Trenbolone Acetate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438877 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Trenbolone Acetate Market Size

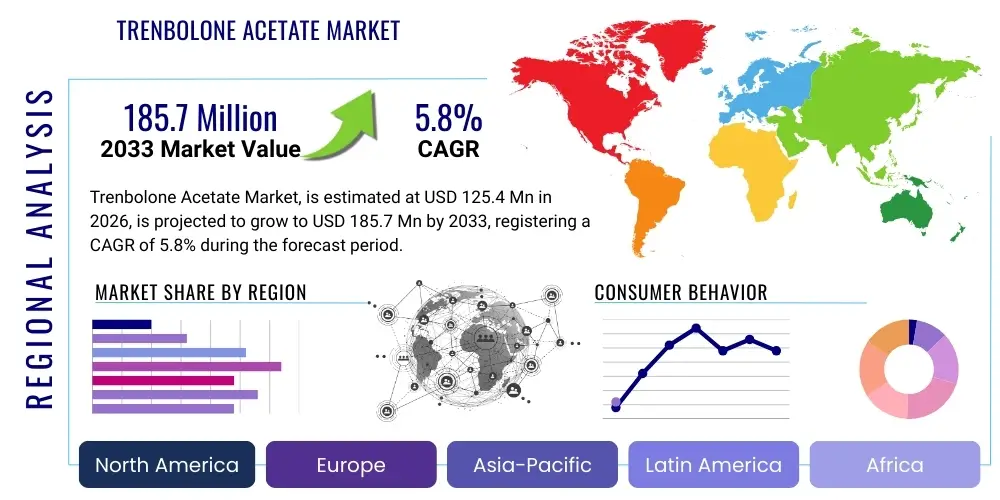

The Trenbolone Acetate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 125.4 million in 2026 and is projected to reach USD 185.7 million by the end of the forecast period in 2033.

Trenbolone Acetate Market introduction

The Trenbolone Acetate market primarily revolves around its application as a potent anabolic agent, predominantly utilized within the livestock industry, specifically for cattle, to enhance muscle growth, feed efficiency, and overall performance. Trenbolone Acetate (TA), a synthetic androgen and anabolic steroid, is regulated strictly across most global jurisdictions due to its pharmacological activity and high potential for misuse outside of approved veterinary treatments. The core market involves the production and distribution of the active pharmaceutical ingredient (API) and its subsequent formulation into veterinary implants or injectable solutions, primarily targeting professional cattle operations in regions like North America and specific parts of Asia Pacific where regulated use is permissible for economic benefit. Market dynamics are heavily influenced by global meat consumption trends, veterinary health regulations, and stringent supply chain monitoring designed to prevent diversion.

The product description centers on its function as a performance-enhancing compound in animals. When administered, TA improves the nitrogen retention capabilities of the animal, leading to increased lean muscle mass deposition and faster weight gain with less feed intake, thereby improving the profitability of cattle farming. Major applications are restricted almost entirely to the regulated veterinary sector for growth promotion in beef cattle, though limited quantities are also allocated for specialized academic and pharmacological research purposes studying steroid mechanism and metabolism. The legal framework surrounding its use is complex, defining the market's boundaries and necessitating significant investment in regulatory compliance and quality assurance from market participants.

Key driving factors include the persistent global demand for cost-effective beef production, particularly in developed agricultural economies, which necessitates efficiency-enhancing compounds like TA. Furthermore, ongoing research into specialized delivery systems and the development of sophisticated detection technologies influence market activity. The inherent benefits of regulated TA use, such as substantial gains in feed conversion rates and reduced time to market for cattle, underpin its continued, albeit controlled, relevance within commercial livestock operations. However, the market faces significant headwinds from strong public scrutiny regarding anabolic use in food animals and persistent challenges posed by the illicit manufacturing and distribution networks that operate parallel to the regulated supply chain.

Trenbolone Acetate Market Executive Summary

The Trenbolone Acetate market demonstrates resilience driven by sustained demand from the commercial beef sector, despite intense regulatory oversight and ethical considerations. Current business trends indicate a critical shift towards increased transparency and traceability within the supply chain, spurred by regulatory bodies like the FDA and EMA demanding stricter inventory controls to mitigate diversion risks. Key manufacturers are focusing on enhancing API purity and developing specialized, tamper-proof veterinary formulations, positioning quality and compliance as primary competitive differentiators. Furthermore, strategic collaborations between API producers and major veterinary pharmaceutical distributors are streamlining the regulated supply channel, reducing costs, and ensuring that products reach only approved end-users. The illegal or grey market for TA derivatives continues to represent a latent risk, influencing legitimate market strategies through the necessity for continuous public education and robust anti-counterfeiting measures.

Regionally, North America remains the dominant market segment, primarily due to the established high-volume beef industry and regulatory frameworks that, while strict, allow for specific, controlled use of growth promotants. However, the Asia Pacific (APAC) region is emerging as a critical hub, not necessarily for end-use application, but for advanced API synthesis and intermediate chemical manufacturing, driven by lower operational costs and expanding pharmaceutical infrastructure. Europe maintains one of the strictest regulatory environments globally, largely restricting TA use in food-producing animals, which limits its market size but simultaneously drives innovation in detection and analytical testing technology. These regional differences create a fragmented regulatory landscape that dictates production, distribution, and research activities.

Segment trends reveal that the veterinary implant segment, specifically designed for controlled-release administration in cattle, holds the largest market share due to its established efficacy and regulatory approval pathway. The API manufacturing segment is witnessing growth, propelled by the need for high-purity inputs for regulated formulations and specialized research purposes. Technology adoption within the market, particularly in chromatographic analysis and mass spectrometry for product testing and forensic tracking, is becoming standard practice, ensuring compliance with global food safety standards. The sustained demand for high-quality, traceable beef globally ensures the regulated market for Trenbolone Acetate maintains a stable, high-value, albeit constrained, growth trajectory.

AI Impact Analysis on Trenbolone Acetate Market

Common user questions regarding AI's impact on the Trenbolone Acetate market frequently revolve around how artificial intelligence can address two major areas: supply chain integrity and the development of safe, non-steroidal alternatives. Users are highly concerned about AI's role in detecting illicit manufacturing labs and tracking diverted regulated API across international borders, seeking assurance that sophisticated models can effectively combat the high incidence of black-market activity. Another significant area of inquiry focuses on AI-driven drug discovery, questioning whether machine learning algorithms can rapidly screen and design novel, non-hormonal growth promotants for livestock that offer similar efficacy without the associated regulatory burden and health risks. Furthermore, there is considerable interest in AI's capacity to enhance forensic science, specifically in analyzing complex metabolomic profiles to improve anti-doping testing in both veterinary and sports contexts, thereby ensuring regulatory compliance and consumer safety.

AI’s influence is rapidly becoming critical in securing the regulated Trenbolone Acetate supply chain. By leveraging predictive analytics and machine learning on large datasets encompassing global shipping manifests, customs declarations, and transactional data, AI systems can identify anomalous patterns that suggest diversion or the movement of precursor chemicals used in illicit synthesis. These algorithms significantly improve the efficiency of regulatory enforcement agencies, allowing them to focus limited resources on high-risk shipments or locations, thereby enhancing the integrity of the legitimate market. This proactive approach helps protect intellectual property and reduces the availability of unregulated products.

Furthermore, within the realm of scientific research, AI is fundamentally changing the landscape of anabolic compound alternatives. Computational chemistry and deep learning models are accelerating the screening of millions of compounds for specific efficacy targets related to muscle growth and feed efficiency, while simultaneously filtering out molecules with adverse hormonal activity. This acceleration in R&D is crucial for eventually phasing out reliance on compounds like Trenbolone Acetate, offering safer, sustainable options for livestock growth promotion. The integration of AI into quality control, ensuring the purity and consistency of legally manufactured Trenbolone Acetate API, also contributes significantly to market reliability and regulatory adherence.

- AI enhances supply chain monitoring through predictive modeling to detect diversion of regulated API.

- Machine learning algorithms optimize precursor chemical tracking, identifying potential illicit manufacturing sites globally.

- AI accelerates the discovery and design of novel, non-steroidal growth promotants for livestock, reducing reliance on TA.

- Advanced analytics improve forensic testing methods for detecting TA metabolites in anti-doping and food safety screens.

- Computational intelligence aids in optimizing manufacturing parameters for high-purity Trenbolone Acetate API production.

DRO & Impact Forces Of Trenbolone Acetate Market

The Trenbolone Acetate market is shaped by a unique combination of strong economic drivers and severe regulatory restraints, creating intense market tension. The primary driver is the undeniable economic benefit offered to the commercial beef industry through enhanced feed efficiency and rapid weight gain, satisfying the massive global appetite for affordable protein. However, this demand is severely counterbalanced by intense regulatory scrutiny from major governmental and international bodies concerning steroid use in food animals, alongside pervasive public and consumer aversion to hormonal treatments, which acts as a powerful restraint. Opportunities lie in developing ultra-precise delivery systems and expanding legitimate veterinary applications under strict monitoring, while the impact forces are largely dominated by the ongoing struggle between controlled clinical utility and the persistent threat of black-market proliferation and subsequent misuse.

Drivers: Economic pressures within the global cattle industry to maximize output and minimize operational costs significantly propel the regulated demand for Trenbolone Acetate formulations. Countries with large-scale, intensive farming operations, particularly in North America, rely on approved growth promotants to maintain competitiveness. Furthermore, sustained investment in veterinary pharmaceutical R&D, focused on improving the stability and controlled release of TA, supports market stability. The demand for high-quality, specialized API for research purposes, particularly in advanced endocrinology and metabolic studies, also serves as a niche but consistent market driver. The robust efficacy profile of TA remains unmatched by many available alternatives, solidifying its place in approved veterinary protocols.

Restraints: The most significant restraint is the extremely stringent regulatory framework imposed globally, requiring complex, costly, and time-consuming approval processes for manufacturing, distribution, and end-use. Concerns over potential human health risks associated with residual hormones in meat products necessitate extensive monitoring and analytical testing, adding considerable overhead. The widespread, unauthorized use of Trenbolone Acetate and its derivatives in illegal bodybuilding and sports doping circles severely tarnishes the compound's reputation, leading to heightened public scrutiny and increasing pressure on regulatory bodies to tighten controls further. The continuous evolution of detection technologies makes illicit use riskier but also mandates higher investment in compliance technologies by legitimate market players.

Opportunity: Key opportunities involve strategic market development through technological innovation. This includes the development of environmentally friendly, biodegradable implant matrices for controlled delivery, minimizing environmental impact while ensuring efficacy. There is also an opportunity for regulated companies to leverage advanced authentication technologies (like blockchain or advanced serialization) to build highly transparent and secure supply chains, distinguishing themselves from illicit operators and gaining trust from both regulators and consumers. Additionally, emerging veterinary markets in certain regions of Latin America and Asia, provided they adopt rigorous regulatory standards, offer potential avenues for controlled market expansion.

Impact Forces: The most prominent impact force is the regulatory compliance burden, which dictates operating margins and market access. Geopolitical factors influencing international trade and import/export regulations for APIs also exert significant pressure. The ethical debate surrounding animal welfare and hormonal use in food production acts as a perpetual external force, compelling the market to constantly justify its existence and demonstrate responsible use. Finally, technological advancements in forensic and analytical science continually raise the bar for product purity and traceability, forcing market participants to invest heavily in modern quality assurance protocols.

Segmentation Analysis

The Trenbolone Acetate market is primarily segmented based on its application, formulation type, and the end-user base that utilizes the compound under regulatory supervision. Segmentation is crucial for understanding the distribution channels and the precise regulatory hurdles faced by different product formats. The analysis reveals a stark dichotomy between the high-volume, regulated veterinary segment and the much smaller, but equally critical, research and development segment. Market players must tailor their regulatory documentation, quality control standards, and packaging to meet the specific demands of each segment, especially concerning API purity and traceability.

The segmentation by Type, specifically distinguishing between the raw Active Pharmaceutical Ingredient (API) and the finished Formulations (e.g., implants or injectables), demonstrates where the highest value is generated and where the bulk of manufacturing activity occurs. The formulations segment, offering ready-to-use, compliant veterinary products, captures the majority of the market value. Conversely, the segmentation by Application clearly highlights the dominance of the beef cattle industry as the primary consumer, overshadowing minor, regulated uses in other livestock or fundamental research. This market structure mandates that manufacturers maintain close relationships with large veterinary distributors and farming cooperatives to ensure adherence to approved usage protocols and withdrawal periods.

Further analysis of the End-User segmentation provides insight into consumption patterns. Veterinary clinics and specialized livestock feedlots are the predominant buyers of finished formulations, operating under strict veterinary supervision to administer the product legally. Academic and pharmaceutical research laboratories represent a smaller, specialized segment requiring ultra-high-purity API for controlled studies. Understanding these segmentation nuances is vital for strategic market entry and compliance efforts, as the scrutiny applied to a specialized research batch differs significantly from the regulatory expectations governing bulk commercial veterinary products.

- By Type:

- Active Pharmaceutical Ingredient (API)

- Finished Formulation (Implants, Injectables)

- By Application:

- Beef Cattle Growth Promotion

- Research & Development (R&D)

- Other Veterinary Uses (Niche)

- By End-User:

- Veterinary Clinics and Hospitals

- Commercial Cattle Feedlots

- Academic and Research Institutions

- By Distribution Channel:

- Direct Sales (Manufacturer to Distributor)

- Veterinary Pharmacies

- Online Regulated Sales

Value Chain Analysis For Trenbolone Acetate Market

The Trenbolone Acetate value chain is highly controlled and verticalized, reflecting the stringent regulatory environment governing anabolic agents. The process begins with the upstream analysis, focusing on the synthesis of complex chemical intermediates. This stage is dominated by specialized chemical and pharmaceutical manufacturers, often located in regions with advanced chemical synthesis capabilities, such as parts of Asia and specific Western countries. Quality control at this stage is paramount, as the purity of precursor materials directly impacts the safety and efficacy of the final API. Key activities include sourcing specialized raw materials and performing multi-step organic synthesis under Good Manufacturing Practices (GMP). Due to the controlled nature of the product, intellectual property protection and secure handling protocols are critical upstream elements.

The midstream section involves the conversion of these intermediates into the final Trenbolone Acetate API and its subsequent formulation into finished dosage forms, such as subcutaneous implants or specialized injectable solutions, which requires advanced pharmaceutical engineering. This is typically carried out by large, regulated veterinary pharmaceutical companies with the necessary licenses for controlled substances. Distribution channels, forming the crucial link to the downstream market, are tightly managed. Direct distribution often occurs from the manufacturer to large, licensed veterinary distributors or directly to major commercial feedlots, ensuring a closed-loop system that minimizes opportunities for diversion. Indirect channels, such as highly regulated veterinary pharmacies, play a smaller role but adhere to the same rigorous inventory tracking requirements.

Downstream analysis focuses on the end-use and regulatory oversight. The ultimate end-users are commercial cattle operations that administer the product under the strict supervision of licensed veterinarians, ensuring compliance with prescribed dosing schedules and mandatory withdrawal periods before slaughter. The entire value chain is audited frequently, emphasizing traceability from raw materials to final administration. The robustness of the value chain, therefore, is measured not just by efficiency but by regulatory compliance and the integrity of inventory management systems designed to track every unit of the controlled substance. This structured approach helps legitimate market participants manage the high risks associated with this specialized compound.

Trenbolone Acetate Market Potential Customers

The potential customer base for regulated Trenbolone Acetate is highly focused and defined primarily by the structure of the intensive livestock industry and the specialized needs of the scientific community. The primary and largest end-user segment comprises large-scale commercial beef cattle feedlots, particularly those operating in North America (US, Canada) and Australia, where regulated use of growth promotants is a standard practice to enhance economic efficiency. These feedlots require consistent supplies of high-quality, pre-approved veterinary formulations (implants) distributed via licensed veterinary supply chains. Their purchasing decisions are driven by proven efficacy, reliability of supply, and strict adherence to regulatory standards regarding withdrawal periods and food safety.

The secondary major customer group consists of veterinary practices specializing in large animal medicine. These professionals act as intermediaries, prescribing and overseeing the use of TA products on behalf of the feedlot operators. They are critical buyers because they mandate products that are easy to administer, comply with all local and national regulations, and come with comprehensive documentation for traceability and audit purposes. The relationship with the veterinarian is paramount, as only licensed professionals can legally acquire and dispense these controlled substances.

A smaller, yet significant, customer segment includes academic and institutional research laboratories, along with pharmaceutical R&D facilities. These entities require ultra-pure Trenbolone Acetate API or specific labeled compounds for controlled metabolic studies, toxicological assessments, and the development of new detection methods. Their demand is sporadic but requires manufacturers to supply specialized batches that meet exacting purity standards far beyond commercial veterinary requirements. In all cases, the 'potential customer' must possess the necessary regulatory approvals and licenses to handle controlled substances, severely limiting the breadth of the market to highly professionalized, compliant entities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 125.4 million |

| Market Forecast in 2033 | USD 185.7 million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck Animal Health, Elanco Animal Health, Zoetis Inc., Ceva Santé Animale, Bayer Animal Health (Acquired by Elanco), Bimeda Animal Health, Dechra Pharmaceuticals PLC, Vetquinol, Indian Immunologicals Ltd., Huvepharma, Jurox, Parnell Pharmaceuticals, Virbac, Tishcon Corp., Hefei Home Sunshine Pharmaceutical, Linyi Kaifu Chemical, Shanghai Chem-Act, Sinopharm, Zhejiang Chemical Industry. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Trenbolone Acetate Market Key Technology Landscape

The technology landscape for the Trenbolone Acetate market is highly centered on three critical areas: efficient API synthesis, advanced delivery systems, and sophisticated analytical verification. In API manufacturing, continuous flow chemistry and microreactor technologies are being explored to improve the yield, purity, and environmental profile of the synthesis process, offering greater control over reaction kinetics compared to traditional batch methods. Given the controlled nature of the substance, ensuring consistent, ultra-high purity is paramount, often requiring advanced crystallization techniques and complex purification chromatography to remove trace impurities that could affect regulatory approval or efficacy. Investment in automated synthesis plants ensures compliance with stringent Good Manufacturing Practice (GMP) standards while reducing the risk of human error or contamination.

Furthermore, the veterinary delivery system technology is crucial for market success. The shift towards controlled-release subcutaneous implants is driven by the need for consistent, therapeutic plasma concentrations over extended periods, minimizing the need for repeated handling of the animals. Technological advancements here include biodegradable polymer matrices and specialized excipients that regulate the dissolution rate of the API. These implants are often engineered to be difficult to tamper with, addressing a key regulatory concern regarding product misuse. Ensuring that the implant is fully absorbed with zero residual hormone by the end of the required withdrawal period is a major engineering and chemistry challenge.

Finally, cutting-edge analytical technology forms the backbone of compliance and anti-diversion efforts. High-Performance Liquid Chromatography (HPLC) coupled with highly sensitive Mass Spectrometry (MS/MS) is the standard for both finished product quality control and forensic detection of trace residues in animal tissues and environmental samples. This technology is continually being refined to detect metabolites at ever-lower parts per trillion (ppt) concentrations, setting higher standards for product withdrawal periods and supply chain security. Additionally, the adoption of serialization and digital tracking technologies (like advanced RFID and blockchain) is gaining traction to provide immutable records of product movement throughout the regulated supply chain, enhancing traceability and security.

Regional Highlights

The market dynamics for Trenbolone Acetate are intrinsically linked to regional regulatory acceptance, agricultural structure, and enforcement capabilities.

- North America (United States and Canada): Dominates the global market share due to its vast, intensive beef cattle industry and established regulatory framework (FDA approval) that permits the use of TA implants for growth promotion under strict veterinary oversight. This region represents the largest consumer base for finished formulations.

- Asia Pacific (APAC): A rapidly emerging market hub, characterized primarily by its role in global API and intermediate chemical manufacturing (especially in China and India). While local veterinary use remains highly restricted or illegal in many APAC countries, the region is crucial for the upstream supply chain, providing cost-effective, high-volume synthetic capabilities for global finished product manufacturers.

- Europe: Characterized by extreme regulatory restriction. The EU maintains a near-total ban on hormonal growth promotants in food animals, significantly limiting the size of the legitimate market. The European contribution is concentrated in high-level analytical testing, R&D focused on detection methodologies, and producing specialized API for controlled research studies only.

- Latin America (LATAM): Represents a potential growth market, driven by expanding beef exports (especially Brazil and Argentina). Market penetration is contingent upon local regulatory evolution and the adoption of robust veterinary supervision standards necessary for global compliance.

- Middle East and Africa (MEA): Currently holds a minimal share, characterized by fragmented agricultural systems and varied, often underdeveloped, regulatory structures regarding veterinary pharmaceuticals. Demand is typically limited to specialized, high-value breeding operations or research initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Trenbolone Acetate Market.- Merck Animal Health

- Elanco Animal Health

- Zoetis Inc.

- Ceva Santé Animale

- Bimeda Animal Health

- Dechra Pharmaceuticals PLC

- Vetquinol

- Huvepharma

- Jurox

- Parnell Pharmaceuticals

- Indian Immunologicals Ltd.

- Tishcon Corp.

- Hefei Home Sunshine Pharmaceutical

- Linyi Kaifu Chemical

- Shanghai Chem-Act

- Sinopharm

- Zhejiang Chemical Industry

- Mylan N.V. (Generic API)

- Teva Pharmaceutical Industries Ltd. (Generic API)

- Bayer Animal Health (Operations largely integrated into Elanco)

Frequently Asked Questions

Analyze common user questions about the Trenbolone Acetate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary legal application of Trenbolone Acetate in the current market?

The primary legal application of Trenbolone Acetate is as a highly regulated growth promotant for beef cattle in approved regions like North America and Australia, administered via subcutaneous implants under strict veterinary supervision to enhance feed efficiency and lean muscle mass development.

How do stringent regulations impact the Trenbolone Acetate market growth rate?

Strict global regulations, particularly the near-total ban in the EU and mandatory withdrawal periods elsewhere, severely constrain market volume and restrict growth to controlled channels. However, these regulations simultaneously drive value by necessitating high-purity API, advanced traceability, and sophisticated formulation technology.

Which technology is most crucial for maintaining compliance in the regulated supply chain?

Advanced analytical technologies, specifically High-Performance Liquid Chromatography combined with Mass Spectrometry (HPLC-MS/MS), are most crucial. These systems ensure both the purity of the manufactured Active Pharmaceutical Ingredient (API) and enable highly sensitive forensic detection of residues in food products and environmental samples, underpinning compliance.

Why is North America the dominant region for the Trenbolone Acetate market?

North America is dominant due to the large scale of its commercial beef industry and a stable regulatory environment that permits the controlled and supervised use of Trenbolone Acetate veterinary implants, driven by intense economic mandates for efficient livestock production.

What are the key differences between the API segment and the Finished Formulation segment?

The API segment involves the synthesis and purification of the raw chemical compound, often occurring in APAC centers. The Finished Formulation segment involves converting the API into a final veterinary product (like implants), capturing higher market value and requiring specialized pharmaceutical licensing and stringent regulatory packaging protocols.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager