Tunnel Furnace Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433671 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Tunnel Furnace Market Size

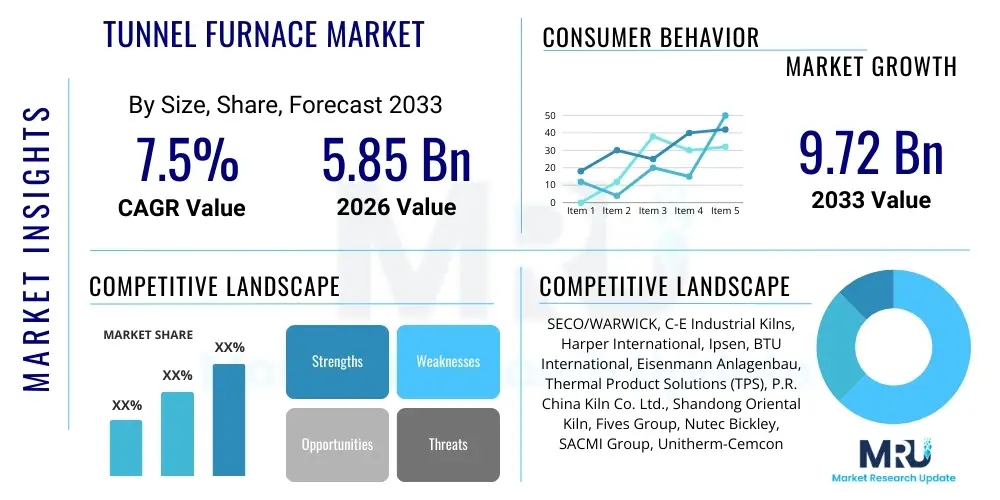

The Tunnel Furnace Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $5.85 Billion USD in 2026 and is projected to reach $9.72 Billion USD by the end of the forecast period in 2033.

Tunnel Furnace Market introduction

The Tunnel Furnace Market encompasses the design, manufacture, installation, and maintenance of industrial thermal processing equipment characterized by continuous material flow through defined heating and cooling zones. These furnaces are essential for high-volume, standardized thermal processing tasks across various heavy and precision industries. Key applications include the firing of ceramics, sintering of metal powders, annealing of glass, and high-temperature heat treatments for components utilized in automotive, aerospace, and electronics manufacturing. The inherent advantages of tunnel furnaces—such as enhanced energy efficiency due to heat recovery systems, superior temperature uniformity, and capability for high throughput—make them critical infrastructure in modern manufacturing settings requiring predictable, continuous output.

A typical tunnel furnace system consists of modular sections: the preheating zone, the high-temperature firing zone, and the cooling zone. Products are conveyed through these zones on specialized refractory cars or belts, allowing for precise control over the temperature profile and atmosphere (oxidizing, reducing, or inert). The market growth is fundamentally driven by the rising demand for sophisticated materials and components, particularly in the rapidly expanding sectors of electric vehicle battery production, advanced technical ceramics used in medical devices, and high-density electronic substrates. Manufacturers are increasingly seeking automated, energy-efficient solutions that minimize processing defects and reduce operational expenditure (OPEX).

Driving factors for the adoption of modern tunnel furnaces include stringent quality requirements in critical industries, necessitating exceptionally tight temperature tolerance and atmospheric control. Furthermore, global sustainability mandates are pushing manufacturers toward highly efficient designs that incorporate waste heat recovery and utilize alternative fuels, such as natural gas or hydrogen blends, to lower the carbon footprint associated with high-temperature processing. The competitive landscape is focused on delivering highly customized, robust, and digitally integrated furnace solutions that can adapt to rapid changes in material science and production scaling requirements.

Tunnel Furnace Market Executive Summary

The global Tunnel Furnace Market is currently experiencing robust expansion, primarily fueled by significant capital investments in the Asia Pacific manufacturing sector, particularly China and India, which dominate the production of tiles, sanitary ware, and advanced ceramics. Business trends highlight a strong shift toward automation and digitalization, where integration with Industry 4.0 technologies—such as IoT sensors and centralized control systems—is becoming standard. This integration enables real-time performance monitoring, predictive maintenance, and highly precise control over thermal profiles, resulting in higher yield rates and reduced energy consumption. Furthermore, the increasing complexity of materials, such as technical ceramics required for semiconductor and aerospace applications, demands furnaces capable of ultra-high temperatures and highly specialized atmospheric conditions, driving innovation among key market players.

Regionally, Asia Pacific (APAC) maintains its position as the largest market, driven by its massive installed manufacturing capacity and continued industrial urbanization. However, North America and Europe are exhibiting high growth in high-value, niche segments, focusing on advanced materials processing, battery manufacturing (gigafactories), and specialized heat treatment for high-performance alloys, necessitating compact, energy-efficient tunnel furnace designs tailored for specific process metallurgy. Segment trends indicate that furnaces designed for extremely high temperatures (above 1500°C) and those utilizing novel heating methods, such as microwave or induction assistance, are experiencing the fastest growth rates. The reliance on traditional brick and refractory materials is evolving, with advanced insulation materials playing a crucial role in improving thermal efficiency and reducing turnaround times.

The market faces challenges related to the high initial investment required for sophisticated equipment and the complexity associated with integrating these large systems into existing production lines. Despite these hurdles, the opportunity landscape is vast, centered on sustainable technology adoption, particularly the development of furnaces optimized for hydrogen combustion or fully electric operation to meet net-zero emission goals. Strategic partnerships between furnace manufacturers and end-user engineering firms are becoming increasingly common to co-develop customized solutions that meet unique material processing requirements, ensuring long-term competitiveness and technological differentiation in this capital-intensive industry.

AI Impact Analysis on Tunnel Furnace Market

Common user questions regarding AI's influence on the Tunnel Furnace Market typically revolve around operational predictability, energy consumption optimization, and mitigating catastrophic failures. Users frequently ask: "How can AI predict material quality variations based on furnace parameters?", "What is the ROI of implementing AI-driven predictive maintenance on my refractory lining?", and "Can machine learning reduce energy consumption without compromising product throughput or quality?" These concerns highlight a market desire for AI to move beyond simple data aggregation and provide tangible, actionable insights that directly impact the bottom line and system reliability. The key themes summarized from user inquiries emphasize the transition from reactive maintenance schedules to proactive, AI-informed decision-making across the entire thermal process lifecycle, from raw material introduction to final cooling.

The core application of Artificial Intelligence (AI) and Machine Learning (ML) in the tunnel furnace domain centers on optimizing complex, non-linear thermal dynamics and enhancing control loop stability. Traditional PID control systems struggle to manage the numerous interacting variables, such as material composition, loading density, atmospheric shifts, and minor fluctuations in burner output, especially in long, multi-zone furnaces. AI models, utilizing historical operational data combined with real-time sensor inputs (including thermal imaging and gas analysis), can accurately map the relationship between control inputs and final product quality. This capability allows for continuous, micro-adjustments to heating profiles and conveyance speeds, ensuring consistently high product quality while minimizing unnecessary energy input, thereby leading to substantial operational savings.

Furthermore, AI significantly enhances the longevity and efficiency of critical furnace components. Predictive maintenance algorithms analyze vibration data, thermal signatures, and historical failure patterns of burners, refractory materials, and conveyor systems. By identifying anomalies and predicting potential failures days or weeks in advance, maintenance can be scheduled proactively during planned downtime, avoiding costly, unscheduled shutdowns that halt high-volume production. This shift not only improves reliability but also optimizes the lifespan of expensive components, translating directly into a lower Total Cost of Ownership (TCO) for end-users operating these high-capital assets across industries like ceramics, steel heat treatment, and specialized battery component manufacturing.

- AI-driven Predictive Maintenance: Forecasts refractory degradation and burner efficiency loss, reducing unplanned downtime by up to 25%.

- Real-time Process Optimization: Machine learning algorithms adjust temperature curves and atmosphere composition to maintain optimal energy consumption per unit of output.

- Quality Control Automation: Vision systems integrated with AI classify and reject defective products instantly based on thermal stress patterns or structural anomalies, improving yield rates.

- Energy Management Systems: AI models analyze utility consumption patterns against production schedules to minimize peak load charges and optimize fuel mixing strategies.

- Digital Twin Simulation: Creation of virtual models of the furnace for testing new material loads or process changes before physical implementation, accelerating R&D cycles.

DRO & Impact Forces Of Tunnel Furnace Market

The dynamics of the Tunnel Furnace Market are fundamentally shaped by the growing global focus on sustainable manufacturing, coupled with the relentless demand for advanced materials in high-growth sectors. The key drivers include the proliferation of electric vehicle (EV) battery manufacturing (requiring extensive sintering and heat treatment processes), and the increasing adoption of technical ceramics in electronics and biomedical applications, which mandate high-precision, continuous thermal processing. Restraints primarily involve the significant initial capital expenditure (CapEx) required for complex, customized furnace installations and the specialized technical expertise needed for operation and complex maintenance schedules. Opportunities are emerging strongly in utilizing alternative energy sources, such as green hydrogen and bio-fuels, for combustion, and developing modular, smaller-scale furnaces to serve specialized, high-margin niche markets.

Impact forces currently influencing the market include intense regulatory pressure concerning emissions (pushing towards electric or hydrogen-ready systems) and rapid technological obsolescence driven by advancements in insulation materials and heating element technology. Furthermore, geopolitical shifts affecting global supply chains for refractory materials and high-nickel alloys used in furnace construction can significantly influence manufacturing costs and lead times. The market structure is highly fragmented yet competitive, with global leaders focusing on providing comprehensive service contracts and high-level integration support to justify the premium price points of highly automated systems. The force of buyer power is moderate, as high customization requirements often limit supplier substitution, while the threat of new entrants remains low due to the immense barrier posed by established expertise and capital requirements.

The market performance is therefore tightly linked to global macroeconomic stability and industrial output. A surge in infrastructure development, particularly in emerging economies, directly translates into increased demand for high-capacity ceramic and cement processing furnaces. Conversely, downturns in the automotive or construction sectors can momentarily dampen investment. The overall impact forces suggest a strong pull toward technologically advanced, energy-efficient, and customized solutions, rewarding manufacturers who prioritize R&D in sustainable heating and process control mechanisms over volume production of standard, outdated designs.

Segmentation Analysis

The Tunnel Furnace Market is analyzed based on several dimensions, providing granular insights into the diverse requirements of end-user industries. Primary segmentation occurs across Furnace Type, Temperature Range, Operation Mode, and End-Use Industry. The segmentation by Furnace Type often includes standard high-temperature brick kilns, laboratory-scale tunnel kilns, and specialized roller hearth or pusher plate furnaces, each designed for different material handling and atmospheric control specifications. The variations in structural design directly impact throughput capacity and operational flexibility, making the Furnace Type a crucial differentiator for buyers based on their production volume needs and material characteristics.

Temperature Range segmentation is critical because material processing requirements vary drastically—from low-temperature drying and tempering (below 1000°C) to ultra-high temperature sintering of advanced ceramics and technical composites (above 1800°C). The ultra-high temperature segment is currently demonstrating superior growth rates, largely driven by the aerospace and semiconductor industries requiring materials with exceptional thermal and mechanical properties. Furthermore, segmentation by Operation Mode distinguishes between continuous (high-volume, standardized products) and semi-continuous or batch operations (often used for lower volume, high-value components requiring complex thermal profiles), influencing the degree of automation and overall system flexibility.

The End-Use Industry segment provides the demand perspective, identifying key revenue streams from sectors such as Ceramics (building materials, refractories, sanitary ware), Electronics & Electrical Components (MLCCs, resistors, sensors), Metallurgy & Metal Powders (sintering, annealing, brazing), and Automotive (heat treatment, battery components). The rapidly expanding battery manufacturing segment for EVs represents a major new demand center, requiring customized tunnel furnaces for cathode and anode material processing, adding significant momentum to the overall market trajectory and encouraging specialization among furnace manufacturers.

- By Furnace Type:

- Roller Hearth Tunnel Furnaces

- Pusher Plate Tunnel Furnaces

- Mesh Belt Tunnel Furnaces

- Car Bottom/Kiln Tunnel Furnaces

- By Temperature Range:

- Low Temperature (Below 1000°C)

- Medium Temperature (1000°C - 1400°C)

- High Temperature (1400°C - 1800°C)

- Ultra-High Temperature (Above 1800°C)

- By Heating Method:

- Electric Heating

- Gas Fired (Natural Gas, LPG)

- Hybrid Heating Systems

- By End-Use Industry:

- Ceramics & Refractories

- Metallurgy & Metal Processing

- Electronics & Electrical Components

- Automotive & EV Batteries

- Aerospace & Defense

- Glass Processing

Value Chain Analysis For Tunnel Furnace Market

The value chain for the Tunnel Furnace Market begins with the upstream suppliers responsible for providing highly specialized raw materials and critical components. This phase includes sourcing advanced refractory materials (such as high-alumina bricks, silicon carbide, and specialized fibers) necessary for thermal insulation and structural integrity, high-performance heating elements (like MoSi2, SiC, or metallic alloys), burner systems, and precision control instrumentation (sensors, PLC units). The quality and durability of these upstream components directly dictate the furnace's maximum operating temperature, energy efficiency, and overall lifespan, making supplier relationships focused on stringent quality control and technical partnership essential for market leaders.

The midstream phase involves the core activities of design, engineering, and manufacturing of the tunnel furnace systems. This stage requires deep expertise in thermal engineering, mechanical design, and software integration to create customized solutions that meet specific processing requirements (e.g., controlled atmosphere, rapid heating/cooling cycles). Manufacturers invest heavily in R&D to improve automation features, enhance energy recovery systems, and ensure compliance with global safety standards. Integration and assembly are complex, often involving modular construction for easier transport and on-site installation, requiring specialized personnel and rigorous quality assurance protocols before handover to the end-user.

The downstream segment encompasses distribution, installation, commissioning, and, most critically, long-term after-sales service and maintenance. Distribution channels typically involve direct sales teams for large, custom installations due to the high contract value and technical complexity, though regional distributors may handle standard furnace models or spare parts. Direct interaction with the end-user is vital for effective commissioning and ensuring optimal performance. Furthermore, long-term revenue streams are significantly driven by high-margin services, including preventative maintenance, technical support, spare parts supply (especially high-wear components like heating elements and conveyor belts), and system upgrades to incorporate newer control technologies or improve energy efficiency over the furnace's multi-decade operational life.

Tunnel Furnace Market Potential Customers

Potential customers for tunnel furnaces are predominantly large-scale industrial manufacturers engaged in continuous thermal processing where high throughput, quality consistency, and energy efficiency are non-negotiable requirements. The primary end-users fall within heavy industrial sectors, including the ceramics industry (covering structural ceramics like bricks and tiles, as well as specialized technical ceramics used in medical and defense applications) and the metallurgical sector, focused on processes such as powder metallurgy sintering, bright annealing, and complex component heat treatment. These buyers are capital-intensive operations that measure equipment value based on operational efficiency, mean time between failures (MTBF), and adherence to strict material specifications, often requiring highly customized furnace geometries and atmosphere control systems.

A rapidly expanding customer base includes manufacturers in the electric vehicle (EV) supply chain, specifically gigafactories and material processing firms responsible for producing cathode and anode active materials for lithium-ion batteries. These processes demand extremely precise and consistent firing and calcination under controlled atmospheric conditions, making advanced tunnel furnaces indispensable. Additionally, the electronics industry, particularly manufacturers of passive components such as multi-layer ceramic capacitors (MLCCs) and specialized sensor elements, relies on high-precision, small-scale mesh belt or pusher furnaces to manage millions of components simultaneously with minimal thermal deviation. For these customers, furnace reliability directly translates to the viability of their mass production lines.

Furthermore, niche markets such as the aerospace and defense sectors, which utilize high-performance alloys and composites, represent high-value customers for ultra-high-temperature and vacuum-capable tunnel furnaces. While their volume requirements may be lower than those of the ceramics industry, the extreme complexity and regulatory demands necessitate state-of-the-art furnace technology and highly specialized service contracts. These diverse potential customers share a fundamental need for highly reliable, custom-engineered thermal solutions that can consistently deliver products meeting stringent international quality standards, driving continuous investment in new or upgraded tunnel furnace technologies to maintain production advantages.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.85 Billion USD |

| Market Forecast in 2033 | $9.72 Billion USD |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SECO/WARWICK, C-E Industrial Kilns, Harper International, Ipsen, BTU International, Eisenmann Anlagenbau, Thermal Product Solutions (TPS), P.R. China Kiln Co. Ltd., Shandong Oriental Kiln, Fives Group, Nutec Bickley, SACMI Group, Unitherm-Cemcon, Aichelin Group, CERAMIC KILN, Keith Company, ZHEJIANG FUDA KILN Co. Ltd., Centorr Vacuum Industries, L&L Special Furnace Co. Inc., Mellen Company Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tunnel Furnace Market Key Technology Landscape

The technological landscape of the Tunnel Furnace Market is defined by innovation aimed at improving thermal efficiency, enhancing process control, and integrating digital solutions for optimal performance. A major focus is on advanced insulation techniques, moving away from traditional refractory materials toward high-performance ceramic fiber blankets, microporous insulation, and vacuum insulation panels (VIPs). These materials drastically reduce heat loss through the furnace walls, allowing for faster ramp-up and cool-down times, which improves throughput and significantly lowers operating energy costs. Furthermore, the design of thermal barriers and modular zone construction allows for unparalleled temperature uniformity and flexibility in customizing complex thermal profiles required for advanced materials like technical ceramics and specialized metal powders.

Another pivotal technological development involves sophisticated heating and combustion systems. There is a strong trend toward hybrid furnaces that combine electric heating elements (for precise zone control) with high-efficiency gas burners, often utilizing recuperative or regenerative heat recovery systems to preheat incoming combustion air, capturing waste heat. Crucially, the increasing feasibility of using hydrogen as a fuel source is leading to the development of 'Hydrogen-Ready' burner technology, which can handle pure hydrogen or hydrogen blends, positioning furnace manufacturers to meet future decarbonization targets, particularly in Europe and parts of Asia where stringent carbon reduction policies are in effect for heavy industry.

The control and monitoring systems represent the most active area of technology advancement, centered on digitalization and Industry 4.0 integration. Modern tunnel furnaces utilize highly sophisticated Programmable Logic Controllers (PLCs) and Distributed Control Systems (DCS) coupled with extensive sensor networks (including infrared pyrometers and specialized atmosphere analysis sensors). This hardware foundation facilitates the deployment of IoT platforms and cloud-based data analytics. Technologies such as high-definition thermal imaging cameras provide continuous monitoring of product temperature and movement, while advanced algorithms, often AI-driven, optimize conveyor speed and atmospheric gas injection in real-time, ensuring maximum yield and minimizing material waste across continuous operations.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market, primarily driven by mass industrialization in China, India, and Southeast Asian nations. The region dominates global production in traditional ceramics (tiles, cement, sanitary ware) and is rapidly scaling up capacity in high-growth segments like EV batteries and specialized electronics components. Government initiatives supporting manufacturing expansion and infrastructure development ensure sustained high demand for large-capacity, energy-efficient tunnel kilns. China, in particular, is a global hub for both manufacturing and exporting advanced furnace technology.

- North America: The North American market is characterized by high investment in high-value, high-precision manufacturing, focusing heavily on aerospace, defense, advanced metallurgy, and the establishment of gigafactories for lithium-ion battery production. Demand here favors smaller, highly automated, and technically complex tunnel furnaces capable of operating under highly stringent regulatory and environmental controls. The emphasis is on adopting AI/ML technologies for process optimization and energy conservation, driving the market toward premium, customized solutions.

- Europe: Europe is a mature but highly innovative market, facing intense pressure for decarbonization. The region's growth is propelled by the need to upgrade existing furnace infrastructure with highly efficient, future-proof technologies, particularly those compatible with hydrogen or fully electric heating. Key demand comes from the automotive sector (specialized component heat treatment) and high-quality technical ceramics manufacturing. European manufacturers lead in developing sophisticated process control software and adherence to the strictest environmental standards.

- Latin America (LATAM): The LATAM market, while smaller, shows steady growth linked to local industrial expansion, especially in Brazil and Mexico, focusing on automotive supply chains and basic building ceramics. Investment is often tied to macroeconomic stability. The region primarily seeks cost-effective, durable furnace solutions with a growing emphasis on localized technical support and lower CapEx models.

- Middle East and Africa (MEA): Growth in MEA is episodic, heavily influenced by major infrastructure projects and regional investments in diversification away from oil economies. Demand is strongest in the basic construction materials sector (cement, tiles) in the Gulf Cooperation Council (GCC) nations and parts of Africa undergoing industrial expansion. The market opportunity lies in providing rugged, high-capacity kilns and integrated energy solutions that can manage high temperatures under challenging operating environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tunnel Furnace Market.- SECO/WARWICK

- BTU International

- Ipsen

- Harper International

- Fives Group

- Eisenmann Anlagenbau GmbH

- Thermal Product Solutions (TPS)

- SACMI Group

- Nutec Bickley

- Aichelin Group

- C-E Industrial Kilns

- Keith Company

- Centorr Vacuum Industries

- L&L Special Furnace Co. Inc.

- Mellen Company Inc.

- CVD Equipment Corporation

- P.R. China Kiln Co. Ltd.

- Shandong Oriental Kiln Co. Ltd.

- ZHEJIANG FUDA KILN Co. Ltd.

- Unitherm-Cemcon

Frequently Asked Questions

Analyze common user questions about the Tunnel Furnace market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of a tunnel furnace over a batch kiln in high-volume production?

The primary advantage is continuous operation, which guarantees superior thermal consistency and significantly higher throughput capacity. Tunnel furnaces maintain steady state conditions, leading to optimized energy usage and uniform product quality, minimizing the thermal cycle time compared to intermittent batch processing.

How is the Tunnel Furnace Market addressing global environmental regulations and sustainability demands?

The market is responding by developing hybrid heating systems, highly efficient insulation materials, and integrating advanced heat recovery technologies. The strongest trend is the shift toward hydrogen-ready burner systems and fully electric furnaces to drastically reduce carbon dioxide and nitrogen oxide emissions, ensuring regulatory compliance and lower operating costs.

Which end-use industry is expected to drive the highest demand for new tunnel furnace installations through 2033?

The Automotive and EV Battery component manufacturing industry is projected to drive the highest demand. The unprecedented global scaling of gigafactories necessitates massive investments in high-precision tunnel furnaces for the calcination and sintering of cathode and anode active materials, requiring highly specialized temperature and atmosphere controls.

What role does Artificial Intelligence play in the operation and maintenance of modern tunnel furnaces?

AI enhances operation by providing predictive maintenance for critical components, optimizing energy consumption through real-time process adjustments, and improving final product quality consistency by managing complex thermal dynamics. AI minimizes unplanned downtime and maximizes the overall system efficiency.

What is the typical lifespan and required maintenance frequency for a high-capacity industrial tunnel furnace?

A high-capacity industrial tunnel furnace typically has an operational lifespan of 20 to 30 years with proper maintenance. Critical maintenance involves scheduled replacement of heating elements, periodic inspection and repair of refractory linings, and annual calibration of control instrumentation, often managed through specialized long-term service contracts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager