Tunneling Machinery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431969 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Tunneling Machinery Market Size

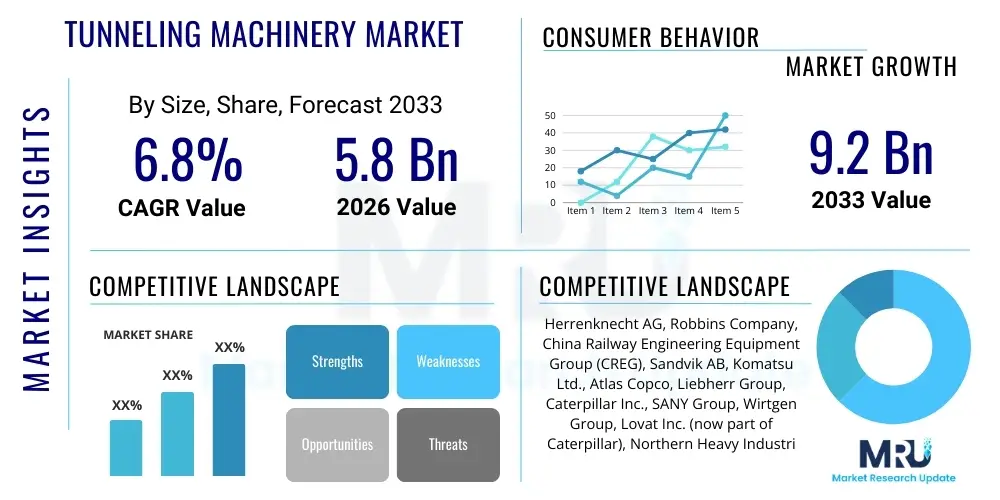

The Tunneling Machinery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 9.2 Billion by the end of the forecast period in 2033.

Tunneling Machinery Market introduction

The Tunneling Machinery Market encompasses a wide range of specialized heavy equipment designed for the excavation, support, and preparation of underground openings, crucial for large-scale civil engineering, infrastructure, and mining projects. This sophisticated machinery, including Tunnel Boring Machines (TBMs), roadheaders, shield tunneling systems, and auxiliary equipment, is vital for creating tunnels for transportation networks (metro systems, highways, railways), utilities (water supply, sewage, power cables), and mineral extraction. The increasing global focus on urban mobility and the necessity for deep underground infrastructure due to surface congestion are the primary catalysts accelerating the adoption of these advanced mechanical solutions. Modern tunneling techniques emphasize speed, precision, and minimizing environmental disruption, making high-performance tunneling machinery indispensable for contemporary construction endeavors.

The core product portfolio within this market spans across equipment designed for hard rock, soft ground, and mixed-face conditions, offering versatility crucial for diverse geological environments worldwide. TBMs, often considered the flagship technology, provide automated and continuous excavation, significantly reducing the time and risk associated with traditional drill-and-blast methods. Major applications are concentrated within metropolitan regions undergoing rapid urbanization, where governments are heavily investing in sub-surface public transit systems and necessary utility upgrades. The benefits derived from using specialized tunneling machinery include enhanced worker safety, increased project efficiency, superior accuracy in alignment, and reduced overall project timelines, all critical factors when dealing with complex urban tunneling challenges.

Driving factors underpinning the robust market expansion include massive global governmental expenditure on public infrastructure, particularly high-speed rail and metro projects in the Asia Pacific and European regions. Furthermore, the persistent demand from the mining sector, especially for deeper and more efficient access to mineral resources, necessitates continuous innovation and deployment of powerful and reliable tunneling machines. Regulatory mandates promoting safety standards and the drive toward sustainable construction practices also propel the adoption of advanced, electric, and digitally integrated machinery capable of optimizing resource consumption and minimizing geological risks. The market is characterized by high capital investment and reliance on specialized engineering expertise, fostering a competitive landscape focused on technological leadership and customization capabilities.

Tunneling Machinery Market Executive Summary

The Tunneling Machinery Market is experiencing strong growth propelled by an unprecedented surge in global infrastructure spending, particularly in densely populated urban centers focusing on subterranean connectivity. Business trends indicate a decisive shift towards fully automated, digitized, and electrically powered machinery, enhancing operational efficiency and reducing carbon footprint. Key manufacturers are investing heavily in hybrid TBMs and smart drilling technologies that can adapt instantaneously to varying geological strata, thereby mitigating costly delays and project overruns. Mergers and acquisitions focused on integrating specialized software and automation capabilities into heavy machinery fleets define the competitive business dynamics. Furthermore, the rising adoption of rental and leasing models provides greater financial flexibility to smaller construction firms, expanding the market reach beyond tier-one construction conglomerates and accelerating the deployment rate of advanced equipment.

Regionally, the Asia Pacific (APAC) dominates the market, primarily fueled by massive infrastructure pipelines in China, India, and Southeast Asian nations committed to modernizing their public transportation and utility infrastructure. China, in particular, remains the largest single market due to its continuous expansion of high-speed rail and subway networks, driving significant demand for large-diameter TBMs. Europe is characterized by stringent environmental regulations and technological maturity, leading to high adoption rates of precise, sustainable, and noise-reducing machinery suitable for tunneling beneath historic cities. North America shows steady growth, driven by aging infrastructure replacement projects and major urban transit expansions, with a strong emphasis on automation and enhanced safety protocols mandated by regional regulatory bodies.

Segment trends highlight the dominance of Tunnel Boring Machines (TBMs) based on value, reflecting their integral role in large-scale, complex projects. Within TBMs, Earth Pressure Balance (EPB) machines and Slurry Shield TBMs are experiencing increased demand due to their effectiveness in soft and water-logged ground conditions common in urban tunneling. The application segment sees the Infrastructure sector (specifically transportation like metro rail and road tunnels) holding the largest market share, though the Mining sector exhibits high growth potential driven by the necessity for deep shaft development and highly automated haulage tunnels. The focus remains on machine reliability and the integration of sophisticated monitoring systems to ensure continuous operation, addressing one of the most significant challenges in deep underground construction—unscheduled downtime.

AI Impact Analysis on Tunneling Machinery Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Tunneling Machinery Market primarily revolve around how AI can enhance safety, predict maintenance needs, and improve real-time decision-making during complex geological events. Users frequently ask about AI's role in autonomous boring, the integration of machine learning algorithms for geological mapping optimization, and whether predictive maintenance (PdM) powered by AI significantly reduces operational costs and downtime. There is a high expectation that AI will standardize performance across different projects and operators, addressing the current reliance on highly skilled, yet scarce, human expertise. Concerns often center on the security of operational data collected by AI systems and the required infrastructure investment for widespread AI integration, leading to a consensus that AI is transitioning from a nascent technology to a core component of future smart tunneling operations.

The integration of sophisticated AI and Machine Learning (ML) models is fundamentally transforming the operational landscape of the tunneling industry. These models are utilized to analyze vast streams of data collected from TBM sensors, including cutterhead torque, penetration rate, thrust pressure, and material excavated. By processing this telemetry data in real-time, AI algorithms can accurately predict equipment failure before it occurs, shifting maintenance practices from reactive to predictive, thereby significantly boosting machine uptime and overall project schedule adherence. Furthermore, AI assists in optimizing tunneling parameters, advising operators on the optimal speed and pressure adjustments necessary to navigate varying rock and soil conditions efficiently, minimizing wear and tear on expensive components.

Beyond predictive maintenance, AI is crucial for risk management and enhanced safety. Machine learning models are being developed to identify patterns indicative of potential geological hazards, such as unexpected water ingress or rock instability, often hours or days before traditional monitoring systems detect a critical issue. This proactive risk detection allows project managers to implement precautionary measures, significantly reducing the likelihood of catastrophic events. Moreover, AI supports the transition towards automated and eventually autonomous tunneling operations, where repetitive boring tasks are managed entirely by intelligent systems, allowing human engineers to focus on complex decision-making and strategic oversight, enhancing both efficiency and worker protection in hazardous underground environments.

- Enhanced Predictive Maintenance (PdM) reduces unplanned downtime by forecasting component failure.

- Real-time geological prediction and hazard mapping optimization using sensor data and ML algorithms.

- Automation of boring cycle parameters (speed, thrust, torque) for maximum energy efficiency and cutterhead longevity.

- Improved decision support systems for operators navigating mixed-face or challenging rock formations.

- Development of autonomous or semi-autonomous TBM operation requiring minimal human intervention in stable conditions.

- Advanced data fusion from multiple sensors (seismic, radar, pressure) to create highly accurate 3D underground models.

- Optimization of concrete lining segment placement and grout injection quality control using computer vision and AI.

DRO & Impact Forces Of Tunneling Machinery Market

The Tunneling Machinery Market is primarily driven by massive global governmental investment in essential infrastructure, particularly in metro systems and high-speed rail, mandated by rapid global urbanization. Restraints include the extremely high initial capital expenditure required for purchasing TBMs and related equipment, coupled with the inherent geopolitical and financial risks associated with large, long-term construction projects. Significant opportunities lie in the adoption of sustainable tunneling practices, such as electric and hybrid machinery, and the expansion into niche applications like smart utility tunnels and deep geological disposal facilities. These dynamics collectively create a strong market pull, moderated by financial constraints and skilled labor shortages.

Drivers fueling market expansion are pervasive and fundamental. The critical need to alleviate traffic congestion in mega-cities worldwide necessitates the construction of underground transit systems, directly translating into high demand for large-diameter TBMs. Furthermore, stricter safety regulations globally compel construction firms to adopt mechanized tunneling methods over older, riskier techniques like drill-and-blast, favoring technologically advanced, enclosed machinery. The replacement cycle for existing aging infrastructure in mature economies like Europe and North America also contributes significantly, requiring modern, high-efficiency equipment capable of operating in constricted and sensitive urban environments. The confluence of these factors ensures a sustained and long-term demand curve for sophisticated tunneling solutions.

Conversely, several key restraints impede faster market growth. The extremely long lead times for TBM manufacturing, customization, and delivery often delay project timelines and require substantial pre-planning, creating barriers to rapid deployment. Moreover, the tunneling industry faces a global shortage of highly specialized engineers and TBM operators, limiting the operational scalability and efficiency of complex machines. Financial constraints, particularly in developing nations, often make the purchase of new, cutting-edge equipment prohibitive, pushing firms towards older or less efficient alternatives. Impact forces, driven largely by technological advancements, include the ongoing pressure to reduce noise and vibration for surface protection and the necessity to manage massive amounts of excavated material (spoil) in an environmentally responsible manner.

Opportunities center on technological innovation and market diversification. The increasing global focus on decarbonization presents a substantial opportunity for manufacturers offering fully electric or hybrid tunneling solutions, aligning with corporate and governmental sustainability mandates. The development of smaller, highly maneuverable micro-TBMs opens up new avenues in utility and pipeline installation, circumventing the need for open-cut methods in dense urban settings. Furthermore, advancements in real-time geological sensing and data analytics, often integrated with AI, allow for safer and faster excavation through challenging strata, minimizing operational risk and boosting overall project viability, attracting more private sector investment into tunneling infrastructure.

Segmentation Analysis

The Tunneling Machinery Market is comprehensively segmented based on the Type of machinery, the specific Application or end-use, and the Operational Mode, reflecting the diverse requirements across geological and project scales. Segmentation by type (e.g., TBMs, Roadheaders) distinguishes based on excavation technique and geological suitability, directly influencing market value distribution. Application segmentation is crucial for understanding demand elasticity across major sectors like transportation infrastructure and mining. The detailed segmentation structure aids stakeholders in strategic planning, allowing for targeted market penetration strategies based on regional infrastructure development phases and specific project needs, particularly emphasizing the shift towards high-automation equipment.

Analyzing these segments reveals critical trends. The TBM segment, further broken down by geological capability (EPB, Slurry, Hard Rock), holds the largest revenue share due to their necessity in large-scale urban metro projects. The infrastructure segment dominates application spending, but the Utilities sector, driven by aging water and sewage systems requiring deep repair and replacement, is emerging as a rapidly expanding, yet smaller, market vertical. Geographically, segmentation highlights the concentrated demand in Asia Pacific due to centralized government planning and large-scale, ongoing urban development initiatives, contrasting with the high-value, quality-driven demand in mature Western markets emphasizing technological sophistication and environmental compliance in equipment selection.

Understanding the interplay between these segments is vital for competitive advantage. For instance, manufacturers specializing in small-diameter EPB TBMs are well-positioned for the burgeoning utility tunneling market, while those focused on high-powered Hard Rock TBMs maintain a strong foothold in the stable but capital-intensive mining sector. The adoption rate of automated and semi-automated machinery within specific segments, especially in drilling and blasting support equipment, indicates the industry's continuous drive toward optimizing labor costs and enhancing safety standards across all project types, regardless of scale or geological challenge.

- By Type:

- Tunnel Boring Machines (TBMs)

- Earth Pressure Balance (EPB) Shield TBM

- Slurry Shield TBM

- Single Shield TBM

- Double Shield TBM

- Roadheaders

- Drill and Blast Equipment (Jumbos, Loaders)

- Mucking Equipment (Conveyors, Haulage Systems)

- Tunnel Boring Machines (TBMs)

- By Application:

- Infrastructure (Road & Highway Tunnels, Rail & Metro Tunnels)

- Mining (Metal Mining, Coal Mining, Non-metallic Mining)

- Utilities (Water Supply, Sewage, Power and Communication Conduits)

- By Operation:

- Fully Mechanized Tunneling

- Semi-Mechanized Tunneling

- By Sales Model:

- Sales/New Equipment Procurement

- Rental and Leasing

Value Chain Analysis For Tunneling Machinery Market

The value chain for the Tunneling Machinery Market is highly complex, beginning with upstream raw material suppliers and specialized component manufacturing, moving through capital-intensive design and assembly, and culminating in downstream deployment and maintenance services. The upstream analysis is dominated by the sourcing of high-grade steel alloys, specialized hydraulic systems, electrical components, and cutterhead materials (often tungsten carbide inserts), where raw material price volatility and supply chain resilience pose persistent risks. Key players in this segment are component specialists providing customized drives and bearings built to withstand extreme pressure and abrasive conditions. Strong supplier relationships are essential for ensuring the quality and consistency required for equipment operating continuously miles underground.

Midstream activities involve the highly skilled design, customization, and final assembly of the machinery, predominantly performed by global OEMs (Original Equipment Manufacturers). Due to the bespoke nature of TBMs—each often tailored to a specific tunnel diameter, length, and geological profile—engineering and intellectual property are the primary value drivers in this stage. Significant value is added through the integration of advanced sensors, automation software, and robust structural fabrication. This stage requires substantial capital investment in R&D and specialized manufacturing facilities capable of assembling these colossal machines, demanding stringent quality control and extensive pre-testing before shipment to the project site.

Downstream activities include the deployment, operation, and maintenance of the machinery. Distribution channels are predominantly direct sales to major construction contractors (e.g., China Railway Construction Corporation, VINCI Construction) or through specialized, high-service rental and leasing agencies for smaller projects or emerging markets. Indirect channels are rarely utilized for TBMs due to their highly customized nature, though standard roadheaders and mucking equipment may utilize distributors. Post-sale support, including the provision of spare parts, on-site technical assistance, and continuous performance monitoring, constitutes a crucial, high-margin revenue stream for OEMs throughout the operational life of the equipment, often extending service contracts for highly critical and long-duration projects.

Tunneling Machinery Market Potential Customers

Potential customers for tunneling machinery span government entities, large multinational construction firms, specialized mining operators, and public utility organizations responsible for maintaining critical urban infrastructure. The primary end-users, large construction and engineering procurement and construction (EPC) companies, serve as the direct buyers, utilizing the machinery under contract for publicly funded transportation and water management projects. These firms prioritize equipment reliability, technical support, and the manufacturer’s track record in navigating similar geological challenges. Their purchasing decisions are heavily influenced by the total cost of ownership (TCO) over the project lifecycle, including projected cutterhead replacement frequency and energy consumption rates, driving demand for fuel-efficient and durable machines.

Government agencies and municipal authorities, while often not the direct purchasers, act as the ultimate decision-makers and funders for most major tunneling endeavors. Their infrastructure development plans (e.g., ten-year metro expansion blueprints) dictate the scale and timeline of machinery demand. In regions like APAC and Europe, where public transport infrastructure is a priority, government policy and tender specifications directly influence the type of machinery procured, favoring technologies that ensure minimal environmental impact and rapid project completion. Utility providers constitute another growing customer base, increasingly needing specialized, small-diameter TBMs for trenchless technology applications, such as replacing aging sewer lines or installing new fiber optic and power conduits beneath urban areas without extensive surface disruption.

The mining sector represents a stable, albeit cyclical, customer segment, particularly for high-powered hard rock TBMs and mechanized drilling jumbos utilized for developing access ramps, ventilation shafts, and ore haulage tunnels. Mining operators prioritize robust, high-performance machinery capable of achieving maximum penetration rates in abrasive rock conditions with minimal maintenance downtime, ensuring continuous ore extraction. Furthermore, the specialized nature of these projects means customers often require extensive consultancy and project support services from the OEM, positioning manufacturers who offer comprehensive turnkey solutions—from geological assessment to operational management—as highly competitive suppliers in this segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 9.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Herrenknecht AG, Robbins Company, China Railway Engineering Equipment Group (CREG), Sandvik AB, Komatsu Ltd., Atlas Copco, Liebherr Group, Caterpillar Inc., SANY Group, Wirtgen Group, Lovat Inc. (now part of Caterpillar), Northern Heavy Industries Group (NHI), Terratec, Hitachi Zosen Corporation, XCMG Group, Akkerman Inc., Bauer AG, Kawasaki Heavy Industries, Mitsubishi Heavy Industries, TRUMPF GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tunneling Machinery Market Key Technology Landscape

The technology landscape of the Tunneling Machinery Market is characterized by continuous innovation focused on improving efficiency, reducing risk, and enabling operations in increasingly difficult geological environments. The dominant technological advancement is the sophisticated hybridization and automation of Tunnel Boring Machines (TBMs), particularly the development of Variable Density TBMs capable of adapting seamlessly between EPB and Slurry modes to handle mixed-face ground conditions effectively. Key players are heavily investing in digital integration, deploying the Industrial Internet of Things (IIoT) sensors across the entire machine to gather real-time operational data, facilitating advanced telemetry and remote monitoring. This technological shift moves the industry towards 'Smart Tunneling,' where proactive adjustments are made based on predictive modeling rather than reactive responses to geological surprises.

Another crucial technological area involves the development of specialized cutter tools and materials. Research is focused on creating highly durable tungsten carbide inserts and disc cutters that can withstand extremely high abrasive environments, significantly extending tool life and reducing the costly and time-consuming need for human intervention to replace cutters under pressure. Furthermore, advancements in guidance systems, utilizing laser technology, gyroscope sensors, and sophisticated navigation algorithms, ensure millimeter-level accuracy over several kilometers of tunneling, essential for meeting precise alignment requirements in major civil engineering works. The integration of 3D geological modeling software with TBM controls allows operators to visualize the subsurface ahead of the machine, minimizing the risk of encountering unexpected voids or high-pressure water inflows.

Sustainability is also driving significant technological change, pushing the adoption of electrical and battery-powered machinery. Traditional diesel-powered roadheaders and mucking equipment are gradually being replaced by electric alternatives, particularly in confined underground spaces, to eliminate harmful emissions, reduce ventilation requirements, and lower operational costs. Moreover, advancements in grout injection technologies and segment lining automation are accelerating the tunnel lining process, enhancing the structural integrity immediately behind the excavation face. The overall technology trajectory is toward fully enclosed, highly autonomous systems that prioritize operator safety, environmental sensitivity, and unparalleled operational reliability throughout the entire duration of the tunneling project, regardless of geological complexity.

Regional Highlights

The global Tunneling Machinery Market exhibits significant regional disparities in terms of growth rates, technological maturity, and demand drivers, heavily reflecting localized infrastructure spending patterns and geopolitical stability. Regional analysis is critical for understanding market penetration strategies and customizing equipment offerings to meet specific geological and regulatory requirements prevalent in different parts of the world.

- Asia Pacific (APAC): Dominates the global market, accounting for the largest share driven by massive investments in new metro systems (e.g., India, China, Vietnam) and high-speed rail networks. Urbanization rates in countries like China and India necessitate deep underground solutions, ensuring sustained high demand for customized TBMs, particularly large-diameter EPB and Slurry Shields. Technological adoption is high, often focusing on speed and cost-effectiveness.

- Europe: Characterized by maturity and technological sophistication, this region exhibits steady demand driven primarily by replacement infrastructure projects, utility upgrades, and cross-border rail links (e.g., AlpTransit, UK high-speed rail). European demand is highly regulated, favoring electric, low-noise, and precision-engineered machinery capable of tunneling safely beneath historic city centers. Germany, France, and the UK are key markets focusing on environmental compliance and automation.

- North America: Experiencing robust growth propelled by large urban transit expansion projects (e.g., Los Angeles, Toronto, New York) and extensive utility infrastructure maintenance needs. The market is highly receptive to AI integration, autonomous operations, and high-safety standard equipment. Demand often focuses on customized, high-reliability machinery for complex urban geotechnical conditions.

- Middle East & Africa (MEA): Growth is sporadic but intense, driven by mega-infrastructure projects (e.g., Saudi Arabia's Vision 2030, UAE development). Demand focuses on machines capable of handling harsh, often dry or coastal, geological environments. High capital expenditure projects rely heavily on imported advanced technology and international EPC contractors.

- Latin America: This region shows moderate growth, primarily focused on mining applications (Chile, Peru, Brazil) and select metro expansions in major capitals. Market dynamics are heavily influenced by commodity price fluctuations and government funding capacity, leading to a higher reliance on rental and refurbished equipment markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tunneling Machinery Market.- Herrenknecht AG

- Robbins Company

- China Railway Engineering Equipment Group (CREG)

- Sandvik AB

- Komatsu Ltd.

- Atlas Copco

- Liebherr Group

- Caterpillar Inc.

- SANY Group

- Wirtgen Group (part of John Deere)

- Lovat Inc. (now part of Caterpillar)

- Northern Heavy Industries Group (NHI)

- Terratec

- Hitachi Zosen Corporation

- XCMG Group

- Akkerman Inc.

- Bauer AG

- Kawasaki Heavy Industries

- Mitsubishi Heavy Industries

- TRUMPF GmbH

Frequently Asked Questions

Analyze common user questions about the Tunneling Machinery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Tunneling Machinery Market?

The primary driver is the massive increase in global public and private investment in urban infrastructure, specifically the expansion of underground rail networks (metros and high-speed trains) necessary to manage rapidly accelerating urbanization and traffic congestion in metropolitan areas across Asia Pacific and Europe.

How is AI impacting the operational efficiency of Tunnel Boring Machines (TBMs)?

AI significantly enhances operational efficiency by enabling predictive maintenance (PdM) to reduce unplanned downtime and by optimizing real-time boring parameters (thrust, torque, speed) based on complex geological data analysis, leading to faster penetration rates and reduced wear on expensive components.

Which geographical region dominates the demand for tunneling machinery and why?

The Asia Pacific (APAC) region dominates the market. This dominance is attributed to large-scale, ongoing governmental infrastructure projects in countries like China and India, which are rapidly expanding their urban subway systems and transportation links, requiring continuous deployment of large-diameter TBMs.

What are the key technological trends shaping the future of the tunneling industry?

Key technological trends include the shift towards fully electric and hybrid TBMs for sustainability, the integration of IIoT sensors for comprehensive data collection and remote diagnostics, and the development of Variable Density TBMs capable of handling highly challenging and mixed-face geological conditions with enhanced versatility.

What is the main financial restraint affecting the adoption of advanced tunneling machinery?

The main financial restraint is the exceptionally high initial capital expenditure (CapEx) required for acquiring specialized Tunnel Boring Machines, which are often custom-built, coupled with the substantial logistical and engineering costs associated with their mobilization, assembly, and operation on complex, long-duration projects.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager