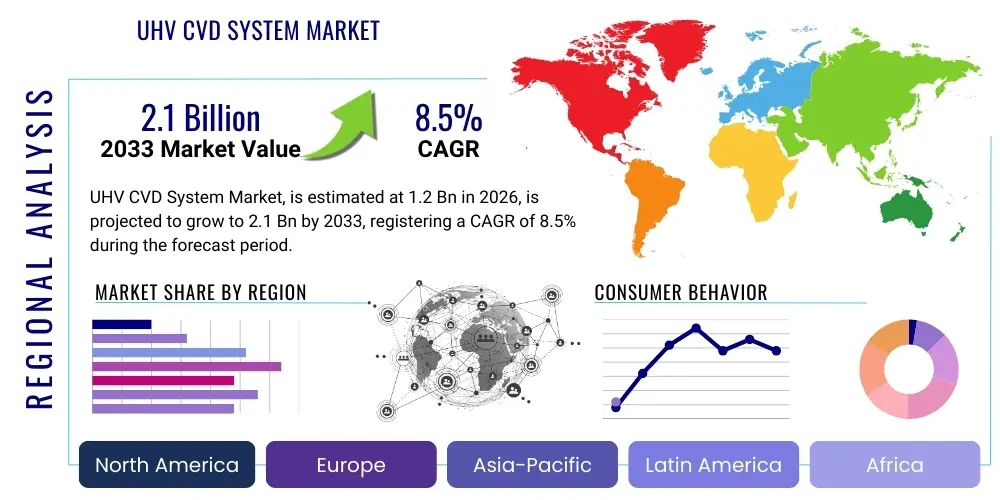

UHV CVD System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439409 | Date : Jan, 2026 | Pages : 243 | Region : Global | Publisher : MRU

UHV CVD System Market Size

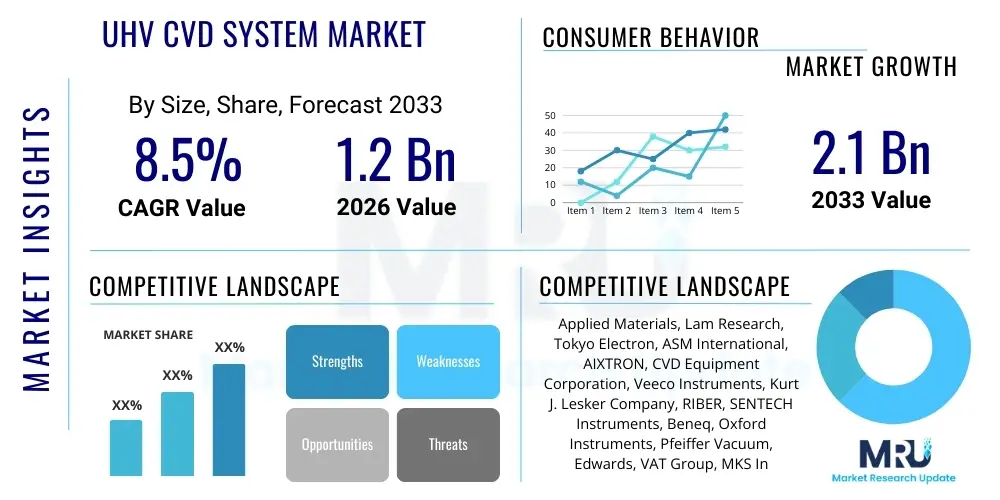

The UHV CVD System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.1 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by escalating demand from the semiconductor industry for advanced materials deposition, alongside significant growth in related sectors such as optoelectronics, medical devices, and thin-film solar cells. The unique capabilities of UHV CVD systems in producing films with exceptional purity, uniformity, and controlled atomic-level interfaces are indispensable for next-generation electronic components and complex material structures. Furthermore, continuous innovation in deposition techniques and materials science, coupled with strategic investments in research and development by key market players, is expected to fuel this growth trajectory. The market's valuation reflects its critical role in facilitating technological advancements across a diverse range of high-tech applications, underscoring its indispensable nature in modern manufacturing processes and scientific discovery.

UHV CVD System Market introduction

The Ultra-High Vacuum Chemical Vapor Deposition (UHV CVD) system market is a highly specialized segment within the broader thin-film deposition industry, crucial for applications demanding unparalleled material purity, precise atomic-level control, and defect-free interfaces. UHV CVD systems operate under vacuum conditions typically below 10-7 Pascal, which minimizes contamination from residual gases, thereby enabling the deposition of ultra-pure thin films and epitaxial layers. These systems are instrumental in creating sophisticated material structures that are fundamental to advanced semiconductor devices, microelectromechanical systems (MEMS), and specialized optical components. The inherent advantage of UHV environments lies in their ability to facilitate highly controlled chemical reactions on substrate surfaces, leading to films with superior electrical, optical, and mechanical properties. This precision is essential for manufacturing processes where even trace impurities or structural defects can significantly impair device performance and reliability. The meticulous control offered by UHV CVD allows for the precise tailoring of material properties, crucial for optimizing functionality in a wide array of high-performance applications. The demand for increasingly complex and miniaturized electronic components, coupled with the ongoing pursuit of novel materials with enhanced functionalities, continues to drive innovation and investment in UHV CVD technology, cementing its position as a cornerstone of modern material science and engineering. Its applications span from the fabrication of silicon-germanium (SiGe) heterostructures for high-speed transistors to the creation of advanced dielectric and metallic films for robust integrated circuits and quantum computing components.

Major applications for UHV CVD systems are predominantly found in the semiconductor industry, particularly for the deposition of epitaxial silicon, silicon-germanium, and various compound semiconductors essential for high-performance logic, memory, and power devices. Beyond semiconductors, these systems are vital in research and development for emerging technologies such as 2D materials (e.g., graphene, h-BN), advanced sensors, and quantum dots, where atomic-scale control is paramount. The benefits of utilizing UHV CVD include the production of films with extremely low defect densities, highly uniform thickness, excellent step coverage, and the ability to achieve precise stoichiometric control over complex materials. These advantages translate directly into enhanced device performance, higher yields, and improved reliability for end-products. Furthermore, the low-temperature deposition capabilities of some UHV CVD variants enable the processing of temperature-sensitive substrates, broadening their applicability. The primary driving factors for this market include the relentless miniaturization and increasing complexity of semiconductor devices, which necessitate advanced deposition techniques capable of handling nanoscale features and novel materials. The proliferation of artificial intelligence, 5G technology, IoT devices, and electric vehicles further fuels demand for high-performance chips, thereby accelerating the adoption of UHV CVD systems. Additionally, government initiatives supporting advanced manufacturing and materials science research, coupled with growing investments in nanotechnology and quantum computing, create significant opportunities for market expansion. The strategic importance of achieving ultra-high purity and precise control in film deposition continues to be a critical differentiator, positioning UHV CVD as an indispensable technology for future technological breakthroughs and industrial advancements across multiple high-tech sectors, driving consistent market growth and innovation. The push for energy-efficient electronics and sustainable manufacturing practices also subtly influences market dynamics, as UHV CVD can contribute to more efficient material utilization and improved device longevity.

UHV CVD System Market Executive Summary

The UHV CVD System Market is experiencing dynamic growth, propelled by the relentless pace of innovation in the semiconductor industry and the expanding frontiers of advanced materials research. Key business trends indicate a strong focus on developing systems capable of depositing a wider array of materials with even greater precision, including novel compounds for quantum computing and next-generation memory devices. Market players are heavily investing in automation and integration capabilities to streamline manufacturing processes and enhance system throughput, addressing the escalating demand for high-volume, high-purity film deposition. There is also a discernible trend towards modular and customizable UHV CVD platforms that can be easily adapted for diverse research and production requirements, offering flexibility and cost-efficiency to users. Strategic collaborations between equipment manufacturers, material suppliers, and end-users are becoming increasingly common, facilitating the co-development of specialized solutions and accelerating time-to-market for new technologies. Furthermore, sustainability considerations are beginning to influence business decisions, with a rising emphasis on energy-efficient systems and processes that reduce environmental impact, reflecting a broader industry shift towards greener manufacturing practices. This market segment is characterized by significant capital expenditure requirements for both R&D and manufacturing, placing a premium on established players with robust financial backing and deep technological expertise. The competitive landscape is intense, driven by continuous innovation and the need to meet stringent performance requirements from demanding industries. Companies are also exploring service and maintenance contract expansion as a means to secure recurring revenue streams and enhance customer loyalty, while also providing critical technical support for complex systems, ensuring optimal operational performance and extended system lifespan in high-stakes environments.

Regional trends highlight Asia Pacific, particularly countries like Taiwan, South Korea, China, and Japan, as the dominant force in the UHV CVD market, primarily due to the concentration of leading semiconductor manufacturing facilities and extensive government support for high-tech industries. This region's robust electronics manufacturing ecosystem and substantial investments in advanced R&D initiatives create a fertile ground for the adoption and innovation of UHV CVD technologies. North America and Europe also represent significant markets, driven by strong research institutions, specialized aerospace and defense applications, and a growing emphasis on re-shoring semiconductor manufacturing capabilities. These regions are characterized by a focus on high-value, niche applications and pioneering research into new materials and device architectures. The adoption rate in emerging economies is gradually increasing as their industrial bases mature and domestic demand for advanced electronics rises, though they currently lag behind established hubs in terms of market share and technological sophistication. Geopolitical considerations and supply chain resilience are increasingly influencing regional investment patterns, prompting diversified manufacturing footprints. Segment trends reveal that the semiconductor manufacturing segment remains the largest end-user, with continuous demand for UHV CVD systems to fabricate advanced logic, memory, and power devices. The burgeoning market for advanced packaging solutions, necessitating precise interconnections and protective layers, is also a key growth driver. The research and development segment, encompassing academic institutions and corporate R&D centers, maintains consistent demand for custom and flexible UHV CVD systems to explore novel materials and device concepts. Additionally, the optoelectronics sector, including specialized LED manufacturing and optical coatings, is showing promising growth, leveraging UHV CVD for high-purity film deposition critical for performance. The market is also seeing emerging applications in areas such as quantum technologies, biosensors, and energy storage, signaling diversification and new revenue streams. The increasing complexity of materials and device structures across these segments underscores the indispensable role of UHV CVD technology in achieving next-generation performance benchmarks, necessitating ongoing advancements in system capabilities and material compatibility to support diverse and evolving industry needs. The shift towards heterointegration and 3D device architectures further intensifies the demand for UHV CVD systems that can precisely deposit multiple layers of different materials with atomic-level accuracy and minimal thermal budget, crucial for maintaining device integrity and performance.

AI Impact Analysis on UHV CVD System Market

The integration of Artificial Intelligence (AI) is set to profoundly transform the UHV CVD System market, addressing critical challenges related to process optimization, predictive maintenance, and materials discovery. Users are increasingly seeking AI solutions to enhance the efficiency and reliability of complex deposition processes, reduce material waste, and accelerate the development cycle for new materials. Key concerns revolve around the data security and interpretability of AI algorithms, the initial investment required for AI integration, and the need for skilled personnel to manage these advanced systems. However, expectations are high for AI to unlock unprecedented levels of precision and control, enable autonomous process adjustments, and facilitate the rapid identification of optimal process parameters for novel film compositions. AI's ability to analyze vast datasets generated during deposition, including real-time sensor data and historical process logs, can lead to significant improvements in film quality, uniformity, and throughput, thereby improving operational efficiency and reducing costs. Moreover, the predictive capabilities of AI can anticipate equipment failures, enabling proactive maintenance that minimizes downtime and extends the lifespan of expensive UHV CVD hardware. The synthesis of new materials with specific desired properties, traditionally a time-consuming experimental process, can be dramatically accelerated through AI-driven simulations and high-throughput screening, fostering innovation and competitive advantage. The market is poised for a shift towards smarter, more autonomous UHV CVD systems that leverage AI for enhanced performance and reduced human intervention, ultimately driving a new era of efficiency and discovery in thin-film technology. The potential for AI to optimize resource allocation, fine-tune energy consumption, and ensure consistent batch-to-batch quality is particularly appealing to high-volume manufacturing environments, promising a future of smarter, more responsive, and sustainable material production.

- Process Optimization: AI algorithms analyze real-time data from sensors (temperature, pressure, gas flow, plasma power) to dynamically adjust process parameters, leading to improved film uniformity, reduced defect rates, and enhanced material properties. This minimizes trial-and-error, saving time and expensive materials, ultimately accelerating product development and manufacturing efficiency.

- Predictive Maintenance: AI models monitor equipment performance and predict potential failures before they occur, scheduling proactive maintenance to minimize downtime, extend the lifespan of critical components, and reduce maintenance costs. This ensures higher system availability and consistent production output, crucial for high-throughput manufacturing.

- Materials Discovery and Design: AI accelerates the discovery of new materials and deposition recipes by simulating complex chemical reactions, predicting material properties, and suggesting optimal precursor combinations and process conditions. This significantly shortens the R&D cycle for novel films and opens doors to breakthrough technologies in semiconductors, energy, and biomedical fields.

- Automated Quality Control: AI-powered vision systems and data analytics automatically inspect deposited films for defects, thickness variations, and compositional inconsistencies, providing instant feedback and enabling closed-loop control to maintain quality standards. This improves product yield and reduces the need for manual inspection, enhancing overall manufacturing efficiency.

- Enhanced System Diagnostics: AI facilitates rapid troubleshooting by pinpointing the root cause of process deviations or equipment malfunctions, reducing diagnostic time and speeding up recovery. This advanced diagnostic capability is invaluable for complex UHV CVD systems, minimizing operational disruptions and optimizing resource utilization.

- Energy Efficiency: AI optimizes energy consumption by learning ideal power settings for various deposition tasks, reducing utility costs and contributing to more sustainable manufacturing processes. This aligns with industry trends towards greener production and operational cost reduction.

- Recipe Development Acceleration: AI can learn from historical deposition data and experimental results to rapidly generate optimized process recipes for new materials or device architectures, reducing the extensive manual experimentation traditionally required. This speeds up time-to-market for innovative products.

- Supply Chain Optimization: AI can predict demand for precursors and spare parts, optimizing inventory levels and ensuring timely procurement, thereby improving supply chain resilience and reducing operational overheads.

DRO & Impact Forces Of UHV CVD System Market

The UHV CVD System Market is shaped by a complex interplay of drivers, restraints, and opportunities, all contributing to its evolving landscape and strategic direction. A primary driver is the incessant demand from the semiconductor industry for advanced materials with atomic-level precision and purity, essential for manufacturing next-generation microprocessors, memory chips, and specialized sensors. The continuous miniaturization of electronic devices, coupled with the increasing complexity of 3D architectures and heterointegration, mandates the superior film quality and control offered exclusively by UHV CVD systems. Furthermore, the burgeoning fields of quantum computing, AI hardware, and advanced photonics are creating new applications that rely heavily on the unique capabilities of UHV CVD for depositing novel materials with highly specific electronic and optical properties. Technological advancements in precursor chemistry, system automation, and in-situ monitoring techniques are also driving market expansion, making UHV CVD more efficient and accessible for a broader range of research and industrial applications. These innovations reduce operational complexities and improve process yields, making the technology more attractive for high-volume manufacturing environments. Government funding for materials science research and strategic investments in domestic semiconductor manufacturing capacities, particularly in regions aiming for technological self-sufficiency, further stimulate market growth by creating demand for cutting-edge deposition equipment. The global race for technological superiority in areas like AI and 5G relies heavily on breakthroughs in material science, often facilitated by UHV CVD, thus reinforcing its strategic importance and driving sustained investment.

Despite these strong drivers, the UHV CVD market faces significant restraints. The extremely high capital cost associated with UHV CVD systems, including their sophisticated vacuum components, precise gas delivery systems, and advanced process controls, represents a substantial barrier to entry for smaller companies and research institutions. This high initial investment can deter widespread adoption, particularly in cost-sensitive environments. Furthermore, the operational complexity of these systems, requiring highly skilled personnel for installation, maintenance, and process development, adds to the total cost of ownership and limits the available talent pool. The long lead times for equipment procurement and customization, often extending over several months, can also impede rapid deployment and responsiveness to market changes. Another restraint is the competition from alternative thin-film deposition technologies, such as Atomic Layer Deposition (ALD), Plasma-Enhanced CVD (PECVD), and Physical Vapor Deposition (PVD), which may offer lower costs or higher throughput for certain applications, even if they cannot always match the ultimate purity and precision of UHV CVD. Additionally, geopolitical tensions and trade restrictions can disrupt global supply chains for critical components and precursors, impacting manufacturing timelines and increasing operational uncertainties. The inherent challenges in scaling up highly precise UHV CVD processes from laboratory research to high-volume manufacturing environments also present a significant hurdle, requiring substantial engineering effort and investment to ensure consistent quality and yield at scale. These challenges collectively necessitate a careful balance between innovation, cost management, and operational efficiency to navigate the competitive landscape successfully.

However, substantial opportunities exist within the UHV CVD market, driven by emerging technological paradigms and evolving industry needs. The rapid development of 2D materials like graphene, molybdenum disulfide (MoS2), and hexagonal boron nitride (h-BN) for applications in next-generation electronics and optoelectronics presents a significant growth avenue, as UHV CVD is a preferred method for their high-quality synthesis. The increasing demand for advanced packaging technologies, such as wafer-level packaging and 3D integration, requires UHV CVD for depositing ultrathin, highly conformal, and contamination-free layers for interconnections and passivation. Furthermore, the expansion of the IoT, AI, and automotive electronics sectors generates a continuous need for custom semiconductor devices and advanced sensors, opening new niches for UHV CVD applications. Opportunities also arise from the development of hybrid deposition systems that combine UHV CVD with other techniques (e.g., UHV-ALD) to achieve synergistic benefits in material properties and process efficiency. The growing focus on sustainable manufacturing practices creates demand for more energy-efficient UHV CVD systems and processes that utilize less hazardous precursors. Moreover, expanding into niche markets like medical devices, aerospace components, and specialized optical coatings, where high performance and reliability are paramount, offers diversification potential. Strategic partnerships between equipment manufacturers and academic institutions can foster innovation and accelerate the commercialization of novel materials and processes. The drive towards localized manufacturing and resilient supply chains in critical technology sectors also presents an opportunity for regional market players to strengthen their positions by offering tailored solutions and enhanced support. The development of advanced data analytics and AI integration into UHV CVD systems further promises to unlock new levels of process control and materials insight, creating competitive advantages for early adopters. These combined factors highlight a robust future for UHV CVD, driven by continuous innovation and the strategic importance of its unique capabilities in the evolving landscape of advanced materials and microelectronics. The growing imperative for atomic-level precision in emerging fields such as quantum computing and neuromorphic computing further cements the long-term relevance and growth potential of UHV CVD technologies.

Segmentation Analysis

The UHV CVD System Market is comprehensively segmented to provide a detailed understanding of its diverse applications, technological advancements, and end-user adoption patterns. This segmentation allows for precise market analysis, identifying key growth drivers and competitive landscapes within specific sub-markets. The primary segmentation categories typically include classification by type of system, which differentiates based on the core deposition methodology (e.g., hot-wall, cold-wall, plasma-enhanced variants adapted for UHV conditions); by application, focusing on the specific industries or functions where UHV CVD systems are deployed (e.g., semiconductor manufacturing, research and development, optoelectronics); and by end-user, categorizing the types of organizations that purchase and operate these systems (e.g., integrated device manufacturers, pure-play foundries, academic institutions, materials research labs). Further granular segmentation can occur based on the type of material deposited (e.g., silicon, silicon-germanium, graphene, nitrides), the substrate size compatibility, or even regional adoption patterns reflecting localized technological strengths and industrial priorities. Understanding these distinct segments is crucial for stakeholders to tailor their product development, marketing strategies, and investment decisions, ensuring they address the specific needs and challenges of each market niche. The dynamic nature of advanced materials science and semiconductor technology necessitates a flexible segmentation approach that can adapt to new breakthroughs and shifts in industry demand, allowing for continuous refinement of market strategies and competitive positioning. This multi-dimensional approach to segmentation enables a holistic view of the market, revealing both established areas of dominance and emerging opportunities for growth and technological innovation, facilitating a more targeted and effective approach to market engagement and business development. Each segment presents unique technical requirements and commercial considerations, demanding specialized solutions from UHV CVD system providers.

- By Type:

- Hot-Wall UHV CVD Systems: Characterized by a heated reaction chamber where the entire wall is maintained at high temperatures, often used for uniform deposition over large areas and for processes requiring longer residence times.

- Cold-Wall UHV CVD Systems: Feature a heated substrate within a cooled reaction chamber, minimizing deposition on the chamber walls and reducing contamination, preferred for rapid heating/cooling cycles and cleaner processes.

- Plasma-Enhanced UHV CVD (PEUHV CVD) Systems: Incorporate plasma generation to activate precursor gases at lower temperatures, enabling deposition on temperature-sensitive substrates and enhancing film quality and deposition rates.

- Catalytic UHV CVD (Cat-UHV CVD/HWCVD) Systems: Utilizes heated filaments to dissociate precursor gases, producing highly reactive radicals for low-temperature deposition of high-quality films.

- Atomic Layer Deposition (ALD) capable UHV CVD Systems: Hybrid systems that combine the precision of ALD at ultra-high vacuum conditions for atomic-scale film growth with CVD advantages.

- By Application:

- Semiconductor Manufacturing: Deposition of epitaxial layers (Si, SiGe), dielectric films, gate stacks, and passivation layers for logic, memory, and power devices.

- Optoelectronics: Fabrication of optical coatings, waveguides, LED components, and photodetectors requiring high purity and precise refractive indices.

- Materials Research and Development: Synthesis of novel materials, 2D materials (graphene, MoS2), nanowires, and complex heterostructures for academic and industrial research.

- MEMS (Micro-Electro-Mechanical Systems): Deposition of structural and sacrificial layers for micro-sensors, actuators, and resonators.

- Solar Cells: Deposition of absorber layers and passivation coatings for high-efficiency thin-film solar devices.

- Quantum Computing and Advanced Sensors: Growth of qubits and other sensitive structures requiring atomic precision and ultra-low defect densities.

- Medical and Biomedical Devices: Creation of biocompatible coatings and advanced functional surfaces for implants and diagnostic tools.

- By End-User:

- Integrated Device Manufacturers (IDMs): Companies that design, manufacture, and sell their own ICs, requiring high-volume production capabilities.

- Pure-Play Foundries: Companies that solely manufacture ICs for other fabless companies, emphasizing high throughput and process flexibility.

- Research and Academic Institutions: Universities and national labs conducting fundamental materials science research and developing new device concepts.

- Materials Research Laboratories: Corporate and government-funded labs focused on advanced materials development and characterization.

- Other Industrial Manufacturers: Companies in optoelectronics, medical devices, and other sectors utilizing UHV CVD for specialized components.

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For UHV CVD System Market

The value chain for the UHV CVD System Market is intricate, involving several specialized stages from raw material sourcing to end-user deployment and ongoing support, each adding significant value and contributing to the overall complexity and efficiency of the industry. The upstream segment begins with the suppliers of ultra-high purity precursor gases and chemicals, which are meticulously manufactured to meet stringent quality and safety standards. These suppliers must ensure consistent quality, as even minute impurities can compromise the integrity of deposited films. Additionally, suppliers of specialized components such as high-vacuum pumps, mass flow controllers, reaction chambers, heating elements, and advanced control electronics form a crucial part of the upstream segment. These components are often custom-designed and fabricated to withstand the extreme conditions of UHV environments and ensure precise process control. Furthermore, the sourcing of high-grade construction materials for system fabrication, such as specialized stainless steels and ceramics, is also integral. The performance and reliability of the final UHV CVD system are fundamentally dependent on the quality and specifications of these foundational components and materials, necessitating robust supplier qualification processes and long-term partnerships to ensure a stable and high-quality supply chain. Innovation in precursor chemistry, offering new deposition capabilities or enhanced safety profiles, also starts within this upstream segment, driving technological evolution throughout the chain. The specialized nature of these raw materials and components means that the supply base is often concentrated, requiring strong relationships and often bespoke manufacturing arrangements to meet specific technical requirements and production volumes for UHV CVD system builders. Ensuring a resilient and diversified supply chain for these critical elements is paramount, especially in light of increasing global supply chain volatility and geopolitical considerations, which can directly impact system manufacturing lead times and costs.

Moving downstream, the value chain involves the design, manufacturing, assembly, and testing of the complete UHV CVD systems by specialized equipment manufacturers. This stage requires extensive engineering expertise in ultra-high vacuum technology, fluid dynamics, thermal management, process control software, and materials science. Manufacturers integrate the various components, ensuring seamless operation and adherence to extremely tight specifications required for atomic-level deposition. The manufacturing process is highly complex, often involving cleanroom assembly and rigorous testing to guarantee vacuum integrity, gas flow accuracy, temperature uniformity, and overall system performance. This phase is capital-intensive, requiring advanced manufacturing facilities and a highly skilled workforce. Distribution channels for UHV CVD systems are typically direct or through highly specialized agents and distributors with deep technical knowledge. Given the high cost, complexity, and customization often involved, direct sales and support from the manufacturer are common, allowing for close collaboration with the end-user during installation, commissioning, and ongoing maintenance. Indirect channels might involve regional distributors who possess strong local market presence and technical support capabilities, particularly in regions where the manufacturer does not have a direct operational footprint. These distributors often provide first-line technical support and spare parts inventory, acting as crucial intermediaries in a globally dispersed market.

UHV CVD System Market Potential Customers

The potential customers for UHV CVD systems represent a highly specialized and technically sophisticated group, primarily consisting of entities at the forefront of semiconductor manufacturing, advanced materials research, and high-tech product development. These end-users are characterized by their stringent requirements for material purity, precise film control at the atomic level, and the need to deposit complex, multi-layered structures with minimal defects. Integrated Device Manufacturers (IDMs) form a significant customer segment, as they are responsible for the entire process of designing, fabricating, and selling their own integrated circuits. IDMs leverage UHV CVD systems to produce advanced logic, memory, and power devices, where the quality of epitaxial layers and dielectric films directly impacts device performance and yield. Their continuous drive for miniaturization and performance enhancement fuels a consistent demand for state-of-the-art UHV CVD technology. Pure-play foundries, which specialize solely in manufacturing ICs for other fabless companies, also represent a substantial customer base. These foundries rely on UHV CVD to offer cutting-edge process capabilities to their diverse clientele, ensuring they can produce the most advanced chip designs with high precision and throughput. Their competitive edge often depends on access to and mastery of the latest deposition technologies, making UHV CVD systems a critical investment. Both IDMs and foundries are constantly upgrading their fabrication facilities to keep pace with Moore's Law

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.1 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Applied Materials, Lam Research, Tokyo Electron, ASM International, AIXTRON, CVD Equipment Corporation, Veeco Instruments, Kurt J. Lesker Company, RIBER, SENTECH Instruments, Beneq, Oxford Instruments, Pfeiffer Vacuum, Edwards, VAT Group, MKS Instruments, Leybold GmbH, Canon Anelva, Optorun, SPTS Technologies |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

UHV CVD System Market Key Technology Landscape

The UHV CVD System Market is characterized by a sophisticated technological landscape, driven by continuous innovation aimed at achieving higher precision, greater material versatility, and improved process efficiency to meet the evolving demands of advanced industries. At its core, UHV CVD technology relies on ultra-high vacuum environments, typically achieving pressures below 10-7 Pascal, which is critical for minimizing background contamination and enabling the growth of high-purity, defect-free thin films. This extreme vacuum is maintained by advanced pumping systems, including turbomolecular pumps and cryopumps, often backed by roughing pumps, ensuring minimal particulate contamination and residual gas presence during deposition. The gas delivery systems are equally critical, employing ultra-high purity gas sources, precise mass flow controllers, and specialized valves to accurately meter and introduce precursor gases into the reaction chamber. These systems are designed to prevent contamination and ensure highly repeatable gas mixtures, which is paramount for controlling film stoichiometry and growth rates. Heating technologies, varying between hot-wall and cold-wall designs, are crucial for achieving the necessary substrate temperatures for chemical reactions. Hot-wall systems heat the entire reaction chamber, providing uniform temperature distribution, while cold-wall systems selectively heat the substrate, reducing deposition on chamber walls and allowing for faster thermal cycling. These heating methods are often combined with sophisticated temperature control feedback loops to maintain stable and precise thermal environments throughout the deposition process. The integration of advanced process control software, often featuring real-time monitoring and feedback capabilities, is essential for managing the complex interplay of vacuum, gas flow, temperature, and plasma parameters, ensuring optimal deposition conditions and consistent film quality. This software provides operators with granular control over every aspect of the deposition, enabling fine-tuning for specific material requirements and device structures. The continuous evolution of these core technologies underpins the market's ability to support breakthroughs in materials science and semiconductor manufacturing.

Beyond these foundational elements, the UHV CVD technology landscape is seeing rapid advancements in several key areas. Plasma-Enhanced UHV CVD (PEUHV CVD) systems are gaining prominence for their ability to deposit high-quality films at lower temperatures, reducing thermal budget concerns for sensitive substrates and enabling new material combinations. These systems utilize RF or microwave plasma to dissociate precursor gases, forming highly reactive species that facilitate deposition, often resulting in denser and more uniform films. In-situ monitoring and diagnostic tools are becoming increasingly sophisticated, incorporating techniques such as ellipsometry, reflectometry, mass spectrometry, and X-time of flight mass spectrometry (ToF-SIMS) to provide real-time feedback on film thickness, refractive index, composition, and surface morphology during the deposition process. This real-time data is invaluable for process optimization, quality control, and the development of new materials, allowing for immediate adjustments and enhanced control. Furthermore, the development of novel precursor chemistries is a continuous area of innovation, with researchers seeking non-toxic, highly volatile, and thermally stable precursors that enable the deposition of new materials with enhanced properties or improved safety profiles. These new precursors are crucial for expanding the range of materials that can be grown via UHV CVD, including advanced dielectric films, high-k gate dielectrics, and complex compound semiconductors. The trend towards modular and cluster tool configurations is also significant, allowing for the integration of multiple UHV CVD chambers with other processing modules (e.g., ALD, PVD, etching) within a single ultra-high vacuum environment. This enables sequential processing without breaking vacuum, minimizing contamination and maximizing throughput, particularly for complex device fabrication flows. These integrated systems enhance efficiency and versatility, catering to diverse manufacturing and research needs. The convergence of these advanced technologies—from ultra-precise vacuum and gas management to intelligent process control and integrated diagnostic tools—positions UHV CVD as a cornerstone for current and future advancements in microelectronics, nanotechnology, and advanced materials engineering. The ongoing investment in these technological improvements ensures that UHV CVD systems remain at the cutting edge, indispensable for achieving the exacting demands of next-generation technological innovations across a multitude of high-tech applications, including the burgeoning fields of quantum information science and neuromorphic computing. This robust technological evolution is crucial for maintaining the market's growth trajectory and addressing the increasing complexity of material requirements.

Regional Highlights

- Asia Pacific (APAC): This region dominates the UHV CVD System Market, primarily driven by the colossal semiconductor manufacturing industry in countries like Taiwan, South Korea, China, and Japan. Massive investments in advanced fabrication plants (fabs) and government initiatives supporting domestic chip production significantly fuel demand. The presence of leading IDMs and pure-play foundries, coupled with a robust ecosystem of research institutions and material suppliers, positions APAC as the global hub for UHV CVD adoption and innovation, particularly for high-volume manufacturing of memory, logic, and AI chips.

- North America: A significant market characterized by strong R&D activities, particularly in emerging technologies like quantum computing, advanced sensors, and next-generation materials. The region's focus on high-value, niche applications, combined with a growing emphasis on re-shoring semiconductor manufacturing and strategic investments in defense and aerospace sectors, maintains a steady demand for UHV CVD systems. Leading equipment manufacturers and a strong academic research base contribute to continuous technological advancements and specialized system development.

- Europe: The European market for UHV CVD systems is driven by a strong focus on materials science research, automotive electronics, and specialized industrial applications. Countries like Germany, France, and the Netherlands have well-established research institutions and high-tech industries that utilize UHV CVD for advanced material development and niche product manufacturing. There is a growing emphasis on collaborative R&D projects and a push towards developing more sustainable and energy-efficient deposition processes, ensuring consistent, albeit more targeted, market growth.

- Latin America: This region currently holds a smaller share of the UHV CVD market but shows potential for gradual growth, primarily driven by increasing investments in academic research, emerging electronics manufacturing capabilities, and a developing industrial base. As technological infrastructure improves and local industries seek to enhance their manufacturing capabilities, the adoption of advanced deposition techniques like UHV CVD is expected to increase, albeit from a lower base, supported by international collaborations and technology transfer.

- Middle East and Africa (MEA): The MEA market for UHV CVD systems is in its nascent stages, with demand primarily stemming from academic research institutions and government-backed initiatives to diversify economies through investments in science and technology. Countries like Saudi Arabia and UAE are investing in research parks and advanced manufacturing capabilities, indicating future growth potential. However, the market is characterized by limited domestic manufacturing capacity for semiconductors and high reliance on imports, which might impact the pace of adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the UHV CVD System Market.- Applied Materials

- Lam Research

- Tokyo Electron

- ASM International

- AIXTRON

- CVD Equipment Corporation

- Veeco Instruments

- Kurt J. Lesker Company

- RIBER

- SENTECH Instruments

- Beneq

- Oxford Instruments

- Pfeiffer Vacuum

- Edwards

- VAT Group

- MKS Instruments

- Leybold GmbH

- Canon Anelva

- Optorun

- SPTS Technologies

Frequently Asked Questions

Analyze common user questions about the UHV CVD System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a UHV CVD System and why is it important?

A UHV CVD (Ultra-High Vacuum Chemical Vapor Deposition) system is specialized equipment used for depositing extremely pure, uniform thin films and epitaxial layers on substrates under ultra-high vacuum conditions (below 10-7 Pascal). Its importance stems from its ability to minimize contamination and precisely control film growth at the atomic level, which is critical for manufacturing advanced semiconductor devices, optoelectronic components, and novel materials requiring exceptional material quality and defect-free interfaces for high performance.

What are the primary applications of UHV CVD technology?

The primary applications of UHV CVD technology are predominantly in advanced semiconductor manufacturing, where it is used for depositing high-purity silicon, silicon-germanium, and compound semiconductor epitaxial layers for logic, memory, and power devices. Other significant applications include materials research and development for 2D materials, quantum computing, MEMS fabrication, and optoelectronics, where atomic-scale control and material purity are paramount for achieving desired functional properties and device performance.

What drives the growth of the UHV CVD System Market?

The UHV CVD System Market's growth is primarily driven by the relentless demand for smaller, more powerful, and energy-efficient semiconductor devices. Key factors include the miniaturization and increasing complexity of integrated circuits, the emergence of advanced technologies like AI, 5G, and IoT requiring high-performance chips, and significant investments in materials science research for novel applications. Continuous innovation in precursor chemistry and system automation also contributes to market expansion by enhancing deposition capabilities.

What are the main challenges or restraints in the UHV CVD market?

The main challenges facing the UHV CVD market include the high capital cost of the systems, which can be a significant barrier to entry. Operational complexity, requiring highly skilled personnel for system management and maintenance, is another restraint. Competition from alternative deposition technologies offering lower cost or higher throughput for specific applications, along with long lead times for equipment customization and potential supply chain disruptions, also pose significant challenges to market growth and adoption.

How is AI impacting the UHV CVD System Market?

AI is set to significantly impact the UHV CVD System Market by enabling advanced process optimization, predictive maintenance, and accelerating materials discovery. AI algorithms analyze real-time data to dynamically adjust deposition parameters, improving film quality and reducing waste. Predictive models anticipate equipment failures, minimizing downtime. Furthermore, AI-driven simulations and data analysis can rapidly identify optimal process recipes and synthesize novel materials, accelerating R&D cycles and enhancing the efficiency and capabilities of UHV CVD systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager