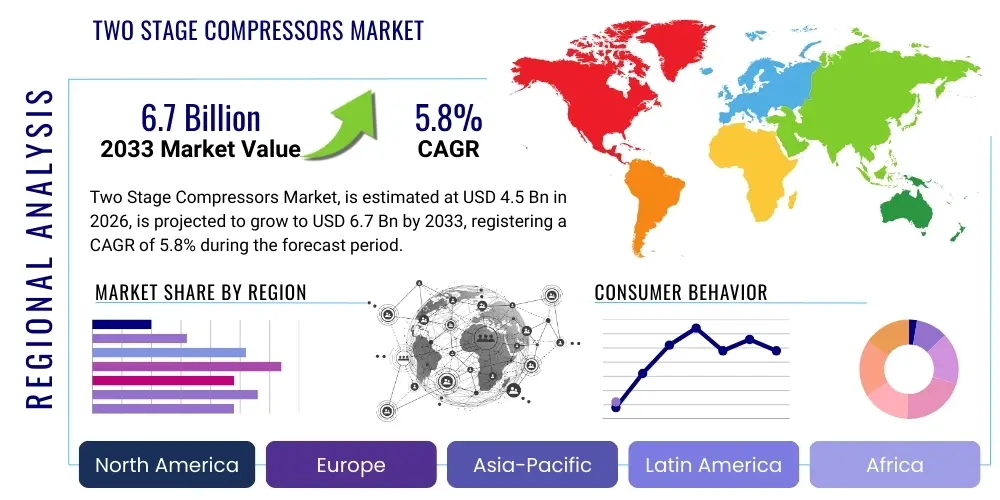

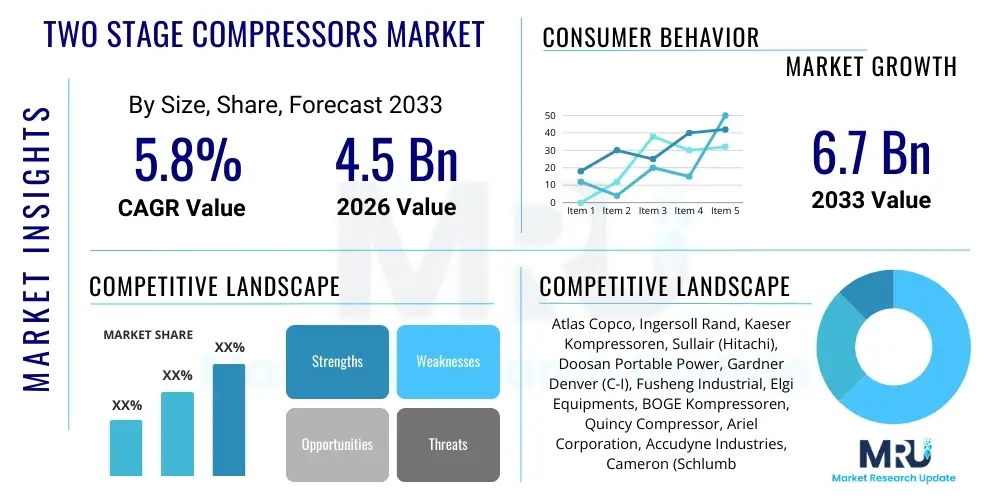

Two Stage Compressors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437349 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Two Stage Compressors Market Size

The Two Stage Compressors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Two Stage Compressors Market introduction

The Two Stage Compressors Market encompasses devices designed to compress air or gas through two sequential compression stages, significantly increasing efficiency and achieving higher pressure ratios compared to single-stage units. These compressors utilize an intercooler positioned between the stages to reduce the temperature of the air, thereby decreasing the volume and minimizing the required power input for the second stage. This inherent design advantage translates directly into substantial energy savings and extended operational life, making them crucial across numerous industrial applications where continuous, high-pressure air supply is non-negotiable.

The primary applications of two stage compressors span across heavily industrialized sectors such as manufacturing, oil and gas, automotive, food and beverage processing, and construction. In manufacturing, they power pneumatic tools and complex automated machinery, while in the oil and gas sector, they are vital for processes like gas lifting and pipeline transportation. The inherent benefit lies in their superior thermal management and reduced strain on components, which provides enhanced reliability and lower total cost of ownership (TCO). Furthermore, the ability to deliver clean, consistent high-pressure air supports specialized industrial processes, including precision engineering and sophisticated painting applications.

Market growth is predominantly driven by the accelerating pace of global industrialization, particularly in emerging economies, coupled with stringent environmental regulations mandating energy-efficient equipment. Industries are increasingly replacing outdated single-stage units with two-stage systems to comply with energy conservation standards and reduce operational expenditure. The robust performance and durability of these compressors ensure consistent output in demanding environments, solidifying their status as essential infrastructure components for modern, large-scale industrial operations focusing on sustainability and high throughput.

Two Stage Compressors Market Executive Summary

The Two Stage Compressors Market is experiencing robust expansion, primarily fueled by the global emphasis on energy efficiency and the rapid expansion of heavy manufacturing and infrastructure development. Key business trends indicate a strong move toward variable speed drive (VSD) technology integration within two-stage systems, optimizing energy consumption based on fluctuating demand and significantly improving overall system efficiency. Furthermore, there is a distinct competitive trend focusing on developing smaller footprint, yet higher capacity, oil-free two-stage compressors, addressing the strict quality requirements of sensitive industries like pharmaceuticals and electronics manufacturing, alongside continued efforts in digitalization for predictive maintenance.

Regionally, Asia Pacific remains the dominant growth engine, driven by massive industrial capacity expansion in China, India, and Southeast Asian nations, where government initiatives support rapid urbanization and the establishment of new manufacturing hubs requiring high-performance compressed air infrastructure. North America and Europe, characterized by mature industrial bases, focus intensely on the replacement market and technological upgrades, emphasizing IoT connectivity and compliance with rigorous energy efficiency standards like ISO 50001. The Middle East and Africa (MEA) are showing promising growth, particularly in the burgeoning oil, gas, and petrochemical sectors.

Segment trends highlight the dominance of the stationary compressor type due to its application in large-scale, permanent industrial settings. Within technology, the reciprocating (piston) segment maintains a strong historical position, but the screw compressor segment is rapidly gaining market share owing to its continuous duty cycle capability and superior energy performance in high-volume applications. The end-user analysis confirms the overwhelming demand originating from the manufacturing, automotive, and chemical industries, with a noticeable increasing penetration into the wastewater treatment and food processing sectors due to the availability of specialized oil-free solutions.

AI Impact Analysis on Two Stage Compressors Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Two Stage Compressors Market frequently center around three main themes: predictive maintenance effectiveness, optimization of compressor fleet efficiency, and the integration of smart control systems. Users are keen to understand how AI-driven analytics can mitigate unplanned downtime, which is costly in large industrial settings, and how machine learning algorithms can dynamically adjust compressor parameters (like pressure settings and intercooler performance) in real-time based on fluctuating production needs. Concerns also revolve around the cybersecurity risks associated with integrating networked, AI-enabled control units into critical infrastructure. The primary expectation is that AI will transform compressors from reactive pieces of equipment into fully autonomous, self-optimizing energy centers, guaranteeing maximum uptime and minimal energy waste.

AI's initial impact is most profound in the realm of asset performance management (APM). By analyzing vast datasets generated by embedded sensors (vibration, temperature, pressure, current draw), AI algorithms can detect subtle anomalies far earlier than conventional monitoring systems. This capability shifts maintenance strategies from time-based or reactive approaches to highly precise, condition-based predictive actions, extending the lifespan of critical components such as pistons, valves, and rotors, thereby maximizing the return on investment for high-capital equipment like two-stage compressors. This ensures the complex interaction between the two compression stages and the intercooler remains optimized for efficiency.

Furthermore, AI is instrumental in energy management within large industrial facilities utilizing multiple compressors. Machine learning models can predict future air demand based on production schedules, weather patterns, and historical data, allowing the central control system to stage the operation of multiple compressors optimally, reducing idling time and minimizing peak energy loads. This algorithmic optimization of load/unload cycles and sequencing is critical for two-stage units, as optimizing the intercooling process directly correlates with significant energy savings. The integration of advanced diagnostics through AI is thus essential for maintaining the market competitiveness and operational excellence of these complex systems.

- AI-driven predictive maintenance drastically reduces unplanned downtime by analyzing vibration and thermal signatures.

- Real-time operational optimization using machine learning minimizes energy consumption by dynamically adjusting load and pressure settings.

- Enhanced diagnostics capabilities improve troubleshooting accuracy and speed for intercooler efficiency and valve performance.

- Facilitation of digital twins allows for virtual testing of operational scenarios and configuration changes before physical implementation.

- AI-enabled sequencing control of multiple compressor units ensures efficient load balancing across the entire compressed air network.

- Automated fault detection and classification reduce reliance on manual inspections and specialized engineering expertise.

DRO & Impact Forces Of Two Stage Compressors Market

The dynamics of the Two Stage Compressors Market are shaped by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and internal/external Impact Forces. The primary driver is the accelerating global imperative for energy conservation, making the inherent efficiency of two-stage compression systems—which achieve greater volumetric efficiency and reduced heat load through intercooling—highly desirable. Conversely, the market faces restraints primarily related to the higher initial capital expenditure (CapEx) associated with two-stage units compared to simpler single-stage alternatives, particularly for small and medium-sized enterprises (SMEs). Opportunities are vast, focused largely on technological advancements such as IoT integration, enabling predictive maintenance, and the surging demand for oil-free solutions in high-purity applications.

A significant Impact Force influencing the market is the regulatory environment, particularly stringent energy efficiency standards established by bodies like the Department of Energy (DOE) and regional directives in the EU. These standards act as a potent driver, forcing end-users to upgrade to high-efficiency two-stage compressors to remain compliant and avoid penalties. Another major force is the volatility of energy prices; when electricity costs rise, the payback period for investing in energy-efficient two-stage technology shortens considerably, accelerating adoption. The inherent complexity of two-stage systems, requiring specialized maintenance, acts as a moderate restraint, countered by the industry's shift towards condition monitoring and remote diagnostic services.

Furthermore, the competitive landscape is intensely focused on innovation, particularly in materials science and rotor geometry, to enhance efficiency and reliability. The growing trend toward modular and containerized compressor solutions represents a compelling opportunity, especially for remote or temporary industrial sites in the construction and oil & gas sectors, offering quick deployment and ease of scalability. Restraints also include global supply chain disruptions impacting the timely delivery of specialized components, though strategic sourcing and regional manufacturing efforts by major players are mitigating this effect. Overall, the powerful demand for superior energy performance outweighs the initial cost hurdles, propelling sustained market growth throughout the forecast period.

- Drivers:

- Growing demand for superior energy efficiency and lower operational costs in heavy industries.

- Expansion of manufacturing, automotive, and chemical industries globally, necessitating higher pressure air supply.

- Technological advancements in Variable Speed Drive (VSD) integration for optimized power usage.

- Strict global environmental regulations mandating reduced energy consumption in industrial equipment.

- Restraints:

- Higher initial capital investment and complexity compared to single-stage compressors.

- Requirement for specialized maintenance and repair due to complex internal components (e.g., intercoolers).

- Perceived technical overkill for small-scale applications that do not require extremely high pressures.

- Opportunities:

- Increasing adoption of oil-free two-stage compressors in sensitive sectors like food, beverage, and pharmaceuticals.

- Integration of IoT, AI, and smart monitoring systems for predictive maintenance and remote operation.

- Untapped potential in emerging economies undergoing rapid industrialization and infrastructure buildup.

- Impact Forces:

- Regulatory Force: Stringent energy efficiency mandates (e.g., DOE standards) accelerate replacement cycles.

- Economic Force: Fluctuations in electricity prices directly influence the return on investment (ROI) of efficient units.

- Technological Force: Ongoing innovation in air end design and material science improves longevity and performance.

- Competitive Force: Price wars and specialization focus in niche markets (e.g., portable high-pressure systems).

Segmentation Analysis

The Two Stage Compressors Market is systematically segmented based on Type, Technology, Lubrication Method, and End-User Industry to provide a granular understanding of demand patterns and market penetration. This segmentation highlights the distinct requirements of various industrial applications, ranging from the need for continuous, oil-lubricated high pressure in heavy manufacturing to the specialized necessity for absolutely oil-free, contaminant-proof air in food processing. The segment analysis confirms that industrial applications demanding high volumes of compressed air for extended, continuous periods heavily favor two-stage configurations, prioritizing efficiency and operational reliability above all else.

The analysis reveals significant disparity in growth rates across segments. While the traditional reciprocating technology remains a staple in specialized high-pressure niche markets, the twin-screw technology segment dominates in terms of overall market share and revenue growth, attributed to its continuous duty capability and superior performance metrics in demanding industrial environments. Furthermore, the stationary compressor segment maintains a substantial lead over portable units, reflecting the heavy reliance of established industrial facilities on fixed, powerful compressed air infrastructure. This detailed breakdown aids market participants in tailoring their product offerings and strategic investments toward the most lucrative and rapidly evolving segments, such as oil-free screw compressors for critical applications.

Geographic segmentation is also paramount, with APAC driving volume growth due to factory floor expansion, while North America and Europe lead in terms of technology adoption and the replacement cycle for energy-efficient models. Understanding these segment dynamics is critical for manufacturers to optimize their distribution channels, develop region-specific marketing strategies, and allocate R&D resources effectively, particularly into enhancing smart monitoring capabilities and reducing the total cost of ownership across all technology types.

- By Type:

- Stationary Two Stage Compressors

- Portable Two Stage Compressors

- By Technology:

- Reciprocating (Piston) Two Stage Compressors

- Rotary Screw Two Stage Compressors

- Centrifugal Two Stage Compressors

- By Lubrication Method:

- Oil-Lubricated Two Stage Compressors

- Oil-Free Two Stage Compressors

- By End-User Industry:

- Manufacturing (General and Heavy)

- Oil and Gas

- Automotive

- Chemical and Petrochemical

- Food and Beverage

- Pharmaceuticals and Healthcare

- Construction and Mining

Value Chain Analysis For Two Stage Compressors Market

The value chain for the Two Stage Compressors Market is complex, beginning with raw material procurement (metals, advanced composites, electronics) and extending through design, manufacturing, distribution, and critical aftermarket services. The upstream analysis focuses heavily on the sourcing of high-quality components, particularly specialized air ends (rotors and pistons), intercoolers, and high-precision bearings, where proprietary technology and material expertise determine product performance and longevity. Suppliers of high-efficiency electric motors and variable speed drive (VSD) systems hold significant bargaining power, as these components directly dictate the energy efficiency of the final product, which is a major purchasing criterion for end-users.

Midstream activities involve sophisticated manufacturing and assembly. Major manufacturers invest heavily in lean production techniques and rigorous quality control to ensure the reliable operation of the two-stage process. Strategic integration, where companies manufacture core components in-house (like air ends), is common to protect intellectual property and maintain quality consistency. The key differentiation here lies in engineering expertise related to thermal management (intercooler design) and noise reduction, optimizing the compact yet powerful systems required by modern factories. This stage transforms raw components into reliable, high-performance capital equipment.

Downstream analysis highlights the vital role of distribution channels. Due to the high cost and technical complexity of two-stage compressors, sales primarily occur through specialized industrial distributors, authorized dealers, and direct sales teams supported by skilled application engineers. Direct and indirect channels are strategically employed: large, custom projects (like petrochemical plants) often involve direct manufacturer engagement, while standard industrial models are sold through extensive dealer networks capable of providing immediate local installation and, crucially, long-term aftermarket support. The aftermarket, including genuine spare parts, specialized lubricants, and continuous service contracts (often incorporating IoT/AI monitoring), represents a high-margin revenue stream and is critical for ensuring customer loyalty and product uptime.

Two Stage Compressors Market Potential Customers

Potential customers for two stage compressors are predominantly large-scale industrial operators requiring a consistent, high volume of pressurized air or gas at superior efficiencies over extended operating hours. The core buyer segments include heavy manufacturing plants, particularly those involved in metal fabrication, large-scale assembly, and durable goods production, where pneumatic machinery demands reliable, high-pressure output to maintain production quotas. These customers prioritize operational reliability, energy efficiency ratings (kW/cfm), and low total cost of ownership (TCO), making the initial investment in higher-cost two-stage units justifiable through energy savings.

Another crucial customer segment is the oil and gas industry, encompassing upstream drilling, midstream pipeline operations (gas boosting and transmission), and downstream petrochemical processing. These environments require specialized, often explosion-proof, two-stage compressors capable of handling extreme pressures and various gases beyond standard air. Similarly, the construction and mining sectors, particularly for large infrastructure projects, utilize heavy-duty portable two-stage compressors for running large pneumatic drills and heavy machinery, valuing robustness and high capacity delivery in harsh, remote conditions.

Finally, purity-sensitive industries—Food & Beverage, Pharmaceuticals, and Electronics manufacturing—represent a rapidly expanding customer base. These sectors specifically require oil-free two-stage technology to eliminate the risk of product contamination. Their purchasing decisions are heavily influenced by ISO 8573-1 air quality certification standards, demanding suppliers that can guarantee zero oil carryover, even in the second stage of compression. These high-value customers often require sophisticated monitoring and validation systems integrated into the compressor package.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Atlas Copco, Ingersoll Rand, Kaeser Kompressoren, Sullair (Hitachi), Doosan Portable Power, Gardner Denver (C-I), Fusheng Industrial, Elgi Equipments, BOGE Kompressoren, Quincy Compressor, Ariel Corporation, Accudyne Industries, Cameron (Schlumberger), Bauer Kompressoren, Kobelco Compressors, Mitsubishi Heavy Industries, MAN Energy Solutions, Mayekawa Mfg. Co. Ltd., GE Oil & Gas, and Siemens Energy. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Two Stage Compressors Market Key Technology Landscape

The core technology landscape for two stage compressors revolves around enhancing energy transfer efficiency, maximizing cooling effectiveness, and reducing operational noise and vibration. The most significant technological advancements are centered on optimizing the air end design, particularly in rotary screw compressors, where asymmetric rotor profiles and improved coatings minimize internal leakage (slip) and friction losses across both stages. The precision required for these air ends, which dictates the volumetric efficiency, demands sophisticated computer numerical control (CNC) machining and robust material selection to withstand continuous high-temperature and high-pressure operation over decades.

A crucial differentiator is the intercooler technology placed between the low-pressure (LP) and high-pressure (HP) stages. Modern two-stage compressors utilize high-efficiency plate or shell-and-tube heat exchangers to rapidly dissipate the heat generated during the initial compression stage. Effective intercooling significantly reduces the air volume before the second stage, leading to substantial power savings—the defining characteristic of two-stage efficiency. Innovation is focused on developing corrosion-resistant materials and smart flow designs that maintain high heat exchange rates while minimizing pressure drop across the cooling unit, ensuring maximum efficiency is preserved throughout the operational lifecycle.

Furthermore, the integration of smart control systems, specifically Variable Speed Drive (VSD) technology, is now standard for premium two-stage systems. VSDs adjust the motor speed to precisely match fluctuating air demand, preventing the wasteful pressure band cycling and idling associated with fixed-speed compressors. Coupled with VSDs are advanced PLC (Programmable Logic Controller) systems and integrated sensors, which monitor operational parameters (pressure, temperature, vibration, energy draw) in real-time. This technological synergy enables highly efficient operation, supports sophisticated diagnostic capabilities, and prepares the equipment for seamless integration into wider industrial IoT and AI-driven maintenance platforms, positioning the market for long-term sustainable growth.

Regional Highlights

- Asia Pacific (APAC): APAC is the fastest-growing and largest regional market, driven by massive investments in manufacturing, infrastructure, and heavy industrialization across China, India, and Southeast Asia. The region’s focus is on installing new capacity, with strong demand for high-capacity rotary screw two-stage compressors to support the scaling automotive, electronics, and textile industries. Government initiatives promoting domestic manufacturing and foreign direct investment further solidify APAC's dominance in volume consumption.

- North America: This region is characterized by high adoption of advanced, energy-efficient technologies, particularly oil-free and VSD-equipped two-stage compressors. The market is primarily driven by replacement cycles, modernization efforts in the oil & gas and chemical processing sectors, and stringent energy efficiency regulations. High operational costs incentivize rapid adoption of systems with the lowest total cost of ownership (TCO), ensuring North America remains a key market for premium, digitally integrated products.

- Europe: Europe exhibits strong demand for high-purity, oil-free two-stage compressors, fueled by the highly regulated food & beverage and pharmaceutical industries. The EU's strict Ecodesign requirements push manufacturers toward innovation in maximum energy efficiency. Germany, Italy, and the UK are major consumers, emphasizing quality, longevity, and connectivity (Industry 4.0 integration) in their procurement decisions for both reciprocating and rotary screw technologies.

- Latin America (LATAM): Growth in LATAM is closely linked to the recovery and expansion of the mining, petrochemical, and foundational manufacturing sectors in Brazil and Mexico. The demand is currently focused on robust, easy-to-maintain oil-lubricated two-stage compressors suitable for intermittent power supply and challenging industrial environments. Investment in new infrastructure projects is expected to significantly boost the portable compressor segment.

- Middle East and Africa (MEA): The MEA market is heavily influenced by large-scale upstream and downstream oil and gas projects in Saudi Arabia, UAE, and Qatar. There is a strong, sustained demand for heavy-duty, customized centrifugal and reciprocating two-stage compressors for gas compression and pipeline duties. Infrastructure development and expanding industrial estates in South Africa and the UAE are also contributing factors, demanding reliable and ruggedized equipment designed to withstand extreme ambient temperatures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Two Stage Compressors Market.- Atlas Copco

- Ingersoll Rand

- Kaeser Kompressoren

- Sullair (Hitachi)

- Doosan Portable Power

- Gardner Denver (C-I)

- Fusheng Industrial

- Elgi Equipments

- BOGE Kompressoren

- Quincy Compressor

- Ariel Corporation

- Accudyne Industries

- Cameron (Schlumberger)

- Bauer Kompressoren

- Kobelco Compressors

- Mitsubishi Heavy Industries

- MAN Energy Solutions

- Mayekawa Mfg. Co. Ltd.

- GE Oil & Gas

- Siemens Energy

Frequently Asked Questions

Analyze common user questions about the Two Stage Compressors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of a two stage compressor over a single stage unit?

The primary advantage is superior energy efficiency and higher pressure output, achieved by utilizing an intercooler between the two compression stages. Intercooling significantly reduces the air temperature, decreasing the power required for the second stage, resulting in less operational heat and longer component life.

Which technology segment dominates the Two Stage Compressors Market?

The Rotary Screw Two Stage Compressor technology segment holds the largest market share, driven by its suitability for continuous, heavy-duty industrial applications requiring consistent, high-volume air delivery with excellent energy performance and minimal maintenance downtime.

How does AI impact the maintenance cycle of two stage compressors?

AI enables predictive maintenance by analyzing real-time sensor data (vibration, temperature, pressure). This allows operators to anticipate mechanical failures, optimize component replacement schedules, and minimize costly unplanned outages, thereby maximizing operational uptime and efficiency.

Which end-user industries are driving the demand for oil-free two stage compressors?

The Food and Beverage, Pharmaceutical, and Electronics manufacturing industries are the key drivers for oil-free solutions. These sectors require air quality certified to stringent ISO 8573-1 standards to prevent product contamination, making the higher investment in oil-free technology mandatory.

What are the key restraints affecting the growth of the Two Stage Compressors Market?

The main restraint is the significantly higher initial capital expenditure (CapEx) required for two-stage compressors compared to single-stage units, which can deter adoption by smaller enterprises despite the long-term energy savings.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager