Tyre Pyrolysis Plant Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434575 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Tyre Pyrolysis Plant Market Size

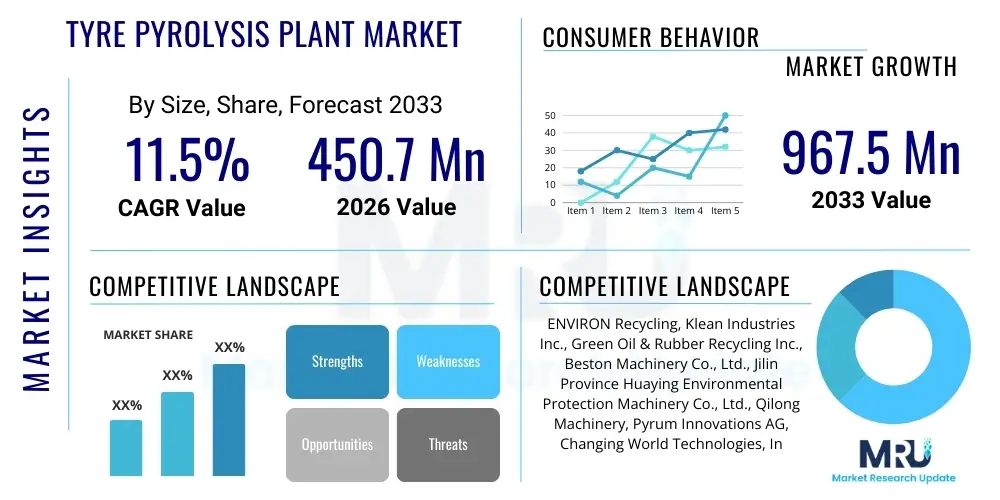

The Tyre Pyrolysis Plant Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 450.7 Million in 2026 and is projected to reach USD 967.5 Million by the end of the forecast period in 2033.

Tyre Pyrolysis Plant Market introduction

The Tyre Pyrolysis Plant Market encompasses the technology and infrastructure designed to convert end-of-life tires (ELT) into valuable commercial products through thermal decomposition in an oxygen-free environment. This process, known as pyrolysis, addresses the critical global challenge of managing massive volumes of scrap tires that pose significant environmental hazards, including land pollution, fire risks, and breeding grounds for pests. The resulting outputs—Pyrolysis Oil (TPO), Recovered Carbon Black (rCB), Steel Wire, and Pyrolysis Gas—represent a pivotal circular economy solution, transforming waste into secondary raw materials, thereby substantially mitigating the need for virgin resources. The increasing stringency of waste disposal regulations, particularly in developed economies, coupled with fluctuating petrochemical prices, acts as a primary catalyst for market adoption.

Pyrolysis Oil, often the highest volume output, is utilized primarily as a heating fuel in industrial burners, cement kilns, and power plants, and increasingly, as a feedstock for refineries. Recovered Carbon Black (rCB) is perhaps the most scrutinized product, offering a sustainable alternative to traditional furnace black in the manufacturing of new tires, conveyor belts, and other rubber and plastic goods. The quality and yield of these products depend heavily on the pyrolysis technology employed, whether batch or continuous processing, and the temperature control mechanisms. Advanced plants are integrating pre-treatment (shredding, de-beading) and post-treatment (oil refining, carbon black activation) processes to enhance product specification and market viability, driving significant investment in research and development across the sector.

Major applications of tyre pyrolysis products span across multiple heavy industries, including rubber manufacturing, metallurgy, and energy generation. Beyond the environmental benefit of waste diversion, the economic viability of pyrolysis facilities is strongly driven by the consistently high availability of feedstock (scrap tires) and the growing market demand for sustainable, circular materials. Benefits include significant reduction in greenhouse gas emissions compared to incineration, decentralized waste processing capabilities, and the creation of valuable commodity streams. These driving factors, underpinned by robust government incentives for renewable energy and waste-to-resource projects, solidify the market's trajectory towards substantial, sustained growth.

Tyre Pyrolysis Plant Market Executive Summary

The Tyre Pyrolysis Plant Market is experiencing vigorous growth, fundamentally driven by the global shift towards circular economy models and stringent environmental mandates concerning End-of-Life Tires (ELTs). Key business trends highlight a move from smaller, less efficient batch pyrolysis systems to large-scale, automated, continuous pyrolysis reactors, which offer superior efficiency, consistent product quality, and economies of scale. Investment is heavily concentrated in sophisticated purification technologies, particularly for refining pyrolysis oil into viable marine fuel or refinery feedstock and upgrading Recovered Carbon Black (rCB) to meet the demanding specifications of primary tire manufacturers. Strategic partnerships between pyrolysis technology providers and downstream consumers (e.g., carbon black users and refining companies) are crucial for market success, ensuring reliable off-take agreements and sustained profitability within the fragmented supply chain.

Regional trends indicate that Asia Pacific (APAC), particularly China and India, dominates the market in terms of installed capacity, largely driven by immense waste tire volumes and lower operational costs. However, North America and Europe lead in technological innovation and regulatory maturity. European growth is spearheaded by the implementation of EU directives promoting waste hierarchy and material recycling targets, spurring high investment in high-yield, low-emission plants. North America focuses on commercializing advanced catalytic pyrolysis methods to produce premium-grade fuels, attracting venture capital and large industrial players seeking environmentally compliant energy sources. Furthermore, the standardization of rCB quality metrics is becoming a critical regional trend, influencing trade and adoption rates globally.

Segment trends underscore the burgeoning demand for Recovered Carbon Black (rCB). While Pyrolysis Oil historically represented the primary revenue stream, the market is rapidly pivoting towards maximizing rCB yield and quality due to its higher value proposition and direct substitution potential in the rubber industry. The market for high-capacity continuous plants (processing over 50 metric tons per day) is witnessing the highest CAGR, reflecting the industry's maturation and consolidation. This segment concentration on large-scale operations is optimizing overall efficiency, reducing environmental footprint per unit of output, and stabilizing the supply of secondary raw materials, thereby solidifying the market’s transition from a niche waste management solution to a formalized industrial commodity production sector.

AI Impact Analysis on Tyre Pyrolysis Plant Market

User queries regarding the impact of Artificial Intelligence (AI) on the Tyre Pyrolysis Plant Market predominantly revolve around optimizing operational efficiency, enhancing product consistency, and achieving predictive maintenance to minimize costly downtime. Users are concerned with how machine learning algorithms can manage the inherent variability in tire feedstock (different rubber compositions, moisture content) to stabilize the pyrolysis reaction conditions, which are highly sensitive to temperature and pressure fluctuations. Key expectations include the use of AI for real-time sensor data analysis to auto-adjust reactor parameters, ensuring maximum yield of high-quality Pyrolysis Oil and Recovered Carbon Black, and integrating sophisticated quality control mechanisms that rapidly identify and correct process deviations. Furthermore, inquiries focus heavily on AI's ability to model and predict equipment failure, extending the operational life of highly specialized and expensive reactor components through proactive maintenance scheduling.

AI and Machine Learning (ML) are set to revolutionize the operational economics of pyrolysis plants by introducing predictive capabilities previously unattainable through traditional control systems. Through the continuous processing and interpretation of multivariate sensor data—including temperature profiles, gas composition, pressure differentials, and feedstock analysis—AI algorithms can generate precise models that correlate input feedstock characteristics with final product quality. This real-time optimization capability ensures that energy consumption (a major operating cost) is minimized while maximizing the throughput of valuable outputs, thereby drastically improving the return on investment (ROI) for plant operators.

Beyond process optimization, AI systems are crucial in managing the complexity of regulatory compliance and environmental monitoring. Advanced computer vision systems, powered by ML, are being utilized for the automated inspection of incoming shredded tires, ensuring contaminant levels (like excessive fiber or metal fragments) remain within acceptable limits before introduction to the reactor. This preprocessing quality assurance is vital for maintaining product purity, particularly rCB. Furthermore, predictive modeling helps plant managers simulate various operational scenarios, assess the environmental impact of emissions, and proactively adjust operations to ensure continuous adherence to increasingly stringent local and international environmental standards, driving sustainable and compliance-focused growth within the sector.

- AI-driven real-time process optimization minimizes energy consumption and maximizes oil/rCB yield.

- Machine learning algorithms enhance feedstock variability management, stabilizing reactor conditions.

- Predictive maintenance schedules, reducing unplanned downtime for high-wear reactor components.

- Computer vision systems accelerate contaminant detection and quality control during feedstock preparation.

- Data analytics correlate operating parameters with environmental compliance metrics automatically.

- Automated quality grading of Recovered Carbon Black (rCB) based on surface area and ash content.

DRO & Impact Forces Of Tyre Pyrolysis Plant Market

The market dynamics of the Tyre Pyrolysis Plant are fundamentally shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the critical Impact Forces influencing market growth and technological direction. A primary Driver is the overwhelming environmental pressure arising from the accumulation of billions of scrap tires globally, coupled with governmental mandates in major economies (EU, US, China) strictly banning landfill disposal or imposing high fees. This regulatory environment effectively mandates recycling, making pyrolysis an economically attractive and compliant waste management solution. Additionally, the fluctuating but generally high price of crude oil directly boosts the attractiveness of Pyrolysis Oil (TPO) as a cost-effective industrial fuel, providing a stable revenue stream for plant operators and fueling market investment.

However, significant Restraints temper this growth trajectory. The most critical constraint is the high initial capital expenditure required to establish a commercial-scale continuous pyrolysis plant, including sophisticated pre-treatment and post-processing units necessary for product quality assurance. Furthermore, technical challenges persist, particularly achieving consistent, high-quality Recovered Carbon Black (rCB) that meets the exacting specifications of primary tire manufacturers, who often remain skeptical about substituting virgin carbon black. Regulatory hurdles surrounding the classification and standardization of TPO and rCB also create market uncertainty, especially in cross-border trade, complicating commercialization efforts and increasing operational complexity for global players seeking standardization.

Opportunities for growth are concentrated in technological advancements and market diversification. The development of advanced catalytic pyrolysis and microwave pyrolysis technologies promises higher energy efficiency and superior-quality outputs, particularly lighter hydrocarbons from the oil fraction. Moreover, the integration of pyrolysis plants with secondary refining units allows for the production of value-added chemicals, biofuels, or specialized carbon products (like activated carbon), moving beyond simple fuel oil and basic rCB. The rising demand for sustainable and certified circular materials across diverse industries presents a strategic opportunity to position rCB as a premium ecological material, thereby securing high-value, long-term contracts and mitigating the historical commodity pricing pressure.

Segmentation Analysis

The Tyre Pyrolysis Plant Market is fundamentally segmented across technology, capacity, and end-product, reflecting the diverse operational approaches and end-user requirements within the industry. Understanding these segments is crucial for investors and operators, as the choice of technology directly dictates operational costs, product quality, and market access. The distinction between Batch and Continuous technology is the most pivotal segmentation criterion, with Batch plants dominating the small-scale, decentralized segment, characterized by lower initial cost but poorer efficiency and variable product quality. In contrast, Continuous plants represent the industry's future, designed for large-scale, 24/7 operation, offering optimized energy recovery and highly consistent, premium output materials suitable for industrial buyers demanding stringent specifications.

Capacity segmentation further refines the market landscape, ranging from small-scale units (processing less than 10 metric tons per day, often utilizing batch reactors) favored in regions with fragmented waste collection, to medium-scale (10-50 TPD), and eventually to large-scale, industrial installations (over 50 TPD). The large-scale segment is the fastest-growing area, driven by institutional investment and the integration of pyrolysis into formal industrial parks or refining complexes, allowing for better management of waste heat and byproduct gas, further boosting overall plant profitability and sustainability metrics. This move towards larger, centralized facilities is indicative of market maturation.

Finally, the End-Product segmentation reveals the primary revenue drivers. While Pyrolysis Oil historically accounted for the largest volume output, the market value is increasingly shifting towards Recovered Carbon Black (rCB). High-quality rCB, meeting the standards for use in non-tire rubber products and even specific tire applications, commands premium pricing and represents the highest value-add component of the pyrolysis process. The monetization of steel wire and non-condensable pyrolysis gas (used internally to power the plant, reducing reliance on external fuel sources) further completes the segmentation landscape, defining the total economic potential derived from waste tire processing.

- Technology

- Batch Pyrolysis Plant

- Continuous Pyrolysis Plant

- Semi-Continuous Pyrolysis Plant

- Capacity

- Small Scale (Less than 10 TPD)

- Medium Scale (10 TPD to 50 TPD)

- Large Scale (Above 50 TPD)

- End-Product Focus

- Pyrolysis Oil (TPO) Focused Systems

- Recovered Carbon Black (rCB) Focused Systems

- Integrated Material Recovery Systems

- Reactor Type

- Rotary Kiln Reactor

- Fluidized Bed Reactor

- Fixed Bed Reactor

Value Chain Analysis For Tyre Pyrolysis Plant Market

The value chain of the Tyre Pyrolysis Plant Market begins with the Upstream segment, dominated by the complex and logistics-intensive process of End-of-Life Tire (ELT) collection, aggregation, and pre-processing. Upstream activities involve municipal waste management entities, specialized tire collection agencies, and tire shredding companies responsible for preparing the feedstock (often shredded rubber or whole tires) for the pyrolysis process. Quality control at this stage is crucial, as the presence of high moisture content, excessive steel, or foreign contaminants directly impacts the efficiency and output quality of the pyrolysis reactor. Suppliers of specialized shredding equipment and de-beading machines are key players in the upstream market, focusing on optimizing particle size and minimizing logistical costs associated with transporting bulky scrap tires.

The core Midstream stage involves the operation of the Tyre Pyrolysis Plant itself. This segment is characterized by specialized technology providers responsible for designing, manufacturing, installing, and maintaining the reactor systems, condensation units, and associated pollution control equipment. Operational excellence here depends on maximizing throughput and product yield while minimizing energy consumption. Post-pyrolysis processing is an increasingly important part of the midstream value chain, particularly the refining of Pyrolysis Oil (TPO) via distillation or hydrotreating to upgrade it to marine fuel or standard diesel substitutes, and the mechanical/chemical processing (pelletizing, activation) of Recovered Carbon Black (rCB) to meet industrial specifications for color, surface area, and volatile content.

The Downstream segment focuses on the distribution and end-use application of the recovered products. Distribution channels are typically categorized as Direct and Indirect. Direct sales involve long-term contracts with major industrial buyers such as cement kilns, power generation facilities, and specialized rubber product manufacturers (for rCB). Indirect channels involve selling bulk TPO to petrochemical trading houses or specialized fuel blenders. The viability of the entire chain relies heavily on the stability and maturity of the downstream market for rCB and refined TPO. Therefore, strong integration and partnership between pyrolysis operators and large, global commodity consumers are essential to secure continuous off-take agreements and stabilize revenue streams across the highly specialized end-markets.

Tyre Pyrolysis Plant Market Potential Customers

The potential customer base for the Tyre Pyrolysis Plant Market is highly diversified, spanning multiple heavy industries that utilize both thermal energy and raw material inputs derived from the recycling process. The largest segment of end-users for Pyrolysis Oil (TPO) includes industries requiring high-volume, cost-effective thermal energy, such as cement manufacturing kilns, which can often co-fire TPO with coal or petcoke. Additionally, industrial power plants and decentralized heat generation facilities use TPO as a heavy fuel oil substitute, especially when regulatory frameworks support the use of recovered fuels. These buyers typically prioritize consistent calorific value and low ash content, driving the demand for pre-refined TPO products.

The secondary, yet rapidly growing, customer segment revolves around Recovered Carbon Black (rCB). Primary consumers of rCB are tire manufacturers seeking to fulfill sustainability quotas, non-tire rubber product producers (e.g., conveyor belts, hoses, mats, seals), and the plastics and coatings industry, where rCB functions as a pigment, UV stabilizer, or filler. The demand in this segment is highly quality-sensitive, requiring rCB that matches specific particle sizes and purity levels. Leading global tire manufacturers are increasingly entering into multi-year supply contracts to secure high-quality rCB supply, driven by corporate mandates to reduce their carbon footprint and promote material circularity within their product lifecycle management.

A third, distinct customer group comprises the metal processing and recycling sector, which purchases the high-grade steel wire recovered from the pyrolysis process. This recovered steel, often sold as scrap commodity, is utilized by secondary steel mills and foundries. Furthermore, the non-condensable pyrolysis gas can occasionally be sold to adjacent industrial facilities for heat recovery or power generation, although it is most commonly consumed internally by the pyrolysis plant itself to reduce operating costs. Overall, the market thrives on establishing robust, specialized supply linkages across these varied industrial end-users, transforming waste into authenticated, certified secondary raw materials ready for immediate industrial application.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.7 Million |

| Market Forecast in 2033 | USD 967.5 Million |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ENVIRON Recycling, Klean Industries Inc., Green Oil & Rubber Recycling Inc., Beston Machinery Co., Ltd., Jilin Province Huaying Environmental Protection Machinery Co., Ltd., Qilong Machinery, Pyrum Innovations AG, Changing World Technologies, Inc., Ecore International, Konieczny Recycling Technology, Niutech Environment Technology Corporation, Kingtiger Group, Wuxi Dadi Environmental Protection Technology, Jinzhen Environmental Protection, D&H Tyre Recycling Machinery, Al-Jabal Group, Technip Energies, Fukuang Energy, Integrated Pyrolysis Industries (IPI), and Scandinavian Enviro Systems AB. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tyre Pyrolysis Plant Market Key Technology Landscape

The technological landscape of the Tyre Pyrolysis Plant Market is rapidly evolving, moving away from rudimentary, small-scale batch reactors towards sophisticated, integrated continuous systems that maximize both yield and energy efficiency. The foundational technology remains thermal degradation, typically employing indirect heating via external furnaces or direct heating using recycled pyrolysis gas. Key technological differentiation lies in the reactor design. Rotary Kiln reactors are highly prevalent, especially in high-capacity continuous setups, favored for their ability to ensure uniform heat distribution and efficient handling of solid residues (rCB and steel). However, managing the sealing mechanisms in high-temperature rotary systems remains a critical engineering challenge impacting maintenance costs.

A second crucial area of innovation is the adoption of advanced reactor types such as Fluidized Bed and Catalytic Pyrolysis systems. Fluidized bed reactors, though complex to operate, offer superior heat transfer efficiency, leading to faster reaction times and potentially higher quality Pyrolysis Oil due to tighter temperature control. Catalytic pyrolysis represents a significant step forward, utilizing specific catalysts (zeolites or metal oxides) to lower the reaction temperature and selectively crack the hydrocarbon polymers in the tires. This selective cracking significantly improves the quality of the resulting oil, transforming it into lighter, more refined fractions suitable for direct use in engines or as high-grade refinery feedstocks, thereby dramatically increasing the oil's market value and competitive edge against conventional fossil fuels.

Beyond the core reactor, the technological landscape is defined by integrated auxiliary units essential for commercial success. These include sophisticated non-condensable gas purification systems (scrubbers and de-sulfurization units) to ensure environmental compliance when the gas is burnt internally, and advanced oil distillation and fractional condensation systems that separate the TPO into distinct heavy and light oil cuts. Crucially, the post-processing technology for Recovered Carbon Black is gaining prominence, encompassing mechanical grinding, thermal activation, and chemical modification to enhance its surface area, reduce ash content, and make it functionally comparable to virgin carbon black, thus unlocking higher-value industrial applications in the rubber and coatings markets. The integration of digitalization and advanced control systems (DCS/PLC) across all these units ensures seamless, optimized operation and forms the bedrock of modern pyrolysis plant design.

Regional Highlights

The global Tyre Pyrolysis Plant Market demonstrates significant regional variation in terms of regulatory maturity, technological adoption, and market drivers. Asia Pacific (APAC) currently dominates the market both in terms of production volume and installed base. This dominance is primarily fueled by the sheer volume of ELT generation, especially in rapidly industrializing nations like China, India, and Southeast Asian countries. While APAC historically relied on smaller, batch-type operations due to lower investment costs, increasing government focus on industrial waste treatment standards and the export potential of rCB is driving rapid investment in large-scale, continuous processing facilities. China, in particular, leverages pyrolysis as a core component of its national environmental strategy, leading to high internal competition and rapid technological diffusion, though regulatory enforcement related to emissions and wastewater management remains a critical differentiating factor between regional players.

Europe represents a mature and highly regulated market, where growth is dictated less by volume and more by high-value output and strict circular economy mandates. The European Union's Waste Framework Directive and targets for material recycling propel demand for pyrolysis as a compliant, high-recovery technology. Key drivers include robust support for sustainable fuel alternatives (TPO) and strong industrial demand for certified sustainable materials (rCB). Countries like Germany and the Netherlands are technological pioneers, hosting several high-capacity, next-generation plants utilizing catalytic and microwave-assisted pyrolysis to achieve premium product quality. The regulatory framework, particularly REACH, places heavy emphasis on the safety and standardization of rCB, positioning European producers at the forefront of quality assurance and environmental compliance, thus securing high-margin contracts within the European rubber and automotive industries.

North America, led by the United States and Canada, presents a market characterized by technological innovation and significant potential for future expansion, driven primarily by private investment and favorable state-level incentives for waste-to-energy projects. The market is witnessing a strong trend towards integration with existing petroleum refining infrastructure, where TPO is co-processed with crude oil to produce transportation fuels, capitalizing on economies of scale and existing distribution networks. Furthermore, the robust automotive sector in the US is a major consumer of carbon black, driving interest in locally sourced rCB to improve supply chain resilience and meet sustainability goals. The key challenge in North America remains the highly variable logistical cost associated with ELT collection across vast geographical areas, requiring advanced logistics planning and decentralized shredding operations to feed centralized pyrolysis hubs efficiently. Latin America and the Middle East & Africa (MEA) are emerging markets, characterized by high growth potential but hindered by fragmented regulatory frameworks and limited access to capital for large-scale industrial projects, though initial small-scale operations are gaining traction due to localized waste accumulation crises.

- Asia Pacific (APAC): Market leader in volume and installed capacity; driven by massive ELT volume and increasing environmental regulation in China and India. Focus shifting towards high-capacity continuous plants.

- Europe: High-value, technologically advanced market; driven by strict EU circular economy policies, high demand for certified sustainable rCB, and innovation in catalytic pyrolysis.

- North America: Strong focus on high-quality fuel production through TPO co-processing in refineries; driven by private investment, state incentives, and demand from the domestic automotive sector for sustainable materials.

- Latin America (LATAM): Emerging market with high untapped potential; growth linked to modernization of waste management infrastructure and combating illegal tire dumping.

- Middle East & Africa (MEA): Nascent market primarily focused on addressing local tire waste crises; dependent on foreign investment and technology transfer for large-scale adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tyre Pyrolysis Plant Market.- ENVIRON Recycling

- Klean Industries Inc.

- Green Oil & Rubber Recycling Inc.

- Beston Machinery Co., Ltd.

- Jilin Province Huaying Environmental Protection Machinery Co., Ltd.

- Qilong Machinery

- Pyrum Innovations AG

- Changing World Technologies, Inc.

- Ecore International

- Konieczny Recycling Technology

- Niutech Environment Technology Corporation

- Kingtiger Group

- Wuxi Dadi Environmental Protection Technology

- Jinzhen Environmental Protection

- D&H Tyre Recycling Machinery

- Al-Jabal Group

- Technip Energies

- Fukuang Energy

- Integrated Pyrolysis Industries (IPI)

- Scandinavian Enviro Systems AB

Frequently Asked Questions

Analyze common user questions about the Tyre Pyrolysis Plant market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary commercial products generated by a tyre pyrolysis plant?

The primary commercial products derived from tire pyrolysis are Pyrolysis Oil (TPO), which is used as industrial fuel; Recovered Carbon Black (rCB), utilized as a sustainable filler in rubber and plastics; high-tensile Steel Wire; and non-condensable Pyrolysis Gas, which is typically recycled to power the pyrolysis reactor itself, maximizing energy efficiency.

How does Recovered Carbon Black (rCB) compare in quality and application to virgin carbon black?

While standard rCB typically has higher ash and lower surface area compared to virgin carbon black, specialized post-processing technologies (e.g., thermal activation, mechanical grinding) are rapidly improving rCB quality. High-grade rCB is widely adopted in non-tire rubber products and is increasingly being integrated into specific tire parts, offering a significant reduction in environmental footprint.

What are the major technological distinctions between batch and continuous pyrolysis systems?

Batch pyrolysis operates discontinuously, requires full cooling and reheating cycles, leading to lower efficiency and variable product quality, but demands lower initial investment. Continuous pyrolysis systems operate 24/7, offering high throughput, optimized energy consumption, and consistent, high-specification output materials, making them preferred for large-scale industrial projects.

What is the regulatory outlook for the use of Pyrolysis Oil (TPO) as a fuel source?

The regulatory outlook for TPO is favorable, particularly in Europe and North America, as mandates push for sustainable, recovered fuels. However, TPO must often undergo refining (desulfurization and stabilization) to meet stringent emission standards for industrial boilers and power generation, especially concerning sulfur and nitrogen oxide content.

Which region currently leads the global Tyre Pyrolysis Plant Market, and why?

The Asia Pacific (APAC) region leads the market due to the enormous volume of End-of-Life Tire generation resulting from rapid economic and vehicular growth. Although historically decentralized, APAC is now investing heavily in large-scale facilities, driven by emerging national waste management policies and the attractive economic opportunity presented by commodity production.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager