Trunnion Spherical Bearings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434039 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Trunnion Spherical Bearings Market Size

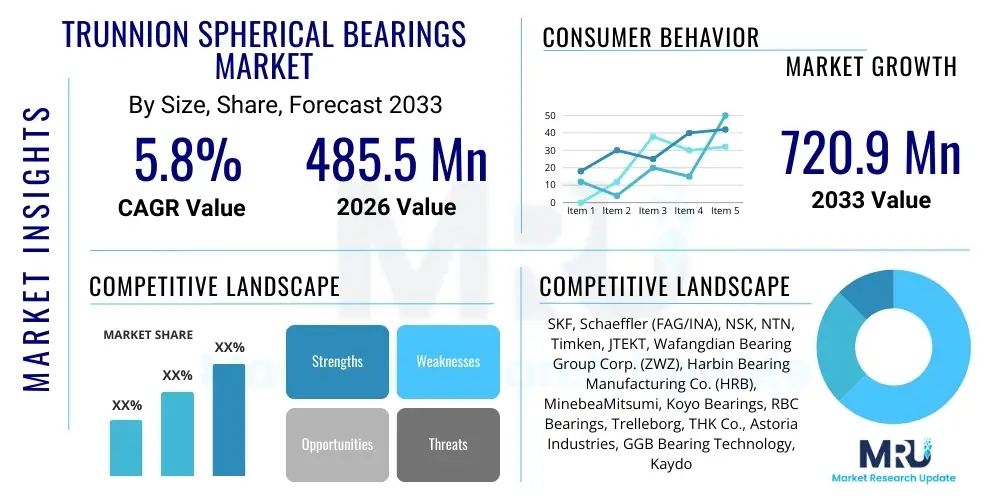

The Trunnion Spherical Bearings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 485.5 Million in 2026 and is projected to reach USD 720.9 Million by the end of the forecast period in 2033.

Trunnion Spherical Bearings Market introduction

Trunnion spherical bearings represent specialized mechanical components engineered to support high radial and axial loads while simultaneously accommodating substantial angular misalignment and oscillation. These bearings are critical in applications where structural rigidity must be maintained despite dynamic operating conditions, intense shock loads, and potential shaft deflections common in heavy machinery. Unlike standard radial bearings, trunnion variants are often integrated into heavy-duty assemblies, featuring enhanced sealing solutions and robust housing structures optimized for extreme, contaminated environments prevalent in mining, construction, and large-scale manufacturing sectors. The fundamental design allows for exceptional self-alignment, ensuring uniform load distribution across the internal bearing geometry, which is crucial for maximizing service life and minimizing catastrophic failures in essential operational equipment.

The primary applications for trunnion spherical bearings are concentrated within the heavy industrial complex, notably in large excavators and loaders used in mining operations, sophisticated pitch and yaw systems in modern wind turbines, substantial construction cranes, critical machinery within steel and paper mills, and steering or control gear used in large marine vessels. The environment in these sectors subjects components to cyclical loads, intense vibrations, and pervasive abrasive contaminants, making the inherent durability and reliability of trunnion spherical bearings indispensable for maintaining operational uptime and safety standards. Their sophisticated construction often includes hardened bearing steels, specialized lubrication channels, and comprehensive surface treatments to resist wear and corrosion.

The core benefits derived from utilizing these specific bearings include dramatically enhanced reliability, superior load-carrying capacity compared to conventional bearing types of equivalent size, and exceptional tolerance to structural deformation or thermal expansion induced misalignment. The market growth is substantially driven by the global surge in infrastructure development, particularly in emerging economies, increasing governmental investment in renewable energy projects requiring highly durable components for turbine systems, and the ongoing worldwide trend toward modernizing heavy industrial fleets. These modernization efforts aim to integrate higher efficiency, reduced maintenance intervals, and ultimately a lower total cost of ownership (TCO) into heavy equipment, favoring high-performance components like trunnion spherical bearings.

Trunnion Spherical Bearings Market Executive Summary

The Trunnion Spherical Bearings market is exhibiting robust growth, fundamentally driven by sustained global investment in capital-intensive sectors such as renewable energy infrastructure, large-scale mining operations, and expansive construction projects. Key business trends indicate a pronounced shift toward developing specialized, sealed-for-life bearing units capable of operating reliably under extreme temperature variations and persistent contamination, reflecting the industry's focus on maximizing mean time between failures (MTBF). Manufacturers are increasingly prioritizing the integration of smart sensor technology within bearing assemblies to facilitate predictive maintenance protocols, moving away from reactive repair models toward proactive asset management solutions. Furthermore, supply chain resilience remains a critical strategic pillar, prompting major players to optimize localized manufacturing and distribution networks to mitigate geopolitical and logistical risks.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, underpinned by aggressive industrialization in countries like China and India, coupled with massive government-backed infrastructure spending. North America and Europe, while mature, demonstrate stable demand driven by the replacement and maintenance of existing industrial machinery and significant penetration in the rapidly expanding offshore wind energy sector, which demands ultra-reliable, heavy-duty spherical bearings. Latin America and the Middle East & Africa (MEA) are emerging as high-potential markets, spurred by commodity extraction activities and nascent infrastructure build-out, though market penetration remains subject to volatility in global resource prices and project financing availability.

Segment-wise, the market is primarily segmented by product type (standard, heavy-duty, customized) and by application (mining, construction, energy, marine). The heavy-duty segment, designed to manage extreme shock loads and oscillating movements, is projected to maintain the highest growth rate, directly correlated with the increasing size and capacity of modern mining excavators and wind turbines. The application segment dominated by mining and construction currently holds the largest market share due to the sheer volume of equipment requiring these components, but the energy sector, particularly onshore and offshore wind farms, is anticipated to record the fastest expansion, driven by regulatory mandates and global decarbonization targets promoting renewable energy adoption.

AI Impact Analysis on Trunnion Spherical Bearings Market

User queries regarding the impact of Artificial Intelligence (AI) on the Trunnion Spherical Bearings market primarily center on maintenance optimization, product design efficiency, and supply chain forecasting. Common concerns include how AI can transition maintenance from time-based scheduling to genuine condition-based monitoring, whether machine learning algorithms can predict bearing failures with higher accuracy than current vibration analysis techniques, and the extent to which generative design tools will influence the geometrical parameters and material selection of future bearings. Users are particularly interested in the practical application of AI in minimizing unplanned downtime in critical heavy machinery where bearing failure is costly, seeking concrete examples of enhanced operational efficiency and reduced lifecycle costs through AI integration.

The analysis reveals that the key themes revolve around leveraging AI for predictive asset performance management (APM). AI systems are being deployed to analyze vast datasets collected from embedded sensors (vibration, temperature, lubrication quality) on trunnion bearings, identifying subtle precursors to failure that human analysis or traditional algorithms might miss. This enhanced diagnostic capability allows for precise, just-in-time maintenance scheduling, dramatically improving asset utilization rates, particularly in remote or hazardous environments like deep-sea platforms or large mining sites. Furthermore, AI is crucial in optimizing inventory management by providing highly accurate demand forecasts based on predicted maintenance cycles across a global fleet, ensuring the right spares are available when needed.

Beyond maintenance, AI-driven simulation tools are transforming the R&D landscape. Generative AI allows engineers to input performance criteria (load profile, expected lifespan, environmental conditions) and receive optimized designs that minimize material usage while maximizing structural integrity, potentially leading to lighter, yet more durable trunnion bearing solutions. While AI does not directly manufacture the physical bearing, its influence permeates the entire lifecycle, from design and stress testing to real-time performance monitoring and supply chain logistics, positioning it as a pivotal technology for operational efficiency and competitive differentiation in this niche component market.

- AI optimizes predictive maintenance schedules, minimizing unplanned downtime in heavy machinery applications.

- Machine learning algorithms enhance fault detection accuracy by processing complex sensor data (vibration, acoustics, thermal).

- Generative Design AI assists in optimizing bearing geometry and material composites for superior stress resistance and lighter weight.

- AI-driven supply chain analytics improve forecasting of replacement part demand, enhancing inventory management and reducing lead times.

- Smart bearing systems utilize AI for real-time condition monitoring, providing actionable insights into operational stresses and remaining useful life (RUL).

DRO & Impact Forces Of Trunnion Spherical Bearings Market

The Trunnion Spherical Bearings market is shaped by a complex interplay of structural dynamics, industry requirements, and macroeconomic factors summarized by Drivers, Restraints, and Opportunities (DRO). The primary drivers include the escalating global demand for renewable energy installations, notably massive offshore and onshore wind farms that rely heavily on robust pitch and yaw bearings capable of handling extreme variable loads. Simultaneously, the continuous global expansion of mining and extraction activities, demanding larger, more powerful, and reliable heavy equipment, reinforces the need for high-capacity trunnion bearings. However, the market faces significant restraints, chiefly the high initial cost associated with specialized, custom-engineered bearings and the substantial complexity involved in their precise installation and required precision maintenance. Furthermore, intense price competition from generic bearing manufacturers in certain low-load applications provides a continuous downward pressure on average selling prices (ASPs).

Opportunities for market expansion are abundant, particularly through technological innovation focusing on enhancing bearing longevity and performance in challenging environments. This includes the development of self-lubricating polymer-composite trunnion bearings for niche markets requiring reduced weight and maintenance, and the integration of sophisticated IoT and sensing capabilities for real-time condition monitoring, unlocking new revenue streams through subscription-based predictive maintenance services. Geographically, untapped potential lies in expanding market penetration within emerging economies, particularly across Africa and Southeast Asia, where large-scale infrastructure and industrial projects are scheduled for execution over the next decade. Strategic partnerships with major OEMs in the heavy equipment and wind energy sectors are critical for securing long-term contracts and establishing market dominance in key segments.

The impact forces influencing the market are high, driven primarily by the bargaining power of major Original Equipment Manufacturers (OEMs), who dictate volume demands, technical specifications, and often exert pressure on pricing. The threat of substitutes, while moderate in heavy-duty applications due to the specialized nature of trunnion bearings, remains a concern in less critical or smaller-scale machinery where alternatives like standard roller or plain bearings might suffice. Supplier power is also moderate, concentrated among specialized steel and component providers, but diversified supply chains mitigate severe risks. Regulatory frameworks concerning safety, material usage, and environmental impact (especially in marine and offshore applications) act as a strong external force, requiring constant compliance and adaptation by bearing manufacturers, ultimately driving the adoption of higher quality, certified products.

Segmentation Analysis

The Trunnion Spherical Bearings market is structurally segmented across various dimensions to reflect the diversity in product design, operational requirements, and end-user applications. The primary segmentation categories encompass product type, load type, material composition, and the specific end-use industry. This structure allows manufacturers to tailor their product offerings, from standard catalog items to highly custom-engineered solutions, addressing the unique performance metrics demanded by sectors ranging from high-precision marine systems to rugged, large-scale mining trucks. Understanding these segments is crucial for strategic planning, resource allocation, and identifying high-growth niche markets within the heavy machinery component sector.

Segmentation by product type typically differentiates between standard (general industrial use), heavy-duty (for mining, steel, and construction), and specialized custom bearings (for aerospace or high-speed rail, although trunnion usage is less common here, it applies heavily to specialized marine and offshore wind applications). Load type segmentation often distinguishes between bearings designed predominantly for high radial loads, high axial loads, or combined radial-axial-oscillating loads, which is the defining characteristic of trunnion-mounted components. Material segmentation highlights the use of high-carbon chrome steel, stainless steel for corrosive environments, and increasingly, specialized surface treatments and coatings to enhance wear resistance and friction characteristics, thereby improving operational efficiency and longevity.

The most influential segmentation is by end-use application, directly linking bearing requirements to specific industry cycles and capital expenditure trends. Mining and construction demand bearings that can withstand extreme shock, vibration, and contamination. The energy sector, particularly wind power, requires components optimized for smooth, oscillating movement under variable, often unpredictable loads over very long operational periods without human intervention. The strategic focus on these high-value, performance-critical applications underscores the market's trajectory towards superior quality, extended service life, and advanced sealing technology.

- By Product Type:

- Standard Trunnion Spherical Bearings

- Heavy-Duty Trunnion Spherical Bearings

- Custom-Engineered Trunnion Bearing Units

- By Load Type:

- Radial Load Optimized Bearings

- Combined Radial and Axial Load Bearings (Oscillating Motion)

- By Application:

- Mining and Aggregate Equipment

- Construction Machinery (Cranes, Excavators, Loaders)

- Energy Sector (Wind Turbines - Pitch and Yaw Systems)

- Marine and Offshore Equipment

- Steel and Paper Mills

- Other Industrial Machinery

- By Material:

- High Carbon Chrome Steel

- Stainless Steel

- Hybrid (with Polymer or Composite Elements)

Value Chain Analysis For Trunnion Spherical Bearings Market

The value chain for the Trunnion Spherical Bearings market commences with upstream activities focused on raw material procurement, primarily high-grade specialty steel alloys, such as high-carbon chrome steel (100Cr6 or equivalent) and increasingly, customized heat-treated variants required for enhanced fatigue life. This stage is critical as the quality of the raw material directly dictates the final product’s load-carrying capacity and longevity. Upstream analysis also includes the sophisticated forging, machining, and heat treatment processes necessary to create the inner and outer rings, rolling elements, and specialized trunnion housings. Key value addition here is achieved through proprietary metallurgical processes and precision engineering to meet stringent performance tolerances required by demanding applications.

The midstream segment involves the core manufacturing, assembly, and quality assurance processes. This includes high-precision grinding, honing, and superfinishing of bearing raceways, along with the assembly of the trunnion unit, incorporation of advanced sealing systems (e.g., labyrinth seals, multiple lip seals), and the application of specialized lubricants or solid lubrication treatments. This stage adds significant value through intellectual property related to design and manufacturing consistency. Downstream activities focus on market penetration, distribution, and after-sales service. The distribution channel is bifurcated into direct sales to large Original Equipment Manufacturers (OEMs) who integrate the bearings into their machinery (the primary channel), and indirect sales through specialized industrial distributors and service partners catering to the Maintenance, Repair, and Overhaul (MRO) market.

Direct channels ensure close technical collaboration and long-term contracts with major industrial players like Caterpillar, Siemens Gamesa, and Liebherr, providing stability and large volume orders. Indirect channels, facilitated by specialized industrial component suppliers and localized resellers, are vital for serving the fragmented aftermarket segment, providing replacement parts and local technical support globally. The final value addition in the downstream lies in providing comprehensive technical support, installation guidance, and advanced condition monitoring services, ensuring optimal performance throughout the bearing’s operational life and fostering customer loyalty.

Trunnion Spherical Bearings Market Potential Customers

The primary customer base for Trunnion Spherical Bearings consists of large Original Equipment Manufacturers (OEMs) operating within sectors characterized by heavy loads, oscillating movements, and extreme operating environments. These customers require high volumes of customized or semi-customized bearings that meet stringent performance specifications and integration standards for their end products, such as massive earth-moving equipment, high-capacity cranes, and complex energy generation systems. They prioritize reliable supply chains, consistent quality assurance, and robust technical partnership for co-development, viewing the bearing as a critical, non-negotiable component that dictates the overall reliability and warranty period of their heavy machinery.

A significant segment of potential customers includes large industrial conglomerates and infrastructure maintenance organizations, such as major mining companies (e.g., Rio Tinto, BHP), large ports, and national railway infrastructure operators. These entities represent the Maintenance, Repair, and Overhaul (MRO) market, requiring replacement parts on demand to minimize costly downtime. Their purchasing decisions are highly sensitive to product lifespan, availability, and the speed of delivery, often relying on global distribution networks and authorized service providers for certified spare parts and rapid technical intervention. They often purchase through specialized distributors rather than directly from the manufacturer.

Furthermore, the rapidly expanding renewable energy sector, specifically developers and operators of wind farms (both onshore and offshore), represents a burgeoning customer segment. Companies like Vestas, GE Renewable Energy, and regional energy utilities are potential buyers, requiring trunnion spherical bearings for critical pitch and yaw control mechanisms in multi-megawatt wind turbines. For these customers, components must offer extremely long service intervals (often 20+ years), resilience to corrosion (especially offshore), and compatibility with remote condition monitoring systems, placing a high premium on specialized materials and advanced sealing technologies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 485.5 Million |

| Market Forecast in 2033 | USD 720.9 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SKF, Schaeffler (FAG/INA), NSK, NTN, Timken, JTEKT, Wafangdian Bearing Group Corp. (ZWZ), Harbin Bearing Manufacturing Co. (HRB), MinebeaMitsumi, Koyo Bearings, RBC Bearings, Trelleborg, THK Co., Astoria Industries, GGB Bearing Technology, Kaydon Bearings, AURORA Bearing Company, M&I Materials Ltd., Altra Industrial Motion, Regal Rexnord. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Trunnion Spherical Bearings Market Key Technology Landscape

The technological landscape for Trunnion Spherical Bearings is rapidly evolving, driven primarily by the need for enhanced durability, reduced maintenance requirements, and higher performance under increasingly extreme operating conditions. A key focus area is material science, particularly the development and use of advanced bearing steels with improved cleanliness, superior fatigue life, and specialized heat treatments such as bainitic hardening or cryogenic processing. These materials are essential for managing the high contact pressures and oscillating stresses inherent in trunnion applications. Furthermore, surface engineering technologies, including Physical Vapor Deposition (PVD) coatings and specific proprietary surface texturing, are being implemented to reduce friction, minimize wear during boundary lubrication, and enhance resistance to harsh chemical environments, extending the functional life significantly.

Another crucial technological advancement involves sealing systems and lubrication methodologies. Since trunnion bearings often operate in highly contaminated environments (dust, moisture, mud in mining), sophisticated multi-barrier sealing arrangements, such as triple-lip seals and labyrinth seals, are becoming standard requirements to prevent the ingress of contaminants and retain specialized high-performance greases. Lubrication technology itself is advancing, with the utilization of solid lubricants (e.g., specialized polymer composites or graphite inserts) and synthetic, high-viscosity index greases specifically formulated to maintain stability across broad temperature ranges and under extreme shock loads, thereby enabling "lubricated-for-life" designs in certain heavy-duty applications, reducing reliance on manual maintenance.

The most transformative technology permeating the market is the integration of Industrial Internet of Things (IIoT) and advanced sensing capabilities. Modern trunnion bearing assemblies are increasingly being designed to incorporate wireless sensors capable of monitoring critical operational parameters like temperature, vibration spectra, and acoustic emissions in real-time. This connectivity allows for continuous condition monitoring and the deployment of AI-driven predictive maintenance systems. This technology shifts the maintenance paradigm, allowing operators to preemptively address potential failures, dramatically increasing uptime and operational safety, making smart, connected bearings a high-growth technological segment.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global market both in terms of consumption and production capacity, driven primarily by extensive infrastructure development projects, burgeoning construction activities, and massive industrial expansion across China, India, and Southeast Asian nations. The region benefits from low manufacturing costs and high local demand for mining and heavy equipment components. China, in particular, is a global hub for both manufacturing and deployment of wind energy systems, ensuring sustained high demand for large trunnion spherical bearings.

- North America: North America represents a mature yet highly valuable market characterized by stringent quality standards and a strong focus on aftermarket services (MRO). Demand is driven by the modernization of aging industrial infrastructure, significant investment in oil and gas extraction equipment (requiring high-reliability components), and the robust expansion of the utility-scale wind energy sector, especially in the US and Canada. The region often prioritizes premium, technologically advanced bearings incorporating sensor integration and predictive maintenance features.

- Europe: Europe is a key market propelled by its pioneering role in offshore wind energy technology and stringent environmental regulations favoring high-efficiency, long-life components. Countries like Germany, Denmark, and the UK are major demand centers, particularly focused on heavy-duty, corrosion-resistant bearings for marine and offshore applications. The automotive and heavy machinery manufacturing base also provides stable, high-specification demand.

- Latin America (LATAM): LATAM is an emerging high-growth region, closely tied to the cycles of global commodity prices, particularly mining (Chile, Peru, Brazil) and construction projects. Market demand is highly dependent on capital expenditure cycles of major mining and infrastructure companies. The region presents opportunities for manufacturers capable of offering cost-effective and robust solutions for challenging operational environments.

- Middle East & Africa (MEA): The MEA region is characterized by substantial investments in construction mega-projects (Saudi Arabia, UAE) and expanding oil, gas, and mineral extraction activities across Africa. Demand is concentrated in large-scale infrastructure and port operations, requiring durable trunnion spherical bearings capable of resisting high temperatures and abrasive desert dust environments. Political stability and project financing remain key determinants of market growth here.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Trunnion Spherical Bearings Market.- SKF

- Schaeffler (FAG/INA)

- NTN

- NSK

- Timken

- JTEKT

- Wafangdian Bearing Group Corp. (ZWZ)

- Harbin Bearing Manufacturing Co. (HRB)

- MinebeaMitsumi

- Koyo Bearings

- RBC Bearings

- Trelleborg

- THK Co.

- Astoria Industries

- GGB Bearing Technology

- Kaydon Bearings

- AURORA Bearing Company

- M&I Materials Ltd.

- Altra Industrial Motion

- Regal Rexnord

Frequently Asked Questions

Analyze common user questions about the Trunnion Spherical Bearings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using trunnion spherical bearings over standard bearing types in heavy machinery?

Trunnion spherical bearings offer superior performance by handling extreme radial and axial loads simultaneously while effectively compensating for significant shaft misalignment and structural deformation. Their integrated, robust housing and advanced sealing systems ensure exceptional longevity and reliability in harsh, contaminated, or oscillating environments, leading to reduced maintenance and lower operational costs in heavy equipment like mining excavators and large wind turbines.

Which industry application contributes most significantly to the demand for heavy-duty trunnion spherical bearings?

The mining and construction sectors are the largest demand drivers due to the sheer volume and size of the heavy equipment used (e.g., hydraulic shovels, large haul trucks, port cranes) which require high-capacity, shock-resistant trunnion bearings. However, the energy sector, particularly wind turbine pitch and yaw systems, is the fastest-growing application segment demanding specialized, highly durable, and maintenance-free trunnion solutions.

How is the integration of IoT and smart technology changing the maintenance paradigm for trunnion spherical bearings?

IoT and smart technology integration enables real-time condition monitoring via embedded sensors that track vibration, temperature, and lubrication status. This transition facilitates a shift from scheduled, time-based maintenance to highly accurate predictive maintenance (PdM). PdM minimizes unplanned downtime, optimizes the operational lifespan of the bearing, and ensures that critical components are replaced only precisely when necessary, maximizing asset utilization and reducing lifecycle costs.

What are the key technical challenges faced by manufacturers in the Trunnion Spherical Bearings market?

Key technical challenges include achieving consistent material quality and heat treatment necessary to withstand ultra-high fatigue loads, developing advanced sealing solutions that maintain integrity in highly contaminated or corrosive environments (like offshore wind), and managing the complex, precision machining required for large-diameter bearings to ensure accurate geometric tolerances and minimize friction during oscillation.

Which geographical region is projected to experience the highest growth rate in the Trunnion Spherical Bearings market?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This growth is fueled by aggressive government investments in infrastructure, rapidly expanding industrialization in emerging economies like India and Southeast Asia, and massive domestic manufacturing and installation of large-scale renewable energy infrastructure, particularly wind power projects in China.

What role do specialized lubrication systems play in enhancing the service life of these heavy-duty components?

Specialized lubrication systems, including high-performance synthetic greases, centralized automatic lubrication provisions, and solid lubrication inserts, are crucial. They ensure that the bearing surfaces receive optimal film thickness under high pressure and oscillation, mitigating wear, dissipating heat, and extending the service interval significantly, often enabling sealed-for-life operation in remote or inaccessible applications.

How does the bargaining power of Original Equipment Manufacturers (OEMs) impact market dynamics?

OEMs hold significant bargaining power as they represent the largest volume buyers. They dictate specific, often proprietary, technical standards and tolerances and exert considerable pressure on pricing structures. Manufacturers must maintain robust R&D and quality control capabilities to meet these demands, often forming long-term contractual partnerships with leading OEMs to secure market stability and revenue pipelines.

Are composite materials being increasingly utilized in trunnion spherical bearing designs?

Yes, composite materials, particularly high-strength polymers and fiber-reinforced plastics, are increasingly utilized, mainly for the bearing cage/retainer and in specialized self-lubricating plain trunnion applications. These materials offer advantages such as lighter weight, inherent corrosion resistance, and reduced friction, although high-load rolling element trunnion bearings still rely heavily on specialized bearing steel alloys for the inner and outer rings.

What is the typical lifespan expectation for a trunnion spherical bearing operating in a wind turbine pitch system?

Due to the critical nature and high cost of replacement in wind turbines, trunnion spherical bearings are often engineered to meet design lifespans ranging from 150,000 hours to over 20 years, provided they receive appropriate maintenance and utilize advanced sealing and lubrication technologies. Lifespan is heavily influenced by the specific load spectrum, climate conditions, and the effectiveness of the sealing system.

What distinguishes a trunnion spherical bearing unit from a standard spherical plain bearing?

While both accommodate misalignment, a trunnion spherical bearing usually refers to a complete, integrated unit designed for a specific mounting configuration (trunnion mount). This unit often includes the bearing elements, a robust, custom-machined outer housing, and advanced, integral sealing packages, optimized for external high-stress oscillating environments, whereas a plain spherical bearing is typically just the internal spherical interface element.

How do global infrastructure spending trends influence the market outlook?

Global infrastructure spending is a direct economic driver for the market. Large governmental and private investments in roads, ports, bridges, and industrial expansion require extensive heavy construction and earth-moving equipment. Increased deployment of this machinery translates directly into higher demand for both new installations and subsequent aftermarket replacement parts for high-performance components like trunnion spherical bearings.

In which specific sub-segment is technological innovation most active?

Technological innovation is most active in the heavy-duty segment dedicated to wind energy and mining applications. This involves the integration of wireless condition monitoring sensors, the development of specialized corrosion-resistant materials (e.g., for offshore use), and advancements in proprietary sealing geometries to ensure ultra-reliable, long-life operation under harsh, remote conditions.

What impact does the increasing size of mining equipment have on bearing design?

The trend towards larger, higher-capacity mining equipment necessitates trunnion bearings that can handle exponentially increased static and dynamic loads, particularly shock loads. This drives manufacturers to design bearings with larger diameters, improved internal geometries, high-strength steels, and superior surface hardness to prevent premature fatigue failure under extreme stress cycles.

What is the significance of the aftermarket (MRO) segment for manufacturers?

The aftermarket segment is highly significant, often providing higher profit margins compared to OEM sales. It represents the consistent demand for replacement parts needed to maintain the global installed base of heavy machinery. Manufacturers prioritize strong distribution networks and quick parts availability to serve the MRO market efficiently and capture this recurring revenue stream.

How do strict regulatory standards affect product development in this market?

Strict regulatory standards, particularly those governing safety, environmental impact, and specific industry certifications (like marine or crane safety), force manufacturers to invest heavily in robust testing, material traceability, and continuous quality improvement. Compliance ensures market access, particularly in mature economies like Europe and North America, driving the adoption of higher-quality, documented products.

What challenges does price volatility in raw materials pose for bearing manufacturers?

Price volatility in high-grade steel alloys and energy costs presents a significant challenge, impacting manufacturing profitability and cost predictability. Manufacturers must employ hedging strategies, optimize production efficiency, and often rely on long-term procurement contracts to mitigate the risk associated with fluctuating input material prices in this capital-intensive sector.

How does the threat of substitute products vary across different application loads?

The threat of substitutes (like standard roller bearings or polymer plain bearings) is low in extreme heavy-duty applications, where the unique load capacity and misalignment capability of trunnion spherical bearings are indispensable. However, the threat is moderate in lower-load industrial machinery where cost-efficiency might favor cheaper, less robust alternative bearing technologies.

What role does digitalization play in supply chain management for these components?

Digitalization plays a critical role by enabling advanced demand forecasting (often AI-assisted based on predicted failures), optimizing global logistics networks, and enhancing transparency in the traceability of high-value components. This ensures reduced lead times and greater supply chain resilience, which is essential for serving both OEM and time-critical MRO requirements globally.

What are the primary factors driving the adoption of customized trunnion bearing solutions?

Customization is driven by unique application requirements, such as extremely large dimensions (e.g., in steel mills or port machinery), unusual load combinations, or highly specific environmental constraints (e.g., extreme temperature or submerged operation). OEMs frequently require custom designs to maximize the performance and competitive advantage of their specialized heavy machinery.

How is the market addressing the need for reduced friction and energy consumption?

The market addresses friction reduction through advanced internal geometry optimization, superior surface finishes (superfinishing, honing), the use of specialized low-friction coatings (PVD/CVD), and the application of synthetic, low-viscosity greases. These innovations collectively improve operational efficiency, minimize heat generation, and contribute to reduced energy consumption in the overall mechanical system.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager