Tubing Bundles Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433818 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Tubing Bundles Market Size

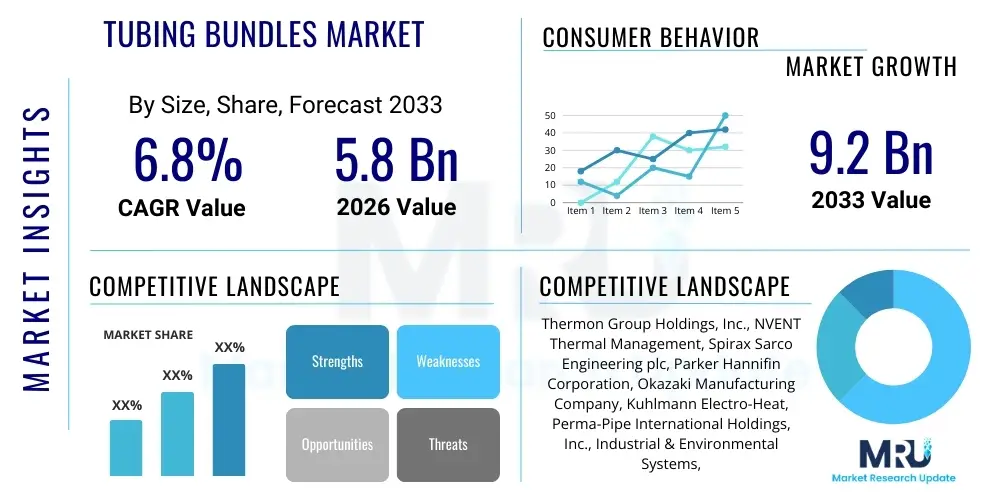

The Tubing Bundles Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $5.8 Billion USD in 2026 and is projected to reach $9.2 Billion USD by the end of the forecast period in 2033.

Tubing Bundles Market introduction

Tubing bundles, often referred to as instrument tubing bundles or heat trace bundles, are prefabricated assemblies designed to streamline fluid transfer, process control, and environmental protection in industrial settings. These systems typically consist of multiple individual tubes—fabricated from materials such as stainless steel, copper, or specialized alloys—packaged together within a protective jacket or sheath. The primary function is to deliver process fluids, pneumatic signals, or hydraulic power efficiently and safely, often incorporating thermal insulation and electrical or steam tracing lines to maintain critical temperatures and prevent freezing or viscosity changes in sensitive media. This integrated approach significantly reduces installation complexity, material waste, and labor costs compared to traditional field-fabricated individual tubing runs, making them indispensable components in large-scale industrial projects across diverse sectors.

The major applications for tubing bundles span industries characterized by rigorous process control and harsh operating environments. In the Oil & Gas sector, they are crucial for upstream, midstream, and downstream operations, including offshore platforms, refineries, and petrochemical plants, where they manage analyzer sample lines and control fluid transfer. The chemical processing industry relies heavily on these bundles for handling corrosive agents and maintaining precise temperature stability during synthesis. Furthermore, the power generation industry, particularly nuclear and thermal facilities, utilizes pre-insulated and trace-heated bundles to ensure reliable operation of monitoring instruments and steam delivery lines, contributing to both safety and operational efficiency.

Key driving factors propelling the market growth include the increasing global investments in new infrastructure projects, particularly in refinery expansions and liquefied natural gas (LNG) facilities, which necessitate extensive instrumentation networks. The stringent regulatory environment emphasizing process safety and leak reduction also fuels demand for high-integrity, factory-assembled bundles. Furthermore, the ongoing trend toward automation and digitization in industrial control systems requires robust and thermally stable conduits for signal transmission and sensor connectivity. The superior protection against mechanical damage, UV exposure, and chemical corrosion offered by modern jacketing materials further solidifies the essential role of tubing bundles in modern industrial infrastructure.

Tubing Bundles Market Executive Summary

The Tubing Bundles Market is experiencing robust expansion driven by global energy sector revitalization and heightened demands for operational efficiency in chemical processing and power generation industries. Business trends indicate a strong shift towards factory-assembled, high-performance bundles, specifically those incorporating advanced thermal insulation and sophisticated electric heat tracing technologies, catering to applications requiring precise temperature maintenance across vast distances. Key manufacturers are focusing on material innovation, utilizing specialized polymers for jacketing to enhance resistance against fire, chemicals, and extreme temperatures, thereby increasing product longevity and compliance with international safety standards such as those required in explosive atmospheres. Furthermore, the market structure is becoming increasingly competitive, with a trend toward strategic partnerships between tubing suppliers and automation integrators to offer complete instrumentation packages, streamlining procurement and installation for large EPC contractors.

Regionally, the market exhibits dynamic growth, with Asia Pacific emerging as the fastest-growing region, primarily fueled by massive infrastructure investments in China, India, and Southeast Asian nations, particularly in expanding petrochemical complexes and gas pipelines. North America, while mature, continues to show significant demand, particularly due to the modernization of existing refineries and substantial capital expenditure in LNG export terminal construction, necessitating high volumes of sophisticated tubing bundles for complex control systems. Europe maintains steady growth, driven by stringent environmental regulations requiring enhanced monitoring capabilities and the replacement of older, less efficient field-installed piping with modern, integrated bundle systems that offer superior thermal retention and reduced maintenance overhead. The Middle East and Africa (MEA) region remains a core growth area, supported by large-scale upstream oil and gas projects and national initiatives aimed at diversifying energy production infrastructure.

Segment trends highlight the dominance of stainless steel tubing materials due to their exceptional corrosion resistance and mechanical strength, although specialized alloy bundles are gaining traction in ultra-high purity and severely corrosive environments. Regarding structure, multi-tube bundles incorporating both instrument lines and integrated steam or electric tracing continue to command the largest market share, as they offer comprehensive solutions for freezing prevention and temperature maintenance in critical process lines. The electric heat trace segment, in particular, is forecasted to exhibit the highest CAGR, spurred by advancements in self-regulating heating cables and smart control systems that optimize energy consumption, aligning with broader industrial sustainability goals and maximizing system efficiency while minimizing potential operational downtime.

AI Impact Analysis on Tubing Bundles Market

User inquiries regarding AI's influence on the Tubing Bundles Market primarily revolve around predictive maintenance, optimization of industrial installation processes, and quality control during manufacturing. Common themes include the ability of AI-driven analytics to forecast material stress and failure points in existing bundled infrastructure, extending the lifespan and ensuring reliability of critical process lines. Users are keenly interested in how machine learning algorithms can analyze vast datasets from instrumentation systems—often housed within the bundles—to detect subtle anomalies indicative of insulation degradation, tracing failure, or potential leak paths long before conventional methods identify them. Additionally, there is significant curiosity regarding AI’s role in optimizing the routing and design of bundled systems during the engineering phase, minimizing material length, reducing installation time, and ensuring compliance with complex spacing and thermal requirements in confined industrial spaces.

The integration of AI is transforming the lifecycle management of tubing bundle installations from design through operation. During the design phase, Generative Design AI tools can rapidly assess thousands of layout permutations, optimizing thermal performance and constructability based on site constraints and process specifications, leading to more efficient material use and lower overall project costs. Operationally, AI platforms leverage data streams from smart sensors embedded within or near the bundles—measuring temperature, pressure, and vibration—to create high-fidelity digital twins. These digital twins enable operators to simulate various fault scenarios and predict the Remaining Useful Life (RUL) of the bundle system, moving maintenance schedules from reactive or time-based models to precise, condition-based interventions. This predictive capability is critical, especially in remote or difficult-to-access locations where bundle failure can lead to severe process disruption or safety hazards.

Furthermore, AI-enhanced vision systems are being deployed in manufacturing facilities to conduct real-time, high-speed inspection of the bundling process. These systems ensure the uniform tensioning, correct placement of insulation layers, and integrity of the outer jacket, guaranteeing adherence to strict quality tolerances, thereby reducing manufacturing defects. By utilizing machine learning for sophisticated non-destructive testing analysis, manufacturers can rapidly verify the thermal performance and structural integrity of the final product. This not only enhances product reliability but also accelerates the production cycle, positioning AI as a key enabler for high-volume, high-specification projects within the tubing bundles market infrastructure.

- AI optimizes bundle routing design, minimizing material waste and installation time.

- Machine learning algorithms enable predictive maintenance, forecasting insulation and heat trace failure.

- AI-enhanced sensor data analytics improve process control stability delivered through bundled lines.

- Generative design tools accelerate the customization of bundles for complex project specifications.

- Vision systems utilize AI for automated, high-speed quality inspection during the manufacturing phase.

- Digital twins, supported by AI, simulate thermal performance and structural longevity in real-time.

DRO & Impact Forces Of Tubing Bundles Market

The dynamics of the Tubing Bundles Market are significantly influenced by a confluence of driving forces, restraining factors, and opportunistic avenues that collectively shape investment decisions and technological advancements. Key drivers include the revitalization of capital expenditure in the global oil and gas sector, particularly for large-scale LNG, petrochemical, and refining expansion projects, which require complex instrumentation infrastructure over extended distances. The continuous push toward industrial automation and the resultant increase in instrumentation density per plant also necessitate integrated, pre-fabricated solutions to manage thousands of control and monitoring lines efficiently. Furthermore, stringent safety and environmental regulations, particularly concerning fugitive emissions and process temperature stability, demand the high-integrity, thermally optimized solutions that tubing bundles inherently provide, thereby pushing market penetration across regulated industries.

However, the market faces several restraining challenges. Fluctuations in the prices of key raw materials, such as stainless steel and high-performance polymers used for jacketing, introduce volatility into manufacturing costs and procurement budgets for end-users. Additionally, the initial capital outlay associated with high-specification, custom-engineered tubing bundles can be significantly higher than traditional field-installed piping, posing a barrier to adoption for smaller projects or facilities with constrained budgets, despite the long-term operational savings. Complexity in international supply chain logistics and the need for specialized installation expertise also act as minor restraints, particularly in emerging markets where skilled labor for advanced thermal management systems may be scarce. Furthermore, intense competition from suppliers offering cheaper, lower-quality alternatives impacts pricing power for premium product manufacturers.

Opportunities for market players are vast, stemming primarily from the growing demand for specialized, high-purity bundles in pharmaceutical and semiconductor manufacturing, sectors requiring ultra-clean, corrosion-resistant transfer lines. The expansion of the hydrogen economy and carbon capture utilization and storage (CCUS) projects presents a nascent yet significant opportunity for bundles designed to handle supercritical fluids and high-pressure gases under extreme thermal conditions. Technological advancements in sensor integration and the development of "smart bundles" equipped with fiber optics for real-time monitoring of temperature and structural health open new revenue streams focused on lifecycle services and predictive maintenance subscription models. The transition towards advanced self-regulating electric tracing technology, which offers superior energy efficiency and simplified control architectures, further fuels opportunities for innovation and differentiation among leading market participants.

Segmentation Analysis

The Tubing Bundles Market is strategically segmented based on crucial parameters including the type of material used for the inner tubes, the specific heat tracing technology incorporated, the physical structure of the assembly, and the end-use industry application. This multifaceted segmentation helps analysts and market participants understand the diverse functional requirements across different industrial landscapes. The segmentation by material is pivotal, as it determines the chemical compatibility and pressure rating, while the tracing technology classification differentiates solutions based on thermal efficiency and maintenance requirements. The structure segment distinguishes between basic insulated lines and highly complex multi-line analytical transport systems, providing clarity on the complexity of the final product and its intended function within the plant infrastructure.

- By Type of Tubing Material:

- Stainless Steel (304, 316, 316L)

- Copper

- Monel and Inconel (Special Alloys)

- PTFE/Polymer Tubing

- By Heat Tracing Technology:

- Steam Traced Tubing Bundles

- Electric Traced Tubing Bundles (Self-regulating, Constant Wattage, Mineral Insulated)

- Non-Traced/Insulated Only Bundles

- By Structure/Configuration:

- Single-Tube Bundles

- Multi-Tube Bundles (2-12 Process Tubes)

- Analyzer Bundles (Specialized for sample lines)

- By End-Use Industry:

- Oil and Gas (Upstream, Midstream, Downstream)

- Chemical and Petrochemical

- Power Generation (Nuclear, Thermal)

- Food and Beverage

- Pharmaceutical and Biotechnology

- Water and Wastewater Treatment

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Tubing Bundles Market

The value chain for the Tubing Bundles Market is initiated by upstream material suppliers who provide the foundational components: specialized metals (stainless steel, high-nickel alloys), high-performance insulation materials (fiberglass, aerogel, closed-cell foams), and polymer resins for jacketing and conduit protection. The quality and stable pricing of these raw materials are critical determinants of the final product cost and performance characteristics, requiring strong vertical relationships between bundle manufacturers and metal mills/chemical suppliers. Innovation at this stage focuses on developing corrosion-resistant alloys and more thermally efficient, environmentally compliant insulation materials. Efficient sourcing and inventory management of these high-cost components are paramount for maintaining competitive manufacturing margins in a project-driven market.

The core manufacturing stage involves highly technical processes including tube cleaning, parallel alignment, specialized insulation wrapping (often using proprietary methods to ensure uniform density), and the extrusion or application of the external protective jacket. Quality control, involving hydrostatic testing and electrical resistance checks, is crucial during this phase to certify bundle integrity and performance. Manufacturers typically engage in engineering-to-order (ETO) processes, customizing bundle lengths, tracing specifications, and jacket materials to meet unique project specifications, especially in complex analyzer system applications. This manufacturing stage represents the highest value addition, transforming raw materials into sophisticated, certified industrial infrastructure components ready for installation.

Distribution channels are multifaceted, employing both direct sales and indirect intermediary strategies to reach global project sites. Direct sales are often preferred for large, strategic projects where bundle manufacturers collaborate closely with major Engineering, Procurement, and Construction (EPC) firms during the front-end engineering design (FEED) phase, offering technical consultation and customized supply. Indirect channels involve utilizing specialized industrial distributors and system integrators who stock standard bundle configurations and provide localized inventory management, cutting, and kitting services to smaller clients or MRO (Maintenance, Repair, and Operations) buyers. The downstream analysis focuses on the end-users—refineries, power plants, and chemical facilities—where the final installation and commissioning occur, often requiring technical support and post-sales service provided either directly by the manufacturer or through certified local partners, emphasizing reliability and long-term operational guarantees.

Tubing Bundles Market Potential Customers

The primary customers for Tubing Bundles are massive industrial complexes involved in energy transformation and chemical synthesis, typically characterized by extensive networks of process control and fluid transport lines. Chief among these are international oil and gas corporations and national oil companies (NOCs) undertaking capital-intensive projects in upstream extraction (e.g., thermal insulation for deep-sea hydraulics), midstream transportation (pipeline heating), and downstream refining and petrochemical operations (critical analyzer sample transfer and steam distribution). These entities procure bundles through large-scale contracts managed by their appointed Engineering, Procurement, and Construction (EPC) contractors, who prioritize certified quality, adherence to strict project schedules, and customized length specifications for seamless field deployment.

Beyond the energy sector, significant potential customers include major chemical manufacturers, particularly those dealing with hazardous, high-viscosity, or crystallization-prone fluids that require continuous temperature control provided by heat-traced bundles. Power generation facilities, especially those operating thermal or nuclear plants, are critical end-users, utilizing bundles for precise instrument sensing lines and steam tracing systems to prevent freezing in harsh external environments or maintain steam quality. Emerging customer segments include the semiconductor industry, which requires ultra-high-purity (UHP) bundles to prevent contamination during gas and chemical delivery, and large municipal water treatment plants, which use standard insulated bundles for chemical feed and sampling purposes, reflecting the broad applicability of these prefabricated solutions across complex process industries globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.8 Billion USD |

| Market Forecast in 2033 | $9.2 Billion USD |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermon Group Holdings, Inc., NVENT Thermal Management, Spirax Sarco Engineering plc, Parker Hannifin Corporation, Okazaki Manufacturing Company, Kuhlmann Electro-Heat, Perma-Pipe International Holdings, Inc., Industrial & Environmental Systems, Inc. (IES), C-FER Technologies, S.A. Armaturen GmbH, Omega Engineering Inc., Precision Tube Technology, Inc., Dekoron Wire and Cable, Chromalox, Inc., Chemelex, Shawflex, O’Brien Corporation, United Flexible, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tubing Bundles Market Key Technology Landscape

The technological landscape of the Tubing Bundles Market is characterized by continuous advancements aimed at improving thermal efficiency, enhancing material durability, and integrating digital monitoring capabilities. A core technological focus involves optimizing insulation methodologies. While traditional fiberglass insulation remains prevalent, the increasing demand for ultra-high performance in compact spaces is driving the adoption of advanced materials like flexible aerogel insulation, which offers significantly superior thermal performance per unit thickness. This is crucial for applications where space is highly constrained, such as offshore platforms or crowded pipe racks. Furthermore, manufacturers are increasingly using fire-resistant and low-smoke zero-halogen (LSZH) polymer jackets to meet stringent safety standards, particularly in enclosed environments or hazardous areas where fire mitigation is paramount.

Another significant technological driver is the evolution of heat tracing systems integrated within the bundles. Electric tracing technology is rapidly gaining preference over steam tracing due to its precise temperature control, ease of installation, and superior energy efficiency. Key advancements include the proliferation of self-regulating heating cables (SRHC), which automatically adjust heat output based on ambient temperature variations along the cable’s length, preventing overheating and minimizing power consumption. For high-temperature maintenance applications, mineral insulated (MI) cables offer robust, high-watt density tracing capabilities. Integrating advanced power limiting technologies and smart control panels (SCRs and microprocessors) allows for remote monitoring and centralized management of the tracing system, optimizing thermal output and reducing utility costs significantly.

The emerging technological frontier involves incorporating intelligence into the bundles themselves, moving toward "smart bundles." This includes embedding Fiber Optic Distributed Temperature Sensing (DTS) systems within the bundle assembly. DTS allows operators to monitor temperature profiles continuously along the entire length of the tubing run with high precision, enabling rapid identification of cold spots, insulation failures, or tracing malfunctions. This predictive diagnostic capability is revolutionizing maintenance practices. Furthermore, non-metallic solutions and specialized alloy bundles (e.g., Monel or Inconel) are critical technologies for handling highly corrosive media or processes requiring ultra-purity, catering to the specialized demands of the pharmaceutical, biotechnology, and advanced materials sectors where standard stainless steel is insufficient or poses contamination risks.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region in the tubing bundles market, driven by extensive investments in industrial infrastructure, particularly in China, India, and Southeast Asia. The region’s rapid urbanization and resulting energy demands necessitate large-scale refinery expansions, new LNG receiving terminals, and massive petrochemical complexes. These mega-projects require vast quantities of complex, multi-tube instrumentation bundles for process control and analytical sampling. Government initiatives supporting manufacturing growth and chemical production further solidify APAC’s dominance in market volume expansion.

- North America: North America holds a substantial market share, primarily driven by the ongoing revival of capital projects in the U.S. Gulf Coast, focusing on natural gas processing, LNG export facilities, and refinery modernization efforts aimed at improving efficiency and environmental compliance. Demand here is characterized by a strong preference for high-quality, corrosion-resistant stainless steel bundles utilizing advanced electric heat tracing systems to cope with extreme climate variations and meet stringent regulatory standards (e.g., NFPA requirements). The replacement and upgrade cycle of aging infrastructure also contributes significantly to sustained demand.

- Europe: The European market demonstrates mature, steady growth, largely spurred by strict environmental regulations and high energy efficiency mandates. The focus is on replacing outdated steam tracing systems with modern, precisely controlled electric-traced bundles to reduce energy wastage and minimize water consumption. Key demand areas include the modernization of chemical processing plants, specialized pharmaceutical production requiring UHP systems, and significant activity in advanced automation and monitoring projects across Western and Central European industrial zones.

- Middle East & Africa (MEA): The MEA region represents a crucial market, intrinsically linked to global oil and gas production capacity expansion. Major national investments in increasing crude oil output, developing vast gas fields, and building integrated downstream facilities (refineries and petrochemical complexes) create immense demand for both instrument and impulse line bundles designed to withstand extremely high temperatures, harsh desert environments, and corrosive saline atmospheres. Long-term strategic projects necessitate highly durable, premium-quality tubing assemblies.

- Latin America: This region presents moderate growth, driven by key markets such as Brazil and Mexico, focusing on optimizing existing oil and gas assets and developing new offshore exploration capabilities. Political and economic stability fluctuations can affect the pace of large project approvals, but the continuous need for reliable process control infrastructure supports consistent baseline demand for standard and specialized heat-traced bundles, particularly for handling high-pour-point crudes and deepwater sampling.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tubing Bundles Market.- Thermon Group Holdings, Inc.

- NVENT Thermal Management

- Spirax Sarco Engineering plc

- Parker Hannifin Corporation

- Okazaki Manufacturing Company

- Kuhlmann Electro-Heat

- Perma-Pipe International Holdings, Inc.

- Industrial & Environmental Systems, Inc. (IES)

- C-FER Technologies

- S.A. Armaturen GmbH

- Omega Engineering Inc.

- Precision Tube Technology, Inc.

- Dekoron Wire and Cable

- Chromalox, Inc.

- Chemelex (Pentair)

- Shawflex

- O’Brien Corporation (A division of CIRCOR)

- United Flexible, Inc.

- Richards Industrials (Steriflow Valve)

- Axelrod & Associates

Frequently Asked Questions

Analyze common user questions about the Tubing Bundles market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using tubing bundles over traditional field-installed piping?

Tubing bundles offer significant benefits, including reduced installation time and labor costs due to factory prefabrication. They provide superior thermal efficiency and environmental protection for instrument lines, ensuring temperature stability and preventing freezing, leading to enhanced system reliability and reduced maintenance frequency in critical process control applications.

How do Electric Traced Tubing Bundles compare to Steam Traced Bundles in modern industrial applications?

Electric traced bundles, particularly those using self-regulating technology, are preferred for modern systems due to superior temperature precision, lower operational energy costs, and easier maintenance. Steam tracing remains viable for processes requiring high heat input or utilizing abundant waste steam, but electric tracing offers enhanced control, simplified installation, and improved long-term energy efficiency, aligning with sustainability goals.

Which End-Use Industry exhibits the highest growth potential for high-specification tubing bundles?

The Oil and Gas (Downstream and LNG) and the Chemical/Petrochemical industries currently show the highest demand volume. However, the Pharmaceutical and Semiconductor sectors represent the fastest-growing niche due to the increasing need for ultra-high-purity (UHP) fluid handling systems and specialized, corrosion-resistant bundles to maintain precise process conditions and prevent contamination.

What role does the jacketing material play in the performance and longevity of a tubing bundle?

The outer jacketing material is crucial as it provides the primary defense against mechanical abrasion, UV degradation, chemical corrosion, and moisture ingress. High-performance jacket materials like PVC, polyethylene, or specialized fluoropolymers (like FEP or PTFE) are selected based on the operating environment to ensure the longevity and structural integrity of the insulation and internal process tubes over decades of service.

Are advanced monitoring technologies being integrated into Tubing Bundles?

Yes, technological advancements are focusing on integrating "smart" capabilities. This includes embedding Fiber Optic Distributed Temperature Sensing (DTS) within the bundles for continuous, real-time thermal monitoring, allowing operators to detect anomalies, predict failures, and optimize the performance of heat tracing systems, transitioning operational strategies towards predictive maintenance models.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager