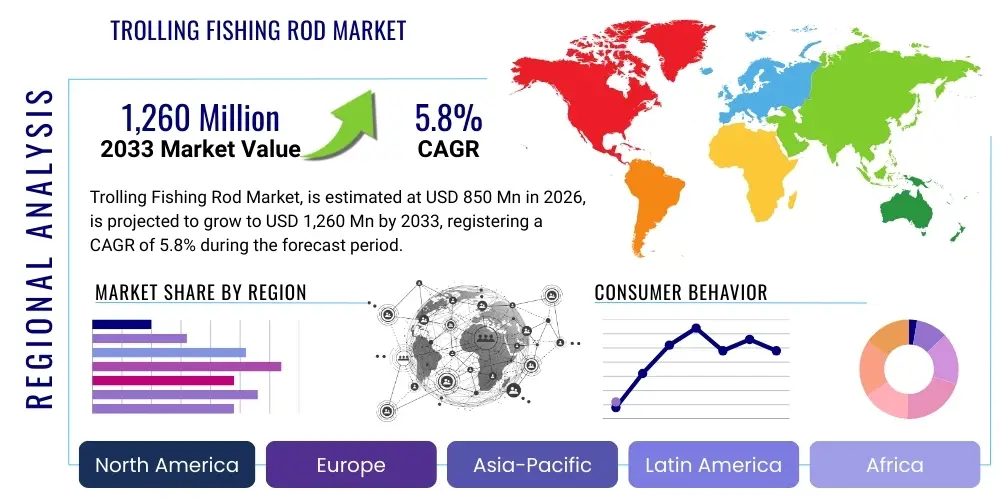

Trolling Fishing Rod Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435893 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Trolling Fishing Rod Market Size

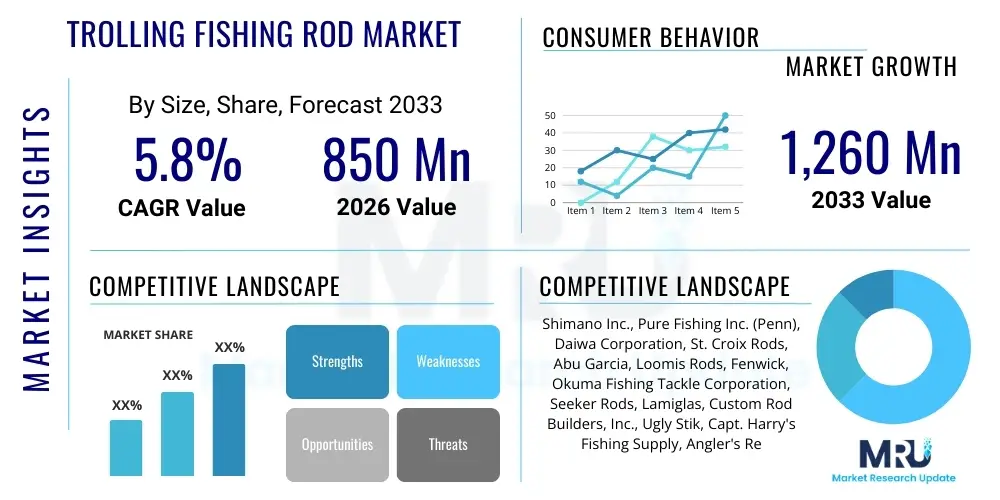

The Trolling Fishing Rod Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,260 Million by the end of the forecast period in 2033.

Trolling Fishing Rod Market introduction

The Trolling Fishing Rod Market encompasses the manufacturing, distribution, and sales of specialized fishing rods designed for the trolling method, where lines are drawn through the water behind a moving boat. These rods are inherently robust, featuring high tensile strength and parabolic action necessary to withstand the continuous drag and sudden, forceful strikes characteristic of large pelagic species like tuna, marlin, and wahoo. Market growth is fundamentally driven by the escalating global participation in recreational fishing tourism and the increasing demand for high-performance, durable equipment capable of targeting big game fish in both saltwater and large freshwater bodies. The continuous technological refinement in material science, particularly the adoption of advanced composites and nano-resins, further solidifies the upward trajectory of market valuation.

Trolling rods are distinguished by their specific design attributes, including heavy-duty roller guides, stout blanks, and specialized reel seats built to handle high line tension and large capacity reels. Major applications span across deep-sea charter operations, competitive sport fishing tournaments, and dedicated recreational anglers seeking precision control and immense lifting power. The primary benefits of using a dedicated trolling rod include superior sensitivity to subtle bait movements, exceptional shock absorption during long fights, and optimized leverage that minimizes angler fatigue. These features are critical for maintaining continuous pressure on large catches, thereby increasing the success rate and overall efficiency of the fishing expedition.

Driving factors propelling this market include the global expansion of disposable incomes leading to greater expenditure on leisure activities, the successful implementation of marine conservation efforts that support healthy big game populations, and pervasive media coverage that popularizes offshore fishing adventures. Furthermore, the advent of specialized fishing electronics, such as advanced sonar and GPS systems, enhances the effectiveness of trolling, prompting anglers to invest in sophisticated rod setups optimized for these modern techniques. The shift towards lightweight yet ultra-strong carbon fiber materials also acts as a significant catalyst, enabling manufacturers to offer premium rods at various price points, catering to both professional and amateur enthusiasts globally.

Trolling Fishing Rod Market Executive Summary

The Trolling Fishing Rod Market exhibits robust business trends characterized by a rapid shift towards customization and specialized gear designed for specific trolling techniques, such as deep dropping or high-speed trolling. Key industry players are focusing on vertical integration, controlling the supply chain from raw material procurement (e.g., carbon sheets and specialized resins) to final assembly, ensuring high-quality standards and rapid product innovation cycles. A critical trend involves sustainability, with increasing consumer preference for products manufactured using environmentally conscious processes and durable, long-lasting components, thereby reducing the equipment replacement cycle frequency. Strategic partnerships between rod manufacturers and leading reel producers are also common, aiming to provide optimized, ready-to-use fishing systems to the end-user.

Regionally, North America maintains market dominance due to its established culture of sport fishing, extensive coastline access, and a high density of professional charter operations, particularly in regions like Florida and the Gulf Coast. However, the Asia Pacific (APAC) region, driven by the expanding middle-class population in countries like China and Australia and burgeoning coastal tourism, is projected to demonstrate the highest Compound Annual Growth Rate (CAGR). Europe remains a mature market, heavily influenced by Atlantic and Mediterranean fishing traditions, with a strong emphasis on high-end, artisanal rod craftsmanship. Regulatory frameworks surrounding fishing quotas and seasonal limitations in these major markets influence regional sales cycles and inventory planning for manufacturers.

Segmentation trends highlight the increasing demand for high modulus carbon fiber rods over traditional fiberglass, primarily due to the superior sensitivity and reduced weight offered by carbon construction. The conventional trolling rod segment, which utilizes stand-up techniques, continues to hold the largest market share, though specialized rod types, such as those optimized for planer boards and downriggers, are gaining traction rapidly as anglers seek specialized tools for precise lure placement. Furthermore, the recreational segment remains the primary revenue source, but the commercial fishing sector, particularly those involved in sustainable catch operations, is showing stable, consistent growth in demand for heavy-duty, commercial-grade trolling equipment.

AI Impact Analysis on Trolling Fishing Rod Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the Trolling Fishing Rod Market predominantly revolve around predictive maintenance, optimizing lure deployment strategies, and integrating smart sensors into the rod and reel ecosystem. Common themes include concerns about whether AI-driven technologies will make traditional fishing skills redundant, the expected cost implications of smart gear, and the practicality of utilizing complex algorithms in harsh marine environments. Users are keenly interested in how AI can process real-time environmental data—such as water temperature, current speed, and bait presence detected by sonar—to automatically adjust line length or retrieve speed, thereby maximizing the probability of a strike. Furthermore, there is significant interest in AI-powered material analysis to design superior rod blanks and predictive modeling to forecast equipment failure.

The immediate impact of AI is less about changing the physical form of the rod itself and more focused on enhancing the auxiliary devices and the data analytics surrounding the fishing activity. AI algorithms are currently being applied within advanced fish finders and chart plotters to identify optimal trolling paths and depths based on historical catch data and real-time bathymetry. This transition means the rod, while remaining a mechanical tool, becomes an integral part of a connected, data-driven system. Manufacturers are exploring the embedding of micro-sensors within rod butts or reel seats to monitor stress levels, flex parameters, and fatigue, providing invaluable data for both professional training and future product development, moving the market toward performance-based engineering validation.

In the long term, AI is expected to revolutionize rod material selection and manufacturing precision. Generative design tools, powered by AI, can simulate millions of material combinations and structural geometries to design the lightest, strongest, and most sensitive rod blanks possible, minimizing waste and maximizing performance characteristics like backbone and tip responsiveness. For the consumer, this translates to highly personalized gear recommendations and enhanced instructional tools, possibly through augmented reality interfaces that provide real-time feedback on fighting technique based on the tension data streamed from the smart rod setup. These advancements are expected to justify premium pricing and attract a new generation of tech-savvy anglers to the sport.

- Enhanced predictive modeling for material stress analysis and optimal rod geometry design.

- Integration of AI-driven sensors in reel seats for real-time tension and flex monitoring.

- Optimization of trolling strategies by AI-enabled sonar systems analyzing current, depth, and temperature.

- Development of personalized fishing analytics platforms based on data collected during active trolling sessions.

- Automated quality control systems in manufacturing utilizing machine vision for defect detection.

DRO & Impact Forces Of Trolling Fishing Rod Market

The Trolling Fishing Rod Market is significantly shaped by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces dictating market trajectory. Key drivers include the substantial global increase in marine recreational activities and sport fishing tournaments, which inherently necessitate high-quality, specialized trolling equipment. Furthermore, continuous material innovation, such as the blending of high-modulus graphite and specialized glass fibers, enables manufacturers to offer lighter yet more powerful rods, compelling anglers to upgrade their existing gear. The growing accessibility of coastal regions and the expansion of the charter boat industry globally also directly stimulates demand, particularly in developing economies.

However, the market faces significant restraints. One primary challenge is the inherent seasonality of the fishing industry, where sales peak and trough dramatically based on weather conditions and species migration patterns, leading to complex inventory management for suppliers. Another major restraint is the increasing regulatory scrutiny and implementation of stricter fishing quotas and restrictions, particularly concerning offshore big game species, which can dampen participation rates in certain regions. Moreover, the specialized nature of high-end trolling rods often results in a high initial investment cost, creating a barrier to entry for novice or casual anglers who may opt for multipurpose, less expensive conventional rods instead.

Opportunities for growth are abundant, particularly in geographical expansion and product diversification. Emerging markets in Southeast Asia and Latin America represent vast, untapped potential as disposable incomes rise and local tourism infrastructure improves. Technological opportunities include the integration of advanced ergonomics and smart connectivity into rod handles and grips, enhancing user experience and performance tracking. Furthermore, there is a substantial opportunity in catering to the eco-conscious consumer through the development of biodegradable components and utilizing manufacturing processes that minimize the carbon footprint, aligning with global sustainability trends which are becoming increasingly important purchasing criteria for the modern angler.

Segmentation Analysis

The Trolling Fishing Rod Market is primarily segmented based on Rod Type, Material, Length, and Application, providing a granular view of consumer preferences and market dynamics. This segmentation allows manufacturers to precisely target specific angler demographics, ranging from weekend recreationalists who require durable, entry-level composite rods, to professional charter captains demanding customized, high-performance carbon fiber equipment optimized for extreme load conditions. Analyzing these segments reveals shifting market preferences, notably the migration towards shorter, stiffer rods for stand-up fighting techniques and the increasing adoption of specialized deep-water rods utilizing electric reels.

Segmentation by material is crucial, defining the rod's strength, sensitivity, and price point. Carbon fiber (graphite) dominates the premium segment due to its lightweight and high sensitivity, while fiberglass and composite blends (combining fiberglass flexibility with graphite strength) maintain strong positions in the mid-range and heavy-duty commercial applications where resilience is prioritized over pure lightness. By application, the clear distinction between recreational fishing—which is volume-driven—and commercial/charter operations—which demand industrial-grade durability and reliability—guides product development and marketing strategies across all major geographic regions, ensuring that specific end-user requirements are met with tailored product lines.

- By Rod Type:

- Conventional Trolling Rods (Stand-up Rods)

- Downrigger Rods

- Planer Board Rods

- Electric Reel Rods (Deep Dropping)

- By Material:

- Fiberglass

- Carbon Fiber (Graphite)

- Composite Materials

- By Length:

- Under 6 Feet

- 6 to 8 Feet

- Above 8 Feet

- By Application:

- Recreational Fishing

- Commercial Fishing and Charter Operations

Value Chain Analysis For Trolling Fishing Rod Market

The value chain of the Trolling Fishing Rod Market begins with upstream activities focused on sourcing and processing specialized raw materials. This includes the acquisition of high-modulus carbon sheets, E-glass or S-glass fiberglass fibers, specialized epoxy resins, and durable components such as stainless steel or aluminum for guides and reel seats. Critical upstream processes involve the precise rolling and curing of rod blanks, often requiring highly specialized machinery and stringent quality control protocols to ensure structural integrity and desired flex characteristics. Supply chain risks at this stage often relate to the volatile pricing of petroleum-derived composite precursors and the dependence on a limited number of specialized component manufacturers for high-quality roller guides and aluminum gimbal butts.

The midstream stage involves the rod manufacturing and assembly process, where the blanks are sanded, painted, components are wrapped (using high-tensile thread and epoxy), and final quality checks are performed. Distribution channels form the critical link to the end-consumer, utilizing both direct and indirect routes. Direct distribution channels typically involve sales through company-owned e-commerce platforms or flagship stores, enabling manufacturers to control branding, gather direct customer feedback, and achieve higher margins on premium products. This model is particularly effective for highly specialized or custom-built trolling rods.

Indirect distribution relies heavily on a tiered structure, including national and regional distributors, specialized fishing tackle retailers, large big-box sporting goods stores (e.g., Bass Pro Shops, Cabela’s), and online marketplaces (e.g., Amazon, specialty tackle websites). The downstream segment involves the end-user, encompassing both recreational anglers and professional charter businesses. The efficiency of the distribution network, particularly the ability to rapidly fulfill orders and provide robust after-sales support (warranty, repair services), significantly impacts brand loyalty and market penetration. Logistics costs associated with shipping long, fragile items like trolling rods also represent a noteworthy consideration in the overall value chain cost structure.

Trolling Fishing Rod Market Potential Customers

Potential customers for the Trolling Fishing Rod Market are primarily categorized into professional entities and consumer segments, each possessing distinct purchasing behaviors and product requirements. The professional segment includes deep-sea charter operators, commercial fishing vessels, and participants in competitive sport fishing circuits. These customers prioritize durability, reliability under extreme stress, consistent performance, and often purchase high-volume, standardized sets of heavy-duty rods. Their buying decisions are influenced heavily by expert recommendations, brand reputation for longevity, and the availability of immediate maintenance and repair services, as equipment downtime translates directly into lost revenue.

The recreational fishing segment forms the largest consumer base, consisting of enthusiasts ranging from affluent boat owners to casual weekend anglers. This group’s purchasing decisions are often driven by aspirational factors, seeking rods that offer an optimal balance between high-end features (like carbon composite construction and ergonomic handles) and moderate pricing. They are heavily influenced by digital marketing, product reviews, social media endorsements, and educational content that demonstrates specialized fishing techniques. This segment shows increasing demand for specialized rods tailored for specific local species or trolling environments, pushing manufacturers toward broader product portfolios.

A rapidly growing customer demographic includes international fishing tourists and travelers who require portable, yet powerful, multi-piece trolling rods suitable for airplane travel. Furthermore, government entities involved in marine research and fisheries management occasionally represent niche buyers requiring specialized, instrumented trolling rods for data collection and tagging operations. Successfully penetrating these diverse customer groups requires manufacturers to maintain varied product lines, robust online educational resources, and strong relationships with specialized tackle distributors who can offer personalized consultation services to match the rod to the specific fishing conditions and target species.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,260 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shimano Inc., Pure Fishing Inc. (Penn), Daiwa Corporation, St. Croix Rods, Abu Garcia, Loomis Rods, Fenwick, Okuma Fishing Tackle Corporation, Seeker Rods, Lamiglas, Custom Rod Builders, Inc., Ugly Stik, Capt. Harry's Fishing Supply, Angler's Resource, Crowder Rods |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Trolling Fishing Rod Market Key Technology Landscape

The technology landscape of the Trolling Fishing Rod Market is primarily centered on advancements in composite material science, manufacturing precision, and ergonomic design, moving beyond basic components towards integrated performance systems. The most critical technological focus is on the rod blank construction, utilizing high-modulus graphite (carbon fiber) that offers superior power-to-weight ratios compared to traditional fiberglass. Manufacturers employ proprietary blending techniques, such as multi-directional fiber layering and nanoresin technologies, to enhance the hoop strength and torsional stability of the rods, minimizing the risk of breakage under extreme load conditions typical of big game trolling. These processes require specialized industrial ovens and precision mandrels to cure the blanks accurately, resulting in consistent, high-performance tapers.

Another significant technological advancement involves the components attached to the rod, specifically the guides and reel seats. Trolling rods increasingly utilize roller guides constructed from marine-grade stainless steel or titanium, featuring specialized bearings to minimize friction and wear on heavy fishing lines, especially when fighting large, fast-running fish. The manufacturing of these guides requires advanced CNC machining to achieve perfect alignment and smooth operation, which is critical for maximizing line life and casting distance (though casting is less critical in trolling, guide quality is vital for managing heavy drag). Furthermore, high-tech aluminum reel seats, often anodized for maximum corrosion resistance, are precision-engineered to securely lock large conventional reels in place, tolerating immense pressures without seizing or failing.

Emerging technologies include the integration of micro-sensors and Bluetooth connectivity within the rod butt, allowing for real-time monitoring of rod flex, maximum exerted force, and total fighting time. This IoT integration enhances the angler's experience by providing quantifiable metrics, which are invaluable for competitive fishing and analyzing tackle performance. Additionally, computational fluid dynamics (CFD) and finite element analysis (FEA) software are routinely used during the design phase to simulate various stress scenarios on the rod blank and components, optimizing the material distribution and reducing weight without compromising structural integrity. This digital approach to product development ensures that new rods meet specific performance metrics before prototypes are even built, significantly shortening the development cycle.

Regional Highlights

- North America (Dominance and Innovation): North America, particularly the US and Canada, represents the largest and most mature market for trolling fishing rods, fueled by a deeply entrenched sport fishing culture, high consumer spending on leisure marine activities, and the presence of major global manufacturers. The region is a hub for high-end customization and rapid adoption of innovative materials like multi-ply carbon fiber construction and titanium components. Florida, California, and the Gulf Coast states are critical consumer bases due to extensive deep-sea trolling opportunities, driving demand for heavy-action, specialized deep-drop and stand-up rods used for species like Marlin, Tuna, and Grouper.

- Europe (Specialization and Heritage): The European market demonstrates steady growth, concentrating on the Atlantic and Mediterranean regions, with countries like Spain, Portugal, and Italy showing high activity levels. The market here is characterized by a demand for high-quality, artisanal rods, often prioritizing aesthetic design alongside performance. Key trends include the adoption of specialized gear for Bluefin Tuna fishing in the Mediterranean and a strong emphasis on environmentally compliant products. Regulatory harmonization across the EU regarding fishing gear standards also influences product specifications and trade flows.

- Asia Pacific (APAC) (High Growth Potential): APAC is projected to be the fastest-growing region, driven by the expansion of recreational boating, rising disposable incomes in coastal metropolitan areas (China, Australia, Japan), and increasing tourism focused on coastal and deep-sea fishing. Japan and Australia are critical markets known for demanding ultra-high-performance rods due to their proximity to highly sought-after pelagic species. The market is increasingly adopting Western-style equipment and techniques, presenting significant opportunities for international manufacturers, although competition from local, lower-cost producers remains a factor.

- Latin America (Emerging Demand): Latin American countries, particularly Mexico, Brazil, and Costa Rica, are emerging as significant destinations for fishing tourism, creating a localized demand for professional charter-grade trolling rods. The growth is intrinsically linked to infrastructure development related to marinas and tourism facilities. Price sensitivity is higher in this region compared to North America, often leading to a preference for durable, mid-range composite rods that offer a better value proposition for commercial operators and developing recreational markets.

- Middle East and Africa (MEA) (Niche Market Development): The MEA market, while smaller, is growing in specific luxury and tourism-focused hubs, such as the UAE and South Africa, which possess vibrant deep-sea fishing industries. Demand is typically segmented, with high-end demand coming from expatriates and luxury tourism operators, while more localized coastal fishing relies on basic, robust equipment. Investment in marine tourism infrastructure is a key driver for future trolling rod sales in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Trolling Fishing Rod Market.- Shimano Inc.

- Pure Fishing Inc. (Penn, Abu Garcia, Fenwick)

- Daiwa Corporation

- St. Croix Rods

- Okuma Fishing Tackle Corporation

- G. Loomis (A Shimano Brand)

- Seeker Rods

- Lamiglas

- Fuji Kogyo Co., Ltd. (Component Supplier Influence)

- Capt. Harry's Fishing Supply (Specialized Distributor/Brand)

- Crowder Rods

- Custom Rod Builders, Inc.

- Ugly Stik (A Pure Fishing Brand)

- American Tackle Company (Component Supplier)

- Ballyhoo Custom Rods

- Tsunami Fishing

- Star Rods

- Accurate Fishing Products (Rod/Reel Systems)

- Maxel Fishing Tackle

- Jigging World

Frequently Asked Questions

Analyze common user questions about the Trolling Fishing Rod market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials are predominantly used in high-performance trolling rods?

High-performance trolling rods primarily utilize high-modulus carbon fiber (graphite) for superior sensitivity and light weight, often blended with E-glass or S-glass fiberglass to create durable composites that offer greater resilience and shock absorption necessary for fighting large, powerful pelagic fish over extended periods. Specialized resins and multi-layer construction techniques enhance overall structural integrity.

How does the length of a trolling rod impact its performance characteristics?

Trolling rod length typically ranges from 5.5 to 8 feet. Shorter rods (under 6 feet) are generally preferred for stand-up fighting, offering maximum leverage and control directly over the reel, increasing lifting power. Longer rods (over 7 feet) are better suited for flat-line trolling, kite fishing, or utilizing planer boards, as they help spread the lines out and absorb boat motion more effectively.

What is the primary difference between conventional trolling rods and downrigger rods?

Conventional trolling rods are built for intense stress and lifting power, featuring heavy-duty guides and thick blanks. Downrigger rods, conversely, are designed with a softer, more sensitive tip that loads easily under the downrigger clip tension. Their primary function is to signal a strike immediately by snapping back when the line releases from the clip, requiring less overall backbone than a stand-up fighting rod.

Which regions are expected to drive the highest growth in the trolling rod market?

The Asia Pacific (APAC) region, driven by expanding middle-class populations, increased disposable incomes, and growing coastal tourism in countries like China and Australia, is projected to exhibit the highest Compound Annual Growth Rate (CAGR). North America, while remaining the largest market in terms of absolute value, is characterized by maturity, whereas APAC offers significant untapped growth potential.

What are the key technological advancements influencing modern trolling rod design?

Key technological advancements include the use of nano-resin systems to improve blank strength without adding weight, the adoption of specialized roller guides with ceramic or titanium components for reduced line friction, and the integration of smart sensor technology in reel seats to monitor tension, stress, and fight dynamics, providing advanced performance data to the angler.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager