UAV Lithium Battery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435399 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

UAV Lithium Battery Market Size

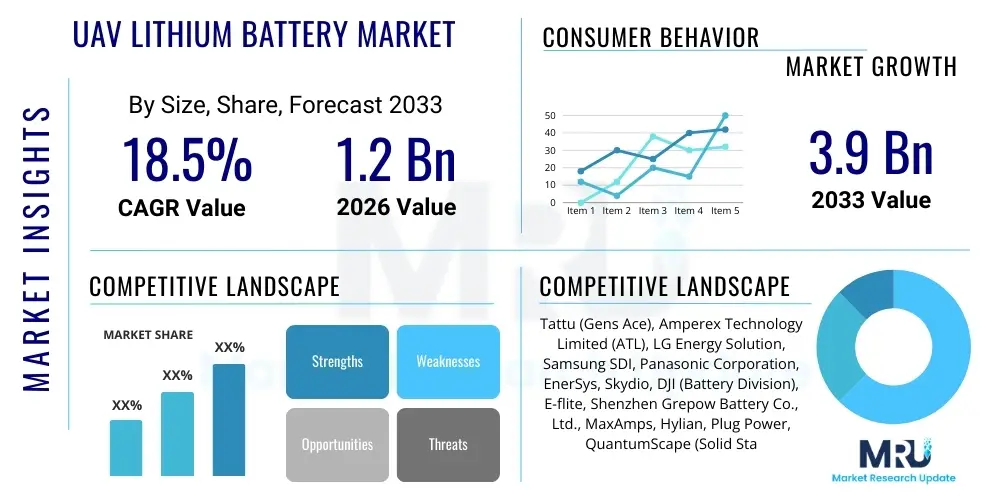

The UAV Lithium Battery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $3.9 Billion by the end of the forecast period in 2033. This substantial expansion is primarily driven by the escalating demand for Unmanned Aerial Vehicles (UAVs) across defense, commercial logistics, and infrastructural monitoring sectors, all of which require high-performance, energy-dense power sources to maximize flight time and payload capacity. The ongoing research and development focusing on enhancing battery longevity and reducing charging cycles further contribute significantly to this rapid market valuation growth.

UAV Lithium Battery Market introduction

The UAV Lithium Battery Market encompasses the manufacturing, distribution, and utilization of high-energy-density rechargeable batteries specifically designed to power various classes of Unmanned Aerial Vehicles (UAVs), commonly known as drones. These batteries, predominantly based on Lithium Polymer (Li-Po) and Lithium-ion (Li-ion) chemistries, are crucial components enabling drone operations ranging from tactical military reconnaissance to commercial delivery services and sophisticated environmental surveys. The core product characteristics revolve around maximizing specific energy (Wh/kg) while maintaining a low weight profile, enabling extended flight endurance and larger payload carriage, which are critical performance metrics in the drone industry. Advances in materials science, particularly the utilization of nickel-manganese-cobalt (NMC) and ongoing exploration into solid-state electrolytes, are continuously redefining performance standards within this specialized market segment.

Major applications of UAV lithium batteries span diverse vertical industries. In the commercial sphere, they power drones utilized for precision agriculture, aerial cinematography, infrastructure inspection (pipelines, wind turbines, power lines), and nascent drone delivery services, especially in last-mile logistics. Concurrently, the defense and homeland security sectors represent a cornerstone application, demanding batteries for surveillance, tactical mapping, intelligence gathering, and specialized combat roles where reliability and operational secrecy are paramount. The reliability and cycling stability of these batteries directly impact the operational efficiency and total cost of ownership (TCO) for drone fleets, leading operators to prioritize high-quality, certified battery solutions over cheaper, less reliable alternatives.

Key market benefits include extended operational ranges and mission durations made possible by improved energy density, enhancing the overall utility of UAV platforms. Driving factors fueling this market growth include significant regulatory advancements supporting commercial drone operations (e.g., relaxed Beyond Visual Line of Sight (BVLOS) regulations), exponential investment in drone technology by global militaries, and the rapidly decreasing cost of high-performance battery packs due to economies of scale in Li-ion manufacturing. Furthermore, the imperative for continuous, reliable data acquisition in complex industrial environments, such as surveying remote construction sites or monitoring environmental hazards, solidifies the indispensable role of robust power sources, thus perpetuating market expansion.

UAV Lithium Battery Market Executive Summary

The UAV Lithium Battery Market is characterized by vigorous business trends focusing on optimizing energy density, improving charging efficiency (higher C-rates), and enhancing battery safety features through sophisticated Battery Management Systems (BMS). Key industry participants are increasingly engaging in strategic partnerships with UAV manufacturers (OEMs) to tailor power solutions for specific drone classes, such as heavy-lift cargo drones or high-altitude, long-endurance (HALE) surveillance aircraft. A notable business trend involves the development of hybrid power systems incorporating fuel cells or solar power augmented by lithium batteries, particularly for missions requiring extended durations beyond the current capabilities of pure electric battery solutions. Competition remains fierce, driven by continuous innovation in cell chemistry and packaging techniques designed to meet stringent weight and thermal management requirements demanded by advanced drone designs, forcing companies to maintain substantial R&D expenditure.

Regionally, the market exhibits uneven growth, with North America and Asia Pacific (APAC) dominating both in terms of consumption and manufacturing capability. North America, driven by massive defense spending and early adoption of commercial drone services (e.g., Amazon, Wing), commands a significant market share. APAC, particularly China, is a crucial manufacturing hub, benefiting from massive Li-ion production infrastructure and rapid internal adoption in logistics and inspection services. Europe shows robust growth, buoyed by the implementation of unified EU drone regulations and strong investment in agricultural and environmental monitoring applications. Regulatory harmonization remains a critical factor, as clear guidelines on battery transportation and disposal influence regional market dynamics and the operational scale of drone fleets.

Segment trends indicate a strong shift towards higher voltage battery packs (e.g., 6S and 12S configurations) to meet the power demands of larger, multi-rotor, and fixed-wing UAVs that carry heavier payloads. While Lithium Polymer (Li-Po) chemistry currently holds the dominant segment share due to its excellent power-to-weight ratio and high discharge rates suitable for demanding flight profiles, the Lithium-ion (Li-ion) segment is rapidly gaining traction, particularly for long-endurance applications where energy density (Wh/kg) is prioritized over peak power output (W/kg). Furthermore, the emerging market for solid-state batteries, though nascent, promises a revolutionary leap in safety and energy density, signaling a forthcoming shift in preferred battery type, especially as production costs decrease and manufacturing scales up over the forecast period.

AI Impact Analysis on UAV Lithium Battery Market

User inquiries regarding AI's influence on the UAV Lithium Battery Market frequently center on predictive battery maintenance, optimization of charging protocols, and leveraging machine learning to extend flight autonomy. Common concerns revolve around how AI can prevent catastrophic battery failures, such as thermal runaway, and whether intelligent systems can dynamically adjust power usage based on mission parameters, weather conditions, and payload changes. Users are actively seeking solutions that integrate AI-driven battery health monitoring (BHM) directly into the drone's flight control systems to provide real-time degradation analysis and improve overall fleet management efficiency. The overriding expectation is that AI will transform battery lifespan prediction from a statistical average calculation into a precise, operational intelligence metric, thereby reducing downtime and replacement costs.

The integration of Artificial Intelligence (AI) algorithms is fundamentally enhancing the operational efficiency and safety profile of UAV lithium batteries. AI is utilized in Battery Management Systems (BMS) to process vast amounts of telemetry data—including voltage, current, temperature, and cycle counts—to accurately predict the State of Health (SOH) and State of Charge (SOC) with significantly higher precision than traditional methods. This predictive capability allows drone operators to schedule proactive maintenance, preventing unexpected failures during crucial missions. Furthermore, AI systems optimize the charging process by learning the specific characteristics of individual battery packs, dynamically adjusting charge rates to maximize cycle life while minimizing degradation induced by heat stress.

Beyond internal battery management, AI algorithms optimize the energy consumption profile of the entire UAV platform. By integrating mission planning AI, the system can intelligently manage power output to the motors based on real-time flight conditions, altitude changes, wind resistance, and payload requirements, effectively squeezing maximum endurance out of the existing battery capacity. This capability is critical for complex operations like BVLOS flights and autonomous package delivery routes, where precise energy usage estimation is vital for mission success and regulatory compliance. Consequently, AI is not merely improving the battery itself but is optimizing the utilization of the stored energy, acting as a crucial enabling technology for next-generation, high-autonomy drone operations across all market segments.

- AI enhances Battery Management Systems (BMS) for precise State of Health (SOH) and State of Charge (SOC) prediction.

- Machine learning algorithms optimize charge/discharge cycles to mitigate capacity fade and extend operational lifespan.

- Predictive maintenance analytics, powered by AI, minimize thermal runaway risk and unplanned battery replacements.

- AI-driven flight control systems dynamically manage motor power consumption based on real-time environmental factors, increasing flight endurance.

- Neural networks are used in material science R&D to accelerate the discovery and testing of new, higher-density battery chemistries.

DRO & Impact Forces Of UAV Lithium Battery Market

The UAV Lithium Battery Market is strongly influenced by a robust interplay of Drivers, Restraints, and Opportunities (DRO), which collectively define the market trajectory and investment landscape. Key Drivers include the exponential global proliferation of commercial drone applications across logistics, agriculture, and construction, each requiring reliable, high-energy power sources to maximize operational efficiency. Military modernization programs globally, particularly the shift towards unmanned warfare systems (UWS), necessitate continuous upgrades in battery technology to meet stringent performance requirements for speed, range, and stealth. These demand-side pressures are amplified by technological progress in lithium chemistry, offering ever-increasing energy density (Wh/kg) and improved safety standards, pushing the boundaries of drone utility and accessibility.

However, the market faces significant Restraints that temper its growth rate. Primary among these is the inherent technological limitation related to energy density; current Li-ion and Li-Po chemistries still cannot provide the endurance necessary for very long-range missions (e.g., multi-day flights), leading to limitations on drone utility in certain sectors. Safety concerns regarding thermal runaway, fire risks associated with high-density batteries, and the complex regulatory framework governing the air transport of these hazardous materials (IATA regulations) impose substantial operational and logistical hurdles. Furthermore, the high initial cost of advanced, customized battery packs and the reliance on specialized global supply chains for critical raw materials, such as cobalt and nickel, introduce price volatility and supply chain vulnerabilities, creating market resistance for smaller operators.

Opportunities for market stakeholders primarily lie in the rapid development and commercialization of next-generation battery technologies, specifically solid-state and silicon-anode batteries, which promise revolutionary improvements in both energy density and safety, potentially overcoming current limitations. The increasing focus on establishing closed-loop battery recycling infrastructure and sustainable sourcing of materials presents an opportunity for manufacturers to improve their environmental profile and secure long-term raw material supply, aligning with global ESG mandates. Additionally, developing interoperable, standardized battery pack sizes and smart charging infrastructure could significantly streamline fleet management for large commercial operators, creating new revenue streams for service providers specializing in power management solutions. These technological and infrastructural advancements are critical Impact Forces, determining which players gain competitive advantage through superior power solutions, ultimately shaping the long-term dominance of key industry participants in this highly specialized and evolving component market.

Segmentation Analysis

The UAV Lithium Battery Market is comprehensively segmented based on several key operational and chemical parameters, allowing for detailed analysis of demand patterns across different end-user verticals and technological preferences. The primary segmentation criteria include battery type (Lithium Polymer vs. Lithium-ion vs. Solid-State), component (Cell, Module, Pack, BMS), application (Military & Defense, Commercial, Consumer), and drone type (Fixed-Wing, Rotary-Wing, Hybrid). This multi-dimensional segmentation is crucial as the performance requirements for a small consumer photography drone differ drastically from those of a heavy-lift industrial inspection UAV or a long-endurance military surveillance platform, driving specialized battery pack design and manufacturing processes across sub-segments. The increasing complexity of drone missions necessitates highly customized power solutions, further enhancing the granularity of these segments and dictating specific pricing and competition dynamics within each niche area.

- By Chemistry/Battery Type:

- Lithium Polymer (Li-Po): High discharge rate, suitable for consumer and high-performance racing/acrobatic drones.

- Lithium-ion (Li-ion): Higher energy density, preferred for long-endurance logistics and inspection UAVs.

- Solid-State Batteries: Emerging segment promising higher safety and superior energy density.

- By Component:

- Battery Cell

- Battery Module

- Battery Pack

- Battery Management System (BMS)

- By Voltage Type:

- Low Voltage (Up to 6S / 25.2V)

- Medium Voltage (6S to 12S / 25.2V to 50.4V)

- High Voltage (Above 12S / Above 50.4V)

- By Application:

- Military & Defense: Surveillance, reconnaissance, targeting.

- Commercial:

- Agriculture (Precision farming)

- Logistics & Delivery

- Inspection & Surveying (Infrastructure, Oil & Gas)

- Filming & Photography

- Consumer: Recreational and hobbyist use.

- By Drone Type:

- Rotary-Wing (Multi-rotor)

- Fixed-Wing

- Hybrid Vertical Takeoff and Landing (VTOL)

Value Chain Analysis For UAV Lithium Battery Market

The value chain for the UAV Lithium Battery Market is intricate, commencing with the upstream sourcing of critical raw materials and culminating in the highly specialized distribution and post-sale services. Upstream analysis involves the extraction and refinement of key battery components, including lithium, cobalt, nickel, manganese, and graphite. A small number of specialized chemical companies process these materials into active electrode materials, which are then supplied to cell manufacturers. This initial stage is heavily impacted by geopolitical stability, commodity price fluctuations, and increasing regulatory scrutiny regarding ethical sourcing and environmental compliance, making supply chain resilience a critical competitive factor for cell producers globally.

Midstream activities center on the manufacturing of the individual battery cells and the subsequent integration into finalized battery packs, modules, and sophisticated Battery Management Systems (BMS). Cell manufacturing requires highly specialized, capital-intensive 'Gigafactories,' particularly in Asia, which often dictates the performance characteristics (C-rate, energy density) available to the market. Downstream activities involve the highly technical process of assembling these cells into customized battery packs, often tailored to meet specific drone platform requirements (weight distribution, size, connector type). These packs are then supplied directly to Original Equipment Manufacturers (OEMs) of UAVs (Direct Channel) or via specialized electronic component distributors who cater to smaller customization houses and aftermarket service providers (Indirect Channel).

The distribution channel is dichotomous: the Direct channel handles large-volume contracts with major defense contractors and tier-one commercial drone manufacturers, necessitating long-term agreements and stringent quality control. The Indirect channel provides crucial access to small and medium-sized enterprises (SMEs), hobbyists, and maintenance workshops, relying on established global electronics distributors and specialized regional resellers. Post-sale services, including battery recycling and mandatory disposal services, are becoming an increasingly important part of the value chain due to environmental regulations. Efficient logistics for transporting these hazardous materials are also a key downstream consideration, often requiring specialized third-party logistics (3PL) providers adept at managing international dangerous goods protocols, ensuring the safe and compliant flow of products to the global end-user base.

UAV Lithium Battery Market Potential Customers

The primary End-Users and Buyers of UAV lithium batteries represent a diverse amalgamation of sectors, fundamentally categorized into Military & Defense organizations, large-scale Commercial enterprises, and individual Consumers/Hobbyists. Military and defense agencies worldwide constitute a high-value, stringent customer base, prioritizing performance metrics such as operational longevity, rapid deployment readiness, and extreme environmental tolerance, often demanding highly customized, robust, and proprietary battery solutions for intelligence, surveillance, and reconnaissance (ISR) missions and advanced weapon systems. Procurement within this segment is characterized by long acquisition cycles, adherence to strict military specifications (Mil-Spec), and reliance on established defense contractors as integrators.

Commercial customers encompass a vast and rapidly expanding segment, including logistics giants (e.g., package delivery services), agricultural technology firms utilizing drones for crop monitoring and spraying, and infrastructure inspection companies focused on energy, telecom, and construction assets. These buyers prioritize total cost of ownership (TCO), cycle life, reliability for continuous fleet operations, and standardized interchangeable battery packs to minimize operational downtime. The procurement process here is often driven by performance-based contracts and increasingly relies on Battery-as-a-Service (BaaS) models or direct agreements with specialized battery pack integrators to ensure rapid maintenance and technology refreshes within their large-scale drone fleets. The demand for modularity and smart battery features, such as integrated GPS and health monitoring, is particularly high in this industrial segment.

The Consumer segment, while representing higher volume but lower average value per unit, consists mainly of recreational drone pilots, aerial photographers, and small-scale media production companies. These buyers are highly price-sensitive but also value portability and high burst discharge rates (C-rates) for dynamic flight requirements, relying heavily on standard retail channels, e-commerce platforms, and direct sales from drone manufacturers. Future purchasing trends across all segments are converging towards battery packs that incorporate intelligent thermal management, wireless charging capabilities, and extended warranties, reflecting the growing operational dependence on UAV technology and the need for zero-failure power systems to ensure mission integrity and protect high-value drone assets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $3.9 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tattu (Gens Ace), Amperex Technology Limited (ATL), LG Energy Solution, Samsung SDI, Panasonic Corporation, EnerSys, Skydio, DJI (Battery Division), E-flite, Shenzhen Grepow Battery Co., Ltd., MaxAmps, Hylian, Plug Power, QuantumScape (Solid State), Sion Power |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

UAV Lithium Battery Market Key Technology Landscape

The technological landscape of the UAV Lithium Battery Market is dominated by continuous advancements aimed at surpassing the physical limits of traditional Lithium Polymer (Li-Po) and conventional cylindrical Lithium-ion (Li-ion) cells. Current innovation is heavily focused on increasing gravimetric energy density (Wh/kg) to maximize flight time without increasing the drone’s overall takeoff weight. Manufacturers are aggressively pursuing the development of silicon-anode technology, which promises significant capacity boosts over conventional graphite anodes. Furthermore, research into higher nickel content cathodes, such as Nickel-Manganese-Cobalt (NMC) 811, is crucial for achieving higher performance metrics, although this necessitates enhanced thermal management systems to mitigate the associated risks of increased reactivity and potential thermal runaway events inherent in these highly energetic chemistries.

A pivotal technological trend is the burgeoning shift towards Solid-State Batteries (SSBs). While still largely in the research and early commercialization phase, SSBs offer a paradigm shift, eliminating the flammable liquid electrolyte found in traditional Li-ion batteries, thereby dramatically improving safety and allowing for potentially far greater energy density. These advancements are particularly attractive for military and heavy-lift commercial applications where safety and performance are non-negotiable prerequisites. Complementing the core cell chemistry improvements, the sophistication of Battery Management Systems (BMS) is rapidly evolving. Modern BMS units now incorporate sophisticated microprocessors, AI-driven algorithms for precise cell balancing, predictive failure analysis, and high-speed communication interfaces (e.g., CAN Bus) to interface seamlessly with the drone’s flight control system, ensuring optimized power delivery under diverse operational stresses.

Beyond the core battery pack, auxiliary technologies are vital for market growth. Rapid charging technology is essential for reducing operational downtime, with specialized charging solutions featuring intelligent temperature control and high C-rate compatibility becoming standard for commercial fleets. Wireless charging solutions, although still limited by efficiency loss and power transfer capability, are being explored for automated drone docking stations and infrastructure monitoring applications, promising truly autonomous charging cycles without human intervention. Furthermore, the integration of modular, interchangeable battery designs that promote standardization and easy swap-out capabilities across different UAV platforms is a technological driver facilitating efficient fleet maintenance and scaling commercial drone operations globally, simplifying logistics and reducing the complexity of energy infrastructure management for end-users.

Regional Highlights

- North America: This region maintains a commanding lead in the UAV Lithium Battery Market, primarily driven by substantial defense spending on sophisticated surveillance and combat drones, coupled with the rapid expansion of commercial applications, particularly in oil and gas inspection and large-scale delivery trials. The U.S. remains the core market, benefiting from established regulatory frameworks (e.g., FAA policies) supporting commercial BVLOS operations and possessing a robust ecosystem of advanced battery and UAV manufacturers. Investment in high-performance, military-grade Li-ion solutions is especially pronounced here, fueling continuous innovation in ruggedized and extended-life battery packs.

- Europe: Characterized by strong growth in precision agriculture, environmental monitoring, and infrastructural maintenance, Europe is rapidly adopting high-end Li-ion batteries for fixed-wing and VTOL platforms. Regulatory alignment across the European Union is streamlining drone operations, boosting demand. Germany, France, and the UK are key markets, focusing not only on consumption but also on localizing advanced battery production and pioneering environmentally friendly recycling technologies to address sustainability mandates and secure the regional supply chain independence from Asian manufacturers.

- Asia Pacific (APAC): APAC is the fastest-growing and largest manufacturing hub globally, dominated by China, South Korea, and Japan. China controls a majority share of the global Li-ion battery manufacturing capacity, providing a cost advantage to UAV OEMs globally. The region sees massive internal demand driven by rapid urbanization, extensive use of drones in infrastructure development, surveillance, and package delivery in dense urban areas, and a massive consumer drone market. South Korea and Japan contribute heavily through technological leadership in advanced battery chemistries and components, setting global benchmarks for energy density and quality control.

- Latin America: This region exhibits emerging demand, predominantly focused on utilizing UAVs for large-scale mining operations, extensive agricultural surveys (soy, corn), and governmental initiatives related to border security and disaster relief. Market growth is restrained by economic volatility and slower regulatory development compared to North America and Europe. The demand is currently focused on cost-effective, durable battery solutions capable of operating reliably in diverse and often challenging climate conditions.

- Middle East and Africa (MEA): Market growth in MEA is largely fueled by defense modernization initiatives, particularly in the UAE, Saudi Arabia, and Israel, which utilize high-end surveillance and reconnaissance UAVs, requiring specialized, high-temperature tolerant battery solutions. Commercial adoption is increasing in sectors like oil and gas infrastructure inspection and land surveying. Investment in local assembly and integration facilities for battery packs is slowly emerging, aiming to serve the defense and critical infrastructure maintenance sectors efficiently.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the UAV Lithium Battery Market.- Tattu (Gens Ace)

- Amperex Technology Limited (ATL)

- LG Energy Solution

- Samsung SDI

- Panasonic Corporation

- EnerSys

- Shenzhen Grepow Battery Co., Ltd.

- MaxAmps

- Plug Power (Hybrid Solutions)

- Skydio (Integrated Solutions)

- DJI (Internal Battery Manufacturing)

- E-flite

- Hylian

- QuantumScape (Solid-State Development)

- Sion Power

- Kokam Co., Ltd.

- CBAK Energy Technology, Inc.

- BYD Company Ltd.

- FDK Corporation

- CLP Power Hong Kong Ltd.

Frequently Asked Questions

Analyze common user questions about the UAV Lithium Battery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors primarily drive the demand for high-performance UAV lithium batteries?

Demand is primarily driven by the escalating global adoption of commercial drones in logistics, infrastructure inspection, and precision agriculture, alongside increased military spending on tactical and surveillance UAVs. The critical need for extended flight endurance and higher payload capacity mandates continuous innovation in energy density and power output characteristics.

How are solid-state batteries expected to impact the future of the UAV battery market?

Solid-state batteries (SSBs) are anticipated to revolutionize the market by offering significantly higher energy density (Wh/kg) and inherently greater safety due to the elimination of flammable liquid electrolytes. While currently costly, SSBs promise to dramatically increase drone flight range and reduce thermal risks, driving next-generation high-endurance UAV designs.

What are the main regulatory challenges affecting the distribution and usage of UAV batteries?

The primary challenges involve stringent international regulations from bodies like IATA concerning the classification, packaging, and air transport of lithium batteries as hazardous materials. Furthermore, evolving national drone operation rules (e.g., BVLOS flight regulations) indirectly influence battery demand by dictating mission complexity and necessary flight duration capabilities.

Which battery chemistry currently dominates the UAV market and why?

Lithium Polymer (Li-Po) chemistry currently holds a dominant share, particularly in consumer and high-performance applications, due to its excellent power-to-weight ratio and ability to deliver very high discharge rates (C-rates). However, Lithium-ion (Li-ion) is rapidly gaining dominance in long-endurance commercial and industrial applications where maximizing flight duration via superior energy density is the main operational requirement.

In what ways does Artificial Intelligence contribute to battery management in UAV operations?

AI is integrated into advanced Battery Management Systems (BMS) to conduct predictive maintenance, accurately assess State of Health (SOH), and optimize charging cycles, minimizing degradation. AI also enables real-time dynamic power management during flight, adjusting energy use based on environmental factors to maximize mission autonomy and prevent unexpected power loss.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager