Travel Application Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432332 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Travel Application Market Size

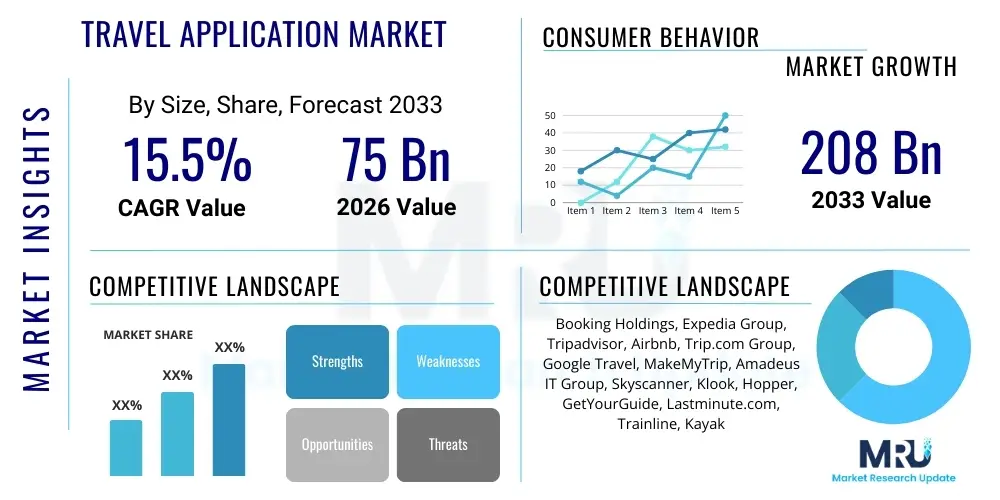

The Travel Application Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at $75 Billion in 2026 and is projected to reach $208 Billion by the end of the forecast period in 2033.

Travel Application Market introduction

The Travel Application Market encompasses a broad ecosystem of mobile software solutions designed to facilitate various stages of the travel journey, including planning, booking, in-trip navigation, and post-trip activities. These applications leverage advanced connectivity and location-based services to offer personalized experiences, integrating features such as flight and hotel reservations, car rentals, itinerary management, real-time updates, local attraction discovery, and peer-to-peer accommodation services. The core product revolves around enhancing user convenience, optimizing travel logistics, and providing immediate access to critical information, thereby transforming traditional travel consumption patterns into digitized, on-demand services. The pervasive penetration of smartphones globally serves as the fundamental platform enabling this digital revolution in the travel sector, pushing established travel agencies and new technology entrants alike to prioritize mobile-first strategies.

Major applications of these platforms span across several industry verticals, most notably Hospitality (hotel booking apps, loyalty programs), Aviation (flight status tracking, mobile check-in), Ground Transportation (ride-sharing, public transit navigation), and Destination Management (local guides, activity booking). Furthermore, niche applications focusing on expense tracking, travel insurance integration, and multi-modal route planning are rapidly gaining traction, offering specialized tools for both business and leisure travelers. The convergence of social media integration within travel apps allows users to share experiences, receive recommendations, and build community, augmenting the value proposition beyond mere transactional capabilities. These platforms are increasingly becoming the primary interface between the traveler and the service provider, demanding high performance, reliability, and robust data security measures.

The primary benefits delivered by travel applications include unparalleled convenience, cost optimization through price comparison tools, and personalized recommendations driven by machine learning algorithms analyzing historical user data. Key driving factors accelerating market expansion include the exponential increase in global mobile data consumption, rising disposable incomes in emerging economies leading to higher travel volumes, and the persistent demand for seamless, integrated digital travel experiences. The shift towards independent, flexible travel itineraries, particularly among Millennial and Gen Z demographics, further necessitates sophisticated mobile tools for on-the-go management, positioning travel applications as essential components of modern tourism infrastructure.

- Market Description: Mobile software designed for travel planning, booking, and in-trip management.

- Product Scope: Flight booking, hotel reservations, itinerary creation, navigation, and local activity discovery.

- Major Applications: Hospitality, Aviation, Ground Transportation, and Destination Management Services (DMS).

- Primary Benefits: Enhanced convenience, real-time information access, personalized recommendations, and cost comparison capabilities.

- Driving Factors: High smartphone penetration, increasing global travel demand, urbanization, and shift towards digital service consumption.

Travel Application Market Executive Summary

The Travel Application Market is currently undergoing a rapid evolutionary phase, characterized by intense competition driven by technological advancements and shifting consumer expectations towards hyper-personalization. Current business trends indicate a strong move towards super-apps—platforms that consolidate multiple travel services (flights, accommodation, activities, local services) into a single user interface, streamlining the entire travel lifecycle. Furthermore, there is significant investment in integrating decentralized identity solutions and secure payment mechanisms to enhance transaction reliability. The industry is witnessing strategic acquisitions where large Online Travel Agencies (OTAs) and technology giants are absorbing niche providers focusing on specific verticals like last-mile transportation or immersive augmented reality (AR) guided tours, aiming to build comprehensive travel ecosystems and secure a dominant position in the customer journey.

Regionally, the Asia Pacific (APAC) market represents the highest growth potential, fueled by a burgeoning middle class, widespread adoption of mobile payment systems, and massive domestic tourism markets in countries like China and India. North America and Europe, characterized by established infrastructure and high digital literacy, remain foundational markets, focusing on advanced personalization techniques, sustainable travel options integration, and robust data privacy compliance. Latin America and the Middle East & Africa (MEA) are emerging as high-opportunity areas, driven by infrastructure improvements and increasing government investment in tourism digitalization. The fragmented nature of local service providers in these regions presents both a challenge and an opportunity for standardized mobile platforms to aggregate fragmented inventory and streamline consumer access.

Segmentation trends highlight the dominance of the Accommodation Booking segment, followed closely by the Transportation segment (including ride-sharing and flight booking). However, the in-trip services segment, including local activity booking, language translation, and real-time mapping, is anticipated to register the fastest growth rate, reflecting the consumer shift from pre-trip planning to dynamic, situational service access while traveling. The adoption rate of AI and Machine Learning within travel apps is accelerating, particularly for dynamic pricing models, predictive itinerary management, and highly accurate customer support chatbots, fundamentally reshaping how service interactions are managed and delivered across all segments. This emphasis on technological differentiation is crucial for long-term competitive advantage in this dynamic digital landscape.

- Business Trends: Shift towards super-apps, increased strategic M&A activity, focus on integration of secure, decentralized identity technologies.

- Regional Trends: APAC leading growth driven by mobile adoption; North America/Europe prioritizing personalization and data security; MEA/LATAM emerging rapidly due to infrastructure investment.

- Segment Trends: Accommodation Booking maintains market share lead; In-Trip Services (Activities/Navigation) exhibiting the highest growth CAGR.

AI Impact Analysis on Travel Application Market

User inquiries regarding the integration of Artificial Intelligence (AI) in travel applications predominantly center on its capacity for personalization, efficiency, and job displacement within traditional travel services. Common questions revolve around the accuracy of AI-driven recommendation engines, the security implications of using large language models (LLMs) to manage sensitive itinerary data, and how AI might dynamically optimize pricing for individual users. Users are highly interested in how predictive AI can proactively solve travel complications, such as suggesting alternative routes before a flight delay is officially announced, or providing instant, high-quality multilingual support without human intervention. Conversely, there is concern about algorithmic bias and the potential for AI to standardize experiences, reducing the spontaneity inherent in travel. The core user expectation is for AI to transform travel planning from a time-consuming administrative task into a seamless, intuitive, and highly predictive digital interaction.

The immediate and tangible impact of AI is most evident in the optimization of the back-end infrastructure and the enhancement of customer-facing interfaces. AI algorithms are essential for parsing vast amounts of structured and unstructured travel data—including real-time inventory changes, fluctuating fuel prices, and global event risks—to offer dynamic pricing and yield management solutions that maximize profitability for service providers while theoretically offering competitive rates to consumers. On the user side, natural language processing (NLP) is powering advanced voice and text chatbots capable of handling complex booking amendments, cancellations, and frequently asked questions, significantly reducing the operational load on human customer service agents and ensuring 24/7 availability, a critical requirement for global travel support.

Furthermore, AI is pivotal in generating highly personalized and context-aware travel recommendations. Machine learning models analyze behavioral patterns, past bookings, search history, and even external data points (like weather forecasts or local event schedules) to craft tailored itineraries, suggest unique local activities, or recommend specific hotel types (e.g., business-friendly vs. family resort). This level of deep personalization moves beyond simple demographic targeting, aiming to predict genuine user preferences and optimize upselling opportunities throughout the entire booking funnel. The future market competitiveness hinges heavily on an organization's capability to effectively deploy and scale sophisticated AI tools, moving travel applications from transactional platforms to intelligent, proactive travel companions.

- AI-driven personalization dramatically enhances recommendation engines for flights, accommodations, and activities.

- Implementation of Large Language Models (LLMs) facilitates highly advanced, multilingual customer support and conversational booking interfaces.

- Predictive analytics optimize dynamic pricing strategies and improve yield management for inventory holders (airlines, hotels).

- Machine learning models are used for real-time risk assessment, predicting flight delays, and proactive itinerary modification suggestions.

- Automation of routine tasks, such as automated check-in and document verification, streamlines the user experience and reduces operational costs.

- Enhanced fraud detection mechanisms using AI minimize financial risks associated with large volumes of mobile transactions.

DRO & Impact Forces Of Travel Application Market

The Travel Application Market's growth trajectory is determined by a complex interplay of Drivers, Restraints, Opportunities, and broader Impact Forces shaping the global tourism and technology sectors. Key drivers include the ubiquitous adoption of smartphones and high-speed internet, which provide the essential infrastructure for mobile application deployment. Additionally, the increasing demand for instant gratification and customized travel experiences among younger demographics compels service providers to maintain cutting-edge mobile platforms. Restraints primarily involve regulatory hurdles concerning data privacy and cross-border data transfer (e.g., GDPR compliance), along with the challenge of market saturation and intense price competition, which squeezes profit margins, especially for pure-play booking platforms. Furthermore, the reliance on stable internet connectivity in remote travel destinations remains a persistent barrier to full service utilization.

Opportunities abound, particularly in integrating emerging technologies and addressing underserved market needs. The move towards seamless multimodal transportation booking—combining flights, trains, and local transit within one itinerary interface—presents a significant growth area. The integration of blockchain technology for secure, transparent transaction verification and loyalty program management offers high potential for innovation and cost reduction. Furthermore, there is a substantial untapped market in catering specifically to sustainable tourism, offering applications that calculate carbon footprints, recommend eco-friendly accommodations, and facilitate responsible travel choices, aligning with global environmental priorities and ethical consumerism.

Impact forces currently reshaping the market environment include the lingering effects of global health crises, which necessitate flexible booking and cancellation policies and robust health verification features within applications. Geopolitical instability also acts as a powerful external force, prompting apps to rapidly update safety warnings and re-route travelers, emphasizing the need for robust real-time alert systems. Competitive intensity is escalating as non-traditional tech players, such as financial institutions and telecom companies, integrate travel services into their existing mobile ecosystems. These forces collectively demand continuous innovation in security, user experience design, and data processing capabilities, requiring travel app developers to be highly agile and responsive to both technological shifts and macro-environmental risks, ensuring resilience and adaptability in a volatile global market.

- Drivers: Widespread smartphone penetration; increasing international and domestic tourism; demand for digitized, personalized, and instant travel management solutions.

- Restraints: Stringent data privacy regulations; intense market competition leading to price wars; dependence on reliable internet infrastructure globally; persistent security threats (phishing, data breaches).

- Opportunities: Integration of Augmented Reality (AR) for enhanced destination exploration; development of comprehensive multimodal booking platforms; niche targeting of sustainable and wellness tourism segments; leveraging blockchain for decentralized loyalty programs.

- Impact Forces: Necessity for resilient platforms addressing global health crises (e.g., verifiable health passes); geopolitical risk requiring enhanced security and real-time alerts; competitive pressure from cross-industry entrants (FinTech, Telecoms).

Segmentation Analysis

The Travel Application Market is meticulously segmented across several dimensions, including Application Type, End-User, Platform, and Region, allowing for targeted strategic planning and resource allocation. Analyzing these segments provides deep insights into consumer behavior and technology adoption patterns. The Application Type segmentation reveals the primary function users seek, separating the market into transactional services like booking (flights, hotels) and informational/utility services (navigation, itinerary management, local discovery). The End-User segmentation differentiates between Business Travelers and Leisure Travelers, each having distinct needs regarding expense management, corporate policy adherence, and flexibility, driving demand for specialized app features tailored to their specific travel contexts.

The dominant segments currently are Booking Applications, which capture the largest revenue share due to the direct transactional nature of their services, and Android platforms, which maintain the highest volume of downloads globally, particularly in high-growth developing markets. However, high-value transactions are often correlated with the iOS platform in developed regions. Future growth is strongly anticipated in the In-Trip Services segment, reflecting the evolution of user expectations from pre-trip planning to dynamic, real-time assistance during their journey. This includes everything from real-time dynamic re-routing advice to last-minute activity bookings based on current location and available time windows, indicating a pivotal shift in the market focus.

Understanding these segments is critical for developing successful marketing and product strategies. For example, focusing on the Business Travel End-User requires robust integration with Enterprise Resource Planning (ERP) systems and stringent compliance features, while targeting the Leisure Travel End-User necessitates emphasis on social sharing, gamification, and immersive content. The fragmentation across geographical regions, especially the varied preferences in payment methods and preferred communication channels (e.g., WeChat integration in China), demands localized product adaptation. Consequently, market participants must utilize sophisticated data analytics to identify rapidly growing micro-segments, such as solo female travelers or adventure tourism groups, and offer highly specialized application variants to capture untapped revenue streams.

- By Application Type:

- Booking Applications (Flights, Accommodation, Rental Services)

- Navigation and Mapping Applications

- In-Trip Information and Utility Applications (Itinerary, Translation)

- Local Activity and Experience Booking Applications

- By Platform:

- Android

- iOS

- Others (Web-based, Cross-platform)

- By End-User:

- Leisure Travelers

- Business Travelers

- By Revenue Model:

- Transaction-Based (Commission)

- Subscription/Premium Features

- Advertising/Sponsorship

Value Chain Analysis For Travel Application Market

The value chain of the Travel Application Market is characterized by a complex, multi-tiered structure involving numerous stakeholders, starting from technology providers and content generators up to the end consumer. The upstream segment is dominated by core technology providers, including mobile operating system developers (Google, Apple), cloud computing services (AWS, Azure), and data aggregators that supply real-time inventory and pricing data from airlines, hotels, and Global Distribution Systems (GDS). This phase focuses on developing robust, scalable, and secure application frameworks, ensuring high availability and seamless data flow necessary for instantaneous booking confirmations and real-time information updates. Strategic partnerships with mapping service providers are also critical upstream inputs, determining the quality of navigation and location-based services offered to the user.

The midstream of the value chain is occupied by the Travel Application developers and owners themselves, which include large Online Travel Agencies (OTAs), independent niche application providers, and direct-to-consumer apps launched by major airlines or hotel chains. Their primary activities involve application design, feature development, user experience (UX) optimization, data analytics processing, and strategic marketing to acquire and retain users. Revenue generation typically occurs midstream through transaction commissions, service fees, or premium subscriptions. Efficiency in this stage is highly dependent on effective inventory management integration, API reliability, and the speed at which new, differentiating features (such as AI chatbots or AR integration) can be deployed and optimized based on user feedback and market testing.

The downstream involves distribution channels and the ultimate consumption by the end-user. Distribution is primarily direct-to-consumer via mobile app stores (Apple App Store, Google Play), although indirect distribution occurs through partnerships with telecom carriers or integration into broader super-apps maintained by third parties. Post-sales services, including customer support, handling cancellations, and managing loyalty programs, constitute the final steps in the value chain. The effectiveness of the downstream segment is measured by customer satisfaction, repeat usage rates, and the application's ability to seamlessly integrate with local payment infrastructure. Successful travel apps manage a continuous feedback loop from downstream users back to midstream development, ensuring continuous product improvement and alignment with evolving traveler needs.

- Upstream Analysis: Technology providers (OS developers, Cloud services), Data aggregators (GDS, specialized data feeds), Mapping service providers.

- Midstream Analysis: Travel application developers, OTAs, Direct service provider apps (airlines/hotels), UX/UI design, Payment processing integration.

- Downstream Analysis: Mobile App Stores (Direct distribution), Telecom partners (Indirect distribution), End-user consumption, Post-sales customer support, Loyalty management.

Travel Application Market Potential Customers

The potential customer base for the Travel Application Market is fundamentally divided into two major categories: Leisure Travelers and Business Travelers, though the modern market increasingly recognizes the 'Bleisure' traveler who combines elements of both. Leisure travelers represent the largest volume segment, characterized by seeking value, flexibility, and inspiration. Their needs center around easy comparison shopping for flights and hotels, discovering unique local experiences, sharing itineraries with companions, and requiring robust, user-friendly interfaces that minimize planning friction. Applications targeting this group often incorporate strong visual content, social media integration, and personalized discovery tools, aiming to facilitate memorable and hassle-free vacation experiences, ranging from budget backpackers to luxury tourists seeking curated recommendations.

Business travelers, conversely, prioritize efficiency, reliability, and corporate compliance. Their core requirements include rapid booking modification capabilities, seamless integration with expense reporting software (ERP integration), corporate rate access, and adherence to company travel policies, often managed through centralized travel management companies (TMCs). Potential customers in the enterprise sector require B2B focused applications that offer robust security, detailed reporting capabilities, and offline functionality for travelers often dealing with inconsistent connectivity. The application becomes a critical tool for minimizing administrative burden and ensuring duty of care compliance during corporate trips, making reliability and integration capabilities paramount over discovery features.

A rapidly growing segment of potential customers includes specialized groups such as digital nomads, solo travelers, and eco-conscious tourists. Digital nomads require applications that efficiently manage long-term accommodation bookings, visa requirements, and co-working space discovery, often valuing community-building features within the app. Eco-conscious tourists seek applications that provide verifiable sustainability metrics for accommodations and transportation, actively allowing them to make ethical choices. Overall, the market's potential lies in catering to these diverse, highly specified needs through modular application design, ensuring that while the core booking platform remains strong, specialized features can be easily toggled or accessed based on the unique profile and purpose of the traveler, maximizing engagement across all demographics and trip styles.

- Leisure Travelers: Individuals, families, and groups seeking value, inspiration, and seamless booking for vacations and recreational trips.

- Business Travelers (Corporate/Enterprise Clients): Employees requiring efficient booking, expense management integration, policy adherence, and reliable real-time updates for corporate trips.

- Digital Nomads and Extended-Stay Travelers: Users needing long-term accommodation management, co-working space locators, and community features.

- Adventure and Niche Tourists: Customers requiring specialized booking for highly specific activities (e.g., trekking permits, extreme sports insurance, customized gear rentals).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $75 Billion |

| Market Forecast in 2033 | $208 Billion |

| Growth Rate | 15.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Booking Holdings, Expedia Group, Tripadvisor, Airbnb, Trip.com Group, Google Travel, MakeMyTrip, Amadeus IT Group, Skyscanner, Klook, Hopper, GetYourGuide, Lastminute.com, Trainline, Kayak |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Travel Application Market Key Technology Landscape

The technological landscape underpinning the Travel Application Market is dynamic, marked by continuous advancements designed to improve speed, personalization, and security. The foundation relies heavily on robust cloud computing architectures, primarily utilizing hyperscalers like Amazon Web Services (AWS) and Microsoft Azure, which provide the scalability and global distribution necessary to handle massive peak-time traffic loads associated with global travel events and simultaneous bookings. Fast, reliable APIs (Application Programming Interfaces) are critical for integrating disparate third-party services—ranging from Global Distribution Systems (GDS) for inventory to specialized financial technology services for local payments—ensuring that the user sees real-time availability and pricing without perceptible delay. The ongoing development of sophisticated algorithms for data caching and edge computing is vital to delivering a high-performance experience, especially in regions with lower mobile network bandwidth.

Artificial Intelligence (AI) and Machine Learning (ML) constitute the most impactful transformative technologies currently being deployed. ML algorithms drive recommendation engines, utilizing complex behavioral analysis to suggest optimized itineraries or upselling opportunities (e.g., flight seat upgrades, premium room selections). Natural Language Processing (NLP) is fundamentally changing customer support interaction by enabling highly intelligent chatbots and voice assistants capable of executing complex booking functions conversationally, thereby optimizing the user experience and reducing reliance on traditional contact centers. Furthermore, predictive AI models are now integral to risk management, forecasting potential disruptions (weather events, strikes) and dynamically generating alternative solutions before the traveler is significantly impacted, moving the application from reactive support to proactive assistance.

Beyond AI, the market is rapidly adopting technologies focused on immersive experiences and enhanced security. Augmented Reality (AR) is being used in destination applications to provide interactive guides, translating street signs or superimposing historical information onto real-world landmarks viewed through the phone camera. Blockchain technology is emerging as a potential solution for managing loyalty programs transparently and securely verifying digital identity and health credentials (e.g., verifiable vaccination status), potentially streamlining airport and hotel check-in processes. The implementation of biometric authentication methods (fingerprint and facial recognition) ensures enhanced security for payment processing and access to sensitive travel documents stored within the application, solidifying trust in mobile-based transactional services.

- Cloud Computing: Utilization of scalable, globally distributed cloud infrastructure for real-time data processing and high transactional volume management.

- Artificial Intelligence (AI) & Machine Learning (ML): Powering personalized recommendations, dynamic pricing, risk prediction, and advanced chatbot support (NLP).

- Application Programming Interfaces (APIs): Essential for seamless, real-time integration with GDS, payment gateways, and local service providers.

- Augmented Reality (AR): Used for immersive in-destination guidance, navigation, and interactive virtual tours.

- Biometric Authentication: Enhancing security for mobile payments and access to digital identity documents stored within the app.

- Blockchain Technology: Explored for secure loyalty program management, digital identity verification, and transparent data logging.

Regional Highlights

Geographical analysis reveals significant disparities in market maturity, growth rate, and application adoption across major global regions. North America holds a substantial market share, driven by high consumer spending power, mature digital infrastructure, and the presence of numerous leading technology companies and major Online Travel Agencies (OTAs). The focus in North America is on product refinement, particularly around AI-driven personalization, ensuring robust data privacy compliance (in alignment with state-specific regulations), and integrating sophisticated FinTech solutions for cross-border transactions. Mobile booking penetration is extremely high, and the region is a leader in adopting specialized corporate travel management applications, emphasizing seamless integration with existing enterprise systems.

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period. This exponential growth is underpinned by factors such as a rapidly expanding middle class in countries like China, India, and Southeast Asia, coupled with high mobile-first and mobile-only internet usage. Local players, often supported by integrated ecosystems (like WeChat or super-apps), dominate the market, requiring global competitors to localize their offerings extensively, including supporting diverse payment methods and niche local services. Intra-regional travel within APAC is massive, generating immense volume for regional flight and rail booking applications. Furthermore, government initiatives promoting digital tourism infrastructure contribute significantly to market expansion.

Europe represents a highly fragmented yet digitally sophisticated market, characterized by stringent regulatory environments, most notably the General Data Protection Regulation (GDPR), which dictates application development requirements regarding user consent and data handling. European travelers prioritize niche travel experiences, sustainability features, and reliable multi-modal transport options (especially high-speed rail integration). The Middle East and Africa (MEA) region is experiencing strong growth, fueled by substantial government investment in tourism diversification (e.g., Saudi Arabia, UAE) and improved mobile connectivity across Africa. Latin America is also growing steadily, with adoption concentrated in major urban centers, driven by a younger, digitally native population increasingly utilizing mobile apps for cost-effective travel management and itinerary comparison tools, often relying on localized payment systems and currency conversion features within the applications.

- North America: Market leader in value; focuses on advanced AI personalization, enterprise integration, and data privacy compliance.

- Asia Pacific (APAC): Highest CAGR; growth driven by mobile-first population, domestic tourism boom, and strong local super-app ecosystems.

- Europe: Mature market characterized by high regulatory scrutiny (GDPR), strong demand for sustainable travel features, and sophisticated multi-modal transport booking integration.

- Middle East & Africa (MEA): High growth potential due to government-led tourism investment and rapidly improving mobile infrastructure; focus on luxury travel and pilgrimage applications.

- Latin America (LATAM): Growing steadily; high adoption among younger demographics, emphasizing mobile payment localization and price comparison features.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Travel Application Market.- Booking Holdings (Booking.com, Agoda, Kayak, Priceline)

- Expedia Group (Expedia, Hotels.com, Vrbo, Travelocity)

- Airbnb Inc.

- Trip.com Group (Ctrip, Skyscanner, Qunar)

- Google Travel

- Tripadvisor, Inc.

- MakeMyTrip Limited

- Amadeus IT Group SA

- Sabre Corporation

- Hopper

- Klook

- GetYourGuide

- Lastminute.com Group

- Trainline PLC

- Despegar (Decolar)

- Trivago N.V.

- eDreams ODIGEO

- Couchsurfing

- Waze (Google subsidiary for navigation)

- Uber Technologies (Integrated travel services)

Frequently Asked Questions

Analyze common user questions about the Travel Application market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Travel Application Market?

The primary drivers include the global surge in smartphone ownership and mobile internet accessibility, the increasing demand for personalized and real-time travel information, and technological advancements such as AI and machine learning that enhance booking efficiency and user experience. The rising propensity for independent travel planning among Millennials and Gen Z also significantly fuels market expansion.

How is Artificial Intelligence (AI) being utilized within modern travel applications?

AI is crucial for dynamic pricing optimization, generating highly personalized accommodation and activity recommendations, and operating advanced customer support chatbots using Natural Language Processing (NLP). AI also aids in predictive itinerary management and fraud detection, making travel applications more intelligent and proactive.

Which geographical region is expected to show the highest growth rate in the market?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is attributed to massive mobile internet penetration, rapid urbanization, the emergence of a large middle-class population, and strong domestic travel volumes, particularly in developing economies like India and Southeast Asia.

What is the main difference between Booking Applications and In-Trip Services applications?

Booking Applications focus primarily on pre-trip transactions, such as securing flights, hotels, and car rentals. In-Trip Services applications, conversely, focus on utilities and assistance during the journey, including real-time navigation, local activity discovery, language translation, and itinerary adjustments based on current location and circumstances.

What are the major challenges restricting market expansion?

Key restraints include the necessity for compliance with complex and varying global data privacy regulations (like GDPR), intense competition leading to reduced transactional margins, and the persistent challenge of ensuring reliable internet connectivity and service functionality in remote international travel destinations.

What role do super-apps play in the current travel application landscape?

Super-apps are consolidating multiple services—booking, payment, communication, and local activities—into a single platform. They streamline the user journey by reducing the need to switch between multiple applications, increasing user retention and market dominance, especially prevalent in the Asian market.

How does the segmentation by End-User influence app development?

Segmentation dictates specific feature requirements. Apps for Business Travelers prioritize expense reporting integration, corporate policy compliance, and specialized loyalty programs. Apps for Leisure Travelers emphasize ease of price comparison, social sharing functionality, and inspirational content for destination discovery.

Is mobile payment security a concern within the travel application market?

Yes, security is a paramount concern due to the high-value nature of transactions. Market players continually invest in robust encryption, multi-factor authentication, and biometric security features. The adoption of tokenization and emerging blockchain technologies is being explored to further enhance transaction transparency and security against fraud.

Which technology provides the foundational support for large-scale travel application services?

Cloud computing infrastructure, provided by major hyperscalers, forms the foundation. It ensures the necessary scalability, high availability, and global distribution required to process millions of real-time inventory updates and simultaneous booking requests efficiently across different time zones, maintaining service reliability.

What is the potential impact of Augmented Reality (AR) on travel apps?

AR is used to provide immersive, context-aware information. Users can point their phone cameras at landmarks to view historical facts, find immediate directions, or see real-time reviews overlaid onto local businesses, enhancing in-destination exploration and wayfinding capabilities without needing complex mapping interfaces.

How are travel applications addressing the growing focus on sustainable tourism?

Many applications are integrating features that allow travelers to calculate the carbon footprint of their flights or ground transportation. They also prioritize filtering and recommending certified eco-friendly accommodations and activities, enabling users to make more environmentally and socially responsible travel choices.

What role does the Global Distribution System (GDS) play in the travel app value chain?

The GDS platforms are upstream data aggregators that provide real-time inventory and pricing data from airlines, hotels, and car rental companies. Travel applications rely heavily on APIs connecting to GDSs to retrieve and process accurate, standardized booking information, forming the essential link between service providers and the mobile platform.

What are the specific needs of Digital Nomads that modern travel apps address?

Apps targeting Digital Nomads offer specialized features such as searching for long-term monthly rentals, identifying stable Wi-Fi speeds at accommodations, mapping out co-working spaces, and providing community forums for networking, catering to those who blend remote work with extended travel stays.

How is the intense competition in the market primarily manifesting?

Competition is mainly characterized by intense price wars, aggressive commission structures, and a race to deploy cutting-edge features, particularly in AI-driven personalization and the creation of highly integrated super-apps. Strategic acquisitions of niche technology companies by major OTAs are also a key competitive manifestation.

What is the significance of mobile platforms like Android and iOS in this market?

These operating systems are the foundational distribution channels. Android dominates in volume and global downloads, particularly in developing economies, while iOS often accounts for a higher share of high-value transactions in developed Western markets. Optimizing app performance and UI for both platforms is mandatory for market relevance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager