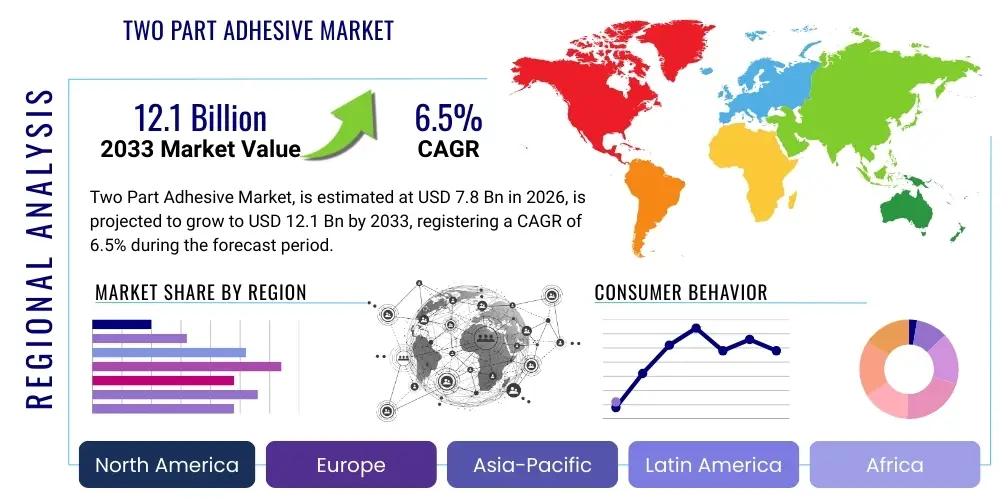

Two Part Adhesive Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434476 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Two Part Adhesive Market Size

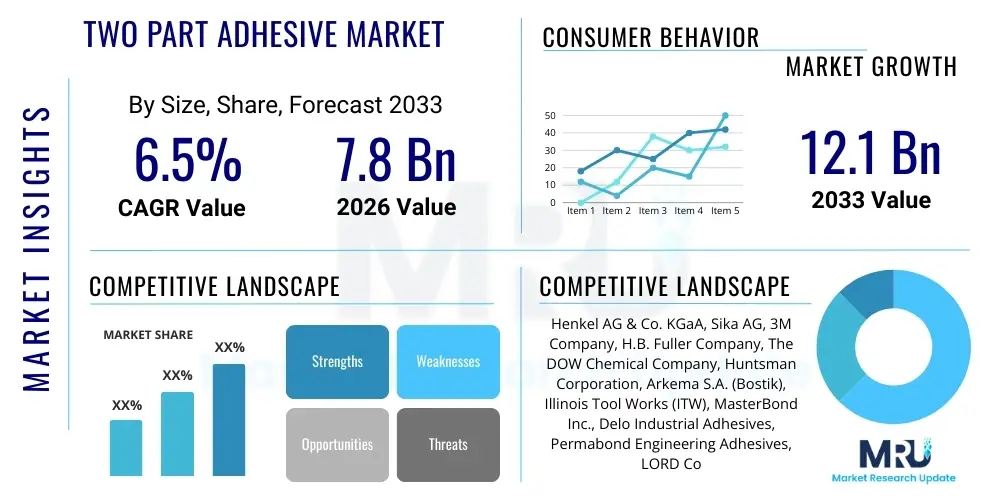

The Two Part Adhesive Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $7.8 billion in 2026 and is projected to reach $12.1 billion by the end of the forecast period in 2033. This substantial growth is primarily fueled by increasing demand from high-performance applications in the automotive, aerospace, and construction sectors, where superior bonding strength, durability, and resistance to environmental stressors are essential requirements.

Two Part Adhesive Market introduction

The Two Part Adhesive Market encompasses advanced bonding agents that require the mixing of two separate components—typically a resin and a hardener or activator—immediately before application to initiate a chemical curing process. This category includes high-strength formulations such as epoxies, polyurethanes, acrylics, and silicones. These adhesives offer significant advantages over traditional single-component systems, including superior structural integrity, gap-filling capabilities, excellent shear and peel strength, and the ability to bond diverse substrates like metals, plastics, composites, and ceramics. Their performance characteristics are crucial for sophisticated manufacturing processes across various industries.

Major applications for two-part adhesives span critical infrastructure and high-value manufacturing, including body-in-white assembly and structural component bonding in the automotive industry, lightweighting initiatives in aerospace, specialized sealing in electronics, and durable installation in building and construction. The immediate benefit of these systems lies in their controlled cure rate, which allows manufacturers to tailor processing times, and their high chemical resistance, ensuring long-term product reliability. The market is fundamentally driven by the accelerating trend towards material substitution, where lightweight composite materials are replacing heavier metals, necessitating highly effective and reliable joining solutions that cannot be achieved through mechanical fasteners or welding.

Two Part Adhesive Market Executive Summary

The Two Part Adhesive Market demonstrates robust growth driven by significant business trends focused on electrification and sustainability. The increasing adoption of electric vehicles (EVs) is generating massive demand for high-performance structural adhesives required for battery pack assembly, chassis bonding, and thermal management, necessitating specific two-part epoxy and polyurethane systems that withstand vibration and temperature extremes. Geographically, Asia Pacific dominates the market, propelled by rapid industrialization, expansion of the regional manufacturing base (especially in China and India), and surging infrastructure development, positioning it as the primary consumption and production hub globally.

Segment trends highlight the dominance of the epoxy resin type due to its unparalleled mechanical strength and versatility across aerospace and automotive applications. However, acrylics are witnessing the fastest growth rate, favored in quick assembly processes due to their rapid curing properties and ability to bond low surface energy plastics. End-use segmentation confirms the automotive sector as the leading consumer, consistently demanding higher volumes of structural adhesives to improve fuel efficiency and ensure safety. This continuous evolution requires manufacturers to invest heavily in R&D to develop non-isocyanate, low-VOC, and faster-curing adhesive systems that comply with stringent environmental regulations and streamline production cycles.

AI Impact Analysis on Two Part Adhesive Market

Common user questions regarding AI's impact on the Two Part Adhesive Market generally revolve around how artificial intelligence and machine learning (ML) can optimize complex formulation processes, predict adhesive performance under variable conditions, and enhance quality control in high-speed manufacturing environments. Users are particularly interested in AI's role in accelerating R&D cycles—specifically, predicting the optimal ratio of resin to hardener and the resulting mechanical properties (such as tensile strength or elongation) without extensive physical testing. The key themes summarized include the desire for predictive maintenance tools for dosing equipment, automated defect detection in bonded structures, and AI-driven recommendations for selecting the ideal adhesive system for novel material pairings, reducing waste, and ensuring compliance with strict industry standards like those in aerospace or medical device manufacturing.

- AI-driven Predictive Formulation: Utilizing machine learning algorithms to predict optimal resin and hardener ratios, improving cure kinetics, and customizing physical properties based on target application criteria, significantly reducing lab trial time.

- Automated Quality Control: Employing computer vision and AI for real-time inspection of bond lines, detecting voids, inconsistencies, or improper mixing during high-speed dispensing operations, thereby ensuring zero-defect manufacturing.

- Supply Chain Optimization: Using AI tools to predict demand fluctuations for raw materials (e.g., Bisphenol A or isocyanates) and manage complex global supply chains, optimizing inventory and mitigating risks associated with commodity price volatility.

- Enhanced Application Robotics: Integrating AI with robotic dispensing systems to dynamically adjust dispensing patterns, volume, and pressure based on real-time material flow characteristics and temperature variations, ensuring precision application consistency.

- Digital Twin Simulation: Creating virtual models of complex bonding processes to simulate long-term aging, fatigue, and environmental exposure effects on the adhesive joint before physical prototyping, accelerating product validation.

DRO & Impact Forces Of Two Part Adhesive Market

The dynamics of the Two Part Adhesive Market are shaped by powerful drivers and constraints, fundamentally governed by the transition across major end-use industries toward lightweight, durable materials and automated assembly. A primary driver is the accelerating substitution of traditional mechanical fastening methods (like rivets or welding) with structural adhesives, particularly in the automotive and aerospace sectors seeking to reduce vehicle weight for improved fuel efficiency and decreased carbon emissions. Concurrently, strict governmental regulations concerning volatile organic compounds (VOCs) and hazardous air pollutants (HAPs) serve as both a restraint and an opportunity, forcing manufacturers to innovate and develop environmentally sustainable formulations, such as non-isocyanate polyurethanes or low-VOC acrylics, increasing R&D costs but opening new market segments for green chemistries.

Opportunities in the market center on emerging technological needs, most notably in the rapid expansion of the renewable energy sector, specifically wind turbine blade manufacturing and solar panel assembly, which require robust adhesives resistant to extreme environmental conditions. However, a significant restraint is the complex handling and storage requirements of two-part systems, which necessitate precise metering, mixing, and dispensing equipment, adding complexity and initial capital expenditure for end-users compared to single-component alternatives. Moreover, the limited shelf life and the critical need for perfect stoichiometry (ratio mixing) can lead to application errors and subsequent joint failure if procedures are not strictly followed, posing a challenge for widespread adoption in less specialized environments.

The impact forces are substantial, particularly the high degree of raw material price volatility, specifically for petroleum derivatives like epoxies and polyurethanes, which directly affects profit margins. This force is mitigated somewhat by the high value-add nature of these specialty chemicals, where performance often outweighs cost concerns in critical applications. Technological advancements in mixing and dispensing equipment (e.g., dynamic mixing heads and automated robotic systems) act as a strong positive force, improving application consistency and reducing labor intensity, thereby overcoming the traditional barrier related to complexity of use. The combined effect of these forces suggests a sustained upward trajectory, heavily favoring innovative companies capable of delivering high-performance, compliant, and easy-to-integrate adhesive solutions.

Segmentation Analysis

The Two Part Adhesive Market is extensively segmented across multiple dimensions, including resin type, curing mechanism, end-use industry, and geography, providing a granular view of market dynamics and specialized demand pockets. The market structure is heavily influenced by the performance characteristics required by specific applications; for instance, the demand for high structural strength in aerospace dictates the use of advanced epoxy and polyurethane systems, whereas rapid production lines in electronics favor fast-curing acrylics and silicones. Understanding these segmentations is critical for market players developing targeted product lines and optimizing supply chain logistics to serve diverse global manufacturing bases effectively. The largest segments by volume typically align with general assembly applications, while segments focused on high-specification, niche uses (like medical devices or specialized industrial maintenance) command higher average selling prices (ASPs).

Resin type segmentation is pivotal, reflecting the core chemistry driving the adhesive properties. Epoxies currently hold the largest market share due to their widespread use across structural applications, offering exceptional chemical, heat, and moisture resistance alongside high tensile strength. However, polyurethanes are experiencing vigorous growth, driven by their flexibility, excellent peel strength, and superior performance in bonding plastics and composites, crucial for the evolving EV battery market. Acrylics provide a distinct competitive edge through rapid room-temperature curing, making them indispensable in applications where speed is paramount, such as sign manufacturing and general assembly. The careful balancing of these chemical attributes against regulatory constraints and cost considerations determines the growth trajectory of each major segment.

- Resin Type:

- Epoxy

- Polyurethane

- Acrylic

- Silicone

- Others (e.g., Polysulfides, Phenolics)

- End-Use Industry:

- Automotive and Transportation

- Aerospace and Defense

- Construction and Infrastructure

- Electronics and Electrical

- Medical Devices

- Marine

- General Industrial

- Application Method:

- Manual

- Automated Dispensing (Robotic)

- Curing Mechanism:

- Room Temperature Curing

- Heat Curing

Value Chain Analysis For Two Part Adhesive Market

The value chain for the Two Part Adhesive Market commences with the upstream extraction and refinement of petrochemicals, which serve as the primary source for key raw materials such as bisphenol A (for epoxies), polyols and isocyanates (for polyurethanes), and various methacrylates (for acrylics). This stage involves complex chemical synthesis and processing, making the market highly sensitive to global oil prices and the supply capacity of major chemical producers. Upstream analysis focuses heavily on securing stable, high-quality material streams and mitigating risks associated with supply bottlenecks or regulatory changes affecting core chemical building blocks, such as REACH regulations impacting certain components in Europe. Manufacturing and formulation represent the critical value-add stage, where specialized chemical companies blend these raw materials with fillers, plasticizers, and proprietary additives to achieve specific performance metrics like viscosity, cure speed, and temperature resistance, demanding significant intellectual property and technical expertise.

The downstream component involves complex distribution and application. Products move from manufacturers through specialized distributors who often provide technical support and tailored solutions to end-users, especially those requiring precise dispensing equipment calibration. Direct distribution channels are typically employed for large-volume customers, such as major automotive OEMs or aerospace manufacturers, ensuring direct technical consultation and bulk delivery. Indirect channels, utilizing regional specialty chemical distributors, serve smaller enterprises and general industrial users. The final stage involves the application process itself, where precision equipment and trained personnel are necessary to ensure the components are mixed accurately (stoichiometry) and cured correctly to achieve the intended bond strength, underlining the importance of technical service within the value chain.

Key profit pools are concentrated in the specialized formulation and proprietary additive segments, where differentiation based on performance (e.g., heat dissipation, impact resistance) allows for higher margins. The value chain is becoming increasingly digitized, with suppliers focusing on providing integration guidance for automated dispensing systems, solidifying their position not just as chemical suppliers but as partners in the end-user's manufacturing process. Efficiency in logistics and the ability to navigate stringent cross-border chemical transportation regulations are also crucial components contributing to overall value delivery and market competitiveness.

Two Part Adhesive Market Potential Customers

The primary consumers and end-users of two-part adhesives are concentrated in manufacturing sectors where structural integrity, durability, and lightweighting are non-negotiable requirements. The automotive and transportation sector stands as the largest buyer, using these adhesives extensively for body structure bonding, hood and trunk lid assemblies, interior component attachment, and crucially, in the structural encapsulation and mounting of lithium-ion batteries in electric vehicles. These customers demand adhesives that offer high crash safety performance, excellent resistance to fluids, and fast curing times compatible with high-volume production lines.

Another major segment comprises the aerospace and defense industry, which relies heavily on advanced two-part epoxies and polyurethanes for bonding composite materials in aircraft structures, rotor blades, and interiors. The emphasis here is on ultra-high performance, fatigue resistance, and compliance with rigorous fire safety and material specification standards (e.g., AMS specifications). Beyond these high-profile industries, the construction sector represents a steadily growing customer base, utilizing these robust systems for civil engineering repairs, concrete anchoring, road maintenance, and bonding large structural elements in prefabricated building systems, where the ability to cure reliably in varied environmental conditions is highly valued.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7.8 billion |

| Market Forecast in 2033 | $12.1 billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Henkel AG & Co. KGaA, Sika AG, 3M Company, H.B. Fuller Company, The DOW Chemical Company, Huntsman Corporation, Arkema S.A. (Bostik), Illinois Tool Works (ITW), MasterBond Inc., Delo Industrial Adhesives, Permabond Engineering Adhesives, LORD Corporation (Parker Hannifin), Dymax Corporation, Parson Adhesives, Mapei S.p.A., Franklin International, Aremco Products, Cyberbond LLC, KPM Group, Cemedine Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Two Part Adhesive Market Key Technology Landscape

The technological landscape of the Two Part Adhesive Market is characterized by continuous innovation focused on enhancing performance, improving sustainability, and streamlining the application process. A critical area of development is the shift towards specialized structural bonding technologies tailored for composite and multi-material substrates, which are increasingly prevalent in electric vehicles and modern aircraft. This requires the development of toughened epoxy and acrylic systems that can manage differential thermal expansion between dissimilar materials while maintaining high impact and fatigue resistance. Furthermore, advancements in nano-filler technology are enabling manufacturers to improve adhesive properties, such as thermal conductivity (critical for EV battery thermal management) and fracture toughness, without sacrificing viscosity control or handling ease.

Application technology represents another significant area of focus. Manufacturers are integrating advanced, highly accurate metering, mixing, and dispensing (MMD) equipment to address the complexity of two-part systems. Key innovations include volumetric piston pumps and gear metering systems coupled with sophisticated process control software to ensure the precise stoichiometry required for optimal curing. The adoption of robotic dispensing cells, often integrated with quality inspection sensors (as discussed in the AI analysis), is becoming standard practice in high-volume industries, reducing human error and maximizing throughput. These systems are crucial because slight variations in mixing ratios can lead to uncured material, inadequate strength, or premature joint failure.

In terms of chemistry, a major technological thrust is the development of environmentally conscious formulations. This includes the commercialization of bio-based epoxies derived from natural sources and the formulation of non-isocyanate polyurethane (NIPU) systems to replace traditional PU adhesives, thereby mitigating health risks associated with isocyanates. Furthermore, rapid-cure technologies, especially in structural acrylics, are being refined to allow for fixture times measured in seconds while still providing robust structural strength. This technological push is essential for meeting both the regulatory demand for safer chemistries and the industrial requirement for faster, more efficient production lines.

Regional Highlights

- Asia Pacific (APAC) stands as the dominant and fastest-growing region in the Two Part Adhesive Market. This leadership is attributed to massive industrial growth, particularly in China, India, Japan, and South Korea, which host vast manufacturing bases for automotive production, electronics, and infrastructure development. The high volume of production, coupled with government investment in urbanization and renewable energy projects (especially wind energy, which uses large volumes of epoxy adhesives), drives continuous demand. The shift towards manufacturing lightweight electronics and the expansion of the regional electric vehicle supply chain further solidifies APAC's market position, consuming both structural epoxies and high-performance polyurethanes at an unparalleled rate.

- North America (NA) represents a mature market characterized by high innovation and stringent performance requirements, driven primarily by the aerospace & defense and the sophisticated automotive sectors. The region is a pioneer in advanced composite bonding techniques and holds a significant market share due to the early adoption of high-performance adhesives for mission-critical applications. The increasing focus on domestic EV production and battery manufacturing dictates a strong and growing need for specialty two-part systems, particularly those adhering to complex safety and longevity standards. Regulatory compliance (e.g., VOC limitations) also pushes regional companies to lead the adoption of sustainable adhesive technologies.

- Europe is characterized by strong regulatory mandates and a high degree of integration between adhesive suppliers and major automotive and construction firms. Key markets like Germany, France, and the UK are leaders in high-end manufacturing and sustainable building practices. The European Union’s push toward circular economy models and rigorous environmental standards, such as REACH, significantly influences product development, driving demand for advanced, low-emission, non-hazardous two-part systems. The regional market growth is steady, bolstered by investments in civil infrastructure repair and maintenance, requiring durable and long-lasting epoxy and acrylic solutions.

- Latin America (LA) exhibits moderate growth, largely dependent on infrastructure investments and the local automotive assembly sector, particularly in Brazil and Mexico. The market is often price-sensitive, leading to a greater reliance on general-purpose two-part adhesives, though increasing foreign direct investment in manufacturing is gradually increasing the demand for higher-specification, structural bonding solutions.

- Middle East and Africa (MEA) shows emerging potential, fueled primarily by large-scale construction projects, particularly in the Gulf Cooperation Council (GCC) states. The demand is concentrated in specialized construction adhesives for high-stress applications and the repair/maintenance of critical oil and gas infrastructure, where resistance to harsh environmental conditions (high heat, humidity) is paramount. The region’s reliance on imports means market growth is often tied to global chemical pricing and localized project timelines.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Two Part Adhesive Market.- Henkel AG & Co. KGaA

- Sika AG

- 3M Company

- H.B. Fuller Company

- The DOW Chemical Company

- Huntsman Corporation

- Arkema S.A. (Bostik)

- Illinois Tool Works (ITW)

- MasterBond Inc.

- Delo Industrial Adhesives

- Permabond Engineering Adhesives

- LORD Corporation (Parker Hannifin)

- Dymax Corporation

- Parson Adhesives

- Mapei S.p.A.

- Franklin International

- Aremco Products

- Cyberbond LLC

- KPM Group

- Cemedine Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Two Part Adhesive market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of two-part adhesives over single-part systems?

Two-part adhesives offer superior strength, durability, and better gap-filling capabilities because the curing process is initiated by a precise chemical reaction upon mixing, rather than relying on external factors like moisture, heat, or UV light. This controlled cure allows for faster, more reliable structural bonding across diverse substrates, essential for high-stress applications.

Which two-part adhesive resin type is most suitable for high-strength automotive structural bonding?

Two-part epoxy adhesives, specifically toughened epoxies, are typically preferred for high-strength automotive structural bonding, including body-in-white and battery assembly. They provide exceptional shear and tensile strength, excellent fatigue resistance, and chemical stability required to meet stringent crash safety and longevity standards in modern vehicles.

How does the rising electric vehicle (EV) market influence demand for two-part adhesives?

The EV market significantly boosts demand for two-part adhesives, primarily polyurethanes and epoxies, needed for structural battery pack assembly, cell-to-module bonding, and thermal management. These adhesives are critical for ensuring the structural integrity, thermal dissipation, and safety of the battery system, supporting the industry's lightweighting and performance goals.

What are the key application challenges associated with using two-part adhesive systems?

Key application challenges include the necessity for extremely precise metering and mixing (stoichiometry) to ensure a complete cure, the requirement for specialized and often expensive dispensing equipment, and the limited pot life once the components are mixed, necessitating efficient application before the adhesive sets.

What role do acrylic two-part adhesives play in the broader market?

Acrylic two-part adhesives are crucial for applications requiring very rapid cure speeds (often minutes or seconds) and effective bonding of low surface energy plastics, metals, and composites without extensive surface preparation. They are widely used in signage, general assembly, and applications where fast throughput and high impact resistance are needed.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager