Two-Wheeler Lighting Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435133 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Two-Wheeler Lighting Market Size

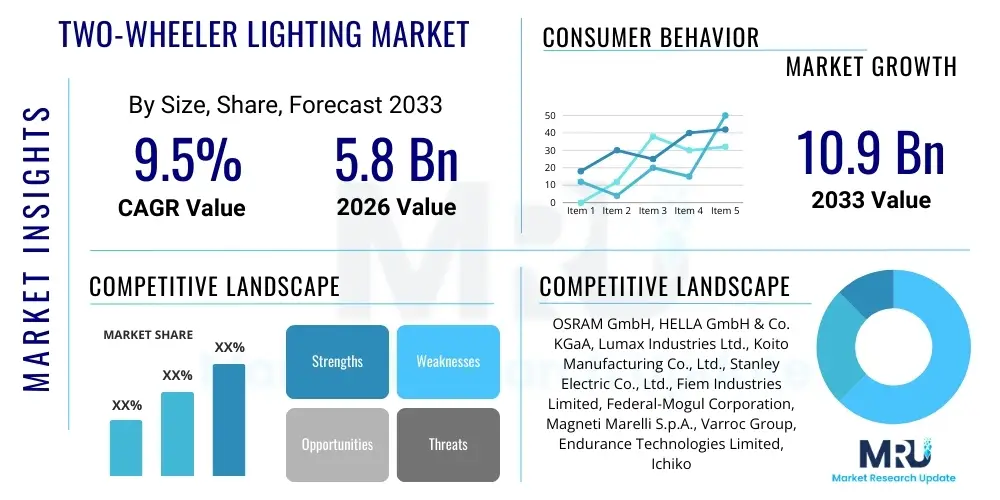

The Two-Wheeler Lighting Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 10.9 Billion by the end of the forecast period in 2033.

Two-Wheeler Lighting Market introduction

The Two-Wheeler Lighting Market encompasses all lighting components essential for the operation, safety, and regulatory compliance of motorcycles, scooters, and mopeds. These components include headlights, taillights, brake lights, turn indicators, and auxiliary lamps. The primary function of these systems is to provide visibility for the rider during low-light conditions and to ensure the vehicle is clearly visible to other road users, thereby drastically enhancing overall road safety. The shift towards modern technology, particularly Light Emitting Diodes (LEDs), has been a defining trend, replacing traditional halogen and incandescent bulbs due to LEDs’ superior efficiency, lifespan, and design flexibility.

Major applications for two-wheeler lighting span across Original Equipment Manufacturers (OEMs) for integration into new vehicle production and the Aftermarket segment, catering to replacement, repair, and upgrade demands. The benefits derived from advanced lighting systems are multifaceted, including enhanced night visibility, reduced energy consumption—which is crucial for electric two-wheelers—and aesthetic enhancement, aligning with evolving consumer preferences for modern vehicle design. Furthermore, regulatory bodies across key regions, such as the implementation of mandatory daytime running lights (DRLs) and advanced braking systems like ABS, are directly driving the demand for sophisticated, reliable lighting solutions.

Driving factors for market expansion are primarily centered on increasing global two-wheeler production, especially in high-density urban areas across Asia Pacific; the rapid adoption of electric two-wheelers, which necessitate low-power consumption components like LEDs; and stringent governmental mandates focused on improving vehicle safety standards globally. Technological miniaturization and the ability to integrate smart features, such as adaptive lighting that adjusts beam patterns based on speed and road conditions, further solidify the market's robust growth trajectory over the forecast period.

Two-Wheeler Lighting Market Executive Summary

The global Two-Wheeler Lighting Market is experiencing significant upward momentum, underpinned by favorable business trends focused on sustainability, miniaturization, and safety technology adoption. The transition from conventional lighting to advanced LED and matrix lighting systems is the most dominant business trend, allowing manufacturers to optimize costs, improve product lifespan, and meet consumer demand for sleek, modern designs. Furthermore, strategic collaborations between component suppliers and OEMs are accelerating the time-to-market for innovative lighting solutions, positioning safety features as key differentiators in highly competitive two-wheeler markets, especially in performance and premium segments.

Regional trends highlight the Asia Pacific (APAC) region as the undeniable powerhouse, driven by massive production volumes in countries like India, China, and Indonesia, coupled with increasing disposable incomes facilitating the purchase of premium two-wheelers featuring sophisticated lighting. While APAC leads in volume, Europe and North America exhibit strong growth in the high-margin segment, emphasizing advanced features such as adaptive cruise lighting and connectivity features. These regions are also early adopters of cutting-edge technologies like OLEDs, albeit at a slower pace due to lower two-wheeler penetration compared to APAC, but offering substantial revenue per unit.

Segment trends underscore the dominance of the OEM channel due to high volume production, though the Aftermarket segment remains vital for maintenance and customization needs. By technology, the LED segment is poised to capture the largest market share and register the highest CAGR, entirely displacing conventional lighting technologies. Motorcycles constitute the largest vehicle type segment, predominantly utilizing complex headlight configurations, while the rapid growth in electric scooter adoption is driving innovation in integrated lighting designs optimized for battery efficiency. The synergy between stricter government regulations and consumer safety awareness ensures sustained growth across all primary product segments.

AI Impact Analysis on Two-Wheeler Lighting Market

Common user questions regarding AI's impact on two-wheeler lighting frequently revolve around the integration of predictive safety features, the autonomy of adaptive headlight systems, and the potential for reduced maintenance requirements through diagnostics. Users are keen to understand how AI algorithms can interpret real-time riding conditions—such as lean angle, speed, and ambient light—to optimize beam patterns instantaneously, going beyond traditional mechanical adjustments. There is also significant interest in how AI can be used in manufacturing processes to ensure quality control, streamline production, and reduce defects in complex LED matrix assemblies. The overriding theme is the expectation that AI integration will elevate two-wheeler lighting from a passive safety feature to an active, intelligent safety and performance system.

The incorporation of Artificial Intelligence is primarily focused on enhancing the functionality and reliability of advanced lighting systems. AI algorithms enable sophisticated data processing from various vehicle sensors, including inertial measurement units (IMUs) and GPS, to create predictive models that anticipate the rider's needs. For instance, in adaptive lighting, AI analyzes the two-wheeler's lean angle during cornering and adjusts the headlight beam swivel and intensity precisely to illuminate the direction of travel, not just the fixed path ahead. This capability significantly improves rider safety during night riding by reducing blind spots and enhancing peripheral visibility on winding roads.

Furthermore, AI plays a crucial role in optimizing the operational efficiency and longevity of lighting components. Through embedded diagnostic capabilities, AI systems can monitor the performance metrics of individual LED clusters, predict potential failures, and alert the rider or service center proactively. In the manufacturing domain, AI-driven machine vision systems are being deployed for high-speed inspection of complex lighting units, ensuring that photometric performance and alignment meet stringent regulatory standards before installation. This technological layer ensures superior product quality and minimizes warranty claims related to electronic failures or degradation over time.

- AI enables adaptive headlight systems to adjust beam geometry based on real-time vehicle dynamics (lean angle, speed, acceleration).

- Predictive maintenance analytics using AI optimizes the lifespan and replacement cycles of complex LED matrix components.

- AI algorithms facilitate the intelligent integration of lighting with Advanced Rider Assistance Systems (ARAS), such as collision warning lights.

- Machine learning improves factory floor quality control, identifying micro-defects in high-density LED arrays during production.

- AI supports personalized lighting profiles and dynamic signaling tailored to specific riding environments (urban, highway, off-road).

DRO & Impact Forces Of Two-Wheeler Lighting Market

The dynamics of the Two-Wheeler Lighting Market are shaped by a complex interplay of regulatory imperatives, technological breakthroughs, and economic factors. Market growth is fundamentally driven by increasingly stringent global safety standards, particularly the mandate for Automatic Headlight On (AHO) features and the rapid penetration of LED technology, which offers superior performance and design flexibility. However, the market faces constraints related to the high initial manufacturing cost of advanced systems like matrix LEDs and adaptive lighting, coupled with the inherent complexities of integrating these sophisticated electronics into cost-sensitive two-wheeler platforms prevalent in emerging markets. These driving and restraining forces define the competitive intensity and pace of innovation within the industry.

Opportunities in the sector are primarily linked to the accelerated global transition toward electric two-wheelers (E2Ws). E2Ws place a premium on energy-efficient components, making LED technology not just an upgrade but a necessity for maximizing battery range, thereby opening significant avenues for specialized, low-power consumption lighting solutions. Furthermore, the development of 'smart' lighting, featuring connectivity (IoT integration) and dynamic visual signaling for enhanced communication with other vehicles, presents a fertile ground for product differentiation and premium pricing strategies. The adoption rate of these smart systems in mid-range and premium motorcycles will significantly influence future market valuation.

The impact forces within the market are predominantly technological and regulatory. The rapid pace of technological innovation, particularly in solid-state lighting and micro-electronics, continuously pushes established product life cycles to obsolescence faster than in previous decades. Concurrently, government safety regulations act as a non-negotiable floor for adoption, compelling both OEMs and Aftermarket suppliers to constantly upgrade their products to meet minimum compliance standards, effectively translating policy into immediate market demand. These forces ensure continuous investment in R&D and maintain a high competitive barrier, favoring suppliers capable of delivering certified, high-performance, and technologically advanced products at scale.

Segmentation Analysis

The Two-Wheeler Lighting Market is strategically segmented across several critical dimensions, including technology type, vehicle type, sales channel, and application, to provide a granular view of market dynamics and opportunities. Understanding these segments is crucial for stakeholders to tailor production, distribution, and pricing strategies effectively. The technological segmentation highlights the decisive market transition, with LEDs rapidly becoming the standard due to their energy efficiency and long life, eclipsing older technologies like Halogen and Xenon, particularly in new vehicle production globally. This shift dictates R&D spending and manufacturing capabilities among key market players.

Segmentation by sales channel demonstrates a clear divide between the high-volume Original Equipment Manufacturer (OEM) segment, which captures the majority of initial component sales, and the robust Aftermarket segment, which is vital for maintenance, repair, and customization demands. While OEM volumes are subject to overall vehicle production cycles, the aftermarket provides resilience and profit opportunities, particularly for standardized replacement parts. Geographically, segmentation reveals the dominance of the Asia Pacific region in volume, while Europe and North America lead in the adoption of high-end, premium lighting features like adaptive headlights and stylized daytime running lights (DRLs).

Application-based segmentation emphasizes the diverse requirements across different lighting functions. Headlights constitute the largest revenue stream due to their complexity, the integration of advanced features (like cornering lights), and high regulatory focus. Taillights, brake lights, and indicators, while simpler, are critical safety components benefiting from LED integration for instant activation and better visibility. The competitive landscape is defined by firms specializing either in high-volume, cost-effective standard components or focusing on advanced, premium integrated lighting modules for higher-end motorcycle segments.

- By Technology:

- Halogen Lighting

- LED Lighting (Dominant Segment)

- Xenon Lighting

- Others (e.g., OLED)

- By Vehicle Type:

- Motorcycles

- Scooters/Mopeds

- By Application:

- Headlights

- Taillights

- Indicators & Hazard Lights

- Auxiliary & Other Lighting

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

Value Chain Analysis For Two-Wheeler Lighting Market

The value chain of the Two-Wheeler Lighting Market begins with the upstream procurement of critical raw materials and electronic components, which include specialized plastics, advanced polymers for lenses, semiconductors for LED chips, microcontrollers, and wiring harnesses. The upstream segment is characterized by specialized chemical and electronics suppliers, where cost optimization and material quality (especially heat dissipation properties and optical clarity) are paramount. The ability of component manufacturers to secure reliable supplies of high-quality LED chips and driver electronics directly impacts the final product quality and competitiveness. Furthermore, geopolitical factors affecting the semiconductor supply chain have a significant ripple effect on the production capacity and costs of downstream lighting module assemblers.

The midstream of the value chain involves the complex process of designing, engineering, and manufacturing the integrated lighting modules. This stage includes sophisticated activities such as photometric design, thermal management integration, and compliance testing to meet international regulations (e.g., ECE, DOT). Component manufacturers and major Tier 1 suppliers assemble the final lighting unit, which is then supplied either directly to OEMs for new vehicle assembly or to the Aftermarket distribution network. The increasing complexity of LED matrices requires specialized engineering expertise, concentrating value generation in firms capable of large-scale, high-precision manufacturing.

Downstream analysis focuses on the distribution channels, which are bifurcated into Direct and Indirect sales. Direct sales largely pertain to the Original Equipment Manufacturers (OEMs), where Tier 1 suppliers deliver large volumes of customized lighting assemblies directly to vehicle assembly lines under long-term contracts. Indirect sales dominate the Aftermarket, utilizing vast distribution networks, independent retailers, specialized workshops, and increasingly, e-commerce platforms. The aftermarket channel is crucial for maintenance, repairs, and performance upgrades, offering higher margins on specialized components, but requiring efficient logistics and brand recognition to navigate diverse global markets effectively.

Two-Wheeler Lighting Market Potential Customers

The primary and largest set of end-users for the Two-Wheeler Lighting Market are the global Original Equipment Manufacturers (OEMs). These large-scale buyers, including major entities such as Honda, Hero MotoCorp, Bajaj Auto, TVS Motor Company, Yamaha, and BMW Motorrad, require massive volumes of standardized, high-quality, and compliant lighting modules for integration into their millions of newly produced motorcycles and scooters annually. For OEMs, the criteria for selecting suppliers go beyond just cost and include reliability, adherence to strict safety standards, integration capabilities with the vehicle's electrical architecture, and capacity for innovation, suchating partnerships that are typically long-term and volume-driven.

The second substantial customer base lies within the Aftermarket segment, comprising a diverse group of buyers including independent repair workshops, authorized service centers, specialized performance modification shops, general automotive retailers, and individual vehicle owners. This segment drives demand for replacement parts following accidents or wear-and-tear, as well as voluntary upgrades. Potential customers here often seek cost-effective replacements (standard lighting) or premium, stylized, and high-performance LED upgrades to enhance both safety and aesthetics. The aftermarket is particularly vibrant in emerging economies where two-wheelers have long operational lives and customization is popular.

A rapidly growing customer segment consists of manufacturers of Electric Two-Wheelers (E2Ws). Companies specializing in electric mobility require lighting systems optimized specifically for low-voltage systems and maximal energy efficiency to preserve battery range. These buyers are driving demand for highly customized, lighter, and more compact LED and smart lighting assemblies. This segment, alongside fleet operators (e.g., last-mile delivery services) who prioritize durability and low energy consumption, represents a significant growth vector for suppliers offering specialized and innovative lighting solutions tailored for sustainable mobility platforms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 10.9 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | OSRAM GmbH, HELLA GmbH & Co. KGaA, Lumax Industries Ltd., Koito Manufacturing Co., Ltd., Stanley Electric Co., Ltd., Fiem Industries Limited, Federal-Mogul Corporation, Magneti Marelli S.p.A., Varroc Group, Endurance Technologies Limited, Ichikoh Industries, ZKW Group, Mindarika Pvt. Ltd., Rinder India Pvt. Ltd., Minda Industries Ltd., Busche GmbH, Unitech Auto Products, Bajaj Electricals Ltd., J.W. Speaker Corporation, KCL Corp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Two-Wheeler Lighting Market Key Technology Landscape

The technology landscape of the Two-Wheeler Lighting Market is rapidly advancing, characterized by a fundamental shift away from filament-based solutions toward highly efficient, durable, and versatile Solid-State Lighting (SSL) technologies, predominantly LEDs. Modern LED clusters allow for greater design freedom, enabling sleeker, more integrated lighting units that complement aerodynamic vehicle styling. Crucially, the superior power efficiency of LEDs is a major technological driver, directly supporting the increasing global push towards electric two-wheelers where every milliwatt saved contributes significantly to maximizing battery range and overall operational efficiency. This technological reliance on semiconductor performance and thermal management systems defines the R&D focus for leading suppliers.

The most transformative technology currently gaining traction is Adaptive Front Lighting Systems (AFS) based on Matrix LED technology. Unlike fixed beams, AFS uses multiple individually controllable LED elements managed by a micro-controller unit (MCU) that processes data from vehicle sensors (speed, lean angle, ambient light, road topography). This allows the system to dynamically adjust the light distribution pattern, providing optimal illumination without dazzling oncoming traffic. For two-wheelers, this includes complex cornering illumination that swivels the beam seamlessly into the curve, drastically improving rider confidence and safety during high-speed maneuvering.

Emerging technologies like Organic Light Emitting Diodes (OLEDs) and integrated IoT connectivity are poised to shape the future of the market, particularly in high-end motorcycles. While OLEDs offer ultra-thin, homogenous light sources that enable revolutionary styling, their high cost currently restricts them primarily to concept models and ultra-premium segments. Furthermore, the integration of wireless communication (IoT) into lighting systems allows for smart signaling, where lighting units can communicate vehicle status, potential hazards, or even support vehicle-to-vehicle (V2V) communication, transforming the lighting module into an intelligent node within the vehicle ecosystem, aligning with the broader trend of smart mobility.

Regional Highlights

The global Two-Wheeler Lighting Market exhibits pronounced regional variations dictated by vehicle penetration rates, regulatory environments, and consumer preferences. The Asia Pacific (APAC) region is the undisputed leader in terms of volume and consumption, accounting for the vast majority of global demand due to the massive populations and high reliance on two-wheelers as primary modes of transport in countries like India, China, Indonesia, and Vietnam. The growth in this region is primarily driven by the OEM segment, supported by rising middle-class disposable income leading to higher demand for feature-rich, safety-compliant scooters and motorcycles. APAC is also the epicenter of the electric two-wheeler revolution, accelerating the adoption of energy-efficient LED technology, making it both a high-volume and high-growth market.

Europe represents a crucial market for technological adoption and high-value components. Although the volume of two-wheelers is significantly lower than in APAC, European regulations are exceptionally stringent regarding safety and environmental standards, compelling rapid adoption of advanced features like mandatory DRLs, AHO, and increasingly, matrix LED systems on premium and mid-range motorcycles. Countries such as Germany, Italy, and France prioritize quality and performance, resulting in higher average selling prices (ASPs) for lighting components. The European aftermarket is also strong, driven by high customization rates and a focus on performance lighting upgrades, sustaining demand for specialized, high-performance LED modules.

North America maintains a specialized market structure, focusing heavily on premium touring and cruiser motorcycles, where lighting plays a critical role in long-distance rider comfort and safety. While overall volume is low, the region is highly responsive to aesthetic design and brand-name technology. Latin America and the Middle East & Africa (MEA) are emerging markets characterized by growing urbanization and increasing penetration of entry-level two-wheelers. Growth in MEA is expected to be steady, driven by infrastructure development and tightening import regulations that mandate basic safety features, creating opportunities for suppliers of cost-effective, standard LED solutions suitable for mass-market applications.

- Asia Pacific (APAC): Dominates the global market by volume; driven by high two-wheeler production (India, China, Indonesia) and accelerating adoption of EVs; focus on mass-market, cost-efficient LED systems.

- Europe: High-value market focused on premium segment and technological sophistication; stringent safety regulations (DRLs, adaptive lighting) drive high ASPs and advanced feature integration.

- North America: Niche market with emphasis on high-performance touring and aesthetic customization; strong demand for premium aftermarket LED lighting solutions.

- Latin America (LATAM): Steady growth fueled by urbanization and rising two-wheeler necessity; growing demand for safety-compliant OEM components.

- Middle East & Africa (MEA): Emerging market opportunities linked to infrastructure investment and improving regulatory frameworks; focus on durability and basic safety compliance in harsh operating environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Two-Wheeler Lighting Market.- OSRAM GmbH (Subsidiary of AMS OSRAM AG)

- HELLA GmbH & Co. KGaA

- Lumax Industries Ltd.

- Koito Manufacturing Co., Ltd.

- Stanley Electric Co., Ltd.

- Fiem Industries Limited

- Varroc Group

- Magneti Marelli S.p.A.

- Endurance Technologies Limited

- Ichikoh Industries, Ltd.

- ZKW Group (Part of LG Electronics)

- Minda Industries Ltd.

- Rinder India Pvt. Ltd. (Part of Rinder Group)

- J.W. Speaker Corporation

- Federal-Mogul Corporation (Tenneco Inc.)

- Busche GmbH

- Unitech Auto Products

- KCL Corp.

- Bajaj Electricals Ltd.

- Samvardhana Motherson Group (Motherson Sumi Systems)

Frequently Asked Questions

Analyze common user questions about the Two-Wheeler Lighting market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technology driving growth in the Two-Wheeler Lighting Market?

The primary technology driving market growth is Light Emitting Diode (LED) lighting. LEDs offer significantly superior energy efficiency, longer lifespan, and greater design flexibility compared to conventional halogen or incandescent systems. This shift is particularly crucial for supporting the global expansion of electric two-wheelers (E2Ws) by minimizing power draw and maximizing battery range, alongside meeting stringent international safety standards requiring brighter, more reliable illumination.

Which region holds the largest market share for Two-Wheeler Lighting?

The Asia Pacific (APAC) region currently holds the largest market share by volume. This dominance is attributable to the region's immense production and sales volume of two-wheelers, driven by high population density and reliance on motorcycles and scooters for commuting in countries like India, China, and Indonesia. Regulatory push for mandatory safety features and the rapid penetration of affordable LED systems further solidify APAC’s leading position in global component consumption.

How do safety regulations impact the demand for two-wheeler lighting?

Safety regulations are the foremost non-market driver, compelling OEMs globally to adopt advanced lighting solutions. Mandates such as Automatic Headlight On (AHO) and forthcoming requirements for sophisticated features like Adaptive Front Lighting Systems (AFS) necessitate higher-quality, complex components, increasing both the demand volume and the average selling price (ASP) of lighting units, thus directly fueling market expansion and innovation expenditure.

What is Adaptive Front Lighting (AFS) and why is it important for motorcycles?

Adaptive Front Lighting Systems (AFS) utilize sensors and micro-controllers to dynamically adjust the headlight beam pattern, intensity, and direction in real-time based on riding conditions, speed, and importantly, the motorcycle's lean angle during cornering. This is crucial for motorcycles because it ensures the light beam is directed into the curve rather than straight ahead, significantly improving visibility, enhancing rider safety, and mitigating the risks associated with night riding on winding roads.

Is the Aftermarket segment a major revenue stream, or is the market dominated by OEMs?

The Original Equipment Manufacturer (OEM) segment dominates the market in terms of sheer volume due to initial installation on new vehicles. However, the Aftermarket segment remains a significant and resilient revenue stream. It is vital for replacement parts (due to accidents or wear) and customization/upgrade demands, often offering higher profit margins on specialized, high-performance LED components, particularly in established markets where vehicle longevity and personalization are highly valued.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager