Truck Auxiliary Braking Device Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436623 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Truck Auxiliary Braking Device Market Size

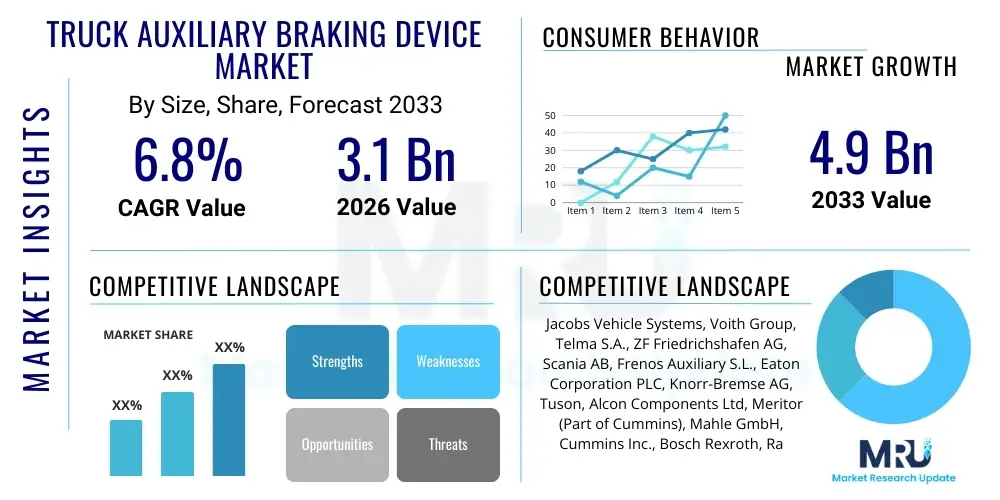

The Truck Auxiliary Braking Device Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.1 Billion in 2026 and is projected to reach USD 4.9 Billion by the end of the forecast period in 2033.

Truck Auxiliary Braking Device Market introduction

The Truck Auxiliary Braking Device Market encompasses systems designed to supplement or assist the primary friction brakes in heavy commercial vehicles. These devices, which include engine brakes, exhaust brakes, retarders (hydrodynamic, electromagnetic), and hybrid braking systems, are crucial for maintaining speed control, especially on long descents or in heavy traffic conditions. The primary function of auxiliary braking systems is to reduce the thermal load on the foundation brakes, preventing overheating, fading, and subsequent mechanical failure, thereby significantly enhancing vehicle safety and extending the lifespan of the service brake components. These systems are essential for trucks, buses, and heavy-duty vehicles operating in mountainous or high-load environments where stopping power and prolonged deceleration capability are paramount for operational integrity and driver safety. Regulatory requirements concerning vehicle weight and mandatory safety standards are key accelerators in the adoption rate of these sophisticated braking technologies globally.

The product description spans across various technological implementations, with engine brakes (Jake Brakes) being widely utilized in North America, while hydraulic or electromagnetic retarders see extensive adoption in Europe and Asia Pacific, particularly in long-haul trucking and passenger transport sectors. Major applications of these devices are predominantly found in the logistics and transportation sector, mining and construction, waste management, and heavy equipment transport. The inherent reliability and effectiveness of these auxiliary systems translate directly into reduced operational costs due to decreased wear and tear on primary brake components, leading to less frequent maintenance and maximizing vehicle uptime. Furthermore, the increasing focus on sustainability and noise pollution reduction is leading manufacturers to develop quieter and more efficient auxiliary braking devices that comply with stringent urban operating regulations, expanding their applicability across diverse logistical scenarios.

Driving factors for this market growth are rooted in several macro and microeconomic trends. The exponential growth in global logistics and freight transportation necessitates higher performance and safer commercial vehicles capable of handling increased payload capacities and covering longer distances efficiently. Mandatory safety regulations imposed by governmental bodies regarding vehicle stability control and braking efficacy are forcing OEMs to integrate advanced auxiliary braking technologies as standard features. Moreover, rising awareness among fleet owners regarding the total cost of ownership (TCO), where preventive maintenance through auxiliary braking saves significant costs over the vehicle's life, further propels market expansion. Technological advancements, such as the integration of electronic controls and enhanced materials for heat dissipation, are continually improving the performance and reliability of these essential safety components.

Truck Auxiliary Braking Device Market Executive Summary

The global Truck Auxiliary Braking Device Market is characterized by robust technological innovation centered on efficiency, safety, and integration with advanced driver-assistance systems (ADAS). Key business trends highlight a significant shift towards hydrodynamic and electromagnetic retarders, particularly in developed markets where longer vehicle lifespan and stringent deceleration requirements are prioritized. Geographically, Asia Pacific is dominating market growth due to rapid infrastructure development, surging industrial activity, and the consequent expansion of commercial vehicle fleets, particularly in China and India. North America and Europe remain mature markets, focusing heavily on replacing older, less efficient braking systems with high-performance, electronically controlled auxiliary devices that support higher gross vehicle weight (GVW) limits and enhanced driver comfort. Strategic partnerships between auxiliary device manufacturers and major truck OEMs are shaping the competitive landscape, ensuring seamless integration during the vehicle manufacturing process, which is a critical success factor in this market.

Regional trends indicate divergent growth patterns influenced by regulatory environments and prevailing trucking traditions. In Europe, the emphasis on engine brake silence and regenerative capabilities in hybrid trucks is strong, driven by environmental mandates. Conversely, in regions like Latin America and the Middle East, durability and low maintenance costs associated with exhaust brakes remain important considerations for fleet operators dealing with diverse road conditions and often challenging terrain. The segment trends reveal that retarders, despite their higher initial cost, are gaining substantial traction over traditional exhaust and engine brakes due to their superior performance in high-speed, heavy-load applications, offering consistent braking torque independent of engine speed and significantly contributing to fuel economy by reducing the need for downshifting. Furthermore, the adoption of electronically controlled auxiliary braking systems (EABS) that communicate directly with the vehicle's electronic control unit (ECU) is rising across all regions, enhancing overall vehicle safety protocols and diagnostics capabilities.

Overall, the market is poised for expansion, driven by regulatory pressures demanding better braking performance and the continuous push by fleet owners for enhanced safety features and reduced operational expenditure. Investment in R&D is heavily focused on developing lighter, more compact, and increasingly powerful retarders suitable for electric and hybrid heavy-duty trucks, ensuring that auxiliary braking remains a critical component even as the industry transitions toward electrification. The integration capabilities of these systems with predictive maintenance algorithms and telematics are creating new value propositions for fleet managers, allowing for proactive servicing and minimizing unexpected downtime, solidifying the market's trajectory towards digitalization and connectivity.

AI Impact Analysis on Truck Auxiliary Braking Device Market

User inquiries regarding AI's influence on truck auxiliary braking devices commonly revolve around predictive maintenance, real-time optimization of braking performance, and the role of AI in autonomous trucking environments. Users are primarily concerned with how AI algorithms can anticipate brake wear before failure occurs, ensuring maximal operational uptime. Another significant theme is the expected integration of AI with sensors to dynamically adjust the auxiliary braking force based on real-time factors such as road gradient, vehicle speed, load distribution, and current weather conditions, moving beyond standardized control methods. Furthermore, potential customers are keen to understand if AI-driven systems will manage the seamless handoff between regenerative braking (in electric trucks), auxiliary braking, and friction braking to optimize energy recovery and system longevity, fundamentally altering the control complexity and performance benchmarks of these devices.

The implementation of Artificial Intelligence and Machine Learning (ML) algorithms is set to revolutionize the operational lifecycle of truck auxiliary braking devices. AI facilitates sophisticated predictive maintenance models by continuously analyzing data streams generated by the braking device sensors, including temperature, pressure, vibration, and duty cycle. This data-driven approach allows fleet managers to schedule maintenance precisely when needed, rather than relying on fixed intervals, thereby significantly reducing unexpected failures and associated repair costs. Moreover, AI enables system diagnostics to identify minor deviations in performance, signaling potential issues that can be rectified proactively, ensuring the auxiliary brakes operate at peak efficiency throughout the truck’s service life. This transition from reactive to predictive maintenance marks a major step forward in operational intelligence within the trucking industry, directly increasing profitability for logistics companies.

Beyond maintenance, AI algorithms are becoming central to enhancing the real-time performance and safety integration of auxiliary braking systems within the wider vehicle ecosystem. In modern trucks equipped with ADAS and eventually, full autonomous driving capabilities, AI serves as the core decision-making unit for braking management. It evaluates external environmental factors alongside internal vehicle dynamics to instantaneously determine the optimal blend and application rate of auxiliary braking (e.g., retarder activation vs. engine braking), ensuring maximum stability and minimum stopping distance under diverse conditions. This intelligent control minimizes driver fatigue, prevents misuse of the auxiliary systems, and ensures the vehicle adheres to precise speed profiles, which is critical for autonomous vehicle safety redundancy, effectively turning the auxiliary braking device into a smart component of the vehicle's safety architecture.

- AI-driven Predictive Maintenance: Analyzing sensor data to forecast component wear and schedule optimal service intervals for auxiliary braking devices.

- Real-Time Braking Optimization: ML algorithms dynamically adjusting auxiliary braking force based on load, gradient, and environmental conditions.

- Seamless System Integration: AI managing the coordinated operation between auxiliary, regenerative, and friction braking systems in hybrid and electric vehicles.

- Enhanced Diagnostics: Automated fault detection and root cause analysis for immediate identification of performance anomalies in retarders and engine brakes.

- Support for Autonomous Driving: Providing high-reliability, intelligent deceleration control as a critical safety layer for Level 4 and Level 5 commercial vehicles.

DRO & Impact Forces Of Truck Auxiliary Braking Device Market

The market dynamics for truck auxiliary braking devices are highly influenced by a confluence of regulatory demands, technological advancements, and economic pressures faced by the global logistics sector. The primary driver is the stringent enforcement of vehicle safety standards globally, which mandate enhanced braking performance for heavy vehicles, especially those exceeding specific weight thresholds or operating on challenging terrains. Complementing this, the ongoing expansion of the global commercial vehicle fleet, fueled by booming e-commerce and infrastructure development, particularly in emerging economies, creates sustained demand for reliable safety components. However, growth is restrained by the high initial cost and complexity associated with advanced systems like hydrodynamic retarders, coupled with the need for specialized technical expertise for installation and maintenance, posing a barrier to entry for smaller fleet operators. Nevertheless, the significant opportunity lies in the rapid adoption of electric and hybrid trucks, necessitating new auxiliary braking solutions that can handle regenerative systems while ensuring powerful mechanical backup, alongside the integration of these systems into telematics platforms for remote performance monitoring and predictive servicing. These internal and external forces interact powerfully, pushing the market towards more technologically sophisticated, yet economically viable, braking solutions.

The impact forces within this market are significant and broadly categorized into regulatory push and operational necessity. Regulatory impact, emanating from bodies like the NHTSA in the US or the UNECE in Europe, mandates specific deceleration capabilities, making auxiliary braking devices essential rather than optional accessories. Operationally, the imperative to reduce Total Cost of Ownership (TCO) drives the adoption of auxiliary brakes, as the prolonged life of friction brakes directly impacts maintenance budgets, offering a compelling economic argument despite the higher upfront investment. Furthermore, the societal force of safety awareness and corporate responsibility drives major fleet operators to invest in the highest performing safety technologies available. The restraining force of price sensitivity, particularly in highly competitive freight markets, encourages manufacturers to develop cost-optimized versions of retarders and to extend the durability of existing engine brake systems. The overarching force is technological innovation, which continually attempts to overcome current restraints by developing lighter, more powerful, and cheaper auxiliary braking solutions, particularly those that are suitable for battery electric vehicles (BEVs) where traditional engine-based auxiliary systems are irrelevant.

The strategic deployment of auxiliary braking systems is also affected by evolving consumer expectations and urbanization trends. As commercial traffic increases within densely populated areas, noise regulations become stricter, favoring quieter options like electromagnetic retarders over the traditional loud engine brakes. This shifting regulatory landscape in urban centers acts both as a restraint on older technologies and an opportunity for specialized, low-noise braking systems. Simultaneously, the global effort to minimize carbon emissions and maximize energy efficiency pushes the market towards systems that offer energy recuperation capabilities. The interplay between safety compliance, economic viability, and environmental responsibility dictates the product development roadmap and market penetration strategies, ensuring that the Truck Auxiliary Braking Device Market remains dynamic and highly responsive to changes in both legislation and trucking technology.

Segmentation Analysis

The Truck Auxiliary Braking Device Market is comprehensively segmented based on the device type, technology, application (truck type), and sales channel, reflecting the varied needs across the global commercial vehicle industry. Device type segmentation distinguishes between the fundamental mechanisms used—primarily engine brakes (compression release or exhaust), hydraulic retarders, and electromagnetic retarders. Technology differentiation focuses on the control mechanism, separating traditional mechanical/pneumatic systems from modern, highly efficient electronic control units (ECUs) integrated auxiliary systems. Application segmentation divides the market based on the vehicle class, specifically focusing on Medium-Duty Trucks (Class 5-7) and Heavy-Duty Trucks (Class 8 and above), as the braking requirements and installed technologies vary dramatically between these classes. Finally, the sales channel analysis separates the original equipment manufacturer (OEM) channel, where the device is factory-installed, from the aftermarket (AM) channel, catering to replacements, upgrades, and retrofits. This multi-faceted segmentation provides a granular view of market adoption trends, competitive strategies, and demand drivers across different end-user groups and geographical regions.

The dominance of specific segments is highly contingent on regional preferences and regulatory alignment. For instance, the Heavy-Duty Truck segment commands the largest market share globally, as these vehicles necessitate robust, continuous deceleration capabilities over extended periods, making retarders a common fitment. Within the Device Type segment, hydraulic retarders are growing rapidly due to their high torque capacity and excellent heat dissipation features, making them suitable for demanding long-haul and mining applications, despite the higher weight and complexity they introduce compared to engine brakes. The Original Equipment Manufacturer (OEM) channel is predicted to maintain its leading position throughout the forecast period, driven by stricter governmental regulations mandating the inclusion of auxiliary braking systems in new truck manufacturing, standardizing safety features across major manufacturers. This integration allows for superior performance tuning and seamless communication with other onboard electronic systems, maximizing efficiency and safety from the moment the vehicle leaves the assembly line.

Furthermore, the electronic control technology sub-segment is witnessing the highest rate of innovation and adoption. Modern electronic control units allow for precise modulation of braking force, integration with Adaptive Cruise Control (ACC) systems, and real-time diagnostic reporting, which significantly enhances system reliability and driver comfort. This shift towards smart auxiliary braking devices is particularly crucial for meeting the demands of high-performance modern logistics operations and future autonomous driving platforms. Understanding these segmentation nuances is crucial for market stakeholders, allowing them to tailor product offerings—such as developing lightweight, energy-efficient electromagnetic retarders for the growing Medium-Duty segment utilized in urban distribution, or powerful hydraulic systems for Heavy-Duty fleets traversing mountainous regions—to capture specific high-value segments effectively.

- By Device Type:

- Engine Brakes (Compression Release, Exhaust Brakes)

- Retarders (Hydraulic/Hydrodynamic Retarders, Electromagnetic Retarders)

- Others (Integrated and Hybrid Systems)

- By Technology:

- Mechanically Controlled Systems

- Electronically Controlled Systems (ECU-Integrated)

- By Application (Truck Type):

- Medium-Duty Trucks

- Heavy-Duty Trucks

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (AM)

Value Chain Analysis For Truck Auxiliary Braking Device Market

The value chain for the Truck Auxiliary Braking Device Market is a complex structure involving raw material suppliers, specialized component manufacturers, core device assemblers, major commercial vehicle OEMs, and finally, the distribution and service network. Upstream analysis focuses heavily on raw material providers for specialized components, including high-grade steel and alloys required for high-temperature resistance in engine brakes and retarder rotors, as well as complex hydraulic fluid and electronic components (sensors, ECUs). The effectiveness and durability of the auxiliary braking device are fundamentally dependent on the quality and metallurgy of these sourced materials, driving close collaboration between device manufacturers and material suppliers, particularly those specializing in heat-resistant materials and sophisticated magnetic components for electromagnetic systems. Managing the supply chain stability and quality control at this early stage is crucial, as any material failure can have catastrophic safety implications downstream.

Midstream activities involve the design, precision manufacturing, and assembly of the core device components. This stage is dominated by specialized Tier 1 suppliers who possess deep expertise in thermal dynamics, fluid mechanics, and electronic control programming. Research and development investments are concentrated here, focusing on reducing system weight, increasing torque capacity, and improving energy efficiency. Once manufactured, the distribution channel plays a dual role: direct sales to major truck OEMs (the dominant channel) for new vehicle assembly, and indirect sales through specialized distributors and service centers for the aftermarket segment. The OEM route demands high compliance, just-in-time delivery, and seamless technical integration, often involving proprietary design specifications, solidifying the relationship between device makers and major truck manufacturers like Volvo, Daimler, and PACCAR. Conversely, the aftermarket channel relies on geographical reach, inventory management, and accessible technical support for installation and retrofitting.

Downstream analysis centers on the end-users—large fleet operators, independent truckers, and logistics companies—and the supporting service infrastructure. The effectiveness of the auxiliary braking system post-purchase depends heavily on the quality of maintenance and technical support provided by certified workshops. This reinforces the importance of the indirect channel, where training and documentation provided by the auxiliary device manufacturer are paramount for ensuring correct usage and sustained performance. The movement towards connected vehicles and telematics is influencing the downstream, as service centers increasingly rely on digitally transmitted performance data for diagnostic and preventive maintenance planning. Thus, the value chain emphasizes high precision manufacturing upstream, streamlined integration midstream via the OEM channel, and robust, informed service provision downstream to maximize product utility and customer satisfaction throughout the truck’s operational life.

Truck Auxiliary Braking Device Market Potential Customers

The primary customers for truck auxiliary braking devices are multifaceted, encompassing commercial vehicle manufacturers (OEMs), large-scale fleet operators, individual heavy-duty truck owners/operators, and specialized industry sectors requiring robust deceleration capabilities. Commercial Vehicle OEMs, such as Daimler Trucks, Volvo Group, and Navistar, represent the largest volume purchasers, as they integrate these auxiliary systems directly into the chassis during the manufacturing process, driven by safety regulations and competitive necessity to offer high-performance, compliant vehicles. For these customers, factors like integration complexity, weight penalty, reliability, and the ability to seamlessly interface with vehicle telematics systems are the critical purchasing criteria, making them highly receptive to advanced electronically controlled retarders that enhance overall vehicle specifications and market value.

Large fleet operators, including global logistics giants, major transport companies, and regional freight carriers, constitute the second most crucial customer segment, purchasing both through the OEM channel and heavily utilizing the aftermarket for replacements and retrofits. For this segment, the Total Cost of Ownership (TCO) is paramount. Auxiliary brakes offer significant savings by dramatically extending the life of primary friction brakes, reducing downtime, and improving fuel efficiency by minimizing repeated acceleration/deceleration cycles. Their purchasing decisions are often data-driven, focusing on durability, maintenance frequency, and the system's proven ability to perform reliably across diverse operational environments, such as long-haul trucking, container transport, and bulk goods logistics.

Specialized industrial applications, such as mining trucks, construction vehicles, timber transport, and public sector services (e.g., refuse collection vehicles and fire trucks), also represent critical customer groups. These vehicles often operate under extreme conditions, involving heavy loads, steep grades, and frequent stopping, making highly efficient, durable auxiliary braking devices indispensable safety features. Mining fleets, for example, typically favor high-capacity hydraulic retarders capable of handling continuous deceleration of massive payloads over long, steep inclines. Additionally, the growing popularity of retrofit programs, particularly in regions where older trucks are being upgraded to meet modern safety standards, expands the customer base to include smaller, independent truck owners seeking to enhance the safety and compliance of their existing rolling stock without purchasing new vehicles. These diverse end-user profiles necessitate a broad portfolio of auxiliary braking solutions ranging from simple exhaust brakes to complex, electronically managed retarder systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.1 Billion |

| Market Forecast in 2033 | USD 4.9 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Jacobs Vehicle Systems, Voith Group, Telma S.A., ZF Friedrichshafen AG, Scania AB, Frenos Auxiliary S.L., Eaton Corporation PLC, Knorr-Bremse AG, Tuson, Alcon Components Ltd, Meritor (Part of Cummins), Mahle GmbH, Cummins Inc., Bosch Rexroth, Rane Brake Lining Ltd., WABCO Holdings Inc. (now ZF), Williams Controls, Kamaz PTC, Shaanxi Fast Gear Co., Ltd., and Dongfeng Motor Group Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Truck Auxiliary Braking Device Market Key Technology Landscape

The technology landscape of the Truck Auxiliary Braking Device Market is defined by a shift from purely mechanical energy absorption systems towards sophisticated electro-mechanical and hydrodynamic solutions integrated with the vehicle's central electronics. Engine braking systems, which include compression release brakes and exhaust brakes, remain prevalent, especially in North America, due to their simplicity and reliability. However, innovation in this segment focuses on minimizing operational noise (often referred to as noise-optimized engine brakes) to comply with urban noise ordinances, utilizing complex valve actuation timing and advanced exhaust muffling technologies. The major technological thrust, however, is seen in retarders. Hydrodynamic retarders utilize the resistance created by hydraulic fluid shear to dissipate kinetic energy as heat, offering exceptionally high, continuous braking power, making them the standard for the heaviest applications. Recent advancements include closed-circuit systems that simplify installation and minimize the chance of contamination, and integration with automated manual transmissions (AMTs) for predictive deceleration assistance.

Electromagnetic retarders represent a rapidly growing technological field, particularly favored in regions like Europe and Asia due to their lighter weight, compactness, and lower noise profile compared to hydraulic systems. These devices function by using magnetic fields to induce eddy currents in a rotor, converting kinetic energy into heat. Key technological developments here focus on improving the efficiency of heat dissipation mechanisms, often utilizing forced air or even integrated liquid cooling, to sustain braking torque under heavy use. Crucially, the newest generation of electromagnetic retarders is being designed with increased efficiency in mind, aiming to reduce the parasitic draw on the truck’s electrical system. Furthermore, hybrid auxiliary braking systems, which combine the features of engine braking with a smaller, secondary electric retarder, are emerging, particularly relevant for vehicles that utilize engines for propulsion but require varied braking capabilities depending on load and terrain, offering enhanced redundancy and flexible performance across diverse driving cycles.

The single most impactful technological trend is the pervasive use of Electronic Control Units (ECUs) and software integration. Modern auxiliary braking devices are no longer standalone systems but are interconnected components of the vehicle dynamics control system. Electronically Controlled Auxiliary Braking (ECAB) allows drivers to precisely modulate braking force using a stalk or pedal, with the ECU automatically adjusting the system based on vehicle speed, gear selection, and even communication from ADAS sensors (e.g., predicting the need for deceleration). This electronic management ensures the auxiliary brake is applied optimally before the service brakes are used, maximizing safety and component life. Looking forward, the landscape is poised for further disruption with the advent of Battery Electric Vehicles (BEVs) and Fuel Cell Electric Vehicles (FCEVs). For these vehicles, traditional engine brakes are obsolete, driving R&D toward advanced electromagnetic or innovative mechanical-based retarders optimized to work synergistically with regenerative braking systems, ensuring safety redundancy without relying on internal combustion engine components. This shift requires expertise in power electronics and thermal management tailored specifically for high-voltage commercial vehicle architectures, redefining the scope of auxiliary braking technology.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to exhibit the highest growth rate, primarily driven by massive investments in infrastructure development, rapid industrialization, and the associated increase in commercial vehicle sales across countries like China, India, and Southeast Asian nations. Regulatory harmonization towards European safety standards is encouraging the shift from basic exhaust brakes to more sophisticated retarder systems, particularly in heavy-duty long-haul fleets. China, being the largest market for commercial vehicles globally, represents a dominant source of volume demand, while India is rapidly adopting advanced auxiliary braking technologies due to growing logistics demands and regulatory emphasis on highway safety. The regional challenge lies in the presence of numerous local manufacturers competing on price, necessitating strategic pricing and localized product adaptation by global players.

- Europe: Europe is a highly mature market characterized by stringent emission and safety regulations, pushing high adoption rates of advanced auxiliary braking devices, especially electromagnetic and hydrodynamic retarders. The region prioritizes systems that minimize noise pollution (essential for operating in densely populated urban centers) and those that offer superior performance and integration with complex ADAS. The transition towards electrification (hybrid and BEV trucks) is accelerating research into auxiliary systems that complement regenerative braking effectively. Western Europe, particularly Germany and France, demonstrates high demand for factory-installed (OEM) retarders due to strict regulatory compliance and higher vehicle performance expectations for international freight transport.

- North America (NA): North America remains the dominant market for engine braking systems (Jake Brakes), particularly in the US, owing to traditional preferences and established maintenance networks. However, the adoption of hydrodynamic retarders is steadily increasing, particularly for specific high-weight applications like logging and heavy equipment hauling, where continuous braking capability is paramount. The market is highly influenced by regulatory activities from the Federal Motor Carrier Safety Administration (FMCSA) and fleet requirements for maximizing uptime and driver safety, pushing manufacturers to offer robust, easy-to-maintain solutions. Integration with telematics and sophisticated diagnostics tools is a major buying factor for large US and Canadian fleets focused on operational efficiency.

- Latin America (LATAM): The LATAM market, while generally cost-sensitive, shows growing demand driven by improved road infrastructure in countries like Brazil and Mexico and the subsequent increase in long-distance freight volumes. Demand is balanced between robust, reliable, and lower-cost exhaust brakes for medium-duty trucks, and high-performance retarders necessary for navigating the challenging mountainous terrains frequently encountered in the Andean regions. Market growth is constrained somewhat by economic volatility but presents significant long-term opportunities as safety regulations are gradually tightened across the continent, leading to higher minimum vehicle safety specifications.

- Middle East and Africa (MEA): MEA is an emerging market where demand is influenced by large-scale government-funded infrastructure projects and mining operations. The challenging environment—characterized by extreme heat and often difficult desert terrain—drives demand for highly durable auxiliary braking devices with excellent thermal management capabilities. Growth is concentrated in the Gulf Cooperation Council (GCC) countries due to high truck purchasing power and strategic logistics hubs. Engine brakes and durable, closed-circuit hydraulic retarders are favored here, offering necessary reliability under high ambient temperatures and heavy load conditions associated with oil and construction transport.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Truck Auxiliary Braking Device Market.- Jacobs Vehicle Systems (Cummins Inc.)

- Voith Group

- Telma S.A.

- ZF Friedrichshafen AG

- Scania AB (Volkswagen Group)

- Frenos Auxiliary S.L.

- Eaton Corporation PLC

- Knorr-Bremse AG

- Tuson

- Alcon Components Ltd

- Meritor (Part of Cummins)

- Mahle GmbH

- Williams Controls

- Bosch Rexroth

- Rane Brake Lining Ltd.

- WABCO Holdings Inc. (now ZF Group)

- Kamaz PTC

- Shaanxi Fast Gear Co., Ltd.

- Dongfeng Motor Group Co., Ltd.

- Sorl Auto Parts, Inc.

Frequently Asked Questions

Analyze common user questions about the Truck Auxiliary Braking Device market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an auxiliary braking device in a truck?

The primary function is to supplement the main friction brakes, absorbing and dissipating kinetic energy during deceleration to prevent the service brakes from overheating, fading, and failing. This enhances vehicle safety and significantly extends the lifespan of brake components, especially on long or steep descents.

Which type of auxiliary braking system is most commonly used in heavy-duty trucks?

For heavy-duty applications, especially long haul and mountainous routes, hydrodynamic (hydraulic) retarders are increasingly common globally due to their continuous, high-torque braking capability independent of engine speed. Engine brakes (compression release brakes) remain highly dominant in North America.

How does the electrification of trucks impact the auxiliary braking market?

Electrification renders traditional engine brakes obsolete, shifting market demand towards advanced technologies like high-efficiency electromagnetic retarders. These devices work synergistically with regenerative braking systems in BEVs and FCEVs to provide mechanical redundancy and enhance overall energy management.

What are the key differences between hydraulic and electromagnetic retarders?

Hydraulic retarders use fluid resistance for high, sustained braking torque, generally favoring the heaviest loads, but adding complexity and weight. Electromagnetic retarders use eddy currents (magnetic resistance), are lighter, quieter, and favored for urban and general freight routes due to lower noise and reduced maintenance requirements.

What role does AI and connectivity play in modern auxiliary braking devices?

AI is crucial for predictive maintenance by analyzing performance data to anticipate component failures. Connectivity (telematics) allows the braking system to integrate with ADAS, enabling real-time, dynamic optimization of the braking force based on environmental and vehicle conditions, thus maximizing safety and efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager