Trust Management Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433407 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Trust Management Service Market Size

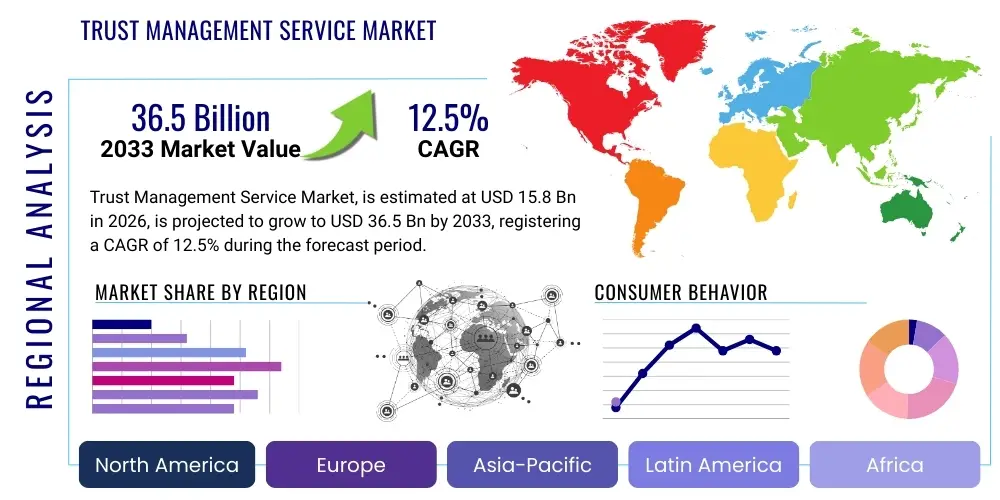

The Trust Management Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 15.8 Billion in 2026 and is projected to reach USD 36.5 Billion by the end of the forecast period in 2033.

Trust Management Service Market introduction

The Trust Management Service (TMoS) market encompasses a sophisticated array of solutions designed to establish, maintain, and verify trust across digital, financial, and interpersonal transactions. These services are crucial for organizations operating in highly regulated industries, focusing on mitigating risks associated with identity fraud, data breaches, regulatory non-compliance, and counterparty reliability. TMoS platforms integrate technologies such as distributed ledger technology (DLT), advanced cryptography, and centralized policy enforcement engines to ensure secure and transparent operations, thereby enabling seamless business processes and fostering user confidence in an increasingly decentralized digital landscape.

The product portfolio within the TMoS sector is broad, ranging from digital identity verification and access management tools (IDAM) to complex fiduciary services and regulatory compliance monitoring software. Major applications span critical sectors, including banking, financial services, insurance (BFSI), healthcare, government, and retail, where data integrity and secure client interactions are paramount. The core benefit derived from adopting trust management services is the ability to streamline complex compliance workflows, reduce operational costs associated with manual verification processes, and significantly enhance customer experience through rapid and secure onboarding and transaction processing.

Driving factors for sustained market growth include the exponential increase in data breaches and cyberattacks globally, mandating higher levels of digital assurance. Furthermore, stringent regulatory frameworks, such as GDPR, CCPA, and evolving AML/KYC requirements, necessitate automated and verifiable trust mechanisms. The rapid acceleration of digital transformation initiatives across emerging economies and the increasing adoption of cloud-based infrastructure further fuel the demand for scalable, trustworthy digital infrastructure solutions that can adapt to dynamic market demands and evolving threat vectors.

Trust Management Service Market Executive Summary

The Trust Management Service Market is currently characterized by robust expansion driven primarily by the need for regulatory certainty and the push for secure digital commerce. Business trends show a distinct shift toward integrated platforms that offer end-to-end trust lifecycle management, moving beyond siloed identity or compliance solutions. Strategic partnerships between technology providers and financial institutions are becoming common, focused on embedding trust verification capabilities directly into core business processes. Furthermore, there is a growing consolidation trend among smaller, specialized vendors, aiming to create comprehensive suites capable of addressing multi-jurisdictional compliance needs and catering to highly sophisticated enterprise requirements for sovereign identity management and verifiable credentials.

Regional trends indicate North America maintaining market dominance, underpinned by high regulatory compliance standards (e.g., HIPAA, GLBA) and significant investment in cutting-edge cybersecurity infrastructure. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), fueled by mass digitalization efforts, increased internet penetration, and the rapid expansion of digital payment ecosystems in countries like India and China. Europe shows stable growth, strongly influenced by the enforcement of data protection laws like GDPR and NIS directives, which mandate strict controls over data access and consent mechanisms, thereby driving demand for advanced consent and preference management platforms.

Segmentation trends highlight the Services segment, particularly professional and managed services, experiencing rapid growth due to the complex integration and maintenance requirements of sophisticated trust platforms. By type, Digital Identity Trust Management is the fastest-growing sub-segment, reflecting the global transition away from traditional password-based authentication toward biometric and behavioral authentication methods. End-user analysis reveals that the BFSI sector remains the primary revenue generator, while the Healthcare sector is rapidly accelerating its adoption rate, spurred by the critical need to secure sensitive patient data and comply with mandated privacy protocols across telehealth and electronic health record (EHR) systems.

AI Impact Analysis on Trust Management Service Market

Common user questions regarding AI's influence on the Trust Management Service market predominantly revolve around three key themes: efficiency gains in compliance and fraud detection, the ethical challenges related to bias and autonomous decision-making in high-stakes scenarios, and the potential security risks introduced by sophisticated AI-powered cyberattacks (Adversarial AI). Users are actively seeking clarity on how AI enhances the predictive accuracy of risk models, reduces false positives in KYC/AML processes, and automates the enforcement of complex contractual trust terms via smart contracts. Simultaneously, there is significant concern about maintaining transparency and auditability in AI-driven trust systems, ensuring that automation does not inadvertently lead to discriminatory practices or systemic bias, particularly in lending, identity verification, and legal trust management contexts.

AI’s integration is fundamentally reshaping the capabilities and delivery mechanisms of trust management services. By leveraging machine learning (ML) algorithms, TMoS providers can analyze vast datasets in real-time to identify anomalies indicative of fraudulent activity with far greater speed and precision than traditional rule-based systems. This predictive capability is vital for mitigating risks related to synthetic identity fraud, money laundering, and credential compromise. Furthermore, AI contributes significantly to the personalization of security policies and the development of behavioral biometrics, moving authentication beyond static factors to continuous, adaptive trust assessments based on user context and activity patterns, thus improving both security posture and user experience.

The adoption of AI also creates new opportunities for market expansion, particularly in automating the governance layer of decentralized trust frameworks. AI-powered tools can manage the lifecycle of digital certificates, autonomously update compliance policy rules based on evolving regulations, and optimize resource allocation for security operations centers (SOCs). However, market growth is contingent upon addressing governance issues surrounding data usage and algorithmic transparency. Vendors focusing on explainable AI (XAI) for trust verification systems are gaining a competitive advantage by offering auditable outputs that satisfy regulatory requirements and build confidence among enterprise users regarding automated trust decisions.

- Enhanced predictive fraud detection through real-time ML analysis of transaction data.

- Automation of complex regulatory compliance checks, reducing manual intervention costs.

- Development of sophisticated behavioral biometrics and continuous authentication systems.

- Improved risk scoring and adaptive access control based on contextual indicators.

- Introduction of Explainable AI (XAI) features to maintain transparency and regulatory auditability.

- Optimization of identity verification processes, enabling faster and more accurate onboarding (eKYC/eAML).

- Increased threat surface due to adversarial AI attacks targeting trust algorithms.

DRO & Impact Forces Of Trust Management Service Market

The Trust Management Service Market is powerfully influenced by a dynamic interplay of Drivers, Restraints, and Opportunities, which collectively form the impact forces shaping its trajectory. Key drivers include the escalating global volume of digital transactions and corresponding sophisticated cyber threats, alongside increasingly rigorous regulatory compliance mandates (such as sector-specific data localization and data sovereignty requirements). These factors compel enterprises to invest heavily in verifiable and auditable trust infrastructure. Conversely, the market faces significant restraints, notably the inherent complexity of integrating disparate legacy trust systems with modern, cloud-native solutions, compounded by the high initial costs associated with implementing and scaling advanced DLT or cryptographic solutions, particularly for Small and Medium-sized Enterprises (SMEs).

Opportunities for exponential market growth are primarily concentrated in the deployment of decentralized identity solutions (DID), which promise user control and enhanced privacy, moving away from centralized vulnerability points. Furthermore, the expansion of trust services into emerging technologies such as the Internet of Things (IoT) and Operational Technology (OT) environments presents lucrative avenues for specialized vendors focusing on device identity and secure communication protocols. The impact forces indicate a strong positive market impetus driven by compliance needs, which far outweighs the restraining factors related to implementation complexity. The overall force vector points toward accelerated adoption, especially as standardization efforts around digital trust frameworks mature and solutions become more interoperable and economically accessible across diverse industry verticals.

The intensity of the impact forces is magnified by global geopolitical uncertainties, which necessitate robust data governance and cross-border trust mechanisms. Regulatory fragmentation across continents acts as both a restraint (due to compliance complexity) and a driver (due to the mandatory requirement for advanced multi-regional compliance platforms). Successful market participants are those adept at navigating this complexity by offering flexible, modular platforms that can quickly adapt to new legal standards, effectively turning regulatory burdens into market opportunities through enhanced governance features and certified compliance readiness. This strategic pivot ensures sustained demand and competitive differentiation in the highly saturated technology ecosystem.

Segmentation Analysis

The Trust Management Service market is meticulously segmented across various dimensions to reflect the diversity of solutions and deployment models catering to specific industry needs. The primary segmentation dimensions include the type of service offered, the constituent components of the solution stack, the mode of deployment, and the end-use application across different industry verticals. This granular categorization assists vendors in tailoring their offerings and helps end-users select platforms that align precisely with their governance, risk, and compliance (GRC) objectives, whether focusing on digital identity verification, transactional transparency, or complex fiduciary management. The market structure emphasizes modularity, allowing enterprises to adopt services incrementally.

Analysis of segmentation reveals that the Component segment is currently dominated by the Services sub-segment (including integration, consulting, and managed services), reflecting the high requirement for expert assistance in implementing, customizing, and continuously monitoring highly secure and regulated trust environments. Conversely, the Software component, encompassing proprietary platforms and specialized applications for authentication, authorization, and data encryption, represents the foundational investment area. Regarding deployment, the Cloud-based model is rapidly overtaking On-Premise deployments, driven by its inherent scalability, flexibility, reduced infrastructure overhead, and capability to support geographically dispersed operations and remote workforce requirements.

From an end-user perspective, the Banking, Financial Services, and Insurance (BFSI) sector maintains its leading market share due to critical reliance on trust services for regulatory compliance (AML/KYC), fraud prevention, and secured digital banking initiatives. However, the Government and Public Sector is rapidly emerging as a significant growth engine, investing heavily in e-governance initiatives, national digital ID programs, and securing critical national infrastructure. The segmentation landscape is shifting toward industry-specific vertical solutions that integrate specialized compliance knowledge, such as health data privacy regulations (e.g., HIPAA in the U.S., regional equivalents globally) within the TMoS framework.

- By Component:

- Software (Platform Solutions, Application Tools, Middleware)

- Services (Professional Services, Managed Services, Consulting and Implementation)

- By Type of Trust:

- Digital Identity Trust Management (Authentication, Authorization, Single Sign-On, Identity Governance)

- Fiduciary Trust Management (Estate Planning, Asset Custody, Wealth Management Compliance)

- Regulatory Trust Management (KYC, AML, GDPR Compliance, Data Lineage)

- By Deployment Model:

- Cloud-based (Public Cloud, Private Cloud, Hybrid Cloud)

- On-Premise

- By End-User:

- Banking, Financial Services, and Insurance (BFSI)

- Government and Public Sector

- Healthcare and Life Sciences

- Retail and E-commerce

- IT and Telecom

- Energy and Utilities

Value Chain Analysis For Trust Management Service Market

The value chain of the Trust Management Service market is characterized by several highly interconnected stages, beginning with core technology development and culminating in complex, specialized service delivery to end-users. The upstream activities involve foundational research and development (R&D) focused on cryptographic algorithms, distributed ledger technologies (DLT), and advanced risk modeling engines. Key participants in this stage include specialized software vendors and infrastructure providers who create the proprietary security layers, data storage solutions, and foundational identity platforms necessary for establishing digital trust roots.

Midstream activities primarily focus on integrating these foundational technologies into marketable solutions. This involves platform development, customization, and quality assurance processes, where core TMoS modules (such as policy management, auditing tools, and identity verification modules) are assembled. Distribution channels are highly varied, consisting of both direct sales teams targeting large enterprises with bespoke integration needs, and indirect channels relying heavily on system integrators (SIs), value-added resellers (VARs), and strategic channel partners. The complexity of these services necessitates strong partnership ecosystems to ensure successful deployment across diverse technological landscapes.

Downstream activities center on service delivery, ongoing support, and continuous adaptation to regulatory changes. This stage includes providing professional services (consulting, implementation, and migration), managed security services (continuous monitoring, threat intelligence integration), and end-user training. Direct relationships are crucial for large financial and government institutions requiring high degrees of customization and dedicated security personnel. Indirect distribution via cloud marketplaces and specialized security consulting firms facilitates broader market penetration, especially among SMEs, by offering subscription-based access and rapid deployment capabilities for standardized trust solutions.

Trust Management Service Market Potential Customers

Potential customers for Trust Management Services are predominantly organizations characterized by high transaction volumes, stringent regulatory obligations, and critical reliance on customer data integrity and protection. The quintessential buyer profile includes large multinational banks, insurance providers, and asset management firms (BFSI sector) that must maintain continuous compliance with global standards like Basel III, MiFID II, and various regional AML/KYC directives. These institutions leverage TMoS platforms to automate onboarding processes, minimize financial crime risks, and secure sensitive client assets, making investment in these services non-negotiable for operational continuity and reputational safeguarding.

Beyond the BFSI sector, potential customers are rapidly expanding across the Public Sector, especially governmental bodies tasked with modernizing citizen services (e-governance) and establishing reliable national digital identity schemes. These government entities utilize TMoS for secure data exchange between agencies, verification of benefits eligibility, and ensuring the integrity of critical infrastructure communications. The need for sovereign identity solutions and securing cross-border data flows mandates robust, verifiable trust platforms that adhere to national security protocols and data residency requirements.

Furthermore, enterprises within the Healthcare and Retail sectors represent highly lucrative segments. Healthcare providers and pharmaceutical companies are intensive users due to the stringent privacy requirements (e.g., HIPAA) surrounding electronic health records (EHRs) and patient consent management for telehealth services. In Retail and E-commerce, TMoS solutions are deployed to reduce payment fraud, secure supply chain logistics, and manage customer consent preferences for marketing and data usage, directly impacting customer retention and perceived brand security. Any entity managing valuable digital assets, proprietary data, or regulated client information is a prime candidate for advanced trust management solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.8 Billion |

| Market Forecast in 2033 | USD 36.5 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Broadridge Financial Solutions, IBM Corporation, Microsoft Corporation, Oracle Corporation, Thales Group, Entrust Corporation, ForgeRock (acquired by Thoma Bravo), Okta Inc., Ping Identity, OneTrust LLC, DocuSign Inc., FICO, TransUnion, LexisNexis Risk Solutions, Thomson Reuters, Mphasis, Wipro Limited, Deloitte (Consulting Arm), KPMG (Advisory Services), PwC (Risk Assurance). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Trust Management Service Market Key Technology Landscape

The technological landscape underpinning the Trust Management Service market is rapidly evolving, driven by the convergence of advanced cryptographic methods, identity management frameworks, and secure computing paradigms. One cornerstone technology is Distributed Ledger Technology (DLT), particularly blockchain, which provides immutable records and transparent transaction histories essential for regulatory compliance and verifiable digital identity issuance. DLT enables decentralized trust mechanisms, reducing reliance on single, centralized authorities and significantly mitigating the risk associated with data silos and single points of failure, crucial for implementing self-sovereign identity (SSI) solutions.

Another pivotal technological area is Advanced Authentication and Authorization (AAA), which extends beyond traditional multi-factor authentication (MFA) to incorporate adaptive authentication using machine learning for risk scoring. This includes sophisticated behavioral biometrics that continuously verify the user based on their interaction patterns, device characteristics, and geolocation, ensuring continuous, context-aware trust. Furthermore, advancements in homomorphic encryption and secure multi-party computation (MPC) are gaining traction, allowing sensitive data analysis and verification processes to occur without exposing the underlying data, thereby addressing critical privacy concerns inherent in global data sharing and regulatory audits.

The market also heavily relies on robust Identity Governance and Administration (IGA) platforms integrated with Privileged Access Management (PAM) solutions. These technologies ensure that access rights are provisioned, reviewed, and revoked automatically based on zero-trust principles and predefined enterprise policies. Cloud security posture management (CSPM) tools are increasingly embedded within TMoS offerings to ensure that trust frameworks extend effectively across hybrid and multi-cloud environments, ensuring compliance continuity regardless of where data resides. The synergistic adoption of these technologies creates highly resilient, scalable, and auditable trust ecosystems necessary for modern digital operations.

Regional Highlights

- North America: This region holds the largest market share, predominantly driven by the presence of major technology innovators, early and widespread adoption of cloud infrastructure, and the stringent regulatory environment necessitating robust trust solutions (e.g., Sarbanes-Oxley Act, HIPAA, CCPA). The United States is the central hub, characterized by high spending on cybersecurity and identity management platforms, especially within the financial services and critical infrastructure sectors. The mature digital ecosystem demands continuous innovation in areas like behavioral biometrics and AI-driven fraud detection, ensuring continued market leadership.

- Europe: Europe represents a highly regulated yet mature market, with growth primarily spurred by the General Data Protection Regulation (GDPR) and the NIS Directive, which enforce strict requirements for data privacy, consent management, and operational resilience. Key markets like the UK, Germany, and France are focused on integrating TMoS with Open Banking initiatives and cross-border digital identity frameworks (e.g., eIDAS). The region exhibits strong demand for privacy-enhancing technologies and solutions that facilitate auditable data processing and transparent consent capture.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by massive government investments in digitalization, large-scale national digital identity projects (like India’s Aadhaar and similar initiatives in Southeast Asia), and rapid proliferation of mobile financial services. Countries such as China, India, Japan, and Australia are accelerating the adoption of TMoS to combat rising cybercrime associated with rapid urbanization and e-commerce expansion. The need to establish secure digital supply chains and manage multi-jurisdictional compliance is a key regional driver.

- Latin America (LATAM): This region is experiencing steady growth, largely focused on modernizing banking infrastructure and increasing financial inclusion, necessitating secure and verifiable identity systems for remote customer onboarding (eKYC). Regulatory push for fraud mitigation, particularly in Brazil and Mexico, drives demand for localized trust solutions that address unique regional fraud patterns and infrastructure challenges, often prioritizing mobile-centric trust frameworks.

- Middle East and Africa (MEA): Growth in MEA is primarily concentrated in the Gulf Cooperation Council (GCC) countries, where large government projects (e.g., Saudi Vision 2030, UAE National Agenda) prioritize smart cities and advanced e-government services. High growth is observed in securing critical national infrastructure (oil and gas, finance) and implementing robust identity frameworks to support rapid infrastructural development and economic diversification away from traditional energy sources.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Trust Management Service Market.- Broadridge Financial Solutions

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- Thales Group

- Entrust Corporation

- ForgeRock (acquired by Thoma Bravo)

- Okta Inc.

- Ping Identity

- OneTrust LLC

- DocuSign Inc.

- FICO

- TransUnion

- LexisNexis Risk Solutions

- Thomson Reuters

- Mphasis

- Wipro Limited

- Deloitte (Consulting Arm)

- KPMG (Advisory Services)

- PwC (Risk Assurance)

Frequently Asked Questions

Analyze common user questions about the Trust Management Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Trust Management Services (TMoS) in the digital economy?

The primary function of Trust Management Services is to establish, verify, and enforce digital and contractual trust across disparate entities, transactions, and devices. TMoS platforms achieve this by integrating advanced security protocols, identity verification tools (KYC/AML), and compliance monitoring mechanisms to mitigate fraud and ensure regulatory adherence in real-time. This allows businesses to conduct secure digital operations and foster confidence among customers and partners.

How does the implementation of Zero Trust Architecture relate to Trust Management Services?

Zero Trust Architecture (ZTA) is a foundational principle of modern TMoS, advocating for the concept of "never trust, always verify." TMoS platforms provide the technological framework—including continuous adaptive authentication, micro-segmentation, and dynamic policy enforcement—required to operationalize ZTA. These services ensure that every user, device, and application access request is authenticated, authorized, and continuously monitored, regardless of its location relative to the network perimeter.

Which industry vertical is currently the largest consumer of Trust Management Services?

The Banking, Financial Services, and Insurance (BFSI) sector is the largest consumer of Trust Management Services. This dominance is due to their critical need for robust fraud prevention, stringent adherence to complex global regulatory mandates (such as AML and KYC laws), and the necessity to secure high-value digital transactions and sensitive client data across rapidly expanding digital channels.

What role does Distributed Ledger Technology (DLT) play in enhancing digital trust?

DLT, specifically blockchain technology, enhances digital trust by providing an immutable, transparent, and auditable record of transactions and identities. This eliminates the need for a central intermediary, thereby reducing single points of failure and increasing data integrity. DLT is foundational for developing self-sovereign identity (SSI) solutions and enabling secure, automated trust mechanisms through smart contracts.

What are the main constraints hindering the rapid growth of the TMoS market?

The main constraints include the substantial initial investment required for sophisticated platform deployment, the complex challenge of integrating cutting-edge TMoS solutions with existing legacy IT infrastructure, and the persistent shortage of specialized technical talent skilled in implementing and maintaining advanced cryptographic and identity management frameworks, particularly in emerging markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager