TV and Radio Broadcasting Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432919 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

TV and Radio Broadcasting Market Size

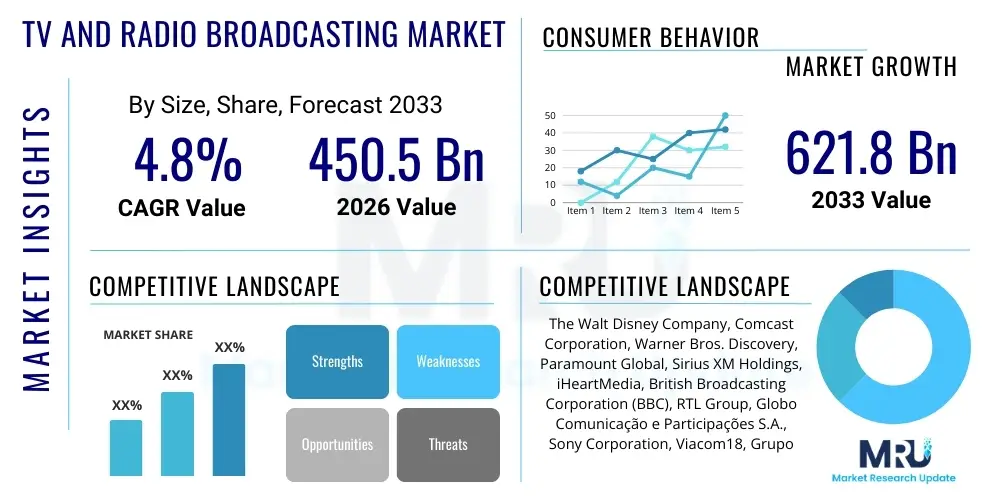

The TV and Radio Broadcasting Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 450.5 Billion in 2026 and is projected to reach USD 621.8 Billion by the end of the forecast period in 2033. This steady expansion is primarily driven by the transition toward digital infrastructure, increasing global penetration of smart devices, and the continuous demand for real-time news, sports, and serialized entertainment content across emerging economies. While traditional linear broadcasting faces competitive pressures from Over-the-Top (OTT) platforms, the market maintains resilience through strategic integration of digital delivery mechanisms and the monetization of exclusive live content, particularly in regions where internet connectivity is still nascent or expensive.

TV and Radio Broadcasting Market introduction

The TV and Radio Broadcasting Market encompasses the generation, transmission, and distribution of audio and visual content to the public via terrestrial, satellite, cable, and IP networks. Products within this market include television programming, radio transmissions, and associated advertising and subscription services. Major applications span entertainment, news dissemination, sports coverage, educational programming, and public service announcements, serving billions of consumers globally. The core benefit of traditional broadcasting remains its wide-reaching, accessible platform, often serving as the primary source of information and cultural cohesion, especially in developing nations and during large-scale national events. Driving factors fueling the evolution of this sector include rapid advancements in digital compression and transmission standards (like ATSC 3.0 and DAB+), rising disposable income in Asia Pacific, and the critical need for seamless integration between linear broadcast content and digital on-demand consumption models. Furthermore, the persistent demand for high-quality, local content continues to anchor the traditional segments, ensuring relevance alongside streaming rivals. The market is currently characterized by a dual transformation: optimizing legacy infrastructure while simultaneously investing heavily in hybrid broadcasting solutions that merge linear scheduling with interactive digital elements.

TV and Radio Broadcasting Market Executive Summary

The TV and Radio Broadcasting Market is experiencing complex strategic shifts, dominated by the imperative to balance legacy revenue streams with aggressive digital transformation. Business trends indicate a consolidation phase, with major broadcasters acquiring technology providers and content production houses to secure intellectual property and distribution control across multiple platforms. This strategy aims to mitigate fragmentation caused by niche streaming services and establish comprehensive cross-platform monetization models, including Addressable TV advertising and programmatic radio ad insertion. Regionally, the Asia Pacific (APAC) market exhibits the highest growth potential, spurred by massive subscriber bases, increasing adoption of 4K broadcasting standards, and governmental prioritization of digital migration, contrasting with the more mature, but intensely competitive, markets of North America and Europe where cord-cutting remains a significant challenge. Segment trends highlight a noticeable pivot from solely subscription-based models toward hybrid Advertising-Supported Video On Demand (AVOD) and Free Ad-Supported Streaming Television (FAST) channels, particularly as consumers become fatigued by high cumulative subscription costs. The strongest growth segment is anticipated in IPTV and OTT delivery methods, even as terrestrial and satellite broadcasting remains essential infrastructure for maintaining high reach and delivering critical, real-time services like disaster warnings and major political events.

AI Impact Analysis on TV and Radio Broadcasting Market

Common user questions regarding AI's influence in broadcasting often center on job displacement in production and editing, the efficacy of AI-driven content recommendations, and the ethical implications of using deepfake technology in news reporting. Users are highly concerned about how AI will personalize advertising to an intrusive degree and whether AI can truly enhance creative storytelling or merely automate mundane tasks. The general expectation is that AI will revolutionize backend operations—such as traffic management, quality control, and predictive maintenance of transmission equipment—while cautiously optimizing front-end user experience through sophisticated content curation. Key themes consistently emerging include AI’s role in accelerating hyper-localization of content, automating closed captioning and multilingual dubbing, and optimizing spectral efficiency in radio frequency utilization, all aimed at reducing operational expenditure and enhancing viewer/listener engagement across fragmented digital environments.

- AI-Powered Content Personalization: Utilizing machine learning algorithms to analyze viewer data and dynamically adjust content recommendations, scheduling, and channel lineup for individual users, significantly enhancing engagement metrics.

- Automated Production Workflows: Implementing AI for tasks such as preliminary video editing, generating closed captions, optimizing audio levels, and automating graphics insertion, leading to faster turnaround times for news and live events.

- Enhanced Advertising Optimization: Employing AI-driven analytics for programmatic ad buying, real-time bidding, and precise addressable advertising on connected TV (CTV) platforms, maximizing ad revenue yield per impression.

- Predictive Maintenance and Network Optimization: Using AI to monitor transmission tower health, predict equipment failure, and dynamically manage broadcast bandwidth allocation, improving network reliability and reducing costly downtime.

- Generative AI for Scripting and Dubbing: Application of generative models to draft preliminary scripts for non-critical content or rapidly create localized voice-overs and synthetic narration, accelerating global content distribution.

- Fraud Detection and Content Moderation: AI tools deployed to automatically detect copyright infringement, manage user-generated content for compliance, and flag malicious or sensitive material broadcast live.

DRO & Impact Forces Of TV and Radio Broadcasting Market

The market dynamics of TV and Radio Broadcasting are shaped by complex interactions between foundational growth factors (Drivers), operational limitations (Restraints), avenues for future expansion (Opportunities), and external pressures (Impact Forces). Major drivers include the global increase in digital terrestrial television (DTT) migration mandates, the sustained demand for live sports rights, and the proliferation of low-cost receiving devices such as smart TVs and internet-enabled radios, which widen the reachable audience. Restraints are primarily rooted in intense competition from global OTT giants, persistent challenges related to signal piracy and unauthorized content sharing, and the substantial capital expenditure required for continuous infrastructure upgrades (e.g., transition to 5G broadcast capabilities and high-definition studios). Opportunities lie heavily in the monetization of niche content, leveraging hybrid broadcast-broadband technologies (HbbTV) for interactive services, and expanding penetration in emerging markets through affordable mobile broadcasting solutions. The combined impact forces—regulatory changes concerning spectrum allocation, shifts in consumer behavior toward non-linear viewing, and rapid technological convergence—compel market players to innovate aggressively or face obsolescence, making strategic agility paramount for survival and growth.

The shift towards cloud-based broadcasting infrastructure represents a significant opportunity, enabling scalability, disaster recovery capabilities, and remote production efficiencies that were previously unattainable with traditional, on-premise hardware setups. This operational shift lowers the barrier to entry for specialized content creators and allows established broadcasters to test new markets and content formats with reduced financial risk. However, the reliance on internet infrastructure and the associated cybersecurity threats pose a substantial restraint, demanding sophisticated investment in data protection protocols and network resilience, especially for live news and critical public service broadcasting. Furthermore, the fragmentation of content viewing across numerous platforms complicates audience measurement, restraining broadcasters' ability to provide standardized, compelling metrics to advertisers, thus impacting premium ad rates. Overcoming this measurement challenge through unified data platforms is a critical determinant of future revenue stability.

A key impact force is the evolving regulatory landscape, particularly regarding media ownership concentration and the preservation of net neutrality principles, which directly affects distribution costs and market access for smaller entities. The global harmonization of broadcast standards (or lack thereof) also dictates technology investment cycles. The market is driven technologically by the transition to IP-based production and distribution (SMPTE ST 2110 standards), allowing for highly flexible, software-defined operations. Conversely, the high cost and complexity of training legacy staff on these new IP workflows acts as a significant operational restraint. The long-term opportunity hinges on leveraging 5G and future wireless technologies to deliver seamless, high-quality mobile broadcast experiences (e.g., 5G Broadcast), bypassing traditional cellular congestion and providing a dedicated, efficient return path for interactive audience engagement.

Segmentation Analysis

The TV and Radio Broadcasting Market is intricately segmented based on technology type, revenue model, and application, reflecting the diverse ways content is produced and consumed globally. The segmentation by technology type, including terrestrial, satellite, and cable broadcasting, highlights the continuing reliance on established infrastructure for reach, contrasting sharply with the dynamic growth seen in IPTV and OTT streaming segments, which prioritize personalization and interactivity. Revenue models segmentation—spanning advertising, subscription fees, and hybrid approaches—is crucial for understanding monetization strategies, with an increasing trend towards blending subscription revenue with targeted advertising to maximize total yield. Application segmentation underscores the foundational role of broadcasting in delivering critical categories like entertainment, news, and sports, each possessing unique consumer demand elasticity and rights valuation structures. These segments are fundamentally influenced by regional internet penetration rates and consumer willingness to pay for premium, ad-free content, driving strategic differentiation among market players.

- By Type:

- Terrestrial Broadcasting (Analog and Digital DTT/DAB)

- Satellite Broadcasting (DTH)

- Cable Broadcasting

- Internet Protocol Television (IPTV)

- Over-the-Top (OTT) Streaming

- By Revenue Stream:

- Subscription Services (Pay-TV, Premium Radio)

- Advertising Revenue (Linear TV Ads, Radio Ads, Digital Ad Insertion)

- Hybrid (Subscription + Ad-Supported Tiers)

- License Fees and Government Grants

- By Application:

- Entertainment and General Programming

- News and Current Affairs

- Sports Broadcasting

- Educational and Public Service Broadcasting

- Religious Broadcasting

Value Chain Analysis For TV and Radio Broadcasting Market

The value chain for the TV and Radio Broadcasting Market is complex and highly integrated, moving sequentially from upstream content creation and production to midstream aggregation and distribution, culminating in downstream consumer consumption and monetization. Upstream analysis focuses on content intellectual property (IP) holders, production studios, and talent acquisition agencies, where high costs and competitive bidding for premium content, particularly live sports and major film rights, define the competitive landscape. Midstream activities involve the highly capital-intensive processes of signal aggregation, playout scheduling, encoding, compression, and transmission via satellite uplinks, terrestrial towers, or fiber optic networks; technological efficiency in this stage directly impacts quality and operational cost. Distribution channels are bifurcated into direct channels (owned platforms, self-managed websites, and proprietary apps) and indirect channels (distribution through third-party cable operators, DTH platforms, telcos offering IPTV bundles, and smart device manufacturers), necessitating sophisticated agreements and revenue-sharing models. The trend is moving towards convergence, where broadcasters increasingly bypass traditional intermediaries through direct-to-consumer (DTC) digital strategies, asserting greater control over pricing and audience data.

Upstream operations are increasingly seeing the impact of vertical integration, where major media conglomerates own both the production studios and the distribution outlets, securing content exclusivity and optimizing cross-platform promotion. The shift to remote production (REMI) utilizing cloud technologies is fundamentally restructuring the cost base of content creation, making production more agile and less dependent on centralized physical facilities. Downstream analysis focuses on the consumer interaction point, encompassing set-top boxes, smart TV applications, mobile devices, and traditional radio receivers. Monetization at this stage relies heavily on sophisticated Customer Relationship Management (CRM) systems to manage subscription billing, analyze viewing habits, and implement targeted advertising campaigns. Direct and indirect distribution channels often compete; for instance, a broadcaster might offer content directly via an app (direct) while also selling packaged access through a dominant cable provider (indirect). The optimization of the downstream user experience, focusing on low latency, seamless VOD integration, and high reliability, is key to retaining subscribers and attracting premium advertisers.

Furthermore, the maintenance and constant modernization of the transmission infrastructure form a critical midstream component. This includes managing complex spectrum licensing and complying with national broadcast standards. The transition from legacy analog systems to highly efficient digital standards necessitates massive coordinated investment. Indirect distribution, though sometimes reducing margins, offers immediate scale and access to established customer bases, particularly valuable in markets dominated by a few large telecom or cable providers. The profitability of the entire value chain is currently being measured not just by viewership numbers but by granular data points related to engagement, interactivity, and the effectiveness of addressable advertising campaigns, demanding deeper collaboration between content creators and ad tech providers.

TV and Radio Broadcasting Market Potential Customers

The primary customers of the TV and Radio Broadcasting Market are highly segmented, including individual consumers, commercial advertisers, and governmental or educational institutions. Individual end-users are the ultimate consumers of content, categorized based on their preferred access method: traditional linear viewers (relying on cable/satellite/terrestrial), and digital consumers (using IPTV/OTT). Their demand centers on exclusive, high-quality, and timely content, particularly live sports, breaking news, and popular serialized entertainment. Commercial advertisers represent the major revenue engine for the ad-supported segments, spanning fast-moving consumer goods (FMCG), automotive, finance, and pharmaceutical sectors; these customers require vast reach, verified audience metrics, and increasingly, precise demographic targeting capabilities offered by addressable TV and digital audio platforms. Governmental and public service organizations are crucial customers for public service broadcasting segments, relying on the infrastructure for critical communications, emergency alerts, and educational programming, often funded through license fees or public grants. The evolving customer profile requires broadcasters to become proficient in both mass marketing (for reach) and micro-targeting (for ad optimization).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Billion |

| Market Forecast in 2033 | USD 621.8 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Walt Disney Company, Comcast Corporation, Warner Bros. Discovery, Paramount Global, Sirius XM Holdings, iHeartMedia, British Broadcasting Corporation (BBC), RTL Group, Globo Comunicação e Participações S.A., Sony Corporation, Viacom18, Grupo Televisa, E. W. Scripps Company, Audacy Inc., Zee Entertainment Enterprises, Netflix Inc., Amazon (Prime Video/Freevee), Google (YouTube TV), Tencent Holdings, FOX Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

TV and Radio Broadcasting Market Key Technology Landscape

The technological landscape of TV and Radio Broadcasting is defined by a rapid migration from proprietary, hardware-centric systems to flexible, software-defined IP infrastructure, collectively known as Media over IP. Key technologies driving this transformation include SMPTE ST 2110 standards, which enable high-quality, uncompressed video and audio routing over standard IT networks, drastically reducing costs and enhancing interoperability in studio and production environments. Furthermore, the adoption of advanced digital broadcast standards such as ATSC 3.0 (NextGen TV) in North America and DVB-T2/S2 globally is enabling Ultra High Definition (UHD) transmission, personalized viewing, and integration of hybrid broadband services, allowing over-the-air signals to combine seamlessly with internet data for interactivity and targeted advertising. On the radio front, Digital Audio Broadcasting (DAB+) and HD Radio are replacing analog signals, offering superior audio quality and increased data services, though the integration of cloud radio and podcasting platforms is increasingly essential for retaining younger audiences.

Cloud-native architectures are foundational to modern broadcasting, allowing for scalable playout, content management, disaster recovery, and global distribution without geographic limitations imposed by physical hardware. Content Delivery Networks (CDNs) are critical for ensuring low latency and high reliability, especially for live streaming events over OTT platforms, where user experience is directly tied to connection quality. The convergence of broadcasting with telecommunications is accelerating with the testing and deployment of 5G Broadcast (or FeMBMS), which promises to utilize dedicated broadcast capabilities within the 5G standard to deliver highly efficient, one-to-many mobile video and radio services, bypassing the capacity constraints of traditional cellular unicast delivery. This technology is viewed as a significant countermeasure to cellular network overload during major events and provides a resilient, high-quality mobile viewing experience essential for future market growth.

Furthermore, data analytics and machine learning tools are now essential components of the technology stack, moving beyond simple viewership measurement to encompass predictive modeling of content success, real-time optimization of advertising inventory, and sophisticated piracy monitoring. Technologies like Blockchain are also emerging, particularly in trials aimed at streamlining rights management and transparent royalty payments across complex global distribution chains, addressing a persistent inefficiency in the industry. The competitive edge in the market is increasingly defined not by the sheer volume of content, but by the efficiency, resilience, and intelligence of the underlying technology stack used for content preparation, delivery, and monetization across heterogeneous consumer devices.

Regional Highlights

Regional dynamics heavily influence the trajectory of the TV and Radio Broadcasting Market, reflecting varying levels of infrastructural maturity, regulatory frameworks, and consumer viewing habits. North America, characterized by high cable penetration and fierce competition from established streaming giants, is undergoing massive transformation, focused intensely on monetizing connected TV (CTV) advertising inventory and rolling out ATSC 3.0 to revitalize over-the-air broadcasting. Europe presents a fragmented but technologically advanced market, where public service broadcasters remain strong and the adoption of Hybrid Broadcast Broadband TV (HbbTV) standards for interactive services is among the highest globally, facilitating seamless integration between linear and VOD services.

The Asia Pacific (APAC) region is projected to be the engine of growth, driven by burgeoning middle classes, rapid urbanization, and massive investment in digital infrastructure in countries like India, China, and Indonesia. While DTH (Direct-to-Home) satellite services dominate rural areas, urban centers are seeing explosive growth in mobile-first OTT consumption. Governments across APAC are actively promoting digital terrestrial migration, creating substantial demand for new transmission equipment and enabling services. In contrast, Latin America (LATAM) faces economic volatility but strong underlying demand for localized content and live sports, driving hybrid models where free-to-air broadcasting coexists with affordable, often ad-supported, pay-TV packages.

The Middle East and Africa (MEA) region is highly diverse. The Middle East benefits from high-value content rights acquisition, particularly in sports, and significant government investment in media hubs. Africa, while still relying heavily on cost-effective terrestrial and free-to-air satellite solutions, represents a massive long-term opportunity, particularly as mobile connectivity improves, facilitating the expansion of mobile broadcasting and digital radio platforms, which are crucial for immediate community access to information and education.

- North America: Focus on Addressable TV, ATSC 3.0 deployment, and consolidation among major media entities to compete with large technology firms entering content distribution.

- Europe: High adoption of HbbTV standards; strong regulatory emphasis on local content quotas; robust presence of public service broadcasting funded by license fees.

- Asia Pacific (APAC): Leading market in terms of subscriber growth and digital migration; massive consumer base for both DTH satellite and mobile OTT; intense competition for localized content rights.

- Latin America (LATAM): Market driven by demand for live football and localized telenovelas; challenges related to piracy and economic instability; growth centered on affordable pay-TV bundles and free ad-supported streaming.

- Middle East and Africa (MEA): Varied infrastructure maturity; significant investment in satellite broadcasting across MEA for high reach; increasing mobile radio and video consumption in developing African nations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the TV and Radio Broadcasting Market.- The Walt Disney Company

- Comcast Corporation

- Warner Bros. Discovery

- Paramount Global

- Sirius XM Holdings Inc.

- iHeartMedia Inc.

- British Broadcasting Corporation (BBC)

- RTL Group

- Globo Comunicação e Participações S.A.

- Sony Corporation

- Viacom18 (Joint Venture)

- Grupo Televisa S.A.B.

- E. W. Scripps Company

- Audacy Inc.

- Zee Entertainment Enterprises Ltd.

- Netflix Inc.

- Amazon (Prime Video/Freevee)

- Google (YouTube TV)

- Tencent Holdings Ltd.

- FOX Corporation

Frequently Asked Questions

Analyze common user questions about the TV and Radio Broadcasting market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth in the TV and Radio Broadcasting Market?

The primary driver is the global mandate for digital migration (e.g., DTT switchover) combined with the persistent, high demand for exclusive live content, particularly major sports events and breaking news, which still rely heavily on robust broadcast infrastructure for real-time, low-latency delivery to mass audiences.

How is Addressable TV advertising influencing revenue generation for broadcasters?

Addressable TV (ATV) allows broadcasters to serve different advertisements to specific households watching the same program, dramatically increasing the precision of ad targeting compared to traditional linear TV. This capability enhances advertiser ROI and allows broadcasters to compete more effectively with digital platforms for premium advertising budgets, thereby boosting average ad revenue yield.

What role does 5G Broadcast technology play in the future of the market?

5G Broadcast (FeMBMS) is anticipated to provide highly efficient, one-to-many content delivery directly to mobile devices, bypassing the need for cellular unicast and relieving network congestion. It promises superior quality, resilience, and scale for mobile viewing, positioning it as a key technology for enhancing mobile-first broadcasting services globally.

Which regional market segment is expected to show the fastest growth rate?

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is fueled by the region's massive, expanding middle class, rapid urbanization, significant government investment in digital infrastructure, and the dual growth in both DTH satellite and mobile OTT consumption.

What are the main restraints impacting traditional linear broadcasting segments?

The major restraints include intense consumer migration toward non-linear, on-demand Over-the-Top (OTT) streaming platforms, leading to "cord-cutting"; the high initial capital expenditure required for continuous infrastructure modernization (e.g., IP migration); and pervasive challenges related to content piracy and illegal distribution.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager