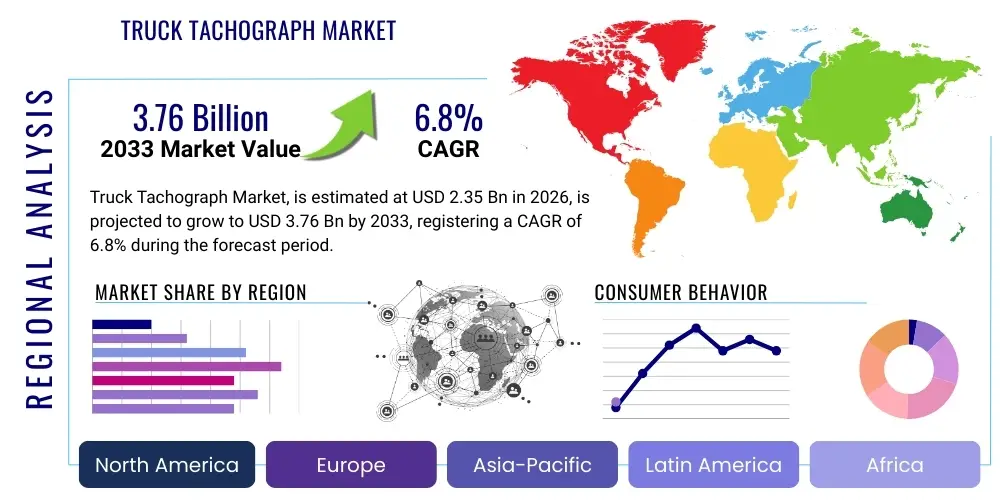

Truck Tachograph Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438116 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Truck Tachograph Market Size

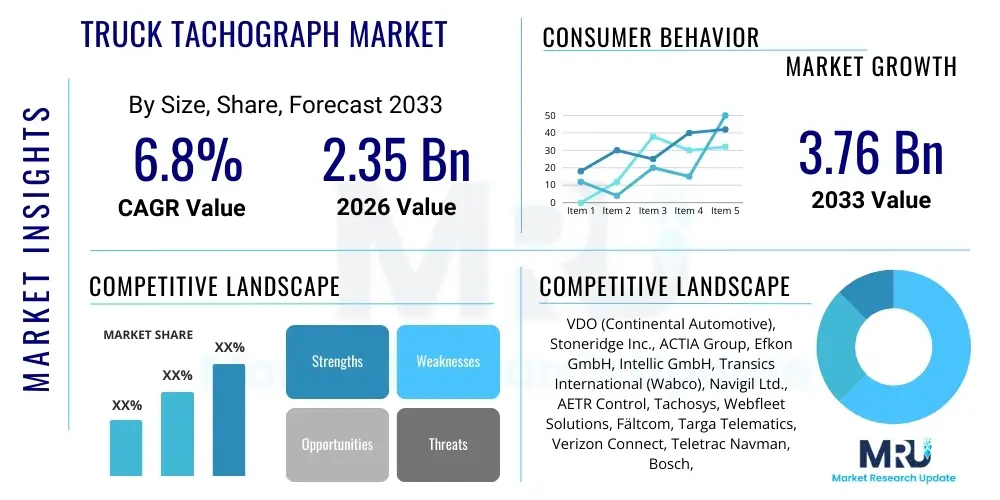

The Truck Tachograph Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 2.35 Billion in 2026 and is projected to reach USD 3.76 Billion by the end of the forecast period in 2033. This consistent expansion is predominantly fueled by stringent regulatory frameworks across major economies, particularly the European Union (EU), which mandates the continuous adoption of advanced digital and smart tachographs to ensure road safety and fair competition within the transport sector. The increasing focus on minimizing driver fatigue and optimizing logistics operations further solidifies this growth trajectory, driving demand for technologically sophisticated monitoring solutions integrated with fleet management systems.

Truck Tachograph Market introduction

The Truck Tachograph Market encompasses the manufacturing, sales, and service of recording devices installed in commercial vehicles, primarily heavy goods vehicles (HGVs) and buses, designed to monitor and record vehicle speed, distance covered, and crucially, driver activity including driving, working, availability, and rest periods. Initially introduced as analog devices, the market has undergone a complete transformation toward digital and, more recently, smart tachographs (incorporating GNSS and DSRC capabilities) which offer enhanced security, improved data integrity, and seamless integration with intelligent transport systems. These devices are fundamental components of modern fleet compliance infrastructure, serving as regulatory tools to enforce standardized working hours and combat illegal manipulation of records, thereby promoting safer roads and preventing unfair labor practices.

Major applications of truck tachographs center on regulatory compliance, fleet management optimization, and insurance risk assessment. Beyond fulfilling legal requirements set by governmental bodies like the European Commission (EC) and equivalent bodies in other regions, modern tachographs provide granular data that fleet operators leverage for optimizing driver scheduling, minimizing fuel consumption through better driving behavior analysis, and enhancing overall operational efficiency. The benefits derived from the adoption of these systems include a significant reduction in road accidents linked to driver fatigue, streamlined processes for roadside checks, and the provision of tamper-proof evidence for legal and operational audits. Furthermore, the integration with telematics platforms is transforming the tachograph from a passive recording tool into an active data source for predictive maintenance and real-time performance management.

The primary driving factors sustaining the market's robust growth include the ongoing mandatory upgrade cycles, notably the introduction of Smart Tachograph Version 2 (ST2) requirements in the EU, which necessitates the replacement of older generation devices. Other key drivers involve the global harmonization efforts concerning driver working hours, particularly in emerging markets recognizing the economic and safety imperative of structured regulatory compliance. The technological shift towards fully integrated, secure, and remote-download capable devices makes compliance less burdensome for logistics companies, simultaneously providing them with valuable operational data. This dual benefit—regulatory fulfillment and operational enhancement—positions the tachograph market for sustained investment and innovation over the forecast period.

Truck Tachograph Market Executive Summary

The Truck Tachograph Market is characterized by intense technological evolution driven primarily by regulatory mandates emanating from Europe, which sets the global benchmark for device complexity and functionality. Current business trends indicate a strong move towards subscription-based software services accompanying the hardware sale, focusing on automated data analysis, remote download capabilities, and seamless integration into larger Transport Management Systems (TMS). Market players are investing heavily in secure data processing and cloud-based solutions to address the increasing volume and complexity of mandatory data storage and retrieval. Geographically, Europe remains the cornerstone of the market due to its rigorous enforcement of regulations (EU Mobility Package 1), while Asia Pacific, driven by rapid industrialization and modernization of logistics fleets in countries like China and India, represents the fastest-growing regional market, transitioning from legacy analog systems directly to sophisticated digital solutions.

Segment trends highlight the dominance of the Digital Tachograph segment, rapidly being superseded by the Smart Tachograph segment, which is expected to command the largest market share by 2030 due to compulsory adoption schedules. The aftermarket segment, concerning replacement and retrofitting older vehicles, continues to offer lucrative opportunities, especially as new regulations require older vehicles operating cross-border to adopt the latest technology. From an end-user perspective, large logistics and freight companies represent the primary revenue stream, demanding sophisticated, network-enabled devices, while smaller owner-operators drive demand for cost-effective, easily manageable solutions. The integration of tachograph data with secondary services, such as driver training optimization and insurance underwriting, is a significant emerging trend reshaping the value proposition of these devices beyond simple compliance.

Furthermore, the competitive landscape is consolidated, dominated by a few major manufacturers that possess the necessary R&D capabilities and regulatory certifications required to supply mandated equipment. Strategic partnerships between hardware manufacturers and telematics providers are crucial for expanding market penetration and offering holistic compliance and fleet management packages. Challenges persist regarding cybersecurity, as the sensitive nature of driver and vehicle data necessitates robust security protocols, making hardware and software security a critical differentiating factor. The future trajectory of the market is unequivocally tied to regulatory updates, specifically those that require advanced data processing and real-time connectivity, pushing the boundaries of traditional recording devices into sophisticated IoT nodes within the commercial vehicle ecosystem.

AI Impact Analysis on Truck Tachograph Market

Users frequently inquire about how Artificial Intelligence (AI) can move tachographs beyond simple historical data recording, specifically asking about real-time driver fatigue prediction, automated infringement detection using predictive modeling, and the potential for AI to challenge or validate human regulatory oversight. The central concern revolves around AI's capacity to integrate vast amounts of tachograph data (driving hours, speed profiles, rest quality) with other contextual data (weather, route complexity, driver medical records) to offer actionable, preventative insights rather than just post-incident reports. Key expectations focus on AI enhancing regulatory compliance management by providing fleet managers with automated, deep behavioral analytics, thereby drastically reducing manual data analysis time and improving overall road safety outcomes beyond current deterministic rule-based systems.

AI's primary influence is pivoting the tachograph's role from a compliance recorder to a real-time driver performance and safety predictor. Machine learning algorithms can analyze complex patterns in historical driving data, identifying subtle deviations indicative of impending fatigue or reckless driving behavior long before a rule is technically violated. This predictive capability allows fleet management systems to issue preventative alerts, recommend mandatory breaks, or even adjust route planning dynamically to minimize risk. Furthermore, AI streamlines the often-laborious task of remote data analysis, automating the categorization and flagging of potential breaches or anomalies, making audit trails far more efficient and accurate for both operators and enforcement agencies. This shift transforms compliance from a reactive reporting function to a proactive risk management discipline.

The integration of AI also addresses the challenge of data volume generated by smart tachographs. With high-frequency data logging, manual inspection becomes impractical. AI tools apply pattern recognition to identify attempted data manipulation or complex schemes of rule avoidance, increasing the integrity of the data stream. Moreover, by correlating tachograph data with in-cab camera feeds and physiological sensors (if integrated), AI can generate holistic safety scores for drivers, facilitating targeted training programs and incentivizing safer driving behavior. This robust, intelligent layer over the raw tachograph output is redefining the competitive advantage in the market, favoring manufacturers and software providers that can efficiently operationalize AI-driven compliance and safety insights for their fleet customers.

- AI enables real-time, predictive analysis of driver fatigue based on complex historical and contextual data.

- Machine learning algorithms automate the detection of subtle non-compliance patterns and potential data manipulation.

- Integration with fleet management systems allows AI to optimize resource allocation and scheduling based on compliance constraints.

- AI facilitates the creation of comprehensive driver risk profiles and personalized safety training modules.

- Automated reporting and audit preparation significantly reduce administrative overhead for fleet operators.

DRO & Impact Forces Of Truck Tachograph Market

The Truck Tachograph Market is powerfully shaped by a combination of stringent regulatory mandates acting as major drivers, counterbalanced by technological hurdles and high initial investment costs as key restraints, while the expansion into new geographical regions and the evolution of integrated telematics systems present substantial opportunities. The primary driver is the unyielding legislative requirement, particularly the enforcement of the EU Mobility Package 1, which necessitates the mass adoption of Smart Tachograph Version 2, accelerating the replacement cycle and stimulating hardware sales significantly across Europe. This regulatory environment creates a captive market for certified manufacturers. The impact force of these drivers is extremely high, as compliance is mandatory for cross-border and even domestic transport operations in regulated zones, directly influencing purchase decisions regardless of short-term economic fluctuations.

Restraints primarily revolve around the initial capital expenditure associated with upgrading an entire fleet, especially for Small and Medium-sized Enterprises (SMEs), and the complexity of ensuring seamless integration and training for drivers transitioning from analog or older digital systems. Furthermore, global market fragmentation, where regulatory standards differ significantly between North America (relying more on Electronic Logging Devices - ELDs) and the EU, complicates product development and market entry strategies for global players. The perceived technological intrusion and privacy concerns related to constant monitoring also act as a soft restraint, requiring careful management of data security protocols and driver acceptance. However, the impact force of these restraints is considered moderate, as the mandatory nature of the solution ultimately overrides cost concerns in regions with strict enforcement.

Opportunities are largely concentrated in the development of ancillary services, specifically integrating tachograph data streams with sophisticated telematics and AI-driven platforms that provide value-added services such as optimized routing, fuel efficiency tracking, and predictive maintenance schedules. Expanding regulatory adoption in regions like Latin America, the Middle East, and parts of Asia that are standardizing their logistics operations offers fertile ground for growth, allowing manufacturers to leapfrog older technologies and deploy smart systems directly. The strong impact force of these opportunities is driven by the fact that modern tachographs are no longer standalone compliance tools but crucial data sources for the entire digital logistics ecosystem, positioning manufacturers who successfully pivot to integrated solutions for long-term strategic growth and higher margin service revenue.

Segmentation Analysis

The Truck Tachograph Market is comprehensively segmented based on the Type of Tachograph, the Vehicle Type utilizing the device, the Sales Channel, and the End-User application. Understanding these segments is crucial as the market evolves rapidly based on technology mandates. The segmentation by Type, specifically the shift from Analog to Digital and subsequently to Smart Tachographs, dictates the investment priorities of manufacturers and the purchasing cycles of fleet operators. The mandatory nature of regulatory upgrades means that the Smart Tachograph category is poised for the most significant expansion, driven by the requirement for advanced functionalities like authenticated location tracking via GNSS and improved enforcement capabilities through Dedicated Short Range Communication (DSRC).

Segmentation by Vehicle Type is critical, differentiating between Heavy Commercial Vehicles (HCVs) and Light Commercial Vehicles (LCVs). While HCVs, particularly long-haul trucks, form the traditional core market due to mandatory requirements for international transport, LCVs are increasingly being included under national or regional compliance regulations, broadening the addressable market, especially in urban logistics and last-mile delivery. The Sales Channel segmentation—OEM vs. Aftermarket—is also vital; OEM sales are driven by new vehicle registrations and built-in technology mandates, while the aftermarket is sustained by the retrofitting required for existing fleets to comply with evolving regulatory updates, offering more stable, long-term revenue streams for service providers and distributors.

The End-User segmentation primarily includes transportation and logistics companies, public transit authorities, and specialized fleet operators (e.g., construction and utility vehicles). The varying size and operational requirements of these end-users influence the complexity and ancillary services demanded from tachograph systems. Large international freight carriers require robust, remote-download systems integrated across multiple jurisdictions, whereas smaller, localized transit operators may prioritize simpler, cost-effective compliance solutions. Analyzing these segments provides a clear map of where regulatory pressure meets commercial utility, highlighting the most promising areas for technological deployment and service expansion across the value chain.

- Type of Tachograph:

- Analog Tachographs

- Digital Tachographs (DT)

- Smart Tachographs (ST1 and ST2)

- Vehicle Type:

- Heavy Commercial Vehicles (HCV)

- Light Commercial Vehicles (LCV)

- Buses and Coaches

- Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Retrofitting and Replacement)

- Component:

- Hardware (Recording Units, Sensors, Cables)

- Software and Services (Data Analysis, Archiving, Telematics Integration)

- Application:

- Compliance and Enforcement

- Fleet Management and Optimization

Value Chain Analysis For Truck Tachograph Market

The value chain for the Truck Tachograph Market begins upstream with raw material suppliers and high-tech component manufacturers specializing in highly secure microprocessors, GNSS modules, cryptographic hardware, and precision sensors. Given the regulatory requirement for device security and tamper-proofing (mandated by EU Annex 1C specifications), the procurement of certified, high-quality components is paramount and often involves limited, specialized suppliers, leading to rigorous quality control processes in the upstream supply chain. Manufacturing and assembly follow, dominated by a few global technology companies that invest heavily in R&D to meet complex certification standards (e.g., approval by relevant transport authorities), which act as a high barrier to entry. This manufacturing stage involves sophisticated calibration, cryptographic key management, and robust production facilities capable of high-volume, precision electronics assembly required for automotive grade devices.

The downstream activities involve distribution, installation, calibration, and essential after-sales services. Distribution channels operate through both Direct and Indirect methods. Direct sales primarily occur in the OEM channel, where manufacturers supply integrated systems directly to commercial vehicle assembly lines (truck and bus manufacturers). The indirect channel, which supports the lucrative aftermarket, relies heavily on a network of certified distributors, specialized tachograph workshops, and qualified fitters who handle the complex installation, mandatory two-year calibration checks, and repair services required by law. These certified workshops are crucial choke points in the value chain, as they must maintain specific authorizations and technical competencies to handle the legally mandated security elements of the device.

Software and data services constitute the final, high-value layer of the downstream chain. Post-installation, the tachograph generates voluminous mandatory data that must be securely downloaded (remotely or manually) and archived for specified periods (e.g., one year in the EU). Specialized software providers offer these archiving, analysis, and reporting tools, often bundling them with broader fleet management and telematics packages. This shift towards data service provision represents a significant monetization opportunity, moving the value chain beyond one-time hardware sales towards recurring software subscription revenue. The security and compliance assurance offered by these data management platforms are critical to end-users, differentiating high-value providers who can seamlessly integrate compliance data into operational decision-making processes.

Truck Tachograph Market Potential Customers

Potential customers, or End-Users/Buyers, in the Truck Tachograph Market are overwhelmingly commercial entities whose operations rely on the movement of goods or people, and who are legally obliged to monitor driver working hours. The largest segment comprises large-scale international and national road freight and logistics companies (e.g., third-party logistics providers or 3PLs). These customers require advanced, smart tachographs that facilitate remote data download and integrate seamlessly with complex, multi-jurisdictional fleet management software, ensuring continuous compliance across borders and minimizing downtime related to manual data handling. Their purchasing decisions are heavily influenced by total cost of ownership (TCO), reliability, data security guarantees, and the ease of regulatory auditing.

A secondary, yet rapidly expanding, customer segment includes local and regional haulage companies and Small to Medium-sized Enterprises (SMEs) that operate small to mid-sized fleets. While equally bound by compliance laws, these customers often prioritize ease of use, competitive upfront pricing, and straightforward data archiving solutions, sometimes preferring simplified, bundled packages offered by local service providers. The continuous inclusion of smaller vehicles and operations into regulatory mandates, particularly within specific national contexts, ensures a steady stream of demand from this segment for both new installations and compliance upgrades. Their needs often drive innovation in user-friendly interfaces and simplified data management applications, accessible via mobile platforms.

Furthermore, specialized end-users include public transport authorities and private bus and coach operators, construction and utility companies with specialized vehicle fleets, and governmental organizations that operate heavy-duty vehicles (e.g., road maintenance or emergency services). These sectors drive demand based on specific operational requirements; for instance, public transit needs highly reliable, long-lifecycle devices suitable for frequent stop-start operations, whereas construction fleets require rugged devices capable of handling severe operational environments. All potential customers, regardless of segment, fundamentally seek solutions that minimize the risk of regulatory fines, maximize vehicle uptime, and provide actionable insights to enhance driver performance and safety, making the tachograph a critical operational tool.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.35 Billion |

| Market Forecast in 2033 | USD 3.76 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | VDO (Continental Automotive), Stoneridge Inc., ACTIA Group, Efkon GmbH, Intellic GmbH, Transics International (Wabco), Navigil Ltd., AETR Control, Tachosys, Webfleet Solutions, Fältcom, Targa Telematics, Verizon Connect, Teletrac Navman, Bosch, Geotab. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Truck Tachograph Market Key Technology Landscape

The technology landscape of the Truck Tachograph Market is defined by continuous digital evolution, regulatory security requirements, and the convergence of recording devices with broader IoT and telematics platforms. The core technology centers around high-precision recording hardware, including motion sensors (usually DSRC/GPS integrated) and secure data processing units designed to be tamper-proof and cryptographically secure, complying strictly with standards like the European Regulation 165/2014. The transition from older digital tachographs (DT) to Smart Tachographs (ST1 and ST2) introduces critical new technologies: the integration of Global Navigation Satellite System (GNSS) modules for automatic location logging at key driving events, and Dedicated Short Range Communication (DSRC) capabilities, allowing roadside enforcement officers to wirelessly check for potential compliance breaches without stopping the vehicle. These technologies significantly enhance enforcement efficiency and data integrity, setting a high bar for technological sophistication and security for market entrants.

A crucial technological component is the development and deployment of robust software for data management, remote download, and analysis. Modern tachograph systems rely heavily on secure cloud infrastructure for archiving the legally required data and sophisticated proprietary software algorithms to interpret complex driving patterns and generate compliance reports automatically. The focus has shifted toward predictive maintenance of the tachograph itself and integrated software solutions that leverage the recorded data for business intelligence. For instance, manufacturers are increasingly offering mobile applications and web portals that allow drivers and fleet managers real-time access to compliance status and remaining driving hours, transforming regulatory burden into an operational advantage. Furthermore, the cryptographic security required for driver cards and vehicle units is a constant area of research, ensuring the immutability of recorded data against cyber threats and physical tampering.

Looking ahead, the technological evolution is centered on further integration with advanced driver-assistance systems (ADAS) and vehicle data buses (CAN bus) to capture richer contextual data. The anticipated next generation of tachographs will likely utilize enhanced biometric security features for driver identification and integrate AI for advanced data validation and predictive modeling, as detailed in the AI analysis section. The widespread adoption of remote data services, driven by efficiency demands, requires highly secure and reliable mobile connectivity protocols. Technological competition is therefore not just in hardware longevity and accuracy, but increasingly in providing a seamless, secure, and insightful software layer that extracts maximum value from the mandated compliance data, making the tachograph an indispensable component of the fully connected commercial vehicle.

Regional Highlights

- Europe: Europe stands as the mature epicenter of the Truck Tachograph Market, underpinned by the stringent and continuously evolving legislation of the European Union (EU) and AETR (European Agreement concerning the work of crews of vehicles engaged in international road transport). The market here is defined by compulsory replacement cycles, most notably the ongoing migration to Smart Tachograph Version 2 (ST2), mandated across all new and retrofitted heavy vehicles engaged in cross-border haulage. High penetration rates, combined with robust enforcement mechanisms and a consolidated service network (certified workshops), ensure stable, high-value demand, primarily concentrated on the sophisticated hardware and associated cloud-based compliance services.

- North America: The North American market operates under a different regulatory structure, primarily utilizing Electronic Logging Devices (ELDs) mandated by the FMCSA (Federal Motor Carrier Safety Administration) in the U.S. and equivalent Canadian regulations. While ELDs perform similar functions (Hours of Service recording), the architecture and data standards differ from the European tachograph. The opportunity here lies in manufacturers adapting their robust, tamper-proof hardware technology to meet ELD specifications, focusing on reliability and integration with US-centric fleet management platforms. The market is driven by compliance with the ELD mandate and the need for enhanced data security in the competitive logistics environment.

- Asia Pacific (APAC): APAC is the fastest-growing region, driven by the rapid expansion of logistics infrastructure, increasing trade volumes, and growing governmental awareness regarding road safety and labor law standardization in emerging economies like India, China, and Southeast Asia. Many nations are in the process of adopting or considering regulatory frameworks analogous to the EU model, or are transitioning directly from zero regulation to digital/smart monitoring systems. The market demand is characterized by a high volume requirement for cost-effective digital solutions and the establishment of new regulatory compliance ecosystems, offering significant Greenfield opportunities for key players to secure early market dominance.

- Latin America: This region presents a market of significant potential, characterized by varied regulatory maturity across countries. Brazil and Mexico show relatively higher adoption rates of digital monitoring, often mandated in certain sectors or for specific vehicle types, while other countries are still defining their regulatory approach. The primary drivers are internal governmental efforts to formalize the transport sector, reduce illegal manipulation, and improve road accident statistics. Market players focus on localized solutions that handle diverse geographical and infrastructure challenges while supporting basic digital compliance functionality.

- Middle East and Africa (MEA): The MEA market is highly diverse. GCC countries, benefiting from substantial infrastructure investments and modernizing logistics hubs (e.g., UAE, Saudi Arabia), are increasingly adopting digital monitoring devices to align with international transport standards and improve safety on long-haul desert routes. Africa's market remains nascent but offers future growth potential tied to large-scale infrastructure projects and international aid-backed initiatives promoting safer trucking standards. Demand often prioritizes rugged hardware capable of operating in harsh climates and remote connectivity solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Truck Tachograph Market.- VDO (Continental Automotive)

- Stoneridge Inc.

- ACTIA Group

- Efkon GmbH

- Intellic GmbH

- Transics International (Wabco)

- Navigil Ltd.

- AETR Control

- Tachosys

- Webfleet Solutions

- Fältcom

- Targa Telematics

- Verizon Connect

- Teletrac Navman

- Bosch

- Geotab

- Tachonet

- Digital Tachograph Solution Provider (DTSP)

- ORBCOMM

- Microlise Group

Frequently Asked Questions

Analyze common user questions about the Truck Tachograph market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Digital and Smart Tachographs?

The Smart Tachograph (ST), particularly Version 2 (ST2), is an evolution of the Digital Tachograph (DT). ST units incorporate mandatory advanced features such as authenticated GNSS for automatic geographical positioning, improved cryptographic security, and Dedicated Short Range Communication (DSRC) for wireless roadside checks by enforcement authorities, making data integrity higher and auditing easier compared to standard DT models.

How do regulatory mandates, particularly the EU Mobility Package, drive market growth?

EU regulatory mandates are the primary market driver because they create a non-negotiable demand for device upgrades and replacements. The Mobility Package 1, for instance, dictates the mandatory installation of Smart Tachograph Version 2 (ST2) in all newly registered commercial vehicles and requires existing international fleets to retrofit these devices by specific deadlines, ensuring a continuous, scheduled demand cycle for manufacturers and service providers across Europe and AETR countries.

What role does the Aftermarket segment play in the Truck Tachograph industry?

The Aftermarket segment, encompassing retrofitting, replacements, calibration, and repair services, is critical and highly stable. It provides ongoing revenue driven by mandatory two-year calibration checks and the necessity for older operational fleets to upgrade their recording devices to comply with new regulations (e.g., replacing analog with digital or DT with ST1/ST2), ensuring long-term profitability for certified workshops and service providers.

What are the main security concerns associated with truck tachographs?

The primary security concerns involve data manipulation and tampering, as accurate driver records are vital for legal compliance and safety. Modern Smart Tachographs mitigate this through advanced cryptographic hardware, secure processors, external seals, and the use of GNSS authentication. Manufacturers must obtain high-level security certification to prevent unauthorized data alteration or device spoofing, making cybersecurity integral to product design and regulatory approval.

In which geographical region is the highest future growth anticipated for this market?

The Asia Pacific (APAC) region is anticipated to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid industrialization, massive investments in logistics infrastructure, and the nascent adoption of digital regulatory frameworks in populous economies like China and India. This shift from unregulated or analog systems directly to modern digital and smart solutions provides a substantial high-volume growth opportunity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager