards in urban water supply and treatment infrastructure is bolstering the growth of the Water/Wastewater Treatment segment. Technology-wise, the trend is moving towards modular designs and integrated monitoring capabilities across all segments, addressing the universal industry requirement for improved uptime, diagnostic accuracy, and reduced total cost of ownership (TCO).

- By Type: Air Cooled, Oil Cooled, Water Cooled

- By Output Current: Low Current (up to 50 A), Medium Current (50 A to 500 A), High Current (above 500 A)

- By Application: Oil & Gas Pipeline Protection, Marine/Offshore Structures, Water/Wastewater Treatment Plants, Electroplating/Metal Finishing, Chemical Processing & Chlor-Alkali Industry

Value Chain Analysis For Transformer Rectifiers Market

The Value Chain for the Transformer Rectifiers Market begins with upstream activities involving the sourcing of core components, predominantly high-grade electrical steel, copper winding materials, semiconductor devices (diodes, thyristors), and specialized insulating oils. Key upstream suppliers include large steel manufacturers and specialized electronics component providers, who dictate the base cost and quality parameters of the final product. Manufacturers focus on highly technical processes such as core winding, tank fabrication, and the precise assembly and testing of the rectifier circuits. Efficiency in this stage is crucial, as material cost constitutes a significant portion of the total manufacturing cost. Given the specialized requirements, particularly for high-power units, proprietary design and thermal management expertise remain critical differentiators among primary manufacturers.

Downstream activities involve sales, distribution, installation, and after-sales service. Due to the highly technical nature of cathodic protection systems and industrial electroplating processes, direct sales models involving specialized engineering consultation are often favored for complex, high-value projects, ensuring that the transformer rectifier is correctly specified for the application environment (e.g., soil type, required potential). Indirect distribution channels utilize systems integrators, certified cathodic protection contractors, and regional distributors who offer localized inventory and installation services, particularly for standard or low-to-medium capacity units. After-sales service, including periodic maintenance, calibration, and replacement of aging units, is a vital part of the value chain, generating substantial recurring revenue and fostering long-term client relationships crucial for market stability.

The choice between direct and indirect distribution heavily depends on the target application and geographical reach. For large international oil and gas projects, a direct sales approach backed by global service agreements is mandatory. In contrast, smaller industrial applications, such as municipal water systems or localized metal finishing shops, are often served effectively through robust indirect networks. The distribution channel must also handle highly specialized logistics, ensuring the safe transport and on-site delivery of often large and heavy, oil-filled equipment. The most successful market participants integrate both channels, utilizing direct engagement for complex specification and large accounts, while employing indirect partners for market penetration, local support, and streamlined delivery processes for standardized products.

Transformer Rectifiers Market Potential Customers

The potential customer base for the Transformer Rectifiers Market is highly concentrated within industries that manage large metallic infrastructure exposed to corrosive environments, necessitating the implementation of impressed current cathodic protection (ICCP) systems. The primary buyers are large energy producers and midstream operators, specifically those running oil and gas pipelines, refineries, and storage facilities, where structural integrity failure poses catastrophic financial and environmental risks. Furthermore, governmental and municipal authorities responsible for maintaining water transmission pipelines, desalination plants, and waste treatment infrastructure represent a rapidly growing customer segment driven by public safety and environmental protection mandates. These end-users typically require robust, long-life, and remotely monitorable units to manage vast, geographically dispersed assets.

A secondary, yet significant, customer segment includes industrial manufacturers involved in electrochemical processes. This includes the electroplating and metal finishing industry, which requires precise, high-current density DC power for processes like chromium plating, galvanizing, and anodizing to achieve specific surface characteristics for automotive, aerospace, and general industrial parts. Chemical processing plants, particularly those involved in the production of chlorine, caustic soda (chlor-alkali), and aluminum smelting, rely on extremely high-capacity, water-cooled or oil-cooled rectifiers for continuous, energy-intensive operations. These industrial buyers prioritize efficiency, current stability, and customized output profiles over generalized durability.

Finally, the marine and offshore sector constitutes another critical customer segment. Shipyards, offshore drilling platform operators, and owners of specialized maritime assets (e.g., ports and jetties) procure transformer rectifiers for ICCP systems that protect submerged and splash-zone structural elements from rapid saltwater corrosion. These clients demand specialized certifications and products designed to withstand extreme humidity, vibration, and saline environments. Procurement decisions across all these sectors are typically driven by engineering specifications, total cost of ownership (TCO) assessments, and proven reliability track records, rather than simple upfront cost.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB, Siemens, GE, Schneider Electric, Neeltran, Inc., S.V. Electricals, Dynapower, Amerapex, M/S Universal Power Systems, PCE Transformer Rectifiers, Loresco, Cathodic Protection Co. Ltd., Matcor, Inc., Corrotherm International Ltd., ZK Rectifiers, Polytronik. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Transformer Rectifiers Market Key Technology Landscape

The technological landscape of the Transformer Rectifiers Market is evolving from traditional saturable reactor control methods towards advanced solid-state power electronics, which significantly improve conversion efficiency and dynamic control capabilities. Modern units heavily utilize Silicon Controlled Rectifiers (SCRs) or thyristors for precise control of the DC output voltage and current, offering superior linearity and response time compared to mechanical tap changers. A key advancement involves the integration of high-frequency switching technologies, such as Insulated Gate Bipolar Transistors (IGBTs) in some specialized high-efficiency models, moving beyond the traditional 50/60 Hz line frequency design. This shift enables smaller, lighter units with enhanced power density and reduced harmonic distortion, crucial for complying with stringent grid interconnection standards and optimizing space utilization in complex industrial settings.

Thermal management constitutes another vital technological domain, especially for high-current applications. While oil-cooled units (using mineral or synthetic oil) remain the standard for large-scale, harsh environment applications due to their exceptional heat dissipation and insulation properties, advancements in air cooling, incorporating forced convection and optimized heat sink designs, are improving the capacity of air-cooled models for medium-power applications. Furthermore, the increasing adoption of microprocessors and digital signal processors (DSPs) facilitates highly accurate digital control loops, allowing for remote parameter adjustment, sophisticated logging of operational data, and robust self-diagnostic routines. This digital core is essential for integrating TR units into modern IoT and Industry 4.0 frameworks, enabling condition-based monitoring and remote supervisory control over geographically distributed assets, which enhances overall operational reliability.

Material science innovation also plays a critical role, particularly in transformer core construction and protective enclosures. The use of amorphous metal cores, though more expensive, offers significantly lower core losses compared to traditional grain-oriented silicon steel, contributing to overall system efficiency improvement. For protection against severe corrosion in environments like coastal areas or chemical plants, enclosures are increasingly fabricated using advanced protective coatings, stainless steel, or even composite materials, extending the operational life and reducing maintenance requirements. The convergence of power electronics miniaturization, advanced thermal engineering, and robust digital control systems is setting the new benchmark for performance, moving transformer rectifiers into a new era of 'smart' power conversion devices integral to infrastructure asset management and maintenance strategies across all major industrial verticals, particularly in compliance-driven sectors.

Regional Highlights

The market dynamics for Transformer Rectifiers are heavily influenced by regional infrastructure spending, regulatory environments, and the concentration of heavy industry. Each major geographic region exhibits distinct characteristics regarding demand patterns, technological maturity, and application focus.

- North America (NA): Characterized by a mature market focused on replacing and upgrading aging pipeline infrastructure (oil, gas, and water) and adhering to stringent regulatory standards (e.g., DOT mandates). Demand is high for digitally integrated, remotely monitored systems and highly efficient units to manage vast, interconnected networks. The key growth driver is the continuous maintenance and expansion of midstream oil and gas assets and the refurbishment of municipal water systems.

- Europe: This region exhibits a strong focus on high-efficiency, sustainable solutions, often incorporating advanced solid-state designs and emphasizing minimal environmental footprint. Significant demand arises from petrochemical plants and marine/port infrastructure protection. Regulatory harmonization and a push towards renewable energy infrastructure also drive modernization of power electronics, including TR units, though the rate of new pipeline construction is lower than in developing regions.

- Asia Pacific (APAC): This is the fastest-growing region, fueled by massive infrastructure investment, rapid industrialization, and urbanization. Countries like China, India, and Southeast Asian nations are undertaking large-scale pipeline projects, rapid growth in electroplating and metal finishing sectors (especially automotive and electronics), and significant expansion of chemical processing capacity. The demand is high for both standardized, cost-effective units and high-capacity units for large industrial complexes.

- Middle East and Africa (MEA): Growth is primarily concentrated in the Gulf Cooperation Council (GCC) countries, driven by mega energy projects, including new oil and gas pipelines, refineries, and massive desalination plants. The demand is specifically geared towards robust, oil-cooled, and highly reliable units capable of withstanding extreme temperatures and harsh desert environments. Cathodic protection is a non-negotiable requirement for regional energy security.

- Latin America (LATAM): Market growth is steady, concentrated in Brazil, Mexico, and Argentina, tied to investments in oil & gas exploration, mining operations, and associated transportation infrastructure. Economic volatility can occasionally restrain investment, but the fundamental need for asset protection provides consistent underlying demand, particularly from state-owned energy enterprises.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Transformer Rectifiers Market.- ABB

- Siemens

- GE

- Schneider Electric

- Neeltran, Inc.

- S.V. Electricals

- Dynapower

- Amerapex

- M/S Universal Power Systems

- PCE Transformer Rectifiers

- Loresco

- Cathodic Protection Co. Ltd.

- Matcor, Inc.

- Corrotherm International Ltd.

- ZK Rectifiers

- Polytronik

- Thermon

- DEHN Protection

- Canusa-CPS

- Trent Inc.

Frequently Asked Questions

Analyze common user questions about the Transformer Rectifiers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Transformer Rectifier in industrial applications?

The primary function of a Transformer Rectifier (TR) is to convert high-voltage AC (Alternating Current) power input from the grid into controlled, stable low-voltage DC (Direct Current) power output. This DC power is essential for processes requiring precision current supply, most notably Impressed Current Cathodic Protection (ICCP) systems used to prevent corrosion in pipelines and metallic structures, and for electroplating/metal finishing.

Which cooling method segment dominates the market and why is it preferred?

The Oil Cooled segment typically dominates the market, particularly in high-power and harsh environment applications (such as oil and gas pipelines in deserts or offshore platforms). Oil cooling offers superior thermal management, allowing for continuous, reliable operation at high currents and voltages under extreme ambient temperatures, which is critical for long-term asset integrity.

How is digital technology impacting the Transformer Rectifiers Market?

Digital technology is profoundly impacting the market by enabling remote monitoring, control, and diagnostics (RMD) through integrated IoT and SCADA systems. This allows operators to adjust DC output parameters, monitor system health, and predict maintenance needs remotely, enhancing operational efficiency and drastically reducing the downtime associated with physical inspections.

What are the main drivers accelerating the growth of this market?

The main drivers include stringent governmental and international regulations mandating the corrosion protection of critical infrastructure (e.g., energy pipelines and water systems), the continuous global expansion of midstream oil and gas transmission networks, and the requirement to replace aging legacy transformer rectifier units with modern, highly efficient solid-state designs.

What is the Compound Annual Growth Rate (CAGR) projected for the Transformer Rectifiers Market?

The Transformer Rectifiers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between the forecast period of 2026 and 2033. This growth is stabilized by essential maintenance needs and ongoing global infrastructure development, particularly in the APAC and MEA regions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Transformer Rectifiers Market Statistics 2025 Analysis By Application (Aircraft, Cathodic Protection), By Type (Air Cooled Transformer Rectifiers, Oil Cooled Transformer Rectifiers, Water Cooled Transformer Rectifiers), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Dry-Type Transformer Rectifiers Market Statistics 2025 Analysis By Application (Aircraft, Cathodic Protection), By Type (Automatic, Manual, CVCC Controlled), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Air Cooled Transformer Rectifiers Market Statistics 2025 Analysis By Application (Aircraft, Cathodic Protection), By Type (Automatic, Manual, CVCC Controlled), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Oil Cooled Transformer Rectifiers Market Statistics 2025 Analysis By Application (Aircraft, Cathodic Protection), By Type (Automatic, Manual, CVCC Controlled), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager