Tryptophan Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432767 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Tryptophan Market Size

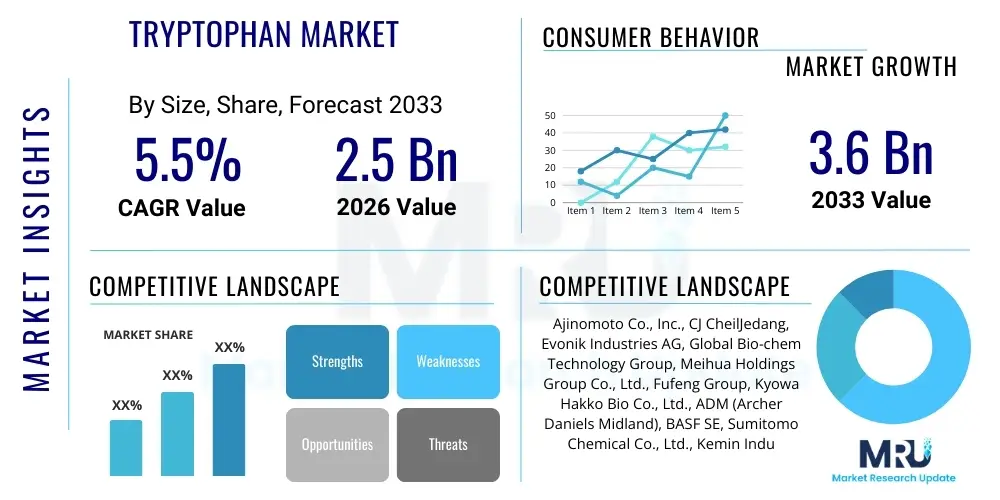

The Tryptophan Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 3.6 Billion by the end of the forecast period in 2033.

Tryptophan Market introduction

The Tryptophan market, a crucial segment within the global amino acids industry, encompasses the production, distribution, and consumption of this essential amino acid. Tryptophan (L-Tryptophan) cannot be synthesized by the human body or livestock and must be acquired through diet or supplementation, highlighting its necessity in nutrition and overall physiological function. This amino acid serves as a precursor to vital biological compounds, including serotonin, a neurotransmitter regulating mood and sleep, and niacin (Vitamin B3). The market is primarily driven by the escalating demand from the animal feed industry, where Tryptophan is used to optimize protein utilization and enhance livestock growth performance, thereby reducing feed costs and minimizing environmental nitrogen excretion. Significant growth is also observed in the nutraceutical and functional food sectors, capitalizing on Tryptophan's role in mental health support and sleep regulation.

Tryptophan is commercially manufactured mainly through fermentation processes, leveraging genetically modified microorganisms (such as certain strains of Corynebacterium glutamicum or Escherichia coli) to yield high-purity L-Tryptophan efficiently. Recent technological advancements focus on improving fermentation yields and reducing production costs to maintain competitiveness against synthetic chemical processes, although fermentation remains the preferred method for high-grade nutritional applications. The versatility of Tryptophan allows it to be incorporated into various products, ranging from concentrated feed additives for swine and poultry to specialized dietary supplements and medical foods aimed at treating specific deficiencies or sleep disorders. Regulatory scrutiny regarding food safety and animal welfare standards across major economies significantly influences product formulation and market entry strategies.

Major applications of Tryptophan span across animal nutrition, human health, and specialized pharmaceutical uses. In animal feed, its application is critical for balancing amino acid profiles, especially in low-protein diets, ensuring optimal muscle deposition and overall animal well-being. For human consumption, the product is valued for its proven efficacy in promoting better sleep patterns, alleviating symptoms associated with depression and anxiety, and supporting the synthesis of melatonin and serotonin. The increasing consumer awareness regarding preventative healthcare and the rise of the self-medication trend using natural supplements further solidify Tryptophan's market position. Additionally, the driving factors include the global expansion of meat production, stricter regulations mandating balanced animal nutrition, and a growing aging population seeking natural solutions for age-related mental and physical decline.

Tryptophan Market Executive Summary

The global Tryptophan market is characterized by robust growth, primarily propelled by the sustained expansion of the livestock industry in emerging economies, particularly across the Asia Pacific region. Business trends indicate a strong move toward sustainable and efficient production methods, focusing on advanced fermentation techniques to reduce resource consumption and enhance purity levels, directly influencing cost structures and supply chain resilience. Key manufacturers are investing heavily in capacity expansion and backward integration strategies to secure raw material supply (glucose or molasses) and maintain competitive pricing. Furthermore, the strategic diversification into high-value pharmaceutical and nutraceutical applications, moving beyond the core animal feed sector, is becoming a defining trend, offering higher margins and stability against commodity price fluctuations.

Regionally, Asia Pacific (APAC) dominates the consumption landscape, driven by large-scale swine and poultry production in China and India, coupled with rising disposable incomes leading to increased meat consumption. North America and Europe, while mature, exhibit strong growth in the human nutrition segment, fueled by rigorous consumer preference for scientifically backed dietary supplements targeting mental wellness and sleep improvement. Regulatory environments in these Western markets demand strict quality control, fostering innovation in analytical testing and purity assurance. Emerging markets in Latin America and the Middle East & Africa show accelerated adoption of Tryptophan in animal feed formulations as they modernize their agricultural practices to meet global standards and enhance export capabilities.

Segmentation trends highlight the dominance of the Animal Feed application segment by volume, although the Pharmaceuticals/Nutraceuticals segment is expected to register the highest Compound Annual Growth Rate (CAGR) due to premium pricing and expanding clinical research supporting its health benefits. L-Tryptophan remains the most widely used product type, representing the majority share due to its bio-availability and regulatory acceptance for both human and animal consumption. Within the animal feed application, poultry and swine remain the largest end-users, reflecting the efficiency gains Tryptophan offers in monogastric animal diets. The market structure remains highly concentrated, with a few large global players controlling significant market share through established production technology and global distribution networks, yet smaller, specialized players are carving out niches in the high-purity supplement market.

AI Impact Analysis on Tryptophan Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and the Tryptophan market often center on optimizing complex fermentation processes, enhancing supply chain transparency, and predicting demand fluctuations. Users frequently ask how AI can improve yield rates, minimize contamination risks in bioreactors, and specifically, whether machine learning models can accelerate the discovery of superior microbial strains for more cost-effective Tryptophan production. Concerns also arise regarding the ethical implications and data privacy issues associated with collecting and utilizing vast amounts of production data, alongside expectations that AI will rationalize pricing and reduce dependence on manual quality checks. The core theme is leveraging AI to achieve higher efficiency, precision, and sustainability throughout the Tryptophan value chain, moving from traditional batch processes to fully optimized, data-driven continuous manufacturing.

AI's impact spans from raw material sourcing and predictive maintenance in manufacturing plants to personalized nutrition strategies utilizing Tryptophan supplements. Machine learning algorithms can analyze historical sensor data from fermentation tanks—including parameters like pH, temperature, nutrient levels, and dissolved oxygen—to dynamically adjust process variables in real-time, thereby maximizing the Tryptophan conversion efficiency of the microbial culture. This sophisticated control minimizes costly batch failures and shortens production cycles. Furthermore, in the animal nutrition sector, AI-powered systems are utilized to formulate highly precise feed mixtures, optimizing Tryptophan inclusion based on real-time factors such as animal weight, environmental conditions, and genetic makeup, ensuring nutritional requirements are met with minimal waste, enhancing feed conversion ratio (FCR).

The application of AI in demand forecasting and inventory management is also transformative. By integrating data from global livestock population trends, regulatory changes, health and wellness trends, and commodity prices, AI models can generate highly accurate forecasts for Tryptophan demand several months out. This predictive capability allows manufacturers to adjust production volumes proactively, reducing holding costs and mitigating risks associated with volatile market pricing. In the pharmaceutical realm, AI accelerates research into Tryptophan derivatives and their metabolic pathways, aiding in the discovery of new therapeutic applications, particularly in psychiatric and neurological health, positioning Tryptophan as a key component in personalized medicine strategies derived from analyzing individual microbiome and genetic profiles.

- AI-driven optimization of microbial fermentation processes for enhanced Tryptophan yield and purity.

- Predictive maintenance analytics deployed in manufacturing facilities to minimize unplanned downtime and extend equipment lifespan.

- Machine Learning models utilized for precise, real-time feed formulation, optimizing Tryptophan usage in animal nutrition.

- Enhanced supply chain visibility and risk assessment through AI integration, improving resilience against global disruptions.

- Accelerated discovery of novel Tryptophan derivatives and personalized dosing recommendations in nutraceutical applications.

DRO & Impact Forces Of Tryptophan Market

The Tryptophan market is shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively constitute the Impact Forces determining its future trajectory. Key drivers include the overwhelming global demand for high-quality, cost-effective animal feed additives, necessitated by intensive livestock farming practices and global population growth putting pressure on protein supply chains. The indispensable role of Tryptophan in animal health, specifically in improving immunity and reducing aggression, further fuels this demand. Simultaneously, the consumer trend towards proactive health management, emphasizing mental well-being, stress reduction, and natural sleep aids, significantly boosts the nutraceutical segment. Opportunities emerge from developing advanced, sustainable biotechnological routes for production and exploring novel therapeutic applications outside conventional nutrition, leveraging its precursor role to neurochemicals.

However, the market faces significant restraints. Price volatility and the high cost of raw materials, such as fermentation substrates (e.g., molasses or glucose), directly impact the profitability and competitiveness of Tryptophan manufacturers. Stringent regulatory hurdles and protracted approval processes, particularly for introducing new microbial strains or specialized medical food formulations in developed markets, can slow down innovation and market entry. Moreover, the cyclical nature of the livestock industry, prone to disease outbreaks (like African Swine Fever), creates demand uncertainty and inventory challenges. Competition from alternative amino acid sources and the risk of oversupply from dominant Asian producers also put downward pressure on pricing, requiring continuous investment in efficiency to maintain margins.

The key impact forces highlight a shift towards value-added differentiation. Companies that successfully implement continuous process improvement, reducing energy consumption and waste (Sustainability Force), and those that effectively navigate the complex global trade tariffs and certification requirements (Regulatory Force) are positioned for long-term dominance. The strongest driving force remains the fundamental necessity of Tryptophan as a limiting amino acid in commercial diets, ensuring its foundational demand across both animal and human nutrition sectors. The convergence of biotechnological innovation (Opportunity Force) and increasing consumer health awareness ensures that the market will continue its upward trend, provided companies can mitigate the risks associated with commodity price volatility and supply chain disruption.

Segmentation Analysis

The Tryptophan market is structurally segmented based on crucial attributes including Product Type, Application, and Form, allowing for precise market sizing and strategic analysis. The Product Type segmentation primarily distinguishes between L-Tryptophan, the biologically active and most utilized isomer, and its less common counterparts, D-Tryptophan and DL-Tryptophan, which have specialized or industrial uses. L-Tryptophan overwhelmingly dominates the market due to its direct incorporation into protein synthesis pathways in humans and animals, making it the standard choice for feed and pharmaceutical applications. The commercial viability and scalability of fermentation technology have further solidified L-Tryptophan's market leadership across all regions.

The Application segment is the most critical determinant of market dynamics, revealing a pronounced divergence between high-volume, lower-margin animal feed usage and lower-volume, higher-margin human nutrition and medical applications. Animal feed utilizes Tryptophan to optimize diets for swine, poultry, and aquaculture, acting as a crucial building block to maximize growth efficiency and reduce protein requirements. Conversely, the Pharmaceuticals and Nutraceuticals segment focuses on the specific therapeutic benefits related to mood regulation, sleep quality, and the treatment of specific clinical deficiencies, driving demand for ultra-high-purity grades and specialized delivery formats. The burgeoning functional food and beverage industry represents an intermediate application area, integrating Tryptophan into consumer products like specialized health drinks and protein bars.

Further segmentation by Form, typically powder or liquid, dictates handling and end-user convenience. The powder form constitutes the vast majority of the market, suitable for bulk handling, blending into compound feed, and encapsulation for supplements. However, the liquid form is gaining traction in specialized applications requiring high solubility or ease of administration in veterinary medicine or hospital settings. Understanding these segment dynamics is essential for market participants to tailor their production capabilities, distribution strategies, and pricing models to address the distinct needs and quality requirements of diverse end-user industries, ensuring efficient resource allocation and maximizing overall market penetration.

- By Product Type:

- L-Tryptophan

- D-Tryptophan

- DL-Tryptophan

- By Application:

- Animal Feed (Swine, Poultry, Aquaculture, Ruminants)

- Pharmaceuticals and Nutraceuticals

- Food and Beverage (Functional Foods)

- By Form:

- Powder

- Liquid

Value Chain Analysis For Tryptophan Market

The Tryptophan value chain begins with the upstream sourcing of raw materials, primarily carbohydrate substrates such as corn starch, molasses, or glucose, which serve as the primary carbon source for the fermentation process. Upstream activities involve agricultural commodity suppliers and specialized chemical companies providing essential nutrients and precursors required by the microbial strains (biocatalysts). Stability in raw material supply and price is critical, as these commodities represent a significant portion of the total production cost. Efficient logistics and robust contracts with agricultural partners are vital for manufacturers to mitigate the inherent volatility in global commodity markets. The quality and consistency of these inputs directly influence the fermentation efficiency and the final purity of the Tryptophan produced.

Midstream processing is dominated by the industrial biotechnology sector, where Tryptophan is synthesized via large-scale fermentation in bioreactors, followed by complex purification and crystallization stages. Leading manufacturers employ advanced genetically engineered strains and optimized process control systems to maximize yield and achieve pharmaceutical-grade purity. This stage requires substantial capital investment in fermentation infrastructure, sophisticated quality control (QC) testing, and specialized expertise in industrial microbiology and chemical engineering. After purification, the Tryptophan product is formulated into its final powder or liquid form, ready for packaging and distribution. Backward integration into raw material supply is a common strategy among large producers to enhance cost control and secure operational stability.

Downstream activities involve distribution channels leading to various end-users. Direct channels are often utilized for large-volume sales to major compound feed manufacturers and pharmaceutical companies, facilitating specialized contracts and technical support. Indirect channels involve distributors, agents, and specialized nutraceutical ingredient suppliers who cater to smaller feed mills, supplement formulators, and local veterinary clinics. Given the sensitive nature of the product, robust cold chain logistics or specialized climate-controlled warehousing may be required, depending on the application and region. The final stage involves the end-use consumption, where Tryptophan is incorporated into animal feed, encapsulated into dietary supplements, or utilized in clinical settings, with regulatory compliance being a paramount concern across all distribution points.

Tryptophan Market Potential Customers

The Tryptophan market serves a diverse clientele primarily segmented into the animal nutrition industry, the human health sector (nutraceuticals and pharmaceuticals), and specialized research institutions. The largest volume buyers are global and regional animal feed integrators and compound feed manufacturers who require Tryptophan in bulk quantities to balance the amino acid profiles of their livestock diets, particularly for poultry and swine. These customers are highly sensitive to price and quality consistency, demanding guaranteed purity and reliable supply to ensure optimal feed conversion ratios (FCR) and compliance with stringent animal welfare standards, representing the foundational demand base for the market.

The second major group comprises pharmaceutical companies and nutraceutical manufacturers. These customers focus on high-purity, often clinical-grade, L-Tryptophan for use in dietary supplements targeting sleep, mood enhancement, and stress management, or as Active Pharmaceutical Ingredients (APIs) in specific medical treatments related to niacin deficiency or neurological disorders. This segment prioritizes product documentation, regulatory compliance (cGMP standards), and scientific evidence supporting health claims. They typically purchase smaller, but higher-value, batches and require specialized technical collaboration from the supplier to ensure formulation efficacy and stability in the final consumer product.

Finally, food and beverage manufacturers, specializing in functional foods, sports nutrition, and customized protein matrices, constitute a rapidly growing customer base. These buyers utilize Tryptophan as an added functional ingredient to enhance the nutritional profile of consumer goods, catering to the health-conscious market. Additionally, academic and private research laboratories are perpetual buyers, utilizing Tryptophan and its derivatives for biochemical studies, metabolic research, and drug discovery initiatives. Targeting these diverse customer needs requires manufacturers to maintain a flexible product portfolio, offering various grades and packaging options suited to industrial scale, clinical compliance, and consumer retail demands.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 3.6 Billion |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ajinomoto Co., Inc., CJ CheilJedang, Evonik Industries AG, Global Bio-chem Technology Group, Meihua Holdings Group Co., Ltd., Fufeng Group, Kyowa Hakko Bio Co., Ltd., ADM (Archer Daniels Midland), BASF SE, Sumitomo Chemical Co., Ltd., Kemin Industries, Novus International, Wuxi Jinghai Amino Acid Co., Ltd., Hebei Donghua Chemical Group, Shandong Kaison Biochemical Co., Ltd., Qingdao Sinosci Chemical Co., Ltd., Shijiazhuang Amino Acid Co., Ltd., Ningxia Eppen Biotech Co., Ltd., Nutriad International, Aliphos |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tryptophan Market Key Technology Landscape

The core technology underpinning the modern Tryptophan market is industrial biotechnology, specifically large-scale microbial fermentation. This process involves utilizing highly specialized, genetically engineered microorganisms—such as strains of Corynebacterium glutamicum or Escherichia coli—that are metabolically optimized to overproduce L-Tryptophan from simple, cost-effective carbon sources like glucose or molasses. Recent technological advancements focus intensely on metabolic engineering, applying CRISPR/Cas9 and other gene-editing tools to enhance the efficiency of the biosynthesis pathway, minimize byproduct formation, and significantly boost final product yields. Manufacturers are continuously investing in R&D to develop robust strains that can tolerate higher substrate concentrations and process stress, leading to substantial cost reductions per unit of Tryptophan produced. The shift toward utilizing sustainable and non-food competing raw materials, like cellulosic biomass, is an emerging area of research aimed at improving the environmental footprint of production.

Beyond fermentation, separation and purification technologies are crucial for achieving the high purity levels required by the human nutrition and pharmaceutical sectors. Techniques such as ion-exchange chromatography, membrane filtration, and sophisticated crystallization methods are employed to isolate L-Tryptophan from the complex fermentation broth. The trend is moving towards continuous processing methodologies, replacing traditional batch operations. Continuous chromatography, for instance, allows for higher throughput, reduced solvent usage, and more consistent product quality, which is vital for meeting stringent regulatory standards like cGMP. Furthermore, advanced analytical technologies, including High-Performance Liquid Chromatography (HPLC) coupled with mass spectrometry, are utilized for precise, rapid quality control and isomer differentiation, ensuring the final product meets specified purity criteria, especially for enantiomeric purity.

Digitalization and automation represent the latest layer of technological evolution. The implementation of bioreactor control systems integrated with advanced sensors and data analytics (often incorporating AI and machine learning, as detailed previously) allows for real-time monitoring and dynamic adjustment of fermentation parameters. This level of precision minimizes human error, optimizes energy consumption, and shortens the time-to-market for new production batches. In the downstream application sphere, advanced microencapsulation and functional coating technologies are being explored to improve the stability and bioavailability of Tryptophan in compound feeds and specialized oral supplements. These coating methods protect the amino acid from degradation during feed processing (e.g., pelleting) or passage through the digestive system, ensuring effective delivery to the target recipient and enhancing the functional value of the final product.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market for Tryptophan, primarily driven by China's massive animal feed industry, followed by rapidly expanding livestock sectors in Southeast Asia and India. The region benefits from lower production costs due to large, vertically integrated manufacturing facilities and easy access to raw materials (like molasses). Demand is strongly tied to pork and poultry production. Regulatory relaxation compared to Western markets sometimes facilitates faster capacity expansion. However, the region faces challenges related to disease outbreaks and achieving consistent high-grade purity for export to Western nutraceutical markets.

- North America: This region holds a significant market share, characterized by high value consumption in the nutraceutical and pharmaceutical sectors. North American consumers exhibit high awareness of supplements for mood and sleep, fueling stable demand growth. The animal feed segment is mature but highly focused on efficiency and sustainability, adhering to strict quality and traceability standards. Innovation often centers around specialized delivery systems and clinical research supporting therapeutic claims, commanding premium pricing compared to the APAC commodity market.

- Europe: Europe represents a technologically advanced market with a strong emphasis on regulatory compliance (e.g., REACH, strict feed additive regulations). The market demand is driven equally by a sophisticated animal feed sector focused on reducing nitrogen emissions and a well-developed market for health supplements. European manufacturers often lead in sustainable fermentation practices and specialized, high-purity Tryptophan grades. Strict limits on certain feed components mandate precise Tryptophan inclusion, ensuring continued technical demand.

- Latin America (LATAM): LATAM is characterized by emerging market growth, particularly in Brazil and Argentina, which are major global meat exporters. The increasing professionalization of the livestock industry, shifting from traditional grazing to intensive feedlot operations, drives substantial demand for essential amino acids like Tryptophan to improve productivity and meet international export quality standards. Market growth here is sensitive to regional economic stability and investment in modern agricultural infrastructure.

- Middle East and Africa (MEA): The MEA region is currently a smaller, but rapidly expanding, market for Tryptophan. Growth is fueled by increasing government investment in domestic poultry and aquaculture production to achieve food security and reduce reliance on imports. Adoption rates are improving as modern feed formulation technologies are introduced, necessitating imported Tryptophan. Challenges include logistical complexities and dependency on imports from Asian suppliers, making price volatility a significant factor.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tryptophan Market.- Ajinomoto Co., Inc.

- CJ CheilJedang

- Evonik Industries AG

- Global Bio-chem Technology Group

- Meihua Holdings Group Co., Ltd.

- Fufeng Group

- Kyowa Hakko Bio Co., Ltd.

- ADM (Archer Daniels Midland)

- BASF SE

- Sumitomo Chemical Co., Ltd.

- Kemin Industries

- Novus International

- Wuxi Jinghai Amino Acid Co., Ltd.

- Hebei Donghua Chemical Group

- Shandong Kaison Biochemical Co., Ltd.

- Qingdao Sinosci Chemical Co., Ltd.

- Shijiazhuang Amino Acid Co., Ltd.

- Ningxia Eppen Biotech Co., Ltd.

- Nutriad International

- Aliphos

Frequently Asked Questions

Analyze common user questions about the Tryptophan market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the growth of the Tryptophan market?

The primary growth drivers are the animal feed industry (especially swine and poultry) seeking optimized nutrition for efficient growth, and the human health sector, driven by increasing consumer demand for nutraceuticals that support sleep, mood regulation, and mental wellness through serotonin synthesis.

How is L-Tryptophan commercially manufactured, and what are the key production challenges?

L-Tryptophan is primarily manufactured through microbial fermentation using genetically modified strains (e.g., E. coli or C. glutamicum). Key challenges involve controlling raw material price volatility (sugars), optimizing high-yield fermentation processes, and ensuring high purity levels required for human consumption.

Which geographical region dominates the consumption and production of Tryptophan?

The Asia Pacific (APAC) region dominates both the production capacity and consumption volume, largely due to China's significant presence in the global amino acid manufacturing sector and its vast, intensive livestock farming industry.

What is the competitive landscape for Tryptophan manufacturers, and who are the major players?

The market is highly concentrated, characterized by intense competition among a few large global players, particularly those with advanced fermentation technologies and economies of scale. Major players include Ajinomoto, CJ CheilJedang, Evonik Industries, and several large Chinese biochemical firms like Fufeng Group.

What role does Tryptophan play in animal nutrition, specifically in feed formulations?

Tryptophan is often the third or fourth limiting amino acid in animal feed (after Lysine and Methionine), crucial for protein synthesis, optimizing muscle growth, improving feed conversion efficiency, and supporting overall animal welfare, particularly by reducing stress and aggression in intensively farmed animals.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Tryptophan Market Size Report By Type (Feed Grade, Pharma Grade, Food Grade), By Application (Feed, Pharmaceutical, Food Nutrient Products, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- L-Tryptophan Market Statistics 2025 Analysis By Application (Feed Industry, Pharmaceutical Industry), By Type (Feed Grade, Pharma Grade), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- L-Tryptophan Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Feed Grade, Pharma Grade), By Application (Feed, Pharmaceutical, Food Nutrient products, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager