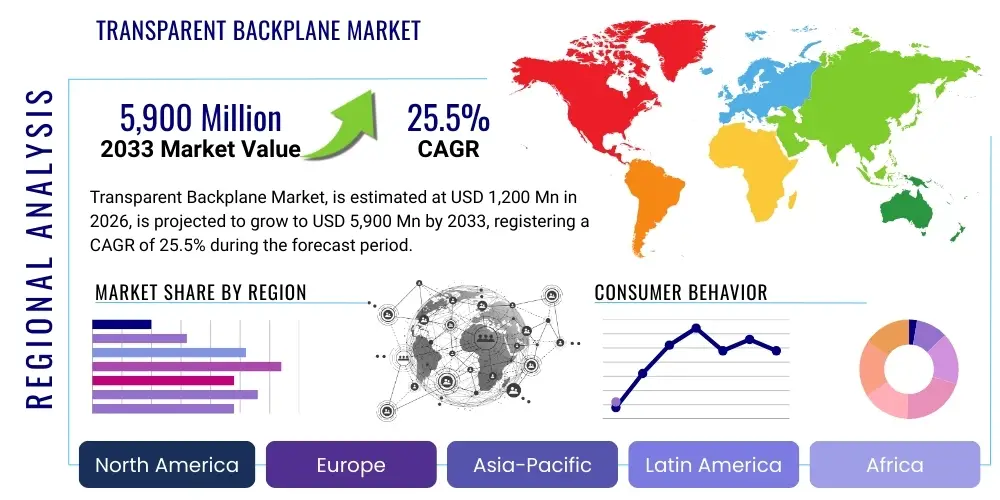

Transparent Backplane Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436964 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Transparent Backplane Market Size

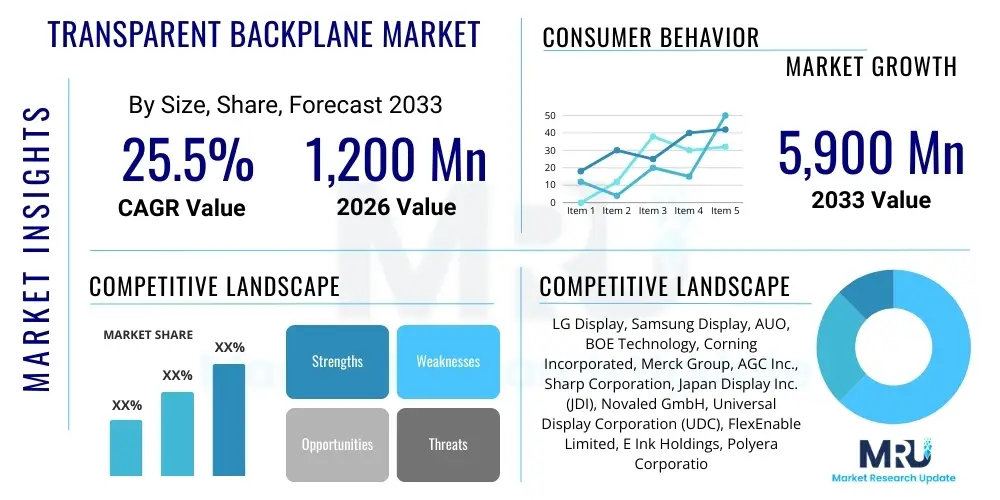

The Transparent Backplane Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 25.5% between 2026 and 2033. The market is estimated at 1,200 Million USD in 2026 and is projected to reach 5,900 Million USD by the end of the forecast period in 2033.

Transparent Backplane Market introduction

The Transparent Backplane Market encompasses the development and integration of components, primarily Thin-Film Transistors (TFTs), deposited on transparent or flexible substrates, essential for driving pixels in advanced display technologies. Unlike traditional opaque backplanes utilizing amorphous or polycrystalline silicon, transparent backplanes leverage materials like Indium Gallium Zinc Oxide (IGZO) or other Oxide TFTs, offering superior electron mobility and transparency. This technological shift is foundational for next-generation devices, including transparent OLED (TOLED) displays, augmented reality (AR) lenses, and smart windows, enabling high-resolution, high refresh rate visuals without obstructing the underlying view.

Major applications driving this market include consumer electronics, particularly smartphones and tablets adopting edge-to-edge transparent screens, and the burgeoning automotive sector integrating transparent displays into windshields for heads-up displays (HUDs) and smart controls. The inherent benefits of transparent backplanes—namely high optical clarity, reduced power consumption, and the potential for flexible or rollable designs—position them as critical enablers for innovation across multiple industries. Furthermore, the technology’s application extends beyond mere display functionality into flexible sensor arrays and transparent photovoltaic cells, significantly broadening its addressable market.

Key driving factors accelerating the market’s expansion include the escalating global demand for augmented reality and mixed reality devices that require high-performance transparent displays, coupled with relentless efforts by display manufacturers to achieve lighter, thinner, and more energy-efficient screens. Increased investment in research and development focused on optimizing deposition techniques, such as atomic layer deposition (ALD) and chemical vapor deposition (CVD), for large-area, defect-free transparent conductors, further solidifies the market trajectory toward widespread commercialization. However, challenges related to yield management and high material costs remain central to achieving mass-market penetration.

Transparent Backplane Market Executive Summary

The Transparent Backplane Market is entering a phase of rapid commercialization, characterized by significant business trends focusing on vertical integration and strategic material partnerships. Leading display manufacturers are aggressively securing long-term supply agreements for key raw materials, specifically high-purity IGZO targets and specialized transparent polymer substrates, to mitigate supply chain risks associated with complex manufacturing processes. Technological advancements, particularly in flexible hybrid electronics and roll-to-roll manufacturing, are lowering the unit cost for medium-sized transparent panels, making them increasingly viable for premium consumer devices and high-end automotive applications.

Regionally, Asia Pacific maintains its dominance, primarily due to the concentration of major display fabrication facilities (fabs) in countries like South Korea, China, and Japan, coupled with substantial government investment in next-generation display technology infrastructure. North America and Europe, while lagging in manufacturing capacity, lead in application development and high-value integration, especially within the AR/VR and defense sectors, driving demand for ultra-high-resolution, specialized transparent backplanes. The competitive landscape is shifting towards intellectual property dominance, particularly concerning the stability and long-term performance of oxide semiconductor materials under varying environmental conditions.

Segment trends indicate a strong pivot towards Oxide TFTs, specifically IGZO, replacing traditional amorphous silicon due to superior mobility necessary for 4K and 8K transparent displays. Application-wise, the Consumer Electronics segment remains the largest revenue contributor, but the Automotive segment exhibits the fastest growth rate, fueled by strict safety regulations and the integration of sophisticated transparent HUDs and panoramic roof displays. Furthermore, the market is seeing increased segmentation based on substrate type, with flexible polymer substrates gaining traction over rigid glass, signifying a clear long-term movement towards fully flexible and conformable transparent electronic devices.

AI Impact Analysis on Transparent Backplane Market

User inquiries frequently center on how Artificial Intelligence (AI) can tackle the persistent manufacturing challenges—specifically high defect rates and material uniformity—inherent in producing large-area transparent backplanes. Common questions explore AI’s role in optimizing the complex deposition and annealing processes required for Oxide TFTs, asking if predictive maintenance and real-time process control enabled by machine learning can significantly enhance yield rates and reduce operational expenditures. There is also substantial interest regarding AI's contribution to material science, particularly the discovery of novel transparent conductive oxides (TCOs) or organic semiconductor alternatives that offer improved conductivity and stability compared to existing IGZO formulations, alongside concerns about the necessary infrastructure and data security implications of integrating AI across sensitive fabrication environments.

The integration of AI and machine learning platforms into the fabrication workflow of transparent backplanes is fundamentally transforming process management and material throughput. AI algorithms are deployed to analyze massive datasets generated by in-line metrology tools, identifying minute process deviations in real-time—such as non-uniformity in thin-film thickness or variations in electron mobility across the substrate—that human operators might overlook. This capability allows for immediate adjustment of parameters like plasma power, gas flow rate, and substrate temperature during the sputtering or deposition phase, leading to a demonstrable reduction in manufacturing variability and a substantial improvement in the overall production yield for high-performance transparent displays.

Beyond process control, AI is a powerful accelerator in materials informatics, simulating the structural and electronic properties of novel transparent semiconductor compounds before costly physical synthesis is required. This drastically shortens the R&D cycle for next-generation backplane materials that must meet stringent transparency, conductivity, and mechanical flexibility standards. Furthermore, AI-driven inspection systems, utilizing computer vision, are becoming standard for quality assurance, rapidly scanning for micro-defects or particle contamination that compromise the optical performance of the transparent panel. These applications ensure that as demand for higher resolution and larger transparent displays increases, the manufacturing complexity does not become an insurmountable barrier to market scaling.

- AI optimizes deposition parameters (temperature, pressure, composition) in real-time, significantly boosting manufacturing yield rates for Oxide TFTs.

- Machine learning facilitates predictive quality control by analyzing sensor data to anticipate and prevent defects related to material non-uniformity and particle contamination.

- AI-driven materials informatics accelerates the discovery and testing of novel Transparent Conductive Oxides (TCOs) with enhanced stability and electrical performance.

- Predictive maintenance systems minimize equipment downtime in fabrication facilities, ensuring high throughput necessary for cost reduction in large-area panels.

- Computer vision systems enable automated, rapid, and ultra-precise defect inspection of finished transparent backplanes, surpassing traditional manual inspection capabilities.

DRO & Impact Forces Of Transparent Backplane Market

The Transparent Backplane Market's trajectory is primarily propelled by the exponential growth in demand for high-end visualization systems across consumer and industrial sectors (Drivers), yet it faces significant headwinds from the capital-intensive nature of advanced fabrication and inherent material limitations (Restraints). However, vast untapped applications in sectors like smart infrastructure and renewable energy present substantial market expansion opportunities (Opportunities). These elements collectively exert powerful impact forces on market adoption, particularly concerning investment cycles, competitive pricing, and the speed of technological substitution within the traditional display industry.

Drivers

The increasing proliferation of Augmented Reality (AR) and Mixed Reality (MR) devices stands as a principal driver for the transparent backplane market. These advanced visualization systems inherently require ultra-high pixel density and high-speed switching capabilities, coupled with complete optical transparency, functionalities that only oxide semiconductor backplanes like IGZO can reliably deliver. As major technology companies heavily invest in creating immersive digital experiences, the underlying demand for lightweight, energy-efficient, and highly responsive transparent display engines solidifies the market’s growth foundation. Furthermore, the push towards integrating these transparent elements into consumer wearables and enterprise training tools necessitates the mass production of reliable, stable backplane components.

A second critical driver is the surging demand from the automotive industry for sophisticated in-car display solutions, moving beyond conventional dashboards to include transparent Heads-Up Displays (HUDs) projected onto windshields and smart panoramic roofs capable of dynamically adjusting opacity. These applications demand backplanes that can function reliably under extreme temperature variations and high solar load while maintaining perfect clarity and rapid switching speeds. The adoption of electric and autonomous vehicles, which prioritize sleek, minimalist, and digitally-integrated interiors, further accelerates the replacement of traditional opaque control surfaces with interactive, transparent displays, significantly broadening the required volume and size range of backplane components.

Finally, the overall trend toward miniaturization and enhanced energy efficiency in portable electronic devices fuels the adoption of transparent backplanes. Oxide TFTs offer significantly higher electron mobility compared to amorphous silicon, allowing for smaller transistor dimensions and reducing the overall power consumption required to maintain high brightness and refresh rates. This energy efficiency is paramount for battery-operated devices, extending operational life and reducing heat generation, thereby making transparent backplanes the preferred choice for premium, slim-profile smartphones, laptops, and flexible electronic devices.

Restraints

The primary restraint facing the market is the exceptionally high manufacturing cost and associated technological complexity of fabricating large-area, defect-free transparent backplanes. Oxide TFT manufacturing requires highly controlled environments and specialized equipment, such as large-area sputtering systems and vacuum processing chambers, which are capital-intensive to install and operate. Achieving high uniformity and stable performance across large glass or flexible polymer substrates presents significant engineering challenges, often resulting in lower yields compared to established silicon-based backplane technologies, which directly translates into higher average selling prices for transparent panels, hindering broad market accessibility.

Another major limiting factor is the inherent material stability of current Transparent Conductive Oxides (TCOs), particularly their vulnerability to degradation under harsh environmental conditions such as high moisture, oxygen ingress, or prolonged exposure to UV light. While significant progress has been made, ensuring the long-term reliability and performance consistency of the conductive layers and active semiconductor films remains a technical hurdle, particularly in applications like outdoor signage or automotive systems. This requirement for complex encapsulation techniques adds further layers of cost and complexity to the manufacturing process.

Furthermore, the reliance on rare earth elements, such as Indium (a key component in IGZO), introduces supply chain volatility and geopolitical risk. Fluctuations in the availability and pricing of these raw materials directly impact the profitability and scalability of transparent backplane production. This dependency drives continuous research into alternative, more abundant materials (e.g., zinc-based oxides or carbon-based transparent conductors), but the technological maturity and performance parity of these alternatives are still lagging, posing a persistent bottleneck until robust, cost-effective substitute materials are widely commercialized and integrated into existing fabrication lines.

Opportunities

A significant opportunity resides in the expanding application of transparent backplanes within smart architectural glass and integrated solar energy solutions. Smart windows, utilizing transparent backplanes to control light filtering, privacy, and thermal regulation, are gaining traction in commercial buildings and residential infrastructure. Integrating these backplanes with transparent photovoltaic technology could allow windows and building facades to generate power while maintaining visual transparency, opening up a massive, largely untapped segment beyond traditional consumer electronics and displays.

The development of fully flexible and stretchable transparent backplanes presents a robust opportunity for revolutionary form factors. Advancements in flexible polymer substrates (like polyimide or PEN) combined with low-temperature processing techniques (LTPS) are enabling the creation of truly rollable displays, electronic textiles, and conformable sensor systems for advanced medical monitoring or industrial robotics. This flexibility moves the technology from fixed devices to ubiquitous computing surfaces, creating entirely new product categories that are currently impossible with rigid display technologies.

Lastly, strategic collaborations between material suppliers, equipment manufacturers, and end-product integrators offer an opportunity for establishing standardized processes and economies of scale. By streamlining the supply chain and jointly investing in next-generation fabrication tools, industry players can collectively accelerate yield improvement and cost reduction. Focused R&D on non-vacuum deposition methods, such as printing and coating techniques, promises to lower the barrier to entry and dramatically reduce the capital expenditure required, potentially unlocking massive scale-up capabilities necessary for widespread market adoption.

Segmentation Analysis

The Transparent Backplane Market is intricately segmented based on technology type, determining performance and fabrication complexity; application, defining the end product functionality; and end-use vertical, identifying the primary market consumer. Analyzing these segments provides a granular view of market dynamics, revealing where investment is flowing and which material science breakthroughs are gaining commercial traction. The segmentation by technology is crucial as it dictates the electron mobility and transparency achievable, directly impacting the display's resolution and efficiency.

The technology segmentation highlights the dominance of Oxide TFTs (specifically IGZO) due to their superior performance characteristics compared to older, less transparent alternatives. However, the application segments illustrate the diversity of product integration, ranging from the demanding visual standards of OLED and MicroLED displays to the specific ruggedness and clarity required for automotive HUDs. Understanding the end-use market ensures that product development aligns with the specific regulatory and durability needs of sectors like Healthcare and Aerospace, which require specialized transparent electronic components beyond standard consumer specifications.

Future growth will largely be driven by the adoption of flexible substrates within the Consumer Electronics and Automotive segments, pushing manufacturers to master low-temperature processing and flexible encapsulation. The convergence of high-performance Oxide TFTs with MicroLED technology promises to unlock ultra-bright, highly transparent displays suitable for high-ambient-light environments, further diversifying the market beyond current OLED limitations. This multi-faceted segmentation structure is essential for strategic planning and targeted marketing efforts within this specialized high-tech market.

- By Technology Type:

- Oxide Thin-Film Transistors (Oxide TFTs, e.g., IGZO)

- Amorphous Silicon Thin-Film Transistors (a-Si TFTs)

- Low-Temperature Polycrystalline Silicon Thin-Film Transistors (LTPS TFTs)

- By Substrate Material:

- Glass Substrates (Rigid)

- Polymer Substrates (Flexible, e.g., Polyimide (PI), PEN)

- By Application:

- Transparent OLED (TOLED) Displays

- MicroLED Displays

- Transparent LCDs

- Flexible and Foldable Displays

- Transparent Sensor Arrays

- By End-Use Vertical:

- Consumer Electronics (Smartphones, AR/VR Headsets, Laptops)

- Automotive (HUDs, Smart Windows, Digital Rearview Mirrors)

- Healthcare (Transparent Monitoring Devices, Diagnostic Tools)

- Aerospace and Defense (Avionics Displays, Specialty Helmets)

- Retail and Advertisement (Transparent Digital Signage)

Value Chain Analysis For Transparent Backplane Market

The Transparent Backplane Value Chain is characterized by intense specialization and high capital expenditure, starting with the complex upstream material sourcing and culminating in the highly specialized downstream integration into end products. Upstream activities involve the extraction and purification of key raw materials, specifically high-purity metals like Indium, Gallium, and Zinc required for Oxide TFTs, alongside the manufacturing of specialized substrates (ultra-thin glass or high-performance flexible polymers). The quality and purity of these materials directly influence the performance and yield of the final backplane, necessitating tight control over the supply chain and strong relationships between material suppliers and component fabricators.

The core manufacturing process, conducted midstream, involves the high-precision deposition and patterning of the transparent semiconductor and conductive layers onto the substrate in cleanroom environments, primarily utilizing advanced techniques such as sputtering, plasma-enhanced chemical vapor deposition (PECVD), and photolithography. Component manufacturers, typically large display panel giants, invest heavily in Generation (Gen) lines dedicated to producing the backplane and integrating it with the front plane (the emissive layer, e.g., OLED or MicroLED). Efficiency at this stage is crucial, as the cost of the backplane component itself represents a substantial portion of the total display module cost, making yield optimization the central focus of operational strategy.

Downstream distribution channels typically involve a mix of direct sales and indirect routes. Direct sales dominate when serving major end-user original equipment manufacturers (OEMs) in the consumer electronics and automotive sectors, ensuring close collaboration for customized specifications and volume delivery. Indirect channels involve specialized display module integrators and distributors who cater to smaller industrial or niche application segments, such as specialized medical devices or industrial machinery. The complexity of the product means that technical support and integration consulting are crucial elements of the distribution phase, distinguishing highly capable suppliers from general component providers in the competitive landscape.

Transparent Backplane Market Potential Customers

The potential customers for transparent backplanes are primarily large Original Equipment Manufacturers (OEMs) and systems integrators operating in highly technologically demanding sectors. The largest customer base resides within the Consumer Electronics sector, specifically major smartphone, laptop, and wearable technology developers like Apple, Samsung, and Huawei, who are continuously seeking innovative display form factors and superior power efficiency for their premium product lines. These customers demand high volume, impeccable uniformity, and cutting-edge specifications to differentiate their offerings in a saturated market, making them the primary drivers for technological advancements in transparent backplanes.

The automotive industry represents another high-growth segment of potential customers, including leading automotive manufacturers (e.g., Mercedes-Benz, BMW, Tesla) and Tier 1 suppliers (e.g., Bosch, Continental). These buyers utilize transparent backplanes for safety-critical applications like windshield-integrated Heads-Up Displays (HUDs) and sophisticated control panels, where durability, thermal stability, and clarity are non-negotiable requirements. The procurement cycles here are longer and require compliance with stringent automotive industry standards (e.g., AEC-Q100), focusing on reliability over a 10-15 year lifespan, leading to specialized backplane requirements.

Emerging markets for transparent backplanes include specialized system integrators serving the Aerospace & Defense industry for helmet-mounted displays and cockpit avionics, and the Medical Technology sector for transparent patient monitoring screens and diagnostic visualization tools. These customers typically require smaller volumes but demand extremely high levels of customization, ruggedization, and regulatory compliance. Furthermore, architectural firms and smart infrastructure developers are becoming target customers, seeking large-area transparent backplanes for integration into dynamic, interactive building facades and smart retail signage.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | 1,200 Million USD |

| Market Forecast in 2033 | 5,900 Million USD |

| Growth Rate | CAGR 25.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LG Display, Samsung Display, AUO, BOE Technology, Corning Incorporated, Merck Group, AGC Inc., Sharp Corporation, Japan Display Inc. (JDI), Novaled GmbH, Universal Display Corporation (UDC), FlexEnable Limited, E Ink Holdings, Polyera Corporation, Applied Materials Inc., Canon Tokki Corporation, Konica Minolta, TDK Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Transparent Backplane Market Key Technology Landscape

The current technological landscape of the Transparent Backplane Market is heavily dominated by advancements in Oxide Thin-Film Transistor (Oxide TFT) technology, primarily utilizing Indium Gallium Zinc Oxide (IGZO) semiconductors. IGZO offers the crucial combination of high electron mobility—essential for driving high-resolution, high refresh rate displays like 4K and 8K transparent OLEDs—and excellent optical transparency, making it the material of choice for next-generation devices. Ongoing research focuses on optimizing the IGZO composition and refining the sputtering and annealing processes to ensure long-term stability and uniformity across increasingly larger substrate areas, addressing the fundamental challenge of scaling production while maintaining performance integrity.

A second pivotal area of innovation is the shift towards flexible substrate materials and low-temperature processing techniques. Traditional glass substrates are being replaced by high-performance transparent polymers, such as Polyimide (PI) and Polyethylene Naphthalate (PEN), to enable the development of flexible, foldable, and rollable transparent displays. This requires the refinement of Low-Temperature Polycrystalline Silicon (LTPS) or specialized low-temperature Oxide TFT processing methods (LT-Oxide), ensuring that the sensitive polymer substrates are not damaged during deposition. The maturity of roll-to-roll (R2R) manufacturing for these flexible substrates is a key technological milestone that will dramatically influence future market scalability and cost reduction.

Furthermore, the development of alternative Transparent Conductive Oxides (TCOs) and novel electrode architectures is critical. While Indium Tin Oxide (ITO) remains the industry standard, its limitations regarding flexibility and cost are pushing research towards alternatives like silver nanowires, carbon nanotubes, and specialized metal meshes that offer superior conductivity and mechanical robustness, particularly for stretchable electronics. The successful integration of these novel transparent conductors with high-mobility Oxide TFTs, combined with advanced thin-film encapsulation (TFE) layers to protect the sensitive components from moisture and oxygen, defines the frontier of current transparent backplane technology development.

Regional Highlights

- Asia Pacific (APAC): APAC is the unequivocal global leader in the Transparent Backplane Market, driven by the massive concentration of Tier 1 display manufacturing capacities (fabs) located predominantly in South Korea, China, and Japan. South Korea, home to LG Display and Samsung Display, pioneered transparent OLED technology, maintaining a lead in high-end panel production and Oxide TFT optimization. China is rapidly catching up, fueled by state investments into companies like BOE Technology and CSOT, focusing heavily on building Gen 8 and Gen 10 lines capable of large-area substrate processing. The region benefits from a robust electronics supply chain ecosystem, lower operating costs, and the largest consumer electronics demand base globally, making it both the primary manufacturing and consumption hub.

- North America: North America holds a leading position in advanced R&D, application development, and high-value integration, particularly within the augmented reality (AR), virtual reality (VR), and specialized defense sectors. Companies like Apple and Microsoft are key drivers, requiring customized, high-specification transparent backplanes for high-definition AR headsets. The region focuses heavily on intellectual property, material science innovation (e.g., flexible polymers, new TCOs), and advanced deposition equipment manufacturing. While actual high-volume panel fabrication is limited, North American firms dictate the technology roadmap and specification requirements for complex, low-volume, high-margin transparent display systems.

- Europe: Europe exhibits strong growth potential, primarily centered on the premium Automotive sector and advanced industrial applications. German automotive giants are early adopters of transparent HUDs and smart glass technologies, driving the demand for highly reliable, thermally stable transparent backplanes suitable for integration into vehicle structures. Furthermore, key European chemical and materials science companies (e.g., Merck) are crucial suppliers of raw materials and encapsulation technologies required for Oxide TFT production. The region also shows strong activity in integrating transparent photovoltaics and smart window solutions into sustainable architecture.

- Latin America (LATAM): The LATAM region represents an emerging market, primarily focused on the importation and integration of finished transparent display products rather than manufacturing. Demand is concentrated in major urban centers for retail signage, high-end commercial displays, and security applications. Growth is steady but dependent on macroeconomic stability and increased foreign investment in infrastructure projects, which drives the need for transparent digital advertisement screens and smart security interfaces.

- Middle East and Africa (MEA): Growth in the MEA region is narrowly focused on wealthy Gulf Cooperation Council (GCC) countries, driven by significant investment in luxury retail, smart cities (e.g., Neom), and large-scale public infrastructure projects. The adoption rate for transparent digital signage and interactive architectural displays is increasing, though technical expertise and component assembly remain highly reliant on imports from APAC and Europe. The challenging climate necessitates transparent backplanes with superior performance in high heat and high dust environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Transparent Backplane Market.- LG Display Co., Ltd.

- Samsung Display Co., Ltd.

- AU Optronics Corp. (AUO)

- BOE Technology Group Co., Ltd.

- Corning Incorporated

- Merck KGaA (Performance Materials)

- AGC Inc.

- Sharp Corporation

- Japan Display Inc. (JDI)

- Novaled GmbH (Samyung SDI subsidiary)

- Universal Display Corporation (UDC)

- FlexEnable Limited

- E Ink Holdings Inc.

- Applied Materials, Inc.

- Veeco Instruments Inc.

- Canon Tokki Corporation

- SK Innovation Co., Ltd.

- TCL China Star Optoelectronics Technology (CSOT)

- Innolux Corporation

- Tokyo Electron Limited (TEL)

Frequently Asked Questions

Analyze common user questions about the Transparent Backplane market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary technological advantages of Transparent Backplanes over traditional display backplanes?

Transparent backplanes, typically utilizing Oxide TFTs (like IGZO), offer significantly higher electron mobility and superior optical clarity compared to amorphous silicon (a-Si). This combination enables higher resolution, faster refresh rates (critical for AR/VR), and drastically improved light transmission, making them ideal for transparent displays and energy-efficient systems.

Which end-use industries are showing the highest growth potential for Transparent Backplanes?

The Automotive sector is projecting the highest growth due to the integration of transparent Heads-Up Displays (HUDs) and smart windows. Consumer Electronics, particularly the manufacturing of sophisticated Augmented Reality (AR) headsets and foldable transparent smartphones, remains the largest revenue segment.

What is the main material used for high-performance transparent backplanes, and why?

The main material is Indium Gallium Zinc Oxide (IGZO). IGZO is an Oxide Thin-Film Transistor (TFT) material known for its high transparency (due to its wide bandgap) and high electron mobility, which allows transistors to switch rapidly and effectively drive high-resolution pixels while remaining nearly invisible.

How is manufacturing complexity restraining the widespread adoption of transparent backplanes?

The manufacturing process requires high-cost, specialized equipment (like large-area sputter deposition systems) and extremely rigorous cleanroom conditions. Achieving uniformity and low defect rates across large substrates is technically challenging, resulting in lower manufacturing yields and higher overall product costs compared to mature opaque backplane technologies.

What role do flexible substrates play in the future of the Transparent Backplane Market?

Flexible polymer substrates (like Polyimide) are essential for enabling next-generation flexible, foldable, and rollable transparent displays. Advances in low-temperature processing techniques are critical to depositing the Oxide TFT layer onto these heat-sensitive flexible materials, paving the way for truly conformable electronic products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager