Turf and Golf Cart Tires Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434180 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Turf and Golf Cart Tires Market Size

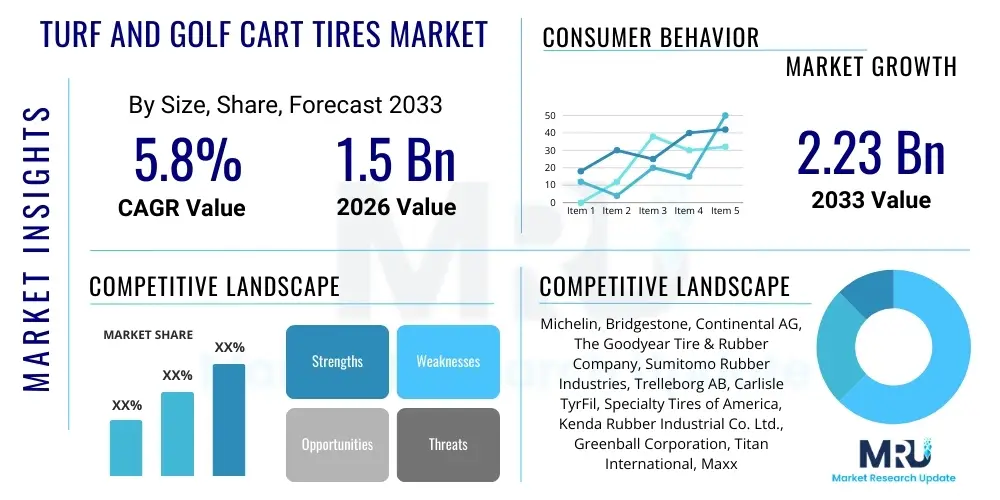

The Turf and Golf Cart Tires Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.23 Billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the sustained growth in the global golf and landscape maintenance industries, alongside the increasing adoption of electric and utility vehicles requiring specialized low-impact tires.

The valuation reflects the high demand for tires that minimize surface damage, particularly on sensitive grass and greens, coupled with the need for enhanced durability and puncture resistance in commercial applications. Furthermore, market size expansion is being supported by technological advancements focused on material science, leading to the development of robust, long-lasting radial and bias-ply options specifically engineered for low-speed, high-traction requirements. The shift toward sustainable maintenance practices is also influencing the demand curve, pushing manufacturers to innovate with environmentally friendly compounds.

Turf and Golf Cart Tires Market introduction

The Turf and Golf Cart Tires Market encompasses the manufacturing, distribution, and sale of specialized tires designed primarily for golf carts, lawnmowers, utility vehicles (UTVs), and various turf maintenance equipment. These products are engineered with distinct, often non-aggressive, tread patterns to ensure optimal flotation, minimize ground pressure, and prevent damage to delicate surfaces like golf course greens, sports fields, and landscaped areas. The core benefit of these specialized tires is their ability to provide stable traction and excellent steering responsiveness across diverse terrains—ranging from manicured grass and sand to hard surfaces—without compromising the integrity of the underlying turf. Major applications span commercial golf operations, residential lawn care, agricultural light utility tasks, and institutional grounds maintenance.

The market's fundamental driving factors include the substantial global investment in golf course infrastructure and maintenance, the rising popularity of recreational golfing, and the increasing reliance on powered equipment for efficient landscape management. Furthermore, the burgeoning popularity of golf carts and UTVs beyond traditional golf courses, migrating into planned communities, retirement villages, and industrial complexes as low-speed utility transportation, significantly boosts demand. Manufacturers are continually focusing on improving tire compounds to enhance longevity, resistance to chemicals and UV degradation, and load-bearing capacity, particularly for heavy-duty commercial mowers and utility vehicles used in extensive maintenance regimes.

These tires are categorized based on construction (bias-ply, radial, or solid/non-pneumatic) and tread type (smooth, rib, or knobby turf-friendly patterns). The industry is highly sensitive to seasonal variations and economic health, particularly in leisure and real estate sectors. However, the persistent need for effective grounds keeping, coupled with the mandatory periodic replacement cycle of tires due to wear and tear, ensures a stable revenue stream. The transition towards battery-electric golf carts also necessitates tire design adaptations to handle the instantaneous torque and specific weight distribution characteristics associated with electric powertrains, driving innovation in carcass structure and sidewall strength.

Turf and Golf Cart Tires Market Executive Summary

The Turf and Golf Cart Tires Market is experiencing robust growth driven by the expansion of the commercial golf industry and significant investments in professional groundskeeping equipment. Business trends indicate a strong focus on sustainability, with leading manufacturers prioritizing the development of eco-friendly rubber compounds and non-marking tires that offer superior longevity and reduced environmental impact. Furthermore, there is a distinct trend towards integrating radial construction, traditionally less common in this segment, into high-end utility tires to provide improved ride comfort, enhanced fuel efficiency, and longer tread life for heavy-use applications, moving beyond the traditional bias-ply dominance. Strategic mergers and acquisitions among tire specialists and original equipment manufacturers (OEMs) are shaping the competitive landscape, aiming for vertical integration and enhanced distribution network control.

Regional trends highlight North America as the dominant market, primarily due to the vast number of golf courses, extensive residential landscaping activities, and high per-capita ownership of utility vehicles and riding lawnmowers. Asia Pacific (APAC), particularly driven by emerging economies like China and India, is registering the fastest growth rate, fueled by rising disposable incomes, urbanization leading to new residential developments with landscaped areas, and the rapid establishment of new leisure facilities. Europe maintains a steady demand, focusing heavily on safety standards and premium, high-durability tires mandated by strict regulatory frameworks governing grounds maintenance equipment and utility vehicle usage in public spaces. These regional disparities dictate varying product specifications, with North America favoring large-flotation tires and Europe focusing on precise, durable treads for compact equipment.

Segmentation trends reveal that the OEM segment holds a substantial share of the market, driven by large contracts with major equipment manufacturers like John Deere, Toro, and Club Car, ensuring consistent volume. However, the aftermarket segment remains crucial, offering higher margin opportunities and catering to specialized needs for replacement and upgrade cycles, often involving high-performance compounds tailored for specific terrain challenges. By product type, pneumatic tires overwhelmingly dominate due to their superior shock absorption capabilities, but the solid/non-pneumatic segment is gaining traction in severe-duty industrial or municipal applications where puncture risk is exceptionally high and downtime minimization is paramount. The increasing adoption of electric vehicles is also accelerating the demand for tires optimized for reduced rolling resistance, preserving battery life and enhancing operational range.

AI Impact Analysis on Turf and Golf Cart Tires Market

User queries regarding the impact of Artificial Intelligence (AI) on the Turf and Golf Cart Tires Market frequently center on predictive maintenance capabilities, autonomous fleet management, and optimization of manufacturing processes. Users are keenly interested in how AI can extend tire lifespan through monitoring internal pressures and wear patterns, thereby reducing replacement costs and equipment downtime. Key concerns involve the integration cost of "smart tire" technologies (sensors embedded in the tire) with existing golf cart and turf equipment fleets, and the data security implications of transmitting continuous operational metrics. Expectations are high regarding AI’s potential to revolutionize fleet logistics on large golf courses, enabling autonomous turf equipment guided by AI to optimize maintenance routes, which, in turn, dictates highly specific requirements for tire durability, precision tracking, and minimal ground disturbance. The collective analysis points towards AI impacting the market primarily through enhanced product quality assurance and predictive service models rather than immediate product transformation.

The application of AI in manufacturing is transforming quality control by utilizing computer vision and machine learning algorithms to detect micro-defects in rubber compounding and curing processes that are undetectable by human inspectors. This results in higher uniformity and reliability of the final tire product, reducing warranty claims and improving performance consistency, crucial for professional equipment. Furthermore, generative design AI tools are being employed to simulate countless tread patterns and rubber compositions based on desired outcomes (e.g., maximum flotation at minimum pressure, extreme puncture resistance), significantly accelerating the R&D cycle for specialized turf tires. This data-driven approach ensures that new product development is precisely aligned with evolving equipment specifications and complex environmental conditions.

In the operational phase, AI-powered fleet management systems utilize telematics data, including real-time load, speed, and terrain information, transmitted via smart sensors installed in the tires. This data is processed to provide actionable insights for groundskeepers, such as alerting them when a specific tire needs rotation or replacement, optimizing maintenance schedules, and ensuring that all equipment operates under ideal conditions. For specialized robotic turf equipment, AI is essential for navigation and trajectory planning; the tire performance data feeds back into the AI control system to compensate for slippage or uneven load distribution, requiring tires to be manufactured with extreme dimensional accuracy and consistency to support these highly automated operations, thereby indirectly setting new quality standards for the tire market.

- AI enhances manufacturing precision, using vision systems for defect detection, resulting in higher quality tires.

- Predictive maintenance analytics, driven by embedded tire sensors, optimize replacement cycles and reduce equipment downtime.

- AI-powered generative design speeds up R&D for specialized tread patterns and rubber compounds tailored for precise turf protection.

- Autonomous turf equipment relies on consistent, high-accuracy tire performance data for effective navigation and maintenance routing.

- Supply chain optimization through AI improves inventory management and forecasting for seasonal tire demand spikes.

DRO & Impact Forces Of Turf and Golf Cart Tires Market

The Turf and Golf Cart Tires Market is shaped by a critical balance of intrinsic demand drivers, structural constraints, and emerging technological opportunities. The market's dynamism is rooted in the expansion of recreational infrastructure and professional landscape services globally. Driving forces include the continuous replacement cycle inherent to rubber products, the increasing number of golf courses worldwide, and the substantial rise in the use of specialized utility vehicles for non-golf applications, such as campus management and industrial site utility. Restraints primarily involve the high volatility of raw material costs, particularly synthetic and natural rubber derivatives, which significantly pressures manufacturing margins. Furthermore, the stringent regulatory environment in various regions governing the disposal and recycling of tires presents logistical and cost challenges for manufacturers. Opportunities emerge from the push towards developing environmentally sustainable tires using biodegradable or recycled content, and the integration of sophisticated monitoring technology (like RFID or pressure sensors) to create 'smart tires' capable of real-time performance feedback, enhancing safety and extending tire life. These forces collectively dictate pricing strategies, innovation timelines, and market entry barriers.

Specific market drivers contributing to volume growth include the aging global population seeking leisure activities like golf, leading to steady course usage and, consequently, tire wear. The trend towards larger, heavier electric golf carts and UTVs demands tires with increased load ratings and optimized rolling resistance to preserve battery life, spurring innovation in sidewall and compound technology. Conversely, a major constraint is the fragmented nature of the aftermarket, which is often saturated with lower-cost, lower-quality imports that undercut established brand prices, forcing leading players to maintain intense competitive pricing pressure. The ongoing global economic uncertainty can also impact discretionary spending on luxury maintenance equipment and golf rounds, temporarily affecting new equipment sales and subsequently, OEM tire demand. Manufacturers must navigate the complex trade-off between cost efficiency and performance durability to remain competitive, especially when catering to professional groundskeepers who prioritize long-term value.

The impact forces influencing the market trajectory extend beyond direct economic factors. Technological shifts, particularly the move towards zero-turn radius mowers and specialized maintenance vehicles, necessitate continuous adaptation in tire design to support unique maneuvering characteristics and heavy payloads without damaging turf. Environmental regulations, such as those related to noise pollution and chemical runoff, compel tire manufacturers to develop quieter treads and compounds that are resistant to common turf chemicals, aligning product development with ecological stewardship. The cumulative impact of these drivers, restraints, and opportunities ensures a constant state of evolution within the market, emphasizing specialization, quality, and technological integration. Success in this market is increasingly dependent on the ability to develop proprietary compounds that offer superior durability and minimize environmental footprint, while maintaining aggressive cost control against fluctuating raw material prices.

Segmentation Analysis

The Turf and Golf Cart Tires Market is comprehensively segmented based on product type, application, end-use, and distribution channel, allowing for granular analysis of market dynamics across diverse consumer and commercial needs. Understanding these segmentations is crucial for manufacturers to tailor their product offerings, marketing strategies, and distribution networks effectively. The segmentation by product type—Pneumatic vs. Solid/Non-Pneumatic—defines the primary performance characteristics, with pneumatic tires dominating due to their superior cushioning and ride comfort, while solid tires serve niche applications requiring absolute puncture immunity in high-hazard environments. Application segmentation, encompassing Golf Carts, Utility Vehicles (UTVs), and Professional Turf Equipment (mowers, aerators), highlights the varying performance demands, such as the need for minimal ground pressure in golf applications versus high load capacity in UTV applications.

End-use categorization differentiates between Commercial (golf courses, sports complexes, professional landscapers) and Residential (homeowners, smaller estates), reflecting significant differences in purchasing power, volume demand, and quality specifications; commercial users prioritize durability and longevity, justifying premium pricing, while residential users often favor cost-effective, multi-purpose solutions. Finally, the distribution channel split between Original Equipment Manufacturer (OEM) and Aftermarket dictates sales volume and profit margins; the OEM channel secures large, consistent orders aligned with new vehicle production cycles, whereas the aftermarket provides higher-margin opportunities driven by replacement needs and consumer upgrades. Each segment faces unique growth prospects influenced by specific macroeconomic factors, such as housing starts impacting residential equipment sales or tourism trends affecting commercial golf operations.

Detailed analysis within the application segment further reveals the specialized nature of demand. For example, tires for high-speed professional reel mowers must possess exceptional stability and consistency to ensure a perfect cut, requiring precision manufacturing and strict quality control. In contrast, tires for standard utility golf carts prioritize longevity and moderate terrain capability. The continuous evolution of equipment, particularly the rise of compact, articulated turf machines, necessitates specialized radial tires capable of handling complex motion profiles and uneven load distribution. This complexity ensures that the market remains fragmented but highly specialized, offering opportunities for niche manufacturers who focus on specific equipment types or performance requirements, such as ultra-low pressure designs for highly saturated turf conditions or extreme-duty solid tires for waste management utility vehicles operating on debris-filled sites.

- Product Type:

- Pneumatic Tires (Bias-Ply, Radial)

- Solid/Non-Pneumatic Tires (Foam-filled, Urethane)

- Application:

- Golf Carts (Electric & Gasoline)

- Utility Vehicles (UTVs/ATVs for Turf Maintenance)

- Lawn Mowers (Riding Mowers, Zero-Turn Mowers)

- Specialty Equipment (Aerators, Sprayers, Tractors)

- End-Use:

- Commercial (Golf Courses, Professional Landscaping, Sports Fields)

- Residential (Homeowner Use)

- Institutional (Campuses, Municipalities)

- Distribution Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Retail, Online, Dealer Network)

Value Chain Analysis For Turf and Golf Cart Tires Market

The value chain for the Turf and Golf Cart Tires Market is complex, beginning with the highly capital-intensive upstream segment involving the sourcing and processing of raw materials. Upstream analysis focuses on the acquisition of synthetic rubber (derived from petrochemicals), natural rubber, carbon black, steel cord, and textile fabrics. Suppliers in this phase, often large chemical and commodity companies, exert significant influence over pricing due to the volatility and concentration of global rubber production, which directly impacts tire manufacturing costs. Key strategic activities at this stage involve securing long-term supply contracts and investing in advanced compounding technologies to reduce reliance on purely petroleum-based inputs, driving the push towards sustainable and recycled materials to mitigate raw material price risk.

The midstream phase involves tire manufacturing and assembly, where core competencies lie in design engineering (tread pattern, casing structure), compounding expertise, and quality assurance processes, particularly the curing and molding stages. Leading manufacturers distinguish themselves through proprietary designs that offer superior turf protection, load-bearing capability, and longevity. The distribution channel analysis is critical, bifurcated into direct sales to OEMs and indirect sales via the aftermarket. Direct distribution to OEMs, such as major golf cart and mower producers (e.g., Club Car, E-Z-GO, Toro), is characterized by long-term contracts, bulk volumes, and stringent quality specifications. This channel is stable but generally lower margin.

Downstream analysis covers the ultimate delivery to end-users. The indirect channel, serving the aftermarket, utilizes a vast network of authorized dealers, specialty tire retailers, online platforms, and general auto service centers. This channel, although more fragmented, offers higher profit margins and caters to specialized replacement needs. Efficient logistics and inventory management are paramount in the downstream segment, especially given the seasonal demand spikes associated with the golf and landscaping seasons. Potential customers, including golf course superintendents, professional landscapers, and residential users, primarily value product durability, minimal turf impact, and competitive pricing, making brand reputation and reliable distribution essential success factors in the final stage of the value chain.

Turf and Golf Cart Tires Market Potential Customers

The primary customers in the Turf and Golf Cart Tires Market are broadly categorized into Commercial Operators and Institutional Buyers, who prioritize performance, longevity, and low total cost of ownership, and Residential Consumers, who often seek affordable, readily available replacement tires. Commercial Golf Course Management represents a cornerstone customer segment, requiring specialized, high-flotation, non-aggressive tires for entire fleets of golf carts, maintenance vehicles (sprayers, aerators), and large commercial mowers. These customers often procure large volumes directly through preferred dealer networks or specific OEM supply agreements, demanding tires that meet strict specifications for preserving highly manicured and expensive turf surfaces while minimizing equipment downtime.

Another significant segment comprises Professional Landscaping and Groundskeeping Services, which utilize heavy-duty utility vehicles and commercial riding mowers across diverse settings, from public parks and corporate campuses to large residential estates. Their purchasing decisions are heavily influenced by tire robustness, resistance to punctures and abrasion on mixed surfaces (pavement, gravel, turf), and the ability to handle heavy implement loads. Institutional clients, including universities, military bases, theme parks, and large industrial facilities, also constitute a stable customer base, relying on turf equipment and golf carts for internal transportation and extensive property maintenance, often purchasing through institutional procurement contracts requiring specific durability and safety compliance.

The residential market, while individually smaller in volume, collectively represents a massive consumer base driven by replacement needs for personal riding lawnmowers and increasingly common neighborhood golf cart transportation. These customers typically purchase through retail channels, home improvement stores, or online marketplaces, often prioritizing ease of installation and competitive pricing over the ultra-premium performance characteristics demanded by commercial superintendents. Manufacturers must develop distinct product lines and pricing strategies to address the divergent needs of these sophisticated commercial buyers—who focus on minimizing turf damage and maximizing operational efficiency—versus the more price-sensitive and convenience-driven residential consumer base, optimizing distribution channels accordingly.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.23 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Michelin, Bridgestone, Continental AG, The Goodyear Tire & Rubber Company, Sumitomo Rubber Industries, Trelleborg AB, Carlisle TyrFil, Specialty Tires of America, Kenda Rubber Industrial Co. Ltd., Greenball Corporation, Titan International, Maxxis International, BKT Tires, GBC Motorsports, Interco Tire Corporation, Mitas a.s. (Trelleborg Group), Deestone International, STI Tire & Wheel, CST Tires, Duro Tire & Wheel. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Turf and Golf Cart Tires Market Key Technology Landscape

The technological landscape of the Turf and Golf Cart Tires Market is increasingly focused on material science innovation, smart integration, and optimized tread design to meet the conflicting requirements of high load capacity and minimal ground impact. A primary area of technological advancement involves specialized rubber compounding, where manufacturers utilize proprietary blends of synthetic polymers, silica, and natural rubber to enhance puncture resistance, extend tread life, and improve chemical resistance against fertilizers and pesticides commonly used on turf. The shift towards Radial Construction, previously rare in this segment, is a significant technological uptake, offering better uniform road contact, improved fuel efficiency for utility vehicles, and superior heat dissipation compared to traditional bias-ply tires, thereby catering to the growing demand for high-performance UTVs operating at higher speeds and over longer distances.

Furthermore, the development of Non-Pneumatic Tire (NPT) technologies is rapidly maturing. While still a niche segment, NPTs, often constructed from advanced polymers or specialized foam filling (such as polyurethane), eliminate the risk of flats entirely, providing uninterrupted operational uptime—a critical feature for commercial maintenance fleets. These technologies require sophisticated structural engineering to mimic the cushioning and compliance provided by air-filled tires while maintaining zero pressure characteristics. Manufacturers are also focusing on optimizing the tire footprint through advanced CAD and simulation tools, creating innovative tread geometry (e.g., sipes, shallow grooves, and wide shoulder blocks) that maximizes flotation and distributes vehicle weight evenly, ensuring the psi exerted on the grass remains below the critical damage threshold, even under heavy load conditions.

A burgeoning technological segment involves the integration of Smart Tire Technology, incorporating RFID chips, internal pressure monitoring sensors (TPMS), and temperature gauges directly into the tire carcass during the manufacturing process. These sensors feed real-time operational data back to fleet management systems, facilitating predictive maintenance and ensuring vehicles consistently operate at optimal inflation levels, which is vital for both turf preservation and maximizing tire longevity. This data integration supports the growing trend of autonomous turf maintenance equipment, requiring highly consistent and precise tire performance data for navigation and load management. Consequently, the industry is witnessing a confluence of traditional rubber expertise with digital sensor technology and advanced material engineering, driving the market toward highly specialized, condition-monitoring products.

Regional Highlights

- North America: North America holds the largest market share, driven by the massive presence of established golf courses, extensive residential landscaping, and high consumer adoption rates of utility and recreational golf carts. The US market, in particular, is characterized by a strong aftermarket demand and a sophisticated commercial landscaping industry that demands high-durability, specialized radial tires for heavy-duty professional mowers and UTVs. Regulatory standards regarding tire safety and load ratings are well-established, promoting market stability. The demand here is mature but consistently grows, focusing on premium quality and technological integration like run-flat capabilities and sensor readiness.

- Europe: The European market shows steady, moderate growth, influenced by stringent environmental regulations and a high emphasis on tire quality and safety standards, particularly within commercial and municipal groundskeeping sectors. Key markets like the UK, Germany, and France prioritize quiet operation and certified eco-friendly compounds. Demand is often concentrated in replacement tires for specialized, high-precision equipment used in sports grounds (football pitches, rugby fields) and institutional estates, favoring manufacturers who can provide reliable supply chains and highly specific tread designs tailored to diverse soil and climate conditions across the continent.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region due to rapid urbanization, increasing disposable incomes, and significant investment in leisure and real estate infrastructure, leading to the development of new golf resorts and planned communities. Countries like China, India, and Southeast Asian nations are witnessing booming domestic golf cart manufacturing and utility vehicle production, boosting OEM demand significantly. The region is highly price-sensitive but is rapidly adopting higher-quality tires as maintenance practices become more professionalized, presenting substantial opportunities for market penetration and establishing new manufacturing hubs.

- Latin America (LATAM): The LATAM market is growing steadily, primarily driven by tourism and the resultant maintenance of resorts and leisure facilities, especially in Mexico and Brazil. Market dynamics are heavily influenced by economic stability and import/export costs. Demand is predominantly for standard bias-ply tires for utility applications, focusing on robustness and cost-effectiveness rather than advanced technological features, though the use of UTVs in agriculture is beginning to drive a need for more durable turf-friendly utility tires.

- Middle East and Africa (MEA): Growth in MEA is concentrated in the Gulf Cooperation Council (GCC) states, fueled by large-scale luxury real estate development, expansive golf courses, and resort complexes requiring specialized turf maintenance equipment capable of operating efficiently in harsh, often arid, climates. The requirement for tires with high heat resistance, UV stability, and exceptional durability against abrasive sand and rough terrain defines the demand profile in this region, necessitating imported premium products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Turf and Golf Cart Tires Market.- Michelin

- Bridgestone

- Continental AG

- The Goodyear Tire & Rubber Company

- Sumitomo Rubber Industries

- Trelleborg AB

- Carlisle TyrFil

- Specialty Tires of America

- Kenda Rubber Industrial Co. Ltd.

- Greenball Corporation

- Titan International

- Maxxis International

- BKT Tires

- GBC Motorsports

- Interco Tire Corporation

- Mitas a.s. (Trelleborg Group)

- Deestone International

- STI Tire & Wheel

- CST Tires

- Duro Tire & Wheel

Frequently Asked Questions

Analyze common user questions about the Turf and Golf Cart Tires market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between turf tires and standard off-road tires?

Turf tires are specifically designed with broad, non-aggressive, rounded treads to maximize flotation and distribute weight evenly, significantly reducing the ground pressure exerted on sensitive surfaces like grass and greens, preventing turf damage, unlike knobby off-road tires designed for aggressive traction and soil displacement.

How does the growth of electric golf carts impact the tire market?

The increasing adoption of electric golf carts necessitates specialized tires capable of handling higher instantaneous torque and different weight distribution profiles due to battery placement. This drives demand for low-rolling-resistance compounds to maximize battery range and designs with reinforced sidewalls to manage the increased vehicle weight.

Which segmentation dominates the Turf and Golf Cart Tires Market?

The Pneumatic Tire product segment dominates the market due to its superior cushioning, comfort, and shock absorption, which are essential for protecting both the delicate turf and the vehicle suspension. The Commercial End-Use segment, encompassing golf courses and professional landscapers, accounts for the highest value share due to high volume replacement cycles and stringent quality demands.

What are the key technological advancements driving innovation in turf tires?

Key innovations include the increased adoption of durable radial tire construction for improved performance and longevity, the development of highly specialized rubber compounds resistant to common turf chemicals and UV light, and the integration of smart tire technologies like TPMS and RFID for real-time performance monitoring and predictive maintenance.

Which region offers the highest growth potential for turf and golf cart tires?

The Asia Pacific (APAC) region, particularly driven by countries undergoing rapid infrastructure development like China and India, is projected to offer the highest growth potential (CAGR). This expansion is fueled by rising tourism, increased construction of golf courses and resorts, and the burgeoning local manufacturing of utility vehicles requiring specialized tires.

What role does sustainability play in the manufacturing of turf and golf cart tires?

Sustainability is a crucial factor, driving manufacturers to research and utilize eco-friendly materials, including bio-based rubber alternatives and recycled content, to reduce environmental impact. Additionally, designing long-lasting tires minimizes waste, while non-marking compounds prevent chemical interaction with the turf, aligning with stricter global environmental regulations and consumer demand for green products.

Are solid or non-pneumatic tires becoming more popular for turf applications?

Solid, or non-pneumatic, tires are gaining traction in severe-duty commercial turf applications where the risk of puncture is exceptionally high, such as municipal maintenance or areas with construction debris. While they offer puncture immunity and zero downtime, pneumatic tires still dominate due to their superior ride quality and lower impact on sensitive greens, limiting solid tire growth primarily to high-risk, rugged utility vehicle applications.

How do manufacturers ensure optimal traction without damaging the grass?

Manufacturers achieve optimal traction through specialized tread designs that feature a wide, shallow footprint and numerous closely spaced, soft edges rather than deep, aggressive lugs. This design maximizes the contact patch for better grip on wet grass while minimizing shear force, preventing soil compaction and tearing of the grass roots.

What are the challenges faced by manufacturers regarding raw material supply?

A primary challenge is the volatile pricing and supply chain instability of key raw materials, including natural rubber, synthetic polymers derived from petroleum, and carbon black. These commodity price fluctuations directly affect production costs and necessitate sophisticated risk management strategies and investments in diversified material sourcing to maintain competitive pricing.

What is the significance of the OEM versus Aftermarket segment split?

The OEM (Original Equipment Manufacturer) segment secures high-volume, lower-margin business based on new vehicle production, demanding strict quality consistency. The Aftermarket segment, serving replacement and upgrade needs, provides higher profit margins and caters to specialized performance requirements, making it crucial for manufacturers seeking enhanced profitability and brand loyalty among end-users.

How does the quality of turf tires affect the total cost of ownership (TCO) for a golf course?

High-quality turf tires, despite a higher initial purchase price, significantly reduce the TCO for a golf course by offering superior durability, extended lifespan, and minimizing equipment downtime due to flats or premature wear. They also reduce labor costs associated with turf repair, as high-flotation tires mitigate damage to expensive greens and fairways, providing substantial long-term savings.

What specific performance characteristics are prioritized for tires used on utility vehicles (UTVs) in turf management?

For UTVs in turf management, the key prioritized performance characteristics are high load-bearing capacity to manage heavy implements and cargo, excellent lateral stability for traversing slopes, superior puncture resistance for mixed-terrain use, and moderate rolling resistance to optimize fuel or battery consumption while maintaining a turf-friendly footprint.

Are there any specific regulatory requirements for turf tires in the European market?

Yes, the European market often imposes stricter requirements regarding noise emissions, tire labeling for efficiency and wet grip (though adapted for low-speed turf use), and end-of-life tire disposal and recycling compliance, forcing manufacturers to adhere to high environmental and safety standards for tires sold within the EU.

How do advanced tread pattern simulations improve turf tire design?

Advanced tread pattern simulations, often utilizing AI and finite element analysis (FEA), allow manufacturers to digitally model countless variations of groove depth, siping, and rubber stiffness. This optimizes the design for maximum flotation and minimal turf damage before physical prototyping, significantly cutting R&D time and ensuring superior performance consistency across different load and terrain conditions.

Why is the demand for radial construction increasing in the utility segment?

Radial construction provides better stability, superior heat dissipation, and a flatter footprint compared to bias-ply tires, leading to more uniform wear and longer lifespan, especially beneficial for utility vehicles that travel longer distances and carry heavier loads on varied surfaces. This improves ride comfort and efficiency, driving its adoption in the premium UTV and high-end mower segments.

What is the major market restraint related to the production of golf cart tires?

The major market restraint is the significant price volatility of raw materials, particularly natural and synthetic rubber, which are dependent on global commodity markets and geopolitical factors. This volatility introduces uncertainty into manufacturing costs and pricing strategies, making consistent margin maintenance challenging for tire producers.

How is the residential segment different from the commercial segment in terms of purchasing behavior?

Residential consumers typically prioritize the lowest cost and immediate availability, purchasing standard-size replacement tires through retail or online channels, often focusing on all-purpose utility. Commercial buyers, such as golf course managers, prioritize specialized high-performance features, longevity, warranty support, and purchase large volumes through direct dealer relationships or OEM suppliers, valuing TCO over initial cost.

What challenges does waterlogged or highly saturated turf pose for tire manufacturers?

Waterlogged turf requires tires with extremely low ground pressure to prevent rutting and compaction. Manufacturers address this through ultra-wide flotation designs and specialized, highly flexible sidewalls that allow the tire to operate effectively at minimal inflation pressures, increasing the contact area without damaging the saturated subsurface.

Which factors contribute to North America's dominance in the market?

North America's market dominance stems from its immense number of golf courses, large-scale commercial landscaping industries, high consumer ownership of riding mowers and golf carts for residential and community use, and the presence of major OEM manufacturers leading the global equipment production cycle, ensuring robust and sustained demand.

How do smart tires contribute to better turf management practices?

Smart tires, equipped with TPMS, ensure optimal inflation levels are maintained precisely, which is the single most critical factor in preventing turf damage and maximizing tire life. By providing real-time data, they help groundskeepers adhere strictly to recommended pressure settings, optimizing equipment weight distribution and protecting the expensive underlying playing surface.

What are the common materials used in modern, durable turf tire construction?

Modern, durable turf tire construction primarily relies on synthetic rubber (Styrene-butadiene rubber or polybutadiene rubber) blended with natural rubber for flexibility. Key additives include carbon black for strength and UV resistance, silica for improved wet traction and reduced rolling resistance, and high-tensile steel cord or specialized textile plies for carcass reinforcement.

What market opportunity is emerging from non-traditional golf cart uses?

A significant opportunity arises from the expanding use of golf carts and UTVs in non-traditional settings, such as airport utility, large industrial warehouses, planned residential communities, and retirement villages. These applications require tires optimized not just for turf, but also for durability and longevity on paved surfaces, leading to demand for robust, all-terrain turf tires with enhanced street-legal specifications.

In the value chain, where does the highest profit margin typically reside?

While OEM contracts secure high volume, the highest profit margins typically reside in the Aftermarket Distribution channel. This is because aftermarket sales involve specialized replacement tires, often sold at premium prices for specific performance upgrades, and allow manufacturers to capture a greater share of the value compared to bulk, standardized OEM sales.

How does the shift toward autonomous turf equipment influence tire design requirements?

Autonomous equipment demands tires with exceptionally high dimensional accuracy and consistency to ensure precise navigation and sensor calibration. Designs must minimize slippage and maximize stability for sophisticated GPS guidance systems, often requiring radial construction and integrated sensor housing to function seamlessly with robotic controls and route optimization algorithms.

What is the expected CAGR for the Turf and Golf Cart Tires Market between 2026 and 2033?

The Turf and Golf Cart Tires Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period, reflecting steady demand growth driven by recreational and professional groundskeeping investments globally and technological advancements in tire materials.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager