UAV Subsystem Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435426 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

UAV Subsystem Market Size

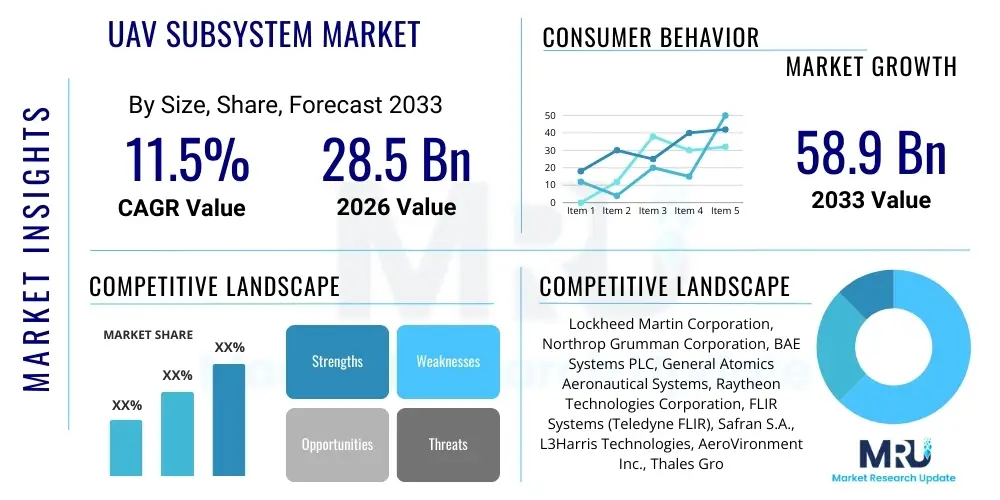

The UAV Subsystem Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. This robust growth trajectory is underpinned by increasing global defense budgets allocated towards modernization and the rapid expansion of commercial drone applications across logistics, agriculture, and infrastructure inspection. The market’s resilience stems from the necessity of advanced components—including sophisticated sensors, propulsion systems, navigation units, and ground control stations—that enhance drone performance, endurance, and autonomy across diverse operational environments.

The market is estimated at $28.5 Billion in 2026 and is projected to reach $58.9 Billion by the end of the forecast period in 2033. This significant valuation increase is driven primarily by technological convergence, where miniaturization, integration of artificial intelligence, and the demand for enhanced payload capacity necessitate continuous innovation in subsystem design. Furthermore, regulatory frameworks are evolving globally to accommodate beyond visual line of sight (BVLOS) operations, which inherently require more reliable and fault-tolerant subsystems, boosting expenditure in high-redundancy and certified components.

Geographically, North America and Asia Pacific are expected to remain the dominant markets, leveraging strong indigenous manufacturing capabilities and high adoption rates in both military and civilian sectors. The military segment, particularly for surveillance, reconnaissance, and combat operations, remains the largest revenue generator, while the commercial sector exhibits the highest growth potential, fueled by drone-as-a-service (DaaS) business models and the widespread implementation of automated aerial data collection systems.

UAV Subsystem Market introduction

The UAV Subsystem Market encompasses all integrated hardware and software components essential for the operation, control, and mission execution of Unmanned Aerial Vehicles (UAVs), commonly known as drones. Key products include flight control systems (autopilots), payload systems (sensors, cameras, LiDAR), propulsion systems (motors, batteries, fuel cells), communication links (data links, telemetry), and navigational modules (GPS/GNSS, IMUs). These specialized components define a UAV's capabilities, including flight duration, range, altitude ceiling, data processing speed, and overall mission effectiveness. The foundational description of the product involves highly reliable, lightweight, and often modular units designed to withstand extreme operating conditions inherent in aerial deployment, serving as the backbone for sophisticated aerial platforms used globally.

Major applications of UAV subsystems span a vast operational landscape, primarily driven by Defense & Military sectors for intelligence, surveillance, and reconnaissance (ISR), target acquisition, and electronic warfare. Commercially, applications are rapidly expanding into precision agriculture for crop health monitoring, construction and infrastructure inspection (bridges, pipelines, cell towers), specialized delivery services, filmmaking, and emergency response for search and rescue operations. The market benefits from the necessity of achieving operational objectives safely, efficiently, and cost-effectively, often replacing human-crewed activities in dangerous or inaccessible environments. The adaptability of modular subsystems allows manufacturers to tailor platforms for highly specific mission profiles, driving customized demand.

Driving factors for this market are multifaceted, including escalating geopolitical tensions necessitating superior aerial reconnaissance capabilities, rapid technological advancements leading to smaller and more powerful components (miniaturization), and increasing investment from venture capital and defense contractors aimed at improving battery life and autonomy. Furthermore, the rising awareness of the commercial viability of drones for logistical optimization and data capture mandates robust, reliable, and standardized subsystem solutions. The shift towards autonomous fleet management and swarm technologies further accelerates the demand for advanced, networked subsystems capable of real-time communication and complex decision-making.

UAV Subsystem Market Executive Summary

The UAV Subsystem Market is experiencing dynamic growth, characterized by significant investment in digitalization and autonomous capabilities, positioning it as a pivotal segment within the broader aerospace and defense industry. Business trends indicate a strong move toward component integration and System-on-Chip (SoC) architectures to reduce size, weight, and power (SWaP), addressing the crucial need for extended endurance in both military and commercial platforms. Major companies are prioritizing strategic partnerships and mergers and acquisitions (M&A) to consolidate intellectual property, particularly in sophisticated sensor technology, anti-jamming communication systems, and advanced power management solutions. Furthermore, the adoption of open-source software and modular hardware designs is democratizing access and accelerating innovation cycles for smaller manufacturers, increasing competitive intensity.

Regional trends highlight North America’s dominance, driven by substantial defense spending, established aerospace giants, and pioneering regulatory environments favorable to commercial drone operations (e.g., FAA approvals). Asia Pacific, however, is projected to achieve the highest CAGR, fueled by rapid military modernization in countries like China and India, coupled with massive commercial deployment in precision agriculture and infrastructure development across dense urban environments. Europe focuses heavily on standardizing air traffic management for drones (U-space) and developing certified subsystems compliant with stringent aviation safety standards, ensuring growth is sustained and integrated into existing air traffic infrastructure. Emerging markets in Latin America and MEA are primarily focused on surveillance and security applications, leveraging imported technology but demonstrating nascent growth in local assembly and maintenance capabilities.

Segment trends reveal that the Payload Segment, encompassing high-resolution imaging and specialized sensors (e.g., Synthetic Aperture Radar - SAR), continues to command the largest market share due to its direct link to mission effectiveness and data quality. However, the Navigation and Control Segment (FCS, GNSS) is forecasted to exhibit superior growth, driven by the escalating requirements for complex autonomous flight profiles and the integration of diverse sensor fusion technologies for highly reliable navigation in GPS-denied environments. By platform, Fixed-Wing UAVs remain critical for long-range ISR, while Rotary-Wing (Multirotor) platforms dominate the commercial sector due to their vertical takeoff and landing (VTOL) capabilities and ease of deployment for localized inspection tasks.

AI Impact Analysis on UAV Subsystem Market

User queries regarding AI's influence on the UAV Subsystem Market frequently center on themes such as "How does AI enhance drone autonomy and decision-making?", "What role does machine learning play in optimizing power consumption and flight path efficiency?", and "Are AI-powered payloads capable of real-time target recognition and tracking?" These questions highlight a primary concern: the transition from remote-piloted systems to truly intelligent, autonomous platforms requiring minimal human intervention. Users are keenly interested in the specifics of edge computing capabilities, where AI algorithms are embedded directly into subsystems (e.g., flight controllers and cameras) to process data instantly, mitigating latency and dependence on constant external communication links. The prevailing expectation is that AI integration will fundamentally revolutionize system reliability, performance envelope, and overall mission complexity execution.

The implementation of Artificial Intelligence and Machine Learning (ML) is transforming key UAV subsystems by enabling sophisticated sensor fusion, predictive maintenance, and highly efficient resource allocation. AI-driven flight control systems utilize reinforcement learning to adapt flight dynamics instantaneously to changing weather conditions or system failures, dramatically improving safety and reliability. In the payload segment, deep learning models embedded within cameras and sensors allow for automatic object classification, anomaly detection, and real-time geographical mapping, significantly enhancing the actionable intelligence derived from aerial data collection missions. This shift not only increases operational efficiency but also drives the demand for specialized hardware, such as dedicated Neural Processing Units (NPUs) within the subsystems, capable of handling intensive computational tasks at the edge.

This transformative impact extends to propulsion and power management, where AI algorithms analyze real-time motor performance and battery degradation to optimize energy usage, providing more accurate estimates of remaining flight time (fuel gauge accuracy). Furthermore, AI is crucial for developing robust counter-UAV (C-UAV) measures, as autonomous systems can swiftly identify and track unauthorized aerial vehicles, requiring advanced integration with communication and control subsystems. The requirement for secure, authenticated communication channels and resilient command links is magnified in an AI-driven ecosystem, ensuring that autonomous decision-making remains within predefined operational boundaries and is protected against cyber threats or unauthorized manipulation.

- AI-Powered Flight Control: Enables full autonomy, dynamic obstacle avoidance, and adaptive flight path optimization using complex algorithms.

- Edge Computing Integration: Allows real-time data processing (image recognition, anomaly detection) directly on the payload or flight controller, minimizing communication latency.

- Predictive Maintenance: ML models analyze sensor data from motors and batteries to forecast failures, scheduling maintenance proactively and increasing operational lifespan.

- Enhanced Sensor Fusion: AI algorithms merge data from multiple sensors (LiDAR, thermal, visual) to create highly accurate and reliable environmental models for navigation in complex or GPS-denied settings.

- Autonomous Target Recognition (ATR): Deep learning models enable payloads to automatically identify, classify, and track specific objects or patterns for ISR and surveillance missions.

- Swarm Technology Enablement: AI is essential for coordinating communication, movement, and task allocation among multiple drones operating collectively.

DRO & Impact Forces Of UAV Subsystem Market

The UAV Subsystem Market is driven by escalating global military spending on drone technology, particularly for intelligence, surveillance, and reconnaissance (ISR) applications, combined with the rapid commercial adoption of drones across key industries like logistics, agriculture, and construction. A primary driver is the continuous demand for superior performance parameters, including longer flight endurance, increased payload capacity, and heightened reliability in extreme operational conditions, compelling manufacturers to invest heavily in advanced propulsion and navigation components. However, this growth faces significant restraints, chiefly high initial component costs, technological complexity requiring specialized skilled personnel, and evolving, often restrictive, aviation regulations (especially concerning BVLOS operations and airworthiness certifications). Opportunities reside in developing highly standardized, interoperable, and certified subsystems compatible with emerging drone air traffic management systems (UTM/U-Space), coupled with the significant potential in hydrogen fuel cell technology for dramatically extending flight time, addressing a critical market limitation.

Impact forces acting on the market are broadly categorized into technological, regulatory, and competitive factors. Technologically, the relentless drive towards miniaturization (reducing Size, Weight, and Power – SWaP) and the integration of quantum sensing technologies (for ultra-precise navigation without GPS) exert a powerful influence, dictating product lifecycles and performance benchmarks. Regulatory pressures are paramount; as global bodies strive to integrate UAVs safely into civilian airspace, manufacturers must comply with increasingly strict cybersecurity standards and airworthiness requirements (e.g., DO-178C for software, DO-254 for hardware), significantly impacting development timelines and certification costs. Competitive forces are intensifying due to the entry of non-traditional aerospace players specializing in advanced software and sensor technologies, fostering a dynamic environment where rapid iteration and specialized niche offerings are key to maintaining market share. Geopolitical stability also impacts procurement cycles and export controls, particularly for high-end military-grade subsystems.

The key challenge lies in balancing the demand for open architectures and interoperability, which promotes rapid innovation, against the necessary proprietary security and performance standards required for critical applications. Addressing the shortage of standardized protocols for inter-subsystem communication and data transfer is crucial for reducing integration risk for UAV platform builders. Ultimately, the market trajectory will be heavily influenced by successful efforts to develop commercially viable, highly autonomous systems that demonstrate both military-grade reliability and compliance with civilian air safety protocols, enabling widespread deployment across critical infrastructure and commercial logistics networks globally.

Segmentation Analysis

The UAV Subsystem Market is highly segmented across several dimensions, primarily component type, platform type, application, and end-user, reflecting the diverse operational requirements inherent to drone technology. This segmentation is crucial for understanding specific market dynamics, technological focus areas, and investment priorities. The component segmentation (e.g., flight control systems, payloads, power systems) allows component manufacturers to target their R&D efforts towards enhancing specific performance metrics, such as battery energy density or sensor resolution. Platform segmentation (Fixed Wing, Rotary Wing, Hybrid) dictates the form factor and weight limitations of the required subsystems, profoundly affecting design and material choices. The increasing complexity of missions requires highly specialized subsystems tailored to specific end-user needs, driving growth in niche segments like advanced electro-optical/infrared (EO/IR) gimbals for border security or high-torque motors for heavy-lift logistical drones.

Market analysts utilize this segmentation to forecast revenue streams and identify high-growth opportunities. For instance, while the military end-user segment drives demand for highly secure communication subsystems (COMINT, SIGINT), the commercial sector focuses on low-cost, high-reliability navigation and power systems optimized for long operational cycles in civil airspace. The application segmentation, ranging from inspection and surveying to defense and logistics, demonstrates the versatility of the core drone platform, but highlights varying critical needs: an inspection drone prioritizes camera quality and stability (payload), whereas a logistics drone prioritizes power efficiency and reliable propulsion (power/propulsion). Strategic companies are positioning themselves as comprehensive system integrators capable of offering modular, certified subsystems that can be quickly adapted across these various application silos.

- By Component:

- Payloads (EO/IR Sensors, Synthetic Aperture Radar (SAR), LiDAR, Hyperspectral Imaging)

- Navigation Systems (GNSS Modules, Inertial Measurement Units (IMU), Air Data Systems)

- Propulsion Systems (Electric Motors, Engines, Batteries, Fuel Cells, Propellers)

- Communication Systems (Data Links, Transceivers, Antennas, Telemetry Modules)

- Flight Control Systems (Autopilots, Embedded Computers, Flight Management Software)

- Ground Control Stations (GCS)

- By Platform:

- Fixed-Wing UAVs

- Rotary-Wing UAVs (Multi-rotor, Single-rotor)

- Hybrid VTOL UAVs

- By Application:

- Military (ISR, Combat, Target Acquisition, Electronic Warfare)

- Commercial (Inspection, Mapping & Surveying, Agriculture, Logistics & Delivery)

- Civil & Government (Public Safety, Border Control, Disaster Management)

- By End-User:

- Defense/Military

- Civilian/Commercial Operators

Value Chain Analysis For UAV Subsystem Market

The value chain for the UAV Subsystem Market is complex, involving highly specialized upstream research and manufacturing, sophisticated integration processes, and varied downstream distribution channels. Upstream analysis focuses on raw material procurement (e.g., high-grade composites, specialized semiconductors, rare earth metals for magnets), fundamental research in battery chemistry (Li-ion, solid-state), and software development for flight algorithms and AI integration. Key upstream participants include semiconductor manufacturers, specialized sensor developers (e.g., MEMS sensor manufacturers), and advanced material suppliers. The high barrier to entry in this stage is driven by the necessity for high reliability, miniaturization, and aerospace certification standards, demanding significant R&D investment and proprietary manufacturing processes.

Midstream activities involve the design, assembly, and testing of the integrated subsystems. Component manufacturers often specialize—one company might produce robust autopilot hardware, while another focuses solely on high-efficiency brushless motors. System integrators (UAV platform builders) then procure these components, integrating them into the final aerial platform. Rigorous testing and certification processes occur at this stage to ensure interoperability and compliance with performance specifications. Distribution channels are bifurcated: direct channels dominate the military and large-scale commercial market, where platform builders procure subsystems directly from Tier 1 suppliers under long-term contracts. This allows for detailed customization and quality assurance control.

Downstream analysis involves the final deployment and utilization of the UAV platforms by end-users (military, commercial operators). Indirect distribution, involving specialized value-added resellers (VARs) and distributors, is common in the small-to-medium commercial market. VARs provide localized technical support, integration services, and regulatory compliance assistance to smaller enterprises adopting drone technology for the first time. The post-sales service and maintenance segment, critical due to the high operational tempo of UAVs, often involves third-party MRO (Maintenance, Repair, and Overhaul) providers. The profitability throughout the chain is highest in the upstream component manufacturing (due to specialized IP) and the downstream service provision (due to recurring revenue models like DaaS).

UAV Subsystem Market Potential Customers

Potential customers for UAV subsystems are primarily divided into two overarching categories: large-scale UAV Platform Manufacturers and Specialized Commercial System Integrators, who then supply the end-users. Platform manufacturers (such as defense contractors and large commercial drone companies) are the direct buyers, requiring reliable, certified, and high-volume subsystems to build their final aerial vehicles. Their purchasing decisions are heavily influenced by factors like component weight, mean time between failures (MTBF), compliance with export control regulations (e.g., ITAR, Wassenaar Arrangement), and the supplier's ability to provide tailored software development kits (SDKs) for seamless integration into proprietary flight stacks. These customers require extensive documentation and support for certification purposes.

The primary end-users, or ultimate buyers of the integrated systems, fall under Defense Ministries and military branches globally (Air Force, Navy, Army) requiring complex, hardened subsystems for national security applications like border surveillance, maritime patrol, and combat support. Commercial end-users span sectors including energy infrastructure companies (oil & gas, power lines), construction firms (site mapping and progress monitoring), agricultural cooperatives (precision farming), and e-commerce/logistics giants (last-mile delivery). These commercial buyers prioritize return on investment (ROI), ease of use, and durability of the subsystems, often opting for pre-integrated solutions offered via a Drone-as-a-Service model to minimize operational complexity.

Furthermore, government agencies and civil entities represent a rapidly growing customer segment. This includes public safety organizations (police, fire departments), disaster response teams, meteorological services, and civil aviation authorities requiring robust and reliable subsystems for situational awareness, mapping post-disaster zones, and aerial inspection of public assets. The increasing use of drones for environmental monitoring and climate change research also positions research institutions and NGOs as burgeoning, albeit specialized, customers. These customers typically require highly accurate sensor payloads and long-endurance power systems to support continuous data collection efforts over vast or remote areas.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $28.5 Billion |

| Market Forecast in 2033 | $58.9 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lockheed Martin Corporation, Northrop Grumman Corporation, BAE Systems PLC, General Atomics Aeronautical Systems, Raytheon Technologies Corporation, FLIR Systems (Teledyne FLIR), Safran S.A., L3Harris Technologies, AeroVironment Inc., Thales Group, Sierra Nevada Corporation, Elbit Systems Ltd., DJI Technology Co. Ltd. (Commercial Subsystems), Insitu (A Boeing Company), UTC Aerospace Systems, MicroPilot, Trimble Inc., Textron Systems, Collins Aerospace. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

UAV Subsystem Market Key Technology Landscape

The technological landscape of the UAV Subsystem Market is defined by a fierce pursuit of autonomy, resilience, and efficiency, underpinned by advancements in sensor technology and materials science. A pivotal area is the miniaturization and enhancement of Inertial Measurement Units (IMUs) and GNSS receivers, moving towards micro-electro-mechanical systems (MEMS) sensors that offer high accuracy navigation in smaller, lighter packages. This focus is critical for maintaining stable flight control and reliable positioning, especially in challenging urban canyons or GPS-denied environments where robust sensor fusion algorithms, often incorporating visual inertial odometry (VIO), are mandatory. Furthermore, anti-jamming and anti-spoofing technologies in communication and navigation modules are becoming standard requirements, particularly for high-end defense and public safety applications, driving innovation in software-defined radios (SDRs) and secure data links.

The propulsion segment is undergoing revolutionary changes with intense focus placed on improving power density. While advanced lithium-ion polymer batteries currently dominate, substantial R&D is directed towards solid-state batteries and hydrogen fuel cells, offering potential five to ten-fold increases in endurance, which is the single most significant barrier to widespread BVLOS adoption. Fuel cells, although heavier initially, provide significantly longer operational times suitable for large, fixed-wing ISR platforms. Concurrently, electric motor technology is evolving, focusing on high power-to-weight ratios through improved magnetic materials and efficient electronic speed controllers (ESCs), ensuring maximum energy conversion efficiency throughout the flight envelope and minimizing thermal management challenges.

Payload technology is shifting towards high integration and multi-spectral capabilities. Modern payloads increasingly combine electro-optical (EO), infrared (IR), and LiDAR sensors onto highly stabilized gimbals, enhanced by onboard AI processors for real-time target detection and data compression. Emerging technologies include Synthetic Aperture Radar (SAR) systems that provide all-weather, day-and-night imaging capabilities, now being miniaturized for tactical and commercial drone use. The integration of advanced cyber-physical security measures directly into subsystem firmware is also a critical technological requirement, addressing the growing threat of system compromise and ensuring data integrity throughout the mission lifecycle, crucial for maintaining regulatory and user trust.

Regional Highlights

Regional dynamics significantly influence the demand and technological sophistication of UAV subsystems, reflecting varied defense priorities, commercial maturity, and regulatory frameworks across the globe.

- North America: This region holds the largest market share, driven by massive defense spending by the U.S. Department of Defense and rapid technological adoption in Silicon Valley and aerospace clusters. The emphasis here is on high-performance, certified components for military applications (e.g., electronic warfare, long-endurance ISR) and pioneering commercial BVLOS operations (e.g., drone delivery and infrastructure inspection). Key drivers include stringent airworthiness standards which necessitate robust, reliable subsystems, and significant private investment in drone startup ecosystems focused on AI and autonomy.

- Asia Pacific (APAC): APAC is the fastest-growing market, primarily fueled by the military modernization programs of China, India, and South Korea, leading to substantial investment in indigenous subsystem development (especially propulsion and communication systems). The commercial sector in APAC is booming, particularly in China and Southeast Asia, utilizing drones for precision agriculture, rapid urbanization mapping, and logistics, generating high demand for cost-effective, high-volume sensor payloads and batteries. Favorable government initiatives promoting technology manufacturing contribute to its market acceleration.

- Europe: The European market is characterized by a strong focus on certification, standardization, and integration into the proposed U-space system for managing drone traffic. Demand is high for subsystems compliant with EASA regulations, driving growth in certified flight control systems, secure data links, and cooperative surveillance technology (ADS-B). Military investment, particularly in France, Germany, and the UK, emphasizes advanced sensor systems and secure tactical communication solutions tailored for NATO interoperability.

- Latin America (LATAM): The market in LATAM is currently smaller but exhibits steady growth, mainly focused on civil security, border surveillance, and resource management (mining and agriculture). Subsystem procurement often relies on imports from North America and Israel, with demand concentrated on surveillance payloads (EO/IR) and reliable navigation systems suitable for operations over vast, often poorly mapped, terrains. Local assembly and MRO services are gradually developing.

- Middle East and Africa (MEA): Geopolitical instability and high defense budgets characterize the MEA market, creating strong demand for military and paramilitary surveillance subsystems, particularly advanced EO/IR sensors, anti-drone systems, and long-range communication components. Investment from oil and gas sectors drives commercial uptake for inspection purposes, requiring specialized methane detection and thermal imaging payloads. UAE and Israel remain key regional technology hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the UAV Subsystem Market, analyzing their product offerings, geographic presence, R&D strategies, and recent competitive developments.- Lockheed Martin Corporation

- Northrop Grumman Corporation

- BAE Systems PLC

- General Atomics Aeronautical Systems

- Raytheon Technologies Corporation

- FLIR Systems (Teledyne FLIR)

- Safran S.A.

- L3Harris Technologies

- AeroVironment Inc.

- Thales Group

- Sierra Nevada Corporation

- Elbit Systems Ltd.

- DJI Technology Co. Ltd. (Commercial Subsystems)

- Insitu (A Boeing Company)

- Textron Systems

- Collins Aerospace

- MicroPilot

- Trimble Inc.

- Auterion AG

- Volz Servos GmbH

Frequently Asked Questions

What are the primary factors driving the growth of the UAV Subsystem Market?

The market growth is primarily driven by escalating global defense modernization programs emphasizing aerial ISR capabilities, coupled with the rapid expansion of commercial applications in high-efficiency sectors like precision agriculture, infrastructure inspection, and last-mile logistics. Crucially, technological advancements in battery performance and AI-driven autonomy enable complex, long-duration missions.

How is regulatory compliance impacting the development of advanced UAV subsystems?

Regulatory compliance, particularly the requirement for airworthiness certification (e.g., EASA and FAA standards) for BVLOS and operations over populated areas, mandates higher levels of reliability and redundancy in critical subsystems, such as flight controls and communication links. This significantly increases R&D costs but ensures market credibility and safety for widespread civilian adoption.

Which component segment holds the largest share in the UAV Subsystem Market?

The Payload segment, encompassing sensors, cameras, LiDAR, and specialized imaging systems (EO/IR, SAR), typically holds the largest market share. This dominance is due to payloads being the primary determinants of mission success and data quality, commanding high unit prices due to their technological complexity and continuous demand for higher resolution and integration.

What is the role of Artificial Intelligence (AI) in future UAV navigation subsystems?

AI is essential for future UAV navigation, enabling true autonomy by facilitating sensor fusion, dynamic path planning, and highly resilient navigation in GPS-denied environments. AI algorithms process real-time environmental data to make instantaneous flight adjustments, moving beyond traditional pre-programmed routes and enhancing operational safety and mission effectiveness.

What major technological advancement is expected to revolutionize UAV propulsion systems?

Hydrogen fuel cell technology is the major advancement expected to revolutionize UAV propulsion, particularly for medium-to-large platforms. While initial adoption is challenging due to infrastructure and size constraints, fuel cells promise significantly increased energy density compared to traditional batteries, potentially extending flight endurance from hours to days, critical for long-range ISR and commercial cargo applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager