Turbine Casing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434097 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Turbine Casing Market Size

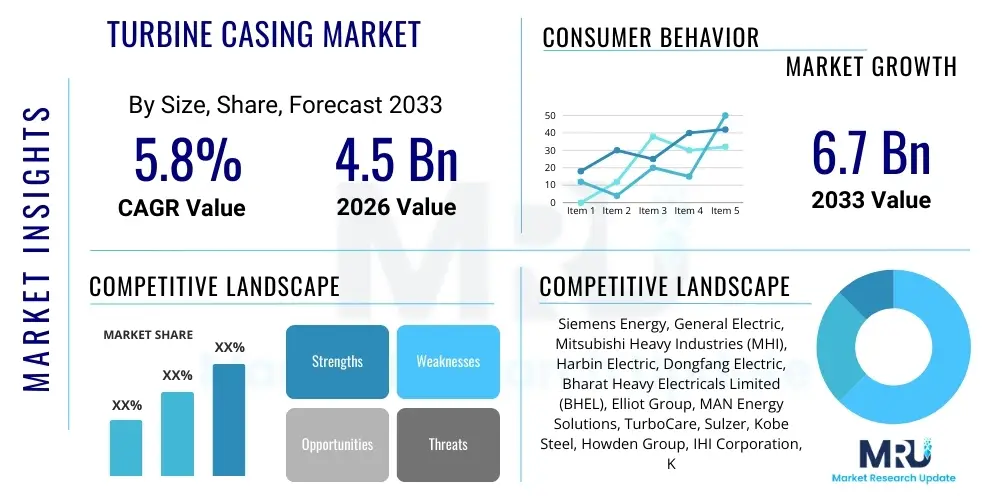

The Turbine Casing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $4.5 Billion in 2026 and is projected to reach $6.7 Billion by the end of the forecast period in 2033.

Turbine Casing Market introduction

The Turbine Casing Market encompasses the manufacturing, supply, and maintenance of specialized components designed to house and protect the internal rotational elements of various types of turbines, primarily gas, steam, and hydro turbines. These casings are crucial structural elements that define the flow path, manage pressure differentials, and safely contain the high temperatures and pressures generated during energy conversion processes. They are often manufactured from highly specialized materials, including high-strength steel alloys, nickel-based superalloys, and sometimes advanced composites, depending on the operational environment and thermal load requirements.

The core product within this market is the casing itself, which can be segmented into high-pressure (HP), intermediate-pressure (IP), and low-pressure (LP) sections, particularly in large power generation turbines. Major applications include utility-scale power plants (both conventional and nuclear), oil and gas facilities (for compressors and generators), industrial processes requiring substantial mechanical drive, and aviation propulsion systems. The turbine casing must withstand immense mechanical stress, thermal cycling, and potential corrosive environments, requiring precision engineering and stringent quality control throughout the manufacturing lifecycle.

Key driving factors accelerating the growth of this market include the global expansion of electricity demand, necessitating new power plant construction and extensive modernization projects for aging infrastructure. Furthermore, the increasing focus on energy efficiency and the transition toward cleaner energy sources, such as combined cycle gas turbine (CCGT) plants, continuously drives demand for high-performance casings that can operate efficiently at higher temperatures and pressures. The benefits derived from advanced turbine casings include enhanced operational safety, minimized energy leakage, improved thermal efficiency, and extended turbine lifespan, contributing significantly to reduced total cost of ownership for operators globally. The specialized nature of casting and forging these massive components ensures high barriers to entry and sustained profitability for experienced manufacturers.

Turbine Casing Market Executive Summary

The Turbine Casing Market is characterized by moderate growth, primarily driven by long-term investments in power generation capacity expansions and critical maintenance activities across established energy grids globally. Business trends indicate a strong move towards advanced manufacturing techniques, such as additive manufacturing (3D printing) for complex, smaller turbine components, though large casings still heavily rely on traditional, highly specialized casting and forging processes. Furthermore, there is a distinct business emphasis on providing comprehensive lifecycle services, including inspection, repair, and refurbishment of casings, which constitutes a significant portion of the aftermarket revenue stream, particularly as the global fleet of installed turbines ages.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by rapid industrialization, urbanization, and ambitious electrification targets in countries like China, India, and ASEAN nations. North America and Europe, while mature markets, maintain stable demand driven by the necessity of replacing or upgrading older, less efficient casings in their existing gas and steam turbine fleets to meet increasingly strict environmental regulations and efficiency standards. The Middle East and Africa (MEA) region shows significant potential due to substantial investments in oil and gas infrastructure expansion and new natural gas-fired power generation projects.

Segment trends reveal that the Gas Turbine Casing segment holds the largest market share, directly correlated with the continued global reliance on natural gas as a transition fuel for power generation. Within materials, high-temperature steel alloys remain dominant due to their balance of cost-effectiveness and performance characteristics, although the adoption of highly specialized superalloys is increasing for advanced high-efficiency gas turbines. The Power Generation application segment continues to dwarf other applications, yet the Oil & Gas sector shows robust demand, particularly in large compression and pumping stations where high-reliability turbine casings are essential for continuous operation.

AI Impact Analysis on Turbine Casing Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Turbine Casing Market frequently revolve around predictive maintenance, optimization of casting processes, and the integration of smart sensors into the casings themselves. Users are keen to understand if AI can significantly reduce expensive downtime caused by casing failure, how digital twins utilizing AI can simulate thermal and mechanical stresses to optimize design longevity, and whether AI-driven quality control can decrease manufacturing defects in large, complex castings. The primary concerns center on the initial investment required for AI infrastructure, data security for proprietary design data, and the availability of specialized labor capable of integrating and managing these advanced analytical systems within the traditionally conservative heavy engineering sector. Expectations are high that AI will transform failure prediction from reactive or schedule-based maintenance to highly accurate condition-based maintenance, radically improving turbine availability and reducing operational risks associated with casing integrity.

- AI-Driven Predictive Maintenance: Utilizes sensor data embedded in casings (e.g., vibration, temperature) to forecast potential component failure, optimizing maintenance schedules and minimizing catastrophic breakdowns.

- Optimized Manufacturing Processes: Machine learning algorithms analyze historical casting data (temperature profiles, material properties) to reduce defects, improve yield, and lower the energy consumption during complex forging and casting operations.

- Digital Twin Modeling: AI creates highly accurate virtual replicas of turbine casings to simulate thermal fatigue, creep, and stress corrosion cracking under various operating conditions, accelerating R&D and design verification.

- Enhanced Quality Control (QC): Computer vision and AI algorithms automate the inspection of large casing surfaces for micro-cracks and material inconsistencies that are difficult for human inspectors to detect, ensuring higher quality standards.

- Supply Chain and Inventory Management: AI predicts demand fluctuations for specialized replacement casings and manages the complex, long lead-time supply chain for exotic materials, improving material flow and reducing excess inventory.

DRO & Impact Forces Of Turbine Casing Market

The dynamics of the Turbine Casing Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), alongside significant internal and external Impact Forces. The market is fundamentally driven by global electricity demand growth, particularly in emerging economies, which necessitates continuous investment in power generation infrastructure, thereby creating a sustained need for new and replacement turbine casings. Furthermore, the stringent regulatory environment in developed nations, mandating higher efficiency and lower emissions from existing power plants, compels operators to upgrade their older turbines with new, advanced casings designed for higher operating parameters, driving the refurbishment market significantly. These technological drivers often mandate specialized material grades and complex manufacturing processes, favoring established players with deep metallurgical expertise.

However, the market faces notable restraints, primarily the exceptionally high capital expenditure and the extended lead times associated with manufacturing large, high-pressure turbine casings. These components require specialized facilities, large-scale casting equipment, and extensive non-destructive testing, making the entry barrier substantial. Economic volatility and the ongoing global shift away from coal-fired power generation present structural headwinds, potentially suppressing demand for certain types of steam turbine casings. Additionally, the increasing reliability and efficiency of renewable energy sources, while not directly replacing thermal turbines instantly, exert long-term pressure on the growth rate of new conventional power plants.

Opportunities for growth are largely centered around the aftermarket services sector, including specialized repair and life extension services utilizing advanced welding techniques, thermal spray coatings, and machining capabilities. The increasing adoption of CCGT technology globally, requiring highly specialized casings for both the gas and steam portions of the cycle, presents a lucrative niche. Furthermore, advancements in materials science, such as the development of ceramic matrix composites (CMCs) and next-generation superalloys, offer opportunities for manufacturers to develop lighter, more heat-resistant casings that can significantly boost turbine performance and fuel efficiency, aligning with global decarbonization goals. The impact forces acting on this market include intense competition among the few global giants and the strong influence of raw material prices (especially nickel and chromium) on manufacturing costs and final pricing.

Segmentation Analysis

The Turbine Casing Market is broadly segmented based on factors such as the type of turbine, the materials used for manufacturing, and the specific application sector. This multi-dimensional segmentation allows market players to accurately tailor their product offerings to highly specialized end-user requirements, ranging from the high thermal stress requirements of gas turbines to the large structural integrity needed for low-pressure steam turbine components. Understanding these segments is crucial for strategic planning, as different turbine types demand entirely distinct manufacturing processes, material specifications, and quality standards, profoundly affecting production costs and market positioning.

The primary segments reflecting market dynamics include turbine type (which dictates design complexity), material type (which determines performance characteristics like temperature resistance and corrosion resistance), and application (which drives volume and investment cycles). Geographically, the market segmentation highlights regional disparities in energy mix and infrastructure investment, with APAC focusing on capacity expansion and mature markets emphasizing efficiency upgrades and replacement cycles. This granular segmentation aids stakeholders in identifying high-growth niches, such as specialized casings for concentrated solar power (CSP) steam turbines or high-performance casings for industrial microturbines, thereby optimizing resource allocation within the capital-intensive manufacturing environment.

- By Turbine Type:

- Steam Turbine Casing (High, Intermediate, and Low Pressure)

- Gas Turbine Casing (Compressor Casing, Combustor Casing, Turbine Section Casing)

- Water Turbine Casing (Hydro Turbines, Pump Turbines)

- By Material:

- Cast Iron

- Steel Alloys (Carbon Steel)

- Stainless Steel and Low-Alloy Steel

- High-Temperature Alloys (Nickel-Based Superalloys, Chromium Alloys)

- Composites (Emerging applications in non-critical parts)

- By Application:

- Power Generation (Utility-scale thermal power, Nuclear, Geothermal)

- Oil & Gas (Pipeline compression, FPSO power generation)

- Industrial Machinery (Process drive, Combined Heat and Power - CHP)

- Aerospace & Defense (Auxiliary Power Units - APUs, Marine Propulsion)

- By Pressure Type:

- High Pressure (HP) Casing

- Intermediate Pressure (IP) Casing

- Low Pressure (LP) Casing

Value Chain Analysis For Turbine Casing Market

The value chain for the Turbine Casing Market is characterized by high capital intensity, long lead times, and a concentration of expertise across only a few stages. The chain begins with the upstream segment, dominated by specialized metal suppliers providing high-purity raw materials such as proprietary steel alloys, nickel, and chromium, which must meet extremely tight specifications regarding metallurgical composition and traceability. This stage requires significant technological synergy between the material providers and the casing manufacturers to ensure the final product can handle the extreme operating conditions of a turbine. Upstream activities also include precision forging and casting preparation, often requiring massive industrial presses and sophisticated melting technologies to handle the large volumes of material involved in a single casing unit.

The core manufacturing stage involves highly specialized casting or fabrication processes, followed by rigorous machining, welding, and heat treatment. This stage is dominated by large, integrated industrial players or specialized foundries capable of handling components weighing many tons and maintaining dimensional accuracy over complex geometries. Once manufactured, the downstream segment includes rigorous non-destructive testing (NDT), quality assurance checks, and assembly preparation. Distribution channels are predominantly direct, especially for large utility and industrial applications. Original Equipment Manufacturers (OEMs) typically control the entire process, either manufacturing casings in-house or working through exclusive, long-term partnerships with certified foundries.

Indirect channels primarily exist in the aftermarket, where third-party service providers and independent repair shops (IRFs) source repair materials, replacement parts, and offer specialized welding and machining services for casing refurbishment. However, the direct relationship between the OEM and the end-user (power plant operators, oil and gas companies) is paramount, dictated by the critical nature of the component and the strict warranty and performance guarantees required. The value chain is structured to prioritize reliability and certification, often limiting participation to suppliers that comply with stringent industry standards like ISO and specific OEM qualifications, thereby sustaining high margins for expert service providers.

Turbine Casing Market Potential Customers

Potential customers for turbine casings are concentrated in sectors that rely heavily on continuous, high-efficiency mechanical power generation or large-scale compression. The most significant customer group comprises utility companies and Independent Power Producers (IPPs) that operate large thermal power plants, utilizing gas turbines, steam turbines (fired by coal, natural gas, or nuclear heat), or combined cycle systems. These entities require new casings for plant construction and critical replacement casings during major overhaul cycles (typically every 5-10 years) to maintain operational efficiency and safety compliance.

The second major customer segment is the Oil & Gas industry, particularly companies involved in upstream extraction, midstream transportation (e.g., natural gas pipelines utilizing large compressors), and downstream processing (refineries). Turbine casings are vital for mechanical drive applications, powering massive compressors and pumps essential for processing and moving hydrocarbons. Given the harsh, often remote environments of oil and gas operations, these customers prioritize robustness, anti-corrosion properties, and extended Mean Time Between Failures (MTBF) for their casings.

Other key buyers include large industrial manufacturing complexes, such as petrochemical plants and heavy industry, that utilize Combined Heat and Power (CHP) systems employing industrial gas or steam turbines for efficient internal energy provision. Finally, governmental and private entities in the Aerospace and Defense sectors also serve as niche customers, requiring highly customized, lightweight turbine casings for marine propulsion systems and specialized military applications where performance under extreme conditions is non-negotiable.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens Energy, General Electric, Mitsubishi Heavy Industries (MHI), Harbin Electric, Dongfang Electric, Bharat Heavy Electricals Limited (BHEL), Elliot Group, MAN Energy Solutions, TurboCare, Sulzer, Kobe Steel, Howden Group, IHI Corporation, Kawasaki Heavy Industries, Doosan Škoda Power, Voith Group, Flowserve Corporation, Capstone Green Energy, Peter Brotherhood, Ansaldo Energia. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Turbine Casing Market Key Technology Landscape

The technological landscape of the Turbine Casing Market is defined by continuous innovation focused on improving material performance, optimizing manufacturing efficiency, and extending service life under increasingly severe operating conditions. A fundamental technological pillar remains advanced casting and forging techniques, specifically Vacuum Arc Remelting (VAR) and Electro-Slag Remelting (ESR), which are crucial for producing ultra-clean, defect-free ingots of high-temperature alloys used in the most critical casing sections, particularly those exposed to high-pressure steam or hot combustion gases. Furthermore, advanced non-destructive testing (NDT) technologies, including phased array ultrasonic testing (PAUT) and sophisticated computed tomography (CT) scanning, are becoming standard to ensure the structural integrity of these large components before they leave the factory floor, minimizing the risk of catastrophic failure in operation.

In terms of materials science, the market is seeing a steady shift towards higher-performance materials. While traditional carbon and low-alloy steels are still used for lower temperature, low-pressure applications, the demand for sophisticated nickel-based superalloys (such as Inconel varieties) and specialized chromium-molybdenum steel alloys is surging. These materials are essential for next-generation gas and steam turbines operating at higher firing temperatures (up to 1500°C for gas turbines) and pressures, which directly correlates with higher thermodynamic efficiency. Research efforts are also concentrated on developing thermal barrier coatings (TBCs) and advanced internal cooling channels to manage localized heat stress on the casing walls, ensuring dimensional stability and extended life.

Digitalization represents a transformative technology area. The integration of advanced computational fluid dynamics (CFD) and finite element analysis (FEA) software allows manufacturers to precisely model thermal stresses, acoustic behavior, and structural deflections during the design phase, leading to lighter, yet more robust casing designs. The adoption of smart technologies, particularly the inclusion of embedded sensors (e.g., fiber optic sensors or wireless acoustic sensors) into the casing structure, enables real-time health monitoring. This supports condition-based maintenance strategies and facilitates the creation of high-fidelity digital twins, allowing operators to proactively address thermal fatigue or creep damage before they become critical, thereby maximizing the operational availability of the turbine unit.

Regional Highlights

- North America: This region is a mature, high-value market characterized by stringent environmental regulations and a strong emphasis on maintaining high fleet efficiency. Demand is driven by the replacement and refurbishment of aging gas and steam turbine casings, particularly within the massive existing fleet of natural gas power plants. Significant investments are focused on modernization projects, adopting advanced materials, and implementing AI-driven predictive maintenance technologies to maximize the lifespan of existing infrastructure. The region also hosts leading aerospace and industrial gas turbine manufacturers, providing a steady, high-specification demand base.

- Europe: Europe is dominated by the energy transition agenda, leading to significant demand for high-efficiency gas turbine casings necessary for combined heat and power (CHP) and flexible power generation balancing intermittent renewables. The market here is highly quality-sensitive, focusing heavily on reducing emissions and increasing fuel efficiency. Countries like Germany, the UK, and France are central to advanced R&D in turbine technology, driving demand for premium, specialized materials and advanced casing designs capable of enduring high cycling stress inherent to renewable energy integration.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for turbine casings globally. Driven by aggressive industrialization, urbanization, and continuous electricity shortages, countries such as China, India, and Indonesia are undertaking massive power generation capacity additions. This includes both new coal-fired (though phasing out slowly) and substantial natural gas and nuclear power construction, resulting in high volume demand for both steam and gas turbine casings. The region is seeing rapid technology transfer and the rise of powerful regional OEMs who are increasingly competing on quality and scale.

- Middle East and Africa (MEA): Growth in MEA is inextricably linked to oil and gas production and substantial government-led investments in domestic power infrastructure fueled by natural gas reserves. Saudi Arabia, UAE, and Qatar are major consumers, requiring reliable, heavy-duty gas turbine casings for both utility-scale power generation and crucial pipeline compression stations. The demand is often characterized by high temperatures and dusty environments, requiring robust, reliable, and sometimes specialized desert-hardened casings.

- Latin America: This region exhibits moderate growth, focused primarily on capitalizing on natural gas reserves (e.g., Argentina, Brazil) and hydropower modernization projects. Demand for steam turbine casings is steady due to existing infrastructure, but the primary growth vector is the installation of new, mid-sized gas turbine units for industrial processes and decentralized power grids, especially as countries seek to stabilize their grids and reduce reliance on volatile energy sources.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Turbine Casing Market.- Siemens Energy

- General Electric

- Mitsubishi Heavy Industries (MHI)

- Harbin Electric

- Dongfang Electric

- Bharat Heavy Electricals Limited (BHEL)

- Elliot Group

- MAN Energy Solutions

- TurboCare

- Sulzer

- Kobe Steel

- Howden Group

- IHI Corporation

- Kawasaki Heavy Industries

- Doosan Škoda Power

- Voith Group

- Flowserve Corporation

- Capstone Green Energy

- Peter Brotherhood

- Ansaldo Energia

Frequently Asked Questions

Analyze common user questions about the Turbine Casing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a turbine casing in power generation?

The primary function of a turbine casing is to safely contain the high-pressure steam or combustion gases, direct the flow path of the working fluid through the turbine stages, support the internal stationary components (stators/diaphragms), and prevent leakage to ensure maximum thermodynamic efficiency and operational safety.

Which material segment dominates the turbine casing market?

High-Temperature Steel Alloys, including specialized chromium-molybdenum and low-alloy steels, dominate the market due to their excellent balance of mechanical strength, creep resistance at high temperatures, and cost-effectiveness for mass production, especially in large steam and gas turbine casings.

How does the shift towards renewable energy affect the demand for turbine casings?

While renewables reduce the need for large-scale baseload thermal plants, the shift increases demand for advanced gas turbine casings in flexible power plants (Combined Cycle Gas Turbines - CCGTs). These flexible turbines are crucial for grid stabilization, necessitating casings designed for frequent start-stop cycles and high thermal fatigue resistance.

What role does predictive maintenance play in the turbine casing aftermarket?

Predictive maintenance, often powered by AI and digital twins, significantly impacts the aftermarket by enabling operators to monitor casing health in real-time, accurately forecast wear and tear, and schedule specialized repair or replacement only when necessary, minimizing unplanned downtime and reducing overall maintenance costs.

Which geographic region exhibits the fastest growth rate for turbine casings?

The Asia Pacific (APAC) region currently exhibits the fastest growth rate, driven by expansive investments in new power generation capacity, industrialization, and urbanization projects, particularly across developing economies like China, India, and Southeast Asian nations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager