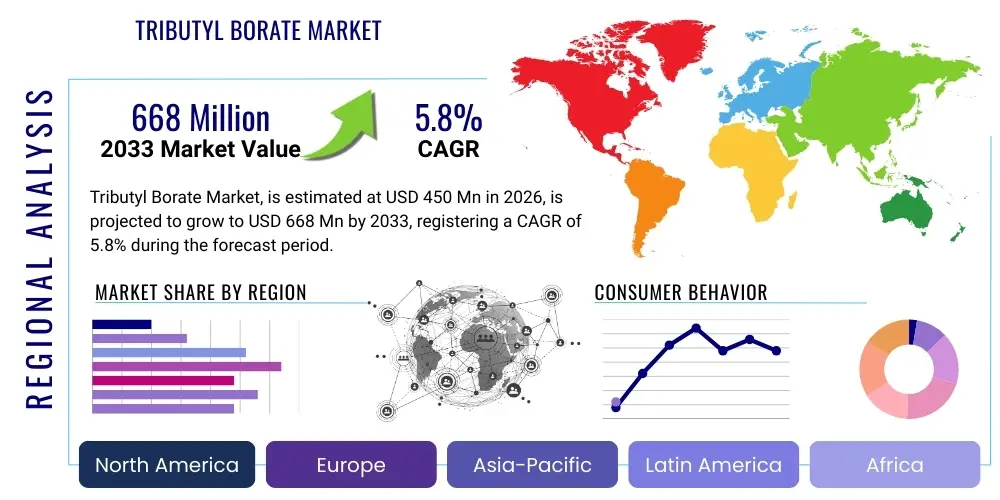

Tributyl Borate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439081 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Tributyl Borate Market Size

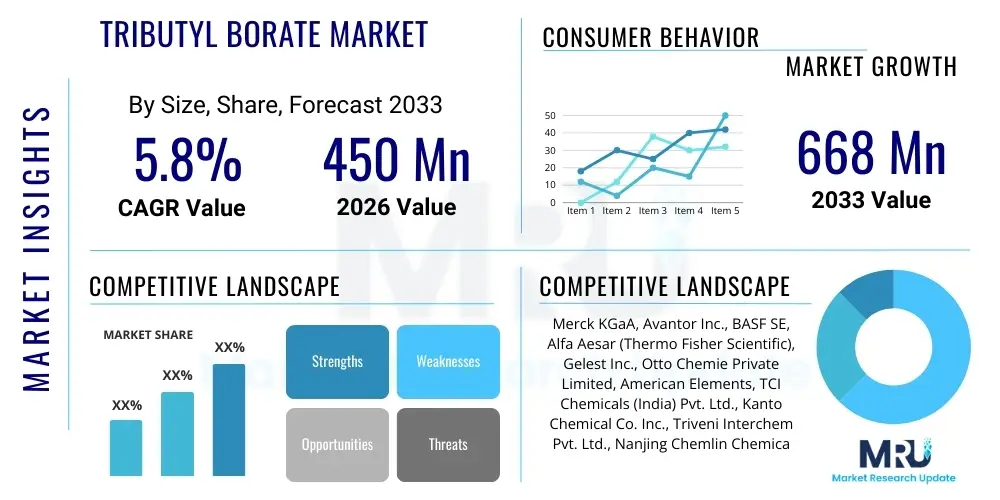

The Tributyl Borate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 668 Million by the end of the forecast period in 2033.

Tributyl Borate Market introduction

The Tributyl Borate market encompasses the production, distribution, and application of the organoboron compound, specifically the triester of boric acid and n-butanol. Tributyl Borate (TBB) is a colorless, transparent liquid widely recognized for its high solubility in organic solvents and its efficacy as a chemical intermediate. Its molecular structure lends itself particularly well to catalytic roles and stabilization processes, making it indispensable in niche sectors of the chemical industry. The primary driver for the market is the escalating demand from the polymers and coatings industry, where TBB serves as an effective cross-linking agent and polymerization catalyst, enhancing the physical properties of final products such as plastics and specialized adhesives. Furthermore, its application as a non-flammable solvent and a constituent in advanced lubrication formulations solidifies its position as a critical specialty chemical.

Tributyl Borate offers several intrinsic benefits, including thermal stability, low volatility, and excellent catalytic performance in esterification and transesterification reactions. These attributes make it highly valued in the synthesis of pharmaceuticals and fine chemicals, demanding high purity reagents. A significant application area involves its use as an additive in aviation fuels and specialized lubricants, where it contributes to anti-wear and extreme pressure properties, vital for high-performance machinery. The increasing complexity of industrial chemical synthesis, coupled with stringent quality requirements for end products in the automotive and aerospace sectors, continuously fuels the demand for high-grade TBB. Market growth is structurally linked to global industrial output, particularly in emerging economies where manufacturing capacity is rapidly expanding.

Driving factors propelling the Tributyl Borate market include the expansion of the paint and coatings industry, driven by global construction and infrastructure projects, particularly in Asia Pacific. TBB is crucial for developing flame-retardant polymers and high-durability coatings. Moreover, regulatory shifts favoring safer, more efficient chemical catalysts over traditional, potentially toxic alternatives are creating lucrative opportunities for TBB. Its role as a crucial boron source in certain advanced materials manufacturing processes, such as glass ceramics and composite materials, further diversifies its application base and secures its sustained market relevance throughout the forecast period. Investment in research and development to explore new applications, especially in sustainable chemical synthesis, remains a key growth accelerator.

Tributyl Borate Market Executive Summary

The Tributyl Borate market is characterized by robust growth underpinned by strong consumption trends across key industrial verticals, notably polymers, coatings, and fine chemicals. Business trends indicate a focus on optimizing synthesis methods to achieve higher purity TBB, crucial for electronic-grade applications and advanced catalysts. Key manufacturers are investing heavily in capacity expansion and backward integration strategies to secure raw material supplies (boric acid and butanol), mitigating volatility risks. Mergers and acquisitions, particularly aimed at securing regional distribution networks in high-growth regions like APAC, are defining the competitive landscape. Supply chain resilience and adherence to evolving global chemical safety standards are becoming primary determinants of market leadership and operational efficiency within the Tributyl Borate sector, dictating investment priorities for the next decade.

Regionally, Asia Pacific (APAC) stands out as the dominant and fastest-growing market, primarily fueled by the burgeoning manufacturing bases in China and India, especially within the construction and automotive sectors. Europe and North America, while exhibiting slower growth, maintain a significant share due to established fine chemical and aerospace industries demanding premium-grade TBB for specialized applications. These mature markets prioritize innovation in sustainable and eco-friendly borate ester production methods. Segment trends highlight the technical-grade TBB category maintaining the largest volume share, driven by bulk applications in polymer cross-linking. However, the high-purity/electronic-grade segment is anticipated to witness the highest CAGR, supported by its critical role in advanced material precursors and sophisticated pharmaceutical intermediates, reflecting a shift towards value-added chemical manufacturing.

The Tributyl Borate market is entering a phase of technological maturity coupled with increasing demand specialization. The market structure remains moderately concentrated, with key global players dominating the intellectual property related to efficient production and purification. Strategic pricing, driven by the fluctuating costs of raw materials, particularly butanol, is a central theme affecting short-term profitability. Long-term success is increasingly dependent on the ability of manufacturers to navigate complex international trade regulations and demonstrate commitment to Responsible Care initiatives, which address environmental and safety concerns associated with chemical handling. This dual focus on operational excellence and regulatory compliance is setting the pace for sustained market expansion and competitive differentiation in the global Tributyl Borate landscape.

AI Impact Analysis on Tributyl Borate Market

User queries regarding AI's impact on the Tributyl Borate market predominantly revolve around optimizing chemical synthesis, predicting demand fluctuations, and enhancing quality control. Users frequently inquire about how AI and Machine Learning (ML) can improve reaction yields, specifically for complex esterification processes, and reduce waste in high-purity TBB production. Concerns often center on the capital intensity required for adopting these technologies and the need for specialized data scientists in traditional chemical manufacturing settings. The overall expectation is that AI will primarily serve as a powerful tool for predictive maintenance in manufacturing plants and for accelerating the discovery of novel catalyst formulations utilizing TBB, thereby enhancing operational efficiency and driving down production costs, particularly for commodity grades.

- AI-driven optimization of TBB synthesis reaction parameters, improving yield and reducing energy consumption.

- Machine learning models used for predictive maintenance of reactors and distillation columns, minimizing downtime.

- Enhanced supply chain visibility and predictive analytics for raw material (boric acid, butanol) price volatility.

- AI algorithms accelerating the discovery and testing of novel TBB-based catalyst formulations for polymer synthesis.

- Automated quality control systems utilizing computer vision and AI for real-time purity verification, essential for electronic-grade TBB.

- Improved safety and risk management through AI monitoring of hazardous chemical storage and handling processes.

DRO & Impact Forces Of Tributyl Borate Market

The Tributyl Borate market is primarily driven by robust growth in end-use industries suchates in developing regions and the high demand for high-performance materials in established markets. However, the market faces significant restraint due to the volatility of raw material prices, particularly butanol, which is petroleum-derived, and increasing scrutiny regarding the environmental persistence of boron compounds. Opportunities arise from the increasing adoption of TBB as an alternative flame retardant and the demand for specialized boron compounds in green energy technologies, such as advanced battery electrolytes. These forces collectively shape the market's trajectory, where technological advancements aimed at improving sustainability will be key differentiators in competitive success and market penetration.

Key drivers include the indispensable role of TBB as a catalyst and cross-linking agent in the rapidly expanding construction and automotive coatings sector, especially for protective and durable finishes. The growing requirement for high-specification lubricants and functional fluids in the aerospace and defense industries, where TBB's anti-wear properties are critical, provides substantial momentum. Conversely, the market is restrained by regulatory hurdles, such as potential inclusion in lists of substances of very high concern (SVHC) in regions like Europe (REACH), which necessitates costly substitution or extensive toxicological assessment. Moreover, the availability of alternative chemical intermediates, while often less effective, poses a substitutional threat, limiting price flexibility for TBB manufacturers.

The most significant opportunities stem from the pharmaceutical sector, where high-purity TBB is essential for advanced organic synthesis, offering high-margin growth. Furthermore, the global transition towards fire safety standards enhances the appeal of TBB-derived compounds in flame-retardant applications for textiles and plastics. Impact forces include significant geopolitical tensions affecting global supply chains and trade tariffs, influencing the localization of manufacturing. The environmental impact force compels manufacturers to invest in cleaner production techniques and efficient waste management, ensuring the long-term viability and social license to operate within this specialized chemical segment, balancing industrial utility against ecological responsibility.

Segmentation Analysis

The Tributyl Borate market segmentation is defined primarily by the product grade, which dictates the application area and purity requirements, and by the various end-use industries that leverage its catalytic and stabilization properties. Product grades are typically categorized into Technical Grade and High-Purity/Electronic Grade, reflecting the stringent purity demands of specialized sectors versus the bulk needs of standard polymer production. The end-use segmentation is highly diversified, encompassing industrial pillars such as Coatings, Adhesives, Lubricants, Pharmaceuticals, and Polymer Manufacturing. This granular segmentation allows manufacturers to tailor their production processes and marketing strategies to specific market niches, ensuring optimized value capture across the diverse TBB value chain.

Segmentation by grade is critical as it determines the price point and manufacturing complexity. Technical grade Tributyl Borate, used extensively in solvents, coatings, and bulk catalysts, accounts for the majority of the market volume due to its widespread applicability and lower production cost threshold. In contrast, the High-Purity segment, demanding rigorous quality control and specialized purification techniques, serves high-value applications such as pharmaceutical synthesis, specialized electronic materials, and aerospace lubricants, commanding premium pricing and exhibiting superior growth rates as advanced technologies proliferate globally. Understanding this distinction is vital for competitive positioning.

The application segmentation illustrates the functional utility of Tributyl Borate. The Lubricants & Fuel Additives segment is crucial due to the compound’s superior thermal stability and anti-friction capabilities, particularly in high-stress environments. Meanwhile, the Coatings & Polymers segment remains a foundational revenue stream, linked directly to global construction and infrastructure spending. As the market matures, new applications in composite materials and advanced ceramics are expected to further refine and expand the existing end-use segment landscape, requiring continuous innovation in product formulation and precise technical specification adherence from TBB suppliers.

- By Grade:

- Technical Grade Tributyl Borate

- High-Purity/Electronic Grade Tributyl Borate

- By Application:

- Catalyst (Polymerization, Esterification)

- Cross-linking Agent

- Lubricant and Fuel Additives

- Non-flammable Solvent

- Chemical Intermediate (Pharmaceuticals, Fine Chemicals)

- Others (Flame Retardants, Specialty Glass)

- By End-Use Industry:

- Coatings and Paints

- Polymer and Plastic Manufacturing

- Automotive and Aerospace

- Pharmaceuticals and Healthcare

- Adhesives and Sealants

- Electronics

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Tributyl Borate Market

The Tributyl Borate value chain begins with the upstream procurement and processing of key raw materials, primarily boric acid (derived from borate minerals) and n-butanol (derived from petroleum or renewable feedstocks). The integration of robust sourcing strategies is crucial, as the cost and purity of these inputs significantly dictate the final product cost and quality. Manufacturers often rely on specialized chemical synthesis providers who possess the necessary expertise and infrastructure for the esterification process, which transforms boric acid and butanol into TBB. Efficiency in this manufacturing phase, particularly in energy consumption and waste minimization, is essential for maintaining competitive margins in the global chemical market, necessitating continuous process optimization and quality control throughout the production cycle.

The midstream phase involves the core manufacturing process, purification, and quality assurance. High-purity grades require advanced separation techniques, such as fractional distillation, to meet stringent specifications required by the pharmaceutical and electronics sectors. Following manufacturing, the distribution channel plays a vital role. Due to the technical nature of TBB, distribution is often handled via specialized chemical logistics providers capable of managing bulk liquid transport under controlled conditions, adhering to strict dangerous goods regulations. Direct sales channels are frequently employed for large industrial end-users (e.g., major polymer producers), ensuring technical support and tailored supply agreements, while indirect channels utilizing chemical distributors serve smaller volume buyers and niche applications.

The downstream segment focuses on the end-use applications, where TBB is integrated into final product formulations, such as coatings, lubricants, or pharmaceutical intermediates. Key downstream activities include formulation blending, application support, and customer relationship management. The reliance on technical expertise means that effective after-sales support and regulatory guidance are critical components of the service offering. The entire value chain is deeply influenced by fluctuating global commodity prices and environmental regulations, pushing manufacturers towards vertically integrated models where feasible, or strong, long-term partnerships with reliable raw material suppliers and specialized distributors to mitigate market risks and ensure continuous, high-quality supply to diverse global end-markets.

Tributyl Borate Market Potential Customers

The primary potential customers for Tributyl Borate are large-scale industrial chemical consumers and formulators requiring high-performance chemical intermediates for specialized applications. This includes major multinational corporations involved in the production of high-specification polymers and plastics, particularly those focused on automotive components, construction materials, and packaging films, where TBB acts as an efficient cross-linking agent and polymerization catalyst. Another significant customer base lies within the aerospace and heavy machinery sectors, specifically manufacturers of advanced lubricants, hydraulic fluids, and functional oils, who require TBB for its superior thermal stability and anti-wear properties under extreme operating conditions. These customers prioritize reliability, technical data, and stringent quality certifications.

Pharmaceutical and fine chemical manufacturers constitute another high-value segment of potential customers. These companies utilize high-purity Tributyl Borate as a versatile reagent in complex organic synthesis, particularly in the production of specialized drug intermediates and active pharmaceutical ingredients (APIs). Their demand is often smaller in volume but commands premium pricing due to the necessity for ultra-high purity, tight impurity specifications, and comprehensive documentation for regulatory approval. Additionally, manufacturers in the electronic materials sector, utilizing boron compounds for specialized glass, ceramics, and semiconductor precursors, represent a growing niche, seeking electronic-grade TBB for its precision application capabilities and minimal metallic impurity content.

Finally, the construction chemical industry, including paint, coatings, and adhesives manufacturers, represents a bulk consumption market for technical-grade TBB. These customers use TBB primarily to improve coating durability, adhesion, and flame retardancy in residential and commercial applications. The purchasing decision for this segment is often driven by cost-effectiveness, large-volume supply capacity, and compatibility with existing formulation processes. Targeting these diverse segments requires a multifaceted sales strategy, balancing direct technical engagement with specialized fine chemical clients against streamlined, high-volume logistics for the construction and polymer industries, catering to distinct purchasing criteria and technical needs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 668 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA, Avantor Inc., BASF SE, Alfa Aesar (Thermo Fisher Scientific), Gelest Inc., Otto Chemie Private Limited, American Elements, TCI Chemicals (India) Pvt. Ltd., Kanto Chemical Co. Inc., Triveni Interchem Pvt. Ltd., Nanjing Chemlin Chemical Co. Ltd., Shandong Borui Chemical Co. Ltd., Finar Chemicals, Parchem fine & specialty chemicals, Central Glass Co. Ltd., GFS Chemicals, Reagents Inc., Spectrum Chemical Manufacturing Corp., Wako Pure Chemical Industries, Boron Specialities. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tributyl Borate Market Key Technology Landscape

The manufacturing technology for Tributyl Borate primarily centers around the esterification reaction between boric acid and n-butanol, typically catalyzed by sulfuric acid or an acidic ion exchange resin. While the fundamental chemical process is mature, the technological landscape is defined by continuous process intensification and optimization aimed at enhancing reaction selectivity, increasing yield, and reducing utility costs. Key technological advancements include the use of continuous stirred-tank reactors (CSTRs) coupled with highly efficient separation and purification systems, critical for meeting the demanding specifications of electronic and pharmaceutical-grade TBB. Manufacturers are increasingly adopting catalytic distillation techniques which combine reaction and separation into a single unit, drastically improving energy efficiency and overall throughput, thereby securing a competitive edge in high-volume production scenarios.

Purity enhancement technologies represent a crucial area of focus, particularly as TBB finds growing use in specialized, impurity-sensitive applications such as OLED display precursors and high-performance semiconductor etching agents. Modern production facilities utilize sophisticated, multi-stage fractional distillation columns operated under vacuum to effectively remove residual water, unreacted butanol, and heavy by-products. Furthermore, the implementation of advanced process control systems (APCS) utilizing real-time spectroscopic analysis (like Near-Infrared or Raman spectroscopy) allows for instantaneous monitoring of product purity, minimizing batch variation and ensuring compliance with stringent quality standards like those mandated by the European Pharmacopoeia or SEMI (Semiconductor Equipment and Materials International) standards for chemical reagents. This precision is non-negotiable for high-purity TBB market penetration.

Looking ahead, emerging technologies in green chemistry are influencing TBB production. Research is focused on developing environmentally benign catalyst systems, moving away from conventional strong mineral acids towards solid acid catalysts or enzymatic methods, minimizing corrosion and simplifying downstream neutralization and waste treatment. Furthermore, solvent-free synthesis methods or the use of sustainable solvents derived from bio-based butanol are being explored to reduce the overall environmental footprint of TBB manufacturing. Digital twin technology and simulation software are increasingly utilized during plant design and modification to model reaction kinetics and flow dynamics, predicting optimal operational parameters before physical implementation, accelerating innovation and sustaining the market's trajectory towards cleaner, more efficient chemical synthesis.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market for Tributyl Borate and is projected to exhibit the highest growth rate during the forecast period. This surge is driven by massive infrastructure spending, rapid urbanization, and the corresponding expansion of the coatings, polymers, and automotive manufacturing industries, particularly in China, India, and Southeast Asian nations. The region serves as a global manufacturing hub, necessitating high volumes of TBB for industrial intermediates and specialty chemical production, supported by comparatively lower operational costs and increasing domestic consumption.

- North America: North America holds a significant, albeit mature, market share. Demand is primarily driven by high-value, specialized applications in the aerospace (lubricants and hydraulics), defense, and advanced electronics sectors, requiring high-purity grades of TBB. Stringent environmental and chemical regulatory frameworks (TSCA) enforce compliance but also push technological innovation towards safer, high-performance formulations, maintaining stable demand for premium products.

- Europe: Europe is characterized by strict regulatory oversight (REACH), which influences supply chain complexity and product formulation, prioritizing eco-friendly and low-toxicity alternatives. Demand remains steady, fueled by the robust automotive sector, pharmaceutical synthesis, and a strong presence of sophisticated fine chemical manufacturers in Germany, France, and the UK, focusing heavily on R&D and specialized, niche applications requiring reliable, certified Tributyl Borate sources.

- Latin America (LATAM): The LATAM market is poised for moderate growth, primarily linked to industrial recovery and expansion in Brazil and Mexico. Key applications include protective coatings, local polymer production for construction, and industrial lubricants. Market growth is sensitive to macroeconomic stability and foreign direct investment into regional manufacturing capabilities.

- Middle East & Africa (MEA): MEA presents emerging opportunities, mainly centered around petrochemical complex expansions and associated industrial development in the GCC countries. The demand for TBB is driven by infrastructure projects, specialized drilling fluids, and lubricants in the oil and gas industry, creating a niche market that is highly reliant on imports from Asia and Europe.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tributyl Borate Market.- Merck KGaA

- Avantor Inc.

- BASF SE

- Alfa Aesar (Thermo Fisher Scientific)

- Gelest Inc.

- Otto Chemie Private Limited

- American Elements

- TCI Chemicals (India) Pvt. Ltd.

- Kanto Chemical Co. Inc.

- Triveni Interchem Pvt. Ltd.

- Nanjing Chemlin Chemical Co. Ltd.

- Shandong Borui Chemical Co. Ltd.

- Finar Chemicals

- Parchem fine & specialty chemicals

- Central Glass Co. Ltd.

- GFS Chemicals

- Reagents Inc.

- Spectrum Chemical Manufacturing Corp.

- Wako Pure Chemical Industries

- Boron Specialities

Frequently Asked Questions

Analyze common user questions about the Tributyl Borate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Tributyl Borate in industrial applications?

Tributyl Borate (TBB) primarily functions as a highly effective catalyst for polymerization and esterification reactions, a cross-linking agent in polymer and coating formulations, and a key component in specialized lubricants and hydraulic fluids due to its exceptional thermal stability and anti-wear properties. It is also utilized extensively as a precursor in the synthesis of pharmaceuticals and fine chemicals.

Which geographical region exhibits the highest growth potential for the Tributyl Borate market?

The Asia Pacific (APAC) region, driven by rapid industrialization, massive construction activities, and booming automotive and electronics manufacturing bases in countries like China and India, is projected to register the fastest Compound Annual Growth Rate (CAGR) and hold the largest market share throughout the forecast period due to high volume consumption of technical-grade TBB.

What are the key differences between Technical Grade and High-Purity Tributyl Borate?

Technical Grade TBB is used for bulk industrial applications such as standard coatings, sealants, and polymer catalysis, focusing on cost efficiency. High-Purity or Electronic Grade TBB undergoes rigorous, multi-stage purification processes to minimize metallic and organic impurities, making it essential for high-specification sectors like pharmaceuticals, advanced electronics manufacturing, and aerospace lubricants, commanding significantly higher pricing.

How do volatile raw material costs impact the pricing of Tributyl Borate?

The pricing of Tributyl Borate is highly sensitive to the cost fluctuations of its primary raw material, n-butanol, which is predominantly derived from petrochemical sources. Volatility in crude oil markets directly translates to instability in butanol prices, compelling TBB manufacturers to implement dynamic pricing strategies and secure long-term supply contracts to mitigate procurement risks and maintain margin stability.

What role does Tributyl Borate play in the lubricant and fuel additives sector?

In the lubricant and fuel additives sector, TBB acts as an anti-wear additive and a dispersant, improving the thermal and oxidative stability of oils and fluids, particularly in extreme pressure environments found in aerospace and heavy-duty machinery. Its boron content contributes significantly to reducing friction and extending the operational lifespan of critical components, making it a valuable high-performance additive.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager