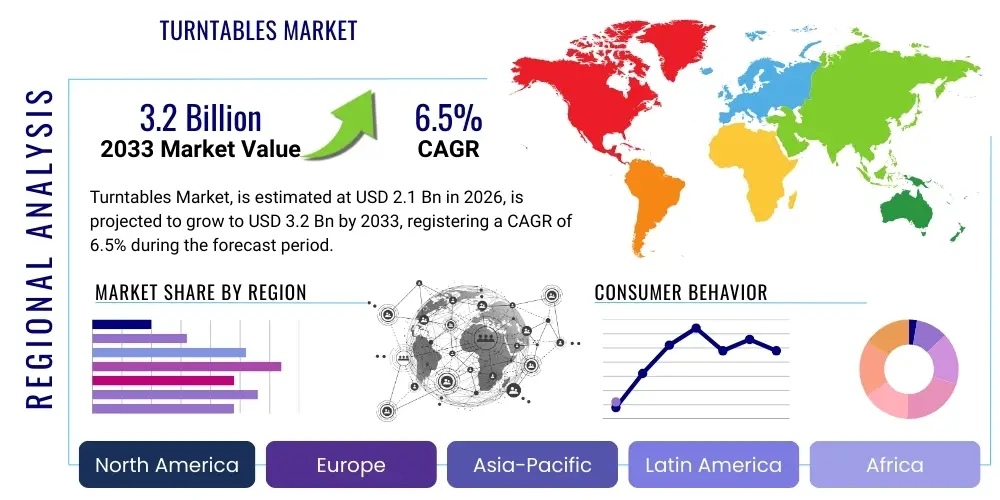

Turntables Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438614 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Turntables Market Size

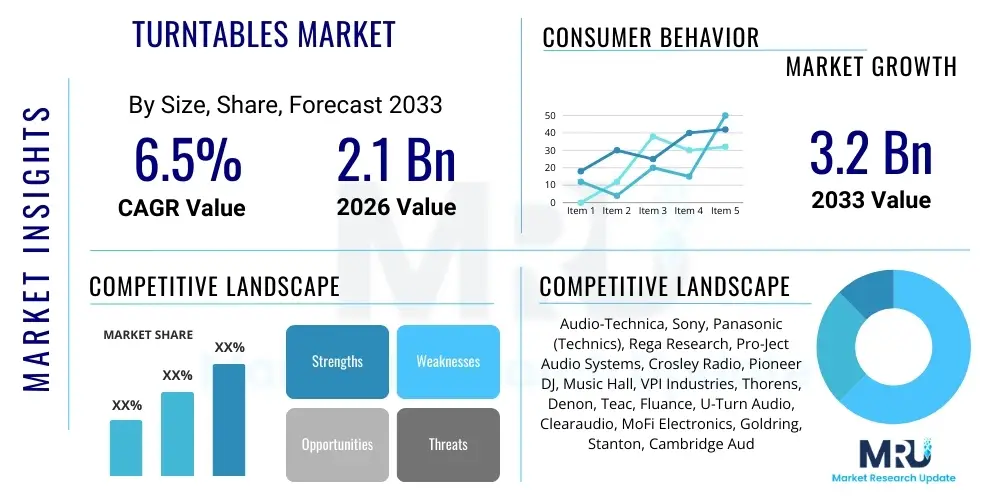

The Turntables Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $2.1 Billion in 2026 and is projected to reach $3.2 Billion by the end of the forecast period in 2033. This growth trajectory is significantly fueled by the ongoing global resurgence in vinyl record popularity, driven by both nostalgic consumers and a new generation of audiophiles seeking superior sound quality and tangible musical experiences. The market expansion is also supported by continuous technological advancements, particularly in automated features, direct-drive motor systems, and integration with modern home audio ecosystems, making high-fidelity vinyl playback more accessible to a broader consumer base across diverse geographical regions.

Turntables Market introduction

The Turntables Market encompasses the manufacturing, distribution, and sale of devices designed to play vinyl records (analog sound storage medium). These devices, traditionally known as record players, have evolved significantly, transitioning from basic consumer electronics to specialized, high-fidelity audio equipment. Modern turntables incorporate advanced engineering to minimize vibration, ensure consistent rotational speed (measured in revolutions per minute, or RPMs), and optimize tracking force for superior sound reproduction. Products range from entry-level, all-in-one systems catering to casual listeners to professional-grade audiophile decks used in critical listening environments and specialized studio applications. The fundamental components—the plinth, platter, tonearm, and cartridge—are engineered with increasing precision to meet the rigorous demands of serious music enthusiasts, thereby sustaining premium pricing tiers and encouraging innovation in material science and mechanical design within the sector.

Major applications of turntables span across home entertainment, professional DJ mixing and production, and archival preservation in libraries and museums. In the home environment, turntables serve as a centerpiece for high-quality music playback, often paired with sophisticated amplifiers and speaker systems. Benefits associated with vinyl and turntable ownership include the tangible experience of physical media, the perceived warmth and depth of analog sound compared to digital formats, and the cultural appreciation of music history and artistic album presentation. The tactile ritual of selecting and placing a record has become a significant draw for consumers seeking a more engaging and intentional listening experience, contrasting sharply with the passive consumption offered by streaming platforms, thus carving out a distinct and resilient niche in the broader audio market landscape.

Driving factors for the market expansion are primarily centered on the renewed consumer interest in analog audio formats, particularly among younger demographics who value authenticity and unique media consumption methods. Complementing this demand is the continuous release of new vinyl titles by major and independent record labels, alongside the robust market for vintage and used records. Furthermore, technological drivers include the integration of features such as built-in phono preamplifiers, USB output capabilities for digital archiving, and wireless connectivity (e.g., Bluetooth) to seamlessly integrate turntables into modern smart home setups without compromising the fundamental analog output quality. These hybrid solutions bridge the gap between classic audio fidelity and contemporary convenience, appealing to a wider spectrum of consumers.

Turntables Market Executive Summary

The global Turntables Market is demonstrating robust resilience and sustained growth, buoyed by deep-seated cultural trends favoring physical media and high-fidelity audio, which collectively drive consumer purchasing decisions across major economic regions. Business trends indicate a strategic focus on premiumization, where manufacturers increasingly invest in high-end materials, precision engineering, and specialized components like Moving Coil (MC) cartridges and sophisticated tonearms to cater to the discerning audiophile segment. Furthermore, strategic partnerships between turntable manufacturers and leading audio equipment brands are common, aiming to provide bundled, optimized vinyl playback solutions. The supply chain is complex, involving specialized components sourced globally, necessitating robust logistics management to maintain quality and meet escalating demand for customized and limited-edition models, a factor particularly relevant in the competitive retail environment where exclusivity often dictates premium pricing.

Regional trends reveal North America and Europe as established powerhouses, characterized by high disposable income, a strong heritage of vinyl culture, and a mature infrastructure for music distribution and record collecting. However, the Asia Pacific (APAC) region, particularly emerging economies like China, India, and South Korea, is experiencing the fastest rate of adoption. This acceleration is attributed to rising affluence, increasing exposure to global music trends, and a growing consumer interest in luxury and lifestyle audio products, suggesting significant future expansion opportunities. Manufacturers are strategically targeting APAC by developing products that balance high quality with regional design preferences and competitive pricing, often leveraging e-commerce platforms for direct-to-consumer sales and brand building, thus minimizing reliance on traditional retail channels.

Segmentation trends highlight the dominance of the belt-drive segment due to its acoustic advantages in mitigating motor noise and vibration, favored by dedicated enthusiasts. Concurrently, the direct-drive segment maintains a strong foothold, especially within the professional DJ community, owing to its high torque and speed stability required for scratching and mixing applications. In terms of distribution, specialized audio retailers and online platforms remain crucial, providing consumers with detailed product information, reviews, and necessary technical support for installation and calibration. The rapid expansion of the entry-level segment, often featuring integrated preamps and automatic functions, is expanding the market base, attracting casual listeners who prioritize convenience without sacrificing the experience of owning and playing records.

AI Impact Analysis on Turntables Market

Analysis of common user questions regarding the impact of Artificial Intelligence (AI) on the Turntables Market reveals key themes centered around enhancing user experience, improving calibration precision, and integrating vinyl playback into smart home ecosystems. Users frequently inquire if AI can automatically calibrate tonearms and adjust anti-skate, eliminating the often-challenging setup process for novices. There is also significant interest in how AI algorithms could analyze listening habits derived from streaming data to provide highly personalized, data-driven recommendations for purchasing new or classic vinyl records, creating a bridge between digital discovery and analog consumption. Concerns primarily revolve around whether AI integration might compromise the purity of the analog signal path or if smart features might introduce unnecessary digital noise, challenging the core audiophile principle that values simplicity and signal integrity in vinyl playback systems. Expectations are high for AI to handle complexity, such as automatic equalization tailored to specific room acoustics and cartridge characteristics, thereby democratizing high-end audio performance without requiring expert user intervention.

- AI-Powered Calibration Systems: Utilizing machine vision and embedded sensors to automate the complex setup process, including automatic tracking force adjustment, azimuth setting, and vertical tracking angle (VTA) calibration, making high-fidelity sound attainable for all users.

- Predictive Maintenance and Diagnostics: AI algorithms monitoring motor health, bearing wear, and stylus degradation in real-time, alerting users to necessary maintenance or replacement cycles before acoustic performance is noticeably affected.

- Personalized Vinyl Curation: Leveraging AI analysis of user’s existing digital playlists, streaming history, and preferred sonic signatures to generate hyper-targeted recommendations for vinyl purchases, merging the convenience of digital discovery with the commitment of physical media ownership.

- Smart Home Integration and Voice Control: Enabling hands-free operation (e.g., "AI, play the B-side of the last record played") and seamless connectivity with multi-room audio systems, integrating vinyl playback into the broader Internet of Things (IoT) audio environment.

- Acoustic Optimization: Implementation of sophisticated AI-driven Digital Signal Processing (DSP) and equalization techniques (when digitizing the output or using hybrid systems) to compensate for room acoustics or minor imperfections in older records, subtly enhancing the listening experience while preserving the core analog characteristics.

- Optimized Manufacturing Processes: Applying machine learning in the production line, especially in precision parts like cartridges and bearings, to reduce manufacturing defects, improve material consistency, and increase overall product reliability and longevity.

DRO & Impact Forces Of Turntables Market

The Turntables Market is shaped by a confluence of powerful drivers, structural restraints, and evolving opportunities, resulting in significant impact forces across the value chain. The primary driver is the pervasive cultural shift back towards tactile media consumption and the widely recognized superior aesthetic and auditory experience associated with vinyl records, appealing strongly to segments prioritizing audio quality and emotional connection over sheer convenience. This nostalgia, coupled with the entry of younger consumers seeking counter-cultural alternatives to streaming, creates persistent demand. However, the market faces considerable restraints, including the high initial cost of quality equipment, the technical complexity required for proper setup and maintenance, and the inherent fragility of both the playback equipment and the vinyl records themselves, which deters casual consumers. Furthermore, manufacturing bottlenecks in vinyl pressing capacity occasionally limit the availability of new releases, indirectly impacting turntable utilization rates and subsequent sales, particularly at peak demand times.

Opportunities in the market are abundant, notably revolving around technology convergence and material innovation. The development of high-performance wireless turntables (incorporating high-resolution Bluetooth codecs) allows seamless integration into modern smart homes without compromising signal quality, expanding market reach beyond traditional audiophile setups. There is also a substantial opportunity in emerging markets, particularly in Asia, where rising disposable incomes translate into increased spending on premium lifestyle electronics. The industry can capitalize on environmentally conscious trends by promoting sustainability through the use of recycled materials for plinths and packaging, appealing to the eco-aware consumer base. The overall impact forces are strongly positive, primarily driven by lifestyle and aesthetic considerations, pushing manufacturers to continuously innovate in design and user accessibility, mitigating the inherent technical challenges.

The core impact force is the differentiation strategy adopted by key players: moving away from commodity electronics and firmly establishing turntables as luxury or specialist lifestyle items. This enables premium pricing and ensures margins remain healthy despite potential supply chain volatilities. The longevity of the vinyl format—now accepted as a permanent fixture rather than a fleeting trend—provides market stability. Competition focuses less on price wars and more on component quality (e.g., tonearm material, bearing precision) and aesthetic design, forcing continuous technological iteration. Restraints related to complexity are being addressed through user-friendly automation and simplified designs aimed at mass-market penetration, balancing the audiophile desire for control with the average user's demand for plug-and-play simplicity, ensuring the market remains dynamically competitive across all price points.

Segmentation Analysis

The Turntables Market is critically segmented based on criteria such as drive type, operation type, speed capability, price range, and end-user application, reflecting the diverse requirements and purchasing power of consumers, ranging from entry-level enthusiasts to professional DJs and high-end audiophiles. Analyzing these segments is essential for understanding market dynamics, optimizing product positioning, and identifying specialized growth niches. The market structure inherently separates performance-driven segments, prioritizing acoustic fidelity and manual control (e.g., belt-drive, manual operation), from convenience-driven segments that value ease of use and affordability (e.g., direct-drive, automatic operation, integrated systems). This distinct segmentation allows manufacturers to tailor marketing strategies and R&D investments effectively, ensuring specialized products meet the exact specifications of their target consumers, whether focusing on torque stability for mixing or vibration isolation for critical listening.

- By Drive Type:

- Belt Drive: Preferred by audiophiles for vibration dampening and superior acoustic performance, focusing on mechanical isolation and smooth rotation.

- Direct Drive: Dominant in the professional DJ segment due to high torque, quick start/stop times, and excellent speed stability under manual manipulation.

- Idler Wheel Drive: A niche, vintage segment known for powerful bass and fast torque, experiencing resurgence among collectors.

- By Operation Type:

- Manual: Requires the user to lift and place the tonearm, favored by audiophiles for minimalist design and maximum control over the listening ritual.

- Automatic: Features mechanisms that automatically place the tonearm and return it after playback, appealing to consumers prioritizing convenience and protection of records/styli.

- Semi-Automatic: Combines manual start with automatic return and shut-off, offering a balance of control and convenience.

- By End-User:

- Audiophiles & Enthusiasts: Seek high-fidelity components, often customizing cartridges, platters, and plinths for optimal sound.

- Casual Listeners: Prefer integrated, plug-and-play systems, often including built-in speakers and Bluetooth connectivity.

- Professional DJs & Producers: Require rugged, high-torque direct-drive models suitable for continuous, heavy-duty mixing, scratching, and sampling applications in nightclubs and studios.

- By Speed (RPMs):

- 33 1/3 RPM

- 45 RPM

- 78 RPM (Multi-speed models for collector appeal)

- By Price Range:

- Entry-Level (Below $300)

- Mid-Range ($300 - $1,000)

- High-End/Luxury (Above $1,000)

Value Chain Analysis For Turntables Market

The value chain of the Turntables Market is intricate, beginning with specialized upstream activities focused heavily on precision engineering and material science. Upstream analysis involves the procurement of high-quality, often proprietary, raw materials such as specialized polymers (for plinths and dust covers), high-density MDF or aluminum composites (for chassis), and micro-machined components like sapphire or ceramic bearings. Crucially, the manufacturing of highly sensitive parts—specifically magnetic cartridges (Moving Magnet/Moving Coil), precision styli (e.g., Shibata, elliptical), and high-tolerance motor components—requires proprietary technology and stringent quality control, often handled by a few specialized global suppliers. Innovation at this stage is focused on reducing resonance, improving speed accuracy, and maximizing stylus lifespan, factors critical for product differentiation in the premium segment.

Downstream activities center on assembly, calibration, branding, and distribution. Assembly often involves both automated processes for mass-market models and highly skilled manual labor for high-end, hand-tuned audiophile decks, where detailed setup and quality assurance checks are paramount. The distribution channel is segmented into direct and indirect routes. Direct distribution involves manufacturer-to-consumer sales via dedicated e-commerce platforms, offering better control over branding and pricing. Indirect distribution relies heavily on specialized audio equipment dealers who provide expert consultation, installation services, and post-sale support, acting as crucial educators for complex products like high-fidelity turntables. Mass-market models frequently utilize large electronics retailers and general e-commerce giants, emphasizing volume and convenience over specialized expertise.

The structure of the distribution network is vital due to the technical nature of the product. Specialized audio dealers remain a linchpin, particularly for premium turntables, because they can demonstrate the acoustic value proposition in a controlled environment and assist customers with system matching (pairing the turntable with the correct amplifier and speakers). This expertise justifies their higher margin compared to general retail. However, the increasing sophistication of online content, including detailed setup videos and user reviews, is empowering consumers to purchase mid-range models directly online. Optimizing the flow of information and ensuring the authenticity of products through authorized channels are critical components of maintaining brand reputation and customer satisfaction across the entire complex value chain.

Turntables Market Potential Customers

Potential customers in the Turntables Market are segmented primarily into three distinct archetypes: the dedicated audiophile, the lifestyle consumer, and the professional DJ. The dedicated audiophile represents the highest value customer, defined by an unwavering pursuit of sonic perfection and a willingness to invest heavily in specialized equipment (including high-end platters, tonearms, and specialized cartridges). These end-users are characterized by extensive knowledge of audio engineering, favoring manual operation and component customization. Their purchasing decisions are primarily influenced by technical specifications such as wow and flutter ratings, signal-to-noise ratio, and material resonance characteristics. They often purchase through specialized dealers who offer deep technical expertise and personalized advisory services, making them vital buyers for luxury and premium product lines.

The lifestyle consumer, or casual listener, constitutes the fastest-growing segment. These buyers are typically younger individuals (Millennials and Gen Z) drawn to vinyl primarily for the aesthetic appeal, the tangible experience, and the cultural cachet associated with the format. They prioritize ease of use, integrated features (like Bluetooth or built-in preamps), attractive design, and overall affordability, often opting for entry-level or mid-range automatic/semi-automatic models. Their purchase journey is predominantly through large e-commerce sites and mainstream electronics retailers, valuing convenience and favorable consumer reviews. This segment is less concerned with granular technical specifications and more focused on the product’s role as a stylish piece of home décor or a connection to a specific cultural identity, making design and brand storytelling crucial marketing tools.

The third major customer group is the professional DJ and music producer community. These end-users require robust, reliable, and high-performance direct-drive turntables optimized for heavy, constant use in clubs, radio stations, and production studios. Key requirements include high torque for instant speed stabilization, pitch control accuracy, and durability against physical wear and tear associated with scratching and mixing. Brands that dominate this segment prioritize industrial design and legendary reliability. While representing a smaller volume of sales compared to the casual listener, this segment provides significant brand validation and sets performance standards that often trickle down into consumer models, influencing overall market innovation and technological focus.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.1 Billion |

| Market Forecast in 2033 | $3.2 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Audio-Technica, Sony, Panasonic (Technics), Rega Research, Pro-Ject Audio Systems, Crosley Radio, Pioneer DJ, Music Hall, VPI Industries, Thorens, Denon, Teac, Fluance, U-Turn Audio, Clearaudio, MoFi Electronics, Goldring, Stanton, Cambridge Audio, Electrohome. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Turntables Market Key Technology Landscape

The technological landscape of the Turntables Market is characterized by a blend of classical analog precision engineering and strategic integration of modern digital components. Core technological innovation revolves around eliminating or mitigating factors that degrade audio quality, such as motor noise, platter resonance, and tracking errors. Belt-drive systems continue to refine their isolation techniques, utilizing advanced elastomer belts and decoupled motor housings to minimize vibration transfer to the platter and stylus. Conversely, direct-drive technology, while historically facing challenges related to motor cogging, has seen advancements in microprocessor-controlled servo systems to ensure extremely accurate and instantaneous speed lock, addressing the needs of high-fidelity listeners while retaining the high torque required by DJs.

Significant innovation is also occurring in the tonearm and cartridge technology. Modern tonearms often employ specialized materials like carbon fiber or sophisticated aluminum alloys to achieve high rigidity and low effective mass, optimizing tracking ability across the record surface. Cartridges are seeing advancements in stylus shape (e.g., microline, Shibata) for improved frequency response and reduced record wear, alongside refined magnetic assemblies (Moving Magnet (MM) vs. Moving Coil (MC)). The move towards higher-output MC cartridges and advanced phono preamplifiers featuring RIAA equalization curves tailored for specific vintage and modern recordings demonstrates a continuous effort to extract maximum musical detail from the vinyl groove while maintaining signal integrity, a central tenet of audiophile design principles.

Furthermore, technology integration focuses heavily on improving user accessibility and connectivity. Many contemporary turntables include integrated solid-state phono preamplifiers, negating the need for separate components and simplifying setup for entry-level users. USB outputs are standard features on many models, enabling users to digitize their vinyl collections (ripping vinyl to digital lossless formats), bridging the analog and digital worlds. Crucially, the increasing prevalence of high-quality, high-bitrate Bluetooth transmitters (supporting codecs like aptX HD or LDAC) allows wireless streaming to modern speakers or headphones without completely sacrificing the sonic advantages of analog playback, positioning the turntable as a versatile source component within the contemporary, wirelessly connected home audio environment, thereby broadening its appeal significantly beyond the traditional niche market.

Regional Highlights

The Turntables Market exhibits distinct consumption patterns and growth drivers across major global regions, reflecting cultural history, economic maturity, and prevailing consumer preferences for audio equipment.

- North America: This region is a mature and significant revenue generator, driven by a deeply ingrained cultural connection to vinyl, particularly among independent music scenes and classic rock enthusiasts. The US market dominates, characterized by robust demand for both high-end audiophile equipment (VPI, MoFi) and fashionable, integrated entry-level players (Crosley, U-Turn). Growth is sustained by Record Store Day events and the continuous expansion of independent record labels catering to diverse genres, ensuring a steady stream of new vinyl releases.

- Europe: Europe stands out as a center for precision manufacturing and brand heritage, hosting many leading global audiophile brands (Rega, Pro-Ject, Thorens). Countries like Germany, the UK, and Scandinavia show high per capita spending on audio equipment. The market here prioritizes acoustic performance, minimalist design, and sustainability, leading to strong sales of mid-range and premium belt-drive models. Regional growth is stable, underpinned by strong disposable income and a highly informed consumer base that views vinyl playback as a cultural investment.

- Asia Pacific (APAC): APAC is projected as the fastest-growing region, fueled by rapid urbanization, rising middle-class income, and the adoption of Western lifestyle trends, particularly in countries like South Korea, Japan (a traditional high-fidelity market leader), and China. While Japan maintains a strong heritage market, the emerging economies present the largest opportunity for mass-market and mid-range products. Consumers are increasingly seeking status-symbol electronics, and the integration of turntables into modern, minimalist home aesthetics is a key driver.

- Latin America (LATAM): The LATAM market is characterized by steady growth, with Brazil and Mexico being primary contributors. Demand is often driven by a fondness for local music history and a growing interest in DJ culture. Affordability is a major factor, leading to higher penetration of entry-level and locally assembled units, though niche markets for imported high-end gear exist in major metropolitan centers.

- Middle East and Africa (MEA): This region is an emerging market with nascent but increasing demand. Growth is concentrated in affluent urban centers (e.g., UAE, Saudi Arabia) where luxury electronics and prestige audio brands find receptive buyers. The market size is smaller but poised for expansion as infrastructure and disposable income improve, focusing primarily on high-end, imported units for affluent consumers seeking status and high-fidelity performance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Turntables Market.- Audio-Technica Corporation

- Sony Corporation

- Panasonic Corporation (Technics Brand)

- Rega Research Ltd.

- Pro-Ject Audio Systems (Audio Tuning GmbH)

- Crosley Radio

- Pioneer DJ Corporation

- Music Hall Audio

- VPI Industries Inc.

- Thorens GmbH

- Denon (D+M Group)

- Teac Corporation

- Fluance

- U-Turn Audio

- Clearaudio Electronic GmbH

- MoFi Electronics

- Goldring (Armour Home Electronics)

- Stanton DJ

- Cambridge Audio

- Electrohome

Frequently Asked Questions

Analyze common user questions about the Turntables market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the renewed interest and growth in the Turntables Market?

The primary driver is the global vinyl resurgence, fueled by younger demographics seeking tangible media, the perceived superior analog sound quality, and the aesthetic appeal of vinyl records. This trend is reinforced by continuous product innovation, integrating classic analog systems with modern features like Bluetooth connectivity and simplified operation for broad consumer accessibility.

Which drive type—belt or direct—is better for acoustic performance versus DJ use?

Belt-drive turntables are generally preferred for high-fidelity acoustic performance as the belt isolates the motor's vibration, resulting in lower noise and flutter. Direct-drive turntables are superior for professional DJ use due to their high torque, instantaneous speed stability, and durability, which are critical for scratching and mixing applications.

How significant is the impact of smart technology and AI on traditional turntable design?

While the core analog signal path remains largely untouched, smart technology integration, including high-resolution wireless streaming and USB output for digital archiving, significantly enhances modern turntable utility. Future AI applications are focused on automated calibration and personalized vinyl recommendations, enhancing user experience without compromising essential analog fidelity.

What are the most critical factors consumers consider when choosing a high-end turntable?

High-end consumers primarily evaluate mechanical precision, focusing on the quality of the tonearm (effective mass, material), the stability of the motor and platter system, the bearing tolerance, and the isolation properties of the plinth. The selection of a high-performance phono cartridge (often Moving Coil) is also a crucial determining factor for audio quality.

Which geographical region offers the highest growth potential for turntable manufacturers?

The Asia Pacific (APAC) region, particularly emerging economies such as China and India, presents the highest growth potential. This growth is underpinned by rapidly increasing disposable incomes, a growing appreciation for premium lifestyle audio products, and strong urbanization trends encouraging the adoption of sophisticated home entertainment systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- DJ Software Market Size Report By Type (Controllers, Mixers, Turntables and Related Accessories), By Application (Personal, Commercial), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Turntables Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Idler-wheel Turntable, Belt-drive Turntable, Direct-drive Turntable), By Application (Music Production, Bar and Music Club, Home Entertainment, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager