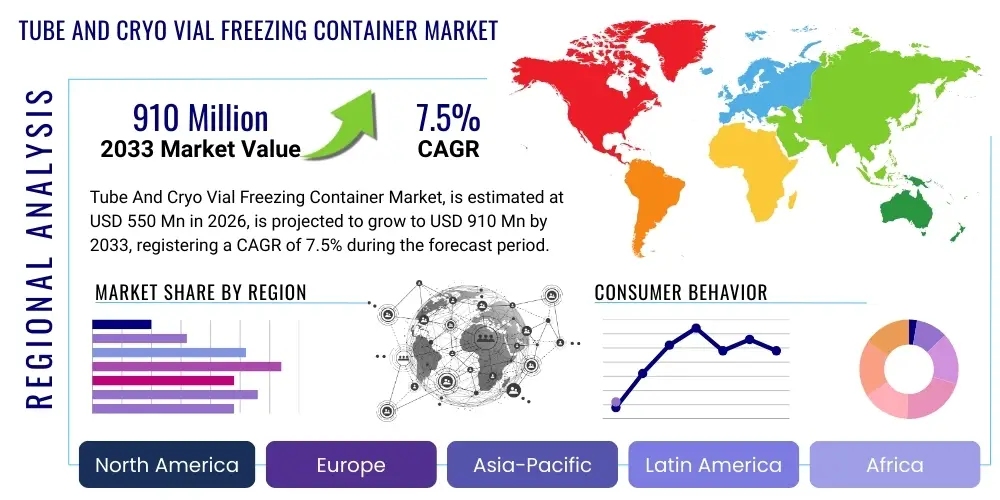

Tube And Cryo Vial Freezing Container Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436778 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Tube And Cryo Vial Freezing Container Market Size

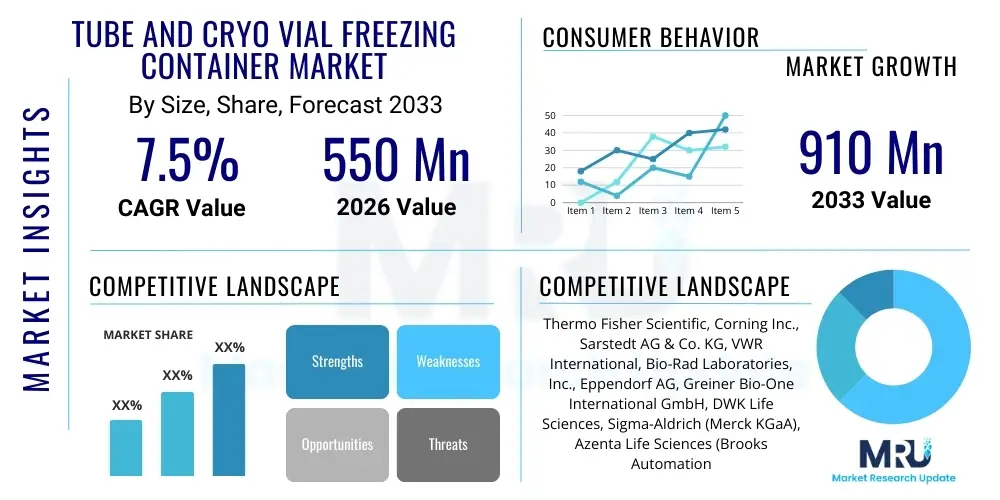

The Tube And Cryo Vial Freezing Container Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 550 million in 2026 and is projected to reach USD 910 million by the end of the forecast period in 2033.

Tube And Cryo Vial Freezing Container Market introduction

The Tube And Cryo Vial Freezing Container Market encompasses specialized devices essential for the controlled, gradual freezing of biological samples, such as cells, tissues, and genomic material, typically stored in cryo vials or tubes. These containers are fundamental components of the cryopreservation process, ensuring sample viability by controlling the cooling rate—often at -1°C per minute—which minimizes intracellular ice crystal formation that can lead to cell lysis. The standard mechanism involves passive cooling, frequently utilizing isopropanol or specialized phase change materials (PCMs) within an insulated environment, ensuring consistent temperature reduction necessary for long-term storage in ultra-low temperature freezers or liquid nitrogen.

Product descriptions within this market focus primarily on material science, thermal conductivity, and structural integrity. Most containers are designed from robust polycarbonate or durable plastics capable of withstanding extreme temperature gradients and are optimized for standard 1.0 mL or 2.0 mL cryogenic vials. Major applications span across diverse sectors including pharmaceuticals, biotechnology, academic research, diagnostics, and large-scale biobanking. The critical benefits delivered by these containers include enhanced sample recovery rates, standardization of freezing protocols across different laboratory setups, and operational simplicity, which collectively improve the reliability and reproducibility of sensitive biological experiments.

The market is predominantly driven by the explosive growth in cell and gene therapy (CGT) research, which necessitates the preservation of living cells (like T-cells for CAR-T therapies) in a viable state for clinical use. Furthermore, the expansion of global biobanks supporting genomics and personalized medicine initiatives contributes significantly to demand. Increased government funding for life sciences research, coupled with advancements in standardized laboratory practices and strict regulatory guidelines concerning sample integrity, further solidifies the essential role of controlled freezing containers in modern scientific infrastructure, ensuring high-quality, reproducible research outcomes and robust clinical sample management.

Tube And Cryo Vial Freezing Container Market Executive Summary

The Tube And Cryo Vial Freezing Container Market is currently witnessing robust expansion fueled by accelerated global investment in regenerative medicine and high-throughput drug screening methodologies. Key business trends include a shift toward sustainable, non-isopropanol-based freezing solutions utilizing advanced phase change materials (PCMs), which offer equivalent cooling efficiency while reducing toxicity and maintenance requirements. Furthermore, manufacturers are focusing on developing high-capacity, automated containers compatible with robotic systems used in large-scale biobanks, addressing the need for enhanced throughput and minimizing human error during the critical freezing step. Strategic mergers and acquisitions among established life science tool providers are observed, aimed at integrating cryopreservation technologies with comprehensive sample management systems.

Regionally, North America remains the dominant revenue generator, propelled by the presence of leading pharmaceutical and biotechnology hubs, substantial government funding in biomedical research, and early adoption of innovative cell therapy protocols. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, primarily driven by expanding clinical trial activities, increasing investment in local biobanking infrastructure in China and India, and rising awareness regarding the importance of standardized sample preservation techniques. European markets maintain stable growth, underpinned by robust academic research institutions and regulatory pressures mandating compliance with standardized cryopreservation practices for clinical samples.

Segmentation trends highlight the dominance of passive freezing containers due to their cost-effectiveness and operational simplicity, particularly in academic and smaller clinical laboratories. However, the application segment focused on cell and gene therapy is expected to exhibit superior CAGR, necessitating sophisticated controlled-rate freezing technology. In terms of end-users, Contract Research Organizations (CROs) and pharmaceutical companies are rapidly increasing their procurement volumes as outsourced R&D activities and complex drug development pipelines require the long-term, high-integrity storage of diverse biological assets. The sustained demand across all segments underscores the market's resilience, intrinsically tied to the foundational requirements of modern biological research and therapeutic development.

AI Impact Analysis on Tube And Cryo Vial Freezing Container Market

Common user questions regarding AI's impact on the Tube And Cryo Vial Freezing Container Market often center on how automation and predictive analytics can improve sample integrity, optimize storage logistics, and ensure regulatory compliance. Users inquire about the integration of AI-driven quality control mechanisms to monitor freezing profiles in real-time and predict potential temperature deviations that could compromise sample viability. Key themes include the shift from manual data logging to automated, AI-enhanced systems that track container inventory, location, and usage history across massive biobank infrastructure. Expectations focus on AI reducing operational bottlenecks, minimizing energy consumption in large freezer farms through predictive loading patterns, and providing high-fidelity data that substantiates the viability of preserved therapeutic cells for clinical applications, thereby integrating the physical freezing container into a smart, traceable cold chain ecosystem.

- AI-enhanced Quality Control: Predictive algorithms monitor real-time temperature stability within freezing containers, identifying anomalous cooling curves before damage occurs.

- Automated Inventory Management: AI systems optimize placement and retrieval logistics for thousands of containers stored in ultra-low temperature freezers, improving efficiency and reducing retrieval time.

- Cryopreservation Protocol Optimization: Machine learning models analyze historical cryopreservation data (freezing rate, cell type, recovery rate) to suggest ideal freezing protocols for novel cell lines, enhancing viability.

- Regulatory Compliance and Data Logging: Automated documentation of environmental conditions and container usage history, providing immutable audit trails necessary for FDA and EMA approval processes.

- Predictive Maintenance: AI forecasts wear and tear on freezer units and container sealing mechanisms, scheduling proactive maintenance to prevent catastrophic cold chain failures.

- Smart Container Integration: Development of containers with integrated sensors communicating data directly to centralized AI cold chain platforms, enabling end-to-end sample traceability.

DRO & Impact Forces Of Tube And Cryo Vial Freezing Container Market

The dynamics of the Tube And Cryo Vial Freezing Container Market are primarily governed by the explosive need for biological sample preservation, juxtaposed against technological and regulatory constraints. Drivers include the global proliferation of biobanking initiatives, spurred by large-scale genomic studies and the rapid clinical translation of cell and gene therapies (e.g., CAR-T, stem cell treatments), all requiring reliable, standardized freezing rates. Restraints predominantly revolve around the high initial capital expenditure associated with setting up and maintaining ultra-low temperature infrastructure, including the ongoing reliance on potentially hazardous or volatile coolants like isopropanol, alongside the challenge of global regulatory harmonization for sample quality across different clinical jurisdictions. Opportunities lie in the emerging demand for sustainable and non-toxic freezing solutions, such as dry shippers and advanced phase change material containers, coupled with the potential integration of RFID and IoT technology into containers for superior real-time monitoring and inventory control, particularly benefiting large pharmaceutical R&D operations and centralized clinical supply chains.

Impact forces within this market are significant. Technological advances in material science, leading to the creation of more robust and thermally efficient container designs, exert a high-level impact force, driving market acceptance by ensuring better cell viability post-thaw. The regulatory environment, particularly stringent standards set by bodies like the FDA and EMEA regarding the quality and traceability of clinical-grade samples, also exerts a strong force, compelling end-users to adopt validated, commercial freezing containers over ad-hoc solutions. Conversely, economic downturns or fluctuations in government funding for basic research can act as a moderate negative impact force, slowing down capital investments in new biobank construction. The critical requirement for high-quality, reproducible data in drug discovery ensures that performance (cell viability) remains the single most important differentiating factor, heavily influencing procurement decisions and driving continuous innovation among key market participants.

Furthermore, the competitive landscape is influenced by the ability of manufacturers to ensure global supply chain stability. As the demand for complex biological materials grows, the need for validated freezing solutions that can be shipped globally, often under challenging logistics constraints, becomes paramount. This emphasis on logistical robustness drives strategic alliances between container manufacturers and specialized cold chain logistics providers, thereby impacting market structure and distribution channels. The growing trend toward decentralized clinical trials and point-of-care cryopreservation solutions introduces new design constraints, requiring smaller, more portable, and easy-to-use containers, shaping future product development strategies and overall market penetration across diverse geographical settings.

Segmentation Analysis

The Tube And Cryo Vial Freezing Container Market is comprehensively segmented based on the container mechanism, the specific application areas utilizing cryopreserved samples, and the nature of the end-user facilities. Mechanistic segmentation differentiates between passive freezing containers, which dominate in volume and typically use isopropanol or specialized material inserts to achieve controlled freezing rates, and controlled-rate freezers (CRFs), which offer precise electronic temperature control but represent a higher capital investment. Application segmentation clearly delineates demand originating from advanced therapeutic areas like cell and gene therapy—the fastest growing segment—compared to more established uses in academic research, drug discovery, and traditional regenerative medicine. End-user classification allows for targeted marketing and product development, distinguishing between the high-volume needs of centralized biobanks and pharmaceutical companies versus the smaller, specialized demands of clinical hospitals and academic research institutes, reflecting disparate budget constraints and throughput requirements.

This segmented view is crucial for strategic planning. The passive freezing container segment holds the largest market share due to its low cost, portability, and simplicity, making it ideal for routine laboratory use and small-scale clinical operations globally. Conversely, the high growth projection in the cell and gene therapy application segment drives innovation toward specialized, validated containers that guarantee optimal cell viability for eventual patient infusion, often utilizing advanced materials to eliminate variations in freezing rate. Analyzing these segments reveals a dual trend: broad penetration of affordable, standard containers and targeted, high-value demand for specialized cryopreservation tools necessary for complex therapeutic manufacturing processes. Understanding these dynamics is essential for forecasting investment into R&D concerning new thermal management technologies and robust container materials.

- By Mechanism:

- Passive Freezing Containers (Isopropanol-based)

- Passive Freezing Containers (Isopropanol-Free/PCM-based)

- Controlled-Rate Freezers (CRFs) – Though distinct equipment, containers are designed specifically for compatibility.

- By Application:

- Cell and Gene Therapy

- Biobanking

- Drug Discovery and Development

- Clinical Trials

- Academic Research

- By End-User:

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutions

- Hospitals and Clinical Laboratories

- Contract Research Organizations (CROs)

- Government and Non-Profit Biobanks

Value Chain Analysis For Tube And Cryo Vial Freezing Container Market

The value chain for the Tube And Cryo Vial Freezing Container Market begins with the upstream segment, dominated by specialized material suppliers providing high-grade, temperature-resistant polycarbonate, polypropylene, and various phase change materials (PCMs) or technical-grade isopropanol. The quality and purity of these raw materials are critical, as they directly influence the thermal properties and durability of the final container. Key activities at this stage include sourcing materials that meet stringent biological inertness and non-toxicity standards. The manufacturing process involves specialized injection molding techniques to ensure precise dimensional accuracy necessary for uniform heat transfer and seamless integration with existing laboratory equipment, followed by rigorous quality assurance testing for thermal performance and structural integrity across extreme temperatures.

The downstream segment primarily involves distribution and end-user adoption. Products are often distributed through a combination of direct sales channels, especially to large pharmaceutical clients requiring customized solutions, and indirect channels via specialized scientific distributors (e.g., Fisher Scientific, VWR) who possess established logistics networks for cold chain supplies. The selection of the distribution channel is heavily influenced by the end-user profile; large centralized biobanks typically negotiate directly, while smaller clinical labs rely on comprehensive catalog sales from distributors. Post-sale activities include technical support and validation services, crucial for ensuring the containers perform optimally within the end-user’s specific cryopreservation protocols and regulatory framework, thereby adding significant value to the overall product offering.

The distribution network complexity is high, as these specialized tools must be handled carefully to maintain sterility and structural integrity before they reach the laboratory. Direct channels provide tighter control over pricing and technical consultation but have limited geographic reach. Indirect distribution leverages the distributor’s existing rapport with diverse laboratories, facilitating broader market penetration. Successful value chain management requires robust coordination between material science R&D, manufacturing efficiency, and a logistics strategy capable of supporting the global life science market, ultimately ensuring that high-quality, validated freezing containers are readily available to maintain the integrity of critical biological assets from academic bench to clinical bedside.

Tube And Cryo Vial Freezing Container Market Potential Customers

The primary consumers and buyers of Tube And Cryo Vial Freezing Containers are institutions engaged in high-stakes biological research, clinical diagnostics, and therapeutic manufacturing. Pharmaceutical and biotechnology companies represent a cornerstone of demand, utilizing these containers extensively during early-stage drug discovery, toxicology screening, and the rigorous process of developing and manufacturing advanced cell and gene therapies. These end-users demand high-throughput, standardized containers that ensure regulatory compliance and guarantee the viability of proprietary cell lines and clinical samples. Academic research institutions, including university laboratories and government-funded institutes, constitute another significant customer base, relying on these tools for fundamental biological studies, genomics, and tissue banking, often prioritizing cost-effectiveness and ease of use in their procurement decisions.

Beyond traditional research environments, clinical facilities are increasingly critical customers. Hospitals operating specialized clinical laboratories, particularly those involved in fertility treatments (IVF centers), transplant medicine, and pathology, require reliable cryopreservation tools for long-term patient sample storage and biobanking efforts associated with specific disease cohorts. Furthermore, Contract Research Organizations (CROs) serve as major volume buyers. As pharmaceutical companies increasingly outsource R&D, CROs require large volumes of standardized, validated freezing containers to manage the vast sample libraries generated during global clinical trials, emphasizing scalability and the maintenance of rigorous quality standards across multiple trial sites. The demand profiles of these groups vary significantly, compelling manufacturers to offer a diversified product portfolio ranging from high-capacity, automated solutions to simple, single-use, temperature-controlled shippers.

The purchasing cycle for these potential customers often involves extensive validation processes. Clinical customers must ensure that any container adopted meets Good Manufacturing Practice (GMP) or Good Clinical Practice (GCP) guidelines, mandating detailed performance documentation from suppliers. Biobanks, whether government-funded or private, focus on long-term capital investments, seeking containers with proven longevity and thermal stability to secure decades of stored assets. Manufacturers must strategically position their products by demonstrating superior thermal performance, material purity, and compatibility with various cryoprotective agents and downstream analytical techniques, ultimately appealing to the end-user’s primary objective: maximizing the recovery and biological functionality of the cryopreserved sample.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 910 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Corning Inc., Sarstedt AG & Co. KG, VWR International, Bio-Rad Laboratories, Inc., Eppendorf AG, Greiner Bio-One International GmbH, DWK Life Sciences, Sigma-Aldrich (Merck KGaA), Azenta Life Sciences (Brooks Automation), MVE Biological Solutions (Chart Industries), Taylor-Wharton, CryoSafe, Nunc (Thermo Fisher Scientific), Saint-Gobain Life Sciences, Becton, Dickinson and Company (BD), Ziath Ltd., REMI Elektrotechnik Limited, Simport Scientific. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tube And Cryo Vial Freezing Container Market Key Technology Landscape

The technology landscape for Tube And Cryo Vial Freezing Containers is centered on thermal engineering principles aimed at achieving the precise, consistent -1°C per minute cooling rate vital for high cell viability. The primary technological approach involves passive cooling systems. Early generations relied heavily on insulated chambers containing high volumes of isopropanol, which acts as a thermal buffer, dissipating heat gradually as the container is placed into a -80°C freezer. Current innovation, however, is heavily invested in developing Isopropanol-Free (IF) technology. This includes using advanced Phase Change Materials (PCMs) that solidify and melt at precise temperatures, effectively replacing the chemical buffer with a non-toxic, reusable, and more environmentally friendly solid-state system. These PCM-based solutions represent a significant technological advancement, reducing variability, eliminating recurring chemical costs, and simplifying regulatory compliance related to hazardous waste management in laboratory settings.

A parallel stream of innovation focuses on enhancing traceability and data integrity. The integration of Radio-Frequency Identification (RFID) tags and QR codes directly onto the container bodies allows for instantaneous, accurate inventory management and linkage to Laboratory Information Management Systems (LIMS). This integration is crucial for maintaining the chain of custody for valuable clinical samples, especially within decentralized clinical trials. Furthermore, smart material science is being explored to create containers with improved thermal stability and mechanical resilience, reducing the risk of micro-cracking or lid failures during temperature extremes, thereby ensuring long-term hermetic sealing and preventing cross-contamination in liquid nitrogen storage environments. The trend is moving towards integrating the container not just as a vessel, but as an active, traceable component of the overall cold chain ecosystem.

While passive systems remain the market volume leader, the compatibility with Controlled-Rate Freezers (CRFs)—electronic, programmable cooling units—is also a key technological consideration. Manufacturers are designing containers optimized for use with these high-precision instruments, ensuring thermal transfer efficiency is maximized. For both passive and CRF applications, standardization of vial geometry and container footprint is essential to maintain interoperability with automated filling, capping, and storage robotic systems prevalent in modern biobanks. Future technological evolution is expected to focus on miniaturization and high-density storage solutions, optimizing space utilization within ultra-low temperature freezers while maintaining impeccable thermal performance and supporting automated handling processes, crucial for meeting the scalability demands of emerging high-volume therapeutic cell production facilities worldwide.

Regional Highlights

- North America: North America, particularly the United States, holds the dominant share of the Tube And Cryo Vial Freezing Container Market, driven by pioneering research in biotechnology, vast governmental and private funding for life sciences, and the early, widespread adoption of advanced cell and gene therapy pipelines. The region benefits from a dense concentration of leading pharmaceutical companies, established Contract Research Organizations (CROs), and massive centralized biobanks demanding high-volume, validated cryopreservation tools. Stringent regulatory standards for clinical sample preservation further compel adoption of high-quality, standardized containers, reinforcing market stability and consistent growth in both passive and specialized controlled freezing technologies.

- Europe: Europe represents a mature and highly structured market, characterized by significant investment in academic research (funded through programs like Horizon Europe) and strong participation in clinical trials. Key growth drivers include the establishment of large national biobanks and increasing regulatory pressure, particularly from the European Medicines Agency (EMA), mandating precise standards for handling and storing human therapeutic cells. Western European countries, including Germany, the UK, and France, lead demand, focusing on non-isopropanol solutions to comply with evolving environmental and occupational safety regulations, making the region a key driver for sustainable freezing technology innovation.

- Asia Pacific (APAC): The APAC region is projected to register the fastest growth rate during the forecast period. This accelerated expansion is attributed to rapidly developing healthcare infrastructure, increasing government investment in local R&D capabilities—especially in China, Japan, and South Korea—and the rising prevalence of outsourced clinical trials. The market in APAC is characterized by a high demand for cost-effective, passive freezing containers in smaller, emerging research labs, alongside surging demand for high-end, traceable cryopreservation systems necessary for supporting burgeoning domestic pharmaceutical manufacturing and the region's expanding role in global biobanking networks.

- Latin America (LATAM): The LATAM market is currently characterized by moderate growth, primarily driven by investments in national public health initiatives and localized academic research expansion. Demand is concentrated in major economies like Brazil and Mexico, focusing predominantly on basic cryopreservation needs for clinical diagnostics and local blood banking. The market remains sensitive to fluctuations in regional economic stability and relies heavily on imported technology, though localized manufacturing partnerships are beginning to emerge to address cost constraints and streamline the supply chain for essential laboratory consumables.

- Middle East and Africa (MEA): Growth in the MEA region is gradual but steady, largely concentrated in technologically advanced healthcare hubs such as the UAE, Saudi Arabia, and South Africa. Market penetration is closely tied to investment in specialized medical sectors, including fertility clinics and advanced pathology labs. Demand is primarily for reliable, validated products from international manufacturers, with increasing focus on establishing basic regional biobanking infrastructure to support genomic studies relevant to local populations. The challenge remains logistical complexity and varying regulatory maturity across different national markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tube And Cryo Vial Freezing Container Market.- Thermo Fisher Scientific

- Corning Inc.

- Sarstedt AG & Co. KG

- VWR International

- Bio-Rad Laboratories, Inc.

- Eppendorf AG

- Greiner Bio-One International GmbH

- DWK Life Sciences

- Sigma-Aldrich (Merck KGaA)

- Azenta Life Sciences (Brooks Automation)

- MVE Biological Solutions (Chart Industries)

- Taylor-Wharton

- CryoSafe

- Nunc (Thermo Fisher Scientific)

- Saint-Gobain Life Sciences

- Becton, Dickinson and Company (BD)

- Ziath Ltd.

- REMI Elektrotechnik Limited

- Simport Scientific

Frequently Asked Questions

Analyze common user questions about the Tube And Cryo Vial Freezing Container market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a tube and cryo vial freezing container?

The primary function is to ensure a precise, controlled-rate freezing process—typically -1°C per minute—for biological samples (cells, tissues) stored in cryo vials. This controlled cooling rate minimizes the formation of detrimental intracellular ice crystals, thereby maximizing cell viability upon thawing for downstream clinical or research applications.

How do Isopropanol-Free (IF) freezing containers differ from traditional systems?

IF containers replace the chemical coolant (isopropanol) with advanced Phase Change Materials (PCMs) or specialized insulation technologies. This eliminates the maintenance, potential toxicity, and environmental concerns associated with isopropanol, offering a safer, reusable, and more standardized freezing method without compromising the required cooling kinetics.

Which end-user segment drives the highest growth in the cryo vial freezing container market?

The Cell and Gene Therapy (CGT) application segment drives the highest growth. The complexity and high value of therapeutic cells (like CAR-T cells) necessitate rigorously validated and traceable cryopreservation containers to ensure optimal viability and regulatory compliance for patient treatments, boosting demand for high-end solutions.

What role does Artificial Intelligence (AI) play in optimizing cryopreservation containers?

AI is increasingly used to monitor and optimize the cold chain by integrating with smart containers. AI systems analyze real-time temperature data and historical freezing profiles to predict deviations, automate inventory tracking (via RFID integration), and suggest optimal preservation protocols for different biological sample types, enhancing data integrity and efficiency.

Which geographical region holds the largest market share, and why?

North America holds the largest market share, primarily due to high levels of government and private R&D funding, the highest concentration of leading pharmaceutical and biotechnology companies, and the established infrastructure necessary for large-scale biobanking and advanced cell therapy manufacturing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager