Trichloroisocyanuric Acid Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435321 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Trichloroisocyanuric Acid Market Size

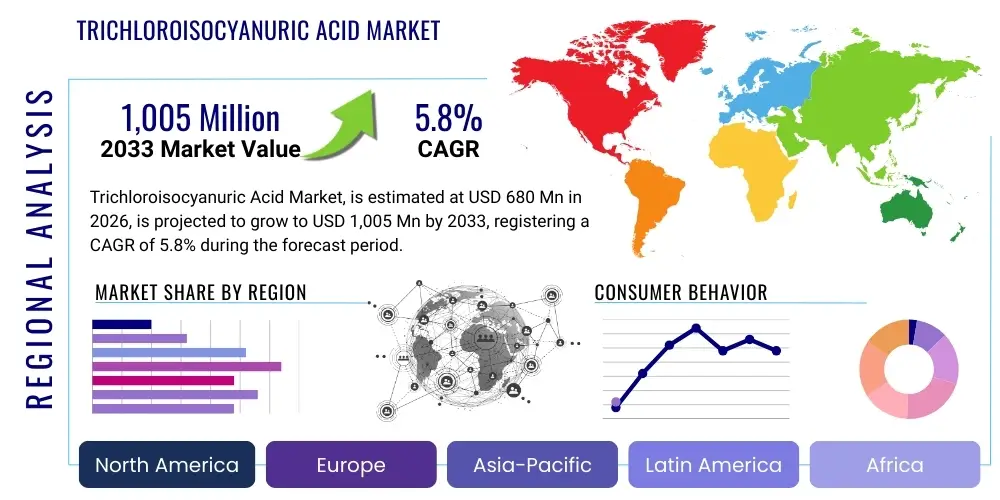

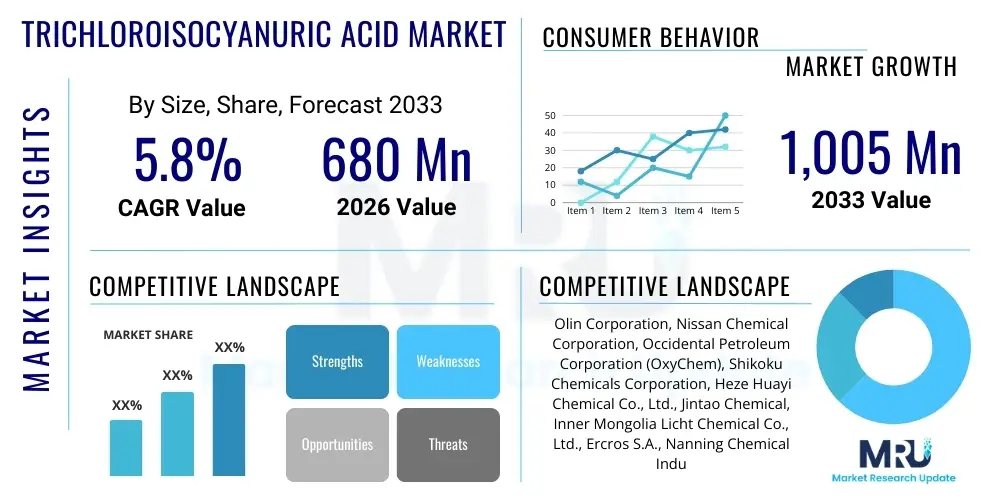

The Trichloroisocyanuric Acid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 680 Million in 2026 and is projected to reach USD 1,005 Million by the end of the forecast period in 2033. This robust expansion is primarily driven by the escalating demand for high-efficacy sanitation products across diverse end-use industries, particularly in recreational water treatment and institutional disinfection. Increased awareness regarding waterborne diseases and stringent public health standards imposed globally contribute significantly to the consistent demand curve for TCCA.

The valuation reflects the critical role TCCA plays as a stabilized chlorine source, offering superior storage stability and sustained release compared to traditional chlorine compounds. While the market faces headwinds from environmental regulations concerning chlorine discharge and competition from non-chlorine alternatives, the compound’s cost-effectiveness and broad-spectrum antimicrobial activity cement its position, particularly in fast-growing municipal and commercial pool sectors in Asia Pacific and Latin America. The transition towards centralized water management systems also necessitates bulk use of reliable disinfectants like TCCA.

Trichloroisocyanuric Acid Market introduction

Trichloroisocyanuric Acid (TCCA), chemically known as 1,3,5-trichloro-1,3,5-triazine-2,4,6(1H,3H,5H)-trione, is a highly effective, stabilized chlorine compound used extensively as an oxidizing and chlorinating agent. It typically contains around 90% available chlorine, making it one of the most concentrated and potent commercially available disinfectants. TCCA is synthesized through the chlorination of cyanuric acid and is marketed in various forms—tablets, granules, and powder—to suit different application methodologies, ensuring flexibility across industrial and consumer use cases.

The major applications of TCCA revolve around water purification, industrial bleaching, and disease prevention. Its largest market segment is swimming pool sanitation, where its slow dissolution rate ensures prolonged disinfection and stabilization against UV degradation, offering superior performance compared to unstabilized chlorine products. Furthermore, TCCA is crucial in circulating water systems, sanitation of poultry and aquaculture facilities, and in the production of certain industrial chemicals, leveraging its strong oxidizing properties for microbial control and material processing.

Key driving factors propelling the TCCA market include global population growth leading to increased demand for potable water infrastructure, rising investments in tourism and recreational facilities (e.g., hotels and resorts with swimming pools), and stringent regulatory mandates requiring effective hygiene protocols in food processing and medical environments. The inherent benefits of TCCA, such as ease of storage, handling safety (compared to liquid chlorine), and stabilized efficacy, solidify its competitive advantage in critical disinfection markets worldwide, despite volatile raw material costs.

Trichloroisocyanuric Acid Market Executive Summary

The global Trichloroisocyanuric Acid market is poised for steady growth, characterized by strong demand driven by the expanding recreational and municipal water treatment sectors, especially in developing economies. Business trends indicate a focus on manufacturing efficiency and vertical integration among key players to mitigate volatility in raw material supply, particularly cyanuric acid and chlorine. Furthermore, manufacturers are increasingly developing specialized, slow-release tablet formulations optimized for residential pool applications, responding to heightened consumer demand for convenient and stable disinfection solutions. Strategic mergers and acquisitions are observed as major companies seek to consolidate market share and expand their global distribution networks, ensuring prompt supply to high-demand regions.

Regional trends highlight the Asia Pacific (APAC) region as the primary growth engine and manufacturing hub, driven by massive infrastructure development, rapid urbanization, and rising disposable incomes leading to greater recreational water use (e.g., private pools and public aquatic centers). North America and Europe, characterized by mature markets, exhibit demand stability supported by strict regulatory enforcement of public health standards, prompting consistent replacement sales of TCCA. However, these regions are also increasingly exploring alternatives, which necessitates innovation in TCCA application methods and sustainability profiles to maintain market relevance.

Segment trends reveal that the water treatment application segment holds the dominant market share, with the swimming pool sanitation sub-segment being the most significant contributor. The granular and tablet forms of TCCA are preferred due to their ease of dosage and handling safety, respectively. There is a noticeable upward trend in the application of TCCA within the institutional sector, specifically for hospital disinfection, food and beverage processing, and public washrooms, reacting to post-pandemic emphasis on heightened hygiene protocols, thereby diversification the consumption base beyond traditional pool maintenance.

AI Impact Analysis on Trichloroisocyanuric Acid Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Trichloroisocyanuric Acid (TCCA) market frequently center on how AI can optimize complex chemical synthesis processes, predict raw material price fluctuations, and enhance supply chain resilience. Users are keen to understand if Machine Learning (ML) algorithms can improve reaction yield during TCCA synthesis, which involves highly controlled chlorination steps. Concerns also arise about using AI for predictive maintenance in large-scale production facilities to minimize downtime and ensure continuous supply, crucial for maintaining low operating costs. The central theme emerging from user inquiries is the expectation that AI integration will primarily lead to substantial improvements in operational efficiency, predictive quality control, and strategic inventory management within a highly regulated specialty chemical sector.

The chemical industry is highly sensitive to input costs and precise reaction controls. AI and ML are being deployed to model complex kinetic reactions involved in TCCA manufacturing, allowing engineers to fine-tune temperature, pressure, and catalyst concentrations in real-time. This predictive modeling minimizes waste, maximizes conversion rates of cyanuric acid to TCCA, and ensures the end product meets strict purity standards required for potable water applications. Consequently, the application of AI moves TCCA production towards a more sustainable and economically competitive framework, countering upward pressure from volatile feedstock prices.

Furthermore, AI-powered demand forecasting and logistics optimization are profoundly impacting the distribution of TCCA, a product categorized as hazardous material requiring specialized handling. ML algorithms analyze seasonal consumption patterns (especially for swimming pool chemicals), regional regulatory changes, and global shipping constraints to predict optimal inventory levels and distribution routes. This enhances market responsiveness, reduces storage costs associated with large chemical stockpiles, and improves customer satisfaction by ensuring timely delivery of tablets and granules before peak sanitation seasons. The impact is moving the supply chain from reactive management to proactive optimization.

- AI-driven optimization of TCCA synthesis parameters leading to higher yield and reduced energy consumption.

- Machine Learning models for predicting raw material cost volatility (chlorine, cyanuric acid) to enhance procurement strategies.

- Implementation of predictive maintenance in manufacturing facilities, minimizing unplanned downtime and ensuring continuous TCCA supply.

- AI-enhanced quality control systems for real-time monitoring of TCCA purity and available chlorine content.

- Advanced supply chain planning using algorithms to forecast seasonal demand and optimize global logistics for hazardous chemical transport.

- Use of generative AI for rapid synthesis of complex regulatory compliance reports and safety documentation required globally.

DRO & Impact Forces Of Trichloroisocyanuric Acid Market

The Trichloroisocyanuric Acid market dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the impact forces steering its growth trajectory. The fundamental drivers include rapidly increasing urbanization, global tourism expansion necessitating high standards of pool and spa sanitation, and growing industrial water usage, all requiring cost-effective microbial control. However, strict environmental regulations concerning the discharge of chlorine byproducts, particularly in North America and Europe, act as significant restraints, promoting the search for non-chlorine or reduced-chlorine alternatives. Opportunities are plentiful in emerging economies where centralized infrastructure for water treatment is rapidly developing, providing untapped potential for bulk TCCA adoption.

The principal drivers sustaining the market momentum are centered on public health imperatives. Government mandates for safe drinking water, coupled with the necessity for sanitizing public infrastructure such as schools, hospitals, and transit systems, ensure a foundational demand base for TCCA’s powerful disinfection capabilities. Furthermore, the inherent stability and high chlorine content of TCCA make it an economically superior choice for long-term storage and use in regions prone to supply chain disruptions or infrastructural limitations. This blend of efficacy and logistical feasibility pushes global consumption steadily upward, overriding some regional regulatory hurdles.

Conversely, the restraints are predominantly regulatory and competitive. The market faces strong competition from alternative disinfectants like ozone, UV sterilization, and stabilized bromine compounds, particularly in high-end or environmentally sensitive applications. The production process of TCCA relies on petrochemical derivatives, making the market susceptible to severe price volatility in upstream raw materials. Moreover, increasing scrutiny on disinfection byproducts (DBPs), such as trihalomethanes (THMs), generated when chlorine compounds react with organic matter in water, compels end-users to seek technologies or chemicals that minimize DBP formation, indirectly slowing TCCA adoption in some municipal settings. The balancing act between efficacy and environmental impact dictates long-term market sustainability.

Segmentation Analysis

The Trichloroisocyanuric Acid market is strategically segmented to address varied industry requirements, focusing primarily on the chemical form, the end-use application, and the geographic landscape. This segmentation allows manufacturers to tailor product offerings—whether high-density tablets for residential use or fine granules for industrial water cooling towers—to optimize performance and cost-effectiveness for specific customer needs. The market is highly segmented by application, reflecting the compound's versatility beyond simple pool sanitation, encompassing areas such as agricultural sterilization and industrial laundering.

The segmentation by form is critical for handling and dosage. TCCA powder is often preferred for large-scale industrial and municipal applications requiring rapid dissolution and immediate action, while the tablet form dominates the residential swimming pool market due to its slow, consistent release of chlorine, minimizing required intervention by pool owners. Understanding these preference shifts across regions is vital for market penetration. Furthermore, the growth rate within the institutional application segment is accelerating, driven by global events that emphasize surface and environmental disinfection outside the traditional water treatment scope.

- By Form:

- Granular

- Tablet

- Powder

- By Application:

- Water Treatment (Swimming Pools, Municipal Water, Industrial Circulating Water)

- Industrial Disinfection (Textile Bleaching, Industrial Cleaning)

- Institutional Disinfection (Hospitals, Food & Beverage Processing)

- Agriculture and Aquaculture

- By End-Use:

- Residential

- Commercial (Hotels, Spas, Recreational Centers)

- Municipal

- Industrial

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain)

- Asia Pacific (China, India, Japan, South Korea)

- Latin America (Brazil, Argentina)

- Middle East & Africa (MEA)

Value Chain Analysis For Trichloroisocyanuric Acid Market

The value chain for Trichloroisocyanuric Acid is deeply rooted in the petrochemical and basic chemical industries, beginning with the upstream supply of core raw materials. The synthesis process relies heavily on the stable and cost-effective availability of cyanuric acid and chlorine gas. Upstream analysis focuses on key suppliers who provide these precursors, noting that fluctuations in energy prices directly influence chlorine production costs (via electrolysis), thereby impacting the final cost of TCCA. Major chemical manufacturers often strive for backward integration into cyanuric acid production to stabilize input costs and ensure supply consistency, mitigating dependence on volatile commodity markets.

The midstream involves the synthesis, purification, formulation, and packaging of TCCA into its various commercial forms (tablets, granules, powder). Manufacturers must employ stringent quality control measures to ensure high available chlorine content and appropriate particle sizing, which significantly affects the product's dissolution rate and application efficacy. Competition at this stage is fierce, with established Asian manufacturers dominating global production capacity through economies of scale and advanced chemical engineering processes designed for efficiency.

Downstream analysis covers distribution channels and end-user engagement. TCCA products are typically moved through a dual system: direct sales to large municipal water treatment facilities and bulk industrial users, and indirect sales via specialized chemical distributors, wholesalers, and retailers (especially for pool chemicals) serving residential and small commercial sectors. Due to the product's classification as a hazardous chemical, the distribution channel requires specialized storage and transport logistics, adding a layer of complexity and cost. End-users benefit from the product's stability, but reliance on knowledgeable distributors is key for proper dosage and safety compliance.

Trichloroisocyanuric Acid Market Potential Customers

The primary customers for Trichloroisocyanuric Acid span a broad range of sectors, reflecting its fundamental role as a versatile disinfectant and oxidizing agent. End-users are segmented into three major groups: water treatment operators, industrial processors, and institutional entities. Water treatment facilities, including municipal bodies and public utility companies, are crucial bulk purchasers, relying on TCCA for centralized water disinfection, particularly in areas where gaseous chlorine handling is impractical or restricted. The residential and commercial swimming pool sector constitutes the most visible segment of potential buyers, comprising private pool owners, hotel chains, fitness centers, and specialized pool maintenance service companies who prioritize the ease-of-use and longevity offered by TCCA tablets.

Industrial customers represent another vital segment, utilizing TCCA for specialized applications. This includes textile manufacturers who employ its bleaching properties, and power generation facilities and petrochemical plants that use it for controlling biofouling in cooling water systems, which is essential for maintaining thermal efficiency and preventing corrosion. These industrial buyers often seek customized bulk packaging and specific dissolution rates tailored to their continuous operational needs, demanding consistent supply security and technical support from manufacturers.

The institutional sector, covering healthcare facilities (hospitals and clinics), educational establishments, and food and beverage processing plants, increasingly requires TCCA for surface sterilization and facility sanitation, especially following global public health crises that highlighted the need for robust environmental hygiene. These buyers are typically governed by highly regulated safety standards, leading them to prefer certified, high-purity TCCA products. The growth in the aquaculture sector, utilizing TCCA to sanitize fish ponds and water tanks to prevent disease spread, also represents a growing and distinct customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 680 Million |

| Market Forecast in 2033 | USD 1,005 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Olin Corporation, Nissan Chemical Corporation, Occidental Petroleum Corporation (OxyChem), Shikoku Chemicals Corporation, Heze Huayi Chemical Co., Ltd., Jintao Chemical, Inner Mongolia Licht Chemical Co., Ltd., Ercros S.A., Nanning Chemical Industry Co., Ltd., ICL Group Ltd, Jiheng Chemical, Shandong Rui-tai Chemical Co., Ltd., Fuji Chemical Industries, Taian Cheerway Chemical Co., Ltd., China Salt Kunshan Co., Ltd., Sinopec Group, Chem-Star Pool Products, Zeel Product, Yixing Xiangsheng Chemical, Cangzhou Continent Chemical Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Trichloroisocyanuric Acid Market Key Technology Landscape

The technology landscape in the Trichloroisocyanuric Acid market is heavily focused on process innovation designed to enhance manufacturing efficiency, ensure product safety, and improve the stability and performance of the final product. A significant technological focus is on optimizing the synthesis pathway—specifically, the highly exothermic chlorination of cyanuric acid. Manufacturers are increasingly adopting continuous reaction systems over traditional batch processing. Continuous systems offer superior control over reaction kinetics, resulting in more uniform product quality, higher yields, and reduced energy intensity per unit of TCCA produced, which is crucial for lowering operational expenditure and maintaining competitiveness against high-volume Chinese producers.

Another pivotal technological area involves formulation science, particularly the development of advanced controlled-release and low-dust formulations. While TCCA tablets offer inherent slow release, new technologies are being researched to incorporate polymer binders or specific coating materials that can precisely modulate the dissolution rate, extending the effective disinfection period for commercial pools and industrial cooling towers. This maximizes efficacy and minimizes the frequency of manual dosing. Low-dust formulations address critical occupational health concerns related to handling fine chemical powders, improving worker safety in manufacturing and end-user environments.

Furthermore, technology related to environmental compliance and byproduct management is becoming indispensable. Novel scrubbing and effluent treatment technologies are being implemented to minimize the release of volatile organic compounds and neutralize chlorine byproducts generated during the synthesis process, aligning production with increasingly stringent global environmental protection standards. Automation and sensor technology are also being integrated into production lines for real-time monitoring of residual moisture and available chlorine content, guaranteeing that every batch meets the critical 90% active chlorine standard required for premium applications and international export markets.

Regional Highlights

The global Trichloroisocyanuric Acid market exhibits distinct regional dynamics, influenced heavily by local regulatory frameworks, climate conditions, urbanization rates, and the density of recreational facilities. Asia Pacific (APAC) dominates the market both in terms of production capacity and consumption growth. Countries like China and India serve as massive manufacturing hubs benefiting from economies of scale and integrated supply chains for precursors. Demand in APAC is skyrocketing due to rapid development of municipal water infrastructure, soaring numbers of residential and public swimming pools fueled by rising middle-class disposable income, and extensive use in aquaculture and agricultural disinfection.

North America and Europe constitute mature markets characterized by stable, consistent demand, underpinned by rigorous public health and sanitation regulations. In North America, TCCA consumption is deeply entrenched in the residential and commercial pool sector, where high aesthetic and hygiene standards are mandatory. The European market, however, is subject to some of the strictest chemical regulations (like REACH), driving a greater focus on high-purity, environmentally compliant TCCA formulations and encouraging modest adoption of alternative disinfection technologies, although TCCA remains a cost-effective standard.

Latin America and the Middle East & Africa (MEA) are emerging as high-potential growth regions. Latin America's growth is driven by increasing tourism infrastructure (resorts, hotels) and population growth requiring better water sanitation services, particularly in countries like Brazil and Mexico. The MEA region, particularly the Gulf Cooperation Council (GCC) states, sees strong demand linked to major real estate and hospitality projects that include expansive water features and recreational pools, necessitating large volumes of stabilized disinfectant to cope with high ambient temperatures and intense UV radiation, making TCCA a preferred choice due to its stability.

- Asia Pacific (APAC): Leading global producer and fastest-growing consumer; driven by China’s manufacturing dominance, urbanization, infrastructure spending, and expanding recreational markets in India and Southeast Asia.

- North America: Mature market characterized by high regulatory standards; stable demand derived primarily from large residential and commercial swimming pool maintenance and established industrial applications.

- Europe: Highly regulated market focused on compliance and high-purity products; steady demand maintained by mandatory public hygiene standards, though constrained by increasing preference for non-chlorine disinfection methods in some niche areas.

- Latin America: High growth potential fueled by rising tourism, burgeoning middle class, and improving municipal water quality projects; TCCA used widely in large commercial facilities.

- Middle East & Africa (MEA): Growth stimulated by large-scale construction projects, extreme climate requiring UV-stable disinfectants, and increasing focus on water reuse and conservation initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Trichloroisocyanuric Acid Market.- Olin Corporation (USA)

- Nissan Chemical Corporation (Japan)

- Occidental Petroleum Corporation (OxyChem) (USA)

- Shikoku Chemicals Corporation (Japan)

- Heze Huayi Chemical Co., Ltd. (China)

- Jintao Chemical (China)

- Inner Mongolia Licht Chemical Co., Ltd. (China)

- Ercros S.A. (Spain)

- Nanning Chemical Industry Co., Ltd. (China)

- ICL Group Ltd (Israel)

- Jiheng Chemical (China)

- Shandong Rui-tai Chemical Co., Ltd. (China)

- Fuji Chemical Industries (Japan)

- Taian Cheerway Chemical Co., Ltd. (China)

- China Salt Kunshan Co., Ltd. (China)

- Sinopec Group (China)

- Chem-Star Pool Products (USA)

- Zeel Product (India)

- Yixing Xiangsheng Chemical (China)

- Cangzhou Continent Chemical Co. Ltd. (China)

Frequently Asked Questions

Analyze common user questions about the Trichloroisocyanuric Acid market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the growth of the TCCA market?

The primary driver is the exponentially increasing global demand for effective and stabilized water sanitation, particularly within the recreational swimming pool sector and emerging municipal water treatment infrastructure in Asia Pacific. TCCA’s high available chlorine content and UV stabilization properties make it a cost-effective choice for public health maintenance.

How does TCCA compare to other chlorine disinfectants like sodium hypochlorite?

TCCA offers significantly higher available chlorine content (around 90%) and is highly stable, often sold in solid form (tablets/granules) for safer handling and easier storage compared to liquid sodium hypochlorite, which degrades rapidly and has a lower effective chlorine concentration. TCCA also includes cyanuric acid stabilizers, protecting the chlorine from sunlight degradation in outdoor pools.

Which form of Trichloroisocyanuric Acid is most commonly used in residential settings?

The tablet form of TCCA is predominantly used in residential settings due to its controlled, slow-release mechanism, which simplifies maintenance by ensuring a steady chlorine level over an extended period, requiring less frequent dosing intervention from homeowners.

What major restraints are impacting the TCCA industry?

Major restraints include stringent global environmental regulations targeting chlorine byproduct discharge (Disinfection Byproducts or DBPs), volatility in the pricing and supply of core raw materials (cyanuric acid and chlorine), and strong competitive pressure from alternative, non-chlorine-based disinfection technologies such as UV and ozone treatment systems.

Where is the largest production base for Trichloroisocyanuric Acid located globally?

Asia Pacific, specifically China, is the largest global production base for Trichloroisocyanuric Acid, benefitting from massive scale, competitive production costs, and readily available raw material supply chains, making it the dominant region for export-oriented manufacturing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Swimming Pool Chemical Market Statistics 2025 Analysis By Application (Residential Pool, Commercial Pool), By Type (Beaching Powder, Sodium Hypochlorite, Liquid Chlorine, Trichloroisocyanuric Acid (TCCA), Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Trichloroisocyanuric Acid Market Statistics 2025 Analysis By Application (Water Treatment, Sericulture & Aquaculture, Daily Disinfection), By Type (Powder, Granular, Tablet), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Swimming Pool Treatment Chemicals Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Calcium Hypochlorite, Sodium Hypochlorite, Trichloroisocyanuric Acid (TCCA), Bromine, Others), By Application (Residential Pool, Commercial Pool), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Swimming Pool Treatment Chemicals Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Beaching Powder, Sodium Hypochlorite, Liquid Chlorine, Trichloroisocyanuric Acid (TCCA), Others), By Application (Residential Pool, Commercial Pool), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Swimming Pool Chemical Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Beaching Powder, Sodium Hypochlorite, Liquid Chlorine, Trichloroisocyanuric Acid (TCCA), Other), By Application (Residential Pool, Commercial Pool), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager