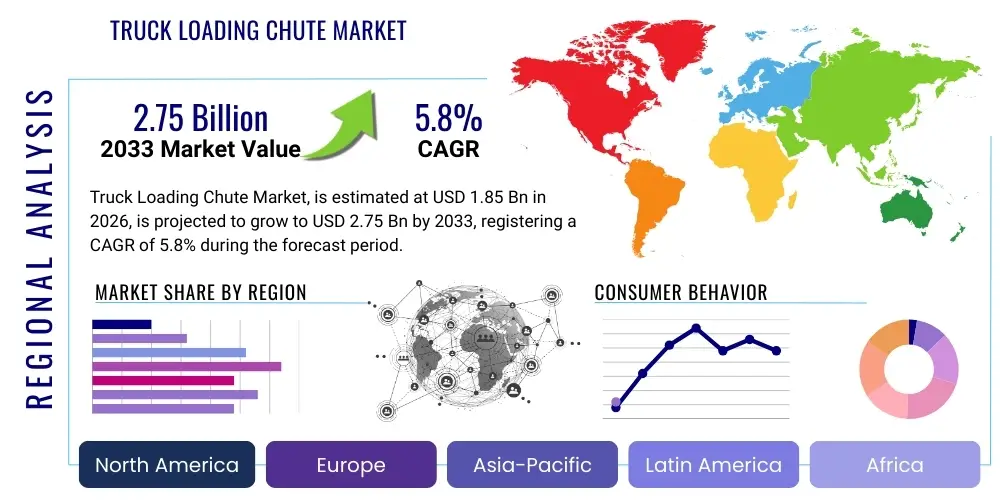

Truck Loading Chute Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435244 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Truck Loading Chute Market Size

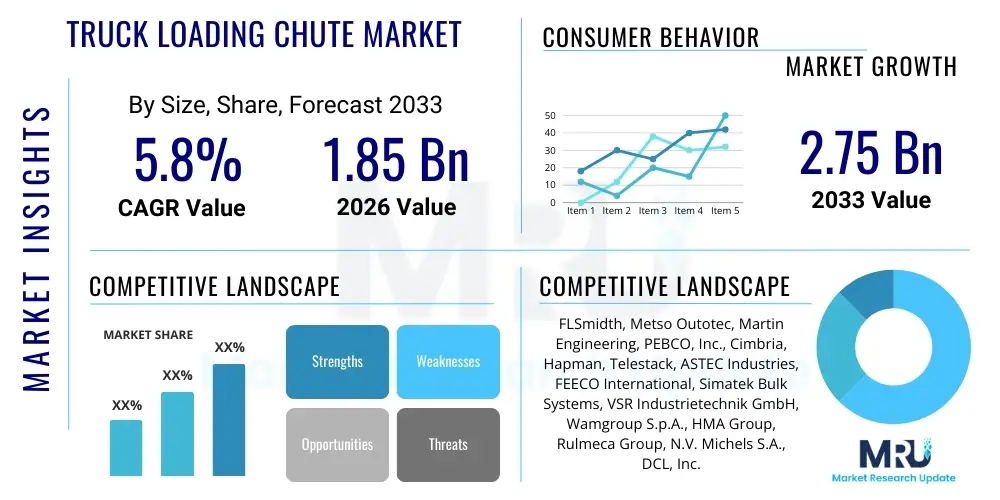

The Truck Loading Chute Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.75 Billion by the end of the forecast period in 2033.

Truck Loading Chute Market introduction

The Truck Loading Chute Market encompasses the manufacturing, distribution, and utilization of specialized equipment designed for efficient and controlled transfer of bulk solid materials—such as minerals, grains, aggregates, and chemicals—from storage silos or conveyors directly into open-top transportation vehicles like dump trucks or rail wagons. These systems are crucial in minimizing dust emission, preventing material segregation, and ensuring optimal load distribution, thereby maximizing payload capacity and complying with stringent environmental and safety regulations globally. The core function of a loading chute is to provide a closed, controlled path for materials, mitigating spillage and ensuring operational cleanliness.

Key applications of truck loading chutes span across heavy industries including mining (for ore and coal handling), construction (for cement and aggregates), agriculture (for grains and fertilizers), and port operations (for bulk commodity transfer). The growing global infrastructure spending, particularly in emerging economies, coupled with continuous production expansion in the mining and agricultural sectors, serves as a fundamental market driver. The demand for systems that offer high throughput capacity with minimal maintenance requirements is pushing manufacturers toward developing robust, corrosion-resistant, and easily deployable solutions. Furthermore, specialized chutes offering features like flow control gates, dust suppression skirts, and integrated weighing mechanisms are gaining significant traction.

The primary benefits derived from the adoption of modern truck loading chute systems include enhanced operational safety by reducing manual intervention, substantial cost savings through reduced material loss and cleanup expenses, and improved environmental compliance due to effective dust containment. Driving factors for market expansion are largely centered on automation trends within bulk handling processes, the increasing focus on worker health and safety regulations (especially concerning silica and respirable dust exposure), and the necessity for rapid loading cycles to improve logistics efficiency. Continuous innovation in chute design, particularly focusing on modularity and materials (e.g., abrasion-resistant linings), ensures sustained market growth.

Truck Loading Chute Market Executive Summary

The global Truck Loading Chute Market is characterized by steady growth driven predominantly by escalating infrastructure investment and the critical need for environmental compliance in bulk material handling. Business trends indicate a strong shift towards intelligent loading systems integrated with telemetry and predictive maintenance capabilities, moving away from purely mechanical operations. Manufacturers are focusing heavily on customization, offering chutes tailored to specific material characteristics—such as temperature, particle size distribution, and abrasiveness—to ensure optimal performance and longevity. Consolidation among mid-sized component providers and strategic partnerships between chute manufacturers and large-scale engineering, procurement, and construction (EPC) firms are defining the competitive landscape, especially in regions undertaking large infrastructural projects.

Regionally, Asia Pacific (APAC) stands as the dominant market, propelled by massive outputs from the Chinese and Indian mining, cement, and agricultural sectors, alongside rapid port modernization efforts. North America and Europe, while representing mature markets, exhibit high demand for advanced, fully automated, and dust-free loading solutions, driven by rigorous Occupational Safety and Health Administration (OSHA) standards and European Union environmental directives. Emerging economies in Latin America and the Middle East and Africa (MEA) are witnessing accelerated market penetration as resource extraction activities increase, fueling demand for robust, high-capacity standard loading systems suitable for rugged operational environments.

Segment trends reveal that the Telescopic Chute segment is experiencing the fastest growth, attributed to its versatility in accommodating varying truck sizes and maintaining effective dust control across different discharge heights. Material-wise, high-density polyethylene (HDPE) liners and specialized ceramic/UHMW linings are increasingly preferred over conventional steel due to superior abrasion resistance and reduced material friction, leading to improved throughput and reduced wear. End-user demand is heavily concentrated in the mining and construction sectors, although the agricultural sector is showing promising growth due to the implementation of automated grain handling facilities and port upgrades.

AI Impact Analysis on Truck Loading Chute Market

Common user questions regarding AI’s influence on the Truck Loading Chute Market frequently revolve around optimizing loading cycles, enhancing preventative maintenance schedules, and integrating real-time environmental monitoring. Users are primarily concerned with how AI can minimize loading time variability, predict component failures (especially chute liners and seals), and ensure consistent dust mitigation regardless of material flow fluctuations or ambient weather conditions. Key themes include the feasibility of using computer vision for precise truck positioning and load scanning, and leveraging machine learning algorithms to fine-tune material flow control gates, moving from static operational settings to dynamic, self-adjusting systems tailored for maximum efficiency and minimized environmental footprint.

AI adoption is transforming operational methodologies by enabling smart flow control and predictive maintenance within bulk handling systems. Machine learning models analyze historical loading data, sensor inputs (such as vibration, temperature, and wear rates), and environmental variables to predict optimal material discharge velocities and chute geometry adjustments in real-time. This level of granular control ensures that the loading process is not only faster but also minimizes segregation, resulting in a higher quality final product or maximized payload. Furthermore, AI-driven scheduling optimizes the movement of trucks under the chute, reducing bottlenecks and improving overall site logistics.

While the initial cost of implementing AI-integrated sensors and control software presents a barrier for smaller operators, the long-term benefits concerning reduced unplanned downtime and compliance certainty are driving adoption among large enterprises. The future of the market hinges on developing user-friendly interfaces for these complex systems, allowing site operators to leverage AI insights without needing specialized data science expertise. Standardization of data exchange protocols between the chute control system and the broader plant management software (SCADA/MES) is crucial for maximizing the value derived from AI-driven insights.

- AI-driven Predictive Maintenance (PdM) analyzing vibration and wear sensors to forecast liner replacement, minimizing unplanned shutdowns.

- Real-time material flow optimization using machine learning to adjust flow rates and gate positions, preventing blockages and optimizing load distribution.

- Integration of Computer Vision systems for automated truck alignment and precise load volume measurement, enhancing operational accuracy.

- Optimization of dust suppression systems (e.g., water sprays, fogging systems) based on real-time atmospheric data and material characteristics input.

- Automated reporting and regulatory compliance monitoring, flagging deviations in dust emission standards instantly.

- Enhanced operator safety through autonomous monitoring of exclusion zones around the loading process.

DRO & Impact Forces Of Truck Loading Chute Market

The Truck Loading Chute Market is significantly influenced by a confluence of driving forces, regulatory constraints, and technological opportunities. The primary driver is the global mandate for stringent dust and particulate matter control, especially in resource-intensive industries, compelling operators to replace outdated, open loading systems with enclosed, high-efficiency chutes. However, high initial capital investment required for automated, customized loading solutions and the extended lifespan of existing, older equipment act as key restraints, slowing the rate of full market penetration. Opportunities arise from the increasing adoption of modular and standardized chute designs suitable for diverse applications and the integration of IoT and smart sensors for enhanced operational transparency.

Impact forces currently shaping the market dynamics include technological advancements and regulatory pressures. Technological forces, such as the development of novel abrasion-resistant materials (e.g., composite polymers and specialized ceramic tiles), directly impact product lifespan and maintenance frequency, offering superior value propositions. Simultaneously, regulatory forces, particularly stricter limits on fugitive dust emissions (PM10 and PM2.5) imposed by environmental protection agencies globally, mandate investment in advanced chute technologies. Economic volatility, while generally restraining large capital projects, also encourages investment in efficiency-boosting equipment like advanced chutes that reduce material loss and operational expenses over the long term.

The interdependence of upstream material supply (steel, polymers) and downstream logistics efficiency means that disruptions in global supply chains can intermittently restrain growth and increase pricing pressure. Conversely, the opportunity to retrofit existing bulk handling infrastructure with modular chute systems represents a significant growth vector. The focus on worker safety, specifically minimizing exposure to hazardous dust, remains a powerful societal impact force accelerating the adoption of fully automated loading systems, thereby justifying higher upfront costs for advanced solutions.

Segmentation Analysis

The Truck Loading Chute Market is comprehensively segmented based on material handled, mechanism type, construction material, and end-use application. Understanding these segments is crucial for strategic positioning, as the requirements vary drastically across industries—a mining operation requires high throughput and extreme abrasion resistance, whereas a grain handling facility prioritizes material integrity and dust containment for lightweight, volatile substances. The market exhibits increasing diversification, driven by the need for application-specific performance optimization, moving away from general-purpose loading solutions.

- By Mechanism Type:

- Telescopic Chutes (Dominant due to adjustability and dust control)

- Fixed Chutes (Used primarily in highly standardized, static loading environments)

- Modular Chutes (Gaining traction due to ease of installation and maintenance)

- By Construction Material:

- Steel (Carbon Steel, Stainless Steel)

- Aluminum

- High-Density Polyethylene (HDPE) and Composites

- Specialized Liners (Ceramic, Polyurethane, UHMW)

- By Application (Material Handled):

- Aggregates and Sand

- Grains and Agricultural Products

- Minerals and Ores (e.g., Coal, Iron Ore, Bauxite)

- Cement and Ash

- Chemicals and Fertilizers

- By End-Use Industry:

- Mining Industry

- Construction and Cement

- Agriculture and Food Processing

- Ports and Logistics

- Power Generation (Coal/Ash handling)

Value Chain Analysis For Truck Loading Chute Market

The value chain for the Truck Loading Chute Market begins with upstream activities involving the sourcing of raw materials, primarily specialized steel alloys, abrasion-resistant polymers, and electronic components for integrated control systems. Manufacturers rely heavily on consistent quality and competitive pricing for these specialized materials, as the performance and longevity of the chute directly depend on the integrity of the liners and structural components. Key upstream activities include metallurgical processing for structural steel, advanced polymer manufacturing for flexible skirting and liners, and procurement of sophisticated sensors and pneumatic/hydraulic actuators necessary for modern telescopic designs. Supply chain resilience, particularly concerning global fluctuations in commodity steel prices, significantly impacts the final cost structure.

Mid-stream activities focus on the design, fabrication, assembly, and testing of the loading chutes. This stage is marked by high engineering complexity, often involving computational fluid dynamics (CFD) simulations to optimize material flow characteristics, minimize wear, and ensure effective dust containment. Customization plays a major role, as chutes must often be tailored to the specific geometry of existing plant infrastructure (silos, conveyors) and the unique flow properties of the material being handled. Quality control and adherence to international safety standards (e.g., ATEX for explosive environments, specific dust control regulations) are paramount during fabrication, defining the competitiveness of manufacturers in key markets.

Downstream activities involve distribution, installation, commissioning, and extensive aftermarket services. Distribution channels are typically a mix of direct sales teams for large, complex, and customized projects (common in mining) and indirect channels utilizing regional distributors or specialized material handling system integrators (common in agriculture and construction). Post-sales support, including providing replacement liners, maintenance contracts, and operational training, constitutes a significant revenue stream and a crucial differentiator. Due to the critical nature of these systems, rapid response and availability of spare parts are essential to minimize downtime for end-users.

Truck Loading Chute Market Potential Customers

Potential customers for truck loading chutes are diverse, spanning multiple heavy industrial sectors that handle large volumes of loose bulk materials. The primary buyers are organizations focused on resource extraction and processing, where efficient loading is critical for transportation logistics and profit margins. These end-users are typically characterized by large-scale, continuous operations, high capital expenditure capabilities, and an acute sensitivity to environmental compliance and worker safety standards. Their purchasing decisions are driven by factors such as throughput rate, system reliability, ease of integration with existing infrastructure, and the total cost of ownership (TCO) including maintenance and energy usage.

The mining sector represents one of the most substantial customer bases, utilizing chutes for loading everything from high-abrasive iron ore and bauxite to coal and various processed minerals into large haul trucks and rail cars. Customers in this sector demand highly durable, heavy-duty telescopic chutes with specialized abrasion-resistant internal linings (e.g., ceramic or basalt). Furthermore, cement manufacturers and aggregate producers constitute a major segment, requiring robust chutes capable of handling fine, dusty materials efficiently, often integrating dust collection interfaces to comply with environmental regulations concerning airborne particulate matter near populated areas.

Beyond traditional heavy industry, the agricultural sector, specifically large grain storage facilities, elevators, and port terminals, forms a growing customer segment. These buyers prioritize gentle material handling to prevent grain damage (segregation and breakage) and require specialized chutes designed for highly volatile, low-density materials, emphasizing hermetic sealing and efficient dust aspiration. Infrastructure developers, EPC contractors overseeing new plant construction, and governmental bodies responsible for port infrastructure upgrades also serve as significant indirect potential customers, influencing procurement decisions for loading chute systems globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.75 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FLSmidth, Metso Outotec, Martin Engineering, PEBCO, Inc., Cimbria, Hapman, Telestack, ASTEC Industries, FEECO International, Simatek Bulk Systems, VSR Industrietechnik GmbH, Wamgroup S.p.A., HMA Group, Rulmeca Group, N.V. Michels S.A., DCL, Inc., Spiroflow Systems, Eriez Manufacturing, Guttridge Limited, JVI Vibratory Equipment |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Truck Loading Chute Market Key Technology Landscape

The technological landscape of the Truck Loading Chute Market is rapidly evolving, moving beyond simple gravity-fed pipes toward highly engineered, often automated, material handling systems. A key technological focus is the development of advanced dust suppression techniques. Modern chutes incorporate sophisticated sealed systems, vacuum aspiration ports, and integrated dry fogging or water spray systems managed by smart controls that adjust humidity and flow based on ambient conditions and material moisture content. This shift is crucial for meeting zero-emission targets and improving operational visibility, particularly in dry bulk handling facilities.

Material science innovation is equally pivotal. Manufacturers are increasingly utilizing Ultra-High Molecular Weight Polyethylene (UHMW), specialized ceramics, and proprietary composite alloys as lining materials. These materials offer significantly lower coefficients of friction compared to traditional steel, reducing material adherence and maximizing flow speed, which is critical for reducing loading cycle times. More importantly, these advanced linings dramatically extend the Mean Time Between Failures (MTBF) by resisting extreme abrasion and corrosion, which translates directly into lower maintenance costs and higher availability for the end-user, providing a significant competitive advantage.

Automation and digitalization represent the most transformative technologies. Modern telescopic chutes are often equipped with PLC-based control systems, laser distance sensors, and load cells that ensure precise positioning and accurate weight measurement during loading. This integration allows for communication with plant-wide supervisory control and data acquisition (SCADA) systems, facilitating predictive diagnostics and remote monitoring. Future technological advances will heavily rely on utilizing AI for autonomous optimization of loading parameters, coupled with modular and customizable designs that allow for easy adaptation to diverse materials and logistical setups without extensive site modification.

Regional Highlights

Regional dynamics heavily influence the demand patterns and technological maturity of the Truck Loading Chute Market, reflecting differences in regulatory environments, industrial output, and infrastructure spending priorities. These geographic variations necessitate region-specific strategies for market penetration and product development.

- Asia Pacific (APAC): Dominates the global market volume due to colossal mining and infrastructure projects in China, India, and Southeast Asia. The demand is characterized by high-throughput, robust, and cost-effective solutions for coal, iron ore, and cement. Rapid industrialization and port modernization are primary growth catalysts, though environmental compliance requirements are accelerating the adoption of dust-free systems.

- North America: A mature market focused on adopting advanced, automated, and IoT-enabled chutes. Demand is driven by strict OSHA regulations concerning dust exposure (particularly silica dust) and the need for precision loading in grain handling and high-value mineral processing. High initial capital costs are offset by long-term operational efficiency and mandatory compliance features.

- Europe: Characterized by stringent environmental standards (e.g., REACH, specific EU directives on particulate emissions), leading to high demand for fully enclosed, integrated dust aspiration, and low-noise solutions. The market exhibits slower volume growth but higher expenditure per unit on specialized, customized systems for chemicals, pharmaceuticals, and agricultural materials.

- Latin America: Growth is concentrated in resource-rich nations like Brazil, Chile, and Peru, fueled by large-scale copper, iron ore, and agricultural commodity exports. The market is highly price-sensitive but is increasingly moving towards durable, high-capacity standard telescopic chutes to handle growing export volumes and operational efficiency demands.

- Middle East and Africa (MEA): An emerging market showing strong growth, particularly in the Arabian Gulf (cement, construction materials) and resource extraction areas in South and West Africa (minerals, phosphates). Demand is generally focused on rugged, reliable equipment that can withstand extreme temperatures and difficult operational environments, often prioritizing durability over advanced automation features initially.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Truck Loading Chute Market.- FLSmidth

- Metso Outotec

- Martin Engineering

- PEBCO, Inc.

- Cimbria

- Hapman

- Telestack

- ASTEC Industries

- FEECO International

- Simatek Bulk Systems

- VSR Industrietechnik GmbH

- Wamgroup S.p.A.

- HMA Group

- Rulmeca Group

- N.V. Michels S.A.

- DCL, Inc.

- Spiroflow Systems

- Eriez Manufacturing

- Guttridge Limited

- JVI Vibratory Equipment

Frequently Asked Questions

Analyze common user questions about the Truck Loading Chute market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary mechanisms used in modern truck loading chutes to effectively control dust?

Modern truck loading chutes utilize telescopic designs with integrated dust skirts and sealed cones to minimize fugitive dust. The most effective systems include automated aspiration ports connected to centralized dust collectors or incorporate dry fogging systems that suppress airborne particulates by agglomeration before discharge. The objective is to maintain a negative pressure environment within the chute structure.

How does the choice of internal chute lining material affect operational lifespan and maintenance costs?

The choice of internal lining material directly correlates with the chute’s resistance to abrasion and impact, which dictates maintenance frequency. High-performance linings like specialized ceramics, basalt, and UHMW polyethylene offer significantly longer lifespans than standard steel, reducing downtime and replacement costs, especially when handling highly abrasive materials such as iron ore or sharp aggregates.

In the Truck Loading Chute Market, what role does IoT integration play in enhancing overall efficiency?

IoT integration enables real-time monitoring of critical operational parameters such as material flow rate, chute position, vibration levels, and internal temperature. This data facilitates dynamic adjustment of loading parameters for optimized speed and load distribution, supports predictive maintenance scheduling, and provides compliance officers with continuous data logs on dust emissions and throughput accuracy.

Which end-use industry segment is currently driving the highest demand for advanced telescopic chute systems?

The Mining Industry, closely followed by the Construction and Cement sector, currently drives the highest demand for advanced telescopic chute systems. This is due to the necessity of handling massive volumes of abrasive materials quickly while adhering to increasingly strict environmental regulations regarding particulate emissions (PM10 and PM2.5) at resource extraction and processing facilities.

What are the key differentiating factors between modular chute designs and traditional fixed systems?

Modular chute designs offer flexibility, standardized components, and easier assembly/disassembly, significantly reducing installation time and facilitating rapid internal liner replacement. Traditional fixed systems, while structurally simpler, require specialized welding and custom fabrication, making modifications or replacements significantly more time-consuming and costly, especially in constrained operational environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager