Translational Regenerative Medicine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431349 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Translational Regenerative Medicine Market Size

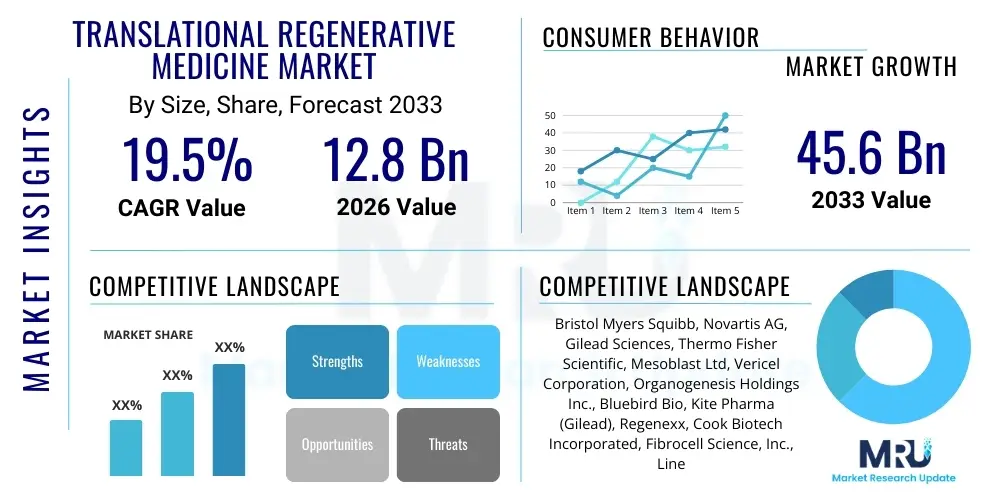

The Translational Regenerative Medicine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 19.5% between 2026 and 2033. The market is estimated at $12.8 Billion in 2026 and is projected to reach $45.6 Billion by the end of the forecast period in 2033.

Translational Regenerative Medicine Market introduction

Translational Regenerative Medicine (TRM) represents the critical nexus where pioneering discoveries in cell biology, molecular genetics, and biomaterials are systematically adapted and moved into practical, clinical applications aimed at repairing, replacing, or regenerating damaged human tissues and organs. This dynamic market is fundamentally focused on shifting medical paradigms from managing chronic symptoms to providing definitive, potentially curative interventions. TRM encompasses a wide array of advanced therapeutic modalities, including sophisticated cell-based therapies like induced pluripotent stem cells (iPSCs) and modified T-cells, highly specific gene therapies utilizing viral and non-viral vectors, and advanced tissue engineering products such as biocompatible scaffolds integrated with biologically active components.

The core promise of TRM lies in its ability to address significant unmet clinical needs across major disease areas, thereby offering profound benefits to patients suffering from conditions historically deemed incurable or requiring complex, often inadequate, surgical procedures. Major applications driving market adoption include oncology (especially CAR-T and TIL therapies), cardiovascular disease (for myocardial repair), musculoskeletal disorders (cartilage and bone regeneration), and neurodegenerative conditions (cell replacement strategies). The immense curative potential offered by these therapies, combined with the growing global burden of age-related and chronic diseases, solidifies the market's strong trajectory.

Driving factors for sustained growth include massive governmental and private sector investments fueling basic and clinical research, particularly in genomics and precision medicine. Furthermore, regulatory agencies across developed economies, such as the FDA and EMA, have established accelerated review pathways (e.g., Regenerative Medicine Advanced Therapy or RMAT designation) designed to expedite the clinical translation of promising regenerative products. These supportive regulatory environments, coupled with breakthroughs in manufacturing scalability and quality control, are crucial in overcoming initial hurdles related to cost and logistical complexity, propelling the market toward widespread clinical integration.

Translational Regenerative Medicine Market Executive Summary

The global Translational Regenerative Medicine market is characterized by intense innovation and rapid commercial scaling, primarily focused on tackling complex chronic diseases. Business trends show a strategic movement towards vertical integration among biotechnology firms, aiming to control the highly sensitive supply chain from raw material sourcing to clinical administration. There is a pronounced business focus on developing allogeneic (off-the-shelf) therapies over autologous (patient-specific) treatments to improve cost-effectiveness and scalability, thereby expanding market access significantly. Furthermore, strategic alliances between large pharmaceutical companies, specialized Contract Development and Manufacturing Organizations (CDMOs), and academic research centers are critical for navigating the challenging regulatory and manufacturing landscape inherent to living therapies.

Regional trends indicate North America currently holds the largest market share, benefiting from robust venture capital funding, cutting-edge research infrastructure, and a well-established regulatory pathway that supports fast-track approvals for novel regenerative products. However, the Asia Pacific (APAC) region is poised for the most rapid expansion, fueled by increasing government investment in biotech, lower operational costs allowing for earlier commercial adoption, and a substantial pool of patients driving clinical trial activity. European markets, while strong in basic research, face fragmentation in regulatory approvals across member states, slightly slowing unified market entry compared to the U.S. and select APAC nations.

Segment trends reveal that Cell Therapy remains the dominant segment by revenue, with significant recent advances in T-cell and mesenchymal stem cell applications. Within this segment, autologous therapies still command high value but allogeneic approaches are gaining volume dominance due to manufacturing efficiencies. Gene Therapy is experiencing accelerated growth, particularly following successful product approvals for rare genetic disorders and oncology targets, though long-term safety and vector immunogenicity remain areas of intensive research. Tissue Engineering and Biomaterials are showing crucial advancements in personalized scaffolding and 3D bioprinting, enabling complex tissue repair strategies and contributing to the maturation of the surgical and orthopedic applications segments.

AI Impact Analysis on Translational Regenerative Medicine Market

User inquiries frequently center on Artificial Intelligence's transformative capacity to de-risk and accelerate the notoriously complex translational pipeline in regenerative medicine, which is often hampered by high variability and low throughput. Users are keen to understand how AI algorithms can effectively manage and interpret the massive, multi-modal datasets generated from genomics, proteomics, single-cell analysis, and high-content imaging—data complexity that exceeds human analytical capabilities. Key themes and expectations involve AI’s role in optimizing crucial upstream processes, specifically automating the screening and identification of potent cell populations or superior biomaterials, thereby streamlining early-stage product development. Concerns often relate to data privacy, algorithmic bias in clinical prediction models, and the necessary regulatory frameworks required for validating AI-driven manufacturing and quality control systems for living therapeutic products.

Furthermore, significant user interest focuses on AI applications in clinical trial efficiency. Regenerative medicine trials are often small, expensive, and difficult to standardize. AI is expected to revolutionize patient stratification, optimizing cohort selection based on deep molecular profiling to ensure higher response rates and targeted therapy delivery, thereby reducing overall trial duration and cost. Predictive modeling, powered by machine learning, is also anticipated to identify potential manufacturing failures or lot-to-lot variations in real-time, allowing for proactive adjustments that ensure product consistency and regulatory compliance—a vital step for large-scale commercialization. The ultimate expectation is that AI serves as a central orchestrator, connecting basic research insights to scalable, reproducible, and personalized therapeutic manufacturing.

The adoption of AI in TRM extends into precision drug delivery and personalized dosing strategies. By analyzing individual patient genetic profiles and disease state biomarkers, AI can determine the optimal cell dosage or vector concentration required for maximum therapeutic effect while minimizing off-target effects. This level of personalization is crucial for maximizing the efficacy and safety of high-value regenerative therapies. The integration of advanced computational models into bioprocessing simulation also promises to dramatically reduce the need for extensive physical experimentation, accelerating scale-up and process validation, which are traditionally major bottlenecks in moving regenerative products from the lab to the clinic.

- AI accelerates biomarker discovery and validation in complex TRM datasets.

- Machine learning optimizes cell culture media formulation and bioprocessing parameters, enhancing scalability.

- Deep learning algorithms improve efficacy prediction and toxicity screening for gene and cell therapies.

- AI facilitates personalized patient stratification for targeted clinical trial enrollment.

- Computer vision systems automate quality control and sterility testing of manufactured cell products.

- Predictive maintenance driven by AI minimizes costly downtime in GMP manufacturing facilities.

DRO & Impact Forces Of Translational Regenerative Medicine Market

The Translational Regenerative Medicine market is primarily driven by the imperative need for curative solutions for chronic, debilitating diseases such as advanced cardiovascular failure, type 1 diabetes, and various cancers that are inadequately managed by current small molecule drugs or surgical interventions. This critical clinical unmet need creates profound market pull, supported by rapidly increasing public awareness and acceptance of cutting-edge cellular and genomic therapies. Strategic financial support, evidenced by robust venture capital inflows and dedicated national research funding schemes, further acts as a powerful driver, pushing novel discoveries through the difficult translational phase. Favorable, streamlined regulatory designations in key markets (e.g., RMAT, PRIME) also substantially accelerate the clinical development cycle, transforming promising research into commercially available treatments more swiftly.

Despite significant tailwinds, the market faces formidable restraints, notably the inherently high cost of personalized, autologous treatments, which necessitates complex reimbursement negotiations and limits widespread patient access, particularly in nascent healthcare systems. Manufacturing scalability represents another severe constraint; ensuring consistent, high-quality production of living biological products under stringent Good Manufacturing Practices (GMP) while maintaining cell viability and potency remains logistically challenging. Additionally, the limited pool of highly specialized clinical professionals capable of administering and managing these complex therapies, coupled with the long-term uncertainty regarding durability and safety for some advanced therapies, necessitates ongoing rigorous pharmacovigilance and specialized infrastructure investment.

Opportunities abound, particularly in leveraging automation and industrialization techniques to mitigate manufacturing bottlenecks, such as adopting closed-system bioreactors and integrating robotics for handling sensitive cellular products, dramatically lowering cost per dose over time. The expansion of applications into high-volume segments like orthopedics, dermatology, and chronic wound healing offers substantial revenue potential, moving beyond rare diseases and specialized oncology. Furthermore, the development of robust, off-the-shelf allogeneic therapies—which require simpler logistics and can be mass-produced—represents a paradigm shift that will significantly broaden the market's reach and profitability. The major impact forces governing the market's direction are regulatory stringency regarding product safety and efficacy, juxtaposed against the patient and provider desire for truly transformative medical breakthroughs.

Segmentation Analysis

The Translational Regenerative Medicine market is meticulously segmented based on the product type, which defines the core technology platform; the therapeutic application, indicating the disease target; and the end-user, specifying the primary purchasing entity. This granular segmentation provides a clear framework for analyzing market dynamics, highlighting areas of rapid investment, and identifying specific bottlenecks in the commercialization pipeline. The complexity of the product segment reflects the diverse scientific approaches utilized in TRM, ranging from highly engineered scaffolds to complex genetically modified living cells. Understanding these segments is crucial for stakeholders to tailor R&D investments and commercial strategies effectively.

The segmentation by application reveals the intense competition and focus within high-burden disease areas where existing treatments fall short, particularly in cancer and degenerative disorders, which demand regenerative and restorative cures. The end-user analysis provides insight into the distribution complexity and infrastructure requirements, showing a reliance on specialized centers of excellence due to the sophisticated handling and administrative needs of these therapies. As the market matures, we anticipate shifts toward decentralized care models and increased adoption by standard hospital networks as production costs decrease and logistical complexities are managed through strategic industry partnerships and technological advancements in cold-chain logistics.

- Product Type

- Cell Therapy

- Autologous

- Allogeneic

- Gene Therapy

- Viral Vectors

- Non-Viral Vectors

- Tissue Engineering & Biomaterials

- Scaffolds (Synthetic, Natural)

- 3D Bioprinting

- Small Molecules & Biologics

- Cell Therapy

- Application

- Oncology

- Cardiovascular Diseases

- Musculoskeletal Disorders (Orthopedics)

- Dermatology & Wound Healing

- Neurology

- Others (Urology, Ophthalmology)

- End-User

- Hospitals & Clinics

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

- Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Translational Regenerative Medicine Market

The value chain for Translational Regenerative Medicine is uniquely intricate, characterized by demanding technical steps and exceptionally stringent regulatory checkpoints compared to conventional drug development. Upstream activities involve intensive discovery research, including identifying novel stem cell sources (e.g., iPSCs, MSCs), developing optimized vectors for gene delivery, and procuring highly specialized raw materials such as GMP-grade culture media, growth factors, and biocompatible polymers. The success of this stage is heavily dependent on academic collaboration and the ability to rapidly validate preclinical efficacy models, ensuring the fundamental biological mechanism holds translational promise before committing significant manufacturing resources.

The midstream stage, dominated by manufacturing and processing, represents the critical bottleneck in the TRM value chain. This phase involves complex processes such as cell isolation, expansion in controlled bioreactors, genetic modification (if applicable), and final formulation under sterile, GMP-compliant conditions. Given the live nature of the products, quality assurance and control (QA/QC) are paramount, involving sophisticated analytical technologies to ensure purity, potency, and absence of contamination. The trend towards outsourcing manufacturing to highly specialized Contract Development and Manufacturing Organizations (CDMOs) is prominent, driven by the need for access to expensive, specialized infrastructure and expertise that few developers possess in-house.

Downstream activities focus on logistics, distribution, clinical administration, and comprehensive patient follow-up. Distribution channels must accommodate ultra-cold chain requirements (-80°C to -196°C) to maintain product viability, necessitating specialized storage facilities, validated transport methods, and highly coordinated logistics providers. Direct distribution is often utilized initially, involving manufacturers delivering directly to major academic medical centers (AMCs) that are certified to handle these products. Indirect channels involve utilizing specialized pharmaceutical distributors equipped with cryogenic handling capabilities. Reimbursement pathways and patient access programs are also critical downstream functions, requiring substantial expertise in health economics and regulatory affairs to ensure market viability and clinical adoption.

Translational Regenerative Medicine Market Potential Customers

The primary consumers and end-users of Translational Regenerative Medicine products are segmented into three distinct categories, each with specific purchasing requirements and consumption patterns that dictate market demand and strategic focus. Hospitals and specialized clinical centers, particularly those designated as Centers of Excellence for oncology, cardiology, and orthopedics, represent the largest and most immediate end-user segment. These institutions integrate regenerative therapies into their standard-of-care protocols, requiring high-throughput, clinically validated products. Their purchasing decisions are heavily influenced by clinical efficacy data, robust safety profiles, established reimbursement codes, and the logistical ease of product preparation and administration within a clinical setting, often involving dedicated staff training and new infrastructure investments.

Academic and governmental research institutes constitute another crucial customer base. While their volume demand for therapeutic doses is lower than clinical centers, they are the primary drivers of demand for enabling technologies and research-grade materials, including specialized cell lines (e.g., iPSCs), viral vectors for research purposes, advanced 3D bioprinters, and high-end analytical equipment used for preclinical validation and process development. Their purchasing power is largely driven by grant funding and institutional priorities in cutting-edge research. These institutes are vital early adopters, often collaborating directly with manufacturers to refine products and generate the initial proof-of-concept data essential for clinical translation, thereby influencing future commercial product specifications and therapeutic targets.

Pharmaceutical and Biotechnology companies, though often producers, also act as significant customers by purchasing critical intermediate components and services. Specifically, small and medium-sized biotech firms heavily rely on Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs) for GMP-compliant manufacturing, preclinical toxicology studies, and complex clinical trial management services. Furthermore, large pharmaceutical companies frequently acquire cell lines, proprietary genetic modification tools, and specialized delivery systems from technology developers to enhance their in-house pipelines. This segment’s demand is driven by the need for speed, compliance, and access to proprietary technological platforms that accelerate the development lifecycle and secure intellectual property advantages in this highly competitive field, demanding services that are both high-quality and fully auditable by regulatory bodies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $12.8 Billion |

| Market Forecast in 2033 | $45.6 Billion |

| Growth Rate | 19.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bristol Myers Squibb, Novartis AG, Gilead Sciences, Thermo Fisher Scientific, Mesoblast Ltd, Vericel Corporation, Organogenesis Holdings Inc., Bluebird Bio, Kite Pharma (Gilead), Regenexx, Cook Biotech Incorporated, Fibrocell Science, Inc., Lineage Cell Therapeutics, Takeda Pharmaceutical Company Limited, MiMedx Group, Orthofix Medical Inc., AlloSource, Bio-Techne Corporation, Advanced Tissues, Celgene (BMS). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Translational Regenerative Medicine Market Key Technology Landscape

The successful translation of regenerative medicine concepts into scalable clinical products relies entirely on a sophisticated and constantly evolving technological infrastructure. At the core of this landscape are high-efficiency cell processing systems, including automated closed-system bioreactors, which are essential for large-scale cell expansion while maintaining stringent sterility and controlling critical quality attributes (CQAs). These systems minimize human intervention, reducing contamination risk and significantly improving the consistency and reproducibility of manufacturing batches, moving TRM closer to industrialization standards. Furthermore, techniques such as magnetic-activated cell sorting (MACS) and fluorescence-activated cell sorting (FACS) are being heavily refined for clinical use to ensure precise isolation and purification of therapeutic cell populations, guaranteeing a high-quality final product free from undesirable cellular contaminants.

The technological arsenal also heavily features advances in gene editing and delivery systems, pivotal for applications in gene therapy and genetically modified cell therapies. Viral vectors, predominantly adeno-associated viruses (AAV) and lentiviruses, remain the gold standard delivery mechanism due to their high transduction efficiency, though research is intensively focused on non-viral methods, such including lipid nanoparticles (LNPs) and electroporation, to enhance safety and reduce immunogenicity. Simultaneously, CRISPR-Cas9 and base editing tools are being optimized for higher specificity and lower off-target effects, enabling the precise correction of genetic defects or the introduction of therapeutic payloads into patient cells, forming the foundation of next-generation personalized medicine strategies.

Finally, technology related to tissue fabrication and structural support is crucial for the tissue engineering segment. Advanced 3D bioprinting technology allows for the precise deposition of cells and biomaterials layer-by-layer, creating complex, functional tissue constructs that mimic native tissue architecture, essential for organ replacement or complex structural repair. Alongside this, the development of novel smart biomaterials—polymers and hydrogels that are bio-resorbable and capable of releasing growth factors in a controlled manner—enhances cell integration and survival post-implantation. These materials provide the necessary mechanical support and biochemical cues to guide the body's natural regenerative processes, marking a significant step toward developing complex, fully functional bioengineered organs for transplantation.

Regional Highlights

North America, particularly the United States, commands the largest market share in Translational Regenerative Medicine, primarily attributable to an exceptionally high concentration of leading biotechnology and pharmaceutical companies, robust governmental funding through institutions like the NIH, and a dynamic venture capital environment highly willing to invest in high-risk, high-reward therapeutic development. The region benefits from the presence of world-class academic research centers and specialized clinical infrastructure necessary for conducting complex phase I and phase II clinical trials for advanced cell and gene therapies. Additionally, the FDA’s sophisticated regulatory framework, including expedited designations like RMAT, provides a clear and competitive advantage, enabling faster market access for novel regenerative products compared to other global regions, solidifying its technological and commercial leadership.

The Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR) over the forecast period, driven by favorable regulatory shifts in countries like South Korea, Japan, and Australia, which are actively prioritizing regenerative medicine as a key area for economic and scientific development. Japan, with its unique regulatory framework allowing conditional approval for certain regenerative therapies, has emerged as a global leader in clinical translation. Furthermore, the immense population size in China and India, coupled with rising healthcare expenditure and the establishment of dedicated stem cell research hubs, ensures a massive patient pool and burgeoning clinical trial activity. Low manufacturing and operational costs further incentivize global players to establish production and research facilities within the region, driving both consumption and innovation.

Europe represents a major market, characterized by strong foundational research excellence, particularly in countries like Germany, the UK, and Switzerland, supported by significant European Union funding for collaborative research projects. However, the commercial landscape faces complexity due to the need for centralized marketing authorization (EMA approval) followed by decentralized health technology assessment (HTA) and reimbursement negotiations within each member state, often resulting in prolonged market entry timelines and variability in patient access. Despite these challenges, strong public healthcare systems ensure a stable market for proven therapies, and advancements in biobanking and standardized clinical protocols across the region are gradually enhancing the efficiency of the translation process for regenerative products.

- North America: Market leader due to pioneering research, high R&D spending, and supportive FDA regulatory pathways (RMAT).

- Asia Pacific (APAC): Fastest growing region, driven by governmental support (especially in Japan and South Korea), medical tourism, and a massive patient population base.

- Europe: Strong basic research foundation and substantial public funding; market access complexity due to fragmented reimbursement policies across EU member states.

- Latin America (LATAM): Emerging market, characterized by lower cost clinical trials and increasing focus on establishing regulatory frameworks for cell-based therapies.

- Middle East and Africa (MEA): Limited adoption, primarily concentrated in specialized private centers in Gulf Cooperation Council (GCC) countries, focusing on highly specialized treatments and medical tourism.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Translational Regenerative Medicine Market.- Bristol Myers Squibb (BMS)

- Novartis AG

- Gilead Sciences, Inc.

- Thermo Fisher Scientific Inc.

- Mesoblast Ltd

- Vericel Corporation

- Organogenesis Holdings Inc.

- Bluebird Bio, Inc.

- Kite Pharma (A Gilead Company)

- Regenexx

- Cook Biotech Incorporated

- Fibrocell Science, Inc.

- Lineage Cell Therapeutics, Inc.

- Takeda Pharmaceutical Company Limited

- MiMedx Group, Inc.

- Orthofix Medical Inc.

- AlloSource

- Bio-Techne Corporation

- Advanced Tissues

- Celgene (A BMS Company)

Frequently Asked Questions

Analyze common user questions about the Translational Regenerative Medicine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Translational Regenerative Medicine market?

The market is primarily driven by the escalating global prevalence of chronic and degenerative diseases, the urgent need for curative rather than palliative treatments, significant advancements in gene editing and cell manufacturing technologies, and supportive regulatory frameworks (like FDA's RMAT designation) accelerating product commercialization.

Which product segment holds the highest revenue share in the Translational Regenerative Medicine market?

The Cell Therapy segment, particularly those utilizing genetically modified T-cells (CAR-T) for oncology and mesenchymal stem cells (MSCs) for orthopedic and cardiovascular applications, currently holds the largest market revenue share, driven by successful clinical outcomes and established commercial products.

What are the key manufacturing challenges restraining market expansion for regenerative therapies?

Major restraints include the difficulty in achieving scalable, cost-effective manufacturing for personalized (autologous) therapies, complex and demanding cold-chain logistics for handling live products, and the stringent regulatory requirements for consistent quality control (QC) and lot-to-lot homogeneity of biological products.

How is Artificial Intelligence (AI) influencing the translational process in regenerative medicine?

AI is critically influencing TRM by accelerating data analysis from complex multi-omics studies, optimizing cell culture parameters to enhance yield and quality, facilitating superior patient selection for clinical trials, and enhancing predictive modeling for manufacturing process validation, thereby reducing time-to-market.

Which geographical region is expected to demonstrate the fastest growth rate in TRM adoption?

The Asia Pacific (APAC) region is anticipated to exhibit the fastest growth, fueled by proactive regulatory reforms in countries like Japan and South Korea, increasing governmental investment in biomedical research, and expanding healthcare infrastructure coupled with a large addressable patient population.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager