Transparent Vapor Deposition Packaging Films Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434634 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Transparent Vapor Deposition Packaging Films Market Size

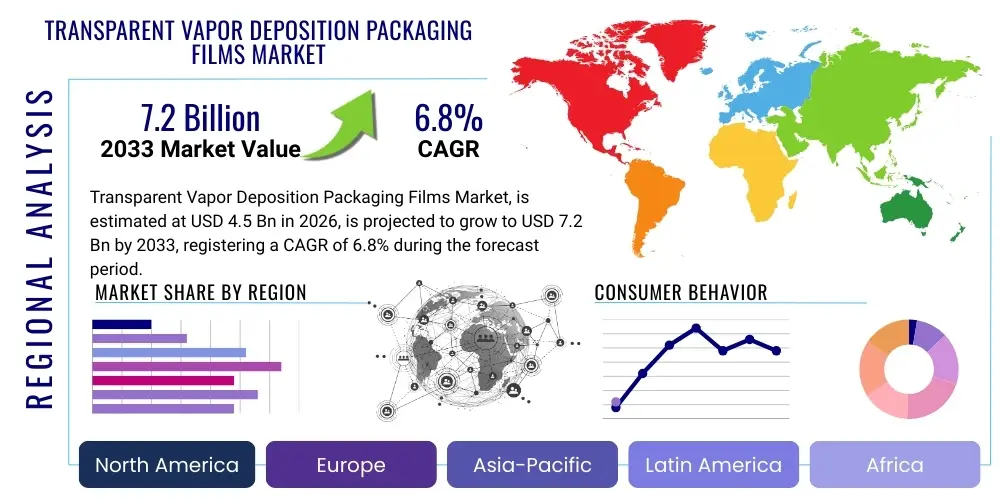

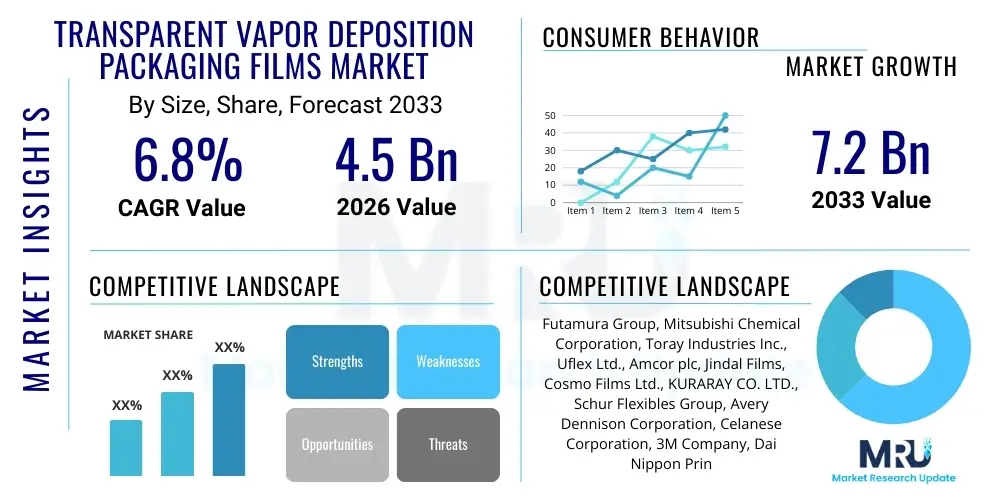

The Transparent Vapor Deposition Packaging Films Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Transparent Vapor Deposition Packaging Films Market introduction

The Transparent Vapor Deposition (TVD) Packaging Films Market encompasses advanced flexible packaging solutions utilizing vacuum deposition technology to apply ultra-thin layers of inorganic oxides, primarily Aluminum Oxide (AlOx) or Silicon Oxide (SiOx), onto polymer substrates like PET, BOPP, and Nylon. These films are distinguished by their exceptional gas and moisture barrier properties, rivaling metallized films and aluminum foil, while maintaining high transparency. This critical combination allows consumers to view the product inside, a highly valued attribute in premium and perishable goods packaging, fulfilling both aesthetic and functional demands for extended shelf life.

These specialized barrier films serve crucial roles across numerous industries, with major applications concentrated in sensitive sectors such as food and beverage, pharmaceuticals, and high-end electronics. In the food sector, TVD films are essential for packaging items sensitive to oxidation and moisture, including processed meats, snacks, coffee, and ready-to-eat meals, thereby minimizing spoilage and food waste. The pharmaceutical industry relies on these films for blister packs and sterile packaging where maintaining the efficacy and integrity of medicinal compounds is paramount, demanding the highest levels of barrier protection and inertness. Furthermore, TVD films are increasingly adopted in cosmetic packaging, leveraging their aesthetic appeal and protective qualities to maintain product freshness.

The primary benefits driving the adoption of TVD films include their superior environmental profile compared to multi-layer structures containing aluminum foil or PVDC, as they are often mono-material and easier to recycle. Key driving factors underpinning market expansion include the surging global demand for packaged, convenient, and safe food products, stringent regulatory pressures advocating for sustainable and recyclable packaging alternatives, and continuous technological advancements in deposition equipment, leading to improved barrier performance and reduced manufacturing costs. The rising consumer preference for transparent packaging that confirms product quality and freshness further solidifies the market’s positive trajectory.

Transparent Vapor Deposition Packaging Films Market Executive Summary

The Transparent Vapor Deposition Packaging Films Market is experiencing robust growth fueled by converging trends in sustainability, food safety, and advanced material science. Business trends indicate a strong shift toward mono-material solutions utilizing AlOx and SiOx coatings, driven by major fast-moving consumer goods (FMCG) corporations committing to 100% recyclable packaging goals by 2030. Strategic collaborations between film manufacturers and deposition technology providers are intensifying, aiming to scale up production capacity and enhance barrier performance consistency, particularly for demanding applications requiring Extended Shelf Life (ESL). Investment flows are concentrated in developing cost-effective high-speed deposition systems that can accommodate wider film widths, optimizing the overall manufacturing efficiency and lowering the barrier to entry for smaller converters.

Regionally, Asia Pacific (APAC) stands as the dominant and fastest-growing market, largely due to rapid urbanization, increasing disposable incomes, and the corresponding shift towards organized retail and packaged foods in countries like China and India. North America and Europe, characterized by mature regulatory environments, are focusing heavily on the sustainable attributes of TVD films, driving demand as alternatives to less recyclable barrier materials. In these Western markets, the pharmaceutical and premium food segments are key demand generators, prioritizing high-performance barriers, while regulatory mandates such as the European Green Deal are accelerating the transition away from complex, multi-material laminates that impede recycling processes. Latin America and MEA are emerging markets exhibiting high potential, correlating with the expansion of local food processing and packaging infrastructure.

Segment trends reveal that the Food & Beverage application segment retains the largest market share, driven primarily by the need for freshness preservation in perishable goods. Within the material segment, Biaxially Oriented Polyethylene Terephthalate (BOPET) is the leading substrate due to its inherent strength and thermal stability, making it ideal for the deposition process. However, Biaxially Oriented Polypropylene (BOPP) and Polyethylene Naphthalate (PEN) films are gaining traction, specifically where lower cost (BOPP) or superior high-temperature performance (PEN) is required. The SiOx coating segment, while currently smaller than AlOx, is projected to witness the highest growth rate, attributed to its ultra-high barrier performance potential, chemical inertness, and superior transparency suitable for sophisticated medical and electronic packaging.

AI Impact Analysis on Transparent Vapor Deposition Packaging Films Market

User queries regarding the impact of AI on the Transparent Vapor Deposition Packaging Films market frequently center on three core themes: predictive quality control, optimization of the vacuum deposition process, and intelligent supply chain management. Users are specifically concerned with how AI-driven machine vision systems can detect microscopic defects in the barrier layer in real-time, drastically reducing waste and improving batch consistency—a critical challenge in ultra-thin film manufacturing. There is also significant interest in leveraging machine learning algorithms to fine-tune complex deposition parameters (such as plasma power, gas flow rates, and web speed) to automatically achieve optimal, uniform barrier properties (e.g., Oxygen Transmission Rate (OTR) and Water Vapor Transmission Rate (WVTR)), which currently relies heavily on expert human intervention.

The application of Artificial Intelligence is poised to revolutionize the operational efficiency and quality assurance within the TVD film manufacturing ecosystem. AI algorithms, integrated with sophisticated inline sensor arrays, can monitor the physical vapor deposition process, identifying subtle correlations between raw material inputs, environmental conditions, and the resulting barrier integrity. This predictive maintenance capability reduces downtime by anticipating equipment failure or required process adjustments before defects manifest, enhancing throughput and reducing operational expenditure. Moreover, AI aids in the rapid development of novel film structures by simulating material interactions and testing hypothetical barrier coating compositions digitally, accelerating R&D cycles for next-generation recyclable high-barrier solutions.

Furthermore, AI-powered systems are crucial for optimizing the complex supply chain of TVD films, which often involves sourcing specialized polymer resins and managing precise manufacturing schedules dictated by just-in-time inventory requirements of major converters. Machine learning models analyze global demand patterns, geopolitical risks affecting raw material availability, and logistics bottlenecks, providing predictive insights for procurement and distribution. This intelligent management ensures the stable supply of high-specification films to demanding sectors like pharmaceuticals, where supply chain reliability is non-negotiable, thereby reinforcing market stability and responsiveness.

- AI integration enhances real-time quality control and defect detection during vapor deposition.

- Machine learning algorithms optimize deposition parameters (pressure, temperature, power) for consistent barrier performance (OTR/WVTR).

- Predictive maintenance driven by AI minimizes machine downtime and maximizes film production throughput.

- AI supports simulation and accelerates R&D for new sustainable, high-performance barrier film formulations.

- Intelligent supply chain management optimizes inventory, forecasts demand, and mitigates risks related to specialized raw materials.

DRO & Impact Forces Of Transparent Vapor Deposition Packaging Films Market

The Transparent Vapor Deposition Packaging Films Market is heavily influenced by dynamic forces, where the powerful push for sustainable packaging acts as the primary driver, urging major brands to replace traditional non-recyclable multi-layer flexible packaging with mono-material TVD alternatives. This demand is restrained, however, by the high initial capital expenditure required for installing sophisticated vacuum deposition machinery and the specialized technical expertise needed to operate these systems effectively and consistently. Significant opportunities arise from the increasing adoption of Silicon Oxide (SiOx) coatings, offering potentially superior barrier properties and thermal stability, enabling market penetration into higher-value electronic and specialized medical device packaging segments. The core impact force is the stringent regulatory landscape surrounding food contact materials and environmental mandates, which directly incentivizes innovation toward highly effective, non-toxic, and circular packaging solutions.

Drivers: A paramount driver is the rising global imperative to reduce plastic waste and enhance packaging circularity. Since TVD films often consist of a single polymer type coated with a minuscule, inert oxide layer, they significantly improve the recyclability profile compared to laminates that rely on difficult-to-separate material combinations (e.g., aluminum foil or complex polymer blends). This inherent recyclability aligns perfectly with corporate sustainability goals and governmental policies globally. Furthermore, the sustained growth in consumer demand for packaged, ready-to-eat, and convenience foods, particularly in fast-developing economies, necessitates packaging that can extend shelf life without compromising product visibility or safety. The superior barrier protection offered by AlOx and SiOx films against oxygen, moisture, and aroma migration is critical for these applications, minimizing product recall risks and food wastage.

Restraints: Despite the benefits, significant restraints limit the market's explosive growth. The primary restraint is the complex and expensive nature of the vacuum deposition process. The initial investment in equipment, particularly high-volume, high-precision coaters, is substantial, creating high entry barriers for smaller players. Secondly, maintaining barrier integrity during downstream conversion processes, such as printing, lamination, and pouch making, remains a technical challenge. Flexing, creasing, or thermal stress can potentially create micro-fissures in the ultra-thin barrier layer, compromising its performance. Ensuring that the barrier properties achieved immediately after deposition are maintained throughout the supply chain requires advanced handling protocols and specialized converting equipment, adding complexity and cost.

Opportunities: Opportunities abound, particularly in exploiting the potential of Silicon Oxide (SiOx) films, which demonstrate superior performance in humid environments compared to AlOx films, making them highly suitable for tropical regions or high-moisture products. Additionally, the growing medical and pharmaceutical packaging sector presents a lucrative niche, demanding chemically inert, highly transparent, and sterilizable barrier films for sophisticated devices and drug delivery systems. Further opportunity lies in developing hybrid barrier technologies that combine plasma-enhanced chemical vapor deposition (PECVD) with atomic layer deposition (ALD) techniques to create multilayer nanoscale structures, promising breakthrough barrier performance at competitive costs. Focusing on bio-based or compostable substrates coated with TVD materials represents a long-term growth avenue aligning with zero-waste targets.

- Drivers:

- Strong consumer and regulatory push for fully recyclable and sustainable packaging solutions.

- Increasing demand for extended shelf life (ESL) packaging for food, reducing waste.

- Preference for product visibility maintained through high transparency films.

- Technological improvements leading to reduced OTR and WVTR values at competitive costs.

- Restraints:

- High capital investment required for sophisticated vacuum deposition equipment.

- Technical difficulty in maintaining barrier integrity during post-coating converting processes (creasing, sealing).

- Relative complexity and specialized operational knowledge required for efficient film production.

- Opportunity:

- Expansion into high-growth, high-value pharmaceutical and specialized electronic device packaging.

- Development of next-generation SiOx coatings offering superior moisture barrier performance.

- Integration of TVD technology with bio-based and compostable polymer substrates.

- Impact Forces:

- Regulatory mandates favoring mono-material structures (Push).

- Price sensitivity of mass-market packaging applications (Pull).

- Continuous innovation in plasma deposition technology (Technology).

Segmentation Analysis

The Transparent Vapor Deposition Packaging Films market is extensively segmented based on material type, coating type, and end-use application, providing a granular view of demand drivers across various industries. Material segmentation is crucial as the choice of substrate (PET, BOPP, PEN) dictates the film’s mechanical strength, thermal characteristics, and recyclability potential, directly influencing its suitability for demanding applications like retort pouches or high-speed flow wrapping. The coatings segment, dominated by Aluminum Oxide (AlOx) and Silicon Oxide (SiOx), defines the barrier efficacy against gases and moisture, with ongoing efforts focused on optimizing these ultra-thin layers to achieve market parity with traditionally superior materials like aluminum foil.

Analysis by end-use application highlights the critical dependency of market growth on the Food & Beverage sector, which demands high volumes of cost-effective, transparent barrier films for product preservation. However, the fastest-growing sectors include pharmaceuticals and specialized electronics, which prioritize ultra-high barrier performance and chemical inertness over cost considerations. Understanding these segmentation nuances is vital for manufacturers to tailor their production capacities and barrier formulations, ensuring compliance with sector-specific requirements, such as FDA approvals for food contact materials or specific sterilization procedures required for medical packaging.

The increasing consumer focus on product freshness and reduced food waste in developed nations reinforces the demand for high-barrier films in the Food & Beverage segment, specifically in premium snack foods and sensitive dairy products. Concurrently, the Materials segment is witnessing a strategic shift towards BOPP films for lower-cost, high-volume applications and PEN films for specialized uses requiring higher temperature resistance, diversifying the market beyond the conventional reliance on BOPET substrates. This market diversification underscores the need for flexible manufacturing capabilities that can efficiently transition between different substrate types based on regional market needs and sustainability targets.

- By Material Type:

- Biaxially Oriented Polyethylene Terephthalate (BOPET)

- Biaxially Oriented Polypropylene (BOPP)

- Polyethylene Naphthalate (PEN)

- Other Substrates (e.g., Nylon, PE)

- By Coating Type:

- Aluminum Oxide (AlOx)

- Silicon Oxide (SiOx)

- Hybrid Oxide Coatings

- By Application:

- Food & Beverage (Snacks, Beverages, Processed Foods, Confectionery)

- Pharmaceuticals and Medical Devices

- Cosmetics and Personal Care

- Electronics and Industrial

Value Chain Analysis For Transparent Vapor Deposition Packaging Films Market

The value chain for Transparent Vapor Deposition Packaging Films is a multi-tiered structure beginning with upstream raw material suppliers and extending through specialized coating processes, film converting, and final distribution to end-users. Upstream activities involve the production of specialized polymer resins (PET, PP, PEN) and the subsequent extrusion and orientation processes conducted by base film manufacturers. This stage is capital intensive, relying on economies of scale to produce films with precise surface characteristics required for high-quality vapor deposition. Suppliers of the source materials for the coating process, such as high-purity aluminum wire or silicon precursors (silanes), form a critical part of the upstream segment, where consistency and purity are non-negotiable for achieving reliable barrier performance.

The middle segment is dominated by the specialized vapor deposition processors, often integrated or semi-integrated with the base film manufacturers. These players invest heavily in high-vacuum coating equipment, which represents the technological core of the value chain. After deposition, the TVD films move to converters, who handle printing, lamination (often to another barrier or sealant layer to create a final structure), slitting, and pouch formation. These converters serve as a vital link, bridging the gap between high-tech film production and diverse, specific end-user packaging formats. The efficiency and quality of this converting stage are crucial, as improper handling can damage the ultra-thin barrier layer, highlighting the interdependence between deposition and conversion specialists.

The downstream distribution channels are categorized into direct sales and indirect distribution networks. Direct sales typically involve large film manufacturers supplying substantial volumes of standard or custom TVD films directly to major FMCG companies or large pharmaceutical packagers. Indirect channels utilize packaging distributors and wholesalers who cater to smaller or regional food processors and brand owners, providing localized inventory and technical support. The choice of channel often depends on the scale and technical complexity of the end-user’s packaging operation. Ensuring traceability and technical support throughout the value chain is paramount, especially considering the sensitivity of the films and the regulatory requirements of the food and medical sectors.

Transparent Vapor Deposition Packaging Films Market Potential Customers

The primary customers and end-users of Transparent Vapor Deposition Packaging Films span sectors that prioritize product freshness, shelf life extension, and clear product visibility, coupled with a strong emphasis on sustainable packaging attributes. The largest cohort of potential customers resides within the Food & Beverage industry, encompassing multinational snack producers requiring extended moisture barriers, coffee roasters needing oxygen protection, and manufacturers of processed foods that utilize retort or pasteurization processes, demanding films with high thermal stability and superior barrier properties. These customers are driven by brand reputation, regulatory compliance related to food safety, and the imperative to minimize product spoilage across complex distribution networks.

A second major segment comprises the Pharmaceutical and Medical Device manufacturers. These entities represent high-value customers who require the utmost chemical inertness, barrier performance, and transparency for packaging sensitive drugs, biologicals, and sterile instruments. TVD films, particularly SiOx-coated variants, are increasingly sought after due to their non-toxic nature, sterilizability, and ability to withstand aggressive environments, often replacing specialized barrier plastics or aluminum foil in blister packaging and specialized pouches. For these customers, supply chain reliability and regulatory dossiers demonstrating film compliance are essential purchase criteria.

Furthermore, cosmetics and high-end electronics manufacturers constitute emerging potential customer groups. Cosmetics companies leverage the aesthetic transparency and premium feel of TVD films while utilizing their barrier properties to preserve volatile active ingredients in skincare and beauty products. In the electronics sector, TVD films are applied in specialized flexible circuits and display packaging where moisture and oxygen must be excluded entirely to prevent device degradation. These customers typically demand custom specifications and smaller batch sizes but are willing to pay a premium for exceptional technical performance and material purity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Futamura Group, Mitsubishi Chemical Corporation, Toray Industries Inc., Uflex Ltd., Amcor plc, Jindal Films, Cosmo Films Ltd., KURARAY CO. LTD., Schur Flexibles Group, Avery Dennison Corporation, Celanese Corporation, 3M Company, Dai Nippon Printing Co. Ltd., Sieyuan Electronic Co. Ltd., Polyplex Corporation, SIBUR Holding, Korozo Packaging, Borealis AG, Klöckner Pentaplast, TC Transcontinental. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Transparent Vapor Deposition Packaging Films Market Key Technology Landscape

The Transparent Vapor Deposition Packaging Films market is defined by several core technologies centered around the deposition process and film production. The foundational technology involves Physical Vapor Deposition (PVD), specifically thermal evaporation and sputtering, which are used to generate the inorganic barrier materials (AlOx or SiOx). Thermal evaporation, often utilizing boat evaporation systems, is widely used for aluminum oxide coating due to its relatively high deposition rates and established industrial footprint, providing a cost-effective method for achieving moderate-to-high barrier levels suitable for most food applications. The refinement of these PVD systems, particularly focusing on optimizing vacuum levels and ensuring uniform plasma distribution across wide webs, is a continuous area of technological investment aimed at enhancing barrier consistency and reducing pinhole defects.

A key area of technological evolution is the shift towards plasma-enhanced chemical vapor deposition (PECVD) for Silicon Oxide (SiOx) coatings. PECVD allows for the deposition of dense, highly cross-linked SiOx layers at lower substrate temperatures compared to traditional PVD, which is critical for heat-sensitive polymer substrates like BOPP. This technology is vital for producing ultra-high barrier films required in pharmaceutical and sensitive electronic applications, where the tolerance for oxygen or moisture ingress is near zero. Advances in precursor chemistry, specifically using environmentally safer silane compounds, and the design of novel plasma sources (e.g., atmospheric plasma deposition) are continually pushing the boundaries of achievable barrier performance while also addressing sustainability concerns regarding manufacturing inputs.

Beyond the core deposition process, supporting technologies are essential for market advancement. These include high-resolution inline barrier measurement systems, such as non-contact optical sensors and advanced spectroscopy tools, which provide real-time monitoring of OTR and WVTR during production. Furthermore, the development of specialized polymer surface treatments, like pre-treatment plasma etching or primer layers, is crucial for improving the adhesion of the vapor-deposited barrier layer to the base polymer, thereby enhancing the film’s mechanical durability during converting processes. Finally, advancements in co-extrusion and sequential orientation lines that can handle the specific thermal and mechanical requirements of the underlying substrate films are integral to supporting the efficient production of high-quality TVD films at an industrial scale.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global TVD packaging films market, primarily driven by demographic shifts, rapid economic expansion, and the subsequent growth of the organized retail and food processing sectors in China, India, and Southeast Asian nations. The region’s immense population and rapidly increasing consumption of packaged convenience foods necessitate robust, cost-effective packaging solutions. While cost sensitivity remains high, the increasing awareness regarding food safety and the adoption of Western-style sustainable packaging targets are accelerating the demand for recyclable AlOx and SiOx films, making APAC the fastest-growing market globally for both production and consumption.

- North America: North America is a mature market characterized by stringent food safety regulations and a high consumer willingness to pay for premium packaged goods, particularly health-focused and organic products. The demand here is primarily driven by major food and beverage corporations fulfilling ambitious sustainability pledges, pushing for the rapid replacement of conventional multi-material packaging with recyclable transparent barrier alternatives. Innovation adoption, particularly in SiOx technology for pharmaceutical blister packs and high-end barrier applications, is swift, supported by a strong domestic converting infrastructure and significant R&D investments.

- Europe: Europe is defined by its proactive regulatory environment, notably the focus on achieving a circular economy through policies like the European Green Deal. This legislative pressure strongly mandates enhanced material recyclability, providing a significant competitive advantage for mono-material TVD films over complex laminates. Demand centers around replacing traditional PVDC-coated films and developing flexible packaging that can pass rigorous recycling stream tests. Germany, Italy, and the UK are key regional markets, heavily investing in high-precision deposition technology to serve premium food, cosmetic, and medical packaging segments.

- Latin America (LATAM): LATAM represents an emerging market where growth is intrinsically linked to infrastructure development in food processing and cold chain logistics. Countries like Brazil and Mexico are witnessing increased demand for films that protect products in challenging climates. While cost remains a determinant, the need to reduce food waste and the gradual adoption of global sustainability standards by international corporations operating locally are fostering steady growth for TVD films, initially focused on basic AlOx-coated PET films.

- Middle East and Africa (MEA): The MEA region exhibits specialized demand patterns, influenced by high ambient temperatures and humidity in certain areas, necessitating excellent moisture barrier performance. The focus in the Middle East is often on high-quality, transparent packaging for imported or high-end domestic products, while Africa’s growth is nascent but accelerating due to urbanization and the expansion of local packaging industries. Regional investments in food manufacturing hubs are expected to gradually increase the reliance on advanced transparent barrier films to ensure product integrity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Transparent Vapor Deposition Packaging Films Market.- Futamura Group

- Mitsubishi Chemical Corporation

- Toray Industries Inc.

- Uflex Ltd.

- Amcor plc

- Jindal Films

- Cosmo Films Ltd.

- KURARAY CO. LTD.

- Schur Flexibles Group

- Avery Dennison Corporation

- Celanese Corporation

- 3M Company

- Dai Nippon Printing Co. Ltd. (DNP)

- Sieyuan Electronic Co. Ltd.

- Polyplex Corporation Ltd.

- SIBUR Holding

- Korozo Packaging

- Klöckner Pentaplast

- TC Transcontinental

- Borealis AG

Frequently Asked Questions

Analyze common user questions about the Transparent Vapor Deposition Packaging Films market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Transparent Vapor Deposition (TVD) films over traditional barrier packaging?

TVD films offer superior gas and moisture barrier properties comparable to aluminum foil while maintaining high transparency, allowing product visibility. Crucially, they are often mono-material structures (e.g., AlOx on PET) which significantly enhances their recyclability compared to complex multi-layer laminates, aligning with circular economy objectives.

How do AlOx coatings compare to SiOx coatings in barrier packaging applications?

Aluminum Oxide (AlOx) coatings are widely used, offering cost-effective, good-to-high barrier performance and high transparency. Silicon Oxide (SiOx) coatings generally provide ultra-high barrier properties, superior moisture resistance, and better thermal stability, making them preferred for high-value applications like pharmaceuticals and electronics, despite typically having a higher production cost.

Is the transparent vapor deposition packaging film market sustainable?

Yes, TVD films are considered a highly sustainable solution. They enable the substitution of non-recyclable multi-material pouches and aluminum foil laminates with recyclable mono-material structures. The ultra-thin nature of the oxide layer (often less than 100 nm) does not typically impede the recycling process of the underlying polymer substrate (PET or BOPP).

Which end-use industry drives the largest demand for TVD packaging films?

The Food & Beverage industry accounts for the largest share of demand, driven by the massive requirement for extended shelf life, especially for snacks, processed foods, and beverages, coupled with the rising consumer preference for viewing the product before purchase.

What major technical challenges are associated with manufacturing TVD films?

The main technical challenges involve maintaining the consistency and integrity of the ultra-thin barrier layer. Ensuring the barrier is uniform across the entire film web and preventing micro-fissures or pinholes during high-speed coating, printing, and converting processes requires highly precise equipment and specialized quality control measures.

How does the use of AI enhance the production process of TVD films?

AI improves production by integrating with inline sensors to enable real-time quality control, automatically detecting microscopic barrier defects. Machine learning optimizes complex vacuum deposition parameters, ensuring consistent oxygen and moisture barrier rates (OTR/WVTR), thereby minimizing waste and maximizing throughput efficiency.

What role does Biaxially Oriented Polypropylene (BOPP) play in the TVD films segment?

BOPP is increasingly important as a substrate due to its lower cost and excellent sealing properties. While historically more challenging to coat than PET, advancements in plasma surface treatment and SiOx technology are making TVD BOPP a viable, cost-effective, and highly recyclable option for medium-barrier, high-volume snack and confectionery applications.

What are the investment requirements for entering the transparent vapor deposition films market?

Entry into this market requires significant capital investment, primarily dedicated to acquiring sophisticated, large-scale vacuum deposition coating equipment. Beyond equipment, substantial investment is needed in specialized R&D, technical expertise for process optimization, and stringent quality assurance systems to meet high-performance barrier specifications.

Which region shows the highest growth potential for TVD film consumption?

Asia Pacific (APAC), particularly driven by China and India, exhibits the highest growth potential. This is attributed to rapid urbanization, expanding middle classes, increased consumption of packaged goods, and growing regulatory pressure to adopt more sustainable packaging solutions across the region.

Are TVD films suitable for retort packaging applications?

Some specialized TVD films, particularly those using PEN substrates or optimized SiOx coatings that offer enhanced thermal resistance, are being developed and adopted for retort applications. Their suitability depends heavily on maintaining the barrier integrity under high temperature and pressure conditions typical of sterilization processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager