Tugger Train Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436260 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Tugger Train Market Size

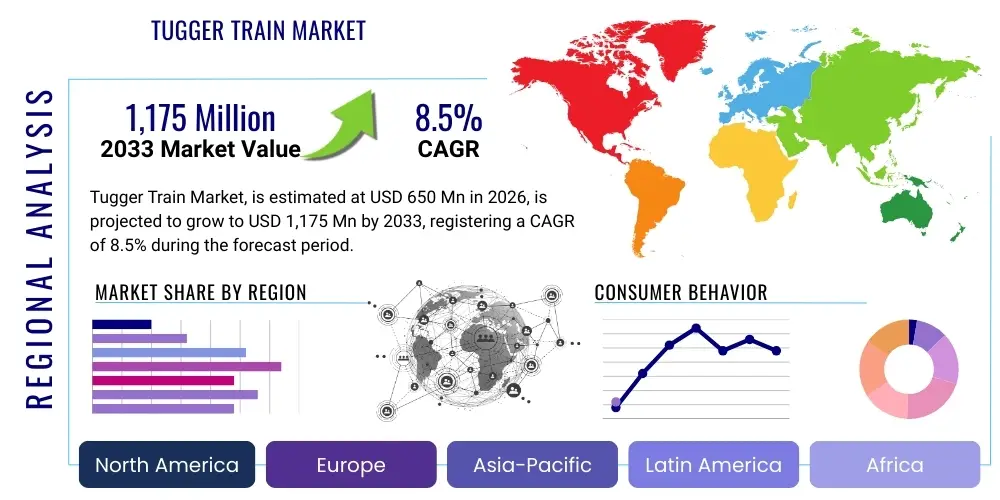

The Tugger Train Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 1,175 Million by the end of the forecast period in 2033. This robust expansion is primarily driven by the escalating demand for streamlined intra-logistics solutions within manufacturing and warehousing environments globally. The shift towards lean manufacturing principles and the necessity for increased operational efficiency are compelling factors contributing to the market's accelerated trajectory. Furthermore, the integration of automation technologies, transforming traditional manually operated tuggers into Automated Guided Vehicles (AGVs) or Autonomous Mobile Robots (AMRs), significantly boosts market valuation and penetration across diverse industrial applications, particularly in regions experiencing high labor costs and shortages.

Tugger Train Market introduction

The Tugger Train Market encompasses specialized material handling systems designed to transport goods, components, and materials efficiently and safely across production floors, warehouses, and distribution centers using a towing vehicle (the tugger) pulling multiple carts (the train). These systems are integral to modern logistics, particularly in environments adopting just-in-time (JIT) or just-in-sequence (JIS) delivery models, minimizing required forklift traffic, and enhancing overall facility safety. Major applications span the automotive industry for line feeding, general manufacturing, retail distribution, and e-commerce fulfillment centers.

The primary benefits of implementing tugger train systems include enhanced operational efficiency through standardized routes, reduced labor requirements compared to individual forklift operations, and a significant improvement in workplace safety by consolidating material flow paths. Driving factors fueling market growth include the global expansion of e-commerce necessitating faster and more reliable fulfillment operations, increasing labor costs pushing companies toward automation, and advancements in battery technology and navigation systems (such as LiDAR and vision systems) enabling autonomous operation. The shift towards Industry 4.0 standards emphasizes the necessity of interconnected, flexible, and data-driven material transport solutions, positioning tugger trains as a critical component of smart factory infrastructure.

Tugger Train Market Executive Summary

The Tugger Train Market is experiencing a major transformation characterized by the rapid adoption of automation and electrification, shifting the business landscape from traditional diesel or manual towing to sophisticated Automated Guided Vehicles (AGVs) and electric autonomous systems. Current business trends highlight significant investments in robust fleet management software (FMS) capable of integrating tugger operations with Enterprise Resource Planning (ERP) and Warehouse Management Systems (WMS) for optimized routing and predictive maintenance. Segmentation trends show the Autonomous Tugger Train segment achieving the highest CAGR, propelled by automotive and 3PL sectors prioritizing uninterrupted, 24/7 operation. From a regional perspective, the Asia Pacific (APAC) region is forecasted to dominate the market share, driven by massive manufacturing expansion, rapid infrastructure development, and escalating e-commerce penetration, particularly in China and India. Europe and North America, while holding mature market status, are focusing intensively on retrofitting existing fleets with advanced sensors and implementing high-capacity electric models to meet stringent environmental regulations and maximize operational throughput.

AI Impact Analysis on Tugger Train Market

Users frequently inquire about how Artificial Intelligence (AI) will enhance the autonomy, safety, and operational efficiency of tugger train systems. Key themes revolve around the feasibility of dynamic, real-time path planning in crowded environments, the role of machine learning in optimizing delivery schedules based on production demands (predictive logistics), and concerns regarding the complexity and cost of integrating advanced AI systems into existing legacy infrastructure. Users expect AI to move tuggers beyond fixed-route AGVs toward truly flexible Autonomous Mobile Robots (AMRs) that can navigate highly dynamic factory floors, handle unforeseen obstructions, and proactively manage battery life and maintenance schedules, thereby maximizing uptime and reducing manual intervention. The integration of computer vision and deep learning for advanced object detection and safety compliance is another major focus area, ensuring collision avoidance in mixed traffic environments.

- AI enables dynamic, real-time path planning and rerouting, maximizing efficiency in congested operational zones.

- Machine learning algorithms optimize fleet allocation and scheduling based on fluctuating production requirements and inventory levels.

- Predictive maintenance driven by AI monitors component wear (e.g., tires, motors, batteries) to minimize unexpected downtime and extend asset lifespan.

- Computer Vision systems utilizing AI improve situational awareness, enabling superior object detection and safe interaction with human workers.

- AI integration facilitates advanced energy management, learning optimal charging cycles to maintain peak operational availability.

DRO & Impact Forces Of Tugger Train Market

The dynamics of the Tugger Train Market are shaped significantly by robust drivers stemming from global manufacturing shifts, regulatory pressures, technical restraints related to implementation complexity, and substantial opportunities arising from technological convergence. Key market drivers include the overwhelming need for operational efficiency and labor cost reduction, especially in high-wage economies, coupled with the rapid growth of distribution networks supporting global e-commerce. Restraints primarily involve the high initial capital investment required for autonomous systems and the complexity associated with integrating new autonomous fleets into heterogeneous, legacy manufacturing environments that often lack adequate digital infrastructure. However, the continuous decline in sensor and battery costs, alongside advancements in standardization protocols (such as VDA 5050), present significant opportunities for broader market adoption.

Impact forces are centered around technological shifts, notably the transition from inductive guidance to natural feature navigation (LiDAR and camera-based SLAM), which reduces infrastructure costs and increases system flexibility. Furthermore, stringent global worker safety regulations act as a critical external force, compelling industries to replace dangerous forklift operations with safer, trackable, and automated tugger train systems. The market is also heavily influenced by macro-economic factors, where supply chain resilience strategies post-pandemic are increasing localized manufacturing and internal logistics investments, directly benefiting the demand for efficient material transport solutions like tugger trains.

Segmentation Analysis

The Tugger Train Market is comprehensively segmented based on technology, towing capacity, power source, and end-user application, allowing for tailored solutions addressing diverse industrial needs. By technology, the market is broadly divided into Manual/Operator-Driven Tuggers, which remain essential for high-variability routes and small operations, and Automated Guided Vehicles (AGVs) or Autonomous Tuggers, which dominate large-scale, repetitive material flow processes. Capacity segmentation differentiates between light-duty systems (carrying less than 5 tons, common in retail) and heavy-duty systems (carrying 5 tons or more, critical for automotive and heavy machinery manufacturing). The power source segment sees a definitive shift toward electric and battery-operated models, driven by sustainability goals and superior operational performance compared to outdated internal combustion engine (ICE) tuggers.

Understanding these segments is crucial for strategic market planning. For instance, the fastest growth is observed in the battery-powered autonomous segment due to its alignment with Industry 4.0 principles and environmental sustainability mandates. The end-user application segmentation reveals that the automotive sector remains the largest consumer, leveraging tugger trains extensively for highly synchronized component delivery to assembly lines, while the logistics and warehousing sector shows the highest growth potential due to rapid e-commerce expansion and the subsequent need for efficient, high-volume order fulfillment infrastructure across vast distribution centers.

- By Technology

- Manual/Operator-Driven Tuggers

- Automated Guided Vehicles (AGVs)

- Autonomous Mobile Robots (AMRs)/Autonomous Tugger Trains

- By Power Source

- Electric (Battery-Powered)

- Internal Combustion Engine (ICE)

- By Towing Capacity

- Light-Duty (Below 5 Tons)

- Medium-Duty (5 to 15 Tons)

- Heavy-Duty (Above 15 Tons)

- By End-User Application

- Automotive

- Manufacturing (General Industry)

- E-commerce and 3PL (Logistics and Warehousing)

- Aerospace and Defense

- Food and Beverage

Value Chain Analysis For Tugger Train Market

The value chain for the Tugger Train Market is complex, stretching from raw material procurement to post-sales services and software integration. Upstream analysis focuses on component manufacturing, which includes specialized suppliers of high-performance electric motors, lithium-ion battery packs, advanced navigational sensors (LiDAR, encoders, safety scanners), and sophisticated control units (PLCs). The competitive differentiation at this stage often relies on quality, reliability, and cost-effectiveness of these critical components. Midstream activities involve the core manufacturing, assembly, and system integration of the tugger vehicle and corresponding cart systems, where customization and adherence to specific industry standards (e.g., robustness for heavy-duty environments) are key competitive factors.

Downstream analysis centers on distribution, implementation, and end-user deployment. Distribution channels include direct sales by major manufacturers to large multinational corporations (MNCs) seeking fleet standardization, or indirect sales via specialized industrial distributors and system integrators who customize the solution for Small and Medium Enterprises (SMEs). System integrators play a crucial role in interfacing the tugger train FMS with the client's existing WMS and ERP systems. Post-sale activities, including maintenance contracts, spare parts supply, and software updates for autonomous navigation logic, represent a growing revenue stream and a vital aspect of customer retention, ensuring system longevity and performance optimization throughout the asset lifecycle.

Tugger Train Market Potential Customers

Potential customers for tugger train systems are primarily industrial enterprises characterized by repetitive, high-volume material movement needs within confined or controlled environments. The largest and most immediate segment comprises Automotive Original Equipment Manufacturers (OEMs) and their Tier 1 suppliers, who rely heavily on precise, sequenced deliveries of components to assembly lines to maintain just-in-time production schedules. Another rapidly expanding customer base includes large third-party logistics (3PL) providers and major e-commerce retailers, particularly those operating vast distribution centers where the speed and efficiency of moving bulk goods from storage to packing stations are paramount.

Furthermore, general manufacturing facilities specializing in white goods, electronics, and heavy machinery constitute significant buyers, utilizing tugger trains to improve shop floor organization and reduce costly material transfer bottlenecks. The shift towards electrification and autonomy is making these systems increasingly attractive to industries previously reliant solely on forklifts, especially as regulatory focus on emissions and workplace safety intensifies. These end-users prioritize systems offering high scalability, seamless integration capabilities, and proven safety records in highly dynamic operational settings, validating the high investment required for state-of-the-art autonomous solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1,175 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Jungheinrich AG, Still GmbH, KION Group AG (Linde Material Handling), Toyota Material Handling, Crown Equipment Corporation, Hyster-Yale Materials Handling, Egemin Automation (Körber Supply Chain), Daifuku Co., Ltd., Schaefer Systems International, JBT Corporation, Balyo, Oceaneering International, Fetch Robotics (Zebra Technologies), Grenzebach Group, Seegrid Corporation, Dematic (KION Group), SSI Schäfer, Transbotics (KION Group), Guidewheel, GNB Industrial Power |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tugger Train Market Key Technology Landscape

The technological landscape of the Tugger Train Market is rapidly evolving, driven by the push towards autonomy and sustainable power solutions. Core technologies include advanced power systems, primarily lithium-ion batteries, which offer superior energy density, faster charging times, and longer cycle life compared to traditional lead-acid batteries, significantly enhancing operational uptime and reducing environmental impact. Navigation technology is critical, with a pronounced shift from older wired or magnetic tape guidance (AGVs) towards natural feature navigation (NFN) utilizing Simultaneous Localization and Mapping (SLAM) via LiDAR scanners and 3D cameras (AMRs). This transition allows tugger trains to operate flexibly without fixed infrastructure, reducing implementation costs and increasing adaptability to changing factory layouts. Furthermore, the reliance on high-speed industrial Wi-Fi or 5G networks is essential for continuous communication between the fleet management system and the individual tugger units, ensuring real-time control and synchronization.

A crucial aspect of the modern technology landscape is the development and adoption of sophisticated Fleet Management Software (FMS). FMS platforms utilize machine learning algorithms to optimize vehicle assignment, traffic control, route planning, and collision avoidance in multi-vehicle environments, integrating seamlessly with higher-level planning systems like MES (Manufacturing Execution Systems) and WMS. Safety technology, mandated by global standards, involves redundant safety scanners (e.g., safety-rated LiDAR) and integrated safety PLCs that ensure the tugger train stops immediately upon detecting an obstruction or breach of safety zones. The standardization efforts, notably the VDA 5050 interface protocol developed by the German Association of the Automotive Industry, are key, as they enable end-users to operate and manage automated vehicles from different manufacturers using a single control system, significantly simplifying fleet expansion and maintenance.

Emerging technologies also include remote diagnostics and Over-the-Air (OTA) software updates, allowing manufacturers to improve navigation logic and fix bugs without physical intervention. Furthermore, integrating augmented reality (AR) or virtual reality (VR) tools is becoming common for operator training and remote maintenance support, improving technician efficiency. The convergence of AI for decision-making, high-precision sensing for navigation, and robust, sustainable power sources forms the backbone of the next generation of highly autonomous, flexible, and efficient tugger train systems required for advanced smart factory environments globally.

Regional Highlights

- North America: This region represents a highly mature market characterized by early adoption of sophisticated automation technologies, driven primarily by high labor costs and the strong presence of major automotive OEMs and large-scale e-commerce distribution centers. The focus in North America is on transitioning from first-generation AGVs to high-capacity, flexible AMRs, often incorporating advanced AI for dynamic routing. Regulatory bodies and safety standards emphasize robust safety features, pushing manufacturers towards advanced sensor technologies and secure fleet management platforms. The demand for highly integrated solutions linking material handling directly to factory floor data systems is particularly pronounced here.

- Europe: Europe is a key center for manufacturing innovation, benefiting from strong government initiatives promoting Industry 4.0 and sustainable logistics practices. The European market is characterized by a high penetration of electric tugger trains, enforced by strict environmental regulations and corporate sustainability targets. Germany, the largest manufacturing hub, leads in the adoption of standardized protocols like VDA 5050, facilitating seamless integration of multi-vendor fleets. The focus remains on maximizing space utilization and implementing dense, automated flow lines, especially within the established automotive and pharmaceutical sectors.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region globally, fueled by rapid industrialization, massive investments in manufacturing capacity in countries like China, India, and Southeast Asia, and the explosion of the regional e-commerce sector. While price sensitivity remains a factor, the sheer scale of new facility construction necessitates high-throughput material handling solutions. The market exhibits dual trends: high volume deployment of cost-effective, basic manual and semi-automated systems, alongside rapidly increasing demand for state-of-the-art autonomous systems tailored for major multinational distribution centers established within the region.

- Latin America (LATAM): The LATAM market is in an emerging growth phase, showing increasing adoption spurred by foreign direct investment in automotive and consumer goods manufacturing. Brazil and Mexico are the primary markets, driven by the need to modernize logistics infrastructure to support regional trade and export competitiveness. Adoption rates are gradually accelerating, primarily concentrating on reliable, medium-duty electric tugger systems to manage internal transport tasks efficiently within centralized production hubs.

- Middle East and Africa (MEA): Growth in the MEA region is driven by large-scale infrastructure projects, expansion of logistics hubs (especially around major ports), and diversification of economies away from oil dependency. The development of massive free zones and specialized manufacturing cities is creating demand for heavy-duty, robust tugger systems capable of operating reliably in challenging environments. The adoption of automation is often seen as a critical lever for maximizing efficiency and minimizing reliance on fluctuating global labor markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tugger Train Market.- Jungheinrich AG

- Still GmbH

- KION Group AG (Linde Material Handling)

- Toyota Material Handling

- Crown Equipment Corporation

- Hyster-Yale Materials Handling

- Egemin Automation (Körber Supply Chain)

- Daifuku Co., Ltd.

- Schaefer Systems International

- JBT Corporation

- Balyo

- Oceaneering International

- Fetch Robotics (Zebra Technologies)

- Grenzebach Group

- Seegrid Corporation

- Dematic (KION Group)

- SSI Schäfer

- Transbotics (KION Group)

- Guidewheel

- GNB Industrial Power

Frequently Asked Questions

Analyze common user questions about the Tugger Train market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Tugger Train Market?

The primary driver is the accelerating shift towards intra-logistics automation, specifically necessitated by rising labor costs globally, the rapid expansion of e-commerce distribution networks, and the requirement for efficient, synchronized material delivery in Industry 4.0 manufacturing environments.

How do autonomous tugger trains differ from traditional AGVs?

Autonomous Mobile Robots (AMRs) utilized as tugger trains use natural feature navigation (LiDAR and SLAM) for dynamic path planning, allowing them to adapt to obstructions and operate without fixed infrastructure, unlike traditional AGVs which rely on rigid, fixed routes via wires or magnetic tape.

Which end-user segment holds the largest market share for tugger train adoption?

The Automotive industry consistently holds the largest market share, utilizing tugger trains extensively for just-in-time and just-in-sequence delivery of components to complex assembly lines, ensuring manufacturing efficiency and precision.

What role does the VDA 5050 standard play in the Tugger Train Market?

VDA 5050 is a crucial standardization protocol that allows different autonomous tugger train brands to communicate and operate seamlessly under a single, unified Fleet Management System (FMS), thereby improving operational flexibility and minimizing vendor lock-in for large fleet operators.

What are the main restraints hindering the broader adoption of autonomous tugger trains?

The main restraints are the high initial capital investment required for implementing sophisticated autonomous systems and the technical challenges associated with integrating complex new technologies into existing, often outdated, warehouse or factory management systems (legacy infrastructure).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager