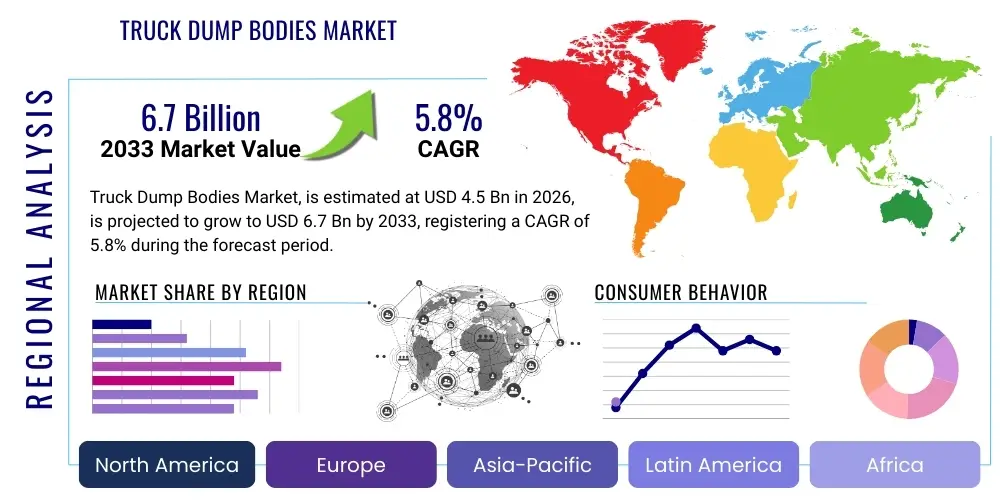

Truck Dump Bodies Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438775 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Truck Dump Bodies Market Size

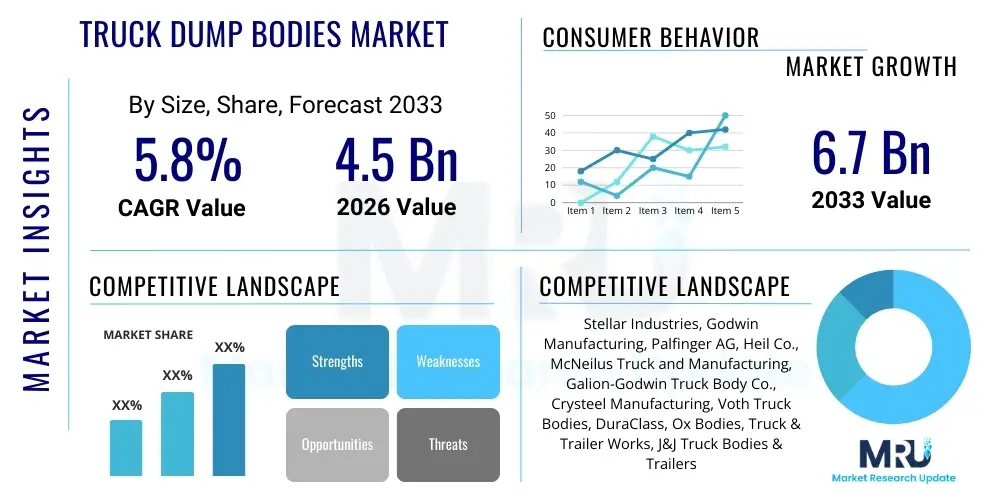

The Truck Dump Bodies Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 6.7 billion by the end of the forecast period in 2033.

Truck Dump Bodies Market introduction

The Truck Dump Bodies Market encompasses the design, manufacturing, and distribution of specialized equipment mounted onto truck chassis, primarily utilized for the transport and controlled dumping of bulk materials such as aggregates, dirt, sand, gravel, waste, and construction debris. These bodies are crucial components across sectors requiring heavy material handling, characterized by robust construction and specialized hydraulic systems enabling efficient unloading. Product varieties range significantly based on material composition—primarily high-strength steel or weight-saving aluminum—and structural design, including standard square bodies, half-round configurations for better load flow, and specialized elliptical models tailored for specific applications like asphalt hauling or severe off-road conditions. The foundational requirement for durable, high-capacity, and reliable hauling solutions drives consistent demand across global infrastructure and resource extraction industries.

Major applications for truck dump bodies span across infrastructure development, residential and commercial construction, extensive mining operations, and public works projects related to sanitation and waste management. In construction, dump bodies facilitate the timely movement of building materials and excavation spoils, directly impacting project timelines and cost efficiency. For the mining sector, bodies are engineered for extreme durability, often featuring specialized liners and high abrasion resistance to handle heavy ores and overburden under stringent operational cycles. The inherent benefits of these products include enhanced operational productivity through rapid unloading, reduced labor costs compared to manual material handling, and improved safety protocols due to automated hydraulic systems. Furthermore, modern designs increasingly focus on optimizing payload capacity while minimizing the body’s own weight, leveraging advanced materials and computational fluid dynamics (CFD) to improve fuel efficiency and structural integrity.

Key factors driving the market include aggressive government spending on infrastructure projects globally, particularly in developing economies where urbanization rates necessitate significant investment in roads, housing, and utilities. The recovery and expansion of the global mining industry, driven by demand for essential minerals needed for electrification and technology manufacturing, further stimulate the requirement for heavy-duty, high-capacity dump bodies. Moreover, continuous technological advancements in hydraulic systems, material science (leading to stronger yet lighter materials), and safety features (such as enhanced stability controls and remote diagnostics) contribute to market growth by offering superior return on investment and compliance with evolving regulatory standards related to vehicle weight limits and occupational safety.

Truck Dump Bodies Market Executive Summary

The Truck Dump Bodies Market exhibits robust expansion, fundamentally driven by global infrastructure rejuvenation and sustained activity in the resource extraction sectors. Current business trends indicate a strong movement toward premium, application-specific dump bodies featuring advanced material construction, predominantly high-strength steel alloys and aerospace-grade aluminum, to optimize the payload-to-weight ratio. Manufacturers are heavily investing in customization capabilities, offering modular designs that can be rapidly adapted for specific material types, climate conditions, or regulatory environments. The adoption of smart truck technologies, including telematics integrated into the dump body’s hydraulic system for predictive maintenance and operational monitoring, is emerging as a critical competitive differentiator, transforming the bodies from simple hauling tools into sophisticated, data-generating assets. Furthermore, sustainability concerns are influencing design, prompting the development of aerodynamic profiles and lighter bodies to reduce fuel consumption and associated carbon emissions.

Regionally, the market dynamics are highly differentiated. Asia Pacific (APAC) dominates the growth trajectory, fueled by rapid urbanization and massive infrastructure initiatives in China, India, and Southeast Asian nations, leading to unprecedented demand for medium and heavy-duty bodies. North America remains a mature but resilient market, characterized by stringent safety standards, high demand for specialized vocational trucks, and a rapid uptake of aluminum bodies due to stricter federal and state weight limitations aimed at preserving road networks. Europe shows consistent demand, particularly influenced by sophisticated waste management requirements and a strong push towards electric and alternative-fuel trucks, necessitating the development of compatible, lightweight body solutions. The Middle East and Africa (MEA) and Latin America are poised for accelerated growth, supported by large-scale mining projects and energy infrastructure expansion, favoring extremely robust, high-abrasion-resistant steel bodies.

Segmentation trends highlight the increasing preference for the Half-round body type due to its efficiency in material shedding, minimizing residue and reducing cycle times, especially in aggregates and mining applications. In terms of material, while steel remains the backbone for extreme heavy-duty tasks, aluminum is experiencing the highest growth rate, penetrating the medium-duty and even some heavy-duty segments where gross vehicle weight optimization is paramount. The Construction application segment holds the largest market share due to the sheer volume of material movement required globally, while the Mining segment commands the highest average selling price (ASP) due to the necessity for specialized, high-capacity, and reinforced bodies capable of operating in harsh environments. The convergence of safety regulations, technological integration, and the focus on material efficiency defines the contemporary segmentation landscape.

AI Impact Analysis on Truck Dump Bodies Market

User inquiries regarding AI's influence on the Truck Dump Bodies Market predominantly center on how Artificial Intelligence can enhance operational efficiency, safety, and maintenance regimes rather than fundamentally altering the product's physical structure. Common questions include: "Can AI predict when a dump body liner needs replacement?" "How will autonomous trucks impact dump body design?" and "Can machine learning optimize hauling routes and dumping procedures for vocational fleets?" Users are keen to understand if AI-driven systems can integrate with existing telematics to provide predictive failure analysis for hydraulic components, detect uneven load distribution in real-time to prevent rollovers, or optimize the material release sequence to minimize strain on the chassis. The core concern revolves around the transition from reactive maintenance and traditional operation to a proactive, data-informed fleet management ecosystem, where AI algorithms provide actionable insights derived from usage patterns, road conditions, and material abrasion rates.

- AI-Powered Predictive Maintenance: Utilizing sensor data from hydraulic systems and body wear indicators (e.g., thickness gauges) to forecast component failure or required liner replacements, significantly reducing unexpected downtime.

- Operational Safety Enhancement: Machine learning models analyzing real-time truck pitch, load distribution, and driver behavior to provide immediate alerts or system overrides (e.g., preventing dumping on uneven terrain), mitigating rollover risks.

- Autonomous Compatibility Design: Designing bodies and mounting points optimized for fully autonomous chassis, ensuring seamless integration with perception systems and automated coupling mechanisms.

- Route and Payload Optimization: AI algorithms using historical data on road friction, traffic, and weight restrictions to recommend optimal payload sizes and hauling routes, maximizing fuel efficiency and minimizing wear and tear.

- Smart Loading Assistance: Integration of vision systems and AI to guide loaders/excavators, ensuring symmetrical and efficient material distribution within the dump body, thereby maximizing capacity and stability.

- Material Wear Analysis: Deploying machine vision and AI processing to continuously monitor the internal surface of the body for excessive abrasion or structural damage, scheduling repairs precisely when needed.

DRO & Impact Forces Of Truck Dump Bodies Market

The dynamics of the Truck Dump Bodies Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the critical Impact Forces shaping its trajectory. The primary Driver is the substantial global investment in public infrastructure, particularly road networks, bridges, and utility expansions, demanding enormous volumes of aggregate material transport. Simultaneously, Restraints, such as highly volatile raw material prices—specifically steel and aluminum—and increasingly stringent environmental regulations governing vehicle weight and emissions, impose cost and design constraints on manufacturers. Opportunities are realized through technological innovation, notably the shift towards lightweight, high-strength materials and the integration of sophisticated telematics and IoT devices that enhance operational efficiency and safety. These three forces create a demanding operational environment where efficiency gains and material science advancements become imperative for competitive advantage.

Driving forces for market expansion include the sustained growth of the global population leading to increased urbanization, necessitating massive residential and commercial construction activities. Furthermore, the recovery of the oil and gas sector and the continuous exploration for minerals required for batteries and electronics further stimulate demand for specialized off-road and heavy-duty dump bodies used in extraction sites. Governments, especially in the US (via infrastructure bills) and major economies in APAC, are consistently allocating large capital expenditure funds toward construction and maintenance, guaranteeing a steady flow of demand for heavy vocational trucks and their corresponding bodies. This sustained demand profile ensures manufacturers maintain high production volumes and encourages continuous product refinement to meet high utilization rates.

Conversely, the market faces significant headwinds from external pressures. Restraints include the complexity of international trade policies and tariffs affecting cross-border supply chains for specialized components and raw materials. Furthermore, the skilled labor shortage in fabrication and welding sectors, coupled with the capital intensity required for advanced manufacturing processes (like laser cutting and robotic welding), limits the growth potential of smaller enterprises. Opportunities, however, lie in leveraging modular construction techniques, which allow for quicker assembly and customization, and the development of bodies specifically designed for electric vehicle platforms, requiring substantial weight reduction and structural reinforcement to compensate for heavy battery packs. The overall impact force matrix suggests a market that is fundamentally stable due to non-discretionary infrastructure spending, yet highly sensitive to material cost inflation and technological obsolescence.

Segmentation Analysis

The Truck Dump Bodies Market is segmented comprehensively based on key functional and structural attributes, providing granular insights into specialized demand clusters across various end-user industries. The segmentation primarily analyzes the market based on Body Type (defining structural geometry), Material (impacting weight and durability), Capacity (determining payload limits and application scale), and Application (identifying end-use sectors). This structured view allows stakeholders to assess market penetration strategies, focusing on specific requirements, such as the need for abrasion resistance in mining versus the payload optimization sought in municipal road maintenance. The diversification across these segments reflects the vocational nature of dump trucks, where a standardized product rarely meets the diverse demands of aggregate hauling, asphalt paving, and scrap metal transportation simultaneously.

- By Type:

- Standard/Square Bodies (Traditional design, maximum volume, diverse use)

- Half-round Bodies (Superior material shedding, high structural strength, common in aggregates)

- Elliptical Bodies (Used primarily for asphalt and high-volume, low-density materials)

- Frameless Bodies (Lighter weight, efficient dumping, often used for highway hauling)

- By Material:

- Steel (High-strength steel, Carbon Steel, Abrasion-Resistant (AR) Steel)

- Aluminum (Weight-saving, corrosion resistance, high demand in weight-restricted areas)

- By Capacity:

- Light-Duty (Up to 10 Cubic Yards)

- Medium-Duty (10 to 20 Cubic Yards)

- Heavy-Duty (Over 20 Cubic Yards)

- By Application:

- Construction (Residential, Commercial, Infrastructure)

- Mining and Quarrying (Ore, Overburden, Aggregates)

- Waste Management and Sanitation (Refuse, Recycling, Debris)

- Logistics and Transportation (General bulk hauling)

Value Chain Analysis For Truck Dump Bodies Market

The value chain for the Truck Dump Bodies Market begins with upstream activities centered on securing and processing high-quality raw materials, primarily specialized steel alloys and aluminum sheets, which are critical determinants of the final product’s durability and weight. Manufacturers depend heavily on suppliers capable of providing certified materials that meet rigorous strength-to-weight standards, often involving long-term contracts with major metal producers and specialized hydraulic system component suppliers (cylinders, pumps, valves). Efficiency at the upstream stage, including hedging against price volatility and optimizing inventory management for specialized materials like AR steel, directly affects the final manufacturing cost and time-to-market. Quality control at this initial phase is paramount, as material defects can lead to catastrophic failure under the high stress loads typical of dump body operations.

The midstream phase involves the core manufacturing process, encompassing design engineering, computer-aided structural analysis, cutting (often utilizing laser or plasma technology), robotic welding, painting, and final assembly. Leading manufacturers differentiate themselves through automation adoption, particularly in welding processes, ensuring structural integrity and consistency across high-volume production runs. This stage also includes the integration of the hydraulic lifting systems and the mounting of the body onto the specialized truck chassis provided by major OEM truck builders. Complex custom orders, which constitute a significant portion of the heavy-duty segment, necessitate close coordination between design teams and fabrication experts to meet specific payload, dimension, and material resistance requirements for unique applications like tunnel construction or extreme cold-weather operation.

Downstream activities focus on distribution, sales, and aftermarket support. Distribution channels are bifurcated: direct sales to large fleet operators, governments, or mining companies, and indirect sales through authorized truck dealers, specialized vocational truck centers, and independent distributors who handle local installation and customization. Aftermarket services, including spare parts supply, maintenance contracts for hydraulic systems, and body repair or re-lining services, represent a significant revenue stream and a crucial element of customer retention. The complexity of the product requires highly trained service technicians, often certified by the original equipment manufacturer (OEM), to ensure the longevity and safety compliance of the installed dump bodies throughout their operational lifespan.

Truck Dump Bodies Market Potential Customers

The core customer base for the Truck Dump Bodies Market is concentrated in sectors that necessitate the high-volume movement of bulk, non-fluid materials. The primary end-users are large infrastructure development companies and construction contractors involved in major civil engineering projects, such as highway construction, airport expansions, and large-scale residential development, demanding reliable fleets of medium and heavy-duty dump trucks for aggregates and soil hauling. Governmental public works departments at municipal, state, and federal levels are consistent buyers, utilizing these bodies for road maintenance, snow removal (often requiring specialized stainless steel bodies), and public sanitation projects. These governmental entities typically procure through long-term tender processes, prioritizing durability, safety certifications, and adherence to specific regulatory requirements.

A second crucial segment comprises mining and quarrying corporations, which utilize the most robust and highest-capacity dump bodies, often custom-designed for extreme off-road conditions and heavy, abrasive materials like iron ore or granite. These customers focus intensely on material resilience (e.g., utilizing specialized AR steel liners), capacity optimization, and integrated safety systems due to the challenging and remote operational environments. Investment decisions in this segment are highly correlated with global commodity prices and long-term extraction forecasts. The demand here is less price-sensitive and more quality-sensitive, favoring manufacturers known for unparalleled engineering and lifetime product support in harsh operational settings.

Further potential customers include specialized logistics firms focusing on bulk transport, waste management companies (both municipal and private), and utilities contractors. Waste management operators require specialized bodies that can handle diverse loads, often integrating features for compaction or controlled release of refuse. Agricultural businesses, though a smaller segment, also use lighter-duty dump bodies for hauling grain, feed, and fertilizer. The purchasing decision for all these end-users is heavily influenced by total cost of ownership (TCO), factoring in fuel efficiency (driven by body weight), anticipated maintenance costs, residual value, and compliance with local payload regulations, making the material choice (steel vs. aluminum) a critical consideration in procurement strategy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 billion |

| Market Forecast in 2033 | USD 6.7 billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stellar Industries, Godwin Manufacturing, Palfinger AG, Heil Co., McNeilus Truck and Manufacturing, Galion-Godwin Truck Body Co., Crysteel Manufacturing, Voth Truck Bodies, DuraClass, Ox Bodies, Truck & Trailer Works, J&J Truck Bodies & Trailers, E-Pak Manufacturing, Knapheide Manufacturing Company, Warren Equipment, TIPL (TIL Limited), XCMG Group, Bibeau, Chelsea Products, Philippi-Hagenbuch Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Truck Dump Bodies Market Key Technology Landscape

The technological landscape of the Truck Dump Bodies Market is increasingly defined by innovations aimed at enhancing safety, maximizing payload, and improving operational longevity through advanced material science and digital integration. A pivotal technological trend is the pervasive adoption of high-strength, low-alloy (HSLA) steel and advanced abrasion-resistant (AR) steel grades, such as AR450 and AR500, which allow manufacturers to reduce the body wall thickness without compromising structural integrity or wear resistance. This material optimization is crucial for minimizing the unladen weight of the truck, directly translating into increased payload capacity and improved fuel efficiency, thereby addressing the strict regulatory environment surrounding gross vehicle weight (GVW) and operational economics.

Beyond material science, the integration of smart technologies is rapidly transforming operational capabilities. Advanced hydraulic control systems, often managed via CAN bus interfaces, provide smoother, faster, and more controlled dumping cycles. These systems incorporate sensors to monitor hydraulic pressure, fluid temperature, and lift angle, feeding critical data back to the driver and fleet manager. Furthermore, stability control systems, leveraging inclinometers and sophisticated algorithms, actively monitor the truck's angle during the lifting process. If the system detects a potential instability threshold being approached due to uneven ground or improper load shifting, it can issue warnings or automatically halt the lifting motion, dramatically enhancing occupational safety and preventing expensive equipment damage.

Another area of intense technological focus is telematics integration. Modern dump bodies are being equipped with dedicated IoT sensors that track usage metrics unique to the body itself—such as the number of dump cycles, total time spent hauling material, GPS coordinates of dumping events, and cumulative material weight transported. This data is synthesized by fleet management software to enable highly accurate predictive maintenance schedules for both the truck chassis and the body components, shifting maintenance philosophy from time-based to condition-based. Future developments are focused on developing composite materials for specialized, non-abrasive applications to push weight reduction even further, coupled with automated, non-destructive testing techniques (like ultrasonic testing) integrated into the manufacturing line to guarantee weld and material quality.

Regional Highlights

- Asia Pacific (APAC): APAC is recognized as the fastest-growing market segment, primarily propelled by unparalleled investment in urban development, transport infrastructure (e.g., Belt and Road Initiative), and large-scale public housing projects across countries like China, India, and Indonesia. High demand exists for heavy-duty steel bodies to support expansive mining and quarrying activities. The region's regulatory environment is gradually tightening, encouraging the adoption of bodies that meet higher safety standards and better payload efficiency, though cost remains a critical determinant in purchasing decisions. Local manufacturing capacity is rapidly expanding to meet surging domestic requirements.

- North America: This region represents a mature and technologically sophisticated market, characterized by a strong regulatory emphasis on axle weight limits, driving substantial demand for lightweight aluminum dump bodies, particularly in highway haulage applications. Demand is consistently robust, fueled by cyclical public infrastructure repairs and new commercial construction. The market is highly competitive, emphasizing superior hydraulic systems, advanced safety features (e.g., electric tarps, stability controls), and extensive aftermarket support networks. Customization for vocational tasks, such as specialized asphalt hauling or snow and ice control, is a key feature of this regional market.

- Europe: The European market is characterized by a high focus on vehicle efficiency, emissions reduction, and overall environmental compliance. This regulatory environment favors lighter construction, often utilizing high-grade aluminum and complex chassis designs compatible with European cab-over-engine (COE) truck architectures. Demand is stable, supported by public works, specialized waste management services, and construction projects, with a growing trend towards smaller, highly maneuverable dump bodies suitable for dense urban environments and adherence to strict noise abatement regulations. The market exhibits high quality and safety expectations.

- Latin America: This region demonstrates significant growth potential, driven primarily by major resource extraction operations (mining in Chile, Peru, and Brazil) and energy infrastructure development. The market generally favors highly robust, traditionally constructed steel bodies designed to withstand harsh operating conditions and heavy loads with minimal technological complexity, prioritizing longevity and ease of field repair. Economic volatility and currency fluctuations can intermittently affect capital expenditure, but the long-term outlook remains positive due to persistent demand for commodities and necessary infrastructure upgrades.

- Middle East and Africa (MEA): The MEA market is heavily influenced by large-scale mega-projects in the Gulf Cooperation Council (GCC) countries (e.g., NEOM in Saudi Arabia) and the burgeoning infrastructure needs across Africa. High-temperature operation and dust resistance are critical design considerations. Demand is concentrated in the heavy-duty segment for use in massive construction sites and large-scale quarrying operations. African markets are seeing increased uptake due to new mining concessions and improving road networks, demanding reliable and rugged bodies capable of handling poor road quality and extreme utilization cycles.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Truck Dump Bodies Market.- Stellar Industries, Inc.

- Godwin Manufacturing Company, Inc.

- Palfinger AG

- Heil Co. (A Dover Company)

- McNeilus Truck and Manufacturing, Inc.

- Galion-Godwin Truck Body Co.

- Crysteel Manufacturing, Inc.

- Voth Truck Bodies, Inc.

- DuraClass (A division of JBPCO)

- Ox Bodies, Inc.

- Truck & Trailer Works, Inc.

- J&J Truck Bodies & Trailers

- E-Pak Manufacturing, Inc.

- Knapheide Manufacturing Company

- Warren Equipment, Inc.

- TIPL (TIL Limited)

- XCMG Group

- Bibeau Inc.

- Chelsea Products (A Parker Hannifin Company)

- Philippi-Hagenbuch Inc.

Frequently Asked Questions

Analyze common user questions about the Truck Dump Bodies market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Truck Dump Bodies Market?

The most significant driver is the global increase in government expenditure on major infrastructure projects, including road construction, bridge replacement, and urban development, which consistently requires high-volume movement of aggregates and construction materials, directly stimulating demand for heavy-duty dump bodies worldwide.

What are the key trade-offs between utilizing steel versus aluminum dump bodies?

Steel bodies offer superior strength, abrasion resistance (especially when utilizing AR grades), and lower initial cost, making them ideal for heavy mining and debris hauling. Conversely, aluminum bodies are substantially lighter, enabling higher legal payload capacity and better fuel economy, crucial advantages in regions with strict road weight limits, though they have a higher purchase price and less resistance to extreme abrasion.

How is the integration of smart technology affecting dump body design?

Smart technology integration focuses on safety and efficiency. This includes sensor-based hydraulic systems providing predictive maintenance alerts, stability controls that prevent rollovers during dumping on uneven ground, and telematics that track usage data (dump cycles, weight) to optimize fleet management and utilization rates.

Which segmentation type currently commands the highest market share in terms of volume?

The Construction application segment dominates the market volume share globally, encompassing both residential construction and large civil infrastructure projects that require continuous material transportation, solidifying its position as the largest end-user category for various types of dump bodies.

What are the major challenges manufacturers face in the Truck Dump Bodies Market?

Manufacturers primarily struggle with the volatility and escalation of raw material costs, particularly steel and aluminum prices. Furthermore, compliance with increasingly rigorous environmental and vehicle weight regulations across different jurisdictions necessitates continuous, often expensive, investment in lightweight materials and sophisticated design engineering.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager