Triangle Warning Plates Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438356 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Triangle Warning Plates Market Size

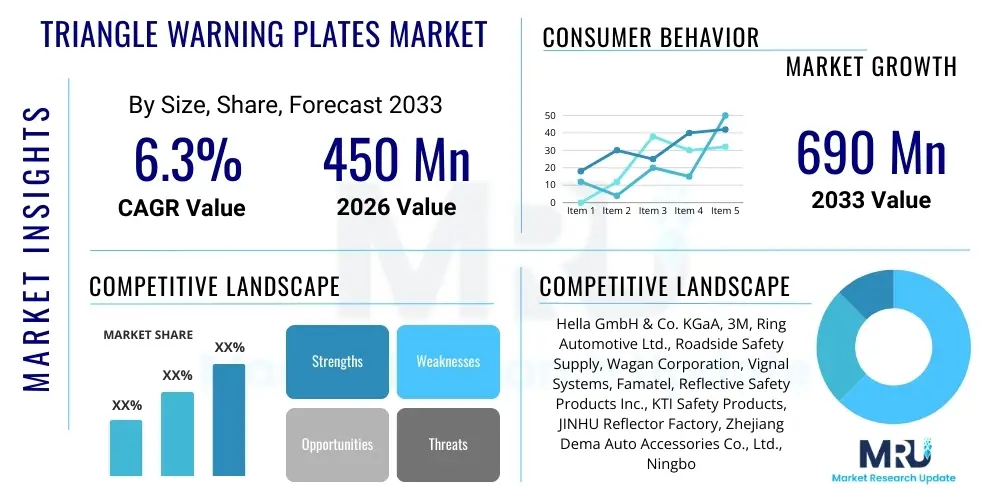

The Triangle Warning Plates Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.3% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 690 Million by the end of the forecast period in 2033.

Triangle Warning Plates Market introduction

The Triangle Warning Plates Market encompasses the manufacturing, distribution, and sale of mandatory roadside safety equipment used globally to alert oncoming traffic of stationary or disabled vehicles. These devices, typically constructed from highly reflective materials like retroreflective plastic or metal, are essential components of vehicle emergency kits, mandated by regulatory bodies in numerous countries to enhance road safety during unforeseen stops or breakdowns. Their primary function is passive safety enhancement, ensuring that vehicles stopped on busy highways or dimly lit roads are visible from a safe distance, mitigating the risk of rear-end collisions. The design adheres strictly to international standards, such as ECE R27, emphasizing stability, portability, and optimal visibility under various lighting and weather conditions. This market is intrinsically linked to automotive production rates, stringent traffic safety laws, and the growing focus on vehicular compliance and preventative safety measures across developed and emerging economies. The fundamental requirement for these plates is robustness; they must withstand wind turbulence created by high-speed traffic and remain upright and visible in all environmental conditions, a specification that drives material choice and base design.

The core product, the collapsible warning triangle, serves a critical role in vehicular safety protocols, providing drivers with a standardized and easily deployable tool for hazard notification. Major applications span across personal passenger vehicles, commercial fleets, heavy-duty trucks, and public transport systems. Demand is driven by new vehicle registrations, the replacement cycle for existing safety kits, and large-scale public safety initiatives promoting mandatory equipment carriage. Key benefits include dramatically improved visibility for disabled vehicles, adherence to legal requirements across many jurisdictions, ease of use, and durability under harsh environmental conditions. The driving factors for market expansion include the global increase in vehicle parc, rapid urbanization leading to higher traffic densities, and ongoing legislative efforts in regions like Asia Pacific and Latin America to mandate the carriage of certified safety equipment, pushing both OEM and aftermarket sales volumes higher. The integration of advanced, weather-resistant reflective materials and compact folding mechanisms further catalyzes market adoption, creating specific product tiers ranging from basic compliance models to premium, heavy-duty variants used in commercial transport.

In terms of product composition, the market is currently experiencing a shift towards materials that offer enhanced environmental sustainability alongside high performance. While traditional ABS plastic remains dominant for its cost and moldability, manufacturers are exploring recyclable polymers and lightweight composite structures to reduce the overall environmental footprint and improve portability without sacrificing stability. Furthermore, regulatory bodies are continually updating photometric standards, demanding higher coefficients of retroreflection. This technological pressure ensures that manufacturers maintain continuous testing and compliance validation, influencing R&D spending towards superior microprismatic sheeting and durable, integrated storage solutions that protect the sensitive reflective surfaces from damage when stored in a vehicle trunk. The need for products to meet diverse certification requirements across different continents dictates complex production protocols and quality assurance processes, distinguishing certified manufacturers from lower-cost competitors.

Triangle Warning Plates Market Executive Summary

The Triangle Warning Plates Market exhibits stable growth driven primarily by regulatory enforcement and expansion of the global automotive industry. Current business trends indicate a strong shift towards durable, high-visibility materials, often incorporating LED or battery-powered illumination features in premium segments, although the standard passive retroreflective plate remains the core volume driver. Manufacturing optimization focusing on lightweight yet highly stable designs is a key competitive factor. The market environment is highly sensitive to the global regulatory landscape; any mandate revision or stricter enforcement immediately translates into increased procurement, especially in the OEM segment. Competitive dynamics are characterized by manufacturers striving for cost leadership while ensuring full compliance with diverse global safety markings (e.g., E-mark, DOT, CCC), making supply chain efficiency a primary differentiator among leading vendors. Strategic emphasis is placed on securing long-term supply agreements with multinational automotive groups to guarantee consistent volume demand throughout the forecast period.

Geographically, Asia Pacific is emerging as the fastest-growing region, fueled by massive vehicle production and the gradual standardization of road safety laws in countries like China and India, making it a critical hub for both production and consumption. North America and Europe, characterized by established regulatory frameworks, show steady replacement demand and high adoption rates of compliant, certified products. The maturity of the European market implies a focus on premium product upgrades and sustainability credentials, whereas APAC market strategies emphasize volume penetration and overcoming challenges associated with diverse regional standards and significant price competition from local players. Macroeconomic factors, such as global vehicle sales trends and consumer confidence in safety standards, exert a direct influence on market volume, particularly within the aftermarket segment where consumer awareness dictates discretionary spending on safety accessories.

Segment trends reveal that the standard collapsible (folding) triangle design dominates the market due to its portability and cost-effectiveness, appealing strongly to both OEM suppliers and the aftermarket. In terms of end-use, the Aftermarket segment, driven by replacement and the need for older vehicles to meet compliance, holds a substantial share, though OEM integration is essential for high-volume sales consistency. Furthermore, the commercial vehicle sector (trucks and buses) represents a robust segment due to stricter regulations requiring multiple warning plates and enhanced durability specifications, leading to higher average selling prices in this niche. The market structure remains moderately fragmented, with large international safety equipment manufacturers holding significant influence, continuously optimizing supply chains to manage cost pressures while meeting stringent global certification requirements. Key strategic moves in this market involve securing long-term contracts with global vehicle platforms and enhancing digital distribution channels to capture the increasingly fragmented retail replacement demand efficiently.

AI Impact Analysis on Triangle Warning Plates Market

User inquiries concerning the impact of Artificial Intelligence (AI) often revolve around the perceived obsolescence of passive safety tools due to the rise of Advanced Driver-Assistance Systems (ADAS) and autonomous vehicles (AVs). Users frequently ask if AI-driven vehicles, capable of instantaneous hazard detection and autonomous maneuvering, will eliminate the need for physical roadside warnings. Key themes include the integration of digital warning systems, the role of AI in material science for improved retroreflection, and the long-term relevance of a physical plate in a fully connected vehicular ecosystem. Concerns focus on the transition period where human-driven and autonomous vehicles coexist, ensuring the physical warning plate remains relevant and visible to both human drivers and integrated sensor systems, while expectations center on AI optimizing production processes and supply chain logistics rather than fundamentally changing the product's core functional requirement.

While AI and advanced sensor technology are rapidly increasing road safety and reducing breakdown incidents, they do not immediately render the physical warning triangle obsolete, particularly in scenarios involving system failure, non-connectivity zones, or required human intervention after an incident. The current primary impact of AI is operational, streamlining manufacturing processes through predictive maintenance, optimizing inventory based on demand forecasting, and enhancing quality control during the production of reflective materials. For example, AI-driven visual inspection systems ensure that reflective sheeting is applied perfectly, minimizing defects that could lead to failure of photometric compliance testing. In the future, AI-integrated vehicle diagnostics might automatically alert drivers to deployment requirements or even prompt deployment mechanisms, although the physical presence of a passive, non-electronic safety marker remains a critical regulatory requirement that autonomous systems must acknowledge and interpret as part of redundancy planning.

The long-term influence of AI will likely shift the market focus towards intelligent, connected warning systems (e.g., V2X communication). However, for the forecast period (2026-2033), the physical triangle warning plate serves as a crucial, universally understood safety symbol, acting as a redundant system that requires no power or digital connectivity, a vital aspect for post-accident scenarios. AI applications are therefore centered on optimizing the traditional product's cost-efficiency and quality, ensuring it meets strict physical criteria even as the automotive environment evolves towards smart mobility solutions. This balance ensures the market remains robust, supported by regulatory necessity and reliability, minimizing the chance of substitution through digital means until regulatory bodies worldwide officially accept V2X systems as full replacements, a transformation unlikely to be completed within the current forecast window.

- AI-driven optimization of manufacturing tolerances and reflective material composition for improved photometric performance and reduced material waste.

- Predictive supply chain management reducing lead times and inventory costs for major OEM suppliers by accurately correlating production volumes with global vehicle assembly schedules.

- Integration of AI data (e.g., breakdown frequency analysis by region) into product design, emphasizing robustness and ease of deployment specifically tailored for high-risk environments.

- Limited direct impact on product function; the primary role remains a passive, non-powered safety device visible to both human drivers and sophisticated autonomous sensor systems.

- Future potential integration of AI-enabled vehicle diagnostics to automatically register and report triangle deployment status to emergency services or other connected vehicles (V2V).

DRO & Impact Forces Of Triangle Warning Plates Market

The market dynamics for Triangle Warning Plates are primarily shaped by governmental legislation and automotive industry growth. Drivers include the increasing stringency of mandatory safety equipment laws globally, particularly the enforcement of ECE R27 standards across various regions, which directly correlates demand to new vehicle sales and fleet maintenance schedules. Furthermore, growing consumer awareness regarding roadside safety and the prevalence of vehicle breakdowns contribute significantly to steady aftermarket demand. The replacement cycle for these plates, often damaged or lost over time, provides continuous revenue stability. These regulatory mandates create a captive market, ensuring continuous baseline demand irrespective of macroeconomic fluctuations, making regulatory compliance the single most significant driver. The introduction of new vehicle safety assessment programs globally often includes the requirement for standardized safety kits, further embedding the triangle warning plate into the necessity category and expanding procurement mandates to previously unregulated jurisdictions.

However, the market faces restraints, chiefly concerning the low-cost structure of the product, leading to intense price competition, especially from non-compliant manufacturers in unregulated markets. This pressure often compromises profit margins for certified manufacturers, forcing continuous efficiency improvements in manufacturing automation and strategic sourcing. Another significant restraint is the technological transition risk; while minimal in the short term, the long-term potential for advanced, integrated digital safety systems (e.g., automated hazard broadcasting via V2X) could eventually disrupt the market for passive tools, necessitating careful monitoring of regulatory changes. Furthermore, supply chain volatility, particularly in the sourcing of high-grade reflective polymers and plastic resins, occasionally impacts production costs and lead times, though manufacturers typically absorb these fluctuations through high-volume contract arrangements and diversified supplier bases. The challenge of maintaining quality control globally while facing high price pressure is a constant constraint, particularly when dealing with cross-border trade and varied enforcement levels.

Opportunities in this sector involve penetrating emerging markets, particularly in parts of Africa and Southeast Asia, where motorization rates are accelerating and local safety regulations are beginning to formalize and enforce mandatory safety kits. This institutionalization of safety creates immediate, large-scale demand. Developing premium products incorporating features like built-in LED lighting, enhanced UV resistance, or highly durable, non-slip base designs allows manufacturers to differentiate offerings and capture higher profit segments within the established European and North American aftermarket. Strategic long-term planning must also include investments in sustainable production practices, utilizing recycled materials to appeal to environmentally conscious OEM partners. The impact forces are characterized by high buyer power, especially from large global OEMs who dictate price and quality standards. Supplier power is moderate, concentrated among manufacturers of specialized reflective films. The threat of substitutes is low due to deep regulatory entrenchment. Competitive rivalry is high, focusing intensely on cost efficiency, robust certification portfolios, and global logistical capabilities to serve dispersed automotive assembly operations efficiently and consistently across diverse markets.

- Drivers (D): Global mandatory safety regulations (ECE R27 compliance), expansion of the global vehicle parc, increasing consumer awareness of preventative roadside safety measures, and continuous enforcement of commercial vehicle safety standards.

- Restraints (R): Intense price competition leading to margin compression, proliferation of non-certified counterfeit products, supply chain volatility for specialized polymers, and the long-term threat of digital safety system substitution.

- Opportunities (O): Penetration into high-growth, newly regulated emerging markets, development of premium (illuminated/enhanced stability) variants, strategic long-term OEM partnerships for global platforms, and leveraging e-commerce for aftermarket penetration.

- Impact Forces: High regulatory dependence (shaping baseline demand), high price sensitivity among bulk buyers, moderate supplier leverage for proprietary reflective materials, and high competitive intensity driven by cost and compliance.

Segmentation Analysis

The Triangle Warning Plates Market is comprehensively segmented based on product type, material, sales channel, and end-use application, providing a granular view of market dynamics and purchasing patterns. The primary segregation lies between rigid and collapsible designs, with collapsible variants dominating the volume due to superior storage and portability features, catering effectively to passenger vehicle trunk space limitations. This dominance is further enhanced by regulatory preference in many jurisdictions for easily storable safety equipment. Material segmentation highlights the dominance of high-grade plastic (e.g., ABS, HDPE) coupled with microprismatic retroreflective sheeting, balancing cost-effectiveness with performance requirements stipulated by regulatory bodies like the European Union's E-mark standard. The selection of materials is crucial as it determines the product's longevity, UV resistance, and structural integrity, particularly the base weight needed for wind resistance.

Sales channels distinctly divide the market into Original Equipment Manufacturer (OEM) and Aftermarket. The OEM channel provides predictable, high-volume consistency driven by new vehicle production and requires stringent quality control aligned with automotive assembly specifications. The Aftermarket segment, comprising replacement sales and retail distribution through auto parts stores and online platforms, represents necessary revenue stability for managing seasonal fluctuations and capturing demand from the existing vehicle parc. The growth of e-commerce platforms has significantly boosted aftermarket reach, allowing smaller, specialized manufacturers to compete based on certification and consumer reviews rather than only reliance on traditional brick-and-mortar retail relationships.

Understanding these segments is crucial for strategic planning. Manufacturers must prioritize cost optimization and integrated supply chain management for OEM agreements while focusing on brand trust, visible compliance certification, and robust retail partnerships to maximize aftermarket penetration. The end-use segmentation reinforces the importance of commercial vehicles (trucks, buses), which often require heavier-duty, certified plates and adhere to stricter deployment regulations (often requiring multiple units). The trend towards enhanced visibility, even within standard segments, suggests a shift towards higher-quality reflective components and robust base designs, slightly elevating the material cost but maintaining critical regulatory competitiveness and reinforcing the product's primary safety function.

- By Product Type:

- Collapsible (Folding) Warning Plates: Dominant segment due to storage convenience and portability; highly preferred by passenger vehicle OEMs.

- Rigid (Non-Folding) Warning Plates: Niche segment, often used in specific industrial or heavy machinery applications where storage space is not a constraint.

- By Material Type:

- Plastic (ABS/HDPE): High volume usage, cost-effective, and easy to mold; typically paired with microprismatic film.

- Metal: Used primarily in heavy-duty or commercial vehicle segments for superior durability and weight/stability.

- Composite Materials: Emerging segment focusing on enhanced strength-to-weight ratios and UV resistance.

- By Sales Channel:

- Original Equipment Manufacturer (OEM): High volume, low margin, focused on new vehicle integration and global automotive platforms.

- Aftermarket (Retail, Online, Replacement): Higher margin potential, driven by consumer replacement cycles and compliance upgrades for older vehicles.

- By End-Use Application:

- Passenger Vehicles: Largest volume consumer, standard collapsible plates.

- Commercial Vehicles (LCVs, HCVs, Buses): Highest durability requirements, often mandates multiple certified plates per unit.

Value Chain Analysis For Triangle Warning Plates Market

The value chain for the Triangle Warning Plates Market begins with upstream activities focused on securing specialized raw materials, specifically high-impact plastics (e.g., ABS, polypropylene) and specialized retroreflective sheeting technology. The criticality lies in sourcing certified reflective sheeting, which often dictates the final product's compliance status and performance metrics (e.g., retroreflection coefficient). Suppliers in this segment hold moderate leverage due to the strict technical specifications required for certification, particularly the specialized chemical companies producing the microprismatic films. Manufacturing involves high-volume injection molding, automated assembly of the frame and base weights, and rigorous quality control testing to ensure structural integrity and photometric performance according to international standards (e.g., ECE R27). Cost efficiency in molding and automation is vital at this stage, dictating profitability in the highly competitive OEM segment.

Midstream activities involve sophisticated logistics and distribution channels, crucial for delivering product on time to globally dispersed automotive assembly plants and retail locations. The direct channel caters primarily to large automotive OEMs, requiring just-in-time delivery and strict inventory management integrated into vehicle assembly lines globally. The indirect channel, serving the extensive aftermarket, relies on global distributors, specialized automotive parts retailers, and increasingly, major e-commerce platforms. Managing certification documentation and regional compliance variations (e.g., different standards required for US vs. EU markets) adds complexity to the distribution process. Effective inventory positioning is key to maximizing aftermarket retail sales and quick replacement cycles, requiring robust inventory management software and strategic warehousing near key consumer markets.

Downstream activities center on end-users: vehicle manufacturers and individual consumers/fleet operators. Vehicle OEMs integrate the plate into the safety kit provided with every new vehicle, generating consistent bulk demand. The aftermarket segment, driven by regulatory compliance checks, vehicle inspections, and replacement needs, requires strong retail visibility and consumer education regarding certified products versus inferior substitutes. Due to the passive safety nature of the product, marketing focuses heavily on compliance, durability, and certification marks to build consumer trust. The overall chain is optimized for high volume and low margin, placing significant pressure on manufacturers to maintain strict cost control while ensuring impeccable regulatory adherence throughout the product lifecycle, necessitating continuous audit and compliance verification across the entire supply chain.

Triangle Warning Plates Market Potential Customers

The core customer base for Triangle Warning Plates is segmented into two primary categories: institutional buyers (Original Equipment Manufacturers and Fleet Operators) and individual consumers (Aftermarket purchasers). Institutional customers, particularly major global automotive manufacturers like Toyota, Volkswagen, Stellantis, and General Motors, represent significant bulk purchasing power. They require certified products integrated directly into new vehicle packages, demanding high volume consistency, adherence to strict quality protocols (ISO/TS standards), and highly competitive pricing under long-term contracts. This segment values reliability and certified compliance above all, treating the warning plate as a standardized commodity within their complex safety specifications. Winning OEM contracts often requires global manufacturing footprints and the ability to certify products according to multiple regulatory regimes simultaneously.

Fleet operators, including logistics companies (e.g., Amazon Logistics, major trucking firms), public transport entities, and taxi/ride-sharing services, constitute a crucial, recurring customer base, especially within the commercial vehicle segment. Their demand is driven by stringent operational safety standards, often requiring multiple, highly durable warning plates per heavy commercial vehicle, exceeding passenger vehicle requirements. They are less price-sensitive than individual consumers if the product offers superior durability, enhanced stability, and meets commercial vehicle safety mandates, prioritizing longevity and robust construction features that can withstand frequent use and harsh operating environments encountered during commercial operations. Procurement cycles for fleets are often tied to vehicle service schedules or major inspection periods.

Individual consumers form the backbone of the lucrative aftermarket segment, purchasing plates either as replacements for damaged/lost items or to ensure older vehicles meet regional safety laws. This customer group is primarily reached through auto parts retailers (e.g., AutoZone, Halfords) and online marketplaces. While more price-sensitive than OEMs, they increasingly seek visibility features (like integrated storage cases and high-grade reflectivity) and rely heavily on certification marks (e.g., E-mark, DOT) as immediate indicators of product quality and legal compliance. Geographical expansion of vehicle ownership worldwide continuously broadens this consumer base, particularly in emerging economies where vehicle safety awareness is rapidly improving.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 690 Million |

| Growth Rate | 6.3% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hella GmbH & Co. KGaA, 3M, Ring Automotive Ltd., Roadside Safety Supply, Wagan Corporation, Vignal Systems, Famatel, Reflective Safety Products Inc., KTI Safety Products, JINHU Reflector Factory, Zhejiang Dema Auto Accessories Co., Ltd., Ningbo Light Industrial Products, Shenzhen Reflector Safety Technology Co., Ltd., Autostyle, Premier Safety Inc., SureWerx. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Triangle Warning Plates Market Key Technology Landscape

The technology landscape for Triangle Warning Plates centers less on digital innovation and more on advanced material science, specifically regarding retroreflective technology and structural durability. The primary technological differential is the quality and type of reflective sheeting utilized. Microprismatic technology, which offers superior reflectivity compared to traditional glass bead lenses, is increasingly becoming the standard, ensuring that plates meet the demanding photometric requirements (such as 1000 cd/lux/m²) mandated by modern safety standards like ECE R27. Manufacturers continuously invest in optimizing the geometry and clarity of the prismatic structure embedded within the plastic film to maximize visibility under low-light and adverse weather conditions, providing a crucial safety margin when deployed, particularly at night or in fog.

In manufacturing, the technology focus is on high-precision injection molding and automated assembly processes designed for efficiency and quality consistency at high volumes. Robust mold designs ensure the structural integrity and stability of the plastic frame and base weights, which are essential for preventing the plate from being blown over by passing vehicle turbulence—a critical failure point for substandard products. Innovations in material technology include using specialized UV-stabilized polymers that resist degradation from prolonged sun exposure and flexible, high-impact plastics (e.g., ABS, specialized polycarbonate blends) that allow for compact folding mechanisms without compromising structural reliability. This continuous refinement in materials allows manufacturers to offer certified products that balance mandated performance with cost efficiency required for highly competitive OEM contracts.

A burgeoning technological development, though still niche, involves the integration of low-power electronic enhancements. This includes battery-operated LED flashers or solar-rechargeable illuminated edges to supplement the passive reflection, particularly targeting premium aftermarket and commercial vehicle segments that prioritize maximum visibility in challenging environments. While not core to the traditional warning plate definition, these illuminated variants represent the market's technological edge, leveraging advancements in battery miniaturization and LED efficiency to offer active warning capabilities alongside the mandatory passive safety standard. Standardization bodies are slowly beginning to address the specifications for these hybrid active/passive safety markers, signaling a potential future segment for technologically advanced, high-performance warning systems.

Regional Highlights

Europe: Market Maturity and Regulatory Rigidity

Europe remains a cornerstone of the Triangle Warning Plates Market, characterized by strict and long-standing regulatory frameworks. Compliance with ECE R27 is rigorously enforced across the European Union and associated countries, requiring all passenger and commercial vehicles to carry at least one certified warning triangle. This creates a high barrier to entry for non-certified manufacturers and sustains consistent replacement and OEM demand. Germany, France, and the UK are key markets, demanding high-quality, certified products. The European market drives premiumization trends, with consumers and fleets often opting for products offering superior stability and enhanced reflectivity features, willing to pay a premium for guaranteed performance. The mature regulatory environment ensures predictable demand and high penetration rates, making product compliance, logistics, and brand reputation paramount for market success.

The regulatory stability in Europe allows manufacturers to invest in niche product differentiation, such as environmentally friendly materials or ergonomic designs for quicker deployment. The market structure is highly consolidated regarding certified suppliers, making it difficult for new entrants without established certification credentials and logistics networks to gain significant traction. Furthermore, European distribution channels, spanning specialized safety equipment distributors and established automotive retailers, place a high value on traceability and adherence to sustainability metrics, influencing sourcing decisions upstream and favoring large, established international suppliers capable of meeting complex ESG criteria. The emphasis on high-speed road safety ensures that photometric performance requirements are strictly maintained.

North America: Commercial Vehicle Focus

In North America, the market exhibits unique characteristics due to fragmented regulation. While passenger vehicle mandates are less unified than in Europe, the commercial vehicle segment (heavy-duty trucks, buses, and trailers) is strictly regulated by federal and state Department of Transportation (DOT) guidelines, which often require two heavy-duty, certified plates per truck or bus. This regulatory environment makes commercial fleets the most reliable and demanding end-user segment, driving the need for extremely robust and highly visible plate designs capable of withstanding severe weather and high wind speeds on major interstates. Manufacturers supplying this market focus heavily on durability, often using metal components or specialized, heavy plastic bases to meet stability tests, emphasizing products that comply specifically with US FMVSS standards for commercial vehicle warning devices.

The aftermarket in the U.S. and Canada is substantial, driven by safety-conscious consumers and the widespread availability of products through large retail chains and online platforms. However, the lack of universal passenger vehicle mandates means that a portion of the market relies on recommendation rather than strict legality, leading to higher variability in product quality sold to individual consumers. Canadian provinces, in particular, often have stricter safety requirements than their U.S. counterparts, presenting specific targets for certified manufacturers. Expansion strategies in North America often involve securing contracts with major fleet leasing companies and developing exclusive retail relationships with national auto parts distributors to capture replacement demand efficiently and maintain brand visibility in a consumer-driven aftermarket.

Asia Pacific (APAC): The Growth Nexus

The APAC region is the primary catalyst for global market expansion, projecting the highest growth rates during the forecast period. This acceleration is directly attributable to the rapid expansion of the vehicle parc in countries like China, India, Indonesia, and Thailand, coupled with an increasing emphasis on formalizing and enforcing traffic safety regulations. As incomes rise and vehicle ownership stabilizes, governments are pressured to adopt international safety standards, leading to the institutional requirement of warning triangles for new vehicles, thereby significantly boosting OEM volumes, especially in China which is the world's largest automotive producer and consumer market.

However, the APAC market is highly complex, characterized by extreme price sensitivity and fierce competition from numerous local manufacturers who often undercut international pricing. The challenge for global players is balancing cost optimization required for large Asian OEM contracts with maintaining certified quality standards (e.g., obtaining China Compulsory Certification, CCC). Manufacturers must strategically locate production facilities within the region to leverage local labor and material sourcing advantages, mitigating high import duties and logistical complexities. The scale of the market necessitates investment in high-volume, automated production lines capable of producing millions of compliant units annually.

Furthermore, the diversity in local standards and distribution infrastructure necessitates localized production and strong regional partnerships. Despite the challenges, the sheer volume potential, particularly in the aftermarket as millions of new vehicles age and require replacement safety equipment, ensures APAC remains the most strategically critical region for future growth, demanding customized marketing and distribution strategies tailored to regional consumer preferences and regulatory timelines.

Latin America (LATAM): Emerging Compliance and Volatility

The Latin American market is defined by emerging regulatory trends and significant economic variability. Countries such as Brazil, Argentina, and Mexico have established laws requiring safety kits, including warning triangles, which creates mandated demand. However, the enforcement of these laws can be inconsistent, and currency fluctuations significantly impact the cost of imported certified materials and finished products, leading to market volatility. Local production efforts are increasing, focusing on meeting national specifications and reducing reliance on costly imports, though quality control often remains a concern compared to European or North American standards, creating an opportunity for certified imports.

The demand landscape is heavily influenced by government purchasing cycles and major fleet contracts within infrastructure projects. For the individual consumer, purchasing decisions are highly sensitive to price, meaning manufacturers must offer highly competitive basic compliance models to capture market share. Strategic entry into LATAM requires navigating complex tariff structures and establishing efficient local supply chains to mitigate logistics costs and currency risks while promoting the value of certified, durable safety equipment over low-cost, non-compliant alternatives through focused educational campaigns.

Middle East and Africa (MEA): Climate Challenges and Infrastructure Development

The MEA market presents unique operational challenges related to extreme climate conditions (intense heat, sandstorms) and varied levels of infrastructure development. In the Gulf Cooperation Council (GCC) region (e.g., UAE, Saudi Arabia), demand is stable and focuses on high-quality, durable plates due to high consumer spending power and alignment with international safety standards. These markets require plates that exhibit excellent UV resistance and structural integrity under prolonged heat exposure, often favoring premium product segments capable of enduring temperatures exceeding 50 degrees Celsius without material degradation.

In contrast, the broader African market is in an early stage of formalization. As national safety and transport laws are modernized, particularly in South Africa, Nigeria, and Kenya, mandatory carriage regulations are emerging. This regulatory push provides significant long-term market opportunities, though distribution logistics are complex, and the market is dominated by price competition. Manufacturers must ensure their products are certified, highly durable, and cost-effective to succeed in this diverse and challenging regional environment, focusing on government fleet contracts and partnerships with major regional importers who can manage the final mile distribution challenges effectively.

- Europe: High regulatory compliance (ECE R27), mature market, strong OEM presence, and premiumization trends driven by consumer demand for superior stability and reflection; high logistical efficiency required.

- North America: Commercial sector dominance (DOT requirements), steady replacement demand, focus on heavy-duty and robust designs for fleet use, and variability in state-level passenger vehicle mandates; strong aftermarket retail presence.

- Asia Pacific (APAC): Highest growth rate globally, driven by massive vehicle production volume, evolving regulatory enforcement in emerging economies (China, India), and necessity for cost leadership due to intense local competition.

- Latin America (LATAM): Developing regulatory frameworks creating new market opportunities; demand tied closely to local economic stability and mandatory use policies; challenges in managing import duties and currency volatility.

- Middle East & Africa (MEA): Growth dependent on infrastructure investment and regulatory formalization; demand for highly durable, certified products capable of enduring extreme climate conditions and high resistance to UV damage.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Triangle Warning Plates Market.- Hella GmbH & Co. KGaA

- 3M (Material Supplier Influence)

- Ring Automotive Ltd.

- Wagan Corporation

- Roadside Safety Supply

- Vignal Systems

- Famatel

- Premier Safety Inc.

- KTI Safety Products

- Reflective Safety Products Inc.

- SureWerx

- Zhejiang Dema Auto Accessories Co., Ltd.

- Ningbo Light Industrial Products Co., Ltd.

- Shenzhen Reflector Safety Technology Co., Ltd.

- Autostyle

- Streetwize Accessories

- First Aid & Safety N.V.

- Pro-Lite, Inc.

- Safex Inc.

- B&B Manufacturing

Frequently Asked Questions

Analyze common user questions about the Triangle Warning Plates market and generate a concise list of summarized FAQs reflecting key topics and concerns.What regulatory standards govern the quality of Triangle Warning Plates globally?

The most critical and widely recognized standard is ECE Regulation 27 (ECE R27), mandatory across the European Union and numerous affiliated countries, defining precise specifications for photometric performance, structural stability, and size. In the United States, commercial vehicle requirements are governed by Department of Transportation (DOT) standards, particularly emphasizing durability and visibility for heavy-duty applications.

Is the Triangle Warning Plate market facing disruption from advanced vehicle safety technologies like ADAS or V2X communication?

While technologies such as ADAS enhance preventative safety, the physical warning triangle remains mandated as a non-powered, universally understood, and redundant safety measure. AI and V2X systems are currently optimizing vehicle safety but are not expected to fully replace the physical requirement within the forecast period (up to 2033) due to regulatory inertia and the critical need for a fail-safe passive system.

Which segment holds the largest market share: OEM or Aftermarket sales?

The Aftermarket segment typically holds a substantial volume share, driven by replacement needs, regulatory non-compliance correction, and retail sales to existing vehicle owners. However, the Original Equipment Manufacturer (OEM) channel provides higher revenue stability and volume consistency directly tied to global vehicle production cycles, often securing higher value contracts despite lower individual unit margins.

What is the primary material technology driving competitive advantage in the market?

The key technology is high-grade retroreflective sheeting, particularly microprismatic technology. This material offers superior reflection coefficients and durability compared to older glass bead reflective films, enabling plates to meet strict regulatory photometric performance requirements crucial for optimal roadside visibility, especially in low-light and adverse weather conditions.

Why is the Asia Pacific region the fastest-growing market for Warning Plates?

The rapid growth in APAC is fueled by two main factors: immense new vehicle production volumes (driving OEM demand) and the increasing formalization and enforcement of mandatory vehicle safety laws in highly populated, emerging economies such as China and India, significantly boosting both OEM and aftermarket procurement while gradually aligning standards with international benchmarks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager