Tread Depth Monitor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432661 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Tread Depth Monitor Market Size

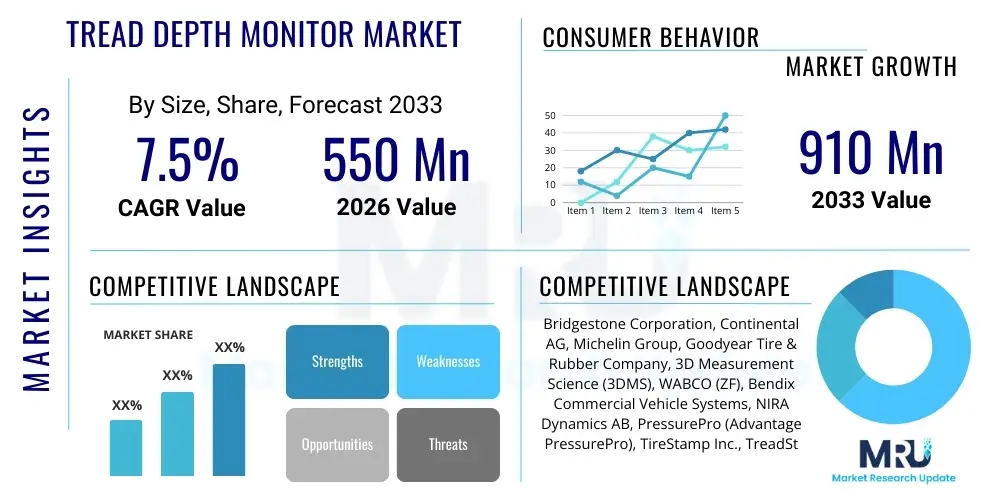

The Tread Depth Monitor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $550 Million in 2026 and is projected to reach $910 Million by the end of the forecast period in 2033.

Tread Depth Monitor Market introduction

The Tread Depth Monitor Market encompasses various technological solutions designed to accurately measure and track the wear level of vehicle tires. These systems, ranging from simple digital gauges to advanced integrated sensors, play a critical role in ensuring vehicle safety, optimizing tire life, and enhancing fuel efficiency. The core function is to provide real-time or periodic data regarding the remaining usable depth of the tire grooves, which is essential for compliance with regional safety standards and fleet management protocols. Increased regulatory scrutiny concerning road safety and the rising costs associated with premature tire replacement are primary factors driving the adoption of these monitoring systems across commercial and passenger vehicle segments.

Product descriptions within this market vary significantly based on technology and application. Solutions include handheld digital depth gauges used by maintenance personnel, drive-over scanning systems employed at transport hubs, and fully integrated in-tire or on-wheel sensor systems connected to vehicle telematics units. Major applications span commercial fleets (trucking, logistics), public transportation (buses, trains), rental car companies, and increasingly, the passenger vehicle OEM market, where enhanced safety features are paramount. The shift towards automated and preventative maintenance models strongly supports the integration of sophisticated monitoring technology, moving beyond traditional manual inspection methods.

The primary benefits derived from using accurate tread depth monitors include substantial reductions in accident rates due to improved tire conditions, optimized maintenance schedules that prevent costly downtime, and maximized asset utilization by ensuring tires are used to their legal limit without being scrapped prematurely. Driving factors for market expansion include the proliferation of connected vehicles (IoT integration), stringent government mandates for tire maintenance, and the overall industrial trend toward digitalization of operational processes, particularly within large fleet operations seeking to minimize variable costs associated with tire management.

Tread Depth Monitor Market Executive Summary

The Tread Depth Monitor Market is characterized by significant momentum driven by safety regulations and the operational efficiency needs of the global logistics and transportation sectors. Key business trends include a rapid shift from manual and handheld devices to automated, fixed-point and integrated sensor solutions, leveraging laser and ultrasonic technologies for continuous monitoring. Technology providers are focusing on developing predictive analytics platforms that integrate tread data with telematics, enabling fleet managers to forecast tire failures and schedule replacement proactively, thereby minimizing unexpected downtime and maximizing tire lifespan. Furthermore, strategic collaborations between sensor manufacturers and automotive OEMs are accelerating the integration of these systems as standard or optional features in new vehicle production lines, establishing a long-term growth trajectory for embedded solutions.

Regional trends indicate that North America and Europe currently dominate the market, largely due to established regulatory frameworks (e.g., mandatory minimum tread depths enforced strictly) and a high adoption rate of advanced fleet management technologies. The Asia Pacific region, particularly emerging economies like China and India, presents the fastest growth opportunities, fueled by rapidly expanding commercial vehicle fleets, increasing awareness of road safety, and substantial investments in smart infrastructure development. The Middle East and Africa also show promising growth, primarily concentrated in logistics corridors and mining operations where tire durability under extreme conditions is a critical operational concern, driving demand for robust monitoring solutions.

Segment trends highlight the dominance of the aftermarket segment, although the OEM segment is witnessing the highest compound growth rate as manufacturers integrate monitoring capabilities directly into tire pressure monitoring systems (TPMS) or vehicle control units. Technology-wise, laser-based scanning systems are preferred for fixed-point applications due to their high accuracy and speed, while embedded sensors (smart tires) are gaining traction for real-time, continuous data feeds during operation. The primary end-user segment remains commercial fleets, which prioritize return on investment (ROI) derived from extended tire life and reduced operational risks, making them the largest consumers of high-end, data-driven monitoring solutions.

AI Impact Analysis on Tread Depth Monitor Market

Users frequently inquire about how Artificial Intelligence and Machine Learning (ML) can evolve tread depth monitoring from simple measurement to predictive maintenance. Common questions revolve around the ability of AI to detect subtle wear patterns indicative of alignment issues, the integration of deep learning for anomaly detection in high-volume fleet data, and the potential for AI-driven scheduling to optimize maintenance windows across large logistics networks. The core concern centers on translating raw sensor data—collected continuously by laser scanners or embedded sensors—into actionable, foresightful insights that surpass the capabilities of traditional rule-based algorithms. Users seek assurance that AI integration will lead to measurable reductions in operational costs and an increase in overall fleet safety metrics, driving the expectation that monitoring systems will become indispensable components of comprehensive fleet health ecosystems.

AI's primary influence lies in transforming reactive maintenance into highly optimized predictive maintenance strategies. By analyzing vast datasets encompassing tread depth readings, vehicle load, route topography, speed profiles, and ambient temperature, ML models can accurately predict the remaining useful life (RUL) of individual tires with far greater precision than standard linear extrapolation methods. This capability allows fleet operators to maximize the use of every tire while mitigating the risk of operational failure. Furthermore, deep learning algorithms can identify non-uniform wear patterns associated with specific mechanical faults (such as suspension or alignment issues) earlier than manual inspections or basic sensor readings, enabling timely mechanical repairs before they cause excessive tire degradation, thereby shifting the monitoring purpose from mere compliance to diagnostic support.

The integration of AI also enhances the utility of drive-over scanning systems, where computer vision and sophisticated image processing techniques analyze 3D scans of the tire surface. ML models are trained to filter out environmental noise, correctly classify different tire types and sizes automatically, and flag unusual or rapid wear rates, minimizing false positives and improving data fidelity. This automation reduces the labor required for data processing and analysis, providing instant, prioritized reports to maintenance teams. Consequently, AI acts as a crucial layer in the ecosystem, ensuring that the increasing volume of data generated by advanced sensors is effectively managed, interpreted, and utilized to provide demonstrable economic value to end-users.

- AI enables predictive remaining useful life (RUL) estimation for individual tires based on usage patterns.

- Machine Learning algorithms detect subtle, non-uniform wear patterns indicating underlying mechanical faults (e.g., misalignment).

- Computer Vision enhances automated drive-over scanning accuracy by filtering noise and classifying tire types.

- Deep learning optimizes maintenance scheduling by prioritizing vehicles requiring immediate tire attention.

- AI integrates tread data with telematics and operational variables (load, speed, temperature) for holistic fleet health reporting.

- Facilitates anomaly detection in real-time, alerting operators to unusually rapid wear rates immediately.

DRO & Impact Forces Of Tread Depth Monitor Market

The Tread Depth Monitor Market is primarily driven by stringent global regulations concerning vehicle safety and tire maintenance, necessitating accurate and verifiable data on tire condition. This regulatory pressure, particularly in North America and Europe, mandates minimum tread depths, making automated monitoring systems essential for compliance and avoiding penalties. Another significant driver is the critical need for operational cost reduction within the commercial logistics industry; tires represent a substantial variable cost, and optimizing their lifespan through precise monitoring directly translates to enhanced profitability and reduced overall expenditure. The integration of IoT and cloud-based fleet management platforms further catalyzes market growth, as monitoring devices become seamlessly connected, providing centralized data access and enhanced analytical capabilities.

However, the market faces several significant restraints. High initial investment costs associated with advanced, integrated sensor systems (especially for embedded solutions and fixed drive-over scanners) pose a barrier to adoption, particularly for smaller fleet operators or individual consumers. Technical challenges, such as ensuring the long-term durability and accuracy of sensors exposed to harsh road conditions, temperature fluctuations, and debris, also impede widespread acceptance. Furthermore, data security concerns regarding the transmission and storage of sensitive vehicle operational data collected by these monitoring systems present a restraint, necessitating robust cybersecurity measures which add complexity and cost to the solutions provided.

Opportunities abound in developing high-accuracy, cost-effective wireless solutions that can be easily retrofitted onto existing vehicle fleets without requiring complex installation procedures. The expansion into the passenger vehicle OEM market, driven by consumer demand for increased safety features and enhanced vehicle diagnostics, represents a massive potential growth area. Furthermore, the convergence of TPMS (Tire Pressure Monitoring Systems) and TDM (Tread Depth Monitoring) into unified, smart tire solutions offers a compelling value proposition. The impact forces are generally high and positive; the driving forces related to safety and economics significantly outweigh the restraining factors, propelling the market forward, albeit with continuous pressure on manufacturers to improve cost-efficiency and durability. Regulatory mandates act as a constant, non-negotiable force requiring adoption.

Segmentation Analysis

The Tread Depth Monitor Market segmentation provides a clear framework for understanding market dynamics based on technology, product type, end-user application, and sales channel. Technology segmentation delineates systems utilizing physical contact probes, laser sensors, ultrasonic waves, and computer vision, each catering to different levels of required precision and deployment scenarios. Product type segmentation distinguishes between handheld manual devices, portable digital scanners, fixed drive-over systems integrated into infrastructure, and permanently embedded sensors within the tire structure (smart tires). This delineation helps in targeting specific customer needs, ranging from simple, low-cost inspection tools to highly integrated, continuous monitoring solutions essential for advanced fleet management.

End-user analysis is crucial, showing a distinct split between the dominant commercial fleet segment (which includes heavy-duty trucking, public transport, and logistics companies) and the passenger vehicle segment (OEM and aftermarket). Commercial users prioritize reliability, integration with telematics, and ROI, demanding robust, high-throughput scanning systems. In contrast, passenger vehicle demand focuses on convenient, passive monitoring systems integrated seamlessly with the car's existing dashboard interfaces. The final segmentation involves the channel of distribution, split between OEM installations, where the system is factory-fitted, and the aftermarket, where solutions are sold directly to fleet maintenance shops, independent garages, and consumers for retrofit applications.

The continuous evolution in sensor technology, particularly the increasing cost-efficiency of laser and ultrasonic components, is blurring the lines between these segments, enabling high-precision monitoring to become accessible across a broader range of applications. For instance, advanced handheld devices now offer near-laser accuracy, challenging the dominance of fixed scanners in some smaller fleet environments. Conversely, the push for autonomous and semi-autonomous vehicles requires constant, verifiable tire condition data, strongly favoring the adoption of embedded, real-time smart tire technology, which is predicted to become the fastest-growing segment in the long term, reshaping the traditional market landscape.

- By Technology:

- Laser-Based Monitoring

- Ultrasonic Monitoring

- Contact/Probe-Based Digital Monitoring

- Computer Vision Systems

- By Product Type:

- Handheld Devices (Digital Gauges)

- Drive-Over/Fixed Scanning Systems

- Embedded Sensor Systems (Smart Tires)

- By End-User:

- Commercial Vehicles (Fleets, Logistics, Public Transport)

- Passenger Vehicles (OEM and Aftermarket)

- Off-Road/Specialty Vehicles (Mining, Construction)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Retail, Service Centers)

Value Chain Analysis For Tread Depth Monitor Market

The value chain for the Tread Depth Monitor Market begins with the upstream suppliers responsible for core components. This stage involves manufacturers of specialized sensors (laser diodes, ultrasonic transducers, magnetic reluctance sensors), microcontrollers, communication modules (Bluetooth, Wi-Fi, cellular), and robust housing materials designed to withstand harsh operating environments. Innovation at this stage is focused on miniaturization, enhanced durability, and improved data accuracy. Key raw material procurement, especially for durable plastics, rubber compounds for sensor encapsulation, and high-performance electronics, dictates the overall production cost and quality of the final monitoring device. Suppliers must adhere to strict automotive-grade standards (e.g., AEC-Q100) to ensure reliability in vehicle applications.

The midstream involves the core manufacturing, assembly, and software development phase. Device manufacturers integrate the procured components, develop the proprietary algorithms necessary for accurate tread depth calculation and compensation (e.g., temperature and pressure variations), and build the physical product. This stage also encompasses the development of user interfaces, mobile applications, and specialized fleet management software required to process, analyze, and present the collected data to end-users. Quality control and rigorous testing, including vibration, temperature cycling, and ingress protection testing, are critical here to ensure the longevity and performance of both integrated and standalone systems. Companies often specialize here, focusing either on hardware development for embedded systems or software platforms for centralized fleet data management.

Downstream distribution channels are segmented into direct and indirect routes. Direct distribution involves sales to large automotive OEMs for factory installation (a growing channel) and direct sales to major commercial fleet operators seeking large-scale deployment contracts. Indirect distribution relies on a network of established automotive component distributors, aftermarket retailers, specialized tire service centers, and maintenance garages. These entities handle the installation, calibration, and support of aftermarket and handheld devices. The service aspect—post-sale support, software updates, and training—is a crucial element of the downstream value chain, particularly for complex fixed scanning or telematics-integrated solutions, ensuring customer satisfaction and maximizing the operational lifespan of the investment.

Tread Depth Monitor Market Potential Customers

The primary and largest potential customers for Tread Depth Monitor systems are commercial fleet operators, spanning various sectors including long-haul logistics, regional delivery services, public transit authorities (city buses and coaches), and specialized heavy industries like construction and mining. These customers operate large volumes of vehicles where tire maintenance directly impacts safety compliance, fuel consumption, and overall operational viability. For these users, the ROI of monitoring systems is high, derived from extended tire life, minimized unscheduled downtime, and reduction in compliance-related fines. Their purchasing decisions are heavily influenced by system integration capabilities with existing telematics systems and the robustness of the data analytics platform provided by the supplier.

A rapidly expanding customer base includes Original Equipment Manufacturers (OEMs) of passenger and commercial vehicles. OEMs are integrating these monitors either as standard safety features or premium options, recognizing the consumer demand for proactive safety alerts and low-maintenance vehicle components. This market segment is critical for long-term growth, as OEM adoption accelerates the standardization and acceptance of advanced embedded sensor technologies. Purchasing criteria here focus on seamless integration into the vehicle architecture (CAN bus), low power consumption, and compliance with global automotive standards (ISO, UNECE regulations).

Other vital segments include tire manufacturers and independent tire service centers. Tire manufacturers utilize monitoring data for warranty validation, performance optimization, and product development, seeking systems that can provide highly granular data on wear characteristics. Service centers use advanced handheld and fixed scanners to offer value-added safety inspection services to their consumer and small business clientele. Finally, individual consumers, though currently a smaller segment, represent potential customers for simple, affordable aftermarket digital gauges and basic wireless monitoring kits, driven by personal safety consciousness and a desire to maximize the lifespan of expensive tires, especially in regions with frequent weather changes affecting traction requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $550 Million |

| Market Forecast in 2033 | $910 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bridgestone Corporation, Continental AG, Michelin Group, Goodyear Tire & Rubber Company, 3D Measurement Science (3DMS), WABCO (ZF), Bendix Commercial Vehicle Systems, NIRA Dynamics AB, PressurePro (Advantage PressurePro), TireStamp Inc., TreadStat (Snap-on Incorporated), ATEQ, Laser Gauge, Tyrata Inc., Nokian Tyres PLC, TreadReader, Bowe Machine Company, Dürr Group, Bartec USA, Hunter Engineering Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tread Depth Monitor Market Key Technology Landscape

The technology landscape of the Tread Depth Monitor Market is rapidly advancing, moving beyond simple mechanical gauges toward sophisticated non-contact measurement systems. Laser-based monitoring stands out as a leading technology, utilizing structured light or triangulation methods to capture high-resolution 3D profiles of the tire surface. These systems are highly accurate, capable of measuring wear down to sub-millimeter precision, and are frequently deployed in fixed drive-over installations due to their speed and reliability. The integration of high-speed digital processing enables these scanners to take measurements in seconds, even while vehicles are in motion, making them ideal for high-throughput logistics terminals and inspection checkpoints. Continuous development is focused on reducing the cost of laser components and improving performance under adverse environmental conditions, such as wet or muddy roads.

Another crucial technological development involves ultrasonic monitoring and embedded sensor systems. Ultrasonic technology offers a durable, low-cost solution for sensing the distance to the tire surface, suitable for integration into existing TPMS platforms. However, the most transformative technology is the development of ‘smart tires’ equipped with permanently embedded sensors (often incorporating microelectromechanical systems or MEMS). These sensors continuously monitor not only pressure and temperature but also track subtle changes in the tire's internal structure and calculate tread wear in real-time. This real-time data is transmitted wirelessly to the vehicle's telematics unit, providing unprecedented granularity and enabling truly predictive maintenance, which is vital for emerging autonomous vehicle applications that require constant self-monitoring capabilities.

Furthermore, software and data analytics form a significant part of the technology landscape. Modern monitoring systems are tightly integrated with cloud-based platforms utilizing advanced algorithms (often AI/ML based, as previously discussed) for data interpretation. This software layer enables the aggregation of data from an entire fleet, visualization of wear trends, comparison against optimal performance benchmarks, and automated alerting for critical maintenance thresholds. The trend of sensor fusion—combining tread depth data with suspension diagnostics, wheel alignment measurements, and vehicle usage profiles—is creating highly comprehensive vehicle health monitoring systems, transforming the simple tread depth monitor into a sophisticated diagnostic tool crucial for maintaining high operational standards in the transportation industry.

Regional Highlights

North America: This region holds a significant share of the global Tread Depth Monitor Market, driven primarily by the large size and high technological adoption rate of its commercial trucking and logistics industries. The United States and Canada feature stringent federal and state-level regulations regarding minimum legal tread depths, making automated compliance verification a priority for fleet managers. High labor costs also incentivize the adoption of fixed, automated scanning systems over manual inspection methods. Key drivers include the mature telematics market infrastructure and the presence of major automotive OEMs and technology developers, fostering rapid product innovation and integration into new vehicles. The focus here is on integrated solutions that provide seamless data flow to centralized maintenance dashboards.

Europe: Europe represents a robust market characterized by strong regulatory enforcement (driven by organizations like the European Union and UNECE) and high standards for road safety. Countries like Germany, France, and the UK are rapid adopters of advanced monitoring solutions, particularly fixed drive-over scanners used in industrial logistics centers and ferry terminals. The European market is also at the forefront of 'smart tire' development, fueled by major tire manufacturers and the push toward electric vehicles (EVs), which often require optimized tire management due to unique torque and weight characteristics. The emphasis is on accuracy, standardization, and systems that contribute to vehicle certification and safety rating compliance.

Asia Pacific (APAC): APAC is projected to be the fastest-growing region during the forecast period. This growth is underpinned by the massive expansion of logistics and e-commerce sectors, leading to a substantial increase in the commercial vehicle fleet size, particularly in emerging markets like China, India, and Southeast Asia. While regulatory compliance is evolving, the economic drivers (reducing operational costs and enhancing safety awareness) are the primary market accelerators. Investment in smart cities and infrastructure projects, coupled with local government initiatives promoting intelligent transportation systems, encourages the deployment of fixed monitoring infrastructure. The challenge in APAC remains cost sensitivity, necessitating the introduction of more affordable, yet reliable, monitoring solutions suitable for varied vehicle types and fleet sizes.

- North America (US, Canada): Strong regulatory environment, high telematics adoption, demand for automated, integrated solutions in large commercial fleets.

- Europe (Germany, UK, France): Focus on high safety standards, leader in 'smart tire' technology development, driven by EV adoption and comprehensive road safety legislation.

- Asia Pacific (China, India, Japan): Fastest growth driven by expanding commercial fleet size, increasing urbanization, and greater investment in smart transportation infrastructure, though cost-sensitivity remains a factor.

- Latin America (Brazil, Mexico): Growing adoption in resource extraction and agriculture logistics, where tire durability and operational uptime are critical.

- Middle East & Africa (MEA): Niche demand in major logistics hubs and specialized heavy-duty fleets (mining, construction) requiring robust monitoring systems due to challenging environmental conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tread Depth Monitor Market.- Bridgestone Corporation

- Continental AG

- Michelin Group

- Goodyear Tire & Rubber Company

- 3D Measurement Science (3DMS)

- WABCO (ZF)

- Bendix Commercial Vehicle Systems

- NIRA Dynamics AB

- PressurePro (Advantage PressurePro)

- TireStamp Inc.

- TreadStat (Snap-on Incorporated)

- ATEQ

- Laser Gauge

- Tyrata Inc.

- Nokian Tyres PLC

- TreadReader

- Bowe Machine Company

- Dürr Group

- Bartec USA

- Hunter Engineering Company

Frequently Asked Questions

Analyze common user questions about the Tread Depth Monitor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between laser-based and embedded tread depth monitoring systems?

Laser-based systems typically provide highly accurate, instantaneous measurements used primarily in fixed, drive-over installations for rapid periodic checks. Embedded systems (smart tires) provide continuous, real-time data during vehicle operation but require more complex integration into the tire structure and vehicle telematics.

How does tread depth monitoring contribute to lower operational costs for commercial fleets?

By providing precise, continuous data, monitoring systems prevent premature tire replacement, ensuring tires are utilized up to their legal and safe limit, thereby maximizing asset lifespan. They also prevent costly unscheduled breakdowns by proactively identifying critical wear levels or alignment issues early.

Is the technology for tread depth monitoring primarily focused on the aftermarket or OEM installations?

Historically, the market was dominated by aftermarket solutions (handheld and retrofit scanners for existing fleets). However, the OEM segment is rapidly accelerating, driven by the integration of sophisticated TPMS/TDM sensors as standard safety and diagnostic features in new vehicle production.

What role does AI play in modern tread depth monitoring beyond simple measurement?

AI/ML algorithms analyze the collected depth data alongside operational variables (load, speed, route) to accurately predict the remaining useful life (RUL) of the tire, identify irregular wear patterns indicative of mechanical issues, and optimize fleet maintenance schedules predictively.

Which geographical region exhibits the highest growth potential for Tread Depth Monitors?

The Asia Pacific (APAC) region is forecasted to show the highest growth rate, fueled by the massive expansion of the commercial logistics and e-commerce sectors, increased road safety awareness, and significant governmental investment in smart transportation infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager