Trommel Screens Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434119 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Trommel Screens Market Size

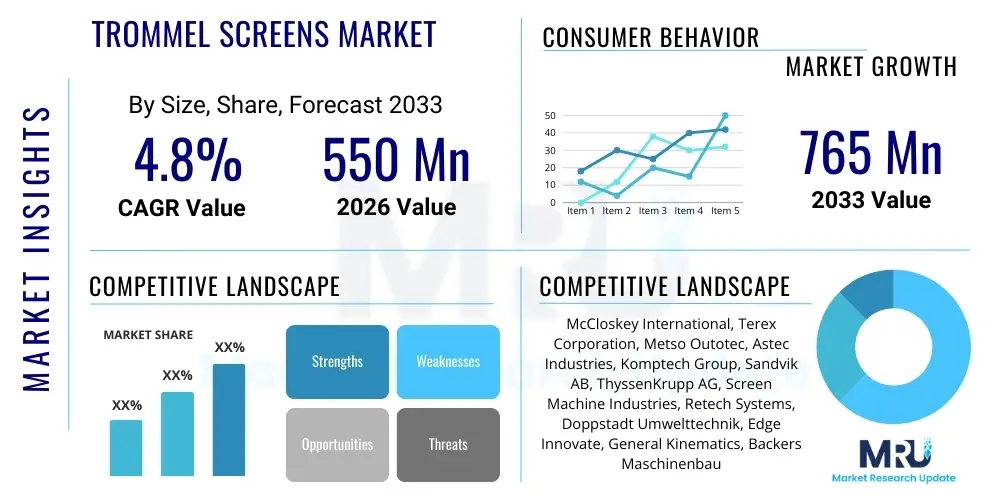

The Trommel Screens Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 765 Million by the end of the forecast period in 2033.

Trommel Screens Market introduction

The Trommel Screens Market encompasses the manufacturing, distribution, and utilization of rotating cylindrical sieves designed for the mechanical separation of materials by size. These machines are crucial in numerous industrial applications, particularly in the bulk handling sectors where high volume, efficient segregation is required. Trommel screens are characterized by their slow rotational speed and inclined drum, which allows materials to tumble and thoroughly separate fines from larger fractions. The core function is improving material quality, reducing contamination, and preparing feedstocks for further processing or disposal, thus making them indispensable assets in waste management, mining, and aggregates processing.

Product descriptions typically highlight features such as adjustable drum angles, variable mesh sizes, and robust construction to handle abrasive materials. Modern trommel screens are increasingly mobile, offering flexibility across multiple worksites, and often integrate sophisticated hydraulic systems and remote monitoring capabilities to maximize uptime and operational efficiency. The major applications span municipal solid waste (MSW) recycling, construction and demolition (C&D) debris sorting, compost production, and mineral sizing in quarrying operations. Their versatility and capacity to handle mixed, often sticky, materials distinguish them from vibrating screens in specific applications.

The primary benefit derived from the use of trommel screens is enhanced material purity, which directly increases the commercial value of recoverable resources and reduces landfill volume. Key driving factors include stringent global environmental regulations mandating higher recycling rates, the massive infrastructural development projects requiring processed aggregates, and the growing demand for renewable energy sources derived from biomass and compost, all of which rely on effective material segregation technology.

Trommel Screens Market Executive Summary

The Trommel Screens Market is currently experiencing robust expansion driven primarily by global sustainability mandates and the escalating volume of waste generated worldwide. Business trends indicate a strong shift towards highly customized and modular screening solutions, allowing operators to adapt swiftly to diverse material inputs, especially within the complex recycling and C&D sectors. Leading manufacturers are investing heavily in hybrid and electrically powered units to meet carbon reduction goals, positioning efficiency and lower operational costs (OPEX) as primary competitive differentiators. Furthermore, digitalization, involving the integration of IoT sensors for predictive maintenance and real-time output monitoring, is transforming traditional equipment into smart, networked assets, enhancing overall site management and data collection capabilities.

Regionally, the market dynamics are highly influenced by governmental policies and existing infrastructure development levels. Asia Pacific (APAC) stands out as the highest growth region, fueled by rapid urbanization, massive infrastructure spending in countries like China and India, and the urgent need to establish formalized waste management systems. North America and Europe, while mature markets, are experiencing demand for replacement equipment featuring higher automation and specialized screening capabilities tailored for complex material streams like electronics and specialized plastics recycling. Emerging markets in Latin America and the Middle East are exhibiting steady growth driven by new mining projects and foundational investments in municipal solid waste treatment facilities.

Segment trends reveal that the recycling and waste management application segment dominates the market due to the sheer volume of material processed and the regulatory pressure to recover valuable resources. By product type, mobile trommel screens are outpacing stationary units, reflecting the industry's need for flexibility and multi-site deployment, particularly in the C&D domain. In terms of technology, hydraulic-drive trommel screens maintain a significant market share, though electric-drive systems are rapidly gaining traction due to superior energy efficiency and lower noise profiles, aligning with increasingly strict operational requirements in urban and semi-urban settings.

AI Impact Analysis on Trommel Screens Market

Users frequently inquire about how Artificial Intelligence (AI) and machine learning (ML) can move beyond simple automation to fundamentally optimize the performance and maintenance cycles of trommel screens. Common questions revolve around the use of AI for real-time material recognition, especially in mixed waste streams, to automatically adjust drum speed, pitch, and flow rates to maintain optimal separation efficiency regardless of input variability. There is significant interest in predictive maintenance algorithms powered by AI that analyze vibration, temperature, and current draw data from motors and bearings to forecast potential equipment failures long before they impact operations. Furthermore, users are keen to understand how AI can assist in overall site logistics, optimizing the feed rate of material handlers to ensure the trommel screen operates continuously at its peak capacity, maximizing throughput while minimizing energy consumption per ton processed.

The implementation of AI is shifting the trommel screen from a purely mechanical device to an intelligent processing unit. By analyzing extensive operational datasets, AI algorithms can create highly accurate digital twins of the screening process, enabling sophisticated simulation and optimization of parameters like aperture selection and drum configuration for novel material streams. This analytical capability is essential for operations dealing with municipal solid waste (MSW) where the composition can change daily, requiring instantaneous machine adjustments. This leads to higher material purity, fewer operational bottlenecks, and significantly reduced reliance on continuous human oversight, which is a major benefit in hazardous or remote operational environments.

Ultimately, the influence of AI translates into quantifiable economic benefits: minimized wear and tear, substantial energy savings, and increased recovery rates for high-value recyclables. The integration of AI-driven control systems, often accessed via cloud platforms, democratizes complex process optimization, allowing operators to achieve world-class efficiency standards without requiring deep in-house engineering expertise. This ensures that trommel screens remain competitive against advanced sensor-based sorting technologies by perfecting the initial mechanical separation stage, which is crucial for the subsequent successful application of high-tech sorting methods.

- AI-driven Predictive Maintenance: Monitoring mechanical stress points (bearings, hydraulic pressure) to schedule proactive maintenance, reducing unplanned downtime by up to 30%.

- Real-time Process Optimization: Utilizing vision systems and ML models to recognize material types and automatically adjust drum speed and angle for maximum efficiency under variable loading conditions.

- Energy Consumption Reduction: AI control systems dynamically manage motor power draw based on actual load, minimizing energy waste during low-demand periods.

- Enhanced Material Purity: Algorithms optimize screening time and agitation to ensure finer particles are completely separated, improving the quality and saleability of output fractions.

- Remote Diagnostics and Troubleshooting: Enabling manufacturers to remotely access operational data and provide instantaneous software updates or configuration changes via AI-supported platforms.

DRO & Impact Forces Of Trommel Screens Market

The Trommel Screens Market is powerfully influenced by a combination of global regulatory push for sustainability and the inherent demand for processed raw materials. Key drivers include the accelerated adoption of circular economy models globally, which necessitates efficient material recovery infrastructure, and the massive scale of infrastructure projects requiring sorted aggregates. However, the market faces constraints such as the high initial capital investment required for heavy machinery and the complexity of maintenance for mobile units operating in harsh environments. Opportunities arise from technological advancements in mobility, automation, and the expansion into emerging applications like specialized agricultural waste processing and biomass preparation. These forces collectively shape the market's trajectory, prioritizing solutions that offer superior total cost of ownership (TCO) and operational flexibility.

The primary drivers are foundational to industrial and environmental policy. Government mandates, particularly in the EU and developed Asian nations, are setting higher targets for landfill diversion and mandatory recycling rates for construction waste and MSW, directly stimulating investment in high-capacity trommel screening equipment. Furthermore, the rising cost of virgin materials makes recovered aggregates and secondary raw materials economically appealing, reinforcing the business case for robust material separation technologies. The global trend towards large, multi-faceted waste processing facilities requires integrated systems where trommel screens serve as the essential pre-sorting backbone, handling the highest throughput volumes.

Restraints are generally tied to economics and logistics. The substantial purchase price of large-scale trommel screens can be prohibitive for smaller operators or those in developing regions, making leasing and rental models increasingly important. Additionally, the operational environment often involves highly abrasive, dirty, or sticky materials, leading to rapid wear of screening media and internal components, translating into higher maintenance and replacement costs. The impact forces — technological innovation, competitive intensity, and stringent environmental policies — exert constant pressure on manufacturers to innovate, focusing on reducing wear through new materials and enhancing ease of maintenance to improve product longevity and reliability in demanding applications.

Segmentation Analysis

The Trommel Screens Market is extensively segmented based on mobility, operating mechanism, capacity, and end-use application, providing a detailed view of market demand across various industrial requirements. Segmentation based on product type—mobile, semi-mobile, and stationary—reflects the trade-off between throughput capacity and site flexibility, with mobile units dominating new sales due to their versatility in C&D and contract screening operations. Application segmentation is critical, highlighting the dominance of the recycling and waste management sectors over mining and aggregates, given the global priority on resource recovery and waste reduction. Furthermore, segmentation by capacity (e.g., small, medium, and large tonnage) allows manufacturers to target equipment specifically designed for scale, from small composting operations to massive material recovery facilities (MRFs).

Analyzing the drive mechanism segmentation reveals the competitive landscape between hydraulic and electric-drive systems. While hydraulic systems offer robust power and reliability in rough environments, electric-drive systems are gaining momentum due to lower energy consumption, reduced noise pollution, and easier integration with electrified equipment fleets, especially in Europe where environmental standards are strictest. The depth of segmentation allows stakeholders to understand niche requirements, such as specialized trommels designed for municipal sludge dewatering or ultra-fine screening in specific mineral processing applications, which often command higher margins due to specialized engineering requirements.

Understanding these segments is crucial for strategic planning. For instance, the high growth expected in the composting application segment suggests opportunities for smaller, dedicated trommel screen models optimized for damp, organic materials, minimizing clogging and maximizing aeration potential. Conversely, the stable demand in the quarrying segment drives innovation in wear-resistant materials and ultra-heavy-duty construction designed for continuous, high-volume processing of hard rock and aggregates, ensuring equipment longevity and consistent output quality over extended operational periods.

- By Product Type:

- Mobile Trommel Screens

- Stationary Trommel Screens

- Semi-Mobile/Tracked Trommel Screens

- By Drive Mechanism:

- Hydraulic Drive

- Electric Drive

- Hybrid Systems

- By Capacity:

- Small Capacity (< 50 Tons/Hour)

- Medium Capacity (50 – 150 Tons/Hour)

- Large Capacity (> 150 Tons/Hour)

- By Application:

- Construction and Demolition (C&D) Waste Recycling

- Municipal Solid Waste (MSW) Processing

- Composting and Biomass Production

- Mining and Aggregates Processing

- Industrial and Sludge Processing

Value Chain Analysis For Trommel Screens Market

The value chain for the Trommel Screens Market begins with the upstream procurement of essential raw materials, primarily high-grade steel plates, heavy-duty components such as bearings, gearboxes, hydraulic systems, and specialized screening media. Upstream analysis involves assessing the stability and pricing volatility of steel and energy costs, which directly impact manufacturing expenses. Key activities at this stage include sourcing standardized, durable components and securing reliable supply chains for specialized parts like high-abrasion resistance alloy steel used in drum fabrication. Manufacturers often focus on establishing long-term relationships with component suppliers to ensure quality control and optimize inventory management, mitigating risks associated with supply disruptions and rising commodity prices.

The core manufacturing stage involves design, fabrication, assembly, and quality testing. Modern manufacturing emphasizes modular design, allowing for easier customization and quicker assembly. After fabrication, the distribution channel plays a critical role. Direct sales models, where manufacturers use their own sales force, are common for large, complex stationary systems sold to major quarrying or municipal clients, enabling direct technical support and customized contract negotiation. Conversely, indirect distribution, utilizing a network of authorized dealers and distributors, is prevalent for mobile trommel screens, especially in regions requiring localized sales, service, and spare parts inventory, leveraging the distributor's regional expertise and established customer base.

Downstream analysis focuses on end-user utilization and after-sales service. The performance of the trommel screen is directly tied to operational efficiency and material separation effectiveness at the client's site (e.g., MRF, quarry, or landfill). A critical component of the value chain is the provision of robust after-market services, including spare parts supply (particularly replacement drums and screening media), preventative maintenance contracts, and technical training. The profitability of the market is heavily influenced by the recurring revenue generated through these high-margin after-sales services, making reliable customer support and rapid response capabilities essential for maintaining long-term customer satisfaction and market share.

Trommel Screens Market Potential Customers

Potential customers for trommel screens represent diverse sectors unified by the necessity for efficient, high-volume material sizing and separation. End-users typically include large-scale operators in the recycling and waste management industry, such as private Material Recovery Facilities (MRFs) and municipal solid waste treatment plants, who utilize trommels as a primary step to separate organic fines, C&D debris, and commingled recyclables. These buyers prioritize high throughput capacity, reliable operation under continuous load, and low operational expenditure (OPEX), focusing on machines built for maximum uptime and minimal maintenance requirements in highly corrosive environments.

Another major buyer segment is the aggregates and mining industry, including quarry operators and mineral processors, who need robust trommel screens for sizing gravel, sand, and various mineral ores. In this sector, the emphasis shifts slightly towards extreme durability, high resistance to abrasion, and precise separation capabilities to meet strict material specifications for construction projects. These customers often opt for heavy-duty, stationary or semi-mobile units with larger capacities, designed for continuous operation in harsh, remote mining locations, demanding exceptional reliability and structural integrity to handle dense, abrasive feedstocks.

Finally, the composting and agricultural sectors form a growing customer base. Compost producers use trommel screens to refine finished compost, removing oversized materials and contaminants to ensure product quality. Agricultural waste processors utilize them for biomass preparation or specialized soil treatment applications. These buyers generally seek medium-to-small capacity, highly mobile units that can be transported between various sites or utilized seasonally, prioritizing features that prevent material clogging (e.g., cleaning brushes and easy-to-change drums) while maintaining high mobility and relatively simple operation. This diverse customer profile necessitates a varied product portfolio from manufacturers, addressing specific industry needs regarding capacity, material handling, and durability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 765 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | McCloskey International, Terex Corporation, Metso Outotec, Astec Industries, Komptech Group, Sandvik AB, ThyssenKrupp AG, Screen Machine Industries, Retech Systems, Doppstadt Umwelttechnik, Edge Innovate, General Kinematics, Backers Maschinenbau GmbH, Waste Systems, Anaconda Equipment. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Trommel Screens Market Key Technology Landscape

The technological landscape of the Trommel Screens Market is characterized by continuous evolution aimed at improving efficiency, reducing wear, and enhancing operational intelligence. A core technological advancement is the integration of advanced automation and sensor technology, moving trommel screens towards becoming essential components of integrated, intelligent processing plants. This includes utilizing proximity sensors and tilt sensors to monitor material flow and drum alignment in real-time, coupled with sophisticated programmable logic controllers (PLCs) that adjust operational parameters automatically based on feed composition and throughput targets. The shift towards variable frequency drives (VFDs) for motor control is standard practice, enabling precise speed adjustments that optimize separation quality and minimize energy consumption when processing materials with varying density or moisture content.

Material science and engineering also play a vital role. Manufacturers are increasingly adopting specialized, highly wear-resistant alloy steels and polyurethane liners for the drum interior and screening media. This focus on material longevity significantly extends the operational lifespan of the equipment, especially in highly abrasive applications like quarrying and C&D waste handling, where traditional steel mesh might require frequent replacement. Another key trend is the development of quick-change drum systems and modular screening sections, significantly reducing the downtime associated with maintenance and screen aperture adjustments, thereby enhancing operational flexibility and facilitating faster transition between different processing tasks or output requirements.

Furthermore, connectivity and digital integration are reshaping the market. Telematics and Internet of Things (IoT) technologies are now standard features on high-end mobile trommels, allowing operators and fleet managers to monitor equipment location, fuel consumption, operating hours, and diagnostics remotely via cloud platforms. This data aggregation is foundational for deploying predictive maintenance strategies and optimizing fleet utilization across multiple job sites. The development of hybrid and fully electric trommel screens, which minimize noise and local emissions, represents a significant investment in sustainable technology, crucial for operating in urban recycling centers and noise-sensitive areas, further diversifying the technological offerings available to the end-user.

Regional Highlights

Regional dynamics significantly influence the adoption and types of trommel screens utilized globally. Market growth is unevenly distributed, reflecting differences in economic development, environmental regulation stringency, and waste management infrastructure maturity.

- North America: This region is a mature but expanding market, heavily driven by infrastructure spending and increasing C&D recycling mandates. Demand focuses on high-capacity, heavy-duty mobile trommel screens that incorporate advanced automation and telematics for large, spread-out job sites. The U.S. and Canada prioritize efficiency and lower emissions, leading to high adoption of electric and hybrid models, particularly in metropolitan areas.

- Europe: Europe leads in regulatory strictness regarding waste management (e.g., EU Waste Framework Directive). This drives continuous investment in advanced trommel technology for highly complex streams like MSW, bio-waste, and specialized industrial recycling. Germany, the UK, and France show high demand for stationary trommels integrated into Material Recovery Facilities (MRFs) and specialized composting plants, favoring low-noise electric systems and stringent material purity standards.

- Asia Pacific (APAC): Currently the fastest-growing market globally, APAC is characterized by rapid urbanization and massive infrastructure expansion, particularly in China, India, and Southeast Asian nations. The region requires high volumes of aggregates and is rapidly building out formal waste management infrastructure. Demand is high for both robust, mid-range mobile trommels for C&D sites and large, affordable stationary units for burgeoning municipal waste treatment centers, often prioritizing throughput over advanced automation.

- Latin America (LATAM): Growth is steady, primarily linked to expansion in the mining and quarrying sectors (Chile, Brazil) and nascent efforts in municipal waste formalization. The market seeks durable, cost-effective equipment. Mobility is often a priority due to challenging logistics and variable site conditions, leading to strong sales of tracked and semi-mobile hydraulic trommels.

- Middle East and Africa (MEA): This region is witnessing concentrated investment in large-scale infrastructure projects (e.g., Saudi Arabia, UAE) and new mining ventures, fueling demand for heavy-duty screening equipment. Waste management is rapidly evolving, driven by population growth, but capital investment remains focused on reliable, high-throughput systems capable of handling harsh, dusty environments with minimal sophisticated electronics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Trommel Screens Market.- McCloskey International (a Metso Outotec Brand)

- Terex Corporation

- Metso Outotec

- Astec Industries, Inc.

- Komptech Group

- Sandvik AB

- ThyssenKrupp AG

- Doppstadt Umwelttechnik GmbH

- Retech Systems

- Screen Machine Industries, Inc.

- Edge Innovate

- General Kinematics Corporation

- Backers Maschinenbau GmbH

- Wirtgen Group (Kleemann GmbH)

- Anaconda Equipment

- IFE Aufbereitungstechnik GmbH

- Powerscreen (a Terex Brand)

- Binder+Co AG

- Screen USA, Inc.

- MB Crusher

Frequently Asked Questions

Analyze common user questions about the Trommel Screens market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key advantages of a trommel screen over a vibratory screen?

Trommel screens excel in processing wet, sticky, or difficult materials, such as compost and certain waste streams, because their tumbling action and large, open surface area prevent blinding (clogging) more effectively than high-frequency vibratory screens. They offer high throughput for mixed municipal solid waste and C&D debris, maintaining better material purity for specific applications.

How is the move towards electrification impacting the mobile trommel screen segment?

The market is shifting towards hybrid and fully electric mobile trommels to comply with stringent emission and noise regulations, particularly in urban environments. Electric models offer reduced operating costs (lower fuel consumption), require less maintenance than diesel hydraulics, and allow for easier integration with facility power grids, enhancing sustainability profiles for operators.

What major factors determine the total cost of ownership (TCO) for a trommel screen?

TCO is influenced significantly by the initial capital expenditure, fuel/energy consumption, the cost and frequency of replacing wear parts (especially screening media and liners), and labor costs for maintenance. Advanced models with IoT capabilities help reduce TCO by enabling predictive maintenance, minimizing unexpected downtime, and optimizing energy use based on real-time operational data.

Which application segment drives the highest demand for trommel screens globally?

The Recycling and Waste Management segment, encompassing Municipal Solid Waste (MSW) and Construction & Demolition (C&D) waste processing, currently drives the highest demand. This growth is mandated by increasing global regulatory pressure to divert waste from landfills and enhance resource recovery rates, requiring robust pre-sorting machinery like trommel screens.

How does the size and material of the screening media affect trommel performance?

The size (aperture) determines the fraction separation point, while the material (e.g., steel mesh, punched plate, or polyurethane) affects durability and anti-blinding properties. Polyurethane media is often preferred for sticky, wet materials due to its flexibility and abrasion resistance, while high-carbon steel is standard for abrasive aggregates, balancing wear resistance with cost effectiveness.

What role does automation play in the efficiency of modern trommel screens?

Automation, facilitated by PLCs and VFDs, allows modern trommel screens to adjust operating parameters (drum speed, angle, feed rate) dynamically in response to varying material input composition. This real-time optimization maximizes throughput, ensures consistent output quality, minimizes energy waste, and reduces the need for continuous manual intervention, drastically improving overall operational efficiency.

In which region are stationary trommel screens most commonly utilized, and why?

Stationary trommel screens are most commonly utilized in mature markets, particularly Western Europe and North America, integrated within large, fixed-site facilities such as Material Recovery Facilities (MRFs) and large composting plants. Their permanence allows for higher capacity, easier integration into multi-stage processing lines (conveyors, separators), and a structure designed for continuous, high-volume operations over decades.

What emerging niche applications are driving innovation in trommel screen design?

Emerging applications include specialized processing of agricultural residues for biomass production, sophisticated sorting of municipal sludge for dewatering, and specific applications in electronic waste (e-waste) pre-shredding and separation. These niches demand highly specialized trommels with customized mesh, internal lifters, and robust cleaning mechanisms to handle unique, often challenging, material characteristics.

How do manufacturers address the challenge of wear and tear in abrasive environments?

Manufacturers address wear by incorporating sacrificial wear plates, utilizing high-manganese or chrome alloy steel in high-impact zones, and employing polyurethane or rubber liners. They also focus on modular component design, allowing for the quick and cost-effective replacement of the most susceptible components rather than the entire drum structure.

What is the significance of the drum angle in trommel screening operations?

The drum angle (or pitch) is a critical operational parameter, as it dictates the material retention time inside the drum. A shallower angle increases retention time, resulting in more thorough separation, which is crucial for maximizing purity in sticky or mixed materials. A steeper angle increases throughput but reduces retention time, suitable for easier-to-screen, high-volume materials.

What competitive pressures does the trommel screen market face from alternative screening technologies?

Trommel screens face competitive pressure from technologies like vibrating scalping screens (for very high-volume aggregates), star screens (for high-speed organic separation), and air density separators (for lightweight material sorting). However, trommel screens maintain a competitive edge due to their superior capability to handle mixed, wet, and often contaminated feedstocks without significant blinding.

How does the concept of circular economy influence trommel screen purchasing decisions?

The circular economy model, focusing on maximizing resource recovery, drives purchasing decisions toward trommel screens capable of producing highly refined, uncontaminated material fractions. Buyers prioritize machines that offer precise sizing capabilities and high separation efficiency, directly contributing to the economic viability of recovered materials and meeting strict recycled content requirements.

What are the primary differences between hydraulic drive and electric drive trommels?

Hydraulic drive systems offer high torque, ruggedness, and flexibility in remote settings, traditionally powered by diesel engines. Electric drive systems (often powered by grid electricity or hybrid generators) are quieter, more energy-efficient, require less fluid maintenance, and are increasingly preferred in urban or enclosed industrial environments due to lower emissions and operational costs.

How important is the availability of spare parts and after-sales service in this market?

The availability of spare parts, particularly high-wear items like screening media and liners, and responsive after-sales service are critically important. Since trommel screens are core production assets, long downtimes are extremely costly. Manufacturers with robust global service networks and localized spare part inventories gain a significant competitive advantage by guaranteeing operational continuity for their customers.

In the C&D waste application, what material characteristics are most challenging for trommel screens?

The most challenging characteristics in C&D waste are the presence of long, fibrous materials (plastics, wiring, ropes) that can wrap around the drum or shafts, and large, irregular chunks of concrete or metal that cause excessive impact and structural wear. Manufacturers mitigate this through advanced drum design, enhanced internal cleaning mechanisms, and heavy-duty shock-resistant construction.

How are manufacturers integrating IoT and telematics into their trommel screen offerings?

IoT integration allows manufacturers to equip trommels with sensors monitoring vibration, temperature, fuel levels, and throughput. This data is transmitted to cloud-based platforms, enabling fleet managers to perform remote monitoring, optimize operational schedules across multiple sites, conduct preventative maintenance based on machine health data, and generate precise operational reports.

What is the typical lifespan of a large, stationary trommel screen used in an MRF?

A well-maintained, high-quality stationary trommel screen used in a Material Recovery Facility (MRF) typically has a lifespan exceeding 20 years. Longevity is highly dependent on rigorous preventative maintenance, adherence to operational load limits, and timely replacement of high-wear components, particularly the screening media and internal liners.

Why is the Asia Pacific region projected to be the fastest-growing market for trommel screens?

APAC's high growth rate is attributed to rapid industrialization, massive infrastructure development driving demand for aggregates and C&D waste recycling, and the developing need for formalized municipal solid waste management systems in populous countries like India and Indonesia, leading to significant new equipment investment.

How do trommel screens contribute to environmental sustainability beyond general recycling?

Beyond traditional recycling, trommel screens are essential in reducing pollution by efficiently sorting and refining organic material for composting, significantly lowering the volume of biodegradeable material sent to landfills (reducing methane emissions), and enabling the recovery of valuable resources from industrial process waste, promoting a closed-loop system.

What safety features are becoming standard in modern mobile trommel screens?

Modern mobile trommel screens increasingly feature sophisticated safety measures, including remote control operation (to keep personnel away from moving parts), emergency stop systems integrated globally across the machine, advanced interlocking mechanisms to prevent access during operation, and improved visibility features like cameras and warning alarms for enhanced site safety compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Trommel Screens Market Statistics 2025 Analysis By Application (Municipal and industrial waste, Mineral processing, Other applications), By Type (Stationary Trommel Screens, Tracked Trommel Screens, Wheeled Trommel Screens), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Trommel Screens Market Statistics 2025 Analysis By Application (Municipal and industrial waste, Mineral processing), By Type (Stationary Trommel Screens, Tracked Trommel Screens, Wheeled Trommel Screens), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Trommel Screens Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Stationary Trommel Screens, Tracked Trommel Screens, Wheeled Trommel Screens), By Application (Municipal and industrial waste, Mineral processing, Other applications), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager