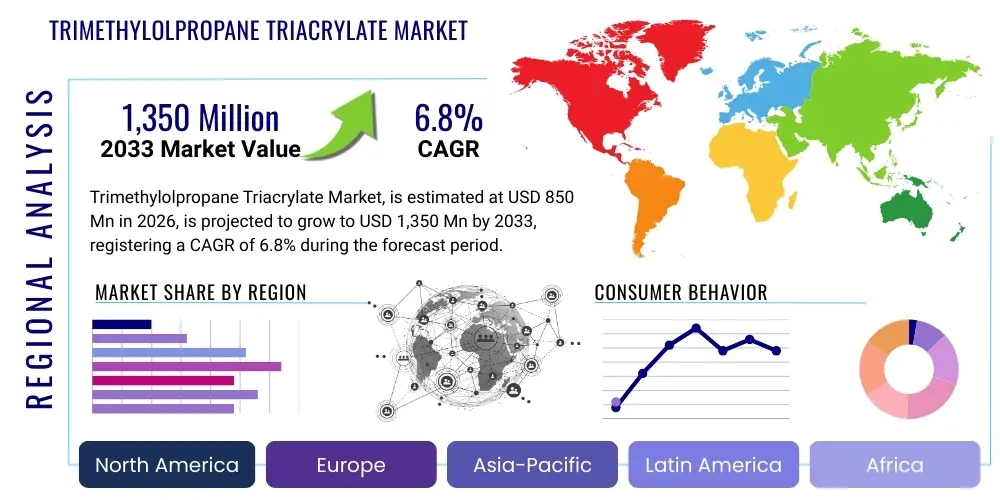

Trimethylolpropane Triacrylate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435260 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Trimethylolpropane Triacrylate Market Size

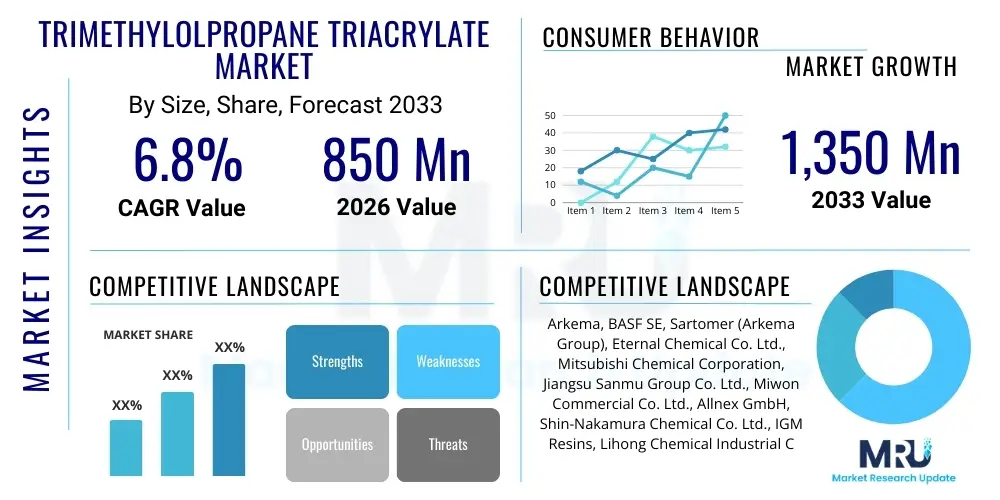

The Trimethylolpropane Triacrylate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,350 Million by the end of the forecast period in 2033.

Trimethylolpropane Triacrylate Market introduction

Trimethylolpropane Triacrylate (TMPTA) is a trifunctional monomer widely recognized for its fast-curing properties, low volatility, and excellent solvent resistance, making it an indispensable component in radiation-curable systems, particularly those utilizing Ultraviolet (UV) light or Electron Beam (EB) energy. As a highly reactive cross-linking agent and viscosity reducer, TMPTA significantly enhances the physical and chemical properties of final products, including hardness, abrasion resistance, and adhesion. Its primary function is to accelerate the polymerization process, enabling high-speed production lines common in printing, packaging, and wood coatings industries. The increasing adoption of sustainable and solvent-free coating technologies globally is fueling the demand for reactive diluents like TMPTA, positioning it as a key enabling chemical in modern manufacturing processes.

The product is synthesized through the esterification of trimethylolpropane with acrylic acid, resulting in a low-viscosity, colorless liquid. Major applications span several high-growth sectors, including graphic arts (inkjet and screen printing inks), protective coatings (automotive, flooring, and metal), and the manufacturing of high-performance adhesives and sealants. The benefit profile of TMPTA is extensive, offering enhanced durability and superior finish quality compared to traditional solvent-borne systems. Moreover, its use aligns with tightening environmental regulations by reducing Volatile Organic Compound (VOC) emissions, which provides a significant competitive advantage in developed economies.

Driving factors for this market include the global expansion of the packaging industry, specifically flexible packaging and food contact materials requiring rapid curing inks, alongside the continuous innovation in 3D printing and advanced composite materials where TMPTA acts as a crucial binder or matrix component. Furthermore, technological advancements in UV LED curing systems, which require highly specialized and efficient reactive oligomers and monomers, are creating new avenues for TMPTA penetration. The shift towards sustainable infrastructure projects and the preference for durable, long-lasting industrial coatings further solidify its market growth trajectory in the coming years.

Trimethylolpropane Triacrylate Market Executive Summary

The Trimethylolpropane Triacrylate market is currently undergoing robust expansion, driven primarily by favorable business trends emphasizing sustainability and operational efficiency. Globally, the accelerating demand for UV-cured coatings in the automotive refinish, electronics, and protective wood coatings sectors is pushing production capacity utilization among key manufacturers in Asia Pacific and North America. The market is characterized by intense R&D activities focused on developing bio-based or highly specialized TMPTA derivatives that offer lower skin irritation and enhanced performance characteristics, catering to stringent regulatory requirements regarding chemical handling and occupational safety. Strategic partnerships and vertical integration across the value chain, particularly between raw material suppliers (acrylic acid producers) and specialized chemical formulators, are becoming increasingly common to secure supply chains and mitigate price volatility.

Regionally, Asia Pacific maintains its dominance, spurred by massive industrialization, high growth in the printing and packaging sectors, and substantial investments in electronics manufacturing hubs, particularly in China, India, and Southeast Asia. Europe and North America, while slower in volume growth, are leading in terms of value, focusing on specialized, high-performance, and high-purity TMPTA grades used in premium applications like aerospace composites and medical device coatings. The regulatory landscape, especially the REACH framework in Europe, significantly influences product innovation, pushing regional companies towards developing low-toxicity alternatives, although TMPTA remains a cost-effective benchmark in numerous industrial applications.

Segment trends reveal a pronounced shift towards the utilization of TMPTA in inks and graphic arts, reflecting the booming e-commerce sector's reliance on high-quality, rapidly printed packaging. By application, industrial coatings remain the largest segment due to their widespread use in metal protection and durable flooring. Furthermore, the burgeoning additive manufacturing (3D printing) segment presents a highly lucrative niche, where TMPTA is utilized in photocuring resins for stereolithography (SLA) and Digital Light Processing (DLP) technologies. This application requires extremely high purity and consistent viscosity, driving demand for premium product grades and specialized formulations designed for precision deposition and rapid curing speeds.

AI Impact Analysis on Trimethylolpropane Triacrylate Market

Common user questions regarding AI's impact on the Trimethylolpropane Triacrylate market predominantly revolve around optimizing formulation complexity, predicting raw material price volatility, and accelerating new product development cycles, particularly concerning regulatory compliance and toxicity profiling. Users are keenly interested in how machine learning algorithms can manage the vast parameter space associated with UV-curable formulations (monomer concentration, photoinitiator selection, curing conditions) to achieve specific performance outcomes (adhesion, flexibility, chemical resistance) without extensive physical experimentation. Key concerns focus on the potential displacement of traditional chemical formulation expertise and the accuracy of AI models in predicting complex chemical interactions and long-term stability in diverse application environments, especially in niche areas like highly specialized optical coatings or biomedical polymers utilizing TMPTA derivatives. Furthermore, there is significant interest in using predictive maintenance algorithms within polymerization plants to minimize downtime and ensure consistent product quality, thereby enhancing supply chain reliability.

AI’s initial impact is most visible in streamlining R&D pipelines. Generative AI models are utilized to design novel oligomers that interact optimally with TMPTA, potentially leading to lower environmental footprint products. Predictive analytics applied to supply chain management helps mitigate the risks associated with sourcing key precursors like acrylic acid, providing producers with advanced warnings about potential shortages or significant price fluctuations caused by geopolitical or logistical disruptions. In manufacturing, AI-driven process optimization, leveraging sensor data from reactors and curing lines, ensures maximum yield and minimizes waste, directly addressing sustainability goals and improving cost efficiency in the production of high-purity TMPTA grades required for sensitive applications.

The future influence of AI lies in personalized chemistry—developing tailored TMPTA-containing formulations rapidly for small, specialized batches requested by customers in high-value industries like aerospace or advanced electronics. This capability, enabled by digital twins and simulation tools powered by AI, allows manufacturers to maintain lean inventories while quickly responding to highly specific market demands. Furthermore, AI is crucial for automating complex quality control processes, ensuring that every batch of TMPTA meets the rigorous specifications required for modern high-speed curing applications, thereby enhancing overall market trust and reducing failure rates downstream.

- AI optimization of UV formulation parameters, reducing trial-and-error costs.

- Predictive modeling for raw material price forecasting and supply chain risk mitigation (e.g., acrylic acid and trimethylolpropane).

- Accelerated R&D and screening of novel TMPTA derivatives for reduced toxicity and improved functional performance.

- Implementation of AI-driven process control for enhanced manufacturing efficiency and consistent product quality assurance.

- Use of machine learning in quality control (QC) to detect subtle deviations in viscosity and purity required for high-precision applications.

- AI-enhanced demand forecasting tailored to fluctuating needs of packaging and 3D printing industries.

DRO & Impact Forces Of Trimethylolpropane Triacrylate Market

The market dynamics for Trimethylolpropane Triacrylate are shaped by a strong interplay between regulatory pushes for low-VOC solutions (Drivers), concerns regarding raw material dependency and potential health hazards (Restraints), and the emergence of specialized, high-growth applications (Opportunities). The primary driving force is the global environmental mandate favoring solvent-free, radiation-curable technologies, particularly in industrialized nations where VOC emission limits are stringent, making TMPTA a preferred reactive diluent. This momentum is supported by the technological maturity and increasing affordability of UV curing equipment, which reduces energy consumption and accelerates production throughput. However, the market faces structural constraints, including the volatility and cyclicality of petrochemical feedstock prices, as well as health and safety concerns associated with acrylates, which necessitate careful handling and regulatory compliance regarding dermal sensitization. The balance of these forces dictates market profitability and strategic direction.

Restraints are further exacerbated by the increasing availability and competitive pricing of alternative monomers, such as various mono-, di-, and tetra-functional acrylates, which manufacturers might substitute based on cost or specific performance requirements (e.g., flexibility). The need for specialized storage and transportation due to the inherent reactivity of TMPTA also adds operational complexity and cost, limiting adoption in regions lacking robust chemical logistics infrastructure. Despite these challenges, significant opportunities exist in developing highly functionalized TMPTA variants, such as modified versions for enhanced bio-compatibility or those specifically engineered for advanced optical applications. These niche markets command premium pricing and require less volume, offering higher margin potential for specialized producers.

The impact forces are substantial, primarily driven by upstream factors related to raw material availability and regulatory changes downstream, affecting end-user formulation choices. The expansion of 5G infrastructure and electronics requiring protective, thermally stable coatings utilizing TMPTA provides a powerful pull factor. Conversely, any significant governmental restrictions on acrylate handling or disposal could instantly curtail usage across large industrial segments. Strategic responses include hedging against feedstock volatility and continuous investment in toxicology studies and safety protocols to address health concerns. The overall market resilience is high due to the lack of a single, universally effective substitute that matches TMPTA’s unique combination of high reactivity, low viscosity, and robust cross-linking capabilities, particularly in high-speed, demanding industrial environments.

Segmentation Analysis

The Trimethylolpropane Triacrylate market is comprehensively segmented based on its grade, application, and geographical region, reflecting the diverse requirements of end-user industries. Grade segmentation distinguishes between standard industrial grade, which dominates volume and serves general-purpose coatings and inks, and high-purity/specialty grade, which caters to demanding sectors like optics, electronics, and medical devices where stringent specifications regarding residual monomers and color stability are paramount. Application segmentation provides deeper insights into end-use consumption patterns, with industrial coatings, inks & graphic arts, and adhesives representing the largest consumers. Understanding these segments is crucial for manufacturers to tailor product specifications, optimize production processes, and focus marketing efforts effectively across different performance expectations and price points, from high-throughput packaging lines to specialized UV-LED 3D printing resins.

- By Grade:

- Industrial Grade

- High-Purity Grade (Specialty Applications)

- By Application:

- Coatings (Wood, Metal, Plastic, Automotive Refinish, Flooring)

- Inks & Graphic Arts (Inkjet, Screen, Flexographic Printing)

- Adhesives & Sealants (Pressure Sensitive Adhesives, Structural Adhesives)

- 3D Printing Resins (Stereolithography, Digital Light Processing)

- Others (Composites, Optical Materials)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Southeast Asia)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For Trimethylolpropane Triacrylate Market

The value chain for the Trimethylolpropane Triacrylate market initiates with the upstream supply of key petrochemical intermediates: acrylic acid and trimethylolpropane (TMP). These raw materials are typically derived from crude oil or propylene, making the entire chain susceptible to volatility in global energy prices and geopolitical stability affecting commodity supply. Large chemical manufacturers often possess integrated production capabilities, ensuring secure sourcing of precursors, which provides a critical competitive advantage. The quality and purity of the upstream raw materials directly impact the synthesis process and the final performance characteristics of TMPTA, necessitating stringent quality control measures at the supplier level. Efficient procurement strategies and long-term supply contracts are essential for stabilizing operational costs in the synthesis phase.

The midstream involves the core manufacturing process—the esterification of TMP with acrylic acid—performed by specialized chemical companies. This stage requires advanced reaction engineering and purification techniques to produce various grades of TMPTA, ranging from industrial-grade to highly refined specialty grades used in electronics. Distribution channels subsequently move the finished product. These typically involve a mix of direct sales to large, integrated end-users (especially in the coatings sector) and reliance on specialized chemical distributors and agents. Direct distribution ensures better technical support and volume consistency for major customers, while indirect channels leverage the distributor network's reach for small to medium enterprises (SMEs) and geographically diverse markets.

Downstream analysis focuses on the formulating industries: coatings manufacturers, ink producers, adhesive formulators, and resin suppliers for 3D printing. These end-users transform TMPTA from a monomer into a complex, functional product by blending it with photoinitiators, oligomers, pigments, and additives. The performance demands of the downstream applications—such as durability for automotive coatings or high-resolution requirements for 3D printing—drive innovation and technical support requirements back up the chain. Successful value chain participation requires strong collaboration and continuous R&D feedback loops between the TMPTA producers and the downstream formulators to meet evolving market specifications and regulatory mandates regarding safety and environmental impact.

Trimethylolpropane Triacrylate Market Potential Customers

The potential customer base for Trimethylolpropane Triacrylate is highly diversified, spanning multiple industrial sectors that rely on rapid curing and high-performance chemical systems. The largest customers are industrial coatings manufacturers, particularly those focusing on durable protection for wood furniture, metal coil coatings, and automotive components (both OEM and refinish). These buyers prioritize TMPTA for its ability to enable fast-line speeds and deliver exceptional abrasion and chemical resistance in the final film. The shift in regulatory preference towards low-VOC products strongly motivates these large enterprises to adopt radiation-curable systems, placing TMPTA as a core raw material in their formulations. High-volume purchases are characteristic of this segment, making price stability and reliable supply paramount concerns for these corporate buyers.

Another major segment consists of printing ink manufacturers, including those producing UV-cured flexographic, screen, and specialized inkjet inks used extensively in the burgeoning flexible packaging and digital graphics markets. These customers require high-purity TMPTA to ensure consistent print head performance and rapid drying on non-porous substrates. The e-commerce explosion has significantly accelerated demand for high-quality packaging inks, solidifying this segment's growth potential. Additionally, manufacturers of specialized resins for advanced manufacturing, particularly 3D printing (additive manufacturing), represent a high-value customer group. These buyers use TMPTA as a fundamental building block in photocuring resins for applications demanding high resolution and mechanical strength, such as medical prototypes and complex industrial parts. This segment often purchases high-ppurity, specialized grades at premium prices.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,350 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Arkema, BASF SE, Sartomer (Arkema Group), Eternal Chemical Co. Ltd., Mitsubishi Chemical Corporation, Jiangsu Sanmu Group Co. Ltd., Miwon Commercial Co. Ltd., Allnex GmbH, Shin-Nakamura Chemical Co. Ltd., IGM Resins, Lihong Chemical Industrial Co., Osaka Organic Chemical Industry Ltd., Wanhua Chemical Group Co. Ltd., Double Bond Chemical Ind. Co., Ltd., Dymax Corporation, Rahn AG, Kyoeisha Chemical Co., Ltd., Solvay S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Trimethylolpropane Triacrylate Market Key Technology Landscape

The technology landscape governing the Trimethylolpropane Triacrylate market is centered on enhancing product purity, optimizing synthesis efficiency, and aligning formulations with modern curing equipment. The synthesis process primarily relies on catalyzed esterification, but key technological advancements focus on post-reaction purification techniques, such as specialized distillation and filtration, to minimize residual components and ensure ultra-low VOC content. High-purity TMPTA, crucial for optical and electronic applications, requires sophisticated refining technologies to achieve strict specifications regarding color, haze, and stability, reducing the risk of yellowing or performance degradation over time. Furthermore, continuous process technologies, as opposed to batch processes, are increasingly being adopted by major players to maximize output and achieve superior consistency, leveraging advanced process control systems for real-time monitoring of reaction parameters.

Downstream technology evolution is equally important, particularly the widespread adoption of UV LED curing systems. Traditional UV lamps required broad-spectrum photoinitiators, but UV LED curing, operating at specific wavelengths (e.g., 365 nm, 395 nm), necessitates monomer formulations, including TMPTA, that are efficiently sensitized by corresponding high-performance photoinitiators. This technological shift is driving demand for specialized TMPTA formulations that offer improved reactivity under lower intensity and narrower wavelength light sources, enhancing energy efficiency for the end-user. Additionally, advances in material handling and storage, including inert gas blanketing and stabilized packaging, are essential to maintain the shelf life and reactivity of TMPTA, preventing premature polymerization during transit or storage.

The increasing use of TMPTA in 3D printing technology dictates specialized requirements concerning rheology and polymerization kinetics. Formulators are blending TMPTA with other specialized monomers and oligomers to create photopolymer resins with tuned viscosity for precise layer deposition and rapid, highly controlled curing kinetics essential for high-resolution stereolithography (SLA) and Digital Light Processing (DLP). Technological research is also focused on developing sustainable, bio-based alternatives for trimethylolpropane and acrylic acid to create 'green' TMPTA, addressing long-term environmental objectives and offering a pathway for circular economy initiatives within the chemical industry. These innovations are critical for maintaining TMPTA’s relevance in an increasingly environmentally conscious global market.

Regional Highlights

The Asia Pacific (APAC) region currently dominates the Trimethylolpropane Triacrylate market in terms of both volume and revenue, largely attributable to the rapid industrial expansion, high concentration of electronics manufacturing, and immense growth in the packaging and printing sectors, particularly in China, India, and South Korea. China stands as the world's largest consumer and producer of TMPTA, leveraging its vast manufacturing base to supply both domestic and export markets, although local producers face increasing competition from stringent quality demands from multinational buyers. The adoption of advanced UV/EB curing systems in packaging printing in Southeast Asia, driven by the expanding middle class and e-commerce growth, is projected to sustain high regional growth rates throughout the forecast period.

North America and Europe represent mature markets characterized by stringent environmental regulations, high technological adoption rates, and a focus on high-value specialty applications. In North America, the automotive refinish, high-performance wood coatings, and aerospace composite industries are key drivers, utilizing high-purity TMPTA for premium formulations. The strong presence of global R&D centers also fuels innovation in new acrylate chemistries. European consumption is heavily influenced by the REACH regulation, leading to a strong emphasis on developing low-irritant TMPTA grades and specialized formulations compliant with evolving safety standards, particularly within the industrial flooring and medical coatings sectors, ensuring market value remains high despite moderate volume growth.

The Latin American and Middle East & Africa (MEA) regions are emerging markets. Latin America, particularly Brazil, shows promising growth in the construction and wood preservation industries, where durable UV-cured coatings are replacing traditional solvent-based systems. Growth in the MEA region is more concentrated in the GCC countries, driven by infrastructure investments and the establishment of local manufacturing hubs requiring protective industrial coatings. However, adoption rates are slower compared to APAC due to lower penetration of advanced UV curing equipment and relatively nascent regulatory frameworks concerning VOC emissions, meaning the market relies significantly on imported specialty chemicals and expertise.

- Asia Pacific (APAC): Dominates the global market volume; driven by China's massive manufacturing sector and accelerated demand from packaging, electronics, and graphic arts industries in India and Southeast Asia.

- North America: Focused on high-value applications in automotive refinish, specialized industrial coatings, and advanced materials (aerospace and 3D printing). Strong driver for technological advancement in UV LED compatibility.

- Europe: Characterized by stringent environmental policies (REACH); high demand for specialized, low-irritant TMPTA grades used in premium coatings and professional flooring applications.

- Latin America: Emerging market with growth tied to industrialization and construction projects, particularly in Brazil and Mexico, favoring durable, rapidly cured protective coatings.

- Middle East and Africa (MEA): Growth driven by infrastructure development and reliance on imported specialty chemicals for protective coatings in the oil and gas sector and commercial construction.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Trimethylolpropane Triacrylate Market.- Arkema S.A.

- BASF SE

- Sartomer (Arkema Group)

- Eternal Chemical Co. Ltd.

- Mitsubishi Chemical Corporation

- Jiangsu Sanmu Group Co. Ltd.

- Miwon Commercial Co. Ltd.

- Allnex GmbH

- Shin-Nakamura Chemical Co. Ltd.

- IGM Resins

- Lihong Chemical Industrial Co.

- Osaka Organic Chemical Industry Ltd.

- Wanhua Chemical Group Co. Ltd.

- Double Bond Chemical Ind. Co., Ltd.

- Dymax Corporation

- Rahn AG

- Kyoeisha Chemical Co., Ltd.

- Solvay S.A.

- DAICEL CORPORATION

- Nippon Shokubai Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Trimethylolpropane Triacrylate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Trimethylolpropane Triacrylate (TMPTA) in chemical formulations?

TMPTA is primarily utilized as a highly reactive, trifunctional monomer and cross-linking agent in UV/EB curable systems. Its main function is to reduce the viscosity of the formulation while significantly accelerating the curing speed and enhancing the final product’s hardness, chemical resistance, and abrasion durability in coatings and inks.

Which industry applications drive the highest demand for TMPTA globally?

The highest demand for TMPTA is driven by the industrial coatings sector, specifically for wood, metal, and plastic coatings requiring high performance and fast processing times. Additionally, the inks and graphic arts industry, particularly in packaging and digital inkjet printing, is a major consumer due to the need for rapid, low-VOC curing systems.

How do global VOC regulations impact the demand and market growth of TMPTA?

Global Volatile Organic Compound (VOC) regulations significantly boost TMPTA demand. As TMPTA is a 100% reactive monomer used in solvent-free UV/EB curing systems, its use helps end-users comply with stringent environmental standards by eliminating the need for traditional organic solvents, positioning it as a preferred, compliant alternative.

What are the key substitutes or alternative materials to TMPTA in UV-curable formulations?

Key substitutes for TMPTA include other multifunctional acrylate monomers like Pentaerythritol Triacrylate (PETA), Dipentaerythritol Pentaacrylate (DPEPA), and various proprietary oligomeric acrylates. Selection depends on the specific balance required between flexibility, hardness, and curing speed, often leading to co-formulation rather than direct substitution.

What role does TMPTA play in the rapidly growing 3D printing market?

In 3D printing, high-purity TMPTA serves as a fundamental cross-linking component in photopolymer resins used in Stereolithography (SLA) and Digital Light Processing (DLP) technologies. It enables the quick polymerization and cross-linking necessary for high-resolution, layer-by-layer fabrication, contributing to the mechanical strength and precision of the final printed object.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager