Trucking Accounting Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432553 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Trucking Accounting Software Market Size

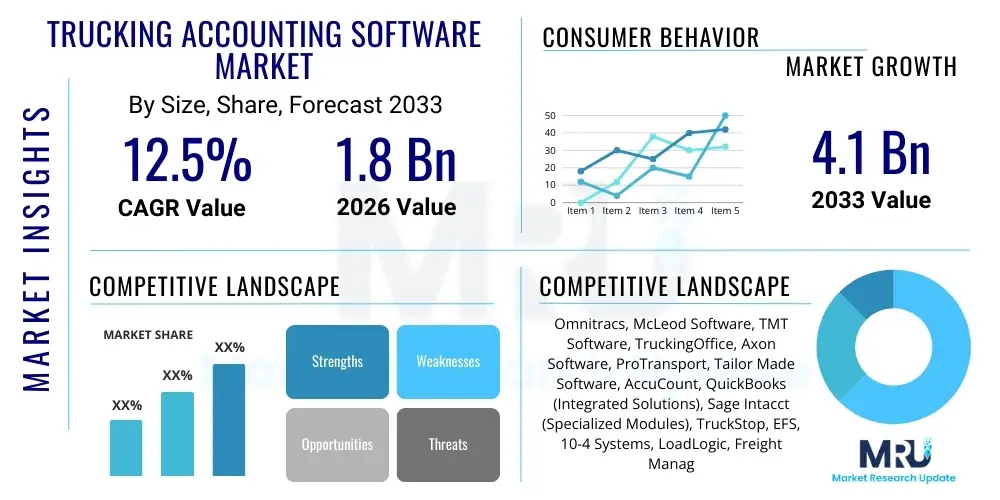

The Trucking Accounting Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 4.1 Billion by the end of the forecast period in 2033.

Trucking Accounting Software Market introduction

The Trucking Accounting Software Market encompasses specialized financial management solutions designed specifically for the transportation and logistics industry. These applications go beyond generic accounting tools, integrating unique industry requirements such as fuel tax reporting (IFTA), driver settlements, load profitability analysis, and complex invoicing structures typical of freight management. The core purpose of this software is to streamline financial operations, ensure regulatory compliance, and provide accurate, real-time insights into fleet profitability, moving the industry away from manual processes or generic ERP systems that fail to address trucking-specific nuances.

Product descriptions typically highlight modules covering accounts payable (AP), accounts receivable (AR), general ledger (GL), and, critically, dedicated modules for owner-operator settlements, payroll integration, and equipment maintenance tracking integrated with depreciation schedules. Major applications include small to medium-sized trucking companies (SMEs), large enterprise fleet operators, and third-party logistics (3PL) providers managing their own assets. The shift towards cloud-based, subscription models (SaaS) is a significant trend, offering scalability and accessibility that is crucial for decentralized trucking operations.

The primary benefits driving market adoption include enhanced financial accuracy, significant time reduction in back-office tasks, improved compliance with state and federal transportation regulations, and optimized cash flow management through faster invoicing cycles. Key driving factors include the increasing complexity of regulatory reporting (especially IFTA andELD mandates), the growing necessity for real-time data integration with telematics and TMS (Transportation Management Systems), and the intense competitive pressure forcing carriers to maximize operational efficiency and scrutinize load profitability at a granular level.

Trucking Accounting Software Market Executive Summary

The Trucking Accounting Software Market is characterized by robust growth, driven primarily by the mandatory digital transformation within the logistics sector and the increasing need for integrated financial and operational data. Business trends indicate a strong preference for SaaS delivery models over on-premise deployments, facilitating rapid adoption among small and mid-sized carriers who require flexible, low-CAPEX solutions. Mergers and acquisitions (M&A) among established software vendors are reshaping the competitive landscape, leading to platform consolidation that offers end-to-end solutions combining accounting, dispatch, and telematics functionalities. Furthermore, the rising cost of fuel and labor is pressuring carriers to adopt software that offers detailed expense tracking and predictive analytics for cost control.

Regionally, North America maintains the largest market share due to its vast transportation infrastructure, strict regulatory framework (requiring sophisticated IFTA and payroll processing), and high penetration of advanced fleet management technologies. However, Asia Pacific (APAC) is projected to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by the rapid expansion of e-commerce, infrastructure investment, and the subsequent modernization of local trucking fleets in emerging economies like India and China. Europe follows a steady growth trajectory, influenced by cross-border complexities and varied VAT regulations, pushing demand for localized, compliant accounting solutions.

Segmentation trends highlight that the adoption rate is highest among small and medium enterprises (SMEs), largely due to the accessibility and affordability of cloud-based solutions tailored to their specific scale. In terms of deployment, the cloud segment dominates the market, offering superior interoperability and reduced IT overhead compared to traditional on-premise systems. Furthermore, specialized modules focusing on compliance and profitability analysis, such as integrated fuel card reconciliation and equipment depreciation tracking, are seeing increased demand as carriers seek deeper financial control beyond basic ledger management.

AI Impact Analysis on Trucking Accounting Software Market

Common user questions regarding AI's impact revolve around how artificial intelligence can automate labor-intensive tasks, specifically invoice processing, expense categorization, and proactive fraud detection. Users frequently inquire about the feasibility of AI-driven compliance checks, asking if machine learning algorithms can predict potential IFTA audit flags or automatically adjust driver payroll based on complex contract rules and Hours of Service (HOS) data. Furthermore, significant interest lies in how AI can move accounting software beyond historical reporting to genuine predictive financial modeling, such as forecasting optimal maintenance schedules based on expense history and route data, or predicting future cash flow fluctuations based on seasonal freight volumes. The prevailing sentiment is a blend of high expectation for efficiency gains and a cautious approach regarding data privacy and the accuracy of automated financial decisions.

The integration of AI and Machine Learning (ML) is fundamentally transforming the Trucking Accounting Software market by introducing layers of automation and predictive capability that significantly enhance operational finance. AI algorithms are now deployed to perform intelligent data entry, automatically extracting and verifying details from thousands of expense receipts, bills of lading, and fuel slips, drastically reducing manual errors and processing time for Accounts Payable departments. This automation allows accounting staff to shift focus from data entry to high-value financial analysis and strategic planning. Moreover, the ML systems learn from historical transaction patterns, improving the speed and accuracy of complex tasks like assigning costs to specific loads or generating compliant IFTA reports by classifying jurisdiction mileage automatically based on GPS/telematics data.

Beyond automation, AI is crucial in offering predictive financial insights. ML models analyze historical profitability data across various lanes, equipment types, and driver cohorts to identify hidden cost centers and optimize pricing strategies for future loads. Furthermore, intelligent systems are being leveraged for advanced fraud detection, flagging anomalies in expense reports or duplicate invoicing patterns that human reviewers might miss. This proactive financial health monitoring, coupled with improved cash flow forecasting based on anticipated payment delays, positions AI-enhanced accounting software as a critical competitive advantage for modern trucking companies focused on maximizing thin profit margins.

- Automated Invoice Processing: AI extracts and verifies details from freight documents (BOLs, PODs, Invoices), accelerating Accounts Payable cycles.

- Intelligent Expense Categorization: Machine learning automatically allocates fuel, maintenance, and toll costs to correct loads or cost centers.

- Predictive Cash Flow Forecasting: Algorithms analyze historical payment trends and freight contracts to forecast future liquidity needs accurately.

- Enhanced Regulatory Compliance: AI assists in error-proofing IFTA calculations by cross-referencing mileage logs with fuel purchase data.

- Fraud and Anomaly Detection: ML models identify unusual transaction patterns in maintenance or driver expense reports, minimizing financial leakage.

- Optimized Driver Settlement: Complex payroll calculations, integrating deductions, bonuses, and HOS compliance data, are automated by AI logic.

DRO & Impact Forces Of Trucking Accounting Software Market

The Trucking Accounting Software Market is primarily driven by the imperative for regulatory compliance and the critical need for integrating operational data (Telematics/TMS) with financial records to achieve accurate profitability analysis. Key restraints include the high initial implementation costs for large enterprise systems and the inherent resistance to change among smaller, family-owned trucking businesses accustomed to legacy processes. Significant opportunities exist in developing specialized solutions for niche transport segments (e.g., hazmat, refrigerated transport) and leveraging API integrations to create seamless, holistic digital ecosystems for carriers. The market forces exert high pressure due to intense competition among vendors offering cloud-native solutions, while technological shifts toward AI and blockchain necessitate continuous product innovation to maintain relevance.

Drivers: The dominant driver is the increasing regulatory burden, including complex IFTA, weight-mile tax, and evolving payroll regulations, which mandate automated, error-free reporting that generic software cannot handle. Furthermore, the proliferation of real-time data generated by ELDs and telematics systems has created a demand for accounting software that can seamlessly ingest and utilize this operational data (e.g., driver hours, route efficiency, fuel consumption) to calculate the true cost per mile and per load. Digital transformation initiatives across the logistics sector, accelerated by the post-pandemic focus on resilient supply chains, necessitate moving financial operations onto scalable, secure, and integrated platforms.

Restraints: Despite the benefits, significant hurdles persist. The initial capital expenditure for implementing a comprehensive, integrated accounting and TMS platform can be prohibitive for budget-conscious smaller carriers. Secondly, the steep learning curve and the necessity for extensive training often lead to resistance from long-tenured employees who prefer familiar spreadsheet-based systems. Data security concerns, particularly regarding sensitive financial and employee payroll information stored in cloud environments, also act as a constraint, demanding robust encryption and compliance from software providers. Legacy system inertia, where carriers are locked into outdated but functional software, slows down market penetration.

Opportunities: The greatest opportunities lie in expanding SaaS offerings that cater specifically to the owner-operator and micro-fleet segment, providing lightweight, mobile-first accounting tools. Furthermore, the convergence of accounting software with predictive analytics and business intelligence (BI) tools allows vendors to market solutions focused on profit optimization rather than just compliance management. Globally, expansion into emerging markets (APAC, MEA) where manual accounting is prevalent offers vast untapped potential. The integration of blockchain technology to secure and automate cross-border payments, smart contracts for freight agreements, and digital documentation verification presents a next-generation opportunity for platform differentiation.

Impact Forces: Porter's Five Forces analysis indicates that competitive rivalry is intense, characterized by many medium-sized players competing on features, price, and integration capabilities. The threat of new entrants remains moderate, as developing specialized, compliant trucking accounting software requires significant domain expertise. Buyer power is high, especially among large fleet operators who often demand customized modules and favorable subscription terms. Supplier power (of underlying technology providers, such as cloud infrastructure) is moderate. The threat of substitutes, while present (generic ERP systems or advanced spreadsheets), is steadily declining as regulatory complexity makes specialized trucking software almost mandatory for serious operators.

Segmentation Analysis

The Trucking Accounting Software market is broadly segmented based on Deployment Model, Component, Organization Size, and Application. The analysis reveals that the preference for flexibility and reduced infrastructure overhead has firmly established the Cloud-based deployment model as the market leader. Within components, the Integrated Solutions segment, which combines core accounting with compliance and asset management features, is experiencing faster growth than standalone accounting modules, reflecting the industry's push toward holistic financial and operational management. Organization Size shows SMEs as the most dynamic segment due to their high volume of new software adoption. Finally, specialized application use cases, such as IFTA reporting and driver settlement management, drive demand.

Organization size segmentation provides insight into vendor focus. While large enterprises (over 1,000 trucks) require highly customized, robust systems that integrate with legacy TMS and ERP infrastructure, small and medium enterprises (SMEs, 1-1,000 trucks) often rely on standardized, scalable SaaS solutions that offer rapid implementation and lower overall cost of ownership. The SMEs segment is critical for market growth, characterized by high churn and constant introduction of new entrants into the trucking sector. Vendors are increasingly tailoring pricing structures and feature sets—such as simplified mobile applications for owner-operators—to capture this large, fragmented segment.

The Component segmentation is evolving toward comprehensive, integrated suites. Basic accounting features (GL, AP, AR) are now considered table stakes. The real value proposition lies in vertical-specific components, such as integrated maintenance modules that automatically capitalize equipment costs and calculate depreciation, or advanced fuel management systems that reconcile purchases against vehicle mileage in real-time. This integration ensures that the financial statements accurately reflect operational realities, supporting better strategic decision-making regarding asset utilization and procurement.

- Deployment Model:

- Cloud-based (SaaS)

- On-Premise

- Component:

- Integrated Suites (Accounting + TMS/Fleet Management)

- Standalone Accounting Modules

- Services (Implementation, Training, Support)

- Organization Size:

- Small and Medium Enterprises (SMEs) (1-1,000 Trucks)

- Large Enterprises (Over 1,000 Trucks)

- Application:

- Driver Settlement and Payroll

- IFTA and Regulatory Compliance Reporting

- Accounts Payable and Receivable

- General Ledger and Financial Reporting

- Equipment Maintenance and Depreciation

Value Chain Analysis For Trucking Accounting Software Market

The value chain for Trucking Accounting Software begins with upstream activities involving core software development, technological innovation (AI/ML integration), and data infrastructure provision, often relying heavily on third-party cloud service providers (AWS, Azure). Key upstream suppliers include technology vendors specializing in API connectivity for telematics and payment processing gateways, which are essential for seamless system integration. High emphasis is placed on ensuring the security and scalability of the software architecture at this initial stage, as the data managed is highly sensitive financial information, driver records, and compliance metrics.

The core midstream activities involve the development of specialized trucking modules, customization, and quality assurance. This phase focuses on adapting general accounting principles to complex industry rules, such as generating multi-jurisdictional tax reports and handling intricate owner-operator pay structures. Distribution channels are predominantly direct, where software vendors market and sell subscriptions directly to trucking companies through dedicated sales teams. This direct approach ensures technical expertise is maintained throughout the sales process and allows for better feedback mechanisms regarding industry needs.

Downstream activities center on deployment, training, and continuous support. For cloud-based solutions, deployment is swift, focusing mainly on data migration from legacy systems. Indirect distribution occasionally occurs through partnerships with larger ERP integrators or specialized transportation consultants who recommend specific software solutions. The highest value addition in the downstream segment comes from ongoing customer success initiatives, including training modules focused on maximizing efficiency (e.g., advanced IFTA reporting techniques) and offering prompt technical support essential for mission-critical financial systems.

Trucking Accounting Software Market Potential Customers

The primary customer base for Trucking Accounting Software comprises any entity involved in commercial goods transportation requiring specialized financial oversight and compliance management. The largest segment includes asset-based common carriers, ranging from single owner-operators to large national and international fleet owners managing thousands of vehicles. These customers require integrated solutions that handle driver settlements, fuel tax reporting, and maintenance cost capitalization efficiently, directly impacting their operational margins.

Beyond asset-based carriers, potential customers extend to specialized third-party logistics (3PL) providers and freight brokers who manage dedicated fleets or need robust financial tools to reconcile invoices and track costs associated with subcontracted carriers. While 3PLs may primarily focus on freight brokerage management, their asset-based divisions necessitate the same granular accounting capabilities as traditional carriers. Furthermore, private fleets, such as those operated by large retailers or manufacturers for internal logistics, are increasingly adopting specialized trucking accounting software to better benchmark and optimize their transportation costs against external carriers.

The demand drivers for these customers are consistent: maximizing profit per load, achieving mandatory regulatory compliance without error, and gaining real-time financial visibility. Small fleet owners seek affordability, ease of use, and quick IFTA reporting, making them ideal buyers for SaaS products. Conversely, large enterprises require robust integration capabilities with existing ERPs, customizable reporting, and advanced security features, leading them to invest in comprehensive, scalable solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 4.1 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Omnitracs, McLeod Software, TMT Software, TruckingOffice, Axon Software, ProTransport, Tailor Made Software, AccuCount, QuickBooks (Integrated Solutions), Sage Intacct (Specialized Modules), TruckStop, EFS, 10-4 Systems, LoadLogic, Freight Management, Transflo, Datatrac, Truckmate. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Trucking Accounting Software Market Key Technology Landscape

The technological landscape of Trucking Accounting Software is rapidly converging, moving away from disparate systems toward fully integrated, real-time ecosystems. The core technology shift is the dominance of cloud-native architecture, utilizing microservices and API-first designs, which enables easy integration with essential third-party operational tools such as Transportation Management Systems (TMS), Electronic Logging Devices (ELDs), and fuel card providers. This architectural approach supports seamless data flow, ensuring that mileage, fuel consumption, and labor hours are instantly reflected in the General Ledger, which is crucial for dynamic cost calculation and IFTA preparation. Furthermore, robust security protocols, including multi-factor authentication and advanced encryption, are becoming standard requirements, especially for cloud deployments handling sensitive financial data.

Artificial Intelligence (AI) and Machine Learning (ML) are emerging as critical differentiators. AI is applied to automate core processes like invoice scanning and expense categorization, reducing manual data entry errors. ML models are being developed to optimize driver settlement calculations, factoring in complex variable pay structures, tax withholdings across multiple states, and deductions based on operational data, significantly reducing payroll disputes and administrative overhead. This shift allows the software to transition from being merely a record-keeping tool to a proactive financial management advisor, offering predictive capabilities for cash flow and profitability analysis.

Furthermore, the utilization of advanced Business Intelligence (BI) and visualization tools built into the accounting platform is standardizing financial analysis. These tools allow trucking executives to drill down into key performance indicators (KPIs) like revenue per mile, deadhead costs, and equipment utilization directly from the financial dashboards. Blockchain technology is beginning to gain traction, primarily in supporting secure digital documentation for cross-border transactions and verifiable smart contracts for load execution, offering potential solutions for payment transparency and reducing disputes over freight charges, although its full adoption in core accounting remains nascent.

Regional Highlights

- North America: North America holds the largest share of the Trucking Accounting Software Market, characterized by the presence of vast national trucking corridors, stringent regulatory demands (specifically IFTA, US DOT regulations, and complex state payroll laws), and high technology adoption rates. The region benefits from a dense concentration of specialized software vendors and a mature logistics technology ecosystem (telematics, TMS). High labor costs and intense competition among carriers drive the demand for efficiency tools, making advanced integration capabilities essential. The US accounts for the majority of the regional market, focusing on solutions that offer comprehensive compliance reporting and sophisticated owner-operator management modules.

- Europe: The European market demonstrates steady growth, driven by the fragmentation of the logistics sector and the necessity of managing complex cross-border VAT, excise duties, and payroll across various EU member states. European carriers require highly flexible software capable of handling multiple currencies, localized tax regimes, and diverse language support. Regulatory harmonization attempts, while beneficial, still necessitate detailed reporting, pushing demand for sophisticated systems. The rapid digitalization of supply chains in Western and Northern Europe, coupled with the need for integration with digital tachographs, fuels market expansion.

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing region during the forecast period. This exponential growth is underpinned by massive infrastructural development, the explosion of e-commerce driving high freight volumes, and significant government initiatives promoting logistics efficiency in countries like China, India, and Southeast Asia. The market here is shifting from reliance on manual processes and generic software to adopting specialized, cloud-based trucking solutions. While the initial adoption of integrated systems is lower than in the West, the sheer volume of new entrants and the modernization push ensures substantial CAGR, focusing primarily on mobile-first and cost-effective solutions.

- Latin America (LATAM): The LATAM market is growing moderately, primarily focused on improving operational security and efficiency amidst complex economic environments and varying trade regulations across countries like Brazil and Mexico. Demand is concentrated among larger national carriers seeking basic digitalization of accounting functions and better control over fleet maintenance costs. Cloud adoption is accelerating as local infrastructure improves, offering vendors an opportunity to introduce entry-level, scalable solutions.

- Middle East and Africa (MEA): Growth in MEA is highly localized, concentrated around the Gulf Cooperation Council (GCC) countries due to massive logistics investments supporting oil/gas and trade hubs. Software demand focuses on fleet maintenance, asset tracking, and basic financial reporting. Regulatory environments are less standardized than in North America or Europe, but the drive for economic diversification and supply chain optimization is slowly pushing the adoption of specialized financial tools for the transportation sector.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Trucking Accounting Software Market.- Omnitracs (Part of Solera)

- McLeod Software

- TMT Software

- TruckingOffice

- Axon Software

- ProTransport

- Tailor Made Software

- AccuCount

- QuickBooks (Integrated Solutions via APIs)

- Sage Intacct (Via Partner Integrations)

- TruckStop

- EFS (Electronic Funds Source)

- Prophesy by Eclipse Business Systems

- Keeptruckin (Now Motive)

- LoadLogic

- Freight Management, Inc.

- Transflo

- Datatrac

- Truckmate (A TMW Systems Product)

- Truckers Helper

Frequently Asked Questions

Analyze common user questions about the Trucking Accounting Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between generic accounting software and trucking-specific accounting software?

Trucking-specific software integrates unique industry features such as automated IFTA fuel tax reporting, detailed driver settlement calculations (including per diem and deductions), load profitability tracking, and seamless integration with operational systems like TMS and ELDs, functions generic software lacks.

Is Cloud-based or On-premise deployment preferred in the current Trucking Accounting Software Market?

Cloud-based (SaaS) deployment is overwhelmingly preferred due to its lower initial cost, accessibility for remote drivers and decentralized offices, faster implementation, automatic updates, and superior integration capabilities with modern telematics and mobile applications.

How does AI impact compliance and IFTA reporting efficiency?

AI significantly enhances IFTA efficiency by automatically categorizing fuel purchases, cross-referencing GPS-tracked mileage data with jurisdiction requirements, and identifying potential discrepancies or errors before submission, ensuring higher compliance accuracy and drastically reducing manual preparation time.

Which geographical region dominates the Trucking Accounting Software Market?

North America currently dominates the market share due to its stringent regulatory environment, mature logistics industry structure, and high demand for integrated software solutions to manage large domestic and cross-border trucking operations efficiently.

What is the biggest challenge preventing small trucking companies from adopting new accounting software?

The biggest challenge is often the perceived high implementation cost, coupled with resistance to change among personnel accustomed to manual processes, requiring vendors to offer highly intuitive, low-cost SaaS subscriptions specifically tailored for owner-operators and micro-fleets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager