Treasury and Risk Management Application Market Report 2023-2030

Treasury and Risk Management Application Market Report is designed to incorporate both qualify qualitative and quantitative aspects of the industry with respect to each of the regions and countries involved in the study. This report also provides a balanced and detailed analysis of the ongoing Treasury and Risk Management Application trends, opportunities-high growth areas, Treasury and Risk Management Application market drivers which would help the investors to devise and align their market strategies according to the current and future market dynamics. The analysis includes Treasury and Risk Management Application Market size, situation, segmentation, price, and industry environment. In addition, the report outlines the factors driving industry growth and the description of market channels.

The report begins with an overview of the industry chain, structure and describes all segments. Besides, the report analyses market size and forecast in different geographies, types, and end-use segments, in addition, the report introduces a market competition overview among the major companies. The report also analyses industry trends, then analyses market size and forecast of Treasury and Risk Management Application by product, region, and application, in addition, this report introduces market competition situation among the vendors and company profile, besides, market price analysis and value chain features are covered in this report.

| Report Attributes | Report Details |

| Base Year | 2022 |

| Forecast year | 2023-2030 |

| Unit | Value (USD Million/Billion) |

Segments Covered | Key Players, Types, Applications, End-Users, and more | | Report Coverage | Total Revenue Forecast, Company Ranking and Market Share, Regional Competitive Landscape, Growth Factors, New Trends, Business Strategies, and more |

| Region Analysis | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Product Types | On-premise, Cloud |

| End-user Industry | Cash and Liquidity Management, Compliance and Risk Management, Financial Resource Management |

| Major Players | SAP SE, Openlink, Oracle Corporation, Reval, Wolters Kluwer, Kyriba Corporation, Calypse, PwC, MORS Software, FIS, Broadridge Financial Solutions, ION, Fiserv |

Global Treasury and Risk Management Application market size will increase to Million US$ by 2030, from Million US$ in 2022, at a CAGR of during the forecast period. In this study, 2023 has been considered as the base year and 2023 to 2030 as the forecast period to estimate the market size for Treasury and Risk Management Application

The report covers market size status and forecast, value chain analysis, market segmentation of Top countries in Major Regions, such as North America, Europe, Asia-Pacific, Latin America and Middle East & Africa, by type, application and marketing channel. In addition, the report focuses on the driving factors, restraints, opportunities and PEST analysis of major regions.

Global Treasury and Risk Management Application Market: Segmentation Analysis

Major companies in the market include:

SAP SE

Openlink

Oracle Corporation

Reval

Wolters Kluwer

Kyriba Corporation

Calypse

PwC

MORS Software

FIS

Broadridge Financial Solutions

ION

Fiserv

On the Basis of Type:

On-premise

Cloud

On the Basis of Application:

Cash and Liquidity Management

Compliance and Risk Management

Financial Resource Management

Regional Analysis For Treasury and Risk Management Application Market

North America

Regional Analysis For Treasury and Risk Management Application Market

North America (the United States, Canada, and Mexico)

Europe (Germany, France, UK, Russia, and Italy)

Asia-Pacific (China, Japan, Korea, India, and Southeast Asia)

South America (Brazil, Argentina, Colombia, etc.)

The Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria, and South Africa)

Our team of enthusiastic analysts, research experts, and experienced forecasters work precisely to produce such kind of market report. The research report defines USD values, CAGR (compound annual growth rate) values, and their variations for the precise projected time frame.

The sample pages for this report are readily available on demand.

Along with the market overview, which comprises of the market dynamics includes Porters Five Forces analysis which explains the five forces: namely buyers bargaining power, suppliers bargaining power, threat of new entrants, threat of substitutes, and degree of competition in the Global Treasury and Risk Management Application Market Size. It explains various participants such as system integrators, intermediaries and end-users within the ecosystem of the market. The report also focuses on the competitive landscape of the Global Treasury and Risk Management Application Market Size.

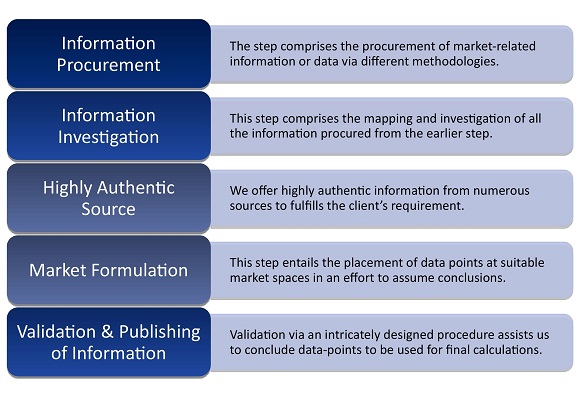

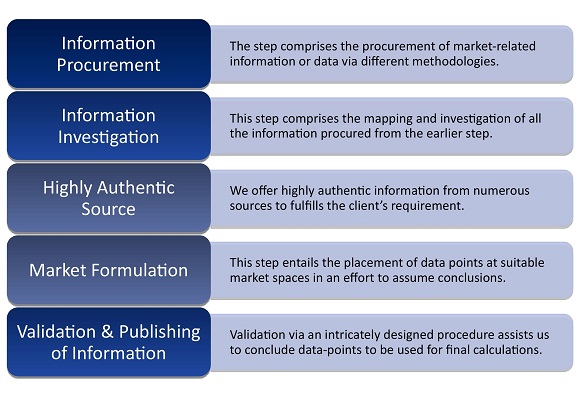

This report provides an all-inclusive environment of the analysis for the Global Treasury and Risk Management Application Market Size. The market estimates provided in the report are the result of in-depth secondary research, primary interviews and in-house expert reviews. These market estimates have been considered by studying the impact of various social, political and economic factors along with the current market dynamics affecting the Global Treasury and Risk Management Application Market Size growth.

Objectives of Research study:

- To observe the industry with reverence to individual future prospects, development trends, and contribution to the overall market.

- The overview of the global Treasury and Risk Management Application market

- The report comprised of the market companies, to describe and define and analyze the Treasury and Risk Management Application market value, share competition landscape, development plans, and SWOT analysis.

- The report also involves the structure of the industry by identifying its several sub-segments.

Before you Purchase get some Insights from this report

The research information and studies associated with participant analysis keep the competitive landscape noticeably into the focus with which the market can select or advance their own policies to increase the market growth.

Key Questions Answered in This Report:

- How has the global Treasury and Risk Management Application market performed so far and how will it perform in the coming years?

- What are the key driving factors and challenges in the global Treasury and Risk Management Application market?

- What is the breakup of the global Treasury and Risk Management Application market on the basis of product type?

- What is the breakup of the global Treasury and Risk Management Application market on the basis of application?

- What are the key regional markets in the global Treasury and Risk Management Application industry?

- What is the structure of the global Treasury and Risk Management Application market and who are the key players?

- What has been the impact of COVID-19 on the global Treasury and Risk Management Application market?

- What are the various stages of growth strategies of the global Treasury and Risk Management Application market?

- What is the degree of competition in the global Treasury and Risk Management Application market?

- How are Treasury and Risk Management Application manufactured?

Table of Content

Treasury and Risk Management Application Market – Overview

1.1 Definitions, Overview, and Scope

1.2 Drivers, Restrain, Challenges, Opportunities

Treasury and Risk Management Application Market – Executive Summary

2.1 Market Revenue and Major Trends, and Challenges

Treasury and Risk Management Application Market – Comparative Analysis

3.1 Product Benchmarking

3.2 Financial Overview

3.3 Market Cost Divided

3.4 Estimating Examination

Treasury and Risk Management Application Market – Industry Market Entry Scenario

4.1 Governing Outline Summary

4.2 New Business index

4.3 Case Studies of Positive Schemes

Treasury and Risk Management Application Market Forces

5.1 Market Drivers

5.2 Market Restrains

5.3 Market New Opportunities

5.4 Market Challenges

5.4 Porters five force model

Treasury and Risk Management Application Market – Strategic Complete Overview

6.1 Value Chain Analysis

6.2 Market Opportunities Analysis

6.3 Market Challenges Analysis

6.4 Market Life Cycle

Treasury and Risk Management Application Market – By Regions (Market Size –USD Million)

7.1 North America

7.2 Europe

7.3 Asia-Pacific

7.4 The Middle East and Africa

7.5 Rest of the World

Continue...

Customization:

We also provide customized reports according to customers specific requirements. We also provide customization for regional and country-level reports individually.