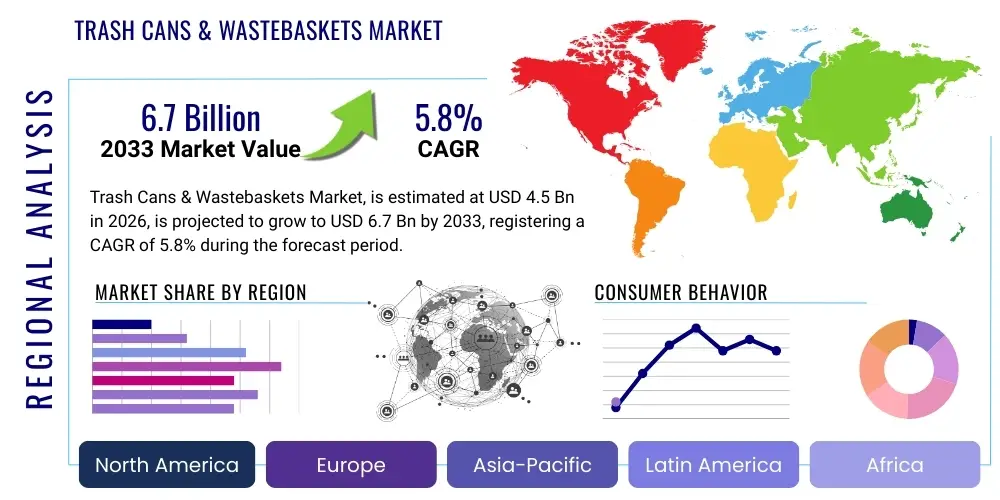

Trash Cans & Wastebaskets Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435669 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Trash Cans & Wastebaskets Market Size

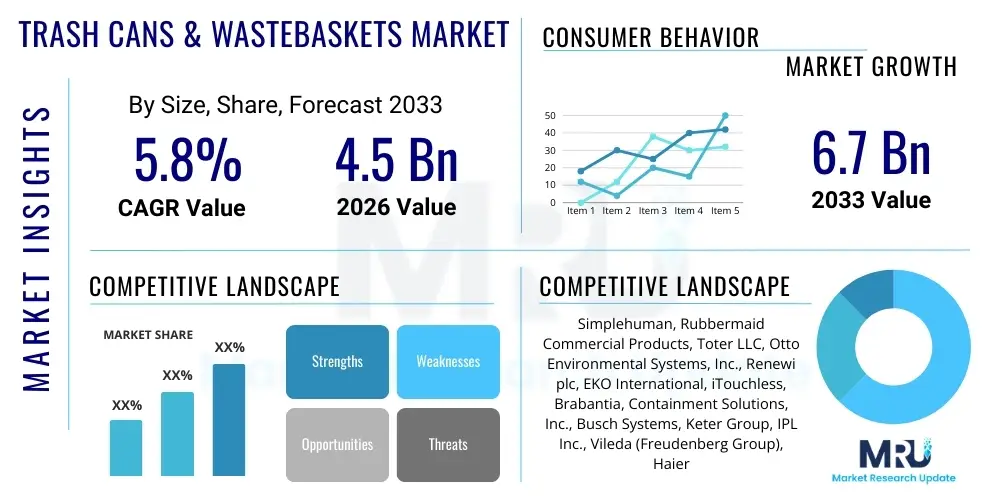

The Trash Cans & Wastebaskets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by increasing global urbanization, stringent public health and hygiene regulations enacted by governmental bodies, and a noticeable shift towards smart waste management solutions incorporating sensor technology and connectivity.

Trash Cans & Wastebaskets Market introduction

The Trash Cans & Wastebaskets Market encompasses the manufacturing, distribution, and sale of containers designed for the temporary storage of waste materials prior to disposal or recycling. These essential sanitation products range from simple, manual plastic wastebaskets utilized in residential settings to sophisticated, high-capacity, stainless steel containers equipped with automated mechanisms for use in commercial, institutional, and municipal environments. The fundamental purpose of these products is to maintain hygiene, minimize odor, and facilitate organized waste collection, aligning with broader public health imperatives globally. Product innovation in this sector is currently concentrated on improving durability, enhancing aesthetics to integrate seamlessly into modern architectural designs, and incorporating technologies such as motion sensors and compaction capabilities.

Major applications of trash cans and wastebaskets span across residential homes, offices, healthcare facilities, educational institutions, hospitality establishments, and large-scale industrial complexes. The market growth is intricately linked to construction activity and economic expansion, particularly in developing economies where improved infrastructure necessitates efficient waste containment. Benefits derived from modern waste containers include improved sanitation, reduced operational costs for waste haulers through optimized collection routes (especially with smart bins), and the successful implementation of source separation programs crucial for recycling initiatives. The diverse material requirements—ranging from high-density polyethylene (HDPE) for durability to metals for fire safety—dictate specific product utility across different application segments.

Key factors driving market expansion include rising environmental consciousness, which mandates separation of waste streams (e.g., organic, recyclable, non-recyclable), thereby increasing the demand for multi-compartment containers. Furthermore, the global COVID-19 pandemic significantly accelerated the focus on touchless operation and enhanced sanitation practices, pushing manufacturers to invest heavily in sensor-activated and antimicrobial-coated products. The growth trajectory is further supported by governmental investments in public parks and transportation hubs, which require robust and vandal-resistant waste infrastructure, ensuring sustained demand across the forecast period.

Trash Cans & Wastebaskets Market Executive Summary

The Trash Cans & Wastebaskets Market is navigating a transformative period characterized by the convergence of sustainability demands and technological integration. Business trends show a strong pivot towards durable, aesthetic, and functional designs, with premium segments experiencing accelerated growth driven by consumers willing to pay more for features like touchless operation, odor control mechanisms, and premium finishes. Strategic mergers and acquisitions are common, as key industry players seek to expand their geographical footprint and acquire niche technology companies specializing in IoT-enabled waste solutions. Material innovation, focusing on recycled plastics and biodegradable components, represents a core competitive differentiator, addressing growing consumer and regulatory pressure concerning environmental responsibility across the supply chain.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, largely due to rapid urbanization, infrastructural development, and increasingly strict government policies related to municipal waste management in countries like China and India. North America and Europe, while mature, exhibit high adoption rates of advanced smart waste systems, focusing on operational efficiency and resource optimization. These developed markets show a preference for high-capacity, robust containers suitable for automated collection systems. Conversely, Latin America and the Middle East and Africa (MEA) are experiencing steady growth, driven by commercial expansion in retail and hospitality sectors, increasing the demand for aesthetically pleasing and durable indoor receptacles.

Segment trends emphasize the rapid proliferation of automated (sensor-activated) trash cans, particularly in high-traffic commercial and residential settings where hygiene is paramount. While traditional manual bins still dominate in volume, the revenue contribution from smart bins is rising significantly, commanding higher average selling prices. Segmentation by material reveals plastics retaining the largest volume share due to cost-effectiveness and versatility, but metals (stainless steel) are gaining traction in premium and institutional sectors due to perceived longevity and professional appearance. The market is increasingly consolidating around specific consumer needs, such as compacting bins for small urban apartments and large, durable wheeled bins for municipal curbside collection.

AI Impact Analysis on Trash Cans & Wastebaskets Market

Common user questions regarding AI's impact on this market typically revolve around "How can a simple trash can be smart?" and "Will AI reduce waste management costs?" Users are keenly interested in the practical application of machine learning for optimized waste segregation, route planning, and predictive maintenance of smart containers. Key concerns focus on data security and the total cost of ownership (TCO) associated with sophisticated, connected bins. The underlying expectation is that AI will transform basic waste containment into an efficient data collection point, fundamentally changing municipal and commercial waste logistics. Analysis shows users anticipate AI-driven smart bins to identify and categorize waste types automatically, ensuring higher recycling purity rates and drastically lowering the incidence of contamination which currently plagues waste processing facilities globally. Furthermore, users expect AI to integrate bin fill-level data with city logistics systems to minimize unnecessary trips by waste collection vehicles, thereby lowering fuel consumption and reducing carbon emissions associated with waste transportation, addressing sustainability goals directly.

The transition toward smart waste infrastructure, heavily reliant on AI and machine learning algorithms, moves the market focus from merely selling containers to providing integrated waste management solutions. AI algorithms analyze real-time data from IoT-enabled trash cans, which monitor fill levels, weight, and sometimes even environmental factors like temperature and gas emissions. This predictive analysis capability allows municipal services and large commercial facilities to anticipate overflow issues before they occur and dynamically schedule pickups, moving away from inefficient fixed-route scheduling. This optimization not only saves time and fuel but significantly improves the quality of urban life by reducing unsightly overfilled bins and minimizing related sanitation risks. The introduction of computer vision in advanced sorting bins is a further area of growth, where AI identifies recyclable materials with high accuracy right at the point of disposal, simplifying user involvement and increasing compliance with sorting protocols.

Manufacturers are embedding AI capabilities into their product lines, often through partnerships with software and IoT platform providers. This integration enhances product utility far beyond simple containment. For example, AI-driven analytics can track usage patterns across different locations within a city or a large campus, helping facility managers deploy appropriate container sizes and types in areas of peak demand. This data-driven deployment strategy maximizes efficiency and minimizes purchasing redundancies. While the initial investment in AI-enabled hardware is higher, the subsequent operational savings, reduced labor costs, and improved regulatory compliance offer compelling return on investment (ROI) propositions, making AI integration a critical strategic imperative for market leadership in the coming decade.

- AI enhances route optimization for waste collection vehicles by analyzing real-time fill-level data from smart bins.

- Machine learning algorithms facilitate autonomous waste segregation at the source, improving recycling purity and efficiency.

- Predictive analytics driven by AI minimizes container overflow and facilitates proactive maintenance of sensor hardware.

- AI supports demand forecasting, enabling facility managers to optimize bin placement and capacity based on historical usage patterns.

- Integration of computer vision allows smart bins to identify and log different waste types, generating valuable municipal compliance reports.

DRO & Impact Forces Of Trash Cans & Wastebaskets Market

The dynamics of the Trash Cans & Wastebaskets Market are shaped by powerful Drivers (D), significant Restraints (R), and transformative Opportunities (O), creating complex Impact Forces. The primary drivers include global mandates for public hygiene, stringent government regulations on waste disposal and recycling (such as Extended Producer Responsibility schemes), and increasing consumer demand for aesthetically pleasing and functional household items that integrate technology. Furthermore, the rapid growth of the hospitality and healthcare sectors, which require specialized, often antimicrobial, waste disposal solutions, sustains demand. The shift towards automated solid waste collection systems globally requires the widespread adoption of standardized, high-durability wheeled carts, creating a consistent market base for industrial-grade containers. These simultaneous forces push the market toward both premium functional design and large-scale industrial standardization.

Conversely, the market faces several restraints. The primary impediment is the high initial capital expenditure required for sophisticated, IoT-enabled smart bins, which limits adoption in price-sensitive developing regions and smaller municipalities. Another restraint involves the long product lifecycle of traditional, durable plastic and metal containers; replacements are infrequent unless damaged, slowing down the replacement cycle for legacy products. Moreover, volatility in the pricing of key raw materials, particularly high-density polyethylene (HDPE) and stainless steel, introduces cost pressures on manufacturers, potentially hindering innovation budgets and impacting profitability. Furthermore, the complexities of ensuring data privacy and cyber security within networked smart waste systems present an operational challenge that must be overcome to build widespread user trust and regulatory approval.

Opportunities for exponential growth are concentrated in the adoption of sustainable materials, including recycled and bio-based plastics, addressing circular economy goals. Significant opportunity exists in expanding market penetration of smart compaction bins in densely populated urban centers, which directly addresses capacity and frequency issues. Furthermore, the growing trend of contactless commerce and automation within institutional settings (e.g., airports, smart buildings) creates a receptive environment for advanced sensor-based waste disposal units. The impact forces are currently pushing the market toward a dual structure: mass-market demand focused on durability and cost, and high-value niche segments focused on intelligent features, integration, and environmental performance. Successful market players will be those who can leverage modular design to offer varying levels of technology integration at competitive prices, capitalizing on both volume and value segments simultaneously across diverse geographic markets.

Segmentation Analysis

The Trash Cans & Wastebaskets Market is critically segmented based on criteria such as product type, material composition, operational mechanism, and end-user application, providing a granular view of market demand and product specialization. Understanding these segments is vital for strategic positioning, as consumer needs differ vastly between residential kitchens requiring aesthetic touchless solutions and municipal streets demanding robust, high-capacity, vandal-resistant containers. The primary segments reflect the evolution of waste containment from simple receptacles to sophisticated, technology-enabled waste management components, with strong differentiation observed between high-volume, low-cost plastic bins and low-volume, high-value stainless steel or smart automated systems. This segmentation allows manufacturers to tailor features, pricing, and distribution strategies effectively across global regions with varying levels of economic development and infrastructure maturity. The dynamic interplay between residential demand for convenience and commercial/institutional demand for durability and sanitation drives continuous innovation across all major segments.

- By Product Type:

- Indoor Wastebaskets (Small Capacity)

- Outdoor Containers (High Capacity/Wheeled Bins)

- Recycling Bins (Multi-Compartment/Dedicated Streams)

- Specialized Containers (e.g., Medical Waste, Ash Cans)

- By Material:

- Plastic (HDPE, Polypropylene)

- Metal (Stainless Steel, Galvanized Steel)

- Wood/Composite

- By Operating Mechanism:

- Manual (Foot Pedal, Swing Top)

- Automated/Sensor-Activated (Touchless)

- Compactor Bins

- Semi-Automated (Assisted Lifting Mechanisms)

- By Application/End-User:

- Residential

- Commercial (Office Spaces, Retail, Hospitality)

- Institutional (Schools, Hospitals, Government Buildings)

- Industrial/Manufacturing

- Municipal/Public Spaces

Value Chain Analysis For Trash Cans & Wastebaskets Market

The value chain for the Trash Cans & Wastebaskets Market begins with upstream activities dominated by the sourcing of essential raw materials, primarily commodity plastics like HDPE and PP, alongside various grades of steel (stainless and galvanized). Key upstream considerations include securing stable supply agreements, managing volatility in petrochemical and metal markets, and increasingly, securing certified recycled content to meet sustainability quotas. Manufacturing involves injection molding for plastic components and stamping/welding for metal bins, often requiring substantial capital investment in specialized machinery and large-scale facilities. Efficiency in the manufacturing stage, particularly reducing material waste and optimizing cycle times, is crucial for maintaining competitive pricing, especially in the high-volume plastic segment. As products become 'smarter,' the upstream dependency extends to electronic components, microcontrollers, and sensor technology sourced from specialized third-party suppliers, adding complexity to the logistics and quality control processes.

Downstream activities center around efficient distribution and market penetration. Distribution channels are highly fragmented, reflecting the diverse customer base. Direct sales are common for large municipal contracts and bulk institutional orders, allowing manufacturers greater control over pricing and service. Conversely, the high-volume residential and small commercial segments rely heavily on indirect channels, including mass merchandisers, specialty retail stores (e.g., home improvement centers), and the rapidly growing e-commerce platforms. E-commerce channels have necessitated product design adjustments, focusing on robust packaging and optimized sizing for shipping, while simultaneously providing an accessible platform for consumers seeking niche or premium smart products. The choice of distribution channel significantly influences inventory management and regional responsiveness, requiring sophisticated logistics management to balance shipping costs against speed to market.

Direct channels offer the benefit of establishing strong, long-term relationships with key institutional buyers, such as hospital groups or major hotel chains, allowing for customized product development and maintenance contracts. Indirect channels, particularly the global retail giants, provide unparalleled reach into residential markets, albeit with higher margin pressure and less brand control. The shift towards digitized commerce and AEO (Answer Engine Optimization) means that successful downstream players must invest heavily in digital marketing, ensuring their product features (e.g., odor control, touchless operation) are easily discoverable and differentiated online. The after-sales service component, primarily focused on warranty claims for mechanical/sensor failures in smart bins and replacement parts for high-use municipal carts, further solidifies the customer relationship and contributes to overall brand loyalty.

Trash Cans & Wastebaskets Market Potential Customers

Potential customers for the Trash Cans & Wastebaskets Market are broadly classified into B2C (Residential) and B2B (Commercial, Institutional, Industrial, and Municipal) segments, each with unique purchasing criteria and product requirements. The residential segment, driven primarily by household refurbishment cycles, lifestyle trends, and aesthetic preferences, demands mid-to-high quality wastebaskets that blend seamlessly with kitchen and bathroom décor, with a strong preference emerging for features such as touchless operation, effective odor sealing, and multi-compartment separation for home recycling. This segment is highly influenced by retail promotions, online reviews, and brand reputation for durability and design innovation, favoring products that simplify daily tasks and enhance home hygiene standards. Consumers in developed markets often prioritize smart features, while emerging markets remain sensitive to price and focus on basic functionality and capacity.

The institutional and commercial sectors represent significant bulk purchasers, driven by regulatory compliance, traffic volume, and fire safety standards. Key buyers include facility managers for hospitals, which require hands-free medical waste disposal units and specialized biohazard containers; hotel groups, which prioritize aesthetically congruent and durable receptacles for lobbies and guest rooms; and large corporate offices, which often implement comprehensive internal recycling programs requiring standardized, clear-labeled multi-stream bins. These B2B customers prioritize factors such as robustness, ease of cleaning, long-term durability under heavy use, and compliance with local sanitation codes. Purchasing decisions are frequently centralized, based on vendor contracts and the ability of the manufacturer to supply large quantities of standardized, high-quality products consistently across multiple sites.

The municipal and governmental segment represents one of the most critical customer bases, demanding large-capacity, wheeled refuse carts and public area litter bins designed for automated collection systems. These customers require products that adhere to strict specifications regarding size, weight, wheel durability, and compatibility with standardized lifting mechanisms (e.g., DIN or EN standards). Durability, resistance to vandalism, and UV stabilization for outdoor exposure are paramount concerns. Furthermore, the municipal market is increasingly focused on smart bins equipped with IoT sensors to facilitate data-driven waste collection route optimization. Industrial customers, such as manufacturing plants and logistics centers, require heavy-duty, often specialized containers suitable for corrosive or high-temperature environments, prioritizing safety features and mobility for internal logistics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Simplehuman, Rubbermaid Commercial Products, Toter LLC, Otto Environmental Systems, Inc., Renewi plc, EKO International, iTouchless, Brabantia, Containment Solutions, Inc., Busch Systems, Keter Group, IPL Inc., Vileda (Freudenberg Group), Haier (Cimarec), Rehrig Pacific Company, Wesco, Perstorp Group, Continental Commercial Products, Curver (Keter Group), Schaefer Systems International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Trash Cans & Wastebaskets Market Key Technology Landscape

The technology landscape within the Trash Cans & Wastebaskets Market is rapidly shifting away from purely mechanical designs towards sophisticated electronic and digital integrations, fundamentally transforming their function from passive containers to active components of the smart city infrastructure. A pivotal area of development is sensor technology, specifically ultrasonic sensors and infrared emitters used for accurate fill-level monitoring. These sensors provide real-time data on capacity usage, enabling immediate alerts for potential overflow and feeding critical information into centralized data platforms for route optimization software. The adoption of IoT connectivity, typically via Low Power Wide Area Networks (LPWAN) such as LoRaWAN or Narrowband-IoT (NB-IoT), ensures robust and energy-efficient data transmission from bins located in challenging urban and remote environments, making large-scale deployment economically viable for municipalities and campus settings.

Another dominant technology trend is the integration of automation and convenience features for residential and commercial users. Motion sensor technology, facilitating touchless opening and closing mechanisms, has become a standard feature in high-end kitchen and restroom wastebaskets, primarily driven by heightened hygiene awareness post-pandemic. Furthermore, compaction technology, traditionally reserved for industrial applications, is now miniaturized and integrated into residential and small commercial bins. These compactors utilize motorized screw or hydraulic mechanisms to reduce waste volume significantly (often by up to 70%), thereby extending the time between pickups, which is a major value proposition for users in densely populated urban areas with limited storage space. Manufacturers must ensure these compaction units are reliable, safe, and consume minimal battery power.

Beyond electronics, material science innovations are playing a critical role in enhancing performance and sustainability. The use of antimicrobial coatings, often based on silver or copper ions, is increasing in institutional and healthcare-focused containers to inhibit bacterial growth and odor generation, providing an added layer of sanitation security. Furthermore, advanced plastics engineering focuses on enhancing the durability, UV resistance, and fire resistance of wheeled carts used outdoors. The increasing focus on the circular economy is driving significant investment in technologies that utilize high percentages of post-consumer recycled (PCR) plastics without compromising structural integrity or aesthetic appeal, ensuring that the containers themselves contribute positively to sustainable resource management practices.

Regional Highlights

- North America: This region represents a mature market characterized by high consumer disposable income and a strong institutional demand for automated and high-durability products. North America is a leader in smart waste management adoption, with major cities implementing full-scale IoT-enabled bin networks for improved collection efficiency. Key drivers include stringent environmental regulations requiring enhanced recycling infrastructure and high labor costs, making automated collection systems (which require standardized wheeled carts) essential. The residential market shows strong brand loyalty and a preference for premium stainless steel and technology-integrated bins (e.g., compaction and sensor-activated). The United States and Canada are pivotal markets, driving innovation in software integration with waste hardware.

- Europe: Europe is defined by its deep commitment to circular economy principles, leading to exceptionally high demand for multi-compartment recycling bins and dedicated composting containers across municipal and residential sectors. Regulations such as the Waste Framework Directive significantly influence product design, requiring clear labeling and segregation capabilities. Western European nations, particularly Germany, the UK, and Scandinavia, are highly receptive to smart, networked waste solutions and innovative sustainable materials (recycled plastics, bio-based polymers). The market is segmented by strong municipal procurement based on rigorous EU standards for safety and longevity, fostering a competitive landscape focused on quality and environmental performance.

- Asia Pacific (APAC): APAC is projected to exhibit the highest growth rate due to rapid urbanization, infrastructural expansion, and rising consumer spending power, particularly in China, India, and Southeast Asia. The sheer volume of waste generated by expanding megacities necessitates scalable and efficient containment solutions. While demand for basic, cost-effective plastic bins remains high in developing sub-regions, countries like Japan, South Korea, and Australia are quickly adopting advanced smart bin technology to manage density and improve recycling rates. Government initiatives focused on improving sanitation and modernizing waste collection systems are the primary market accelerators.

- Latin America (LATAM): Growth in LATAM is steady, driven by increasing commercial construction, particularly in the hospitality and retail sectors across countries like Brazil and Mexico. The market is moderately fragmented, with a growing transition from basic open bins to closed, durable containers to improve public hygiene. Price sensitivity remains a factor, leading to higher penetration of cost-effective plastic bins, but modernization efforts in capital cities are creating opportunities for vendors offering mid-range and institutional-grade waste solutions, particularly robust outdoor containers suitable for challenging climates and heavy use.

- Middle East and Africa (MEA): The MEA market growth is propelled by massive infrastructural projects and high-end commercial development, especially in the GCC countries (UAE, Saudi Arabia). These regions show a strong demand for premium, highly aesthetic, and often customized waste receptacles for luxury hotels, modern shopping malls, and smart city projects. In the African continent, the emphasis is on durable, high-capacity waste carts for improving municipal sanitation systems, supported often by international aid or government investment aimed at managing urban population density effectively. Extreme weather conditions also necessitate UV-stable and highly resistant materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Trash Cans & Wastebaskets Market.- Simplehuman

- Rubbermaid Commercial Products (Newell Brands)

- Toter LLC (Wastequip)

- Otto Environmental Systems, Inc.

- Renewi plc

- EKO International

- iTouchless

- Brabantia

- Containment Solutions, Inc.

- Busch Systems

- Keter Group

- IPL Inc.

- Vileda (Freudenberg Group)

- Haier (Cimarec)

- Rehrig Pacific Company

- Wesco (Maxxair)

- Perstorp Group (Material Supplier Focus)

- Continental Commercial Products

- Curver (Keter Group)

- Schaefer Systems International

Frequently Asked Questions

Analyze common user questions about the Trash Cans & Wastebaskets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the smart trash can segment?

The growth of the smart trash can segment is primarily driven by increasing urbanization, which demands optimized waste logistics, and heightened consumer focus on hygiene, accelerating the adoption of touchless, sensor-activated technology. Furthermore, municipal efforts to improve recycling purity through automated sorting capabilities are fueling demand.

How significant is the shift towards sustainable materials in the market?

The shift towards sustainable materials, specifically high-percentage post-consumer recycled (PCR) plastics and bio-based polymers, is highly significant. This trend is mandated by increasing environmental regulations in developed economies and serves as a major competitive differentiator for manufacturers seeking to align with circular economy objectives and consumer expectations.

Which application segment holds the largest share in the Trash Cans and Wastebaskets Market?

The municipal and residential application segments collectively hold the largest volume share. Municipalities are high-volume purchasers of standardized wheeled bins for curbside collection, while the residential segment consistently drives demand for diverse indoor wastebaskets, particularly those featuring advanced design and technology integration.

What role does IoT technology play in commercial waste management solutions?

IoT technology, integrated into commercial and municipal containers, enables real-time monitoring of fill levels and weight via sensors. This data is crucial for implementing dynamic route optimization, which significantly reduces collection frequency, lowers fuel costs, and improves operational efficiency across large fleet operations, maximizing resource utilization.

What are the primary restraints affecting market expansion in developing regions?

Primary restraints in developing regions include the high initial cost associated with advanced smart waste systems, which often exceeds municipal budgets, and volatility in the cost of raw materials. Furthermore, the limited infrastructure for digital connectivity can hinder the widespread, effective deployment of IoT-enabled waste solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager