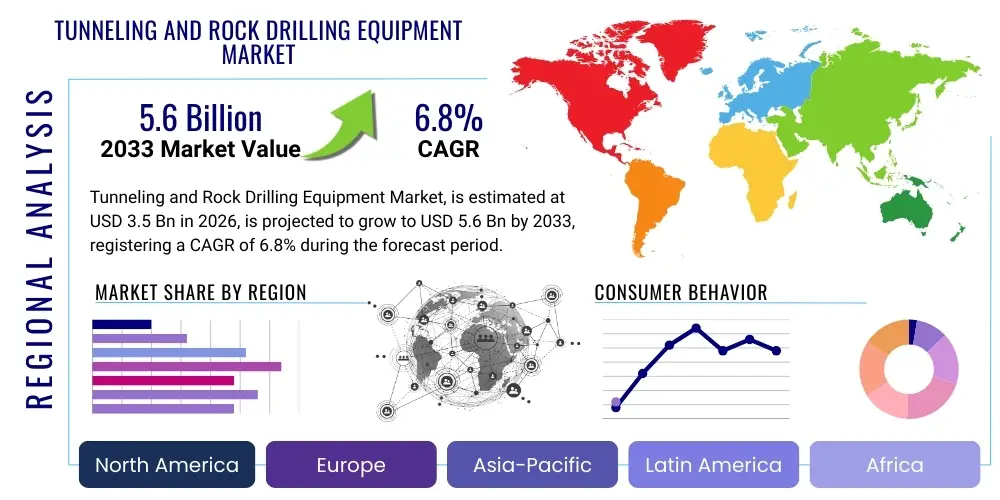

Tunneling and Rock Drilling Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438799 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Tunneling and Rock Drilling Equipment Market Size

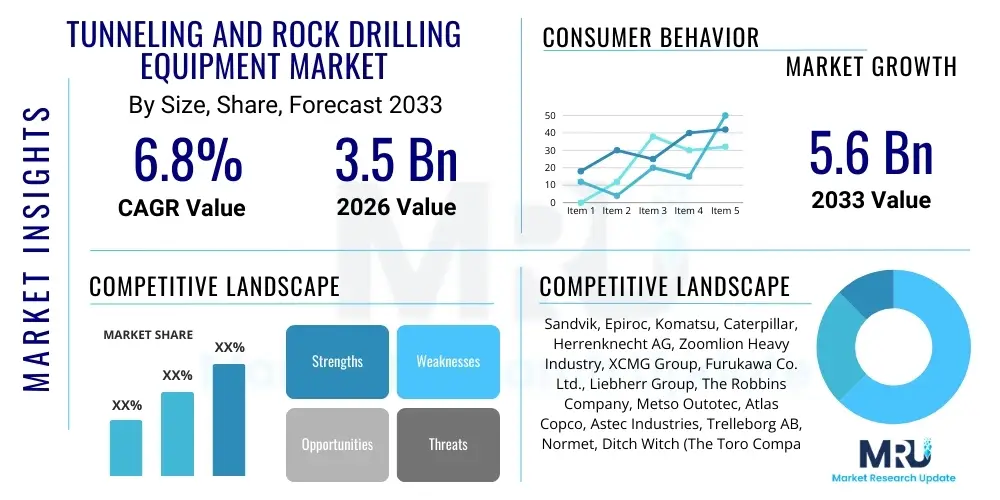

The Tunneling and Rock Drilling Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.6 Billion by the end of the forecast period in 2033.

Tunneling and Rock Drilling Equipment Market introduction

The Tunneling and Rock Drilling Equipment market encompasses specialized machinery vital for underground construction, mining, and infrastructure development globally. This equipment is engineered to handle extreme geological conditions, providing the necessary power and precision for excavating tunnels, preparing blast holes, and stabilizing rock formations. Key products include Tunnel Boring Machines (TBMs), jumbo drills, rock drilling rigs, roof bolters, and associated ancillary systems. The operational scope of this machinery is broad, ranging from small-scale quarrying operations to massive urban transit projects and deep underground mines, making it indispensable for modern industrial and civil engineering feats.

Major applications of this equipment span several critical sectors, prominently infrastructure, utility installation, and resource extraction. Infrastructure development, particularly the construction of metropolitan subways, high-speed rail lines, and highway tunnels, represents a significant demand driver. Furthermore, the global shift towards deeper and more complex mining operations for essential minerals, coupled with oil and gas exploration in challenging subterranean environments, mandates the use of highly efficient, durable drilling and tunneling solutions. These applications require equipment that can optimize material removal rates while prioritizing worker safety and environmental compliance.

The primary benefits driving the adoption of advanced tunneling and rock drilling equipment include enhanced operational efficiency, reduced project timelines, and improved worker safety. Modern machinery incorporates sophisticated automation and telematics, allowing for real-time monitoring and predictive maintenance, thereby minimizing downtime. The increasing global focus on urban expansion and infrastructure renewal, especially in emerging economies, solidifies the market's growth trajectory. Equipment manufacturers are continually innovating to produce more powerful, energy-efficient, and digitally integrated machinery capable of tackling varied rock hardness and geological complexities, ensuring sustained market expansion throughout the forecast period.

Tunneling and Rock Drilling Equipment Market Executive Summary

The Tunneling and Rock Drilling Equipment market is poised for robust expansion, primarily fueled by massive global investments in transportation infrastructure and a sustained boom in deep-level mining activities. Business trends highlight a strong industry pivot toward automation, electrification, and digitalization, aimed at enhancing operational performance and reducing carbon footprints. Manufacturers are increasingly prioritizing the development of battery-electric vehicles (BEVs) and automated drilling solutions, catering to stringent safety and environmental regulations, particularly in confined underground spaces. Mergers, acquisitions, and strategic partnerships centered on technology transfer and geographic expansion are defining the competitive landscape, allowing major players to consolidate market share and penetrate emerging markets effectively.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, driven by extensive urbanization projects in China and India, focusing heavily on metropolitan subway systems and water conveyance tunnels. North America and Europe, while mature markets, are experiencing a renaissance driven by the replacement cycle of aging equipment and significant governmental funding allocated for infrastructure modernization and deep geological waste repositories. The Middle East and Africa (MEA) are also emerging as key regions due to large-scale infrastructure visions and the ongoing exploitation of mineral wealth, demanding substantial investment in high-capacity rock drilling solutions. However, geopolitical instability and fluctuating commodity prices pose intermittent challenges to sustained regional growth.

Segment trends indicate that Tunnel Boring Machines (TBMs) and automated jumbo drills are experiencing the fastest growth, reflecting the complexity and scale of modern tunneling projects. The mining application segment, particularly hard rock mining for copper, gold, and lithium, continues to dominate market revenue, necessitating high-performance drilling consumables and robust service contracts. Furthermore, the maintenance, repair, and overhaul (MRO) services segment is gaining importance as sophisticated equipment requires specialized technical support and genuine spare parts, guaranteeing high operational uptime for critical infrastructure projects. The shift from hydraulic to electric drives across various equipment types is a defining trend influencing component manufacturing and supplier strategies.

AI Impact Analysis on Tunneling and Rock Drilling Equipment Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Tunneling and Rock Drilling Equipment Market frequently revolve around three core themes: enhancing autonomous operation, improving predictive maintenance capabilities, and optimizing geological risk assessment. Users are keenly interested in how AI can move equipment beyond simple automation to true self-learning capabilities, specifically asking about the integration of machine learning algorithms for optimizing drilling parameters (such as feed rate and penetration force) in real-time based on encountered rock characteristics. There is also significant anticipation regarding AI's role in processing vast amounts of sensor data generated by TBMs and drilling rigs to accurately predict component failure, thereby minimizing costly downtime. Furthermore, geotechnical engineers seek clarity on how AI-driven analysis of seismic and geological survey data can reduce uncertainty before and during excavation, leading to safer and more efficient tunneling paths.

The implementation of AI is rapidly transforming operational efficiency and safety across the tunneling and rock drilling sector, moving the industry closer to fully autonomous underground operations. AI algorithms process real-time sensor inputs from gyroscope systems, pressure gauges, and vibration monitors to dynamically adjust machine parameters, ensuring optimal energy consumption and maximum penetration rates regardless of immediate rock variability. This ability to instantly adapt minimizes wear and tear on expensive drilling bits and cutting tools, significantly extending their lifespan and reducing operational expenditure. Beyond immediate process optimization, AI contributes to superior data governance, allowing project managers to benchmark performance across different sites and identify systemic inefficiencies, driving long-term improvements in project execution methodologies.

AI also serves as a critical tool for enhancing safety protocols and mitigating inherent geological risks associated with subterranean work. By applying neural networks to historical drilling data and correlating it with geophysical reports, AI can identify patterns indicative of unstable ground, potential water ingress, or weak fault lines far earlier than traditional methods. This capability enables proactive measures such as targeted ground consolidation or immediate machine stoppage, drastically reducing the likelihood of catastrophic collapses or equipment damage. The integration of advanced diagnostics through AI-powered anomaly detection ensures compliance with increasingly strict global safety standards, thereby protecting both personnel and high-value capital investments. The market is thus shifting towards equipment-as-a-service models where AI analytics are the primary value differentiator.

- AI-driven real-time optimization of drilling and boring parameters based on rock density and hardness.

- Implementation of Machine Learning (ML) for predictive maintenance, anticipating component failures in TBMs and drills.

- Enhanced autonomous navigation and steering for Tunnel Boring Machines (TBMs) using complex sensor fusion and path correction algorithms.

- Automated rock mass classification and geological mapping utilizing AI analysis of drill core samples and seismic data.

- Improved safety through early detection of ground instability or unexpected water inflows using anomaly detection systems.

- Optimization of energy usage and operational output through continuous learning models integrated into power management systems.

- Streamlining data management and reporting for compliance and performance benchmarking across large-scale projects.

DRO & Impact Forces Of Tunneling and Rock Drilling Equipment Market

The Tunneling and Rock Drilling Equipment market is fundamentally shaped by a powerful interplay of Drivers (D), Restraints (R), Opportunities (O), and pervasive Impact Forces. A primary driver is the accelerating pace of global infrastructure development, particularly megaprojects focused on urban rail, water sanitation, and long-distance connectivity, which demand high-throughput, continuous excavation capabilities. Furthermore, the global trend towards deep and complex mining—accessing lower-grade, deeper ore bodies—necessitates highly specialized, powerful, and automated drilling equipment capable of operating safely and efficiently under extreme pressures and temperatures. The rapid adoption of digital technologies, including telematics and IoT integration, acts as an intrinsic driver, pushing manufacturers to continuously upgrade their offerings to meet client demands for data-driven operational control.

However, the market faces significant restraints that temper its growth trajectory. The high capital investment required for modern tunneling and drilling equipment, especially for large TBMs, restricts the participation of smaller contractors and slows down fleet modernization cycles in developing regions. Operational risks associated with complex subterranean environments, including geological surprises, unforeseen ground instability, and high technical skill requirements for machine operation and maintenance, present considerable challenges. Furthermore, stringent environmental regulations governing noise pollution, vibration control, and dust mitigation necessitate expensive design modifications and operational adjustments, potentially increasing project costs and timelines.

Significant opportunities exist in the transition towards sustainable and electrified equipment fleets. The move to Battery Electric Vehicles (BEVs) for underground loaders and drills offers a pathway to eliminating diesel emissions and reducing ventilation requirements, presenting a substantial competitive advantage and market opportunity for early movers. The growing global need for deep geological repositories (DGRs) for nuclear waste storage and large-scale pumped hydro storage projects represents a niche but highly lucrative application requiring specialized, precision drilling and tunneling. The aftermarket segment, encompassing maintenance, refurbishment, and digital service contracts, offers stable revenue streams and high-margin opportunities for established Original Equipment Manufacturers (OEMs). The key impact forces include fluctuating raw material prices (steel, specialized alloys), geopolitical tensions affecting large infrastructure funding, and the continuous pressure from regulators to enhance worker safety standards, necessitating continuous investment in automation and remote operation capabilities.

Segmentation Analysis

The Tunneling and Rock Drilling Equipment Market is primarily segmented based on Equipment Type, Application, and Sales Channel. Equipment Type categorization helps differentiate specialized machinery, ranging from large-scale excavation tools like TBMs to versatile tools such as jumbo drills and handheld pneumatic devices. The diversity in equipment reflects the wide array of geological conditions and project scales encountered globally. Analyzing these segments is critical for manufacturers to allocate R&D resources effectively, focusing on areas where technological advancements, such as electrification and automation, provide the highest return on investment and address pressing industry challenges like energy efficiency and operational safety.

The Application segment is crucial as it dictates the required technical specifications, durability, and operational frequency of the equipment. Mining remains a cornerstone application, driving demand for powerful, robust equipment designed for continuous, high-volume extraction. In contrast, civil construction applications, such as metro systems and utilities, require greater precision, steering capability, and noise suppression. Understanding these distinct user requirements allows service providers to tailor maintenance contracts and customization options, maximizing the lifespan and utility of the capital equipment. The dynamics between hard rock and soft ground tunneling also significantly influence product sales.

Further segmentation by Sales Channel (Direct Sales vs. Indirect Sales/Distributors) sheds light on market access and distribution strategies. Direct sales are typically preferred for high-value, complex equipment like TBMs, where extensive post-sales support and customization are mandatory. Conversely, smaller, standardized drilling tools and consumables often utilize extensive indirect distribution networks for wider geographical reach and efficient inventory management. The evolving trend towards leasing and rental models, often categorized within the indirect channel, also represents a growing segment, offering greater financial flexibility to project developers who seek to minimize upfront capital expenditure.

- By Equipment Type:

- Tunnel Boring Machines (TBMs)

- Jumbo Drills (Face Drilling Rigs)

- Rock Drilling Rigs (Surface and Underground)

- Roof Bolting Machines

- Drill and Blast Equipment

- Loaders and Haulage Equipment (LHDs)

- Continuous Miners and Roadheaders

- By Application:

- Mining (Metal, Non-metal, Coal)

- Construction (Roads, Railways, Subways)

- Oil & Gas (Pipeline and Storage Caverns)

- Utilities and Hydropower (Water Conveyance, Sewage)

- By Sales Channel:

- Direct Sales (OEM to End-user)

- Indirect Sales (Distributors, Rental Fleets)

Value Chain Analysis For Tunneling and Rock Drilling Equipment Market

The value chain for the Tunneling and Rock Drilling Equipment market is highly structured, beginning with upstream raw material suppliers and concluding with intensive post-sales support. Upstream activities involve the procurement of specialized materials, including high-strength steel alloys, hydraulic components, advanced electronics, and specialized cutting tools (PDC cutters, carbide inserts). The reliability and cost stability of these raw materials directly influence the manufacturing efficiency and final price point of the equipment. Strong supplier relationships are paramount, especially for proprietary components such as sophisticated gearing systems and specialized hydraulic pumps required for TBM operations.

The manufacturing stage, which includes design, assembly, and rigorous testing, adds the most significant value. This is where intellectual property related to drilling automation, machine resilience, and energy efficiency resides. Distribution channels form the crucial link between the manufacturers and end-users. For highly customized, expensive machinery, direct sales channels dominate, offering consultative selling, tailored logistics, and installation support. Smaller equipment and consumables, conversely, rely heavily on well-established indirect distributor networks and global rental fleets, which provide regional market penetration, localized inventory, and immediate availability for shorter-term projects.

Downstream activities center on the deployment, operation, and extensive maintenance lifecycle of the equipment. Given the harsh operating environments, the aftermarket segment, including MRO (Maintenance, Repair, and Overhaul) and the provision of genuine spare parts and consumables, is a high-margin area and a core competitive battleground. OEMs are increasingly focusing on digital services, offering predictive maintenance packages, remote diagnostics, and operator training programs as part of their service agreements. The efficiency of the downstream support directly impacts the operational uptime of critical customer projects, making responsive and expert service delivery a key determinant of customer loyalty and market success.

Tunneling and Rock Drilling Equipment Market Potential Customers

The primary customers for tunneling and rock drilling equipment are large-scale civil engineering contractors, global mining corporations, and governmental agencies involved in large infrastructure projects. Civil contractors undertaking complex urban projects, such as metropolitan subway extensions, utility tunnels, and large road networks, constitute a significant buyer segment, demanding high-precision TBMs and powerful drilling jumbos. These buyers prioritize operational speed, minimal surface disruption, and adherence to tight contractual deadlines. They often favor rental or leasing models for flexibility, particularly for equipment like roadheaders and drill rigs used on finite-duration projects.

Mining companies, especially those engaged in hard rock underground extraction of base metals (copper, nickel) and precious metals (gold, silver), represent the most financially substantial customer base. These companies require heavy-duty, highly automated, and often electric-powered drilling and loading equipment designed for continuous, high-volume production in challenging, deep environments. Their purchasing decisions are heavily influenced by total cost of ownership (TCO), machine reliability, and the availability of sophisticated service contracts that guarantee high operational utilization rates over the long term. They are increasingly adopting fully autonomous fleets to improve safety and productivity.

Governmental entities, particularly those managing public works, water resources, and specialized storage facilities (like nuclear waste repositories or strategic oil reserves), are also critical end-users. These organizations often require specialized, durable equipment for long-term projects and may procure equipment directly or through Public-Private Partnerships (PPPs). Utility companies requiring new pipeline installations or maintenance of existing infrastructure also drive demand for smaller, more agile drilling and micro-tunneling equipment. The common thread among all these buyers is the need for highly reliable machinery backed by robust technological support and immediate access to expert field services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sandvik, Epiroc, Komatsu, Caterpillar, Herrenknecht AG, Zoomlion Heavy Industry, XCMG Group, Furukawa Co. Ltd., Liebherr Group, The Robbins Company, Metso Outotec, Atlas Copco, Astec Industries, Trelleborg AB, Normet, Ditch Witch (The Toro Company), Shanghai Tunnel Engineering Co. Ltd. (STEC), Beijing General Research Institute of Mining and Metallurgy (BGRIMM), Mitsui Miike Machinery Co., Ltd., J. H. Fletcher & Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tunneling and Rock Drilling Equipment Market Key Technology Landscape

The technological evolution of tunneling and rock drilling equipment is centered on achieving higher degrees of automation, increasing efficiency through electrification, and improving data connectivity via the Industrial Internet of Things (IIoT). Modern equipment now incorporates sophisticated sensor arrays, high-definition cameras, and positioning systems that enable precision drilling and guidance, particularly crucial for long-distance TBM drives and complex blast hole patterns. Advanced control systems utilize proprietary algorithms to autonomously adjust drilling parameters, optimizing penetration rate (ROP) and minimizing energy consumption, thereby transforming operational consistency and reducing reliance on manual adjustments by operators. This move toward 'smart drilling' is a defining factor in the competitive technology landscape.

Electrification represents another paradigm shift, moving away from conventional diesel-hydraulic systems, especially in underground mining and metropolitan tunneling. Battery-Electric Vehicles (BEVs) for drilling jumbos, LHDs (Load-Haul-Dump), and utility vehicles significantly reduce exhaust emissions, noise levels, and heat generation underground. This subsequently lowers the need for intensive ventilation systems, resulting in substantial savings in operational energy costs and creating a safer working environment. Manufacturers are investing heavily in high-density battery technology, rapid charging infrastructure, and robust power management systems to ensure minimal interruption to continuous operations, offering performance parity or superiority compared to their diesel counterparts.

Furthermore, technology focusing on maintenance and longevity is gaining prominence. Advanced materials science is yielding more durable drill bits, specialized cutters, and wear components capable of handling extremely abrasive rock formations, extending the service life between necessary replacements. Digital twin technology is increasingly applied during the design and planning phases of major tunneling projects, allowing engineers to simulate various geological scenarios and machine interactions before deployment. Telematics and cloud connectivity facilitate remote monitoring, enabling predictive maintenance schedules based on real-time component wear data, rather than fixed time intervals, which maximizes machine uptime and significantly contributes to the overall profitability of construction and mining projects.

Regional Highlights

- Asia Pacific (APAC)

The Asia Pacific region currently holds the largest market share and is projected to exhibit the highest growth rate throughout the forecast period. This dominance is intrinsically linked to massive, sustained infrastructure spending, particularly in China, India, and Southeast Asian nations. China's "Belt and Road Initiative" and extensive metropolitan expansion programs necessitate thousands of kilometers of new rail, road, and utility tunnels, driving unparalleled demand for large-diameter Tunnel Boring Machines (TBMs). Furthermore, the rapid growth of urbanization across India and Indonesia requires robust rock drilling equipment for foundation preparation, hydropower projects, and sophisticated metro rail systems built beneath dense urban environments.

The mining sector in APAC, particularly in Australia (iron ore, gold) and Indonesia (coal, nickel), relies heavily on advanced rock drilling equipment to maintain high extraction volumes. The stringent requirements for safety and efficiency in these operations compel contractors to invest in automated and semi-autonomous drilling and bolting rigs. Regional manufacturing hubs are also emerging, leading to localized production and intensified competition. This localized presence, combined with strong governmental support for public works, ensures that the APAC market remains the primary global focal point for both equipment sales and technological adoption, specifically favoring solutions that promise high throughput and swift project completion.

- North America

The North American market, comprising the United States and Canada, is characterized by a strong focus on modernization, replacement cycles, and increasing regulatory pressure for environmental compliance. Significant governmental funding, notably through recent infrastructure acts in the U.S., is spurring major investments in repairing and expanding aging transportation systems, including water tunnels and highway bypasses, thereby boosting demand for specialized hard-rock drilling equipment. Contractors in this region prioritize advanced automation and telematics capabilities, utilizing data analytics to comply with strict safety standards and maximize labor productivity, which is crucial given high labor costs.

The mining sector, particularly in the Canadian Shield and various U.S. states, remains a stable purchaser, with a pronounced shift towards Battery Electric Vehicles (BEVs) for underground operations. This transition is driven by environmental goals and the significant cost savings associated with reduced ventilation infrastructure. North American buyers demand high-quality, durable machinery, focusing on equipment Total Cost of Ownership (TCO) over immediate purchase price. The market growth here is steady, driven less by new large-scale greenfield projects and more by technological upgrading, enhanced safety features, and the replacement of aging, legacy hydraulic fleets with modern, digitized, and electrified alternatives.

- Europe

The European market is highly mature and technology-driven, placing a premium on sustainability, precision engineering, and adherence to the strictest environmental and safety regulations globally. Demand is generated primarily by complex cross-border rail links (e.g., Brenner Base Tunnel), sophisticated metropolitan expansion projects, and critical clean energy initiatives, such as pumped-hydro storage and deep geological repositories for nuclear waste. European manufacturers are often pioneers in TBM design and advanced tunneling techniques, focusing heavily on continuous innovation in areas like ground conditioning, automated segmental lining, and energy recuperation systems for TBMs.

The push for decarbonization is particularly influential, resulting in rapid adoption of electric and hybrid drilling solutions across construction sites and quarries. Scandinavian countries, known for their deep mining expertise, are leading the charge in implementing fully automated and remotely operated rock drilling fleets. Despite slower overall population growth compared to APAC, the mandatory maintenance and refurbishment of extensive existing infrastructure assets across Western and Central Europe ensures sustained, high-value demand for specialized drilling and tunneling service contracts, along keeping the aftermarket segment exceptionally strong.

- Latin America (LATAM)

Latin America is a volatile yet high-potential market, strongly linked to commodity cycles and resource extraction activities, especially copper mining in Chile and Peru, and gold mining across the continent. These robust mining operations are the primary drivers of demand for heavy-duty, powerful rock drilling equipment, including blast hole drills and underground production rigs. While civil infrastructure investment can be intermittent due to political and economic instability, countries like Brazil and Mexico are undertaking significant urban transit projects that sporadically require large tunneling capabilities.

The market faces challenges related to financing large capital equipment purchases and reliance on imported machinery. However, the requirement for improving safety standards and increasing productivity in deep mines compels companies to invest selectively in reliable and modern equipment. Manufacturers often penetrate this market through strong local distributors and comprehensive after-sales service packages, recognizing that localized support is essential for mitigating risks associated with remote operating environments and challenging logistics.

- Middle East and Africa (MEA)

The MEA region is characterized by substantial governmental investment in mega-city projects (e.g., NEOM in Saudi Arabia) and expansion of oil and gas infrastructure, which requires considerable tunneling and rock drilling expertise. The Middle East, with its ambitious urban development and reliance on secure water conveyance systems, generates significant demand for both micro-tunneling equipment and TBMs designed to handle varying soil and rock conditions, often under high-temperature environments. Financial stability stemming from oil revenues supports these massive, long-term construction initiatives.

In Africa, demand is predominantly driven by the expansion of mining activities (platinum, diamonds, cobalt) and the development of energy and transportation corridors. Southern Africa, with its deep gold and platinum mines, remains a critical hub for high-performance underground drilling and bolting equipment. The logistical challenges and varied regulatory environments across the continent necessitate durable, robust machinery that is easy to maintain and repair in remote locations. The market is increasingly adopting digital solutions to manage scattered fleets effectively and improve operational oversight.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tunneling and Rock Drilling Equipment Market.- Sandvik AB

- Epiroc AB

- Komatsu Ltd.

- Caterpillar Inc.

- Herrenknecht AG

- The Robbins Company

- Zoomlion Heavy Industry Science and Technology Co., Ltd.

- Xuzhou Construction Machinery Group Co., Ltd. (XCMG)

- Furukawa Co., Ltd.

- Liebherr Group

- Normet Group Oy

- J. H. Fletcher & Co.

- Astec Industries, Inc.

- Trelleborg AB (TBM seals and components)

- Metso Outotec Oyj (Consumables and Services)

- Shanghai Tunnel Engineering Co. Ltd. (STEC)

- Beijing General Research Institute of Mining and Metallurgy (BGRIMM)

- Mitsui Miike Machinery Co., Ltd.

- LiuGong Machinery Co., Ltd.

- Ditch Witch (The Toro Company)

Frequently Asked Questions

Analyze common user questions about the Tunneling and Rock Drilling Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What major trends are currently driving innovation in the Tunneling and Rock Drilling Equipment Market?

The primary drivers of innovation are the comprehensive shift towards electrification (Battery Electric Vehicles or BEVs), increased integration of AI and machine learning for predictive maintenance and autonomous drilling optimization, and the demand for enhanced safety features such as remote operation and collision avoidance systems. These trends are aimed at reducing emissions, lowering operational costs, and increasing machine uptime in complex subterranean environments, especially within deep mining and urban tunneling projects globally.

How does the high capital cost of equipment, such as Tunnel Boring Machines (TBMs), impact market adoption?

The substantial capital outlay for large-scale equipment is a significant restraint, particularly for mid-sized contractors and projects in emerging markets. This restraint is being mitigated by the increasing popularity of equipment leasing, rental programs, and customized financing options offered by OEMs. Furthermore, the high initial cost is often justified by the superior efficiency and precision these machines offer, leading to shorter project timelines and reduced overall labor and operational expenditure over the project lifespan.

Which geographical region is expected to lead the demand for rock drilling equipment, and why?

The Asia Pacific (APAC) region, specifically countries like China and India, is forecast to lead the demand due to unparalleled levels of governmental investment in critical infrastructure, including extensive metropolitan subway systems, large-scale highway tunnels, and rapid urbanization efforts. This region requires a continuous supply of both high-capacity Tunnel Boring Machines and versatile rock drilling rigs for foundation and utility work.

What is the role of digitalization and IoT in modern tunneling and drilling operations?

Digitalization and the Internet of Things (IoT) are fundamental for modern operations, facilitating real-time remote monitoring, data collection, and analysis of machine performance (e.g., vibration, temperature, power draw). This connectivity enables highly accurate predictive maintenance schedules, optimized operational parameters based on geological feedback, and immediate fault diagnosis, drastically improving efficiency, minimizing unplanned downtime, and ensuring adherence to safety compliance standards.

What is the difference in equipment requirements between hard rock mining and civil construction tunneling?

Hard rock mining requires equipment focused on sheer power, robustness, and continuous high-volume extraction (e.g., heavy-duty jumbo drills and powerful LHDs), prioritizing durability and blast optimization. Civil construction tunneling, especially in urban areas, emphasizes precision, steering control, minimal ground disturbance (vibration/noise), and ability to handle mixed face conditions, leading to greater reliance on highly specialized, often shielded, Tunnel Boring Machines and perimeter control drilling systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager