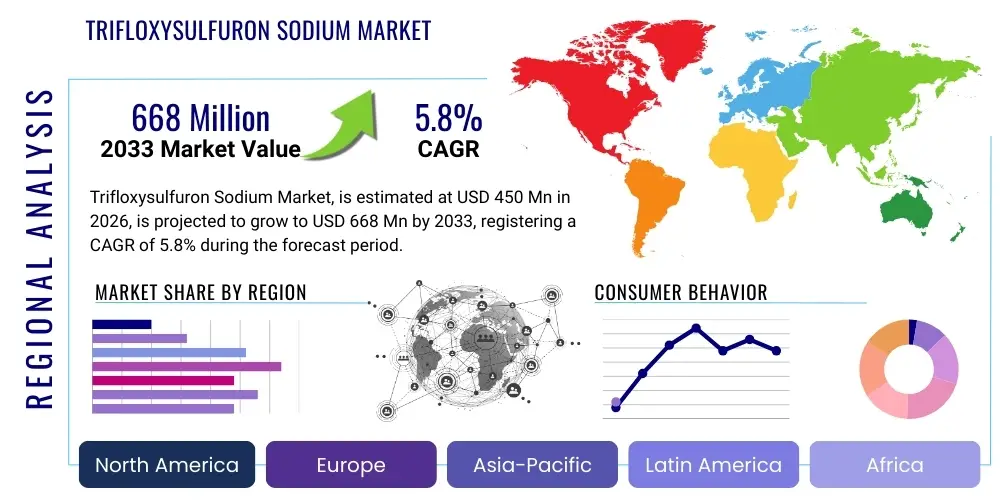

Trifloxysulfuron Sodium Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436044 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Trifloxysulfuron Sodium Market Size

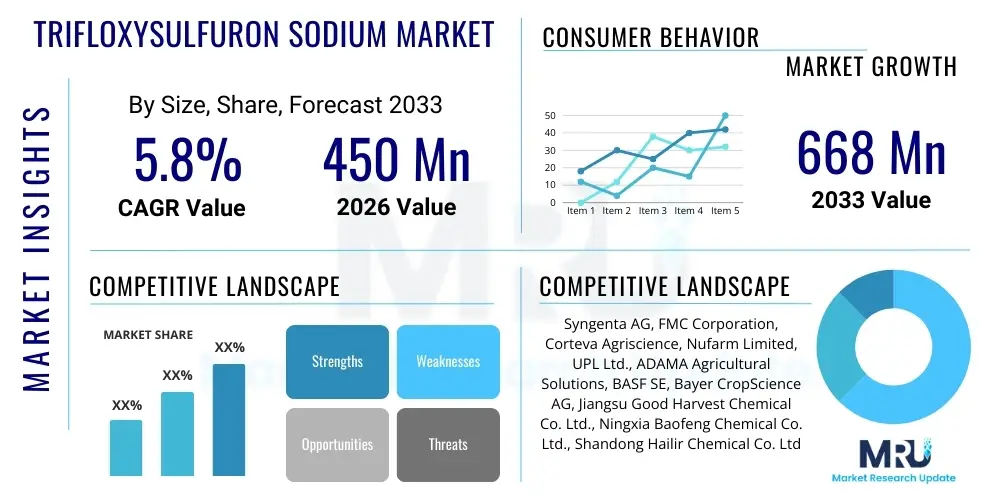

The Trifloxysulfuron Sodium Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 668 Million by the end of the forecast period in 2033.

Trifloxysulfuron Sodium Market introduction

The Trifloxysulfuron Sodium market centers on a highly effective, low-use rate sulfonylurea herbicide utilized globally for selective, post-emergence control of problematic broadleaf weeds and certain annual grasses in key agricultural crops. As a critical input in modern crop protection, Trifloxysulfuron Sodium offers significant selectivity, making it invaluable for maximizing yields in sensitive crops such as cotton, sugarcane, and specialty turfgrasses. Its mode of action involves inhibiting the acetolactate synthase (ALS) enzyme, a mechanism that prevents amino acid synthesis and subsequently halts plant growth, providing growers with a reliable tool for weed management, particularly against difficult-to-control species like nutsedge and various Amaranthus variants. The primary applications span large-acre row crops where efficacy and crop safety are paramount, influencing planting density and harvesting efficiency across diverse climatic zones.

The product's efficacy profile, combined with favorable environmental dissipation characteristics compared to older herbicide chemistries, positions it as a preferred choice in integrated weed management (IWM) programs. It is commonly marketed in formulated products such as water-dispersible granules (WG) or wettable powders (WP), catering to easy mixing and application through standard agricultural spraying equipment. The increasing global focus on maximizing agricultural output from limited arable land, coupled with the persistent threat of evolving weed resistance to established chemical classes, underscores the continuous demand for high-performance active ingredients like Trifloxysulfuron Sodium. Furthermore, the inherent benefits, including flexibility in application timing and compatibility with various tank mixes, drive its adoption across developing and developed agricultural economies, solidifying its role as a foundational component in modern chemical crop protection portfolios.

Driving factors for the market include the expansion of large-scale commercial farming operations, particularly in Asia Pacific and Latin America, where cotton and sugarcane are primary cash crops. Regulatory pressures favoring environmentally benign, low-dose application chemicals also contribute to its market traction. Conversely, the market faces constraints related to the development of ALS-inhibitor resistance in certain weed populations, necessitating continuous investment in research and development for effective rotation strategies and synergistic formulations to maintain long-term viability. The convergence of yield optimization requirements and stringent food safety standards further emphasizes the market's trajectory towards precision application and sustainable usage.

Trifloxysulfuron Sodium Market Executive Summary

The Trifloxysulfuron Sodium market is experiencing dynamic shifts characterized by robust business trends focusing on vertical integration among key manufacturers and enhanced distribution networks targeting high-growth agricultural regions. Key business trends involve strategic mergers and acquisitions aimed at consolidating market share and securing intellectual property related to formulation patents and application technology, primarily driven by the necessity to offer comprehensive crop solutions rather than isolated chemical products. Simultaneously, there is a marked trend towards developing co-formulations that combine Trifloxysulfuron Sodium with alternative modes of action to mitigate the risks associated with weed resistance, ensuring prolonged product life cycles and sustained grower adoption in intensive farming systems globally. The structural business environment is increasingly competitive, compelling major players to emphasize customer education, technical support, and data-driven farming practices to differentiate their offerings in saturated markets.

Regional trends highlight accelerated growth in the Asia Pacific (APAC) and Latin American (LATAM) markets, fueled by expanding acreage dedicated to cotton and sugarcane cultivation and less restrictive regulatory approval processes compared to North America and Europe. APAC, particularly India and China, serves as both a major consumption hub and a significant production center for the technical grade material, often influencing global pricing dynamics and supply chain stability. In contrast, mature markets such as North America exhibit steady demand, driven primarily by the high-value specialty turf segment and advanced resistance management programs in cotton. European markets show more constrained growth due to stringent environmental regulations and a general shift towards biological and non-chemical alternatives, although pockets of demand remain strong where specific weed challenges persist and high-efficacy chemistry is required.

Segmentation trends reveal a strong performance in the application segment pertaining to sugarcane, where the herbicide is crucial for maximizing stalk yield by controlling critical perennial and annual weeds that compete aggressively with the crop. Furthermore, the market for high-concentration technical grade (TC) material remains dominant, serving formulators who supply generic products, especially in price-sensitive regions. The ongoing development of specialized, controlled-release formulations represents a significant segment trend, promising reduced environmental exposure and extended residual control, thereby enhancing the overall value proposition for end-users seeking highly efficient and sustainable agricultural inputs. These segment trajectories indicate a market that is mature yet capable of innovation, adapting to both regulatory demands and the evolving biological pressures within agricultural ecosystems.

AI Impact Analysis on Trifloxysulfuron Sodium Market

User inquiries regarding the role of Artificial Intelligence (AI) in the Trifloxysulfuron Sodium market frequently center on how machine learning (ML) algorithms can enhance efficacy, optimize usage, and predict resistance patterns. Key user concerns revolve around the feasibility of AI-driven precision spraying (reducing chemical load), the speed of integrating AI into existing farm machinery, and the ability of predictive analytics to preemptively manage weed resistance before yield losses occur. Users also express interest in how AI can refine formulation chemistry by analyzing vast datasets related to soil types, climatic variability, and biological responsiveness. The overarching expectation is that AI will transform Trifloxysulfuron Sodium application from a generalized broadcast activity into a highly targeted, site-specific treatment, leading to reduced overall volume consumption but higher economic efficiency and improved environmental sustainability, thereby extending the utility and lifespan of this crucial active ingredient in an era of increasing environmental scrutiny.

- AI-driven optimization of application rates based on real-time satellite imagery and drone data identifying weed density hotspots.

- Machine Learning models predicting the onset and spread of ALS-inhibitor resistance in specific geographical areas, guiding rotation strategies.

- Enhanced efficacy mapping through AI processing of weather patterns, soil moisture, and pH levels to determine optimal spraying windows and formulation absorption.

- Automation of inventory and supply chain forecasting, aligning production of Trifloxysulfuron Sodium technical material with anticipated regional agricultural demand cycles.

- Development of smart sprayers utilizing computer vision to selectively target individual weed plants, drastically reducing overall herbicide usage volumes (Precision Agriculture integration).

- Accelerated discovery and screening of new synergistic compounds by AI to combat resistant weed biotypes when used in conjunction with Trifloxysulfuron Sodium.

- Improved environmental risk assessment modeling to comply with increasingly strict regulatory requirements, utilizing AI to simulate dissipation and off-target movement.

DRO & Impact Forces Of Trifloxysulfuron Sodium Market

The Trifloxysulfuron Sodium market dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces determining its future trajectory. A primary driver is the necessity for highly effective, systemic post-emergence weed control, particularly in high-value, sensitive crops like cotton and specialty turf, where traditional mechanical methods are impractical or damaging. The product's inherent low-use rate is highly appealing, aligning with global trends favoring reduced environmental load per unit of yield. However, the market is significantly restrained by the growing prevalence of ALS-inhibitor resistant weed species, forcing continuous, costly research into new synergistic combinations and application protocols, which increases the total cost of ownership for end-users. Opportunities arise from expanding cultivation of bio-engineered herbicide-tolerant crops, which, while not directly related to Trifloxysulfuron Sodium tolerance, create a market shift where IWM programs demand rotation of chemistries, thus opening doors for non-glyphosate dependent solutions.

The core drivers are deeply rooted in global agricultural economics and the pressure to maintain food and fiber supply security. The consistent high yields obtained by utilizing Trifloxysulfuron Sodium translate directly into significant economic benefits for farmers, especially in regions with intense weed pressure, such as tropical and subtropical zones. This economic incentive reinforces demand, overriding short-term price fluctuations. Conversely, regulatory hurdles, particularly in major Western markets where active ingredients face lengthy and expensive re-registration processes based on evolving toxicity data and environmental standards, act as significant restraints, limiting market expansion and increasing operational risk for manufacturers. The impact force of substitution risk is moderate, as few alternative chemistries offer the same combination of broad-spectrum control and specific crop safety offered by sulfonylureas in niche applications.

Strategic opportunities include leveraging digital agriculture and precision application technologies to optimize product placement, thereby mitigating the resistance restraint by ensuring perfect application accuracy and timing. Furthermore, the untapped potential in emerging economies, particularly across Africa and Southeast Asia, where modern agricultural practices are rapidly being adopted and new crop varieties are being introduced, presents a major growth avenue. The overall impact forces suggest a market characterized by high inherent demand but requiring sophisticated technical and regulatory navigation. Success will depend heavily on the continuous ability of market players to offer effective resistance management tools and invest in advanced formulation chemistry that can overcome the biological and regulatory restraints currently affecting market growth.

Segmentation Analysis

The Trifloxysulfuron Sodium market is segmented based on the technical concentration of the active ingredient (Type), and the specific agricultural or non-agricultural context in which it is utilized (Application). Segmentation by Type typically includes Technical Grade (95% TC and above) and various formulated products such as Water Dispersible Granules (WDG/WG), Soluble Concentrates (SC), and Wettable Powders (WP). Technical Grade material dominates the volume share as it is the feedstock for all subsequent formulated products, particularly in regions like China and India which are major global suppliers. However, the WDG segment typically commands a higher value share due to the complexity and proprietary nature of the formulation required for stable, easy-to-use end products preferred by farmers. This segment is driven by the demand for improved handling safety and dispersion quality in large-scale spray operations.

Segmentation by Application is crucial as it reflects the primary economic drivers for consumption. Cotton cultivation represents one of the largest and most valuable end-use segments, utilizing Trifloxysulfuron Sodium for critical post-emergence control of problematic broadleaf weeds that severely impact lint yield and quality. Sugarcane follows closely, where the herbicide is vital for managing persistent grasses and sedges in tropical environments, ensuring vigorous stand establishment and optimal cane biomass production. The specialty Turf and Ornamentals segment, while smaller in volume, is highly lucrative, driven by demand for precise weed control in high-profile areas like golf courses, professional athletic fields, and commercial landscaping, where product safety and aesthetic results are paramount and pricing elasticity is low. The need for specialized application protocols and specific residual activity dictates the formulation type adopted within each application segment, further customizing market demand.

Emerging applications include niche specialty crops (e.g., certain transplanted vegetables and forestry nurseries) and use in non-cropland areas like industrial sites and railways for bare-ground weed control. However, these currently remain marginal contributors to the overall market revenue compared to the core crop segments of cotton and sugarcane. The evolution of segmentation is heavily influenced by regional crop diversification patterns and regulatory clearances for specific crop-chemical pairings. Future growth is anticipated to be highest in the WDG/WG formulation type due to user preference for safety and efficacy, and in the sugarcane application segment, propelled by sustained global demand for sugar and ethanol production, especially in LATAM and APAC.

- By Type:

- Technical Grade (TC)

- Water Dispersible Granules (WDG/WG)

- Wettable Powders (WP)

- Soluble Concentrates (SC)

- By Application:

- Cotton

- Sugarcane

- Turf and Ornamentals

- Specialty Crops

- Non-Cropland/Industrial Uses

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, UK, Italy, Spain, Rest of Europe)

- Asia Pacific (China, India, Japan, Australia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Trifloxysulfuron Sodium Market

The value chain for Trifloxysulfuron Sodium begins with the upstream sourcing of crucial chemical intermediates, which typically include complex organic compounds derived from petrochemical processes, often involving highly specialized synthesis steps. Key raw materials, such as specific pyrimidine derivatives and sulfonylurea precursors, are procured from specialized chemical manufacturers, predominantly located in Asia Pacific due to cost advantages and established synthesis infrastructure. The upstream phase is characterized by intense capital investment in proprietary chemical reaction processes to ensure the purity of the active ingredient, as minor impurities can significantly impact the efficacy and regulatory profile of the final product. Volatility in petrochemical feedstock pricing and complex intellectual property surrounding synthesis routes pose the primary challenges in this initial stage, making supply chain resilience a critical competitive factor for integrated companies.

The midstream phase involves the technical synthesis of the Trifloxysulfuron Sodium active ingredient (TC) followed by sophisticated formulation into end-use products like WDG or SC. Formulation processes require specialized blending, grinding, and dispersion technologies to ensure stability, optimal particle size, and ease of application, maximizing bioefficacy and shelf life. This stage is where intellectual property rights, particularly around formulation patents, provide significant competitive differentiation, allowing branded manufacturers to command premium prices over generic counterparts. Quality control is rigorous, adhering to international standards (e.g., FAO specifications), ensuring that the formulated product maintains its low-dose effectiveness and crop safety profile when applied in diverse field conditions. The successful management of this stage dictates the operational efficiency and the overall reputation of the manufacturer in the global market.

The downstream distribution channels are multifaceted, utilizing both direct and indirect routes to reach the ultimate agricultural end-user. Direct distribution involves large multinational agrochemical companies supplying major commercial farming operations or large cooperative purchasing groups, offering technical support and customized integrated pest management packages. Indirect channels, which dominate regional and small-to-medium farm supply, rely on a network of regional distributors, local dealers, and agro-retailers. Effective logistical management, including secure storage and handling of agricultural chemicals, is essential in the downstream process. The primary demand pull is driven by seasonal agricultural requirements, particularly planting and post-emergence windows for cotton and sugarcane. The efficiency of the distribution system, combined with robust technical advisory services provided through dealer networks, is critical for market penetration and timely adoption by farmers globally.

Trifloxysulfuron Sodium Market Potential Customers

The primary customers for Trifloxysulfuron Sodium are commercial agricultural producers engaged in large-scale cultivation of high-value row crops, particularly those where weed interference severely threatens economic viability. Cotton farmers represent a significant segment globally, relying on this herbicide for critical post-emergence control of broadleaf weeds, ensuring clean fields that facilitate mechanized harvesting and maximize lint quality. These customers prioritize efficacy, crop safety, and flexibility in application timing, especially in regions utilizing minimum tillage practices where chemical control is paramount. Decisions by large cotton growers are heavily influenced by the cost-to-benefit ratio, technical support, and the reputation of the chemical provider in managing localized weed resistance challenges, necessitating a consistent supply of robust and compliant formulations.

Sugarcane planters, predominantly located in tropical and subtropical zones of Latin America, Asia, and Africa, form another vast customer base. In sugarcane production, competition from fast-growing weeds, especially nutsedge and certain grasses, can dramatically reduce stalk growth and sugar yield. Trifloxysulfuron Sodium offers reliable, long-lasting control crucial for the establishment of new cane fields and for maintaining productive ratoons (regrowth crops). These customers seek formulations that can handle high humidity and require minimal rain-fastness periods, often purchasing through large cooperative procurement systems or through government-backed agricultural input schemes, making price stability and regulatory compliance essential factors in supplier selection.

The high-value specialty turf sector, encompassing professional groundskeepers managing golf courses, sports fields, and public parks, constitutes a crucial segment of potential buyers. For this non-agricultural segment, the primary requirements are aesthetic perfection and environmental safety, specifically low volatility and minimal leaching risk near water bodies. These users require highly specialized, precision-engineered formulations and are typically less price-sensitive than commodity crop farmers, prioritizing technical performance, low odor, and quick visual results. Additionally, formulators who produce generic, off-patent versions of the herbicide act as large, intermediate customers for Technical Grade (TC) Trifloxysulfuron Sodium, purchasing in bulk for regional marketing under their own brands, catering particularly to price-sensitive smallholder farmers in developing regions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 668 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Syngenta AG, FMC Corporation, Corteva Agriscience, Nufarm Limited, UPL Ltd., ADAMA Agricultural Solutions, BASF SE, Bayer CropScience AG, Jiangsu Good Harvest Chemical Co. Ltd., Ningxia Baofeng Chemical Co. Ltd., Shandong Hailir Chemical Co. Ltd., Hebei Veyong Bio-Chemical Co. Ltd., Kenvos Group Co. Ltd., Wynca Group, Lier Chemical Co. Ltd., Sino-Agri Leading Biosciences Co. Ltd., Rallis India Limited, Sumitomo Chemical Co. Ltd., Isagro S.p.A., Nissan Chemical Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Trifloxysulfuron Sodium Market Key Technology Landscape

The technological landscape of the Trifloxysulfuron Sodium market is continuously evolving, driven primarily by the need to enhance application efficiency, manage resistance, and comply with tighter environmental regulations. Formulation technology represents a crucial area of innovation. The transition from older Wettable Powders (WP) to advanced Water Dispersible Granules (WDG) and Soluble Concentrates (SC) is a dominant trend. WDG formulations utilize sophisticated extrusion and drying processes to create dust-free, highly concentrated, easily measured granules that rapidly disperse in water, significantly reducing user exposure risks and improving tank mix compatibility. The technological advancements in these formulations focus on achieving optimal particle size distribution (typically in the micron range) to maximize foliar uptake and systemic transport within the target weed plant, ensuring low-dose efficacy and reliability under variable field conditions.

Beyond physical formulation, the application technology landscape is being revolutionized by the integration of digital tools and precision agriculture. Key technologies include variable rate application (VRA) systems, supported by geospatial mapping and drone-based imaging, which allow farmers to adjust the application rate of Trifloxysulfuron Sodium dynamically within a field. This targeted approach minimizes total herbicide usage while maximizing its impact on localized weed populations. Furthermore, research into encapsulating the active ingredient within polymer matrices represents an emerging technological frontier. Controlled-release formulations aim to extend the residual activity of the herbicide, providing longer-term weed control with a single application, which is highly valuable in perennial crops like sugarcane and turf. This encapsulation also provides enhanced photostability, protecting the chemical from degradation prior to reaching the weed’s surface.

A third vital technological focus is the development of advanced resistance management solutions. This involves chemical research into synergistic adjuvants and safeners—compounds added to the formulation that enhance the herbicide’s uptake or protect the crop from injury without sacrificing weed control efficacy. Modern analytical techniques, including high-throughput screening and genomic analysis, are deployed to rapidly identify resistance mechanisms in weed populations, allowing manufacturers to quickly tailor synergistic co-formulations. The overall technology trajectory is moving towards highly specific, data-informed application systems that treat the Trifloxysulfuron Sodium molecule as part of a complex, interconnected biological and digital ecosystem, ensuring its longevity and continued high performance despite biological and environmental challenges.

Regional Highlights

North America (U.S., Canada, Mexico)

North America constitutes a mature but critically important market for Trifloxysulfuron Sodium, driven primarily by the extensive cotton acreage in the Southern U.S. (the Cotton Belt) and the massive high-value specialty turf market (golf courses and professional lawns). The U.S. market is characterized by high technical adoption, with farmers readily employing precision agriculture tools like GPS guidance and VRA, which favor high-performance, quality-assured formulations. Demand here is strongly influenced by the need to manage established resistance to older chemistries, positioning Trifloxysulfuron Sodium as a key component in rotational programs against weeds like Palmer Amaranth. Regulatory oversight by the Environmental Protection Agency (EPA) is stringent, requiring substantial data for registration and usage limitations, which favors companies with robust product stewardship programs. The emphasis on minimizing off-target movement and ensuring high crop tolerance maintains a demand premium for advanced, encapsulated WDG formulations.

In the turf segment, which accounts for a disproportionately high revenue share due to premium pricing, Trifloxysulfuron Sodium is essential for selective control of stubborn sedges and specific broadleaf species in Bermuda grass and Zoysia grass without causing turf injury. Canadian and Mexican demand is smaller but steady, with Mexico’s agricultural sector showing increasing investment in modern inputs for cotton and specialty vegetable production. The region's stability, high purchasing power, and focus on efficacy and reliability ensure that North America remains a benchmark market for new formulation technologies and integrated weed management strategies, significantly influencing global market perception of product performance and safety.

Europe (Germany, France, UK, Italy, Spain, Rest of Europe)

The European market for Trifloxysulfuron Sodium faces significant headwinds primarily due to the European Union's stringent regulatory framework, including the implementation of the Sustainable Use Directive and the general reduction targets specified in the European Green Deal. Usage of synthetic herbicides is under constant review, leading to slow and highly expensive re-registration processes. Consequently, the volume of Trifloxysulfuron Sodium consumed in the EU is lower compared to its American and Asian counterparts. The market is highly fragmented, with usage concentrated in specific southern European countries (Spain, Italy) where traditional crops that benefit from the product, such as specialty vegetable transplants and localized sugarcane patches, are grown, and where localized weed pressures are high.

Despite the regulatory constraints, there is sustained niche demand for high-efficacy turf applications, particularly in countries with extensive golf and sports facilities (UK, Germany). Companies operating in Europe must prioritize exceptionally high environmental safety profiles and invest heavily in toxicology data to maintain their marketing authorizations. The market strategy often pivots towards integrated pest management (IPM) solutions that utilize minimal chemical inputs, positioning Trifloxysulfuron Sodium as a targeted, last-resort tool rather than a mass-market staple. The future growth here is highly dependent on specific country-level derogations and the successful demonstration of the chemical's minimal environmental persistence and high selectivity, necessitating strong collaboration between industry and regulatory bodies.

Asia Pacific (China, India, Japan, Australia, Rest of APAC)

Asia Pacific represents the largest and fastest-growing regional market, serving as both a primary manufacturing hub (China and India) and a massive consumption center, driven by vast acreage under cotton and sugarcane cultivation. China and India are major global producers of the Technical Grade active ingredient, often dictating global supply and pricing dynamics. The demand in India is particularly robust due to the large-scale cultivation of cotton and the need for cost-effective, high-performance herbicides suitable for smallholder farms. Regulatory environments in many APAC countries are generally more conducive to market entry than in Europe, allowing for quicker adoption of new agricultural chemicals, although enforcement regarding environmental disposal can be varied.

Australia is a technologically advanced subset of the APAC market, characterized by large-scale, mechanized cotton farming and sophisticated weed resistance management programs, similar to the U.S. Here, Trifloxysulfuron Sodium is integral to resistance rotation strategies. The region's growth is further fueled by high population density, which drives the imperative for maximum agricultural productivity and efficient land use. Challenges include managing the influx of counterfeit or substandard generic products and dealing with regional variations in application practices. The market demands flexibility, high concentration formulations for reduced transport costs, and robust local technical support networks to address immediate field challenges efficiently.

Latin America (Brazil, Argentina, Rest of LATAM)

Latin America is a powerhouse for agricultural commodities, making it a critical market for Trifloxysulfuron Sodium, particularly due to the extensive cultivation of sugarcane (Brazil) and the growing cotton sector (Brazil, Argentina, Paraguay). Brazil is the world’s leading sugarcane producer, and the herbicide is heavily utilized throughout the crop's lifecycle for effective, long-residual weed control crucial for maximizing sugar and ethanol production. The regulatory climate, particularly in Brazil and Argentina, supports the rapid registration of necessary agricultural inputs to maintain global competitiveness, though environmental concerns are increasingly gaining prominence.

The region’s large-scale farms (latifundios) utilize advanced equipment and favor bulk purchasing, demanding large quantities of highly reliable products. The market growth is inherently linked to global commodity prices for sugar and cotton, which incentivize investment in yield-protecting chemicals. Furthermore, the tropical climate exacerbates weed pressure, necessitating effective solutions against fast-growing and persistent weed species. Market strategies in LATAM focus on aggressive pricing, robust field trials demonstrating efficacy under intense tropical conditions, and establishing strong relationships with major agricultural cooperatives and commodity exporters. The continued expansion of cultivated land and the adoption of modern farming practices ensure sustained high demand for Trifloxysulfuron Sodium.

Middle East and Africa (MEA)

The MEA region is characterized by highly diverse agricultural sectors, ranging from advanced, irrigated commercial operations to subsistence farming. The primary demand for Trifloxysulfuron Sodium is centered in countries with significant irrigation infrastructure supporting cotton and specialty crops, such as Egypt and South Africa, or those expanding large-scale commercial farming in sub-Saharan Africa. In these regions, water scarcity places a premium on highly efficient, low-dose chemicals that maximize yield per unit of water used. The challenge in MEA is infrastructure—logistics, distribution networks, and access to advanced application equipment can be limited, particularly in sub-Saharan Africa.

Market penetration relies heavily on development programs, government tenders, and establishing strong local partnerships to facilitate distribution and technical training. South Africa’s market is relatively advanced, incorporating the product into sophisticated IWM strategies for high-value crops. Overall, the MEA market is marked by high growth potential but requires specialized supply chain solutions and careful management of credit risk. Opportunities are increasing as modernization efforts gain traction, particularly through foreign direct investment aimed at improving regional food security and commercial agricultural output, which necessitates the adoption of high-performance inputs like Trifloxysulfuron Sodium.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Trifloxysulfuron Sodium Market.- Syngenta AG

- FMC Corporation

- Corteva Agriscience

- Nufarm Limited

- UPL Ltd.

- ADAMA Agricultural Solutions

- BASF SE

- Bayer CropScience AG

- Jiangsu Good Harvest Chemical Co. Ltd.

- Ningxia Baofeng Chemical Co. Ltd.

- Shandong Hailir Chemical Co. Ltd.

- Hebei Veyong Bio-Chemical Co. Ltd.

- Kenvos Group Co. Ltd.

- Wynca Group

- Lier Chemical Co. Ltd.

- Sino-Agri Leading Biosciences Co. Ltd.

- Rallis India Limited

- Sumitomo Chemical Co. Ltd.

- Isagro S.p.A.

- Nissan Chemical Corporation

- Gharda Chemicals Limited

Frequently Asked Questions

Analyze common user questions about the Trifloxysulfuron Sodium market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function and key application of Trifloxysulfuron Sodium?

Trifloxysulfuron Sodium is a selective, post-emergence sulfonylurea herbicide primarily used to control broadleaf weeds and sedges in sensitive crops. Its key commercial applications are in cotton, sugarcane, and high-value specialty turfgrasses, where its low-use rate and high selectivity ensure crop safety while effectively eliminating yield-robbing weeds.

How is weed resistance impacting the demand for Trifloxysulfuron Sodium formulations?

The increasing prevalence of ALS-inhibitor resistance limits the standalone use of Trifloxysulfuron Sodium. This constraint drives market demand towards advanced co-formulations and mixtures that incorporate multiple modes of action, ensuring effective control and prolonged utility of the chemical within comprehensive Integrated Weed Management (IWM) programs, ultimately sustaining demand for the active ingredient.

Which geographical regions demonstrate the highest growth potential for Trifloxysulfuron Sodium consumption?

The Asia Pacific (APAC) and Latin American (LATAM) regions exhibit the highest growth potential. This is primarily driven by expanding agricultural acreage for major cash crops like cotton and sugarcane, coupled with the rapid adoption of modern chemical inputs necessary to boost yields in agricultural powerhouses such as India, China, and Brazil.

What technological advancements are crucial for the future of Trifloxysulfuron Sodium market growth?

Key technological advancements include the shift towards highly efficient Water Dispersible Granules (WDG) formulations, which improve user safety and efficacy, and the integration of precision agriculture technologies (e.g., AI and VRA systems) which optimize application rates, reduce environmental impact, and enhance overall cost-effectiveness for growers.

What are the main regulatory challenges faced by manufacturers in the Trifloxysulfuron Sodium market?

Manufacturers face significant regulatory hurdles, particularly in mature markets like the European Union and North America, involving stringent re-registration requirements based on evolving environmental toxicity data. Compliance demands substantial investment in data generation and product stewardship to maintain marketing authorizations and manage complex residue limits (MRLs).

Detailed analysis of Trifloxysulfuron Sodium synthesis pathways, intermediate chemical sourcing strategies, and supply chain logistics optimization. Understanding the technical grade purity requirements for registration and the economic implications of generic entry versus branded innovation. Exploration of the regulatory differences between EPA, EFSA, and regional Asian authorities. Focus on the impact of climate change on weed distribution and the resultant demand shift for specialized herbicides. Market segmentation expansion to include formulation type preference analysis by application region (e.g., WDG preference in high-tech farming vs. WP in price-sensitive markets). Characterization of the competitive landscape based on vertical integration, R&D spending, and patent portfolios for sulfonylurea chemistries. The role of contract manufacturing organizations (CMOs) in global supply chain flexibility. Examination of downstream market consolidation among distributors and large farming corporations. In-depth analysis of specific weed control targets, including purple nutsedge and yellow nutsedge, and their prevalence in cotton and turf environments. Assessment of the market impact of new genetically modified crops designed to handle ALS-inhibitor herbicides. Comprehensive breakdown of the value proposition in specialty crops and non-cropland areas, focusing on roadside maintenance and utility management. Discussion on the sustainability metrics (e.g., EIQ values) favoring Trifloxysulfuron Sodium over older, high-dose chemistries. Strategic recommendations for manufacturers aiming to penetrate emerging African agricultural markets. Detailed comparison of residual activity across various soil types and pH levels. Future forecasting incorporating global economic trends, commodity prices, and input cost inflation. The influence of farmer education and extension services on product adoption rates and correct usage protocols to prevent resistance development. Advanced formulation chemistry involving nano-encapsulation techniques and their projected market impact. Analysis of end-user feedback regarding product handling, storage stability, and consistency of efficacy across seasons. The competitive threat posed by bio-herbicides and integrated cultural control methods. Regional deep dive into key countries like India, Brazil, and the U.S., detailing specific regulatory milestones and local consumption patterns for Trifloxysulfuron Sodium. Elaboration on the critical role of adjuvants (surfactants and crop oils) in maximizing herbicide performance in different environmental conditions. The technical specifications of 95% TC vs. 98% TC and the pricing differentiation across the supply chain. Market analysis of pre-mix products containing Trifloxysulfuron Sodium combined with other active ingredients to broaden the weed control spectrum and address resistance challenges effectively. Evaluation of capital expenditure requirements for setting up modern WDG formulation plants versus traditional WP facilities. Strategic implications of global supply chain disruptions on raw material procurement for sulfonylurea synthesis. Assessment of intellectual property protection post-patent expiration and the resultant competitive dynamics in the generic market space. The integration of sensor technologies in agriculture influencing localized demand for targeted weed control. Regulatory landscape evolution regarding pesticide residue limits on harvested crops and their impact on application windows for Trifloxysulfuron Sodium. Long-term forecasting model based on global acreage expansion projections for target crops.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager