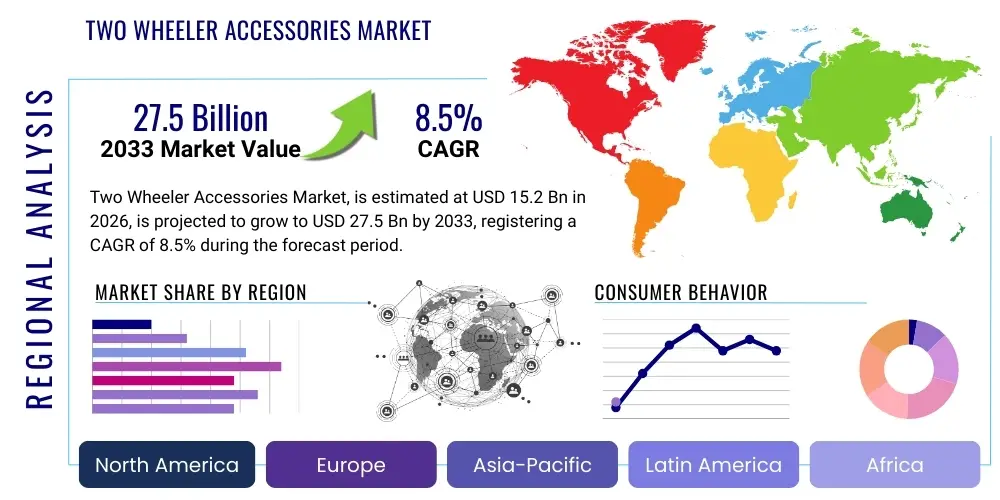

Two Wheeler Accessories Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438236 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Two Wheeler Accessories Market Size

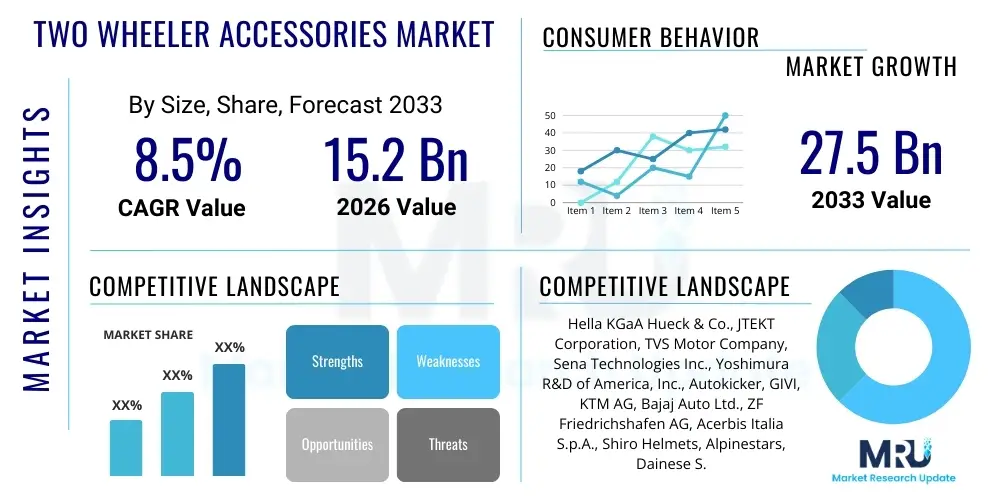

The Two Wheeler Accessories Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 15.2 Billion in 2026 and is projected to reach USD 27.5 Billion by the end of the forecast period in 2033.

Two Wheeler Accessories Market introduction

The Two Wheeler Accessories Market encompasses a vast array of products designed to enhance the functionality, safety, aesthetics, and performance of motorcycles, scooters, and mopeds. This sector includes critical components such as safety gear (helmets, jackets, gloves), functional add-ons (luggage systems, GPS mounts, protective guards), performance modifications (exhaust systems, air filters), and cosmetic enhancements (decals, customized seats). The increasing global penetration of two wheelers, particularly in emerging economies due to their affordability and ease of navigation in congested urban environments, acts as the foundational driver for accessories demand. Accessories play a crucial role in enabling personalization and addressing specific riding conditions, ranging from daily commuting to long-distance touring.

Product descriptions within this market vary widely. Safety accessories, mandated by stringent governmental regulations across several key regions, represent a cornerstone segment, characterized by ongoing innovation in materials science, such as carbon fiber helmets and advanced protective textiles. Performance-enhancing accessories cater to enthusiasts seeking optimized power output, handling characteristics, and weight reduction. Major applications span across personal commuting, delivery and logistics services, recreational riding, and professional motorsports. The market benefits significantly from the high rate of two-wheeler adoption, increasing disposable incomes allowing for discretionary spending on customization, and a growing consumer focus on rider safety and comfort, particularly during extended usage periods.

Key driving factors stimulating market expansion include the burgeoning popularity of motorcycle touring and adventure riding, which necessitates durable and specialized luggage and navigation systems. Furthermore, the robust aftermarket ecosystem, driven by e-commerce platforms and specialized customization shops, makes accessories easily accessible to a global consumer base. Technological integration, especially in smart helmets and advanced monitoring systems, is also fueling demand for premium, high-value accessories that enhance connectivity and safety features, positioning the market for sustained long-term growth predicated on innovation and rider experience improvement.

Two Wheeler Accessories Market Executive Summary

The Two Wheeler Accessories Market is characterized by robust expansion driven by pronounced consumer preference for personalization and elevated safety standards, coupled with rapid urbanization across the Asia Pacific region. Business trends show a significant shift towards smart accessories, integrating IoT and connectivity features, with leading manufacturers focusing on lightweight, high-strength materials like specialized plastics and composite fibers to improve product efficacy and user comfort. The aftermarket segment dominates, although Original Equipment Manufacturers (OEMs) are increasingly offering specialized accessory packages at the point of sale, enhancing revenue streams and brand loyalty. Supply chain optimization remains a key focus area for competitive advantage, utilizing localized manufacturing and agile inventory management to meet fluctuating regional demand patterns efficiently.

Regionally, Asia Pacific (APAC) stands as the undisputed leader, primarily due to the massive volumes of two-wheeler sales in countries such as India, China, and Indonesia, where two-wheelers are the primary mode of personal transport. European markets exhibit strong growth in the premium accessory segment, driven by strict safety regulations and a culture of motorsports and long-distance touring, emphasizing high-end technical gear and sophisticated performance parts. North America, while having lower unit sales compared to APAC, contributes substantially to market value through high-value custom components and lifestyle accessories targeted at the large cruiser and sportbike segments. Regulatory harmonization regarding helmet standards and protective gear is influencing product development globally.

Segment trends reveal that the protective gear segment, particularly advanced helmets and riding apparel, maintains the largest market share owing to mandatory usage laws and heightened consumer awareness regarding road safety. The luggage and storage segment is experiencing rapid growth, fueled by the increasing use of two wheelers for commercial delivery and utility purposes, necessitating robust, weather-proof solutions. Furthermore, the aesthetics and styling segment, encompassing components like customized lighting and body kits, continues to see strong demand from younger demographics prioritizing vehicle appearance and identity expression. The ongoing transition toward electric two-wheelers presents a burgeoning sub-segment for specialized EV accessories, including charging cable management systems and unique battery protection guards.

AI Impact Analysis on Two Wheeler Accessories Market

User inquiries regarding the impact of AI on the Two Wheeler Accessories Market commonly center on how technology can enhance rider safety, personalize the riding experience, and optimize supply chain efficiency. Key concerns revolve around the integration of AI into smart safety gear, specifically asking about predictive crash detection, real-time physiological monitoring embedded in apparel, and AI-driven navigation systems that adapt routes based on traffic and rider fatigue. Users also frequently question how AI algorithms could personalize accessory recommendations during the purchasing process and whether generative AI will streamline the design and manufacturing of custom parts. The overarching expectation is that AI will move accessories from passive protection tools to active, intelligent components that improve both performance and safety autonomously.

- AI-driven predictive maintenance systems integrated into sensors for accessory monitoring (e.g., tire pressure, brake wear).

- Personalized e-commerce recommendations for accessories based on rider profiles, habits, and installed vehicle modifications.

- Smart helmet integration utilizing AI for real-time fatigue detection, voice command interpretation, and optimized navigation assistance.

- Optimizing inventory and demand forecasting for aftermarket parts using advanced machine learning models.

- Generative design AI facilitating rapid prototyping and customization of ergonomic and aerodynamic accessory parts.

- Enhanced security features through AI-powered anti-theft tracking systems embedded in valuable luggage or component mounts.

DRO & Impact Forces Of Two Wheeler Accessories Market

The Two Wheeler Accessories Market is propelled by strong demographic and economic forces, counterbalanced by inherent challenges in material sourcing and regulatory compliance. Drivers include the substantial increase in the global two-wheeler parc, especially across populous Asian nations where two-wheelers offer essential mobility solutions, translating directly into higher demand for both mandatory safety gear and discretionary comfort/utility items. Furthermore, the rising interest in powersports and recreational touring activities among affluent consumers in developed economies fuels the market for premium, specialized accessories such as sophisticated navigation tools, advanced performance exhausts, and high-tech communication systems. This growth is sustained by a continuous cycle of product innovation focused on lighter weight, enhanced durability, and improved connectivity.

Restraints primarily revolve around the volatility in the prices of key raw materials, including specialized plastics, metals, and textiles, which directly impacts manufacturing costs and accessory pricing, potentially deterring price-sensitive consumers. Regulatory fragmentation across different geographical markets poses another significant challenge; varying safety standards for helmets and protective apparel necessitate tailored product lines, complicating global standardization and increasing certification costs. Additionally, the proliferation of counterfeit or substandard accessories, particularly in unregulated aftermarket channels, undermines consumer confidence in quality products and poses severe safety risks, requiring significant efforts in intellectual property protection and consumer education.

Opportunities for market stakeholders are substantial, particularly in leveraging the transition towards electric two-wheelers, which demands a completely new suite of accessories focused on charging solutions, battery protection, and unique digital interfaces. The expansion of connected vehicle technology allows for the development of smart accessories that communicate with the bike and the rider’s mobile ecosystem, offering significant competitive differentiation. Furthermore, strategic mergers, acquisitions, and partnerships focusing on integrating advanced sensor technology (IoT) and material science breakthroughs (e.g., graphene, advanced composites) offer pathways for companies to capture high-value niche segments, especially in professional racing and high-performance modification markets. The impact forces are thus heavily weighted towards rapid technological adoption and market penetration in emerging geographies.

Segmentation Analysis

The Two Wheeler Accessories Market is segmented across various dimensions, including Product Type, Vehicle Type, Distribution Channel, and End-User, reflecting the diverse applications and consumer needs within the sector. Segmentation based on product type is critical, separating safety components from performance, utility, and aesthetic items, allowing manufacturers to tailor R&D investments effectively. Vehicle type segmentation, distinguishing between motorcycles, scooters, and mopeds, acknowledges the distinct accessory requirements of each category—for instance, motorcycles often require high-performance modifications and robust touring luggage, whereas scooters prioritize utility and urban protective solutions. The distribution channel breakdown (OEM vs. Aftermarket, Online vs. Offline) is vital for strategic market access and pricing decisions.

- By Product Type:

- Protective Gear (Helmets, Riding Jackets, Gloves, Boots)

- Luggage and Storage (Tank Bags, Saddle Bags, Top Boxes)

- Performance Enhancements (Exhaust Systems, Air Filters, Engine Guards)

- Styling and Comfort (Custom Seats, Decals, Handle Grips)

- Electrical and Electronic Accessories (GPS/Navigation Systems, Charging Ports, Smart Dashcams)

- By Vehicle Type:

- Motorcycles (Standard, Sport, Cruiser, Touring, Off-Road)

- Scooters/Mopeds

- Electric Two-Wheelers

- By Distribution Channel:

- OEM (Original Equipment Manufacturer)

- Aftermarket (Online Retail, Dealer Stores, Independent Workshops)

- By End-User:

- Individual Riders

- Commercial Fleets (Delivery Services, Rental)

Value Chain Analysis For Two Wheeler Accessories Market

The value chain for the Two Wheeler Accessories Market begins with upstream activities focused on raw material sourcing and component manufacturing, involving specialized suppliers of high-strength alloys, advanced composite materials, textiles, and electronic components. Successful upstream operations depend heavily on securing stable supply chains for materials like polycarbonate for helmets, specialized leathers and synthetic fabrics for apparel, and stainless steel or titanium for performance exhausts. Efficient material conversion, often involving precision injection molding, cutting, and assembly, is critical to ensuring product quality and safety standards are met before items proceed downstream.

Midstream activities involve core manufacturing, branding, and quality assurance. Manufacturers often invest heavily in R&D to innovate product designs, improve ergonomics, and integrate new technologies such as Bluetooth communication systems or embedded sensors. Quality control is paramount, especially for protective gear, where compliance with international standards (e.g., DOT, ECE, ISI) is mandatory. The resulting products are then prepared for distribution, typically involving a dual-channel strategy: direct supply to OEMs for factory fitment, or distribution into the vast aftermarket network.

Downstream analysis focuses on distribution channels and end-user engagement. The distribution framework is bifurcated into direct channels (manufacturer websites, flagship stores) and indirect channels. Indirect distribution heavily relies on specialized two-wheeler dealerships (often OEM-affiliated), independent multi-brand accessory shops, and increasingly, major e-commerce platforms which offer unparalleled reach and inventory depth. The aftermarket segment is characterized by high competitive intensity and requires robust marketing and customer service to drive sales, capitalizing on customization trends and specialized installation services provided by local workshops. E-commerce facilitates global reach, making unique and niche accessories accessible to a worldwide customer base.

Two Wheeler Accessories Market Potential Customers

Potential customers for the Two Wheeler Accessories Market span a broad demographic spectrum, segmented primarily by riding behavior, vehicle type, and purchasing power. The largest group comprises individual riders who use two-wheelers for daily commuting and utility purposes, predominantly in urban and semi-urban settings across Asia Pacific. These buyers prioritize practical, cost-effective accessories such as basic safety helmets, protective guards, and reliable luggage systems. Safety is often a primary motivator, driven by legislative mandates and increasing personal health awareness, making high-quality helmets and protective apparel indispensable purchases.

A second major customer segment consists of enthusiasts, including sports riders, touring aficionados, and cruiser owners in developed markets (North America, Europe). These end-users are characterized by higher disposable incomes and a strong desire for performance enhancement and extensive vehicle customization. They represent the core market for premium, high-margin accessories, including advanced electronic navigation aids, specialized performance exhausts made of exotic materials, high-tech riding gear with integrated climate control, and aesthetic upgrades designed for unique personalization. This segment is highly brand-conscious and receptive to technological innovations.

The third critical segment includes commercial fleets and logistics providers, utilizing two-wheelers for last-mile delivery services, particularly food and e-commerce logistics. These corporate buyers require heavy-duty, durable accessories focused on utility and operational efficiency, such as robust, high-capacity storage boxes, weather protection gear for riders, and specialized telematics accessories for fleet management and security. Their purchasing decisions are often bulk-driven and based on total cost of ownership, durability, and compliance with operational health and safety standards. The rise of the gig economy has significantly bolstered demand from this commercial fleet segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 27.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hella KGaA Hueck & Co., JTEKT Corporation, TVS Motor Company, Sena Technologies Inc., Yoshimura R&D of America, Inc., Autokicker, GIVI, KTM AG, Bajaj Auto Ltd., ZF Friedrichshafen AG, Acerbis Italia S.p.A., Shiro Helmets, Alpinestars, Dainese S.p.A., Cardo Systems, Pillion Comfort, Rizoma S.r.l., Oxford Products Ltd, Steelbird Hi-Tech India Ltd., Studds Accessories Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Two Wheeler Accessories Market Key Technology Landscape

The technological landscape of the Two Wheeler Accessories Market is rapidly evolving, driven by advancements in material science, electronics miniaturization, and seamless integration of connectivity features. A significant trend involves the increasing adoption of lightweight and high-strength composite materials, such as carbon fiber and advanced polycarbonates, particularly in protective gear (helmets) and performance components (exhausts, fairings). These materials offer superior impact resistance and structural integrity while reducing overall vehicle weight, directly translating to improved performance and rider safety. Furthermore, specialized textiles with embedded protective features, like D3O or similar energy-absorbing polymers, are becoming standard in premium riding apparel, offering flexible protection that hard armor components cannot match, enhancing both comfort and safety.

Connectivity and IoT integration represent another critical technological frontier. Smart accessories, including high-definition dashcams, GPS trackers, and interactive helmet communication systems (like Sena and Cardo devices), are transitioning from niche items to mainstream requirements. These devices often feature Bluetooth mesh networking, voice command capabilities, and integration with smartphone applications, allowing riders to manage navigation, music, and communication without compromising focus on the road. The deployment of advanced sensor technology, such as tire pressure monitoring systems (TPMS) and sophisticated vehicle diagnostics tools that connect via OBD ports, is enhancing utility accessories, providing riders with real-time operational data critical for preventive maintenance and safe operation.

Manufacturing technologies are also undergoing transformation, with 3D printing (Additive Manufacturing) gaining traction for the rapid prototyping of custom parts and the production of small-batch, highly specialized components. This allows aftermarket providers to respond quickly to new vehicle models and tailor accessories to specific aesthetic or performance requirements on demand. Additionally, the electrification wave is necessitating new technological developments for accessories, including inductive charging solutions for gear, specialized fire-resistant casings for battery protection, and unique mounting systems optimized for the architectural constraints and weight distribution characteristics of electric two-wheelers, ensuring the accessory market remains aligned with the shifting core vehicle industry.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global Two Wheeler Accessories Market, fueled by the highest volume of two-wheeler sales worldwide in countries like India, China, Vietnam, and Indonesia. The market here is dual-natured: high-volume sales of functional and mandatory safety accessories (basic helmets, protective guards) driven by affordability and regulatory compliance, and a burgeoning premium segment catering to the growing middle class who invest heavily in customization and high-end protective gear for touring. Government mandates promoting road safety, especially for helmet usage, are a primary driver.

- Europe: Europe is characterized by stringent safety regulations (e.g., ECE certification for helmets) and a strong culture of motorcycle leisure and motorsports. This region is a leader in adopting premium, high-technology accessories, including advanced rider communication systems, high-specification technical riding apparel, and specialized performance tuning parts. Countries like Germany, Italy, and the UK demonstrate high average accessory spending per rider, focusing heavily on quality, brand heritage, and technical innovation.

- North America: The North American market is driven by high customization rates, particularly within the cruiser and touring segments. Consumers emphasize lifestyle and aesthetic accessories, high-end chrome components, custom exhaust systems, and large-capacity touring luggage. Demand for electronic accessories, such as integrated GPS and sophisticated helmet communication systems, is also high. The market is primarily aftermarket-driven, with specialized custom workshops playing a significant role in value addition.

- Latin America (LATAM): LATAM is a rapidly growing market, similar to APAC, with two-wheelers being critical for personal transportation, particularly in Brazil and Mexico. The market growth is contingent upon improving economic conditions and increased focus on rider safety. Demand is concentrated on basic protective gear and utility accessories, but the premium segment is expanding due to rising urbanization and the influence of international motorsports.

- Middle East and Africa (MEA): Growth in MEA is steady but constrained by diverse regional regulations and varying consumer purchasing power. The market shows potential in specific segments like off-road riding accessories, particularly in Gulf nations, and utility accessories for harsh, high-temperature environments. Investment in road safety infrastructure and enforcement of protective gear mandates are key factors influencing accessory adoption rates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Two Wheeler Accessories Market.- Hella KGaA Hueck & Co.

- JTEKT Corporation

- TVS Motor Company

- Sena Technologies Inc.

- Yoshimura R&D of America, Inc.

- Autokicker

- GIVI

- KTM AG

- Bajaj Auto Ltd.

- ZF Friedrichshafen AG

- Acerbis Italia S.p.A.

- Shiro Helmets

- Alpinestars

- Dainese S.p.A.

- Cardo Systems

- Pillion Comfort

- Rizoma S.r.l.

- Oxford Products Ltd

- Steelbird Hi-Tech India Ltd.

- Studds Accessories Ltd.

Frequently Asked Questions

Analyze common user questions about the Two Wheeler Accessories market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the demand for smart helmets and connected two-wheeler accessories?

Demand is primarily driven by heightened focus on rider safety, regulatory mandates requiring better communication tools, and the desire for seamless integration of features like GPS navigation, music playback, and hands-free communication, all facilitated by miniaturized electronics and IoT connectivity.

Which product segment holds the largest share in the Two Wheeler Accessories Market globally?

The Protective Gear segment, particularly helmets and riding apparel, consistently holds the largest market share due to stringent governmental safety regulations across major markets (APAC, Europe) making their usage mandatory for riders and pillions.

How is the transition to electric vehicles (EVs) impacting the accessories market?

The EV transition is creating demand for specialized accessories, including robust battery protective guards, advanced charging solutions, unique aerodynamic components, and new digital display integrations tailored specifically for electric two-wheeler platforms.

Why is the Asia Pacific region the dominant geographical market for two-wheeler accessories?

APAC dominates due to its status as the world's largest producer and consumer of two-wheelers, driven by high population density, economic necessity, and increasing disposable income leading to greater adoption of both utility accessories and mandated safety equipment.

What is the significance of the aftermarket distribution channel versus OEM channels?

The aftermarket channel is crucial as it offers a vast selection of performance, customization, and aesthetic parts, capturing the majority of revenue driven by rider personalization preferences, while the OEM channel focuses mainly on essential, brand-specific fitments and packaged upgrades at the point of sale.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager