Tungsten Hexafluoride Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434936 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Tungsten Hexafluoride Market Size

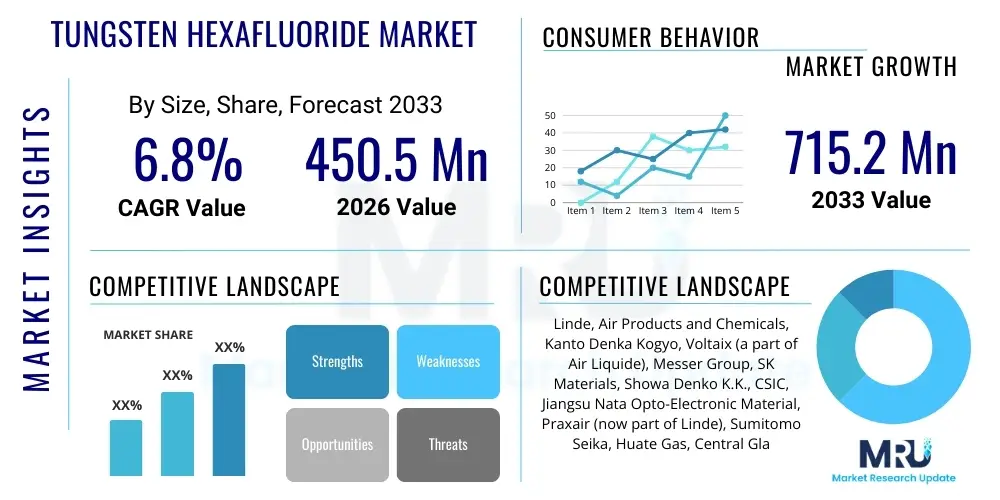

The Tungsten Hexafluoride Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450.5 million in 2026 and is projected to reach USD 715.2 million by the end of the forecast period in 2033.

Tungsten Hexafluoride Market introduction

Tungsten Hexafluoride (WF6) is a highly specialized, colorless, corrosive gas primarily utilized in the semiconductor industry for chemical vapor deposition (CVD) processes, specifically for the fabrication of tungsten interconnects and barrier layers on silicon wafers. Its exceptional purity and highly reactive nature make it indispensable in advanced microelectronics manufacturing where precise material deposition and uniformity are critical for device performance and yield. The market dynamics are intricately linked to the overall growth of the global semiconductor industry, particularly the expansion of memory (DRAM, NAND) and logic chip production, which increasingly rely on smaller node geometries requiring high-quality tungsten films. Furthermore, its role in enabling lower resistance interconnects addresses the growing demand for faster and more power-efficient electronic devices, establishing WF6 as a foundational material in the digital economy.

The core application of WF6 is in depositing thin tungsten films, offering superior characteristics compared to other metals like aluminum or copper in specific layers. The process involves introducing WF6 into a reaction chamber where it decomposes upon reaction with reducing agents (like hydrogen or silane) at high temperatures, forming a pure tungsten layer. This chemical specificity and control over the deposition process are difficult to replicate with alternative precursors, solidifying WF6's market position, especially in 3D NAND and advanced DRAM fabrication where complex vertical structures require highly conformal coating. The stringent requirements for electronic grade WF6—often demanding purity levels exceeding 99.9999% (6N) or 99.99999% (7N)—drive significant R&D investments in purification and handling technologies, influencing the competitive landscape dominated by a few specialized chemical suppliers.

Key driving factors propelling the market include the massive global investment in foundry capacity expansion, driven by geopolitical focus on supply chain resilience and the accelerating proliferation of technologies like 5G, IoT, AI, and advanced automotive electronics. These applications necessitate a continuous increase in chip complexity and density, directly translating to higher consumption of high-purity WF6. Additionally, emerging applications, such as high-efficiency solar cells and certain chemical synthesis processes, are beginning to contribute to demand, although the semiconductor sector remains the overwhelming primary consumer. The stable supply chain management of WF6 is crucial, given its hazardous nature and the limited number of production facilities worldwide, emphasizing the need for robust logistics and safety protocols across the supply chain.

Tungsten Hexafluoride Market Executive Summary

The Tungsten Hexafluoride market is characterized by robust growth primarily fueled by unprecedented expansion in the semiconductor industry, particularly in Asia Pacific, which accounts for the vast majority of global demand due to concentrated manufacturing hubs in Taiwan, South Korea, China, and Japan. Business trends highlight strategic alliances between WF6 producers and major semiconductor foundries to ensure long-term supply stability, reflecting the material’s critical role in front-end manufacturing processes. Technologically, the shift towards smaller manufacturing nodes (below 10nm) and the mass production of 3D stacked devices (V-NAND and advanced DRAM) necessitate higher consumption rates of ultra-high-purity WF6, sustaining premium pricing in the 7N grade segment. Regional expansion is driven by massive governmental subsidies and private investments aimed at increasing domestic chip production capacity in North America and Europe, diversifying the supply chain away from APAC over the long term, though APAC currently maintains dominance in consumption.

Segment trends underscore the criticality of the Purity Grade segmentation, where 6N and 7N grades command the market. The high-purity segment (7N and above) is experiencing faster volumetric and value growth as leading-edge semiconductor fabrication demands increasingly stringent material specifications to minimize defects and maximize yield. The Application segment remains overwhelmingly dominated by semiconductor manufacturing, overshadowing minor uses in solar cells and chemical synthesis. However, within semiconductors, logic device fabrication and advanced memory production represent the fastest-growing sub-segments. Pricing stability remains a key concern, as the production relies on upstream tungsten sources and energy-intensive fluorination processes, making the market susceptible to geopolitical pressures affecting raw material costs and global logistics disruptions, compelling end-users to secure long-term contracts.

Competitive dynamics are shaped by high barriers to entry, including extensive capital investment, complex purification technologies, and demanding safety regulations associated with handling highly corrosive fluorinated gases. The market structure is highly consolidated, with a few major global specialty chemical companies dominating the supply landscape. Key strategic moves include vertical integration by gas suppliers to control precursor quality from raw material sourcing, and geographical expansion, particularly into emerging high-growth manufacturing regions like China, where domestic suppliers are rapidly attempting to capture market share, often supported by local industrial policies. Overall, the market outlook is overwhelmingly positive, tied directly to the structural growth of digital infrastructure and next-generation electronics, but supply chain security remains a critical element influencing strategic decision-making across the value chain.

AI Impact Analysis on Tungsten Hexafluoride Market

User inquiries regarding the impact of AI on the Tungsten Hexafluoride (WF6) market often revolve around three core themes: first, how AI-driven demand for advanced chips (like GPUs and specialized accelerators) translates into increased WF6 consumption; second, the role of AI in optimizing semiconductor manufacturing processes, potentially reducing WF6 waste; and third, whether AI can accelerate the discovery of alternative deposition precursors. The predominant user concern is the direct correlation between the exponential growth of generative AI, large language models, and data centers, and the subsequent necessary expansion of advanced foundry capacity, which relies heavily on WF6 for manufacturing high-density interconnects in these powerful chips. Users seek reassurance that the existing WF6 supply chain can scale rapidly enough to meet this unprecedented AI-induced demand surge.

The most immediate and significant impact of AI on the WF6 market is the intensification of demand. AI applications necessitate high-performance computing units manufactured at the most advanced process nodes (e.g., 5nm, 3nm). These advanced nodes inherently require more sophisticated and denser interconnect layers, increasing the reliance on and consumption of high-purity tungsten films, directly translating to higher WF6 usage per wafer. AI's role in optimizing the manufacturing process (Smart Manufacturing), however, presents a nuanced impact; while AI algorithms can reduce yield variability and improve tool utilization, potentially minimizing material waste per batch, the overall output increase driven by AI demand outweighs these efficiency gains, leading to a net positive demand spike for WF6 precursors. Therefore, AI primarily acts as a massive demand multiplier rather than a disruptive technological threat to WF6 usage itself.

Furthermore, AI-driven R&D is accelerating material discovery, but replacing WF6 remains a significant technical challenge due to its unmatched properties for conformality and low-resistivity film formation in current CVD chambers. While future materials might emerge, WF6 is deeply entrenched in established process recipes and equipment infrastructure, ensuring its continued relevance for the immediate forecast period. The complexity of current AI hardware necessitates denser chip architectures, often relying on hybrid bonding and sophisticated 3D stacking techniques. These structures require extremely uniform metallization layers, which WF6 reliably provides, reinforcing its position as a bottleneck precursor that must scale in tandem with AI hardware production capacity worldwide.

- AI-Driven Demand Spike: Accelerates global foundry output, particularly for high-end GPUs and AI accelerators, increasing overall WF6 consumption volumes significantly.

- Advanced Node Requirement: AI hardware necessitates manufacturing at 5nm and below, increasing the density of tungsten interconnects and demanding higher purity (7N+) WF6 grades.

- Manufacturing Optimization: AI/Machine Learning (ML) is used in Smart Manufacturing to optimize CVD processes, potentially improving WF6 utilization efficiency and yield stability.

- Supply Chain Monitoring: AI tools enhance predictive maintenance and logistics planning for WF6, crucial due to its hazardous nature and specialized handling requirements.

- R&D Acceleration: AI models are used to simulate new precursor materials, although a direct replacement for WF6 currently faces high technical barriers and significant capital costs for retooling.

DRO & Impact Forces Of Tungsten Hexafluoride Market

The Tungsten Hexafluoride market's trajectory is defined by powerful growth drivers stemming from the semiconductor industry's structural expansion, counterbalanced by inherent restraints related to material handling, purity requirements, and supply chain fragility. The primary driver is the relentless scaling and complexity of microelectronic devices, including the global shift towards advanced node manufacturing and the deployment of 3D architectures like V-NAND, which critically rely on WF6 for tungsten deposition in high aspect ratio features. Opportunities lie in the continued geopolitical push for regional semiconductor manufacturing capacity and the gradual increase in adoption within non-semiconductor fields, such as specialized photovoltaic cell production. Conversely, the market faces significant challenges due to the extreme toxicity and corrosivity of WF6, necessitating high-cost, specialized infrastructure for transportation, storage, and waste management, alongside the stringent purity requirements that restrict the number of viable suppliers and increase production complexity.

Impact forces governing the market are primarily driven by technological advancement and regulatory scrutiny. Technological forces are overwhelmingly positive, driven by continuous innovation in CVD equipment and process chemistry that seeks to improve WF6 efficiency, though these advancements also raise the bar for required precursor purity. Regulatory forces impose significant constraints; the classification of WF6 as a hazardous substance mandates strict environmental, health, and safety (EHS) compliance, which adds substantial operating costs and contributes to high barriers to entry for new market participants. Economic factors, such as volatile global raw material (tungsten powder) prices and energy costs associated with gas production and purification, indirectly affect WF6 pricing and profitability. The concentration of end-users in a few high-tech regions (East Asia) creates vulnerability to localized disruptions, necessitating robust contingency planning and supply chain diversification efforts by major suppliers.

The long-term stability of the market depends heavily on maintaining a stable supply chain for ultra-high-purity materials. The cyclical nature of the semiconductor industry, while currently in a robust upswing, remains a periodic risk factor, causing fluctuations in short-term demand and inventory management challenges. However, the foundational role of tungsten films in nearly all modern chip designs, irrespective of application (AI, mobile, automotive), insulates WF6 demand somewhat from typical industry downturns, as investment in leading-edge capacity tends to be continuous. Strategic market participants focus on vertical integration, controlling the purification steps to guarantee 7N-grade material availability, thereby mitigating the risk associated with relying on third-party purifiers and securing preferred supplier status with major global foundries seeking assured high-quality material access.

Segmentation Analysis

The Tungsten Hexafluoride market is primarily segmented based on the critical parameters of purity grade and the application domain, reflecting the highly specialized nature of the product and its demanding end-use environments. Purity is the most crucial differentiator, directly correlating with pricing and suitability for advanced semiconductor nodes; the market distinguishes between standard electronic grades (6N) and ultra-high-purity grades (7N and above). Application segmentation highlights the overwhelming dependence on the semiconductor sector, where WF6 is deployed for specific CVD and atomic layer deposition (ALD) steps, alongside smaller, niche applications in other high-tech industries. Understanding these segments is vital for suppliers to align their production capabilities and pricing strategies with the stringent technical demands of leading global foundries.

The dominance of the Purity Grade segmentation reflects the technological arms race in microelectronics. As semiconductor feature sizes shrink, defects caused by even trace amounts of impurities (parts per billion or trillion) become catastrophic to chip yield. Consequently, the demand for 7N (99.99999%) purity is growing faster than 6N, necessitating significant capital investment in advanced gas purification and analysis infrastructure. Suppliers capable of consistently delivering these highest grades secure long-term, high-value contracts. The Application segmentation clearly shows that semiconductor manufacturing, covering everything from logic to memory fabrication, consumes over 90% of the WF6 produced globally, establishing the industry's investment cycles as the single most critical predictor of market health. Other applications, while growing, remain marginal contributors to the overall volume and value proposition of the market.

Geographically, market segmentation reveals a strong concentration of demand in regions housing major semiconductor manufacturing clusters, specifically the Asia Pacific region. This concentration creates inherent logistical and supply chain challenges, prompting strategies by both producers and consumers to establish localized supply chains or buffer stocks to mitigate risk. Future growth is anticipated to diversify regionally as new fabs are built in North America and Europe, supported by governmental incentives, yet the technical standards and purity requirements established by the primary APAC foundries will continue to set the global benchmark for WF6 quality. Strategic planning for WF6 suppliers must therefore prioritize both technical innovation in purification and robust, globally redundant distribution networks.

- Purity Grade

- 6N (99.9999% purity)

- 7N (99.99999% purity)

- Other Ultra-High Purity Grades (e.g., 8N)

- Application

- Semiconductor Manufacturing (Primary Segment)

- Logic Devices (CPUs, GPUs, ASICs)

- Memory Devices (DRAM, NAND Flash)

- Power Devices

- Solar Cells (Photovoltaics)

- Chemical Synthesis and Others

- Semiconductor Manufacturing (Primary Segment)

- Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Tungsten Hexafluoride Market

The Tungsten Hexafluoride value chain is highly specialized, beginning with the upstream sourcing of high-purity tungsten metal powder and hydrofluoric acid (HF). Upstream activities are critical as the quality of the raw tungsten material directly influences the feasibility and cost of achieving electronic-grade WF6 purity. Tungsten refining is typically energy-intensive and subject to geopolitical supply risks, as much of the world's tungsten is sourced from specific regions. The next crucial step involves the chemical reaction—fluorination of tungsten—followed by extensive, sophisticated purification stages, often involving fractional distillation and proprietary adsorption technologies, necessary to achieve 6N and 7N electronic purity levels required by foundries. Only specialized chemical manufacturers possess the technical know-how and safety infrastructure to execute these steps, creating significant barriers to entry.

The midstream segment involves the packaging, storage, and complex distribution of WF6. Given its high toxicity, corrosivity, and classification as a hazardous material, WF6 is transported in specialized, high-pressure cylinders requiring proprietary coatings and rigorous maintenance protocols. Distribution channels are highly controlled and often direct, involving close collaboration between the gas supplier and the major end-user foundries. Indirect distribution, involving traditional chemical distributors, is minimal or non-existent for ultra-high-purity grades due to the need for strict quality control, purity assurance, and technical support directly from the manufacturer. Suppliers must manage vast networks of dedicated transportation and handling specialists compliant with international hazardous material regulations, significantly adding to the operational complexity and cost structure.

Downstream analysis focuses heavily on the end-user—the semiconductor fabrication plants (fabs). These facilities utilize WF6 in their CVD reactors for metallization layers. The integration between the gas supplier and the fab is often deep, involving Just-In-Time (JIT) inventory management, on-site storage optimization, and shared safety procedures. The high cost of WF6 and its direct impact on chip yield means end-users prioritize reliability and purity consistency over marginal cost savings. The long-term contractual nature of these relationships reinforces the consolidated structure of the supplier market. Any disruption in the supply of ultra-high-purity WF6 can halt billions of dollars worth of chip production, making supply chain redundancy and resilience a paramount concern for all participants in the downstream segment.

Tungsten Hexafluoride Market Potential Customers

The primary and most critical customer base for Tungsten Hexafluoride are global semiconductor manufacturers, encompassing integrated device manufacturers (IDMs), pure-play foundries, and advanced memory producers. These entities require ultra-high-purity WF6 for use in front-end wafer fabrication processes, specifically for chemical vapor deposition (CVD) of tungsten thin films. Key applications include forming interconnect plugs, contact layers, and barrier layers in modern semiconductor devices, especially those manufactured using advanced nodes (e.g., 14nm, 7nm, 5nm, and below). The stringent technical demands of these customers—such as zero-defect purity requirements and seamless supply integration—dictate the quality standards and business models adopted throughout the market.

Beyond the core semiconductor industry, potential customers include manufacturers in the advanced photovoltaic (solar) sector and specialized chemical research laboratories. While these secondary applications consume significantly lower volumes compared to semiconductor fabs, they often require similar high-purity standards. Certain high-efficiency solar cell designs utilize specialized deposition techniques that may incorporate WF6 precursors, particularly in highly regulated research environments aiming for breakthroughs in material efficiency. The diversification of potential customers is often limited by the high cost and complex handling requirements of WF6, making it economically viable only for high-value manufacturing processes where purity and performance are non-negotiable.

Furthermore, equipment manufacturers and tool vendors specializing in CVD and ALD technologies constitute an important indirect customer group. Although they do not consume the material themselves, their demand for testing, calibration, and R&D activities drives a baseline consumption of WF6. Strategic partnerships with these equipment providers are crucial for WF6 suppliers to ensure their product meets the specifications of next-generation processing tools. Ultimately, the long-term growth of the WF6 market is directly tied to the capital expenditure cycles and technological roadmaps of the top five global semiconductor foundries and memory producers, confirming their status as the definitive potential customers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 million |

| Market Forecast in 2033 | USD 715.2 million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Linde, Air Products and Chemicals, Kanto Denka Kogyo, Voltaix (a part of Air Liquide), Messer Group, SK Materials, Showa Denko K.K., CSIC, Jiangsu Nata Opto-Electronic Material, Praxair (now part of Linde), Sumitomo Seika, Huate Gas, Central Glass Co., Ltd., Versum Materials (now part of Merck KGaA), Wuxi Deli Gas |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tungsten Hexafluoride Market Key Technology Landscape

The technological landscape of the Tungsten Hexafluoride market is primarily centered on enhancing purity, improving deposition efficiency, and ensuring safe handling. The core technology remains the production of WF6 via the direct fluorination of high-purity tungsten metal powder using elemental fluorine (F2). However, the real technological challenge lies in the purification stage. Current key technologies involve highly sophisticated, multi-stage purification processes, predominantly relying on deep cryogenic distillation and advanced adsorption techniques to strip trace impurities like molybdenum hexafluoride, chlorides, and unwanted fluorocarbons down to sub-parts per billion levels (PPB), which is essential for achieving 7N purity required for 5nm and 3nm semiconductor nodes. Continuous innovation in analytical chemistry, utilizing techniques like ICP-MS and specialized gas chromatography, is vital to verify these ultra-low impurity levels, driving the competitive edge of major suppliers.

In the application technology domain, WF6 is intrinsically linked to Chemical Vapor Deposition (CVD) and Atomic Layer Deposition (ALD). Modern semiconductor manufacturing heavily uses spatial ALD and pulsed CVD techniques, which require precise control over precursor delivery. This necessitates technological advancements in the storage cylinders and delivery systems (gas panels) to ensure consistent flow, stability, and absence of particle generation during use. Suppliers invest heavily in specialized internal cylinder coatings (e.g., proprietary passivation layers) and specialized valves designed to resist corrosion from WF6, maximizing product lifetime and minimizing contamination risk. This integrated technology approach, covering production, containment, and delivery, defines the material's viability in high-volume, high-yield fabrication environments.

Furthermore, environmental safety and process efficiency are driving related technological developments. Research is ongoing into novel WF6 recycling and abatement technologies to mitigate the environmental impact of this greenhouse gas and reduce operational costs for end-users. The development of advanced WF6 abatement systems that chemically or thermally convert the gas into less hazardous byproducts before release is crucial for regulatory compliance, especially in densely populated manufacturing regions. Simultaneously, advancements in metrology and real-time process control within CVD tools are optimizing the tungsten deposition process, ensuring minimal WF6 waste and highly conformal film growth, reinforcing the need for reliable, high-purity precursors that function predictably under ultra-precise deposition conditions.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global Tungsten Hexafluoride market, driven by its unparalleled concentration of semiconductor manufacturing facilities, including major foundries and memory producers in Taiwan, South Korea, China, and Japan. This region is the largest consumer globally, responsible for the vast majority of WF6 demand due to continuous expansion and technological leadership in advanced node fabrication (3nm, 5nm). Investments by Chinese domestic gas suppliers, supported by governmental policies aimed at semiconductor self-sufficiency, are rapidly increasing regional production capacity, though quality control to reach 7N standards remains a critical competitive bottleneck against established international suppliers.

- North America: North America represents a critical market for WF6, characterized by high demand from leading R&D centers, specialized logic manufacturers, and the resurgence of domestic manufacturing driven by legislative initiatives like the CHIPS Act. While historically a strong producer and early adopter of advanced node technology, current consumption volumes are lower than APAC but are projected to see the fastest growth rate as new gigafabs, particularly in the US, become operational throughout the forecast period. The region focuses heavily on supply chain security and reliability.

- Europe: The European market for WF6 is characterized by stable demand from established automotive and industrial chip manufacturers, along with significant research institutes. Growth is expected to accelerate due to the European Chips Act, which aims to boost regional chip production capacity and diversify the global supply chain. Key demand centers are primarily concentrated around Germany, France, and Ireland, targeting specialized applications and future logic manufacturing, driving demand for high-grade WF6 precursors.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions currently represent marginal consumers of WF6, primarily limited to small-scale research operations, specialized electronics assembly, or specific materials processing activities. While not significant in volume terms, these regions are strategically important for the global supply of raw tungsten powder (upstream commodity). Future growth in WF6 consumption is contingent on successful large-scale investments in local electronics manufacturing or advanced solar energy production, which is a long-term prospect.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tungsten Hexafluoride Market.- Linde

- Air Products and Chemicals

- Kanto Denka Kogyo

- Voltaix (a part of Air Liquide)

- Messer Group

- SK Materials

- Showa Denko K.K.

- CSIC

- Jiangsu Nata Opto-Electronic Material

- Praxair (now part of Linde)

- Sumitomo Seika

- Huate Gas

- Central Glass Co., Ltd.

- Versum Materials (now part of Merck KGaA)

- Wuxi Deli Gas

Frequently Asked Questions

Analyze common user questions about the Tungsten Hexafluoride market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Tungsten Hexafluoride (WF6) primarily used for?

WF6 is primarily used as a precursor gas in the semiconductor industry for Chemical Vapor Deposition (CVD) processes. It deposits thin, highly conductive tungsten films used for interconnect plugs and contact layers in advanced integrated circuits, crucial for high-speed logic and memory chips.

Why is ultra-high purity WF6 (7N grade) increasingly important in the market?

The shift to advanced semiconductor nodes (5nm and below) requires extremely dense and defect-free circuits. Ultra-high purity 7N (99.99999%) WF6 minimizes metallic and particulate contaminants, which are critical for maximizing yield and device performance in complex 3D architectures like V-NAND and advanced DRAM.

Which region dominates the global demand for Tungsten Hexafluoride?

Asia Pacific (APAC), particularly South Korea, Taiwan, and China, dominates the global WF6 market. This dominance is due to the high concentration of major semiconductor fabrication facilities (foundries and memory manufacturers) located within these countries.

What are the main restraints impacting the WF6 market growth?

The main restraints are the high complexity and cost associated with achieving and maintaining ultra-high purity levels, the inherent handling risks due to WF6's extreme toxicity and corrosivity, and volatility in the upstream supply chain of tungsten raw materials.

How is the growth of Artificial Intelligence (AI) influencing WF6 consumption?

AI is significantly increasing WF6 consumption by driving exponential demand for advanced high-performance chips (GPUs, accelerators). These chips are manufactured at leading-edge nodes, requiring higher volumes of tungsten interconnects per wafer, directly boosting the need for high-purity WF6 precursors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager