Tylosin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431760 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Tylosin Market Size

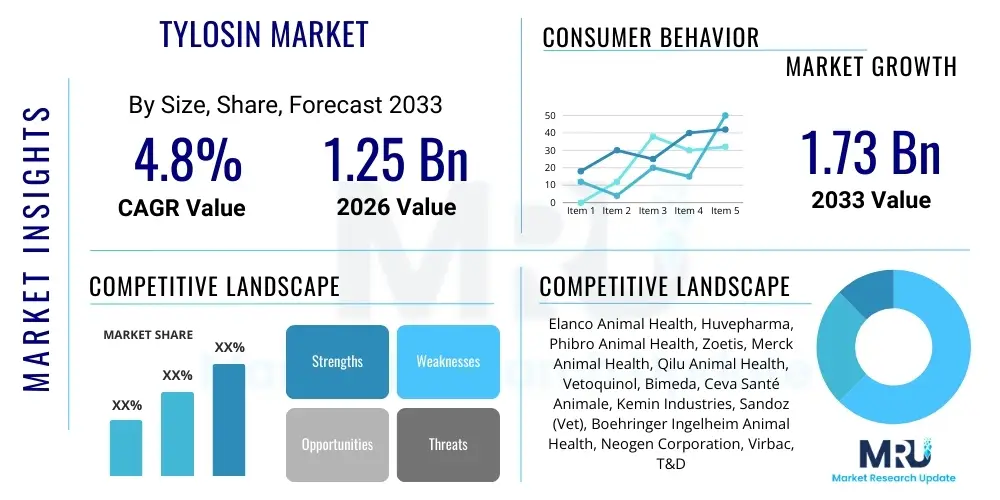

The Tylosin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.73 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily driven by the escalating global demand for animal protein, necessitating robust strategies for livestock health management and disease prevention across large-scale farming operations, particularly in poultry and swine industries.

Tylosin Market introduction

The Tylosin Market encompasses the production, distribution, and utilization of Tylosin, a macrolide antibiotic primarily employed in veterinary medicine to treat and prevent infections in livestock and companion animals. Tylosin is highly effective against gram-positive bacteria, mycoplasmas, and certain gram-negative organisms, making it an essential tool in maintaining animal welfare and enhancing productivity in intensive farming environments. It is predominantly used for conditions such as enzootic pneumonia in swine, chronic respiratory disease (CRD) in poultry, and foot rot in cattle, ensuring reduced morbidity and mortality rates across commercial herds and flocks.

The product is available in various forms, including Tylosin Phosphate, Tylosin Tartrate, and Tylosin Base, allowing for flexible administration via feed premixes, water-soluble solutions, or injectable formulations, catering to diverse farming practices and disease control strategies worldwide. Key applications center around therapeutic treatment and prophylactic use in livestock, particularly swine and poultry, where large group housing increases the risk of rapidly spreading bacterial infections. The primary benefit of Tylosin is its broad spectrum of action against common veterinary pathogens, leading to improved feed conversion ratios (FCRs) and overall economic returns for producers.

Major driving factors influencing market expansion include the exponential increase in global meat and dairy consumption, especially in developing economies, which inherently boosts the scale of commercial livestock production. Additionally, heightened awareness regarding zoonotic diseases and the implementation of stringent biosecurity protocols necessitate reliable antibiotic solutions like Tylosin to safeguard public health and ensure a stable food supply chain. Furthermore, continuous research and development efforts aimed at optimizing Tylosin formulations and delivery mechanisms contribute significantly to its sustained market relevance despite growing regulatory scrutiny on antimicrobial usage.

Tylosin Market Executive Summary

Current business trends in the Tylosin market highlight a significant shift towards sustainable antibiotic stewardship and the integration of advanced diagnostics to ensure targeted usage. Market participants are increasingly focusing on the development of combination products that enhance efficacy or reduce dosage frequency, addressing concerns related to antimicrobial resistance (AMR). Strategic alliances, mergers, and acquisitions among key pharmaceutical and animal health companies are also shaping the competitive landscape, aiming to consolidate market share and expand geographical footprints, particularly into high-growth regions like Asia Pacific and Latin America, driven by massive livestock populations.

Regionally, the market dynamics are characterized by differential growth rates. Asia Pacific leads in consumption volume due to the concentration of the world’s largest swine and poultry production centers (e.g., China, India). North America and Europe, while mature, exhibit strong market value driven by sophisticated regulatory frameworks emphasizing high-quality veterinary care and preventative health programs, accelerating the adoption of premium and compliance-focused Tylosin formulations. Regulatory changes, such as restrictions on antibiotic use for growth promotion, are compelling manufacturers to pivot their strategies towards therapeutic and disease prevention applications, ensuring product sustainability.

Segmentation trends indicate that the Poultry application segment remains the largest consumer of Tylosin products globally, attributable to the intense nature of poultry farming and the pervasive issue of CRD. In terms of product type, Tylosin Phosphate, often utilized in feed premixes for mass treatment, maintains significant market dominance. However, there is a burgeoning trend toward injectable and water-soluble Tylosin Tartrate formulations, favored for acute interventions and ease of precise dosing. These segmentation shifts reflect a broader industry move towards more targeted and efficient disease management protocols that minimize wastage and maximize treatment outcomes in line with global animal welfare standards.

AI Impact Analysis on Tylosin Market

User inquiries regarding AI's influence on the Tylosin market frequently center on how artificial intelligence can mitigate antimicrobial resistance (AMR) risks, optimize drug efficacy, and streamline the livestock disease diagnosis process. Key themes revolve around the potential for AI-driven predictive analytics to forecast disease outbreaks, thereby allowing for proactive and minimal Tylosin application rather than broad-spectrum prophylactic use. Concerns often address the cost and complexity of integrating AI systems into traditional farming environments and the accessibility of these advanced technologies to smaller producers. Overall expectations include AI enhancing precision livestock farming (PLF) by integrating sensor data and historical treatment records to generate optimal health protocols, ensuring Tylosin is used judiciously and effectively.

- AI-driven predictive modeling for livestock disease outbreaks (e.g., respiratory diseases in swine), optimizing the timing and location of Tylosin intervention.

- Development of AI-powered diagnostic tools for rapid, accurate identification of specific pathogens, ensuring Tylosin treatment is reserved for responsive infections.

- Optimization of drug dosage and delivery schedules in large herds using machine learning algorithms to minimize resistance development and maximize therapeutic effect.

- Enhancement of clinical trial design and drug discovery processes for next-generation veterinary antibiotics or alternatives to Tylosin.

- Automated monitoring of animal behavior and physiological parameters through computer vision and sensors, triggering early alerts for Tylosin necessity, reducing blanket usage.

DRO & Impact Forces Of Tylosin Market

The dynamics of the Tylosin market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO). A primary driver is the persistent global surge in demand for affordable animal protein sources, particularly meat and eggs, which correlates directly with the expansion of high-density livestock farming practices that require robust disease management strategies like those provided by Tylosin. Additionally, the increasing incidence of bacterial diseases in farmed animals, coupled with the need to adhere to rigorous food safety and animal welfare standards, compels producers to utilize effective, proven antibiotics, ensuring the continued relevance of Tylosin in the veterinary pharmaceutical portfolio. These fundamental market demands exert strong positive pressure on market growth.

Conversely, significant restraints impede the market's trajectory, most notably the escalating global concern over antimicrobial resistance (AMR). Regulatory bodies, particularly in the European Union and North America, have tightened controls on the prophylactic use of medically important antibiotics, including Tylosin, for growth promotion, necessitating market adaptation. Furthermore, the development and commercialization of alternative treatments, such as vaccines, probiotics, and prebiotics, pose a competitive restraint by offering non-antibiotic solutions for maintaining animal health. Manufacturers also face challenges related to the high initial investment required for research into new, sustainable formulations and ensuring regulatory compliance across diverse international jurisdictions.

Opportunities for growth are primarily concentrated in emerging economies, where rapid urbanization and increasing disposable incomes are fueling the professionalization and industrialization of local livestock sectors, opening vast untapped markets for effective veterinary medicines. There is also a substantial opportunity in developing specialized Tylosin formulations tailored for enhanced bioavailability and reduced environmental impact, aligning with sustainability goals. The integration of precision livestock farming (PLF) techniques offers a pathway to optimized Tylosin usage, shifting the market focus from mass medication to targeted, data-driven treatment, providing substantial value addition and mitigating AMR risks, thereby strengthening the long-term viability of the product.

Segmentation Analysis

The Tylosin market is comprehensively segmented based on product type, application, form, and geographic region, reflecting the diverse needs of the global veterinary health sector. Understanding these segments is crucial for strategic market positioning, enabling manufacturers to tailor their production and distribution efforts to maximize efficacy and market penetration. The segmentation structure highlights the dominance of the swine and poultry sectors as primary consumers, while differentiating between various chemical forms of the drug that dictate its end-use method and regulatory classification.

- By Product Type:

- Tylosin Phosphate

- Tylosin Tartrate

- Tylosin Base

- By Application:

- Poultry (Chickens, Turkeys)

- Swine (Pigs)

- Cattle (Beef and Dairy)

- Companion Animals and Others

- By Form:

- Premixes

- Injectable Solutions

- Oral Solutions (Water Soluble)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Tylosin Market

The Tylosin market value chain begins with the upstream segment, primarily focused on the sourcing of raw materials, which include specific fermentation inputs (such as carbohydrate and nitrogen sources) and essential chemical precursors required for the biosynthesis and purification of the Tylosin molecule. Leading chemical and pharmaceutical companies specializing in fermentation technology play a critical role in this stage, leveraging proprietary strains of Streptomyces fradiae to achieve high-yield production. Efficiency in the upstream segment, particularly fermentation optimization and sterile processing, directly influences the final cost and quality of the active pharmaceutical ingredient (API).

The subsequent phases involve the manufacturing and formulation of the API into finished veterinary products (Tylosin Phosphate, Tartrate, etc.). This stage includes stringent quality control, regulatory compliance checks, and conversion into various dosage forms—premixes for feed, injectable solutions, and water-soluble powders. Distribution channels for Tylosin are complex and multifaceted, encompassing both direct and indirect routes. Direct distribution often involves large pharmaceutical companies supplying key veterinary distributors or major integrated livestock producers directly. Indirect distribution relies heavily on veterinary wholesalers, retail pharmacies specializing in animal health, and licensed feed mills that incorporate the premix forms into feed.

Downstream analysis focuses on the end-users: livestock producers, veterinarians, and animal owners. The effectiveness of the distribution network is crucial, ensuring that time-sensitive medication reaches rural and remote farming locations efficiently. The direct channel offers greater control over pricing and inventory, facilitating closer relationships with key accounts, whereas the indirect channel provides broader market coverage. Given the regulatory scrutiny on antibiotics, the role of veterinarians as gatekeepers and prescribers is paramount throughout the downstream segment, driving demand based on diagnostic needs and treatment protocols, ensuring responsible usage and market integrity.

Tylosin Market Potential Customers

The primary end-users and potential buyers of Tylosin products are large-scale commercial livestock operations, which utilize the antibiotic extensively for disease control and management across their herds and flocks. Specifically, integrated poultry producers and industrial swine farms represent the largest customer base. These operations require massive volumes of Tylosin, usually in the form of premixes (Tylosin Phosphate), for metaphylactic and therapeutic treatment of common diseases such as Chronic Respiratory Disease (CRD) in poultry and Enzootic Pneumonia in swine, where rapid spread among dense populations mandates effective medication.

Another significant customer segment includes dairy and beef cattle producers. While their usage volumes are typically lower than swine or poultry, Tylosin Tartrate and injectable forms are critical for treating conditions like bovine respiratory disease (BRD) and infectious bovine keratoconjunctivitis (pink eye) in cattle, maintaining the health and productivity of high-value dairy and breeding stock. Furthermore, veterinary clinics and hospitals constitute indirect but vital customers, purchasing injectable and oral Tylosin solutions for individualized treatment of companion animals (e.g., dogs and cats, though less common) and smaller-scale livestock farms.

Pharmaceutical distributors, veterinary supply wholesalers, and specialized feed mills act as crucial intermediaries and aggregators, representing another layer of potential customers. These entities purchase Tylosin API or bulk finished product and distribute it down the value chain. Their needs revolve around supply chain reliability, compliance documentation, and competitive pricing. The future growth of the market is increasingly dependent on forging strong relationships with these distributors in emerging markets where livestock production is rapidly scaling and requiring established veterinary infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.73 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Elanco Animal Health, Huvepharma, Phibro Animal Health, Zoetis, Merck Animal Health, Qilu Animal Health, Vetoquinol, Bimeda, Ceva Santé Animale, Kemin Industries, Sandoz (Vet), Boehringer Ingelheim Animal Health, Neogen Corporation, Virbac, T&D Pharma, Shandong Lukang Pharmaceutical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tylosin Market Key Technology Landscape

The technological landscape of the Tylosin market is heavily influenced by advancements in large-scale pharmaceutical fermentation and downstream processing techniques designed to maximize yield and purity of the active pharmaceutical ingredient (API). Modern facilities utilize highly optimized bioreactors and sophisticated control systems to precisely manage variables like temperature, pH, and nutrient delivery to the Streptomyces fradiae microorganism, thereby enhancing the biosynthesis efficiency of Tylosin. Continuous process improvement through high-throughput screening and genetic engineering of microbial strains is a key focus, aiming to reduce production costs and improve scalability to meet global demand efficiently.

Further technological innovation is concentrated in formulation science and drug delivery systems, particularly driven by the need for enhanced stability, bioavailability, and reduced withdrawal periods. Advanced microencapsulation techniques are being explored for feed premixes (Tylosin Phosphate) to ensure the stability of the antibiotic through the feed milling process and proper release in the animal’s gut. For injectable solutions (Tylosin Tartrate), manufacturers are developing long-acting formulations utilizing polymers and specialized carriers, which allow for less frequent dosing, minimizing handling stress on the animals and improving compliance with therapeutic regimens in intensive farming.

The integration of digital technologies, though often falling under AI impact, is transforming administration. Smart monitoring systems and precision delivery tools are emerging, particularly in developed markets. These technologies—ranging from electronic dispensing pumps for water-soluble solutions to sophisticated veterinary management software—ensure accurate dosing based on real-time flock or herd data, minimizing antibiotic overuse. This technological shift supports the global move towards responsible antimicrobial stewardship, maintaining Tylosin's therapeutic efficacy by ensuring it is deployed optimally and only when necessary.

Regional Highlights

Geographic analysis reveals distinct consumption patterns and regulatory environments that shape the Tylosin market across major regions. Asia Pacific (APAC) currently dominates the market in terms of volume and exhibits the highest growth potential, largely fueled by China, India, and Southeast Asian countries. The sheer size and rapid industrialization of the swine and poultry sectors in these nations drive substantial demand for antibiotics to manage high-density farming risks. However, regulatory oversight in APAC is rapidly increasing, pushing local producers towards better compliance and documented usage.

North America and Europe represent mature markets characterized by stringent regulatory environments, emphasizing therapeutic use over growth promotion. The European market, particularly following recent bans on prophylactic use, prioritizes high-quality, targeted Tylosin formulations and alternatives. The North American market, led by the US, maintains robust demand due to its large cattle, swine, and poultry industries, but compliance with Veterinary Feed Directive (VFD) regulations and equivalent measures mandates veterinary oversight for all Tylosin administration.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging regions experiencing accelerated market growth. Countries like Brazil and Mexico (LATAM) are significant meat exporters, driving the professionalization of their veterinary infrastructure and increasing the uptake of pharmaceuticals like Tylosin. In MEA, the market is primarily driven by expanding local poultry production to enhance food security. These regions offer significant opportunities for market penetration but require strategies that navigate diverse distribution challenges and evolving, often inconsistent, regulatory standards.

- Asia Pacific (APAC): Highest volume market; driven by large swine and poultry populations in China and India; major focus on balancing high production with emerging regulatory demands.

- North America: Mature, high-value market; demand centered on therapeutic use in cattle and swine; governed by strict veterinary oversight (VFD in the US).

- Europe: Highly regulated market; strong emphasis on reducing overall antibiotic consumption; market pivots towards specific therapeutic interventions and premium, compliant products.

- Latin America (LATAM): Rapidly expanding market, particularly Brazil and Mexico; driven by increasing export-oriented meat production and industrialization of farming.

- Middle East & Africa (MEA): Growth stimulated by regional efforts to achieve self-sufficiency in poultry production; infrastructure development remains a key challenge for market access.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tylosin Market.- Elanco Animal Health

- Huvepharma

- Phibro Animal Health

- Zoetis

- Merck Animal Health

- Qilu Animal Health

- Vetoquinol

- Bimeda

- Ceva Santé Animale

- Kemin Industries

- Sandoz (Vet)

- Boehringer Ingelheim Animal Health

- Neogen Corporation

- Virbac

- T&D Pharma

- Shandong Lukang Pharmaceutical

- Zydus Animal Health

- Shenzhen Greatec Animal Health

- Hester Biosciences

- Alfasan Woerden BV

Frequently Asked Questions

Analyze common user questions about the Tylosin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Tylosin primarily used for in veterinary medicine?

Tylosin is a macrolide antibiotic chiefly used to treat bacterial infections in livestock, particularly respiratory and gastrointestinal diseases in poultry (Chronic Respiratory Disease - CRD) and swine (Enzootic Pneumonia), as well as certain infections in cattle.

How is the global push for antimicrobial stewardship affecting Tylosin market growth?

Antimicrobial stewardship restraints are forcing a shift away from Tylosin use for growth promotion, particularly in Western markets. This leads to reduced volume but increases demand for higher-value, specialized therapeutic formulations used strictly under veterinary supervision.

Which geographical region holds the largest market share for Tylosin?

The Asia Pacific (APAC) region currently holds the largest volume market share due to the immense scale of swine and poultry production in countries such as China and India, making it the dominant consumer of feed-grade Tylosin premixes.

What are the different commercial forms of Tylosin available?

Tylosin is predominantly available as Tylosin Phosphate (used mostly in feed premixes), Tylosin Tartrate (water-soluble for drinking water or injectable forms), and Tylosin Base, catering to various administration needs in intensive animal agriculture.

Are there viable alternatives to Tylosin being adopted in the livestock industry?

Yes, increasing regulatory pressure and AMR concerns are driving the adoption of alternatives such as specific vaccines, customized probiotics, prebiotics, organic acids, and phytogenics, which are often utilized preventatively to reduce the reliance on conventional antibiotics like Tylosin.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager