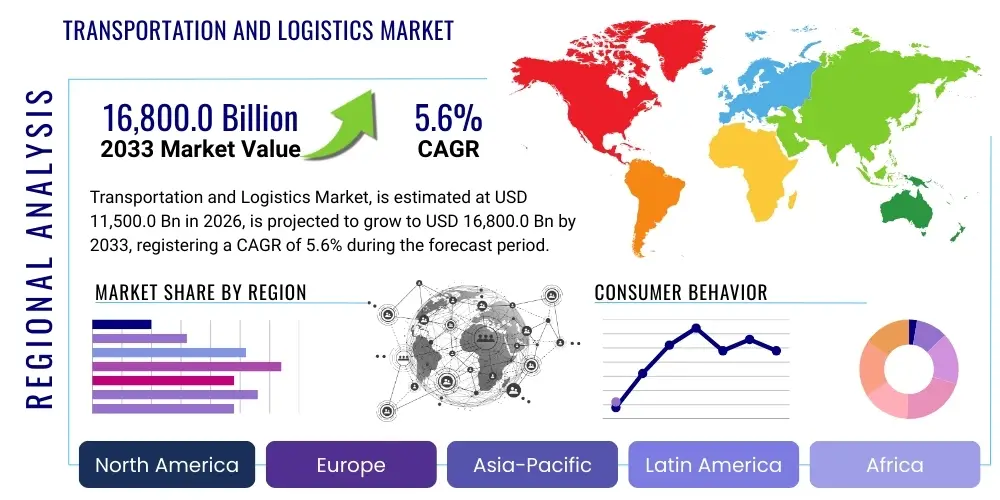

Transportation and Logistics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437710 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Transportation and Logistics Market Size

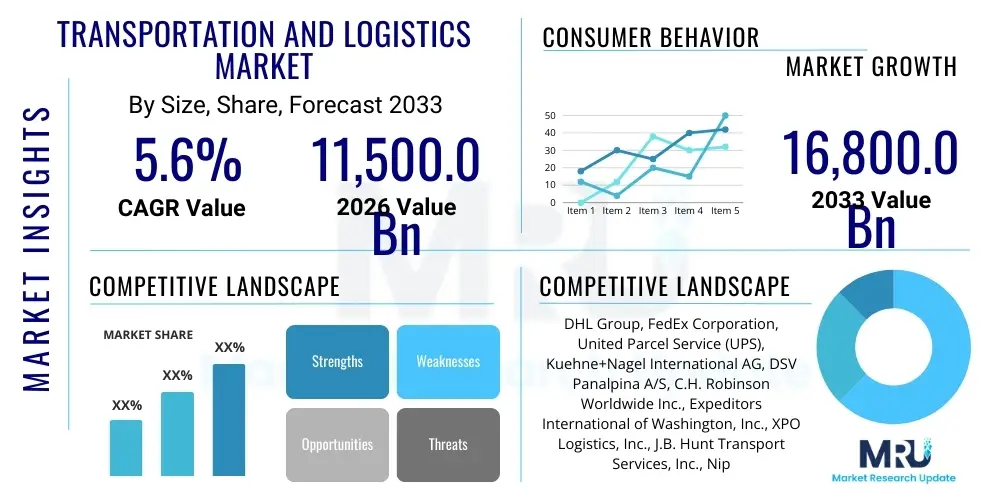

The Transportation and Logistics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.6% between 2026 and 2033. The market is estimated at USD 11,500.0 Billion in 2026 and is projected to reach USD 16,800.0 Billion by the end of the forecast period in 2033.

Transportation and Logistics Market introduction

The Transportation and Logistics Market encompasses a vast array of services crucial for the global movement, storage, and flow of goods, spanning across all modes including road, rail, air, and sea freight. This essential sector provides the backbone for international trade and commerce, facilitating complex supply chain operations from raw material procurement to final product delivery (last-mile logistics). Key product offerings within this market include freight forwarding, warehousing and storage, courier and express delivery services, and various value-added services such as customs brokerage, supply chain consulting, and specialized transport solutions like cold chain management. The integration of advanced technological solutions, particularly in supply chain visibility and optimization, is rapidly redefining service standards and operational efficiencies across the industry.

Major applications of transportation and logistics services are diverse, catering to virtually every industry vertical globally. Sectors such as manufacturing (including automotive and heavy machinery), retail and e-commerce, healthcare and pharmaceuticals, and food and beverage rely heavily on efficient logistical networks. The primary benefits derived from robust logistics systems include reduced inventory costs, improved delivery speed, enhanced supply chain resilience against disruptions, and greater efficiency in resource allocation. Effective logistics management is paramount for maintaining competitive advantage and meeting increasingly stringent consumer demands for rapid and reliable fulfillment.

Driving factors for the market's expansion are fundamentally linked to globalization trends, the explosive growth of e-commerce necessitating advanced last-mile infrastructure, and the increasing complexity of global supply chains which demands sophisticated third-party logistics (3PL) solutions. Furthermore, government investments in infrastructure development (ports, roads, railways) across emerging economies, coupled with a growing focus on sustainable and green logistics practices, are creating significant momentum. The necessity for real-time tracking, risk management, and predictive analytics in increasingly volatile global environments further fuels demand for advanced logistics services.

Transportation and Logistics Market Executive Summary

The global Transportation and Logistics market is characterized by accelerating digitalization and a strong pivot toward resilience following recent geopolitical and health crises. Business trends indicate significant consolidation among larger 3PL providers aiming for comprehensive global reach and specialized service portfolios, particularly in highly regulated sectors like pharmaceuticals and specialized goods transport. Key strategic shifts include the widespread adoption of automation in warehousing, the deployment of advanced fleet management systems using IoT, and a robust focus on integrating end-to-end visibility platforms that utilize cloud computing. Companies are heavily investing in green logistics solutions, including alternative fuel vehicles and optimized routing, driven by corporate sustainability goals and mounting regulatory pressures globally.

Regional trends reveal that the Asia Pacific (APAC) region continues to dominate market growth, primarily fueled by massive e-commerce penetration in countries like China and India, coupled with ongoing infrastructural investment supporting manufacturing and export hubs. North America and Europe, while mature markets, are leading the charge in technological innovation, particularly in autonomous vehicle testing, drone delivery applications, and establishing highly automated fulfillment centers. Emerging markets in Latin America and the Middle East and Africa (MEA) are seeing rapid growth driven by urbanization, expanding trade routes, and efforts to diversify economies, which necessitates modernizing existing logistics infrastructure and enhancing cross-border capabilities.

Segment trends demonstrate a pronounced shift toward asset-light models, where technology and managed services drive value rather than pure asset ownership. The express and parcel delivery segment is experiencing the highest growth rate due to e-commerce dynamics, putting immense pressure on last-mile efficiencies. Furthermore, the specialized logistics sub-segment, including cold chain and hazardous material handling, is growing significantly faster than general cargo, reflecting the increasing complexity and value of goods being transported globally. Intermodal transport solutions are gaining traction globally, providing a balance of cost-efficiency and reduced environmental impact, optimizing the use of rail and sea networks in conjunction with road transport.

AI Impact Analysis on Transportation and Logistics Market

User inquiries regarding Artificial Intelligence (AI) in logistics predominantly center on three core themes: its practical application in optimizing complex operations, the potential for autonomous decision-making in real-time supply chain management, and the expected impact on labor dynamics. Users frequently ask about how AI can improve route planning, reduce fuel consumption through predictive maintenance, and enhance demand forecasting accuracy to minimize inventory holding costs. Significant concerns relate to the initial investment required for AI infrastructure, data security implications associated with utilizing vast datasets, and the necessity for skilled talent capable of managing and interpreting AI-driven insights. Overall, the expectation is that AI will be the central catalyst for achieving hyper-efficiency, true supply chain resilience, and a competitive edge through optimized resource deployment and reduced human error across the entire logistics lifecycle.

- AI-Powered Predictive Maintenance: Reduces vehicle downtime and operational costs by forecasting equipment failures based on real-time telematics data and historical performance trends.

- Optimized Route Planning: Utilizes machine learning algorithms to dynamically adjust delivery routes in real time, accounting for traffic, weather, and delivery window constraints, significantly improving efficiency.

- Demand Forecasting Accuracy: Improves inventory management and warehousing operations by analyzing vast datasets (seasonal trends, promotions, external events) to predict future demand with higher precision.

- Autonomous Warehouse Management: AI drives robotic systems and automated storage and retrieval systems (AS/RS), enhancing throughput, accuracy, and labor productivity in fulfillment centers.

- Fraud Detection and Risk Management: Analyzes transaction patterns and shipment data to identify and flag potential security breaches, cargo theft risks, and regulatory compliance issues.

- Natural Language Processing (NLP) in Customer Service: Automates customer interactions, tracking inquiries, and query resolution, providing instant support and reducing the workload on human agents.

- Algorithmic Pricing and Yield Management: Determines optimal pricing strategies for freight capacity based on fluctuating market supply, demand, capacity utilization, and competitive analysis.

- Enhanced Supply Chain Visibility: Creates digital twins of the supply chain, allowing AI to simulate disruption scenarios and recommend proactive mitigation strategies, fostering resilience.

DRO & Impact Forces Of Transportation and Logistics Market

The market dynamics are shaped by a complex interplay of growth accelerators (Drivers), operational hurdles (Restraints), emerging avenues for expansion (Opportunities), and overarching external pressures (Impact Forces). The primary Drivers fueling the sector include the sustained growth of global trade volumes, catalyzed by robust cross-border e-commerce activity, and the pervasive requirement for increased efficiency and transparency across fragmented supply chains. Conversely, key Restraints involve acute infrastructural bottlenecks, particularly in port capacity and road congestion in highly developed urban areas, compounded by significant labor shortages (truck drivers, warehouse personnel) and high volatility in fuel prices, which directly impacts operational margins. Opportunities are vast, driven by the digital transformation wave, particularly in adopting IoT for enhanced tracking, the rollout of 5G connectivity enabling real-time data exchange, and the strategic focus on building sustainable, decarbonized logistics pathways through regulatory incentives and corporate mandates.

Impact Forces exert external pressure on market participants, dictating strategic priorities and operational frameworks. Geopolitical volatility, including trade wars and sanctions, forces companies to rapidly restructure supply chain networks, prioritizing diversification and regionalization (reshoring or nearshoring) over purely low-cost sourcing. Regulatory shifts concerning emissions standards (e.g., IMO 2020 for shipping, EU Green Deal mandates) compel massive capital investment in cleaner technologies and fleet upgrades. Furthermore, evolving consumer expectations for expedited delivery, combined with increasing scrutiny over ethical sourcing and sustainable operations, necessitate rapid investment in advanced last-mile technology and transparent reporting mechanisms. These forces collectively mandate a shift from traditional, purely transactional logistics models to agile, technology-integrated service provider roles, focusing heavily on risk mitigation and environmental compliance.

The combined effect of these forces results in a market environment demanding continuous innovation. Companies unable to integrate advanced technologies—such as AI, blockchain for documentation, and autonomous vehicles—will struggle to compete against large, integrated logistics giants and agile, tech-focused startups. The pressure to maintain profitability while meeting environmental targets and managing labor issues requires sophisticated operational balancing. Successful market players are those who can leverage digitalization to turn Restraints (like congestion and complexity) into efficiency gains (through predictive modeling and optimized modal shift), thereby capitalizing on high-growth Opportunities like cold chain expansion and integrated 4PL services, demonstrating robust resilience against unpredictable Impact Forces.

Segmentation Analysis

The Transportation and Logistics market is segmented based on the mode of transport, the type of service offered, and the industry end-user served, providing a detailed breakdown of revenue streams and growth areas. Segmentation helps stakeholders understand where technological investment and operational focus should be directed. The primary modes—road, rail, sea, and air—each offer distinct advantages in speed, cost, and capacity, catering to varied cargo types and delivery urgencies. Service segments range from basic freight movement to highly complex, integrated supply chain management solutions (3PL and 4PL), reflecting the maturity and specialization of market participants. End-user segmentation highlights the unique logistical requirements of major vertical industries, such as the need for cold chain reliability in pharmaceuticals versus high-volume, quick-turnaround requirements in e-commerce and retail. This granular analysis is crucial for developing targeted business strategies and identifying underserved niches within the logistics ecosystem.

- By Mode of Transport:

- Roadways (Trucking, Courier, Parcel)

- Railways (Intermodal, Bulk Freight)

- Maritime (Ocean Freight, Shipping Lines)

- Airways (Air Cargo, Express Delivery)

- By Service Type:

- Freight Forwarding (International, Domestic)

- Warehousing and Storage (General, Cold Storage, Hazardous Goods)

- Value-Added Services (Customs Brokerage, Packaging, Cross-Docking)

- Courier, Express, and Parcel (CEP)

- Logistics Technology and Consulting

- By End-Use Industry:

- Manufacturing (Automotive, Heavy Industry)

- Retail and E-commerce (B2C, B2B)

- Healthcare and Pharmaceuticals (Cold Chain Logistics)

- Food and Beverage (Perishable Goods Transport)

- Energy and Utilities (Specialized Equipment Transport)

- Construction and Mining

Value Chain Analysis For Transportation and Logistics Market

The Transportation and Logistics value chain is a multifaceted structure that begins with upstream activities, progresses through core logistical operations, and culminates in downstream interactions with end-users. Upstream activities primarily involve sourcing and procurement of critical assets, including transport vehicles (trucks, ships, aircraft), infrastructure development (warehouses, sorting centers), and increasingly, acquiring sophisticated logistics technology platforms (TMS, WMS, advanced analytics software). Relationships with fuel suppliers, vehicle manufacturers, and technology vendors are critical at this stage, dictating capital expenditure and operational readiness. Effective upstream management focuses on asset utilization optimization and strategic long-term contracting to mitigate cost volatility and ensure sustainability compliance.

The core middle section of the value chain involves primary logistical services: transportation (freight movement across modes), warehousing (storage, inventory management, fulfillment), and specialized value-added services (packaging, labeling, customs processing). This is where the majority of value is created through efficient execution, utilizing network optimization, labor management, and technology deployment to achieve speed and cost-effectiveness. The choice between direct operations (asset ownership) and outsourcing (3PL/4PL partnerships) significantly impacts this stage. The distribution channel spans both direct and indirect routes. Direct distribution involves owned fleet delivery directly from the logistics provider's hub to the consignee (common in last-mile CEP services), while indirect distribution often utilizes intermediaries, regional hubs, or local distribution partners to cover vast geographic areas or specialized delivery requirements, creating extensive network coverage.

Downstream analysis focuses on service delivery, customer relationship management, and ensuring transparency in the final delivery phase. This stage is crucial for building customer loyalty and includes real-time tracking visibility, proof of delivery, claims management, and reverse logistics handling (returns). The integration of IT systems with customer platforms (e.g., e-commerce interfaces) is paramount for seamless service. The efficiency of the downstream process, particularly in managing the final mile, dictates overall customer satisfaction. The flow of information (data analytics on performance, delivery success rates, and customer feedback) back up the chain allows for continuous process improvement and adaptation to evolving market demands and regulatory changes globally.

Transportation and Logistics Market Potential Customers

Potential customers, or end-users and buyers of transportation and logistics services, are spread across nearly every sector of the global economy, unified by the fundamental requirement to move goods efficiently and reliably. The complexity and scale of customer needs vary significantly; major multinational corporations often require sophisticated 4PL services encompassing global supply chain management, risk assessment, and integrated IT solutions. Conversely, small and medium-sized enterprises (SMEs) predominantly seek reliable 3PL services focused on competitive rates for freight forwarding and flexible warehousing options. E-commerce businesses, in particular, represent a rapidly expanding customer base demanding high-speed, scalable, and technologically advanced last-mile delivery solutions, prioritizing system integration and real-time communication.

The manufacturing sector, including automotive and heavy machinery, represents a core customer segment requiring complex inbound logistics (Just-In-Time delivery) and outbound distribution networks, often involving specialized heavy transport and precise scheduling. The pharmaceutical and healthcare industries are growing customers characterized by demanding regulatory requirements and a critical need for cold chain logistics and secure, validated transport paths for high-value and temperature-sensitive products. Retail businesses, navigating omnichannel pressures, seek logistics partners capable of blending store fulfillment with direct-to-consumer delivery, optimizing inventory placement across national and international distribution centers.

Moreover, governmental and non-governmental organizations (NGOs) are significant buyers, especially concerning infrastructure projects, defense logistics, and humanitarian aid distribution, which necessitates highly scalable and robust logistical capabilities, often operating in challenging environments. Energy and utilities companies rely on specialized logistics for moving oversized project cargo and managing the continuous flow of resources, such as specialized chemicals or renewable energy components. Therefore, the market caters to a spectrum of buyers, from large volume commodity movers seeking cost-efficiency to high-value, niche producers demanding precision, security, and regulatory compliance, necessitating providers to offer highly customizable service levels.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11,500.0 Billion |

| Market Forecast in 2033 | USD 16,800.0 Billion |

| Growth Rate | 5.6% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DHL Group, FedEx Corporation, United Parcel Service (UPS), Kuehne+Nagel International AG, DSV Panalpina A/S, C.H. Robinson Worldwide Inc., Expeditors International of Washington, Inc., XPO Logistics, Inc., J.B. Hunt Transport Services, Inc., Nippon Express Holdings, Geodis, Sinotrans Limited, Bolloré Logistics, Agility Public Warehousing Company K.S.C.P., Maersk Group, Hapag-Lloyd AG, Crowley Maritime Corporation, DB Schenker, TFI International Inc., Schneider National, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Transportation and Logistics Market Key Technology Landscape

The technology landscape within the Transportation and Logistics market is undergoing a profound transformation, moving rapidly toward interconnected, data-driven ecosystems centered around automation, visibility, and predictive capabilities. Core to this transformation is the ubiquitous adoption of Internet of Things (IoT) sensors and telematics devices integrated into fleets, assets, and infrastructure. These devices provide continuous, granular data streams on location, condition (temperature, vibration), and performance, which is vital for real-time asset tracking and highly efficient fleet management. Coupled with advanced analytics and cloud computing platforms, this data enables logistics providers to shift from reactive maintenance and operational management to proactive, predictive scheduling and resource allocation, significantly minimizing operational disruptions and optimizing delivery timelines.

Another pivotal technological area is the deployment of sophisticated software solutions, specifically Transportation Management Systems (TMS) and Warehouse Management Systems (WMS). Modern TMS solutions are leveraging AI and machine learning to tackle complex network optimization, dynamic pricing, and regulatory compliance across multimodal operations. WMS implementations are increasingly focusing on automation through robotics, Automated Guided Vehicles (AGVs), and Automated Storage and Retrieval Systems (AS/RS), enhancing the speed and accuracy of fulfillment processes, which is crucial for handling the massive volume demands of e-commerce. Furthermore, the integration of 5G networks is critical, providing the low latency and high bandwidth necessary to support massive sensor deployment and real-time communication essential for potential future applications such as remote operation of autonomous vehicles and sophisticated drone surveillance in large hubs.

Beyond operational optimization, technologies aimed at enhancing transparency and security are also gaining prominence. Blockchain technology is being explored and piloted globally for secure, immutable record-keeping, standardizing international shipping documentation, and facilitating transparent cross-border trade settlements, addressing long-standing issues of fraud and paperwork complexity. Finally, the push toward sustainability is driving technological adoption, including route optimization software that minimizes carbon footprint, investment in electric and hydrogen-powered vehicles, and developing optimized packaging solutions that reduce shipment volume and material waste. These technological advancements collectively define the competitive edge, demanding continuous research and development investment to stay relevant in a highly digitized logistics market.

Regional Highlights

The global Transportation and Logistics market exhibits distinct characteristics and growth trajectories across major geographical regions, influenced by localized trade patterns, infrastructure maturity, and regulatory frameworks. Understanding these regional dynamics is crucial for strategic market penetration and investment decisions.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, dominating the market in terms of volume and value expansion. This growth is underpinned by the region's position as the world's primary manufacturing hub, vast intra-regional trade, and explosive consumer base driving rapid e-commerce expansion. Countries like China, India, and Southeast Asian nations are heavily investing in modernizing port facilities, expanding high-speed rail networks, and developing robust cold chain capabilities to support burgeoning middle classes and pharmaceutical exports. The focus here is on scale, speed, and leveraging technology to manage massive, complex domestic and cross-border logistics flows.

- North America: Characterized by high technological adoption and a mature market structure, North America leads in implementing advanced logistics technologies, including autonomous trucking pilots, sophisticated warehouse automation, and advanced predictive analytics. The market is primarily driven by large domestic consumption, high demand for expedited B2C services, and a strong emphasis on supply chain resilience following trade disruptions. Labor costs and infrastructural efficiency challenges (such as road congestion) are key strategic focuses, driving investment into intermodal transport and domestic manufacturing support.

- Europe: The European market is highly regulated and strongly influenced by sustainability mandates (e.g., carbon neutrality targets). This focus translates into significant investment in electric vehicle fleets, rail freight revitalization, and developing efficient, multimodal corridor logistics. Cross-border logistics within the EU are highly integrated but complex due to varying national regulations. The region excels in specialized logistics, particularly cold chain management for pharmaceuticals and high-value manufacturing components, emphasizing reliable, traceable, and environmentally compliant services.

- Latin America: This region presents substantial growth potential but faces challenges related to inadequate infrastructure (road quality, port congestion) and political instability in certain sub-regions. Growth is driven by expanding trade relationships (especially with Asia and North America), increasing consumer demand, and efforts to formalize and digitize logistics processes. Investment is concentrated on improving last-mile capabilities in large urban centers and modernizing customs procedures to streamline international trade.

- Middle East and Africa (MEA): The MEA region is strategically positioning itself as a global trade nexus, particularly the Gulf Cooperation Council (GCC) states, leveraging massive infrastructure projects (e.g., new ports, economic zones) and investments in air cargo hubs to connect Asia and Europe. The market is propelled by economic diversification away from oil, rapid urbanization in Africa, and high demand for specialized logistics for energy and construction projects. Technological adoption, often leapfrogging older systems, focuses on smart logistics solutions and high-security storage facilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Transportation and Logistics Market.- DHL Group

- FedEx Corporation

- United Parcel Service (UPS)

- Kuehne+Nagel International AG

- DSV Panalpina A/S

- C.H. Robinson Worldwide Inc.

- Expeditors International of Washington, Inc.

- XPO Logistics, Inc.

- J.B. Hunt Transport Services, Inc.

- Nippon Express Holdings

- Geodis

- Sinotrans Limited

- Bolloré Logistics

- Agility Public Warehousing Company K.S.C.P.

- Maersk Group

- Hapag-Lloyd AG

- Crowley Maritime Corporation

- DB Schenker

- TFI International Inc.

- Schneider National, Inc.

Frequently Asked Questions

Analyze common user questions about the Transportation and Logistics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Transportation and Logistics Market?

The market growth is fundamentally driven by the exponential rise of global e-commerce, which mandates enhanced last-mile delivery and fulfillment services. Additionally, increasing globalization and the critical need for sophisticated supply chain resilience (post-pandemic) compels companies to rely on advanced third-party logistics (3PL) providers capable of integrating AI and real-time tracking technologies.

How is AI specifically transforming operational efficiency within logistics?

AI is transforming logistics by optimizing complex operational tasks. Key applications include dynamic route optimization, minimizing transit times and fuel consumption, significantly improving the accuracy of demand forecasting to reduce unnecessary inventory, and enabling predictive maintenance programs to prevent costly equipment downtime across vast fleet networks globally.

Which regional segment is expected to show the highest growth rate during the forecast period?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is due to its dominance in global manufacturing, massive consumer market size, ongoing rapid urbanization, and extensive governmental and private sector investments in critical logistics infrastructure like ports, roads, and digital freight corridors.

What are the major challenges currently restricting the expansion of the logistics sector?

Key restraints include pervasive labor shortages, particularly in long-haul trucking and warehousing roles, volatile global energy prices directly impacting operational costs, and enduring infrastructural bottlenecks such as port congestion and traffic issues in dense urban areas, all of which strain capacity and profitability margins.

What role does sustainability play in modern transportation and logistics strategies?

Sustainability is now a core strategic imperative, driven by stringent environmental regulations and corporate ESG goals. Logistics providers are investing heavily in green fleet technologies (EVs, hydrogen), optimizing routes for reduced carbon emissions, implementing sustainable packaging solutions, and increasing the use of lower-emission transport modes like rail and maritime freight.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager