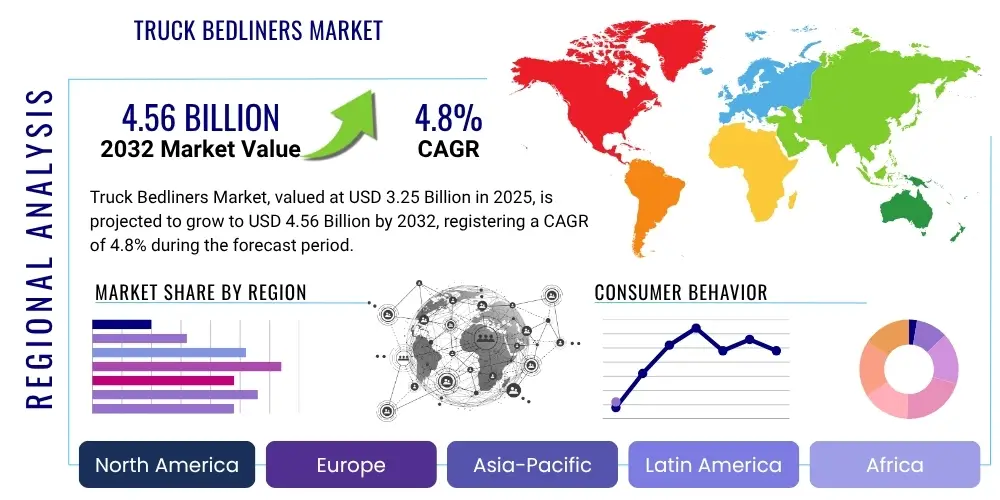

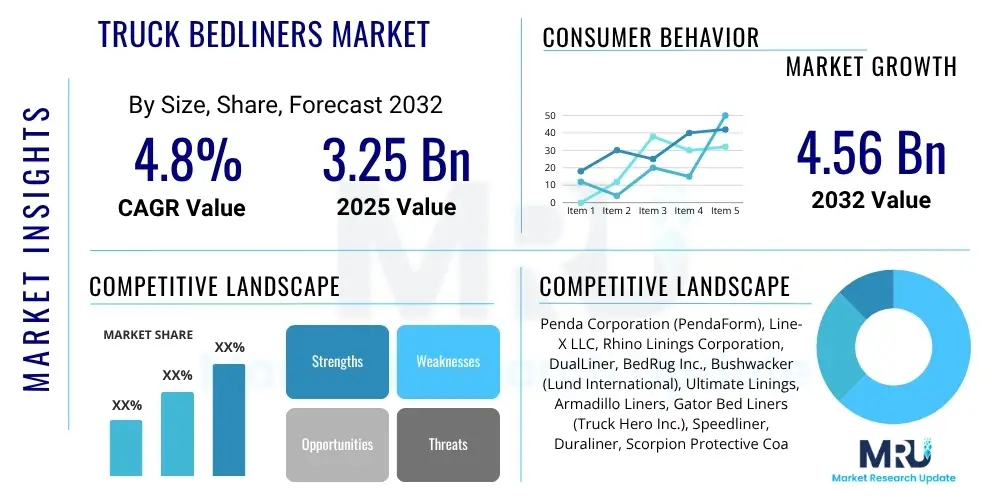

Truck Bedliners Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434691 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Truck Bedliners Market Size

The Truck Bedliners Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $2.1 Billion in 2026 and is projected to reach $3.1 Billion by the end of the forecast period in 2033.

Truck Bedliners Market introduction

The Truck Bedliners Market encompasses the manufacturing and distribution of protective coatings and liners designed to shield the interior surface of a pickup truck bed from damage caused by impacts, abrasion, chemical spills, and weather elements. These products are crucial accessories, serving both aesthetic and functional purposes by preserving the structural integrity and resale value of the vehicle. Bedliners are categorized primarily into two types: drop-in liners, which are rigid, pre-formed polyethylene or composite shells, and spray-on liners, which are polyurethane or polyurea elastomers applied directly to the truck bed surface, offering superior custom fit and permanent protection. The versatility of truck bedliners allows their application across diverse vehicle classes, ranging from light-duty consumer pickups used for personal errands and recreational activities to heavy-duty commercial trucks utilized in construction, agriculture, and utility sectors, ensuring payload protection and reducing maintenance costs for fleet operators.

The primary applications of truck bedliners involve safeguarding the cargo area against physical wear and tear incurred during loading, transport, and unloading activities. They prevent dents and scratches that commonly occur when carrying tools, construction materials, gravel, or recreational gear. The benefits extend beyond physical protection, including noise reduction, anti-skid properties that secure cargo and enhance safety, and resistance to corrosion and rust development, particularly in regions prone to heavy precipitation or road salt exposure. The durability provided by modern bedliner formulations, especially the advanced spray-on coatings, significantly extends the lifespan of the truck bed, making the investment highly cost-effective over the vehicle's ownership period.

Driving factors propelling the market growth include the robust and sustained demand for pickup trucks globally, particularly in North America, which remains the largest market segment due to the cultural prevalence and practical necessity of pickup ownership. Furthermore, increasing consumer awareness regarding vehicle maintenance and the long-term value preservation associated with protective accessories contribute significantly to market expansion. Technological advancements, such as the development of environmentally friendly, volatile organic compound (VOC) compliant, and rapid-cure spray-on materials, are enhancing product performance and application efficiency, making bedliners more appealing to both original equipment manufacturers (OEMs) and aftermarket consumers seeking premium, durable solutions. Regulatory standards related to worker safety and cargo securing in commercial fleets also implicitly drive the adoption of bedliners with enhanced anti-slip features.

Truck Bedliners Market Executive Summary

The Truck Bedliners Market is characterized by intense competition between traditional drop-in manufacturers and specialized spray-on coating providers, with a pronounced shift in consumer preference favoring the higher protection and customization offered by spray-on products. Business trends indicate strong integration between bedliner suppliers and OEM programs, where manufacturers increasingly offer factory-installed spray-on liners as premium options, streamlining the consumer buying process and ensuring quality control. Simultaneously, the aftermarket segment remains robust, driven by vehicle customization trends and the demand for replacement or upgraded protection solutions for older vehicles. Geographically, North America dominates the revenue share due to high truck density and a strong culture of vehicle personalization, while the Asia Pacific region is demonstrating the fastest growth, propelled by rapid industrialization, expansion of logistics sectors, and rising disposable incomes leading to increased utility vehicle purchases.

Regional trends highlight distinct market maturity levels. In established markets like North America and Europe, growth is primarily fueled by technological innovation (e.g., UV resistance, self-healing coatings) and replacement cycles. Conversely, emerging markets in Asia Pacific, particularly China and India, are witnessing market penetration driven by infrastructural development projects and the subsequent necessity for utility vehicles capable of transporting heavy and abrasive cargo. This regional dynamic emphasizes the need for tailored strategies: focusing on premium, technology-driven offerings in mature markets and emphasizing cost-effectiveness and durability in developing economies. Furthermore, Latin America presents significant untapped potential, tied closely to the cyclical performance of the mining and agricultural industries, which rely heavily on durable pickup truck fleets.

Segment trends confirm the ascendance of the Spray-on Bedliners segment, which consistently outperforms Drop-in Liners in terms of market share gain, attributing its success to superior adhesion, seamless fit, and comprehensive protection against moisture and rust compared to its counterpart. Within materials, polyurethane and polyurea blends are gaining traction due to their enhanced tensile strength and elasticity. The Distribution Channel segmentation reveals a balanced competition, though OEM channels are capturing a larger share of new truck sales, while the aftermarket remains critical for specialized coatings and DIY installations. Overall, the market's trajectory is bullish, underpinned by continuous product innovation aimed at improving chemical resistance, anti-skid performance, and application speed for both professional installers and automated OEM assembly lines.

AI Impact Analysis on Truck Bedliners Market

User queries regarding AI's influence on the Truck Bedliners Market frequently revolve around optimizing manufacturing efficiency, improving coating quality assurance, and enhancing supply chain predictability. Users are specifically concerned about how AI can automate complex spraying processes to ensure uniform thickness and coverage, particularly for customized or complex truck bed geometries, thereby minimizing material waste and human error. Another key theme is the expectation that AI-driven analytics will revolutionize demand forecasting based on specific vehicle model sales and regional truck ownership trends, allowing manufacturers to optimize inventory levels and reduce lead times. Furthermore, there is significant interest in using machine learning to analyze the correlation between material composition and long-term durability metrics (like fade resistance and crack prevention) in real-world conditions, leading to accelerated material science innovation for next-generation bedliners.

- AI-powered robotics enhance precision and consistency in spray-on bedliner application processes at OEM facilities.

- Machine learning algorithms optimize supply chain logistics and inventory management for raw materials (polyurethanes, resins).

- Predictive maintenance analytics applied to application equipment minimizes downtime and ensures operational efficiency in large-scale manufacturing.

- AI-driven image processing systems perform rapid, non-destructive quality checks on cured liners, identifying defects or inconsistencies instantly.

- Data analytics facilitate advanced material science research by simulating stress tests and optimizing chemical formulas for superior durability and UV resistance.

- Chatbots and AI assistants improve customer service by providing specialized recommendations for bedliner types based on vehicle usage profiles and regional environmental factors.

DRO & Impact Forces Of Truck Bedliners Market

The dynamics of the Truck Bedliners market are heavily influenced by a balanced combination of factors stemming from economic stability, technological advancements in materials science, and fluctuating consumer behavior regarding vehicle customization and preservation. The primary drivers include the consistently high sales volume of new pickup trucks, particularly in the North American market, coupled with the increasing trend among commercial fleet operators to utilize durable bed protection to minimize vehicle depreciation and maximize cargo security. Opportunities are largely concentrated in the expansion of high-performance spray-on technology into new geographic regions and the development of specialized coatings, such as those with antimicrobial properties or extreme chemical resistance, catering to niche industrial applications. However, the market faces significant restraints, notably the volatility in raw material prices, particularly for petrochemical-derived polymers (polyurethane and polyurea), and the presence of low-cost, inferior drop-in alternatives that can saturate price-sensitive market segments. These forces collectively dictate the strategic pathways for market players, emphasizing innovation and supply chain resilience as critical success factors.

Drivers: The consistent global increase in construction, mining, and agricultural activities demands robust utility vehicles, thereby generating strong demand for protective accessories. Additionally, the growing consumer propensity for vehicle personalization and preservation, recognizing the positive impact of bedliners on the truck’s resale value, fuels the aftermarket sector. The integration of bedliner installations into OEM production lines is simplifying the purchase decision for consumers, further driving market penetration. Technological advancements in application techniques, such as quick-cure and environmentally friendly (low-VOC) formulations, are also making spray-on liners more attractive and accessible, overcoming historical barriers related to curing time and environmental compliance. Furthermore, the longevity and anti-slip characteristics of modern liners align perfectly with enhanced workplace safety standards, particularly in utility fleet operations.

Restraints: The most persistent challenge is the fluctuation and general upward trend in the cost of key raw materials, directly impacting the manufacturing cost of both drop-in plastics and specialized spray-on polymers. Economic downturns or reduced consumer spending capacity can lead potential buyers to postpone accessory purchases or opt for cheaper, less effective protection methods. Environmental regulations governing the use of solvents and certain chemicals in coating processes impose compliance costs and restrict formula development in specific regions. Moreover, the technical skill required for professional spray-on application creates a barrier to entry for new aftermarket installers and maintains a service premium, which can deter price-sensitive consumers who might otherwise upgrade from a drop-in option.

Opportunity: The strongest opportunities lie in expanding the OEM partnerships globally, ensuring bedliners are viewed as essential standard or high-tier features rather than mere accessories. Developing smart bedliners incorporating embedded sensors for load monitoring or temperature control presents a future avenue for diversification. Furthermore, targeting emerging markets in Asia and Latin America, where vehicle ownership rates and utility usage are increasing rapidly, promises substantial growth. Specific product development focused on military-grade durability, extreme temperature tolerance, and specialized chemical resistance (e.g., oil and gas sector applications) allows companies to capture high-value, niche industrial contracts. The rise of electric pickup trucks also necessitates specialized, often lighter-weight, high-insulation bedliners, presenting a unique technological opportunity.

Segmentation Analysis

The Truck Bedliners Market is comprehensively segmented based on product type, material composition, vehicle class, distribution channel, and primary end-use application. The segmentation analysis provides granular insights into consumer preferences and market maturity across different product categories, highlighting the continuous technological evolution from rigid, removable drop-in products toward custom-fit, chemically bonded spray-on coatings. Understanding these segments is vital for manufacturers to tailor their production capabilities and marketing strategies, addressing the specific needs of diverse customer groups, ranging from large automotive OEMs requiring high-volume consistency to specialized aftermarket installers focusing on premium, customized solutions for individual truck owners.

- By Product Type

- Drop-in Bedliners

- Spray-on Bedliners

- By Material

- Polyethylene (PE)

- Polyurethane

- Polyurea

- Composite Materials (Fiberglass, Rubber Mats)

- By Vehicle Type

- Light-Duty Pickup Trucks (e.g., Ford F-150, Chevrolet Silverado 1500)

- Heavy-Duty Pickup Trucks (e.g., Ford F-250/350, Ram 2500/3500)

- Medium-Duty Trucks (Niche Applications)

- By Distribution Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

- Professional Installers

- Do-It-Yourself (DIY)

- By End-Use

- Commercial (Construction, Mining, Agriculture, Logistics)

- Personal/Recreational

Value Chain Analysis For Truck Bedliners Market

The value chain for the Truck Bedliners Market begins with the upstream procurement of specialized raw materials, primarily polymers such as polyethylene, polyurethane, and polyurea resins, which are heavily influenced by the petrochemical industry's price and supply dynamics. Key upstream activities involve chemical synthesis and formulation, where suppliers develop proprietary blends optimized for durability, UV stability, and application characteristics (e.g., fast cure times). Strategic partnerships between bedliner manufacturers and polymer suppliers are essential to ensure consistent quality and mitigate supply chain risks. Following material procurement, core manufacturing involves either injection molding or thermoforming for drop-in liners, or blending and packaging specialized two-component systems for spray-on products, which requires significant investment in mixing and application technology to maintain product consistency and meet stringent quality control standards.

The midstream process focuses on efficient manufacturing and logistics, particularly for OEMs where just-in-time delivery and integration into the vehicle assembly line are critical. The distribution channel acts as the crucial link to the end-customer. Direct distribution occurs through the OEM channel, where truck manufacturers install the liners during the vehicle production process, guaranteeing fit and quality. The indirect distribution channel is fragmented and robust, encompassing a vast network of authorized aftermarket dealers, independent auto accessory retailers, dedicated spray-on liner franchises (like Line-X or Rhino Linings), and e-commerce platforms catering to DIY consumers. This dual-channel approach allows manufacturers to capitalize on both new vehicle sales and the vast replacement and customization market, ensuring broad market reach.

Downstream activities involve the professional installation service, which is particularly vital for the performance of spray-on liners. Proper surface preparation, mixing, and application technique are paramount to achieving the protective qualities advertised. Poor installation can lead to peeling or bubbling, diminishing product effectiveness and brand reputation. Thus, bedliner companies heavily invest in installer training and certification programs to maintain quality standards across their dealership network. The final stage involves the consumer utilization and the subsequent replacement cycle, driven by either the end of the product's lifespan or the purchase of a new vehicle. The efficiency of the downstream professional service network significantly impacts overall customer satisfaction and brand loyalty within this specialized vehicle accessory market.

Truck Bedliners Market Potential Customers

The potential customer base for the Truck Bedliners Market is highly diversified, encompassing a vast spectrum of end-users ranging from large corporate entities operating expansive vehicle fleets to individual consumers who utilize pickup trucks for everyday commuting and weekend recreational purposes. The primary distinction lies between the Commercial segment and the Personal/Recreational segment. Commercial customers represent a high-volume, performance-driven market, prioritizing durability, chemical resistance, and minimal vehicle downtime. These buyers include construction firms, utility providers, mining operations, oil and gas companies, agricultural producers, and specialized government agencies that require their vehicles to withstand rigorous operating conditions and transport abrasive or corrosive materials safely.

Within the Commercial sector, purchasing decisions are typically centralized, driven by total cost of ownership (TCO) analysis, safety compliance standards, and fleet maintenance schedules. These customers often opt for factory-installed (OEM) or heavy-duty, professionally applied spray-on liners (e.g., polyurea formulations) due to their superior adhesion, impact absorption, and guaranteed long-term protection against rust and structural damage, which are critical for maximizing the residual value of assets. The selection process is meticulous, favoring suppliers that can demonstrate consistent quality, provide extensive warranties, and offer volume discounts, positioning reliability and fleet compatibility as key buying criteria over initial product cost.

The Personal/Recreational customer segment is characterized by individual truck owners who primarily use their vehicles for non-commercial activities, such as tailgating, moving personal goods, off-roading, and hobbies. These buyers are often motivated by aesthetic appeal, ease of installation (favoring DIY drop-in or easily installed composite mats), and product customization options like color matching and texture preferences. While still valuing protection, this segment is generally more price-sensitive than the commercial segment and highly influenced by retail promotions and brand perception driven by online reviews and social media. Ultimately, the market caters to anyone who owns a pickup truck and seeks to protect their investment, whether the usage involves hauling heavy industrial equipment or simply securing camping gear.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.1 Billion |

| Market Forecast in 2033 | $3.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LINE-X LLC, Penda Corporation, Rhino Linings Corporation, DualLiner, BedRug (by Truck Hero), The Ground Up, Industrial Polymers, U-POL Ltd., BASF SE, Lord Corporation (Parker Hannifin), PPG Industries, Custom Shop, Herculiner (by Custom Shop), Scorpion Protective Coatings, Speedliner (by Industrial Polymers), Deezee Inc., Husky Liners, Gatorback Coatings, TruXedo (by Truck Hero), WeatherTech. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Truck Bedliners Market Key Technology Landscape

The technological landscape of the Truck Bedliners Market is dominated by advancements in polymer chemistry and sophisticated application equipment, which collectively aim to enhance the durability, appearance, and efficiency of the protective coatings. A major technological focus lies in the formulation of high-performance polyurea and polyurethane hybrid systems. Polyurea, in particular, is gaining prominence due to its rapid cure time, which minimizes vehicle downtime for installers, superior tensile strength, chemical resistance, and hydrolytic stability. Innovations in these formulations include adjusting the hardness and flexibility to optimize performance based on the specific end-use application, such as higher abrasion resistance for mining trucks versus greater elasticity for recreational vehicles. Furthermore, the incorporation of advanced UV inhibitors and stabilizers is a critical technological development, addressing the historical weakness of early polymer coatings which tended to fade or chalk when exposed to intense sunlight, thus ensuring long-term aesthetic integrity and structural performance.

In terms of application technology, the shift towards specialized high-pressure, two-component spray systems is paramount, ensuring precise on-ratio mixing of the resin and hardener components necessary for optimal cure and performance of polyurea and polyurethanes. These advanced spray guns and heated hose systems maintain precise temperature control, crucial for achieving consistent viscosity and flawless texture. Automation and robotics are increasingly utilized within OEM assembly plants to ensure highly repeatable and uniform coating thickness across large production volumes, reducing waste and minimizing quality variation compared to manual spraying. This OEM-centric technological advancement is crucial for scaling up production while maintaining the demanding quality specifications set by automotive manufacturers. The digital monitoring capabilities integrated into modern application equipment allow for real-time tracking of process variables, further reinforcing quality control.

Beyond traditional chemical coatings, the market is also seeing niche innovation in composite and thermoplastic elastomer (TPE) materials, primarily used in the development of premium drop-in and specialized protective mats. These materials offer benefits such as lighter weight and easier installation or removal, appealing to consumers concerned about fuel economy or vehicle versatility. Technologies focusing on surface preparation, such as advanced adhesion promoters and primer systems, are equally important. These chemical systems ensure a powerful, permanent bond between the coating and the metal truck bed, preventing delamination, which is the leading cause of coating failure. The continuous technological thrust is centered on creating coatings that are not only highly protective but also environmentally compliant, featuring reduced or zero volatile organic compound (VOC) content, aligning with global sustainability mandates and health regulations.

Regional Highlights

- North America: This region stands as the dominant market for truck bedliners globally, driven primarily by the high penetration rate and cultural significance of pickup trucks in both the United States and Canada. The mature aftermarket segment is characterized by strong brand loyalty and a high willingness among consumers to invest in premium accessories, especially spray-on liners. OEM adoption is extremely high, with many truck manufacturers offering bedliners as a factory option. The market is highly competitive, focusing on innovation in polyurea durability, UV stability, and installer network efficiency.

- Asia Pacific (APAC): Expected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is fueled by massive infrastructure projects, burgeoning logistics and transportation sectors, and increasing industrialization in key economies like China, India, and Southeast Asia. As vehicle ownership and commercial fleet utilization rise, the demand for protective accessories grows. While the market historically favored more economical drop-in liners, increasing awareness of long-term vehicle maintenance and the entry of international spray-on brands are gradually shifting preferences toward higher-quality, durable solutions.

- Europe: The market is relatively smaller compared to North America due to lower overall pickup truck sales, which are often classified differently or subject to higher taxation. However, steady growth is observed in utility and commercial segments, particularly in agriculture, construction, and specialized public services across Western Europe. Demand is highly focused on quality, environmental compliance (low-VOC products), and professional installation standards, adhering to strict EU regulations regarding chemical usage and worker safety.

- Latin America: This region presents a market with significant untapped potential, heavily influenced by the performance of the commodity sectors, including mining and large-scale agriculture in countries like Brazil, Argentina, and Mexico. These industries rely extensively on robust pickup fleets, driving commercial demand for heavy-duty protection. Market growth is closely tied to economic stability, with sales volatility often mirroring macroeconomic conditions. The focus is typically on rugged, high-impact resistance products suitable for harsh operating environments.

- Middle East and Africa (MEA): Growth in the MEA region is bifurcated. The Middle East, particularly the GCC countries, shows high consumer demand driven by high disposable incomes and a strong affinity for luxury and performance pickups. Demand here often leans towards aesthetically pleasing, UV-stable coatings. In Africa, the market is constrained by lower overall disposable income but driven by essential utility use in resource extraction and infrastructure development, favoring cost-effective durability and simple logistics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Truck Bedliners Market.- LINE-X LLC

- Penda Corporation

- Rhino Linings Corporation

- DualLiner

- BedRug (A Brand of Truck Hero, Inc.)

- The Ground Up

- Industrial Polymers Corporation

- U-POL Ltd.

- BASF SE (Raw Material Supplier/Partner)

- Lord Corporation (A Division of Parker Hannifin)

- PPG Industries, Inc. (Coating Solutions)

- Custom Shop (Manufacturer of Herculiner)

- Herculiner

- Scorpion Protective Coatings, Inc.

- Speedliner (A Product of Industrial Polymers)

- Deezee Inc.

- Husky Liners

- Gatorback Coatings

- TruXedo (A Brand of Truck Hero, Inc.)

- WeatherTech

Frequently Asked Questions

Analyze common user questions about the Truck Bedliners market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between drop-in and spray-on truck bedliners, and which offers better protection?

Drop-in bedliners are pre-molded, removable plastic shells providing basic impact protection. Spray-on liners are permanent, seamless polyurethane or polyurea coatings applied directly to the truck bed. Spray-on liners generally offer superior, comprehensive protection against rust, abrasion, and moisture intrusion due to their custom fit and chemical bond, significantly enhancing vehicle resale value compared to drop-in counterparts.

Which factors are primarily driving the growth of the spray-on bedliner segment?

The spray-on segment growth is driven by increasing consumer awareness regarding long-term vehicle preservation, the adoption of high-performance polyurea materials offering rapid cure times and extreme durability, and the rising trend of OEMs offering factory-installed spray-on options, which guarantees quality and streamlines the purchase process for new truck buyers seeking premium protection.

How does the Truck Bedliners Market account for sustainability and environmental regulations?

The market is increasingly focusing on developing low-VOC (Volatile Organic Compound) and zero-VOC formulations, particularly within the spray-on segment, to comply with stringent environmental regulations in North America and Europe. Manufacturers are innovating materials to be more eco-friendly while maintaining or improving performance attributes such as durability and chemical resistance, reducing the environmental footprint of the application process.

Is the aftermarket or OEM distribution channel more significant for market revenue?

While the OEM distribution channel is growing rapidly due to factory installations, the aftermarket segment currently remains highly significant, especially for customized applications, replacement liners, and specialty coatings. Aftermarket sales are fueled by the large existing fleet of pickup trucks requiring protection upgrades or replacement accessories, ensuring a balanced revenue stream across both channels.

What role do raw material prices play in the profitability of bedliner manufacturers?

Raw material prices, particularly for petrochemical-derived polymers like polyurethane and polyurea, represent a significant operational cost. Volatility in global oil and gas markets directly impacts these costs, exerting constant pressure on manufacturer profitability. Companies mitigate this through strategic long-term procurement contracts and by focusing on high-value, high-margin specialized coatings that justify premium pricing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Truck Bedliners Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Truck Bedliners Market Size Report By Type (Drop-In Bedliners, Spray-On Bedliners), By Application (Original Equipment Markets, Aftermarket), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Truck Bedliners Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Spray-On Bedliners, Drop-In Bedliners), By Application (Aftermarket, OBM, OEM), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager