Tubular Steel Wind Tower Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440410 | Date : Jan, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Tubular Steel Wind Tower Market Size

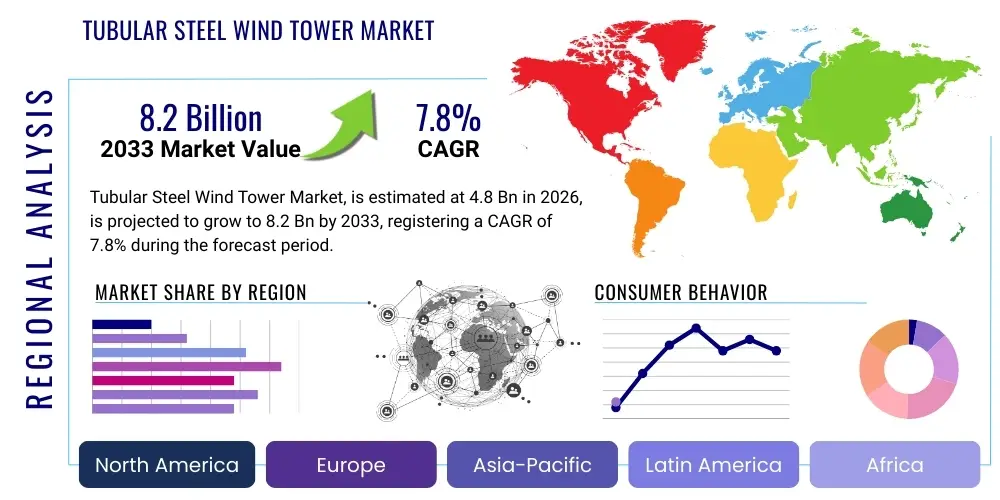

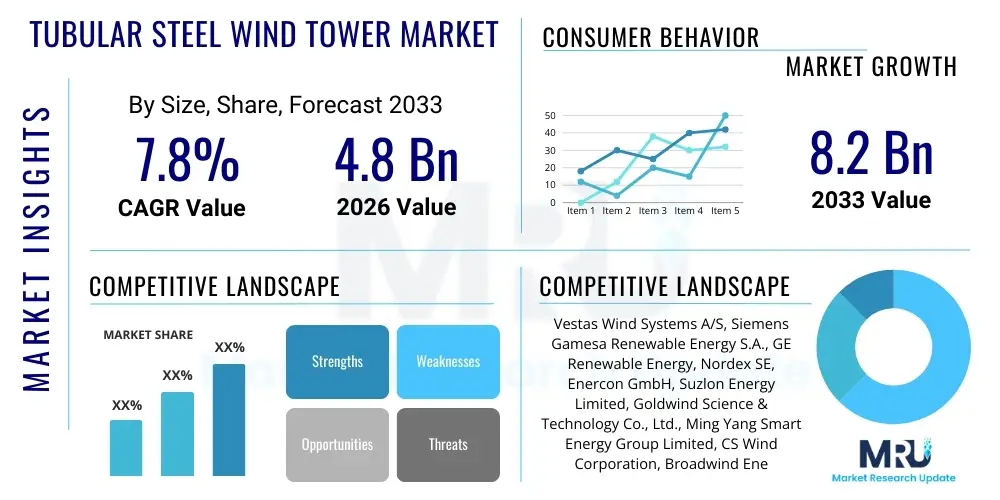

The Tubular Steel Wind Tower Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 8.2 Billion by the end of the forecast period in 2033.

Tubular Steel Wind Tower Market introduction

The Tubular Steel Wind Tower Market is a foundational segment within the broader renewable energy infrastructure, driven by the global imperative to decarbonize energy systems and combat climate change. These towers are the structural backbone of modern wind turbines, elevating the nacelle and rotor blades to optimal heights where wind speeds are consistently higher and less turbulent, thereby maximizing energy capture. The design and construction of these towers are critical, influencing not only the efficiency and longevity of the wind turbine but also the overall cost-effectiveness and scalability of wind energy projects. As wind turbines continue to grow in size and capacity, the demand for increasingly robust, taller, and more innovative tubular steel towers escalates, pushing advancements in material science, manufacturing techniques, and logistical solutions.

Tubular steel wind towers are primarily characterized by their cylindrical or conical sections welded together to form a robust, hollow structure. Their primary function is to provide stable support for the heavy components of a wind turbine, including the nacelle, rotor, and blades, while withstanding immense static and dynamic loads from wind forces, gravity, and operational vibrations. These towers are engineered for durability, designed to endure decades of exposure to harsh environmental conditions, ranging from extreme temperatures and humidity to corrosive saline atmospheres in offshore applications. The manufacturing process typically involves precise steel plate rolling, longitudinal and circumferential welding, internal and external coating for corrosion protection, and flange attachment for secure segment connections.

Major applications for tubular steel wind towers span both onshore and offshore wind energy developments. Onshore, these towers are integral to utility-scale wind farms located in areas with favorable wind resources, supplying clean electricity to national grids. In the burgeoning offshore wind sector, specialized tubular steel towers, often integrated with monopiles, jackets, or floating foundations, support massive turbines in marine environments, capitalizing on stronger and more consistent offshore winds. The benefits of tubular steel towers include their high strength-to-weight ratio, excellent structural integrity, relative ease of fabrication, and the ability to be transported and assembled in sections. Driving factors for market growth include ambitious national and international renewable energy targets, supportive government policies and incentives (such as production tax credits and feed-in tariffs), continuous technological advancements in turbine design leading to larger and more efficient models, and the steadily declining levelized cost of electricity (LCOE) for wind power, making it increasingly competitive with traditional energy sources.

Tubular Steel Wind Tower Market Executive Summary

The Tubular Steel Wind Tower Market is experiencing dynamic shifts, driven by robust business trends emphasizing scalability, technological innovation, and sustainability across the value chain. Business trends are largely characterized by consolidation among major manufacturers, strategic partnerships for supply chain resilience, and significant investments in advanced manufacturing technologies such as automation and robotic welding to enhance production efficiency and reduce costs. There is a growing focus on modular tower designs and advanced materials like high-strength steel to accommodate larger, more powerful turbines while optimizing logistics and installation. Furthermore, companies are increasingly prioritizing sustainability in their operations, adopting greener manufacturing processes and exploring recycled steel content to reduce the carbon footprint of tower production, aligning with broader ESG (Environmental, Social, and Governance) investment criteria.

Regional trends reveal a significant divergence in growth patterns and market maturity. Asia Pacific, particularly China and India, stands out as the primary growth engine due to aggressive renewable energy targets, substantial government investments, and a rapidly expanding energy demand. Europe continues to be a mature but innovative market, leading in offshore wind development and advanced tower designs, with countries like Germany, the UK, and Denmark at the forefront. North America, driven by favorable policy landscapes such as the Inflation Reduction Act (IRA) in the United States, is witnessing a resurgence in onshore and nascent offshore wind projects, stimulating demand for domestic manufacturing capabilities. Latin America and the Middle East & Africa regions are emerging markets, gradually increasing their wind energy penetration with support from international financing and technology transfer, presenting long-term growth opportunities.

Segment trends indicate a pronounced shift towards towers designed for higher capacities and greater heights, especially in both onshore and offshore applications, reflecting the industry's pursuit of higher energy yields. The demand for towers exceeding 120 meters in height is rapidly expanding as turbine manufacturers deploy models with larger rotor diameters to capture more energy. The offshore segment is experiencing exponential growth, necessitating specialized, more robust, and often custom-engineered tubular steel towers capable of enduring severe marine conditions and supporting multi-megawatt turbines. While standard onshore tubular towers remain a significant segment, there is increasing interest in hybrid tower solutions that combine steel with concrete bases to achieve extreme heights more economically and with reduced logistical complexities, especially for remote or challenging terrains. The emphasis across all segments is on optimizing structural integrity, minimizing transportation costs, and accelerating installation times.

AI Impact Analysis on Tubular Steel Wind Tower Market

The integration of Artificial Intelligence (AI) across the Tubular Steel Wind Tower Market is poised to revolutionize various stages of the product lifecycle, from initial design and manufacturing to operational maintenance and end-of-life management. Common user questions and industry discussions frequently revolve around how AI can enhance efficiency, reduce costs, and improve the reliability of these critical components. Stakeholders are keen to understand AI's role in optimizing structural integrity through advanced simulations, streamlining complex manufacturing processes, and enabling predictive maintenance strategies that extend tower lifespan and minimize downtime. There is also significant interest in AI's potential to optimize supply chain logistics for large, heavy tower sections and to inform strategic decision-making regarding material selection and site-specific tower customization. Overall, the market expects AI to deliver unprecedented levels of precision, predictive capability, and cost-effectiveness, fostering a more sustainable and resilient wind energy infrastructure.

- AI-driven design optimization: Utilizing machine learning algorithms to analyze vast datasets of structural loads, material properties, and environmental conditions to design more efficient, lighter, and stronger tubular steel towers, reducing material consumption and costs while enhancing performance.

- Smart manufacturing processes: Implementing AI in robotic welding, automated inspection systems, and real-time quality control to improve precision, reduce defects, and accelerate production timelines for tower sections, ensuring consistent quality and compliance.

- Predictive maintenance and structural health monitoring: Deploying AI-powered sensors and analytics on operational wind towers to detect subtle anomalies, predict potential structural fatigue or damage, and schedule proactive maintenance, thereby extending asset life and preventing costly failures.

- Logistics and supply chain optimization: Using AI to optimize the complex transportation routes and schedules for oversized tower sections, considering weather conditions, road restrictions, and port availability, significantly reducing logistical costs and project timelines.

- Enhanced wind resource assessment and site selection: Leveraging AI to analyze meteorological data, terrain topography, and environmental factors to more accurately predict wind patterns and optimize tower placement for maximum energy yield and structural stability.

- Improved quality control and defect detection: AI-powered vision systems can conduct rapid and highly accurate inspections of welds and coatings during manufacturing, identifying imperfections that might compromise structural integrity, far exceeding human capabilities.

- Digital twin creation and simulation: Developing AI-enhanced digital twins of wind towers to simulate various operational scenarios, stress tests, and environmental impacts, allowing for virtual testing and optimization before physical construction, reducing risks and design iterations.

- Optimized resource allocation and project management: AI tools can analyze project timelines, resource availability, and potential bottlenecks to optimize scheduling for tower fabrication, delivery, and installation, ensuring projects are completed on time and within budget.

DRO & Impact Forces Of Tubular Steel Wind Tower Market

The Tubular Steel Wind Tower Market is profoundly shaped by a combination of powerful drivers, inherent restraints, promising opportunities, and overarching impact forces that dictate its growth trajectory and competitive landscape. The market is primarily driven by the escalating global demand for clean energy, spurred by ambitious climate change mitigation targets and the increasing cost-competitiveness of wind power compared to fossil fuels. Supportive governmental policies, including renewable energy mandates, tax incentives, and feed-in tariffs, provide a robust framework for investment and expansion. Furthermore, continuous advancements in wind turbine technology, leading to larger and more efficient turbines, directly translate into a demand for taller and more robust tubular steel towers, pushing the boundaries of engineering and manufacturing capabilities.

Despite significant tailwinds, the market faces notable restraints. The substantial upfront capital expenditure required for wind farm development, including tower fabrication and installation, can be a barrier, particularly in emerging economies. Logistical challenges associated with transporting oversized tower sections to remote wind farm sites pose significant hurdles, often requiring specialized infrastructure and meticulous planning, which adds to project costs and complexity. Material price volatility, particularly for steel, can impact manufacturing costs and profit margins. Additionally, environmental concerns and public opposition (NIMBYism – Not In My Backyard) related to visual impact, noise, and land use can delay or halt projects, while complex permitting processes add administrative burdens and extend project timelines, impacting market momentum.

Opportunities for growth are abundant and diverse. The burgeoning offshore wind market represents a significant long-term opportunity, as it requires specialized, high-strength tubular towers capable of withstanding harsh marine environments and supporting multi-megawatt turbines. The development of hybrid power plants integrating wind with solar or energy storage solutions opens new avenues for optimized grid integration and stable power supply, increasing the overall attractiveness of wind projects. Emerging markets in Asia, Latin America, and Africa are progressively investing in wind energy infrastructure to meet rising energy demands and enhance energy security, presenting vast untapped potential. Moreover, innovation in advanced materials, such as ultra-high-strength steel and composite hybrid structures, coupled with modular construction techniques, offers pathways to reduce costs, enhance performance, and overcome logistical constraints, fostering a new generation of wind tower solutions that are more efficient and adaptable.

Segmentation Analysis

The Tubular Steel Wind Tower Market is meticulously segmented to provide a comprehensive understanding of its diverse facets, allowing for precise market analysis and strategic planning. These segmentations typically categorize the market based on distinct characteristics such as tower type, application, and height, reflecting the varying demands and technological solutions across the wind energy landscape. Each segment represents unique engineering challenges, market drivers, and customer requirements, influencing manufacturing processes, material selection, and logistical considerations. Understanding these segments is crucial for manufacturers to tailor their product offerings, for developers to select optimal tower solutions for specific projects, and for policymakers to formulate targeted support mechanisms, ultimately driving innovation and efficiency across the entire value chain.

- By Type

- Tubular Steel Wind Towers: Standard market offering, comprising conical or cylindrical steel sections.

- Lattice Wind Towers: Less common for modern utility-scale turbines but still used in specific applications, offering material efficiency.

- Hybrid Wind Towers: Combining steel with concrete bases for increased height and reduced material costs, particularly beneficial for very tall towers.

- By Application

- Onshore: Towers installed on land-based wind farms, often optimized for varied terrains and logistical accessibility.

- Offshore: Towers designed for marine environments, requiring enhanced corrosion protection, specialized foundations (e.g., monopiles, jacket foundations), and robust structural integrity against wave and current forces.

- By Height

- Less than 80 meters: Typically for older or smaller capacity turbines, often used in less complex wind regimes.

- 80-120 meters: The most common height range for many current utility-scale onshore wind turbines, balancing cost and energy capture.

- Greater than 120 meters: Increasing in demand for larger, higher-capacity turbines to access stronger and more consistent winds, particularly for next-generation onshore and offshore projects.

Value Chain Analysis For Tubular Steel Wind Tower Market

The value chain for the Tubular Steel Wind Tower Market is a complex ecosystem involving multiple stages, from raw material extraction to final installation and operation, each contributing significantly to the overall cost and efficiency of wind energy projects. Upstream analysis focuses on the sourcing and processing of primary raw materials, predominantly high-grade steel plates. Key players in this segment include major steel manufacturers that supply the specialized low-carbon, high-strength steel required for tower fabrication. Other upstream components include flanges, bolts, internal platforms, ladders, and protective coatings, sourced from various specialized industrial suppliers. The quality and timely delivery of these materials are paramount, as they directly impact the structural integrity, durability, and production schedules of the towers. Geopolitical factors, trade policies, and global commodity prices for steel exert considerable influence over this upstream segment.

Midstream activities encompass the actual manufacturing of the tubular steel tower sections. This involves highly specialized processes such as steel plate cutting, rolling into conical or cylindrical shapes, precision welding of longitudinal and circumferential seams, internal and external grit blasting, and multi-layer coating application for corrosion protection. Tower manufacturers, ranging from large multinational corporations to regional specialists, employ advanced fabrication techniques and quality control measures to ensure each section meets stringent engineering specifications. Assembly of tower sections, often involving the integration of internal components like platforms and electrical systems, also falls within this stage. The efficiency of these manufacturing processes, driven by automation, robotic welding, and streamlined logistics within production facilities, directly impacts the cost-effectiveness and delivery timelines of the finished tower segments.

Downstream analysis covers the installation, operation, and eventual decommissioning of wind towers. The primary end-users and buyers are wind farm developers, utility companies, and independent power producers (IPPs), who procure towers as part of larger wind energy projects. Distribution channels are predominantly direct, involving direct sales from tower manufacturers or their parent turbine OEMs to project developers and EPC (Engineering, Procurement, and Construction) contractors. Given the custom nature and significant scale of wind towers, indirect distribution through wholesalers or general distributors is rare, though specialized logistics providers play a crucial role in the physical movement of tower sections from factory to site. Post-installation, the value chain extends to operation and maintenance (O&M) service providers who ensure the long-term performance and structural integrity of the towers, often employing inspection and repair services. Direct engagement between manufacturers and developers is essential throughout the entire project lifecycle, facilitating design optimization, logistics planning, and after-sales support.

Tubular Steel Wind Tower Market Potential Customers

The primary potential customers and end-users of tubular steel wind towers are entities engaged in the development, ownership, and operation of wind energy generation facilities. These include large-scale

utility companies that are transitioning their energy portfolios towards renewables to meet regulatory mandates and sustainability goals. These utilities often invest directly in wind farm projects or procure power through long-term purchase agreements, requiring robust and reliable tower infrastructure. Independent Power Producers (IPPs) represent another significant customer segment; these companies specialize in developing, financing, owning, and operating power generation assets, including wind farms, and sell electricity to utilities or directly to consumers. IPPs are often agile in adopting new technologies and seeking cost-efficient solutions, making them key buyers of innovative tower designs. Government energy agencies and state-owned enterprises in various countries also serve as critical customers, particularly in emerging markets where national renewable energy targets drive large-scale infrastructure projects. Furthermore, large industrial consumers with substantial energy needs may also invest in dedicated wind farms for corporate power purchase agreements (CPPAs) or for direct energy supply, contributing to the demand for tubular steel wind towers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 8.2 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vestas Wind Systems A/S, Siemens Gamesa Renewable Energy S.A., GE Renewable Energy, Nordex SE, Enercon GmbH, Suzlon Energy Limited, Goldwind Science & Technology Co., Ltd., Ming Yang Smart Energy Group Limited, CS Wind Corporation, Broadwind Energy, Inc., EEW Group, Shanghai Taisheng Windpower Equipment Co., Ltd., Trinity Industries, Inc., Titan Wind Energy (Suzhou) Co., Ltd., Dongfang Electric Corporation, Harland & Wolff (formerly Burntisland Fabrication), Senvion GmbH (acquired assets), Ventower Industries, Acciona Energia, S.A., Max Bögl Wind AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tubular Steel Wind Tower Market Key Technology Landscape

The technological landscape of the Tubular Steel Wind Tower Market is continuously evolving, driven by the need to support increasingly larger and more efficient wind turbines, reduce manufacturing costs, enhance structural integrity, and streamline logistics. One of the primary technological advancements lies in the metallurgy of steel itself. Manufacturers are increasingly utilizing high-strength steel alloys, which allow for thinner tower walls while maintaining or exceeding required load-bearing capacities. This not only reduces the overall weight of the tower, simplifying transportation and installation, but also decreases the amount of raw material needed, contributing to cost savings and environmental benefits. Additionally, advanced corrosion protection systems, including multi-layer epoxy coatings and specialized paint systems, are crucial, particularly for offshore applications where exposure to saline environments is constant, significantly extending the lifespan and reducing maintenance requirements of the towers.

Manufacturing technologies have also seen significant innovation. Robotic welding and automated production lines are becoming standard in modern tower fabrication facilities. These technologies ensure precise and consistent weld quality, reduce labor costs, and accelerate production cycles, minimizing human error and enhancing the overall structural integrity of the towers. Digitalization is playing a pivotal role through the adoption of digital twin technology, where virtual replicas of wind towers are created. These digital twins allow for real-time monitoring of structural health, predictive maintenance, and simulation of various operational stresses and environmental impacts, enabling engineers to optimize designs and anticipate potential issues before they arise. This not only improves reliability but also reduces costly downtime and extends the operational life of the assets.

Beyond fabrication, technologies aimed at improving the logistics and installation of these massive structures are also crucial. Modular construction techniques, where towers are built in smaller, more manageable sections, facilitate easier transportation to remote or challenging sites. Innovations in heavy lifting and installation equipment, such as specialized cranes and jacking systems, are essential for erecting taller and heavier tower components safely and efficiently. Furthermore, advancements in bolt technology, particularly high-strength bolted connections, are critical for securely joining tower sections, ensuring long-term stability and resistance to fatigue. The integration of IoT sensors within tower structures for continuous monitoring of vibrations, stress, and environmental conditions provides valuable data for operational optimization and predictive maintenance, further enhancing the reliability and performance of tubular steel wind towers over their extensive operational lifespan.

Regional Highlights

- Asia Pacific (APAC): Dominating the market, driven primarily by China and India. China leads with massive investments in both onshore and offshore wind farms, fueled by ambitious renewable energy targets and robust domestic manufacturing capabilities. India is also expanding its wind energy capacity rapidly to meet growing energy demand and reduce reliance on fossil fuels. Other emerging economies in Southeast Asia are gradually increasing their wind energy adoption, positioning APAC as the largest and fastest-growing market.

- Europe: A mature and highly innovative market, especially in offshore wind. Countries like Germany, the UK, Denmark, and the Netherlands are at the forefront of developing advanced tower designs and large-scale offshore projects. Strong regulatory support, high carbon pricing, and a focus on energy independence continue to drive demand, with significant investment in repowering older wind farms and expanding new capacities.

- North America: Experiencing significant growth, largely due to supportive policies in the United States, such as the Inflation Reduction Act (IRA), which provides substantial incentives for renewable energy development and domestic manufacturing. Texas, Iowa, and Oklahoma are key states for onshore wind expansion, while nascent offshore wind projects along the East Coast are poised for substantial growth, stimulating demand for new tower supply chains.

- Latin America: An emerging market with strong potential, particularly in countries like Brazil, Mexico, and Chile. Favorable wind resources, growing energy demand, and governmental initiatives to diversify energy mixes are driving investments. While infrastructure and financing challenges exist, the region represents a key area for future expansion of wind energy, especially with international collaborations.

- Middle East and Africa (MEA): Gradually increasing its share in the wind energy market, with countries like Saudi Arabia, UAE, and South Africa investing in large-scale renewable projects as part of their economic diversification strategies. Abundant land and wind resources, coupled with a drive for sustainable development, are opening up new opportunities for wind tower deployment in the region, albeit from a lower base.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tubular Steel Wind Tower Market.- Vestas Wind Systems A/S

- Siemens Gamesa Renewable Energy S.A.

- GE Renewable Energy

- Nordex SE

- Enercon GmbH

- Suzlon Energy Limited

- Goldwind Science & Technology Co., Ltd.

- Ming Yang Smart Energy Group Limited

- CS Wind Corporation

- Broadwind Energy, Inc.

- EEW Group (Erndtebrücker Eisenwerk GmbH & Co. KG)

- Shanghai Taisheng Windpower Equipment Co., Ltd.

- Trinity Industries, Inc.

- Titan Wind Energy (Suzhou) Co., Ltd.

- Dongfang Electric Corporation

- Harland & Wolff (formerly Burntisland Fabrication)

- Senvion GmbH (acquired assets by Siemens Gamesa, but some historical market presence)

- Ventower Industries

- Acciona Energia, S.A.

- Max Bögl Wind AG

Frequently Asked Questions

Analyze common user questions about the Tubular Steel Wind Tower market and generate a concise list of summarized FAQs reflecting key topics and concerns.What drives the growth of the Tubular Steel Wind Tower Market?

The market is primarily driven by escalating global demand for renewable energy, aggressive government policies and incentives promoting wind power, and continuous advancements in wind turbine technology leading to larger, more efficient turbines that require taller and more robust towers.

What are the primary challenges faced by the Tubular Steel Wind Tower Market?

Key challenges include high upfront capital costs for wind projects, complex logistical requirements for transporting oversized tower sections, volatility in steel prices, and potential project delays due to permitting processes or public opposition.

How does offshore wind energy impact the demand for tubular steel towers?

Offshore wind energy significantly boosts demand for specialized tubular steel towers, as these projects require extremely robust, corrosion-resistant structures capable of supporting massive multi-megawatt turbines in harsh marine environments, often integrated with monopile or jacket foundations.

What technological innovations are shaping the future of wind tower manufacturing?

Technological innovations include the use of high-strength steel alloys, advanced robotic welding and automated production processes, digital twin technology for predictive maintenance, and modular construction techniques to improve efficiency, reduce costs, and enhance structural integrity.

Which regions are leading the growth in the Tubular Steel Wind Tower Market?

Asia Pacific, particularly China and India, is currently the largest and fastest-growing region due to extensive renewable energy investments. Europe remains a mature leader, especially in offshore wind, while North America is experiencing a resurgence driven by favorable policy landscapes and expanding project pipelines.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager