UHMWPE Rope Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432501 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

UHMWPE Rope Market Size

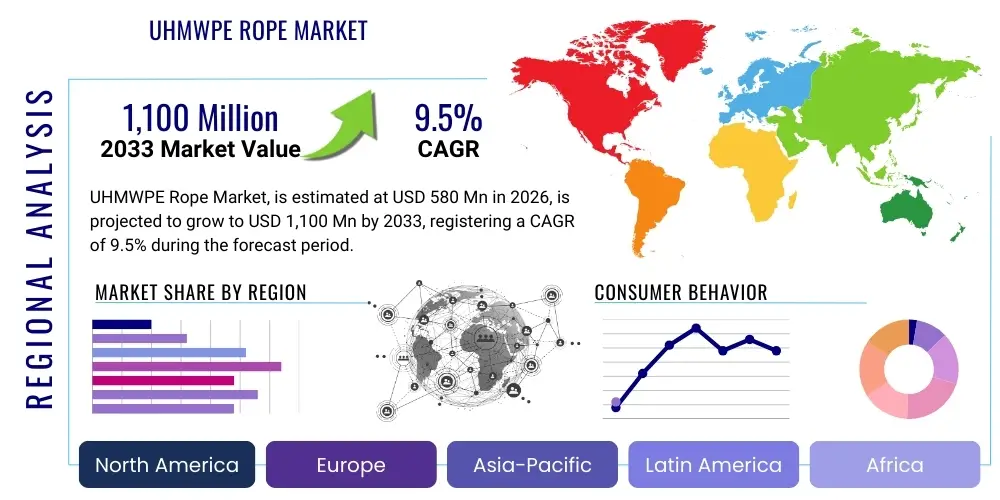

The UHMWPE Rope Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $580 million in 2026 and is projected to reach $1,100 million by the end of the forecast period in 2033.

UHMWPE Rope Market introduction

Ultra-High Molecular Weight Polyethylene (UHMWPE) rope, often marketed under brand names like Dyneema or Spectra, represents a revolutionary advancement in high-performance synthetic fiber technology, offering unparalleled strength-to-weight ratio, superior to traditional steel cable and other synthetic fibers. This product is characterized by its exceptionally long molecular chains, which provide high load-bearing capacity, remarkable abrasion resistance, and excellent resistance to UV light, moisture, and chemical degradation. Its low density ensures that it floats, a critical advantage in marine and offshore applications, making it safer and easier to handle than heavy steel wire. The principal applications span demanding sectors such as deep-sea mooring, heavy lifting operations, tactical defense applications, and high-performance sailing.

The core benefits driving the market adoption include enhanced safety margins due to lighter handling and reduced recoil risk compared to steel wire, significant operational efficiency gains from faster deployment and retrieval, and lower maintenance costs due to superior longevity and corrosion resistance. These technical attributes have positioned UHMWPE rope as the preferred alternative in environments where durability, lightness, and reliability are paramount. Key driving factors include the rapid expansion of offshore energy exploration, particularly in deep-water and ultra-deep-water areas, which necessitates advanced mooring and lifting solutions. Furthermore, increasing global military modernization programs, focused on lighter and more resilient equipment, consistently boost demand within the defense sector, solidifying the market’s growth trajectory despite fluctuating raw material costs.

UHMWPE Rope Market Executive Summary

The UHMWPE Rope Market is currently experiencing robust growth, primarily fueled by significant investments in the marine and offshore sector, specifically within oil and gas deep-water activities and the burgeoning offshore wind energy market. Business trends indicate a strong move toward product innovation, focusing on developing specialized coatings and fiber treatments that enhance creep resistance and prolong service life under extreme cyclical loading conditions. Major manufacturers are engaging in strategic partnerships with end-users to co-develop bespoke rope solutions, establishing long-term supply agreements that stabilize revenue streams and foster market loyalty. Furthermore, sustainability is becoming a critical competitive factor, with market leaders exploring recycling technologies for UHMWPE fibers to appeal to environmentally conscious industrial consumers and maritime organizations seeking reduced carbon footprints.

Regionally, Asia Pacific is anticipated to exhibit the fastest growth, driven by rapid industrialization, expanding naval capabilities in countries like China and India, and increasing maritime trade volume necessitating reliable port operations and vessel handling. North America and Europe maintain leading market shares, primarily due to their established offshore energy infrastructure, advanced sports and leisure marine industries, and stringent safety regulations demanding high-performance lifting and towing equipment. Segment trends highlight that the marine and offshore application category remains the dominant revenue generator, owing to its mandatory reliance on high-strength mooring lines and specialized lifting slings. However, the industrial sector, particularly in manufacturing and heavy construction where lightweight lifting solutions improve efficiency, is projected to show accelerated adoption rates throughout the forecast period, diversifying the overall market landscape.

AI Impact Analysis on UHMWPE Rope Market

User inquiries regarding AI's influence in the UHMWPE Rope market frequently center on optimizing the complex manufacturing process, predicting material failure under dynamic stress, and streamlining supply chain logistics for highly specialized fiber production. Users are keenly interested in how Artificial Intelligence can enhance quality control during the extrusion and braiding phases, minimize material waste, and improve the consistency of tensile strength across large batches. Specific concerns revolve around leveraging machine learning to analyze real-time usage data from deep-sea environments to more accurately predict rope lifespan and schedule preventative maintenance, thereby reducing operational downtime and catastrophic failures. The key themes emerging are efficiency maximization, predictive maintenance capability, and supply chain resilience through automated demand forecasting, underscoring expectations for AI to fundamentally transform both production management and field deployment reliability in this niche sector.

The integration of AI into the UHMWPE value chain promises significant enhancements in operational efficacy and product performance. In the manufacturing stage, AI-powered computer vision systems can monitor fiber alignment and braiding quality continuously, immediately identifying defects far beyond human capabilities and maintaining micron-level consistency, which is crucial for achieving advertised breaking strengths. Furthermore, predictive modeling using historical operational data, environmental variables (like temperature, salinity, and UV exposure), and real-time sensor feedback allows end-users, particularly offshore operators, to move from time-based maintenance to condition-based monitoring, dramatically extending the safe operating window of expensive mooring systems and deep-sea recovery lines while mitigating the risks associated with unexpected fiber fatigue and failure.

- AI-driven optimization of fiber extrusion and rope braiding processes enhances material consistency and reduces production defects.

- Machine learning algorithms enable sophisticated predictive maintenance models for in-field rope performance, extending service life in harsh environments.

- AI supports real-time monitoring of tension and strain during critical lifting and towing operations, enhancing safety and operational control.

- Automated supply chain management utilizes AI for raw material sourcing (UHMWPE polymer) forecasting, minimizing inventory risk and ensuring timely delivery of specialized products.

- Data analytics derived from AI systems inform next-generation rope designs, optimizing geometry and coating requirements for specific application loads.

DRO & Impact Forces Of UHMWPE Rope Market

The dynamics of the UHMWPE Rope Market are primarily governed by the balance between its outstanding performance benefits and external economic and technological constraints. The primary drivers (D) include the escalating global demand for deep-water offshore solutions, especially within the renewable energy and oil and gas industries, where the lightweight and non-corrosive properties of UHMWPE are indispensable for efficiency and safety. Simultaneously, significant restraints (R) exist, notably the high initial cost of UHMWPE fiber compared to conventional materials like polyester or steel, which can deter adoption in less critical or cost-sensitive industrial applications. Additionally, the market faces challenges related to creep and long-term temperature sensitivity, requiring ongoing R&D to enhance longevity under sustained high tension.

Opportunities (O) for market expansion are vast, centered on substituting traditional steel wire ropes across various industrial sectors, including heavy construction, mining, and aerial applications, where the benefit of reduced weight translates directly into energy savings and increased payload capacity. The burgeoning drone and robotics industries also present a niche opportunity for extremely lightweight, high-strength tethering and lifting lines. The market is subject to powerful Impact Forces, including regulatory pressures emphasizing marine safety and environmental protection, which favor safer synthetic materials over potentially damaging steel cables. Furthermore, the volatility of petrochemical raw material pricing directly influences manufacturing costs, acting as a periodic external force that can impact short-term profit margins across the value chain, requiring agile supply chain management to stabilize pricing for end-users.

Segmentation Analysis

The UHMWPE Rope Market is highly segmented based on construction type, diameter, and application area, allowing manufacturers to tailor products precisely to the strenuous demands of various end-user industries. The segmentation reflects the diverse operational environments—from the deep-sea mooring systems requiring maximum fatigue life and creep resistance, to sports and leisure sailing where light weight and handling characteristics are prioritized. Analyzing these segments provides a clear view of where growth capital is being invested and where technological innovation is most rapidly occurring, ensuring that market players can effectively address the specialized needs of sectors ranging from naval defense to commercial fishing. The detailed differentiation in product offerings is critical for maintaining high pricing and margin control in this specialized material market.

- By Construction Type:

- 8-Strand Rope (Used for lower tension, higher abrasion resistance)

- 12-Strand Rope (High strength, popular for mooring and towing)

- Braided Rope (High strength, low stretch, popular for running rigging)

- Parallel Strand Rope (Specialized for lifting and heavy static loads)

- By Application:

- Marine & Offshore (Mooring, Towing, Deepwater Recovery, Oil Rigs, FPSOs)

- Sports & Leisure (Sailing, Yachting, Paragliding, Kitesurfing)

- Industrial & Lifting (Crane Slings, Mining, Heavy Construction)

- Defense & Aerospace (Tactical Ropes, Parachute Cords, Vehicle Recovery)

- Fishing & Aquaculture (Trawl Lines, Netting, Trap Lines)

- By End-Use Industry:

- Oil & Gas

- Shipping & Maritime

- Renewable Energy (Offshore Wind)

- Construction & Manufacturing

- Government & Defense

Value Chain Analysis For UHMWPE Rope Market

The UHMWPE Rope market value chain begins with the complex upstream manufacturing of the base polymer, a process highly dominated by a few global chemical giants who hold proprietary spinning technology, such as DSM (Dyneema) and Teijin (Spectra). This initial phase, characterized by high capital investment and technical expertise, dictates the quality and cost of the primary raw material—the UHMWPE fiber. Intermediate processing involves spinning the fibers into yarns and then treating them with specialized coatings to enhance UV resistance, creep performance, and abrasion properties, transforming the raw fiber into a specialized textile component ready for rope construction. This upstream control provides significant leverage to the fiber producers and influences the overall profitability of the downstream rope manufacturers who purchase the yarn.

The midstream component of the value chain involves the specialized rope manufacturers who utilize advanced braiding and stranding techniques to produce the final product, often adhering to strict international standards (like DNV or ABS) required by the offshore and defense sectors. Distribution channels are typically specialized; direct sales are common for high-value offshore projects (mooring systems), where technical consultation and installation support are required. In contrast, smaller industrial and sports/leisure ropes are often sold through indirect channels, including specialized maritime suppliers, industrial distributors, and sometimes direct-to-consumer e-commerce platforms. The downstream focuses on the end-use service life, including inspection, maintenance, and eventual disposal or recycling.

Downstream analysis emphasizes the demanding end-use environment, primarily marine and offshore, which necessitates strong after-sales service, including periodic inspection, re-certification, and potentially, splicing and repair training. The channel structure reflects the product's criticality: direct distribution is prevalent for complex, high-stakes applications (e.g., deep-sea permanent mooring lines), ensuring technical specifications and quality control are maintained. Indirect channels serve smaller, fragmented markets such as general industrial lifting and leisure boating. Given the high cost and performance demands, the value chain is relatively short but intensely collaborative, often involving joint development between fiber producers, rope makers, and large end-users (like major oil and gas companies or naval forces) to develop bespoke, certified rope systems optimized for specific operational profiles.

UHMWPE Rope Market Potential Customers

The primary consumers of UHMWPE rope are organizations operating in extreme or safety-critical environments where the combination of lightweight handling and exceptional strength is non-negotiable. The largest end-user segment is the marine and offshore industry, encompassing major deep-sea drilling operators, Floating Production Storage and Offloading (FPSO) units, vessel owners needing high-performance towing and recovery lines, and increasingly, developers of large-scale offshore wind farms who rely on these ropes for installation and permanent mooring systems. These customers prioritize longevity, certification compliance, and low maintenance costs over initial purchase price, seeking operational reliability above all else.

Another rapidly expanding segment consists of governmental and defense organizations. Navies utilize UHMWPE ropes for high-stakes applications such as helicopter retrieval, tactical assault lines, and advanced naval towing, leveraging the material’s stealth properties (non-magnetic and low visibility) and superior handling characteristics compared to traditional steel wire. The third significant customer base is the high-performance sports and leisure sector, specifically competitive sailing and yachting, where every reduction in weight aloft translates directly into improved speed and stability, making UHMWPE rigging the default standard for high-end racing vessels. These customers seek performance optimization and ease of handling.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $580 million |

| Market Forecast in 2033 | $1,100 million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DSM, Teijin Limited, Cortland Company (Actuant Corporation), Bridon-Bekaert Ropes Group, Samson Rope Technologies, Marlow Ropes Ltd., Southern Ropes, Puget Sound Rope, Lancelin, Katradis Marine Ropes, Hampidjan, English Braids Ltd., Lankhorst Ropes, Mampaey Offshore Industries, WireCo WorldGroup, Miami Cordage, Yale Cordage, Selian, Funaifu, Wuxi Ropenet. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

UHMWPE Rope Market Key Technology Landscape

The technological landscape of the UHMWPE Rope market is defined by continuous innovation aimed at optimizing the base polymer characteristics and the subsequent rope manufacturing processes to overcome inherent material limitations, particularly creep and temperature sensitivity. Core technology is centered on gel spinning, a patented process used to produce the ultra-long molecular chains necessary for the material’s extreme strength. Further advancements involve integrating proprietary plasma or chemical coatings, which are essential for increasing resistance to abrasion, minimizing UV degradation in prolonged exposure scenarios, and critically, reducing internal friction which generates heat and contributes to fiber fatigue. These coatings significantly extend the service life of ropes used in highly dynamic applications like subsea lifting and mooring.

Beyond material science, key technological developments are concentrated in the manufacturing methodologies, specifically advanced braiding and stranding machines that ensure optimal load sharing across individual fibers. Techniques such as parallel strand construction and specialized core-dependent braided designs are employed to maximize strength efficiency and minimize internal wear. Furthermore, the market heavily relies on digital integration, utilizing advanced non-destructive testing (NDT) methods like optical fiber monitoring embedded within the rope structure. These integrated technologies allow for real-time sensing of strain, temperature, and residual strength, providing unprecedented data for predictive maintenance models and enhancing the overall safety assurance required by certification bodies such as DNV and ABS.

The emerging technological focus is on developing hybrid ropes that combine UHMWPE fibers with other high-performance materials, such as carbon fiber or aramid, to mitigate the creep challenges associated with pure UHMWPE under sustained load, particularly in high-temperature environments. This hybridization aims to create a new generation of ropes that offer the lightness and strength of UHMWPE while possessing the stiffness and high melting point of alternative polymers. The adoption of automation and robotic inspection systems in the manufacturing process is also critical for maintaining the high levels of quality required in the aerospace and defense sectors, ensuring that every meter of rope meets rigorous standards for homogeneity and defect avoidance, which are essential for zero-failure tolerance applications.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, primarily driven by massive investments in maritime infrastructure, rapid expansion of naval fleets, and increased demand for fishing and aquaculture lines. Countries like China, South Korea, and Singapore are leading the growth due to their dominant shipbuilding industries and expanding deep-water oil and gas operations. The rising popularity of sailing and leisure marine activities among affluent consumers also contributes significantly to demand for lightweight rigging.

- North America: North America holds a dominant share, fueled by stringent safety regulations in the oil and gas extraction sector, necessitating the use of certified high-performance lifting and mooring ropes. The US defense expenditure, particularly the demand for specialized tactical ropes and aerospace tethers, provides a consistent, high-value revenue stream. Innovation in manufacturing technology and adoption of smart ropes with integrated sensors are characteristic of this mature market.

- Europe: Europe is a vital market, largely driven by the rapid development of the offshore renewable energy sector, especially wind farms in the North Sea. European markets, particularly the UK, Norway, and the Netherlands, demand superior mooring and lifting solutions for turbine installation and maintenance. High-end yachting and competitive sailing are also strong drivers, sustaining robust demand for advanced, lightweight rigging systems, emphasizing sustainability and compliance with environmental standards.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated around the massive oil and gas extraction projects in the Arabian Gulf and the growing demand for port development. The region requires durable, heat-resistant ropes for extreme climate operations, making UHMWPE a strategic material for both permanent mooring systems and temporary heavy lifting in desert and offshore environments. Investment is often tied to volatile global commodity prices, affecting demand fluctuation.

- Latin America: This region shows steady growth, linked primarily to offshore oil and gas exploration in Brazil (pre-salt reserves) and general commercial shipping operations. The demand is often project-specific, focusing on imported high-specification ropes rather than localized manufacturing, making supply chain efficiency a key factor for market entry.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the UHMWPE Rope Market.- DSM (Royal DSM N.V.)

- Teijin Limited

- Cortland Company (Actuant Corporation)

- Bridon-Bekaert Ropes Group

- Samson Rope Technologies

- Marlow Ropes Ltd.

- Southern Ropes

- Puget Sound Rope

- Lancelin

- Katradis Marine Ropes

- Hampidjan

- English Braids Ltd.

- Lankhorst Ropes

- Mampaey Offshore Industries

- WireCo WorldGroup

- Miami Cordage

- Yale Cordage

- Selian

- Funaifu

- Wuxi Ropenet

Frequently Asked Questions

Analyze common user questions about the UHMWPE Rope market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary performance advantages of UHMWPE rope over traditional steel wire?

UHMWPE rope is significantly lighter, offering an equivalent breaking strength to steel at approximately one-seventh the weight, enabling easier handling, reduced vessel fuel consumption, and higher safety due to low kinetic energy and non-recoil properties upon failure. It also exhibits superior resistance to corrosion, moisture, and UV degradation compared to untreated steel.

Which application segment drives the highest demand for UHMWPE ropes?

The Marine and Offshore application segment is the largest driver of demand, encompassing deep-sea mooring systems, towing operations, and specialized lifting slings for vessels and offshore platforms, including oil rigs and expanding offshore wind farm installations, where lightweight, durable, and certified ropes are mandatory for operational success.

What are the major challenges restraining the UHMWPE Rope Market growth?

The main restraints are the high initial cost of the specialized UHMWPE polymer fiber (Dyneema or Spectra) compared to conventional materials, and the technical challenge of creep (gradual elongation under sustained load), which necessitates ongoing research into fiber treatment and rope structure to ensure long-term stability and maintain certified performance standards in static applications.

How does AI technology specifically benefit the manufacturing of UHMWPE ropes?

AI benefits manufacturing by optimizing the complex braiding and stranding processes using computer vision systems for real-time quality control, ensuring consistent fiber alignment and minimizing defects. Machine learning models also improve raw material forecasting and reduce waste, enhancing overall production efficiency and final product reliability.

Which geographic region is expected to show the fastest market expansion?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth, propelled by robust regional economic development, extensive investments in critical maritime infrastructure, rapid growth in commercial shipping and aquaculture, and expanding naval modernization programs across key economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager