Trypsin Inhibitor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433328 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Trypsin Inhibitor Market Size

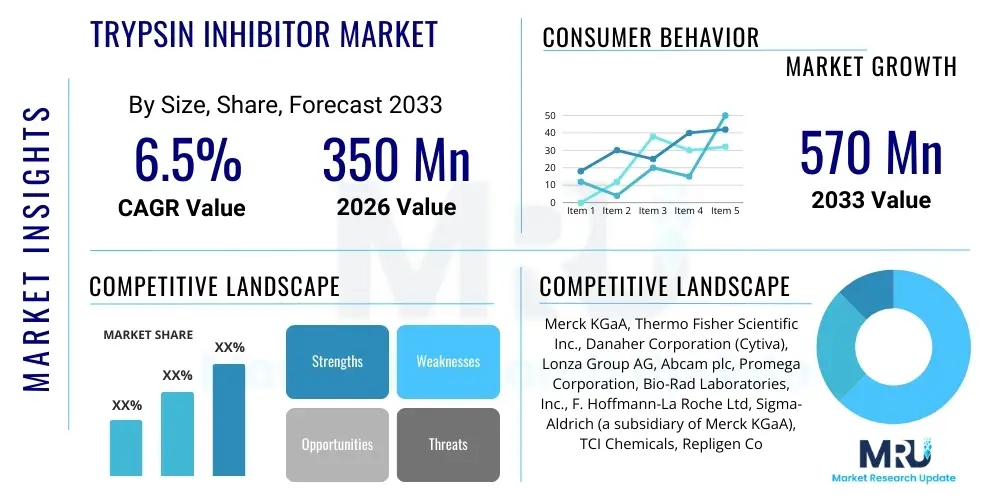

The Trypsin Inhibitor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 570 Million by the end of the forecast period in 2033.

Trypsin Inhibitor Market introduction

Trypsin inhibitors are biological molecules, typically proteins, peptides, or small molecules, that interfere with the proteolytic activity of the enzyme trypsin. Trypsin, a key serine protease involved in digestion, is also crucial in various cellular and physiological processes, including inflammation, blood clotting, and protein processing. The primary product in this market includes purified extracts, recombinant proteins, and synthetic compounds designed to specifically block the active site of trypsin or related proteases, thereby controlling biological processes or protecting other proteins from degradation during experimental procedures.

Major applications for trypsin inhibitors span across the biopharmaceutical industry, clinical diagnostics, and academic research. In pharmaceuticals, they are essential for stabilizing protein formulations, particularly enzyme-based drugs, and are increasingly used in therapeutic areas such as acute pancreatitis, where uncontrolled trypsin activity leads to tissue damage. Furthermore, these inhibitors are vital reagents in cell culture media, preventing cell damage and optimizing yields in biomanufacturing processes.

The core benefits driving market growth stem from their specificity and efficacy in modulating protease activity. Their utility in regulating complex biological systems provides substantial value in drug discovery and development. Key driving factors include the rapid expansion of the biotechnology sector, the rising demand for high-purity biological reagents for research and diagnostics, and the increasing incidence of protease-mediated diseases, necessitating targeted inhibitory therapies.

Trypsin Inhibitor Market Executive Summary

The global Trypsin Inhibitor Market exhibits robust growth, primarily fueled by significant advancements in bioprocessing and personalized medicine. Business trends indicate a shift towards recombinant and synthetic inhibitors, offering higher purity and scalability compared to traditional plant or animal extracts. Strategic alliances between biotechnology firms and contract research organizations (CROs) are optimizing the supply chain for specialized research reagents. The market structure is moderately consolidated, with key players focusing intensely on proprietary purification techniques and the development of targeted protease inhibitor cocktails to address diverse application needs in therapeutic development.

Regional trends highlight North America and Europe as dominant markets, largely due to high investment in pharmaceutical research and development, established biotechnology infrastructure, and stringent regulatory standards demanding high-quality inhibitors for clinical trials. However, the Asia Pacific region, particularly China and India, is emerging as the fastest-growing market segment. This accelerated growth is attributed to the expansion of contract manufacturing organizations (CMOs), increasing local biopharmaceutical production capabilities, and governmental initiatives supporting life sciences research, leading to heightened demand for essential reagents like trypsin inhibitors.

Segment trends reveal that the Pharmaceuticals and Bioprocessing application segment commands the largest market share, driven by the indispensable role of trypsin inhibitors in preventing cell dissociation and maintaining the integrity of recombinant proteins during production. In terms of source segmentation, soybean-derived inhibitors remain highly utilized due to cost-effectiveness, but the synthetic and recombinant segments are gaining traction due to superior batch-to-batch consistency, reduced risk of contamination, and customization capabilities tailored for highly sensitive diagnostic and therapeutic applications. Investment is heavily concentrated in optimizing genetic engineering techniques for large-scale, cost-efficient production of highly specific inhibitors.

AI Impact Analysis on Trypsin Inhibitor Market

Users frequently inquire about how artificial intelligence (AI) and machine learning (ML) are transforming the identification, synthesis, and application of protease inhibitors. The primary concerns revolve around AI's ability to accelerate the discovery of novel inhibitor structures and optimize the synthesis processes, potentially reducing reliance on traditional biological sourcing methods. Key themes center on leveraging predictive modeling for understanding enzyme-inhibitor kinetics, enhancing the efficiency of clinical trials involving protease-targeting drugs, and improving quality control in biomanufacturing. Users expect AI to streamline hit-to-lead processes, predict off-target effects of new inhibitors, and potentially personalize inhibitor dosages based on individual patient proteomic profiles.

AI is playing a pivotal role in accelerating the drug discovery pipeline for novel therapeutic trypsin inhibitors. Machine learning algorithms are now utilized to screen vast chemical libraries, predict the binding affinity of compounds to the trypsin active site, and model complex kinetic interactions more accurately than traditional empirical methods. This computational approach significantly reduces the time and cost associated with identifying promising lead candidates, moving the focus from broad-spectrum screening to highly targeted computational biology. Furthermore, AI tools are essential for analyzing structural data (such as X-ray crystallography and cryo-EM data) to refine inhibitor design based on minute molecular interactions, leading to more potent and specific therapeutic agents.

Beyond discovery, AI impacts the manufacturing and quality assurance aspects of the trypsin inhibitor market. In bioprocessing, ML models optimize fermentation conditions for recombinant inhibitor production, ensuring maximum yield and purity while minimizing batch variability. Predictive analytics are being deployed to monitor real-time process parameters, allowing manufacturers to anticipate and correct deviations swiftly, thereby guaranteeing the consistency required for pharmaceutical-grade reagents. This integration of AI not only enhances operational efficiency but also raises the overall quality and reliability of trypsin inhibitor products available for both research and commercial applications.

- AI-driven structure-based drug design accelerates identification of novel non-peptide trypsin inhibitors.

- Machine Learning optimizes binding affinity prediction and pharmacokinetic modeling for therapeutic agents.

- Predictive analytics enhance bioprocess optimization for recombinant trypsin inhibitor manufacturing efficiency.

- Natural Language Processing (NLP) assists in synthesizing vast scientific literature to identify emerging therapeutic applications.

- AI tools improve quality control and batch consistency tracking in high-volume production environments.

- Automated high-throughput screening analysis identifies potent inhibitors with minimized off-target interactions.

DRO & Impact Forces Of Trypsin Inhibitor Market

The market trajectory is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities. The primary driver is the pervasive use of trypsin inhibitors in the rapidly growing field of biotechnology, particularly in large-scale cell culture and protein purification where protecting sensitive biomolecules is paramount. However, the market faces restraints such related to the complexity of purification processes required to meet stringent pharmaceutical standards and the high production costs associated with recombinant or synthetic varieties. Opportunities lie in developing advanced delivery systems for therapeutic applications, exploring novel natural sources, and expanding utilization into emerging areas like personalized diagnostics and gene therapy. These forces collectively dictate the supply dynamics, pricing structures, and technological innovation within the market landscape.

Key drivers include the global increase in chronic diseases, particularly those involving inflammation and dysregulated proteolysis, which fuels demand for targeted protease inhibitor therapeutics, such as those used for pancreatitis and hereditary angioedema. Furthermore, the constant need for highly purified and stable research reagents, driven by the expansion of academic and corporate life sciences research, sustains demand across various purity grades. Technological advancements in protein engineering and fermentation techniques enable manufacturers to produce purer and more cost-effective recombinant inhibitors, further stimulating market uptake by ensuring better performance consistency compared to traditional extracts.

Major restraints impeding market growth include regulatory hurdles related to animal-derived products, which necessitate costly and complex viral inactivation steps, particularly for bovine or porcine-sourced inhibitors destined for clinical use. The high capital investment required for state-of-the-art purification infrastructure (e.g., advanced chromatography systems) acts as a barrier to entry for smaller players. Additionally, the constant threat of substitution, where researchers or manufacturers opt for alternative protease inhibition methods or synthetic buffers, poses a continuous challenge to market volume stability, requiring incumbent companies to consistently innovate in terms of purity and application specificity.

The primary impact forces shaping the market include technological advancements in separation science, which improve the yield and purity of inhibitors; regulatory pressures that increasingly favor recombinant and synthetic sources over animal-derived ones; and the rising therapeutic potential of protease inhibition, which attracts substantial venture capital into related drug development. These forces dictate innovation cycles and investment patterns, pushing manufacturers towards greater vertical integration and specialized product portfolios tailored for sensitive clinical and biomanufacturing applications. The necessity for high-grade reagents in diagnostic kits also serves as a strong, non-cyclical demand driver.

Segmentation Analysis

The Trypsin Inhibitor Market is comprehensively segmented based on its Source, Application, and Purity Level, reflecting the diverse requirements of end-users across research, diagnostics, and therapeutics. Segmentation by Source is crucial as it determines regulatory compliance, potential contamination risks, and production scalability, with traditional natural extracts competing intensely with modern recombinant and synthetic products. The Application segment highlights the disparate end-use demands, ranging from bulk stabilization in industrial bioprocessing to highly specific reagents needed in sensitive clinical assays, directly influencing product specifications and pricing strategy.

The Purity Level segmentation is perhaps the most critical determinant of product value, categorized typically into research grade, diagnostic grade, and pharmaceutical grade. Pharmaceutical-grade inhibitors, required for drug formulation or direct clinical use, command premium prices due to the rigorous quality control, regulatory documentation, and low endotoxin levels mandated by global health authorities. Understanding these granular segments allows manufacturers to tailor marketing strategies, optimize production capacities, and focus research and development efforts on high-growth, high-value niches, particularly those driven by emerging biotherapeutic modalities.

- By Source:

- Soybean Trypsin Inhibitor (SBTI)

- Bovine Pancreas Trypsin Inhibitor (BPTI)/Aprotinin

- Recombinant Trypsin Inhibitor (e.g., expressed in E. coli or yeast)

- Synthetic Trypsin Inhibitor

- Other Plant-derived Inhibitors (e.g., derived from corn, potatoes)

- By Application:

- Bioprocessing and Biomanufacturing (Cell culture media supplementation)

- Pharmaceutical and Therapeutics (Drug stabilization, acute pancreatitis treatment)

- Diagnostics (Clinical chemistry assays, Immunoassays)

- Academic and Scientific Research (Protein purification, Proteomics)

- Food and Beverage Industry

- By Purity Level:

- Research Grade (Standard Purity)

- Diagnostic Grade (High Purity, Low Endotoxin)

- Pharmaceutical Grade (Highest Purity, GMP compliant)

Value Chain Analysis For Trypsin Inhibitor Market

The value chain for trypsin inhibitors commences with the upstream activities involving the sourcing of raw materials. For traditional inhibitors like Soybean Trypsin Inhibitor (SBTI), this involves agricultural procurement and initial extraction. For Bovine Pancreas Trypsin Inhibitor (BPTI), raw material sourcing is highly dependent on the meat processing industry, necessitating robust supply chain management and rigorous screening for pathogens. In the case of recombinant inhibitors, the upstream phase involves genetic engineering and the procurement of specialized fermentation media and host cell lines, demanding high technical expertise and quality control over biotechnological inputs.

The core midstream activity involves extensive processing, purification, and formulation. This is the most value-adding stage, where raw extracts undergo highly complex chromatographic separation (e.g., affinity, ion exchange) and filtration steps to achieve the required purity level, especially for diagnostic and pharmaceutical grades. Manufacturers must invest heavily in GMP-compliant facilities and advanced analytical testing to ensure product stability, potency, and compliance with global regulatory standards (e.g., FDA, EMA). Formulation into stable lyophilized powders or liquid solutions is also critical for market readiness and shelf-life extension.

Downstream activities focus on distribution and end-user access. The distribution channel is bifurcated into direct sales to large biopharmaceutical companies and indirect sales through specialized life science distributors and catalog houses catering to smaller research labs and hospitals. Effective direct and indirect distribution strategies require specialized logistics for temperature-sensitive products and strong technical support. Key competitive differentiators at this stage include rapid delivery, comprehensive regulatory documentation (Certificate of Analysis), and localized technical expertise to assist highly demanding end-users like Contract Research Organizations (CROs) and clinical laboratories.

Trypsin Inhibitor Market Potential Customers

The primary potential customers and end-users of trypsin inhibitors are diverse, spanning the entire life science ecosystem, ranging from large-scale manufacturers to small academic research units. Biopharmaceutical companies represent the largest consumer segment, utilizing inhibitors extensively in their bioprocessing workflows to stabilize proprietary enzymes, prevent protein degradation during purification, and as essential components in complex cell culture media used for monoclonal antibody and vaccine production. Their purchasing criteria are dominated by product purity, batch consistency, and reliable supply chain logistics, specifically demanding pharmaceutical-grade or GMP-compliant materials.

Another significant customer base comprises Contract Research Organizations (CROs) and Contract Development and Manufacturing Organizations (CDMOs). These organizations require a broad spectrum of inhibitor grades for various outsourced services, including early-stage drug screening, stability studies, and manufacturing scale-up. Their demand is project-based and volume-flexible, requiring suppliers to maintain extensive stock and rapid fulfillment capabilities. Academic and government research institutions, focusing on fundamental biological research, proteomics, and biochemistry studies, represent a consistent demand segment, typically purchasing research-grade inhibitors through centralized university procurement systems or specialized distributors.

Clinical diagnostic laboratories form a distinct segment, relying on diagnostic-grade trypsin inhibitors for quality control and as critical components in various coagulation and clinical chemistry assay kits where precise enzyme activity control is mandatory. Furthermore, specialty therapeutic manufacturers, particularly those developing treatments for pancreatitis or administering enzyme replacement therapies, purchase pharmaceutical-grade inhibitors for direct human or animal therapeutic use, requiring the highest level of regulatory scrutiny and documentation from suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 570 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA, Thermo Fisher Scientific Inc., Danaher Corporation (Cytiva), Lonza Group AG, Abcam plc, Promega Corporation, Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd, Sigma-Aldrich (a subsidiary of Merck KGaA), TCI Chemicals, Repligen Corporation, GenScript Biotech Corporation, Enzo Life Sciences, Inc., Worthington Biochemical Corporation, Amano Enzyme Inc., Sekisui Diagnostics, LLC, CSL Behring, Sanofi S.A., Novo Nordisk A/S, Serva Electrophoresis GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Trypsin Inhibitor Market Key Technology Landscape

The technological landscape of the trypsin inhibitor market is dominated by sophisticated bioseparation and protein engineering techniques, crucial for achieving the high purity levels required by the pharmaceutical and diagnostic sectors. Affinity chromatography remains the gold standard purification technology, utilizing specialized resins conjugated with ligands that specifically bind to the inhibitor molecule, allowing for high-yield isolation from complex crude extracts. Recent innovations focus on optimizing resin chemistry and column design to enhance throughput and reduce processing time, making large-scale production more economically viable while maintaining batch-to-batch consistency. Furthermore, ultrafiltration and diafiltration techniques are essential for concentrating the final product and ensuring the removal of small molecular contaminants and salts, critical for achieving low endotoxin levels in GMP-grade material.

Genetic engineering and recombinant expression systems represent a paradigm shift in inhibitor production, addressing the limitations of traditional plant and animal sources, such as supply variability and potential viral contamination. Utilizing host systems like E. coli, yeast (Pichia pastoris), or mammalian cells allows for the controlled, scalable biosynthesis of highly specific trypsin inhibitors (e.g., synthetic Aprotinin analogs). The ability to modify the genetic sequence also facilitates the creation of engineered inhibitors with enhanced thermal stability or altered specificity profiles, opening avenues for developing patented and differentiated products with superior performance in complex biological media.

High-throughput screening (HTS) technologies are increasingly integrated, especially in the discovery phase of novel synthetic inhibitors. Automation, coupled with fluorescence or luminescence-based assay systems, allows researchers to rapidly screen thousands of small molecule libraries to identify compounds that potently inhibit trypsin activity. This technology is vital for pharmaceutical companies seeking to identify new therapeutic candidates for conditions like acute inflammation. Moreover, the integration of advanced bioinformatics and molecular modeling software enables structure-activity relationship (SAR) studies, optimizing the chemical structure of synthetic inhibitors to maximize efficacy and minimize systemic toxicity before costly in vitro and in vivo testing.

Regional Highlights

The global distribution of the Trypsin Inhibitor Market reflects the geographical concentration of advanced biotechnology and pharmaceutical manufacturing capabilities. North America, specifically the United States, holds the dominant share, driven by unparalleled investment in drug discovery, a high volume of complex clinical trials, and the presence of major biopharmaceutical companies and advanced academic research institutions. The region demands high-purity, GMP-grade inhibitors for its robust cell culture and protein therapeutic manufacturing sector, often prioritizing recombinant sources for enhanced safety and supply stability. Regulatory infrastructure (FDA) necessitates meticulous quality control, favoring suppliers with strong analytical verification processes.

Europe represents the second-largest market, characterized by strong governmental support for biomedical research, particularly in Germany, the UK, and Switzerland. The market here is driven by well-established diagnostics companies and a focus on therapeutic development for rare protease-mediated disorders. European manufacturers often lead in the development of synthetic inhibitors and novel purification methods, spurred by the strict regulatory landscape (EMA) regarding the use of animal-derived materials, which encourages the adoption of safer, chemically defined alternatives in both research and clinical applications.

The Asia Pacific (APAC) region is projected to register the fastest growth rate throughout the forecast period. This rapid expansion is primarily attributed to the burgeoning biotechnology industries in China, Japan, and India, coupled with increasing government expenditure on R&D infrastructure and the rise of local CDMOs and CMOs. While cost sensitivity remains a factor, the increasing complexity of locally manufactured biologics is driving a substantial shift toward high-quality, reliable trypsin inhibitors, presenting immense opportunities for both local suppliers scaling up production and global vendors seeking market expansion and diversification.

- North America: Dominant market share due to high R&D spending, extensive bioprocessing infrastructure, and demand for pharmaceutical-grade reagents.

- Europe: Strong focus on diagnostics, specialized therapeutic applications, and pioneering synthetic inhibitor development driven by rigorous regulatory standards.

- Asia Pacific (APAC): Highest projected CAGR fueled by expanding biopharmaceutical manufacturing capacity, growing academic research budgets, and rising demand in emerging markets like India and China.

- Latin America (LATAM): Developing market characterized by growing local pharmaceutical production and increasing international collaboration in clinical research, favoring cost-effective solutions.

- Middle East and Africa (MEA): Nascent market primarily focused on clinical diagnostics and imported biopharmaceuticals, with slowly increasing investment in local biotechnology hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Trypsin Inhibitor Market.- Merck KGaA

- Thermo Fisher Scientific Inc.

- Danaher Corporation (Cytiva)

- Lonza Group AG

- Abcam plc

- Promega Corporation

- Bio-Rad Laboratories, Inc.

- F. Hoffmann-La Roche Ltd

- Sigma-Aldrich (a subsidiary of Merck KGaA)

- TCI Chemicals

- Repligen Corporation

- GenScript Biotech Corporation

- Enzo Life Sciences, Inc.

- Worthington Biochemical Corporation

- Amano Enzyme Inc.

- Sekisui Diagnostics, LLC

- CSL Behring

- Sanofi S.A.

- Novo Nordisk A/S

- Serva Electrophoresis GmbH

Frequently Asked Questions

Analyze common user questions about the Trypsin Inhibitor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary therapeutic uses of trypsin inhibitors?

Trypsin inhibitors, particularly Aprotinin and synthetic analogs, are primarily used therapeutically to manage and treat conditions involving excessive or unregulated protease activity, most notably in acute pancreatitis and in reducing bleeding during complex surgical procedures, like cardiac surgery, by stabilizing the proteolytic cascade.

Why is there a market preference shifting from natural to recombinant trypsin inhibitors?

The market is shifting towards recombinant and synthetic trypsin inhibitors primarily due to concerns regarding purity, batch variability, and the risk of viral or prion contamination associated with traditional animal-derived sources (e.g., bovine pancreas). Recombinant production offers superior consistency, scalability, and enhanced regulatory compliance (GMP).

Which application segment holds the largest market share for trypsin inhibitors?

The Bioprocessing and Biomanufacturing application segment holds the largest market share. Trypsin inhibitors are indispensable components in large-scale cell culture media, where they stabilize therapeutic proteins, prevent cellular damage, and enhance the yield and integrity of complex biologic drugs.

How does the purity grade impact the pricing of trypsin inhibitors?

Purity grade significantly impacts pricing, with pharmaceutical-grade inhibitors commanding the highest premium. These require rigorous purification, extensive analytical testing, stringent quality control measures, and comprehensive regulatory documentation (low endotoxin, validated processes), justifying the increased cost over research-grade materials.

What role does the Soybean Trypsin Inhibitor (SBTI) play in the current market?

Soybean Trypsin Inhibitor (SBTI) remains a foundational and widely utilized product due to its cost-effectiveness and ready availability. It is primarily used in standard academic research, initial drug screening, and general bioprocessing applications where the stringent requirements for pharmaceutical-grade material are not yet necessary.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager